October 2025

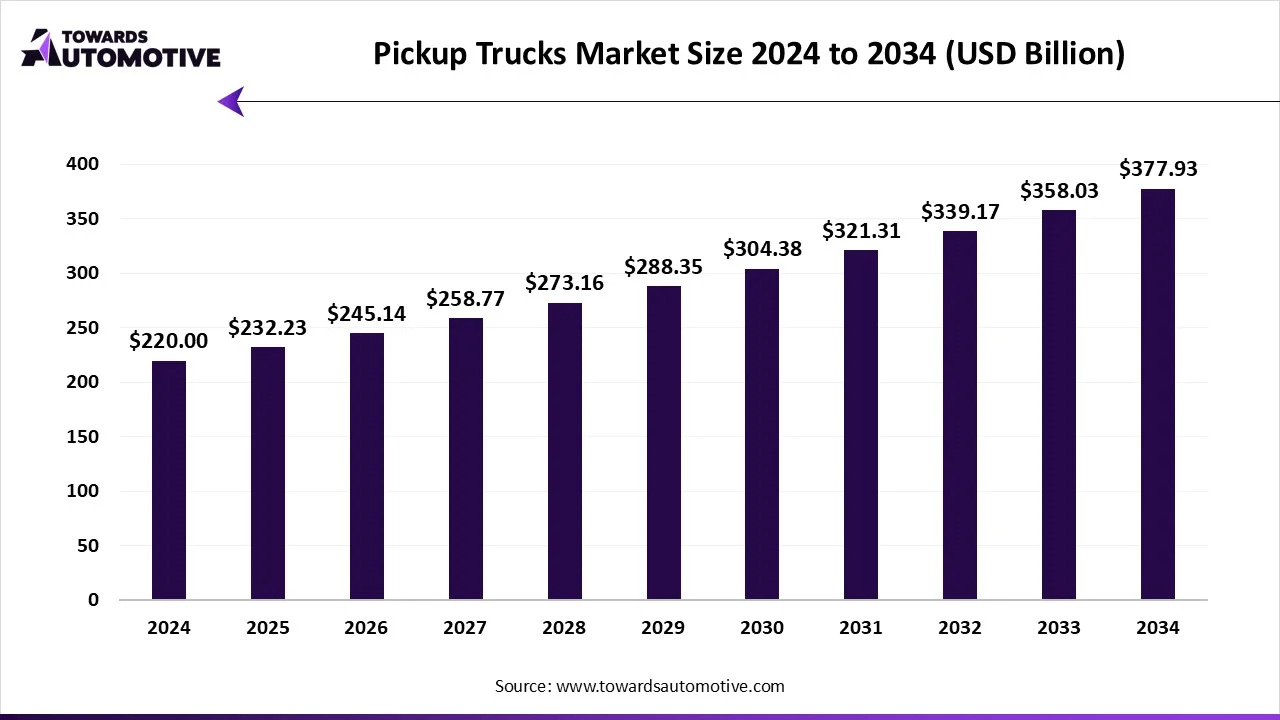

The pickup trucks market is forecasted to expand from USD 232.23 billion in 2025 to USD 377.93 billion by 2034, growing at a CAGR of 5.56% from 2025 to 2034. The pickup trucks market is rapidly expanding as demand has transformed from its traditional usage in the logistics, farming, and construction industries to personal usage to recreation and travel.

Moreover, growth is also supported by government policies and companies investing in electric vehicle models. Also, growth in the demand for last-mile delivery has increased the demand for pickup trucks, along with increased income levels of consumers and a variety of financing offers.

Pickup trucks are light-duty vehicles designed for both work and lifestyle. Pickup trucks offer much heavier, stronger engines and a significant cargo area. Depending on the need, they can provide a major ownership advantage (pace of transportation) for rides around towns or rural roads with a houseful of tools, products, parts, or heavy equipment. The global pickup trucks market covers the manufacturing, distribution, and sales of pickup trucks from light-duty to heavy-duty vehicles designed with an enclosed cabin and open cargo bed, widely used for personal, commercial, agricultural, industrial, and utility purposes. The pickup trucks run on gasoline, diesel, and electricity. Pickup trucks are used for personal use (lifestyle, recreational), commercial use (logistics, e-commerce, fleets), industrial & construction, and agriculture & utility applications.

