October 2025

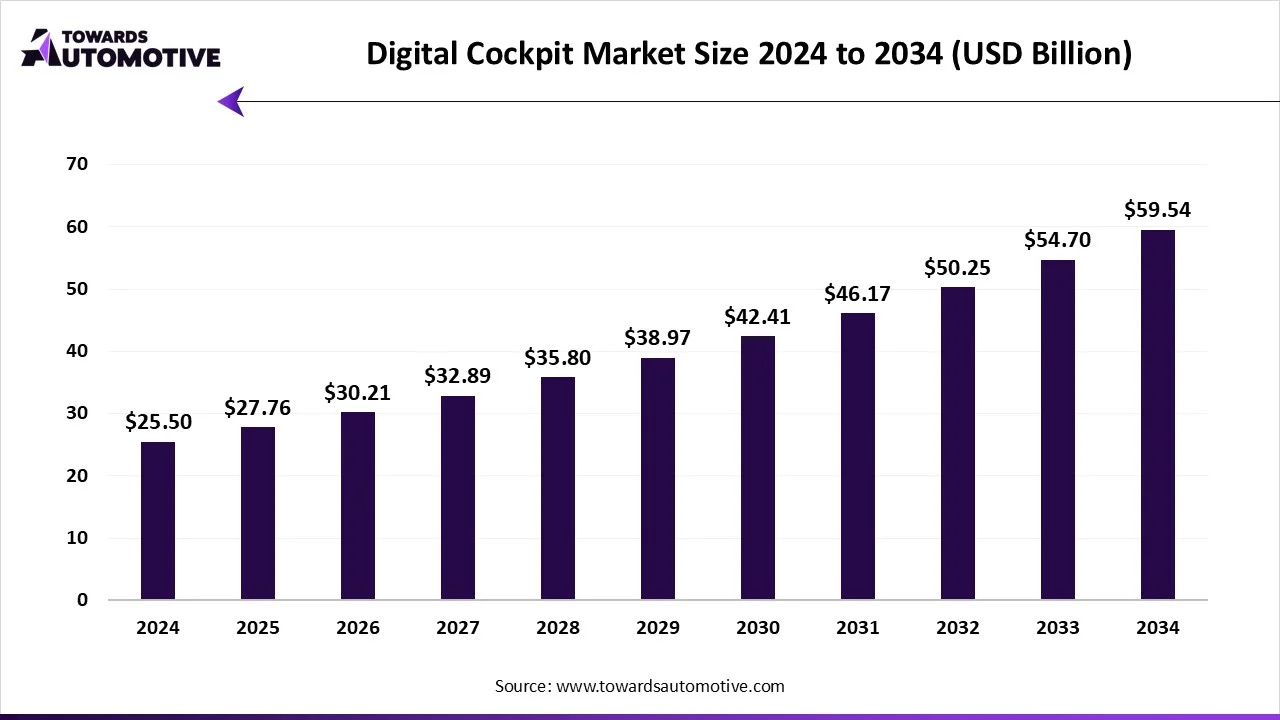

The digital cockpit market is forecasted to expand from USD 27.76 billion in 2025 to USD 59.54 billion by 2034, growing at a CAGR of 8.85% from 2025 to 2034. The digital cockpits market is increasing at a rapid rate due to the increased demand for connected and intelligent vehicles. Consumers want their driving experience to be improved through advanced displays, voice controls, and touchscreens that enhance safety and comfort. The current growth in electric and autonomous vehicles will support market growth as well, as these vehicles require increasingly intelligent interfaces.

Along with the developments in electric vehicles and autonomous driving technology, the digital cockpit market is also expanding due to technological advancements such as AI, cloud-enabled connected devices, and enhancements in sensor technologies and costs, which will make digital cockpits more pervasive for automotive manufacturers in consumer vehicles worldwide.

The digital cock[it market growth is being driven by increased consumer interest in smart vehicles, new regulations to improve safety, and the rapid advancement of display and AI technology.Digital cockpits market are high-tech control systems inside vehicles that include displays, infotainment, navigation, and driver-assistance features in one digital interface. Digital cockpits are used in vehicles, including cars, trucks, and other vehicles that support electric and autonomous driving technologies in order to deliver the user an experience that provides real-time information and/or entertainment to the driver and passengers, but advances driving performance, safety, and experience.

| Metric | Details |

| Market Size in 2024 | USD 25.5 Billion |

| Projected Market Size in 2034 | USD 59.54 Billion |

| CAGR (2025 - 2034) | 8.85% |

| Leading Region | Asia-Pacific |

| Market Segmentation | By Equipment Type, By Vehicle Type, By Display Size, By Display Technology and By Region |

| Top Key Players | Hyundai Mobis, Faurecia SE (now part of Forvia), LG Electronics Inc., Qualcomm Technologies Inc., Nippon Seiki Co., Ltd., Faurecia Clarion Electronics, Garmin Ltd., Alpine Electronics Inc., Nippon Seiki Co., Ltd., Clarion Co., Ltd., Alpine Electronics Inc. |

The trends in the digital cockpits market are technology partnership, collaboration and product launches.

