October 2025

The fleet electrification market is expected to grow from USD 104.5 billion in 2025 to USD 231.69 billion by 2034, with a CAGR of 9.25% throughout the forecast period from 2025 to 2034. The rising demand for sustainable transportation solutions in developing nations coupled with rapid investment by fleet operators to deploy EVs for lowering vehicular emission has boosted the market growth.

Also, numerous government initiatives aimed at developing the EV charging infrastructure along with collaborations among battery manufacturers and automotive companies for integrating high-quality batteries in electric buses is playing a vital role in shaping the industrial landscape. The surging expansion of the vehicle-to-grid (V2G) technology and technological advancements in AI-driven fleet management solutions is expected to create ample growth opportunities for the market players in the upcoming days.

The fleet electrification market is driven by the growing emphasis of fleet owners for adopting electric vehicles to lower emission coupled with rapid expansion of the EV charging infrastructure in different parts of the world. Fleet electrification refers to the transition of municipal, commercial, and corporate vehicle fleets from internal combustion engines (ICE) to electric powertrains. There are several types of vehicles adopted by fleet operators including electric light commercial vehicles (LCV) / vans, electric medium-duty trucks (MDV), electric heavy-duty trucks (HDV), electric buses, two-/three-wheeler cargo EVs, off-road / specialty fleet vehicles and some others. These vehicles are powered by different types of batteries consisting of lithium iron phosphate (LFP), nickel manganese cobalt (NMC), nickel cobalt aluminum (NCA), solid-state batteries and some others. It finds application in various sectors comprising of logistics & delivery fleets, public transit & municipal fleets, corporate & utility fleets, ride-hailing & shared mobility fleets, airport & port service fleets and some others. This market is expected to rise significantly with the growth of the overall automotive sector across the globe.

The major trends in this market consists of partnerships, government initiatives and investments.

Numerous fleet operators are partnering with automotive brands for accelerating fleet electrification in different parts of the world. For instance, in September 2025, Uber Freight partnered with Tesla. This partnership is done for enabling fleets to benefit from cost advantages across the U.S.

Government of various countries such as India, China, UK, the U.S., Switzerland and some others have started deploying electric buses in public fleets for enabling sustainability. For instance, in April 2025, the government of UK announced to invest around 38 million euros. This investment is done for deploying 319 electric buses across England with an aim at lowering vehicular emission.

Several funding corporations are investing in electric fleet companies for deploying electric vehicles to operate industrial applications. For instance, in July 2025, the Clean Energy Finance Corporation (CEFC) announced to invest around US$ 6 million. This investment is aimed at deploying BEV trucks in Australia.

The light commercial vehicles segment dominated the market with a share of around 30%. The growing sales of light commercial vehicles in several countries including China, India, South Korea and some others has boosted the market growth. Also, rapid investment by automotive companies for opening up new LCEV manufacturing centers is expected to drive the growth of the fleet electrification market.

The heavy-duty trucks segment is expected to rise with the highest CAGR during the forecast period. The rising demand for heavy-duty electric trucks from several industries such as mining, construction, logistics and some others has driven the market expansion. Additionally, collaborations among battery manufacturers and automotive brands for developing advanced batteries for heavy-duty trucks is expected to boost the growth of the fleet electrification market.

The BEV segment led the market with a share of around 70%. The growing adoption of BEVs in developed nations such as India, the U.S., Canada, Germany and some others has boosted the market growth. Additionally, rapid investment by battery manufacturers for developing high-quality batteries for BEVs is expected to accelerate the growth of the fleet electrification market.

The FCEV segment is expected to rise with the fastest CAGR during the forecast period. The increasing demand for FCEVs from several industries such as mining, logistics, construction and some others has driven the market expansion. Additionally, rapid investment by automotive companies for developing high-quality FCEVs is expected to boost the growth of the fleet electrification market.

The LPF batteries segment led the market with a share of around 40%. The growing use of lithium iron phosphate batteries in modern EVs manufactured by Tesla, Ford, Rivian and some others has boosted the market growth. Additionally, numerous advantages of these batteries including long lifespan, enhanced safety, high efficiency, light-weight, superior usable capacity and some others is expected to propel the growth of the fleet electrification market.

The solid-state batteries segment is expected to grow with the highest CAGR during the forecast period. The increasing investment by automotive brands for advancing research and development related to solid-state batteries has boosted the market expansion. Additionally, various benefits of these batteries such as enhanced safety, high energy density, fast charging capability, compact design and some others is expected to foster the growth of the fleet electrification market.