The industries that utilize pickup trucks include consumer & retail, transportation & logistics, construction & infrastructure, agriculture & forestry, and government & defense. Market growth for the pickup truck market is driven by increasing consumer preference for lifestyle and recreational vehicles, rising demand for light commercial vehicles (LCVs) in logistics and e-commerce, advancements in electric and hybrid pickup trucks, and infrastructure & construction sector expansion.

| Metric | Details |

| Market Size in 2025 | USD 232.23 Billion |

| Projected Market Size in 2034 | USD 377.93 Billion |

| CAGR (2025 - 2034) | 5.56% |

| Leading Region | North America |

| Market Segmentation | By Vehicle Type, By Fuel Type, By Application, By End-User Industry, By Distribution Channel and By Region / Country |

| Top Key Players | Stellantis N.V., Ford, Toyota, Nissan, Volkswagen, Tata Motors, Ashok Leyland, GM, Hyundai, Suzuki, Kia, Mahindra & Mahindra |

The trends in the pickup trucks market are partnerships and product innovation

The light-duty pickup trucks segment captured almost 50% of the market share. Light-duty pickup trucks dominate the pickup truck market as they are the most favorable type of pickup truck when it comes to power, fuel economy, and affordability. They are more manageable on city streets than heavy-duty trucks and offer plenty of power for the usage of small businesses and personal use. Moreover, the versatility for towing, hauling, and driving will keep these the most widely accepted choice globally.

The electric pickup trucks segment is expected to grow at the fastest rate in the market. Electric pickup trucks are rapidly expanding in the market due to growing clean energy vehicle demand, government incentives, and improved charging infrastructure. Combined with brand offerings that align with traditional trucks in various spaces and specifications, including range, towing, and hauling capacity, has made electric pickup trucks more appealing. Factors such as the rising fuel pricing and stricter emissions laws are leading buyers to consider all-electric options for both cost savings and sustainability.

The gasoline segment captured 45% of the total market share. Gasoline-powered pickup trucks currently hold the largest share of the existing and emerging market, as gasoline is readily available, and fueling infrastructure is strong and widespread. This helps the gasoline-powered pickup trucks segment be more affordable and convenient. Moreover, gasoline pickup trucks provide a better performance than electric pickup trucks for personal and light commercial uses. Moreover, since most buyers use cost and convenience factors as motivators to purchase, gasoline trucks are likely to remain the most useful and practical option in many markets for the foreseeable future.

The electric segment is expected to be the fastest-growing segment in the market. The electric fuel type segment has the fastest-growing market share as a result of advancements in battery capacity and declines in battery costs. Moreover, electric pickup trucks are being produced that are more powerful and cost-efficient. Increasing environmental concerns, zero-emission mandates, and ongoing decreases in fuel costs, maintenance costs, parts costs, and repair costs make electric pickup trucks appealing to individuals and businesses alike.

The commercial use (logistics & fleets) segment captured around 40% of the pickup trucks market. The commercial use (logistics & fleets) segment dominated the market because pickup trucks are critical to logistics, fleets, and small businesses. They are used for delivery-type services, transporting goods from point A to point B, and for carrying certain pieces of equipment. Companies prefer pickup trucks due to their longevity, which is valued when choosing types of vehicles to cover greater distances than other vehicle types at lower costs of ownership than larger trucks (medium to heavy duty).

The personal use (lifestyle & recreation) segment is expected to grow at the fastest rate in the forecasted period. Personal use of pickup trucks is the fastest-growing application for pickup trucks because they have become recognized as lifestyle vehicles. Newer models have discovered new lifestyles for these vehicles as their latest designs provide more comfort, contain all the required safety and tech, attract families looking to enjoy the spaces offered, and also spike the interest of younger shoppers for outdoor activities like camping and towing recreational vehicles. The increase of overall disposable income has allowed people to purchase pickup trucks as a lifestyle expense.

The transportation & logistics segment captured around 35% of the total market share. Transportation and logistics are the formidable leaders in the pickup trucks industry because these types of trucks are essential for moving cargo from one location to another. The fact that these trucks can accommodate heavy loads, provide weather protection, and travel through different terrain makes these trucks easier to use in supporting supply chain operations. Moreover, fleet operators rely on pickups to be able to make various deliveries on schedule, and this ensures high demand.

The construction & infrastructure segment is expected to expand at the fastest rate in the forecasted period. The construction and infrastructure sector is growing the quickest, as many projects require vehicles able to carry tools, cargo, raw materials, and laborers to job sites. The design requirements of pickup trucks provide toughness and rugged performance, off-road capability, and high payload capacity, making pickup trucks an ideal choice. Additionally, increased investments in infrastructure and urban development will rapidly increase the demand in this sector.

The OEM/dealerships segment captured around 70% of the market share. OEMs and retailers are the dominating distributors due to most customers' preference to buy directly from the brand/authorized sellers. The OEM/ dealerships provide financing, offer warranty programs, deliver after-sales customer service, and have well-built customer trust. Moreover, customers can check out pickup trucks, test drive, and have a model-to-model comparison in person, which builds the buyer's confidence. Also, the physical presence of the OEM/dealerships makes it an important sales channel.