The digital instrument cluster segment dominated and captured almost 64% of the market share. The digital instrument cluster segment represented the largest market share as more vehicle manufacturers switched from analog instrument displays to fully digital and customizable displays. These digital clusters allow the driver to visualize and monitor data in real time with improved awareness of their surroundings and the ability to connect seamlessly to other on-board systems. Moreover, premium and electric vehicles continue to drive the segment given their focus on smart displays with a modern aesthetic.

The head-up display (HUD) segment is expected to grow at the fastest rate in the forecasted period due to increasing demand for driver safety and convenience. HUDs work by projecting key information on the windshield, such as speed and navigation, to reduce distractions to the driver, thereby improving roadway safety. Additionally, manufacturers are now investing in augmented reality (AR) HUDs that overlay navigation cues on the real world to increase situational awareness. Advances in projection and display technologies will also play a crucial role in reducing cost and adoption across vehicle categories.

The passenger vehicles segment dominated and captured almost 69% of the digital cockpits market share. Passenger cars lead the digital cockpit market due to changing consumer trends towards vehicles that are connected, comfortable, and have on-board infotainment, while being operated continues to rise. Passenger vehicles have a better adoption rate for digital displays, smart assistants, and personalized connected offerings, especially in the mid-range to premium categories. The rise in electric vehicle sales and associated safety legislation is also causing manufacturers to design and incorporate more sophisticated cockpit systems, which only strengthens the market lead of this segment globally.

The commercial vehicles segment is expected to grow at the fastest rate in the forecasted period due to fleet operators and logistics companies beginning to use digital cockpits to enhance efficiencies and reduce accident rates. Navigation aids, driver behavior monitoring, and on-board connectivity features are designed to reduce accidents and increase productivity for logistics companies. The trend towards smart fleet management systems using telematics, as well as the rise of electric vehicles in the commercial vehicle segment, is further driving the adoption of digital cockpits as manufacturers seek to enhance driver comfort and vehicle performance through the development of digital cockpits.

The 10-15-inch segment dominated and captured around 56% of the digital cockpits market share. Screens in the 10–15-inch range have become the prevailing choice because of an effective balance of usability, cost, and visual clarity. It is a near enough standard size for instrument clusters and localization systems in most modern vehicles. These dimensions allow enough space for functionality without sacrificing intelligent design. The segment preeminence is further magnified by the wider use of the size range units in mass-market and mid-tier cars, where practicality and affordability are considerations.

The >15 inches segment is expected to be the fastest-growing segment in the forecasted period due to panoramic and multi-screen orientations becoming progressively common in luxury and electric use vehicles. These displays add an aesthetically pleasing component while creating a more robust infotainment experience, advantageously through split-screen usage or augmented navigation. Along with other vehicle interiors moving towards more connected hubs, a large-format OLED screen and/or protruding curved screen is truly becoming an induction into the premium nature of digital cockpits.

The TFT-LCD segment dominated and captured almost 55% of the digital cockpits market share. The TFT-LCD sector led the way due to its robustness, adherence to quality standards, and cost advantages. These displays deliver decent brightness, color fidelity, and fast response times, making them a good fit for the automotive space. TFT-LCDs are utilized extensively in instrument clusters as well as infotainment systems, benefiting from existing supply chains and design compatibility with current vehicle architecture. This results in sustained adoption across target entry and mid-tier level models, thus supporting its dominance in the market.

The OLED segment is expected to grow at the fastest rate in the forecasted period, as it provides more flexibility and design options with respect to a curved transparent display. OLED delivers much deeper blacks, higher contrast, and more energy savings than an LCD. High-end gross vehicle manufacturers prefer OLEDs in first edition vehicles, partly due to the aesthetic advantage of a curved thin display in the cockpit design. Moreover, decreasing manufacturing costs and ease of availability are further opportunities in the digital cockpit market.

The digital cockpits market is expected to witness significant changes in technology as a result of integrations based on AI, developments in display technology, and the propensity for better connectivity. In an effort to improve the user experience, automakers began embedding huge OLED screens and curved screens, advanced voice assistants, and augmented reality head-up displays into their cabin systems. Cloud-based software system architectures for cockpit systems provided better adaptability and readiness for the future. The introduction of 5G allowed for quicker transfer and sharing of information from the vehicle to other infrastructures. Smart sensors and driver monitoring technology also contributed to improving safety or allowing greater personalization in next-level vehicles.