The DC fast charging segment led the market with a share of around 45%. The rapid deployment of DC fast chargers by EV charging companies in developing nations has boosted the market expansion. Also, the integration of blockchain technologies in DC fast chargers for charging vehicles at a faster rate is expected to expected to boost the growth of the fleet electrification market.

The ultra-fast DC charging segment is expected to expand with the highest CAGR during the forecast period. The rising emphasis of automotive brands to develop ultra-fast charging systems for luxury cars has boosted the market growth. Additionally, numerous advantages of ultra-fast charging systems including rapid charging speed, overcoming range anxiety, enhanced operational efficiency and some others is expected to propel the growth of the fleet electrification market.

The depot / private fleet segment dominated the market with a share of around 50%. The growing investment by fleet operators for deploy fast-chargers in their places to charge their vehicles quickly has boosted the market expansion. Also, partnerships among private fleet operators and charging providers is expected to propel the growth of the fleet electrification market.

The public / highway charging segment is expected to expand with the fastest CAGR during the forecast period. The growing focus of charging companies for deploying ultra-fast chargers in highways has driven the market growth. Additionally, rapid investment by government for opening new charging stations in expressways is expected to boost the growth of the fleet electrification market.

The fleet-owned segment dominated the market with a share of around 40%. The growing emphasis of fleet owners to deploy EVs for commercial purposes has boosted the market growth. Additionally, collaborations among fleet owners and automotive brands is expected to propel the growth of the fleet electrification market.

The CaaS segment is expected to grow with the fastest CAGR during the forecast period. The growing adoption of charging-as-a-service by fleet owners has boosted the market expansion. Also, partnerships among bus operators and charging solution providers is expected to foster the growth of the fleet electrification market.

The grid electricity segment dominated the market with a share of around 55%. The growing emphasis of charging brands for deploying advanced grid systems to support fast charging has boosted the market expansion. Additionally, rapid investment by energy providers for developing high-quality generators for powering charging stations is expected to accelerate the growth of the fleet electrification market.

The renewable energy segment is expected to grow with the highest CAGR during the forecast period. The growing dependency of car manufacturers on renewable energy sources such as solar and wind for charging different types of vehicles has boosted the market growth. Also, increasing emphasis of government to develop renewable energy sources is expected to propel the growth of the fleet electrification market.

The telematics segment led the market with a share of around 35%. The growing demand for advanced telematics solutions by fleet operators to increase operational efficiency has boosted the market expansion. Additionally, the integration of AI and blockchain in telematics solutions is expected to foster the growth of the fleet electrification market.

The smart charging & optimization segment is expected to grow with the highest CAGR during the forecast period. The growing emphasis of automotive brands to developed advanced software for supporting smart charging in luxury cars has boosted the market expansion. Additionally, collaborations among technology providers and charging solution providers is expected to propel the growth of the fleet electrification market.

The battery packs & modules segment dominated the market with a share of around 40%. The growing emphasis of automotive companies for integrating high-quality batteries in EVs has boosted the market expansion. Additionally, collaborations among battery companies and automotive brands is expected to drive the growth of the fleet electrification market.

The power electronics segment is expected to rise with the highest CAGR during the forecast period. The rising demand for advanced power electronics from EV manufacturers to operate several functions has driven the market growth. Also, rapid investment by electronic companies for opening new automotive component manufacturing centers is expected to accelerate the growth of the fleet electrification market.

The installation & commissioning segment dominated the industry with a share of around 30%. The growing emphasis of automotive brands for installing EV powertrain in modern vehicles to maintain sustainability has boosted the market expansion. Additionally, rapid investment by EV brands for opening new installation centers in different parts of the world is expected to boost the growth of the fleet electrification market.

The recycling & repurposing segment is expected to rise with the highest CAGR during the forecast period. The growing focus of automakers to enhance recycling activities of commercial vehicles has boosted the market growth. Also, rising awareness of recycling and repurposing among eco-friendly consumers is expected to propel the growth of the fleet electrification market.

The medium fleets segment led the market with a share of around 35%. The growing demand for electric- sized electric vans by medium-sized fleet operators has boosted the market growth. Also, rise in number of medium fleet operators in developing nations such as India, Vietnam, Thailand and some others is expected to drive the growth of the fleet electrification market.

The large fleets segment is expected to grow with the fastest CAGR during the forecast period. The rising emphasis of truck operators to deploy electric trucks for lowering emission has driven the market expansion. Additionally, partnerships among large fleets and EV companies for deploying electric vehicles in public transit is expected to propel the growth of the fleet electrification market.

The new fleet electrification segment dominated the market with a share of around 60%. The increasing adoption of electric trucks by new fleet operators has boosted the market growth. Also, rapid investment by new fleets for deploying electric vehicles to lower vehicular emission is expected to drive the growth of the fleet electrification market.