The online platforms segment is expected to grow at the fastest rate in the forecasted period. E-commerce is the fastest-growing channel since more customers are researching cars/vehicles and purchasing them digitally. Online car manufacturers' websites provide the same detailed comparisons, pricing, home delivery feature, along with many other conveniences. Younger customers prefer to buy online due to convenience and time-efficient comparison. Moreover, the growth of digital financing tools as part of the sales process, plus the development of virtual showrooms, has increased the level of trust (of both buyers and sellers) in online sales.

North America captured around 55% of the total market share. North America is the dominant market for pickup trucks in the world due to pickup trucks being so closely connected with lifestyle, work, and culture. Demand from delivery and logistics companies, farmers, and construction companies continues to drive sales of pickup trucks in North America. Additionally, advances in manufacturing, more flexible financing options, and an extensive dealership network have also aided the growth of this region. Moreover, opportunities also exist for electric pickups, connected vehicle technology, and fleets modernizing through the purchase of pickup trucks. North America has one of the highest income levels in the world, and consumers have a strong preference for larger, multi-purpose vehicles, which contributes to the dominance of North America in the pickup truck market.

The U.S. led the North American pickup truck market. In the U.S., there are high consumer preferences for pickup trucks, especially in rural and suburban areas. Automakers in the U.S. also recognize the value of pickup trucks and are constantly making an effort to develop better vehicles to cater to consumer needs. As a result, they have committed significant resources to new model development, which also includes electric and hybrid trucks, to accommodate changing preferences. Moreover, the U.S. also provides strong support to the pickup truck market through a vast road network and lower fuel prices, compared to several parts of the world.

Asia-Pacific is expected to be the fastest-growing region in the pickup truck market because of increases in disposable income, urbanization, and the development of infrastructure. Countries in the region are beginning to adopt pickup vehicles for both work and personal use. Strong e-commerce presence and logistics network also drive sales growth. There are also opportunities for low-cost electric pickup vehicles, multi-funding model financing options, and vehicles designed and developed with local tastes and uses in mind. Moreover, government incentives for cleaner energy vehicles present a great opportunity for electric truck growth in this region.

China is the leading nation in the Asia-Pacific pickup truck market because of its huge population, rapid growth in industry capacity, and a government motivation toward promoting new energy vehicles. Domestic makers are also producing low-cost pickup trucks for rural populations and suburban use. Additionally, China is not only increasing its policies in favor of electric vehicles, but it also has an institutional policy push in meeting logistics demand.

The raw materials required in production of pickup trucks are steel, aluminum, plastics, glass, and rubber.

The components used in the pickup trucks include engines, transmissions, axles, suspensions, electronics, and interiors.

The various components are then combined with the frame of the pickup truck. The pickup trucks go through several safety checks after they are assembled with all necessary components.

In January 2025, Dr. Ling Shiquan, CEO of RIDDARA New Energy Automobile Co., Ltd., said, “RIDDARA is an electric pickup brand under GEELY Holding Group, a leading global automotive conglomerate committed to developing new energy vehicles. RIDDARA leverages the strengths in technology, manufacturing, and quality control from GEELY Holding as a foundation to create an electric pickup that will redefine lifestyles by combining the capabilities of a pickup that can adapt to diverse road conditions with the smooth and comfortable driving experience of a SUV, catering to the lifestyles of modern families and delivering an exceptional experience typical of electric vehicles with modern innovations.

The pickup trucks market is highly competitive. Some of the prominent players in the market are Stellantis N.V., Ford Motor Company, Toyota Motor Corp., Nissan Motor Co. Ltd., Volkswagen Group, Tata Motors Ltd., Ashok Leyland Ltd., General Motors Company, Hyundai Motor Company, Suzuki Motor Corp., Kia Corporation, and Mahindra & Mahindra Ltd. The companies are heavily investing in factories and battery plants to develop affordable electric pickup trucks. These companies are also focusing on integrating advanced technologies into the pickup trucks, such as solar panels and advanced batteries, to increase the range of the vehicle. Moreover, companies are also entering into partnerships and collaborations, while also expanding businesses to rural and suburban regions to increase their market dominance.

Tier 1

Tier 2

Tier 3

By Vehicle Type

By Fuel Type

By Application

By End-User Industry

By Distribution Channel

By Region / Country

The Asia Pacific region dominated the vehicle electrification market, while North America is expected to see the highest growth rate during the foreca...

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us