Asia-Pacific dominated and captured around 45% of the total digital cockpits market share and is expected to be the fastest-growing region in the forecasted period. Growth in the region was driven by electric vehicle adoption, growing income, and acceptance of advanced digital technologies in passenger vehicles. The region was also home to very large automotive manufacturers and some of the manufacturers of electronic components for production automotive vehicles, enabling the possibility of mass production. In terms of growth opportunities, there was an expanding demand in mid-range vehicles, supportive government policy for smart mobility, and an increasing trend of automakers collaborating with technology companies to develop cost-effective connected cockpit systems.

China was the country in the Asia Pacific region for the digital cockpits market, owing to its automotive base, early acceptance of electric vehicles, and extensive investments in artificial intelligence and display technologies. Bringing together local and established technology companies producing in China, the country sought to develop more economically, reliable, and feature-rich digital cockpit systems. Additionally, local regulations promoting electric and connected vehicles also encouraged local and international players to establish or bolster business in the country.

Japan had a major influence on the digital cockpit market in Asia-Pacific due to its developed automotive and electronics industries. The top automakers in the digital cockpit market in Japan include Toyota, Honda, Nissa, Denso, and Stellantis. Automakers in Japan emphasized a focus on ergonomic and dependable high-quality display systems, including head-up displays and infotainment systems that integrated with the vehicle and the driver. The strong investments in research and development in Japan and the desire for precision-based manufacturing helped create reliable, user-friendly cockpit technologies. There was also innovation, due to partnerships between automakers and technology companies in building connected vehicles that could navigate autonomous technologies and display them in the cockpit.

North America is expected to grow at a considerable rate in the digital cockpit market due to rising demand for both luxury and connected vehicles. The increased adoption of electric and hybrid vehicles by automakers also contributed to the growing number of digital cockpit systems. The North American emphasis on safety, innovation, and consumer experience facilitated the growth of the market. Some of the top automotive companies whcih utilize digital cockpits include General Motors, Ford, Stellantis, Tesla, and Lucid Motors. Investment by Tier 1 suppliers into the development of autonomous vehicles, collaborations with several automakers on AI integration and software updates, and improvements for continuous performance upgrades of the information and communication systems in vehicles further provided growth opportunities.

The United States dominated the North American digital cockpit market. It has developed automotive technology, multiple leading Tier 1 vehicle manufacturers, and an array of supporting technology manufacturers to enable further innovation in the region. Some of the top automakers in the U.S. digital cockpit market include General Motors, Tesla, and Ford. Premium and electric vehicle demand in the U.S. served as a driving force for the growth of these digital cockpit systems. Additionally, the high per capita income, government advocacy for smart mobility solutions, and emphasis on AI-embedded solutions to vehicle connectivity options helped the United States maintain dominance in this expanding market.

Canada demonstrated significant growth in the digital cockpit market, with changes in demand for vehicles made from connected and electric vehicles. Automakers in Canada worked on integrating infotainment systems and navigation systems with the potential of providing connectivity in real-time to improve efficiency on the road, and the growing consumer demand for adopting EVs, and the advancement of 5G technology to support a future smart cockpit technology. As the country adopted EVs, there was also a degree of influence for consumers looking for the increased safety, comfort, and digital communication opportunities provided by next-generation cockpit technologies.

Europe had a well-established presence in the digital cockpit space, which was largely due to its premium car makers, its tougher safety & emissions regulations, and the increasing demand for EVs. Among the identifiers listed above, Germany, France, and the UK were characterized by high levels of innovation in integrated infotainment, driver-monitoring systems, and AR HUDs. Car makers in Europe were investing heavily in their software-defined cockpits to meet EU safety standards, largely in the areas of driver distraction and cyber safety and security. Moreover, consumers were expecting the build quality of the vehicle they were interacting with to align with the intuitive experience. Some of the opportunities in Europe include advanced cockpit technology and scaling it for mass-market vehicles (not just for luxury), developing modular cockpit architectures (to lower costs), developing even stricter cybersecurity and data privacy features, and developing AR/HUD systems for countries with safety regulations to satisfy the safety regulation requirement, as well as enhance the user experience.

Germany dominated the European digital cockpit market. It has a few of the premium native automakers, such as BMW, Mercedes-Benz, and Volkswagen, that are the leading users of cockpit hardware and software. German companies were also leaders in creating curved displays, AR up displays, advanced driver assistance recorders, as well as multiple levels of safety and cybersecurity features. Germany's regulatory frameworks, from the EU regime and more empowered consumer marketplaces, created a unique environment for companies willing to invest capital to develop high-quality usable cockpits. The German supplier network and engineering ethos ensured that companies could efficiently bring new systems to market while also being trusted suppliers.