The retrofit projects segment is expected to rise with the highest CAGR during the forecast period. The rising focus of automotive owners to deploy high-quality electric vehicles for conducting retrofit projects has boosted the market growth. Additionally, rapid investment by automotive companies for conducting research projects based on EVs is expected to boost the growth of the fleet electrification market.

The logistics & delivery segment led the market with a share of around 33%. The growing emphasis of logistics companies for deploying electric vehicles to transport goods in different parts of the world has boosted the market expansion. Additionally, partnerships among automotive brands and logistics operators for developing customized FCEVs is expected to propel the growth of the fleet electrification market.

The public transit fleets segment is expected to grow with the fastest CAGR during the forecast period. The increasing focus of bus operators to adopt electric buses for lowering vehicular emission has boosted the market growth. Additionally, collaborations among truck operators and automotive brands to provide sustainable transportation solutions in developed nations is expected to foster the growth of the fleet electrification market.

Asia Pacific dominated the fleet electrification market with a share of around 38%. The increasing sales of electric vehicles in several countries such as India, China, Japan, South Korea, Australia, Singapore and some others has boosted the market growth. Also, rapid investment by government for strengthening the EV charging infrastructure coupled with technological advancements in the automotive sector is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as BYD, Yutong, Hyundai, Tata Motors and some others is expected to drive the growth of the fleet electrification market in this region.

China and India are the major contributors in this region. In China, the market is generally driven by the rising investment of automotive companies for developing commercial EVs coupled with rapid expansion of fast-charging network. In India, the rise in number of EV startups along with growing adoption of LCEVs in the e-commerce sector is playing a vital role in shaping the industrial landscape.

North America is expected to grow with the highest CAGR during the forecast period. The growing adoption of electric trucks by fleet operators in the U.S. and Canada for lowering emission has driven the market growth. Additionally, numerous government initiatives aimed at deploying electric vehicles in public transportation along with rapid investment by EV charging companies for expanding the charging network is contributing to the industry in a positive manner. Moreover, the presence of several market players such as Tesla, Nikola Corporation, Rivian, MAN and some others is expected to propel the growth of the fleet electrification market in this region.

The U.S. and Canada held significant share of the market in this region. In the U.S., the market is driven by the growing awareness of consumers related to the benefits of EVs along with rapid investment by automotive brands for opening up new EV production facilities. In Canada, the increasing focus of bus operators to deploy electric buses coupled with surging investment by government for expanding EV charging infrastructure is contributing to the industry in a positive direction.

| October 2025 | Announcement |

| Dan Marokane, the CEO of Eskom Group | The launch of these vehicles is not only about mobility, it is about reimagining the energy landscape, reducing carbon emissions, and ensuring every community benefits from the transition to sustainable transport. We see ourselves as more than just an electricity provider – we are enablers of progress. |

| October 2025 | Announcement |

| Sarah MacKinnon, CEO at Delta-Q Technologies | We are proud to announce new capabilities to engineer unique charging solutions for the most demanding environments across industries.With modular features like integrated Power Line Communication modules, DC-DC converters, and advanced digital controls, these solutions aim to set a new standard for performance and adaptability. We are excited to give our OEM partners greater flexibility and more opportunities to design systems that meet their unique requirements. |

| August 2025 | Announcement |

| Conrad Mummert, Head of SBRS at Shell | Our integrated charging network supports fleet operators by providing dependable access and helps to reduce the total cost of ownership for battery-electric trucks by up to 25%.1 That reduction is driven by a combination of cost-saving and revenue-generating opportunities – from stable, discounted energy pricing and charging optimisation, to monetising depot access during off-peak hours. |

| September 2025 | Announcement |

| Tammy Klein, the founder of Transport + Energy | I’m delighted that Transport + Energy are publishing its first Fleet Electrification Manifesto. The manifesto highlights the large, diverse range of discussion captured during the Forum, and has ensured that the voice of the fleet industry is being captured at this critical time for the sector. Myself and the team at T+E look forward to welcoming everyone back to Warwick Conferences in November for the annual T+E Forum, which again will bring together and facilitate the collaboration across the private and public sectors, ensuring that the UK’s ambitious decarbonisation targets are met. |

| May 2025 | Announcement |

| Alan White, Global Head of Emerging Transportation Platforms at Siemens Smart Infrastructure | The new Depot360 Home Charging Reimbursement solution, part of our Managed Services portfolio, is a game-changer for fleet operators looking to accelerate their electrification journey, enabling remote and home charging for fleets while minimizing capital investment and risk. This innovative approach reflects our strong customer focus, fast pace of innovation, and our ability as a leading technology company to provide agile, unrivalled end-to-end solutions for fleet electrification. |

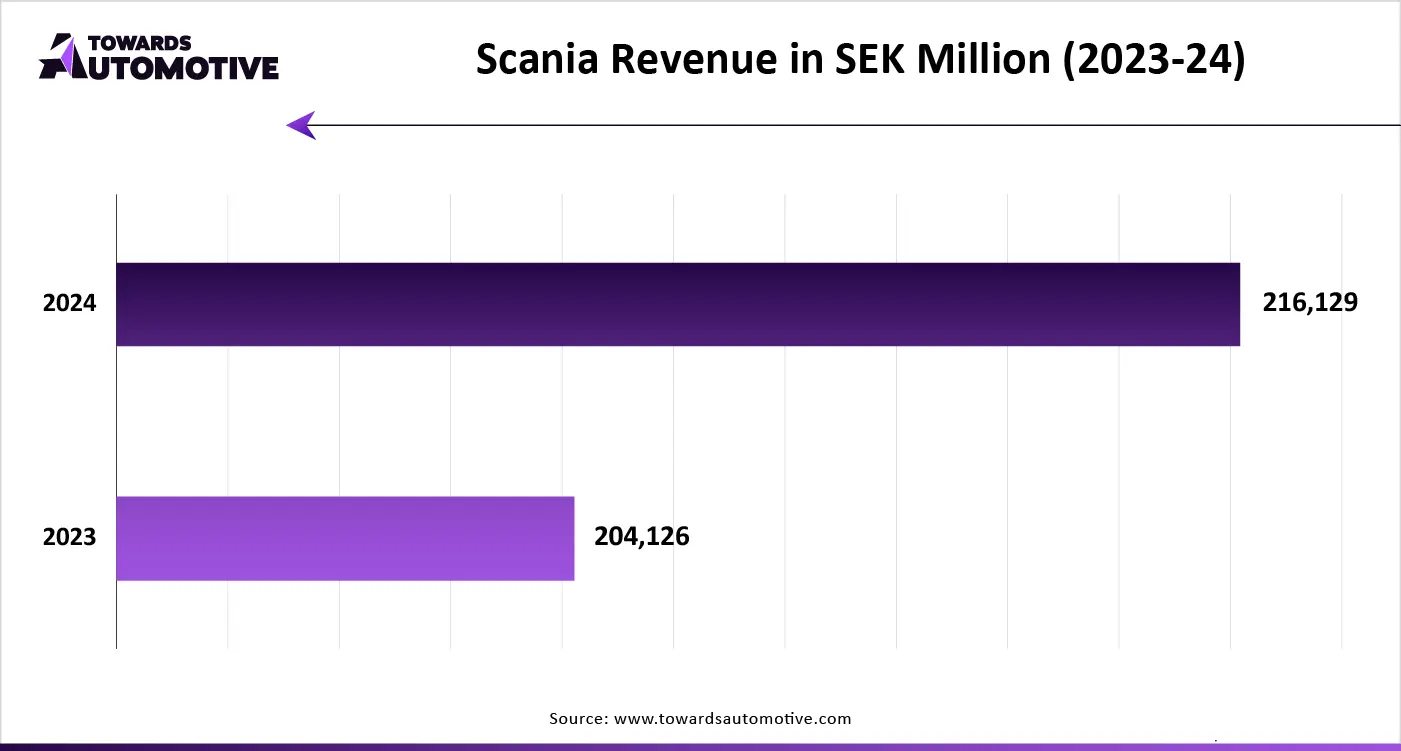

The fleet electrification market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of BYD, Hyundai Motor Company, Hino Motors, Tesla, Volvo Group, Daimler Truck AG, Scania (Traton Group), MAN Truck & Bus (Traton Group), Ford Motor Company, General Motors (BrightDrop), Rivian, Proterra, Yutong, NFI Group (New Flyer), Nikola Corporation, Ashok Leyland, Tata Motors, Iveco Group, Isuzu Motors, Renault Trucks and some others. These companies are constantly engaged in providing numerous solutions for the EV fleets and adopting numerous strategies such as collaborations, business expansions, launches, partnerships, acquisitions, joint ventures and some others to maintain their dominance in this industry.

Tier 1

Tier 2

Tier 3

By Vehicle Category

By Propulsion Technology

By Battery Type

By Charging Type

By Charging Location

By Ownership Model

By Energy Source

By Digital & Fleet Management Function

By Component Type

By Service Type

By End-use Application

By Fleet Size

By Deployment Type

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us