The raw material required for producing digital cockpits such as high-quality plastics for dashboard panels, glass and polymers for display screens, semiconductors and chips for computing and AI systems, and cables and connectors for wiring.

The components required in the digital cockpits market are displays, sensors, processors, and connectivity modules.

These component are there integrated in making digital cockpits and then are fitted into which are further sold to customers.

| September 2025 | Announcement |

| Juhapekka Niemi, Senior Vice President of Product Management at Qt Group. | We’re committed to building technology and transforming the car experience for everyday users. Suzuki’s e VITARA is a great example of how Qt can help automakers bring premium digital experiences to a wider audience. This partnership is about making beautiful, responsive digital experiences more accessible across the automotive sector. |

| September 2025 | Announcement |

| Enrico Salvatori, Senior Vice President and President, Qualcomm Europe/MEA, Qualcomm Technologies, Inc. | This technology collaboration with Harman represents a pivotal moment in automotive innovation. Together, we’re bringing the power of AI to the cockpit, transforming how drivers and passengers interact with their vehicles. |

| July 2025 | Announcement |

| Savi Soin, Senior Vice President, India President, Qualcomm Technologies, said in a statement. | We are excited to collaborate with Spark Minda to deliver advanced, localised cockpit solutions tailored for India’s evolving automotive landscape using our Snapdragon Cockpit Platform. The Snapdragon Digital Chassis continues to transform the driving experience, empowering manufacturers with premium technologies. We aim to redefine the in-vehicle experience for Indian consumers, bringing innovation and connectivity to the next generation of vehicles. |

| March 2025 | Announcement |

| Ziyu Shen, Chairman and CEO of ECARX. | This awarding by the Volkswagen Group is a great opportunity for ECARX to partner with one of the most well-known and respected automakers in the world, and also a significant step forward for ECARX as a global company, partnering with international OEMs to deliver the best in intelligent automotive technology. |

The digital cockpits market is highly competitive. Some of the prominent players in the market are Continental AG, Robert Bosch GmbH, DENSO Corporation, Visteon Corporation, Harman International (Samsung), Panasonic Corporation, Aptiv PLC, Hyundai Mobis, Nippon Seiki Co., Ltd., Faurecia SE, LG Electronics Inc., Qualcomm Technologies Inc., NVIDIA Corporation, Magna International Inc., Marelli Holdings, Pioneer Corporation, Alps Alpine Co., Ltd., Valeo SA, Yazaki Corporation, and Garmin Ltd. These companies are focused on innovation, partnerships, or the integration of software in a model of competition. From AI-based systems, displays, and connected platforms, they demonstrated their interest in improving the user experience and safety for drivers and passengers. Many companies would collaborate with an OEM or other tech companies to build systems at a lower cost using flexible, modular cockpits. In terms of opportunities, the incorporation of electric vehicles allowed potential in the market expansion that did not previously exist, creating user subscriptions for software upgrades and the market.

| Company | About |

| Continental AG | Continental AG was established in 1871. The organization creates sophisticated digital cockpit solutions, encompassing display solutions, head-up displays, and connectivity technologies that enhance driver comfort, safety, and vehicle intelligence. |

| Robert Bosch GmbH | Robert Bosch GmbH was founded in 1886. It provides multiple integrated digital cockpit solutions, which include infotainment systems, driver assistance technology, and software solutions for connected and automated vehicles. |

| DENSO Corporation | DENSO Corporation was established in 1949. It designs smart cockpit systems that combine displays, sensor technology, and connectivity capabilities to improve driver interaction and vehicle steering in modern automobiles. |

| Visteon Corporation | Visteon Corporation was established in 2000. It is a high-tech firm specializing in automotive electronics and provides digital instrument clusters, infotainment systems, and cockpit domain controllers for connected vehicles. |

| Harman International (Samsung) | Harman International (Samsung) was established in 1980. It provides infotainment systems, digital cockpits, and audio technology, which create connectivity and immersive entertainment experiences in the automobile. |

| Panasonic Corporation | Panasonic Corporation was established in 1918. It produces components for digital cockpits such as display panels, infotainment platforms, and driver monitoring systems that are found in next-generation vehicles. |

| Aptiv PLC | Aptiv PLC was established in 1994. It specializes in intelligent vehicle architectures, including software and hardware that enable digitally connected cockpit systems and vehicle communication. |

Tier 1

Tier 2

Tier 3

By Equipment Type

By Vehicle Type

By Display Size

By Display Technology

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us