October 2025

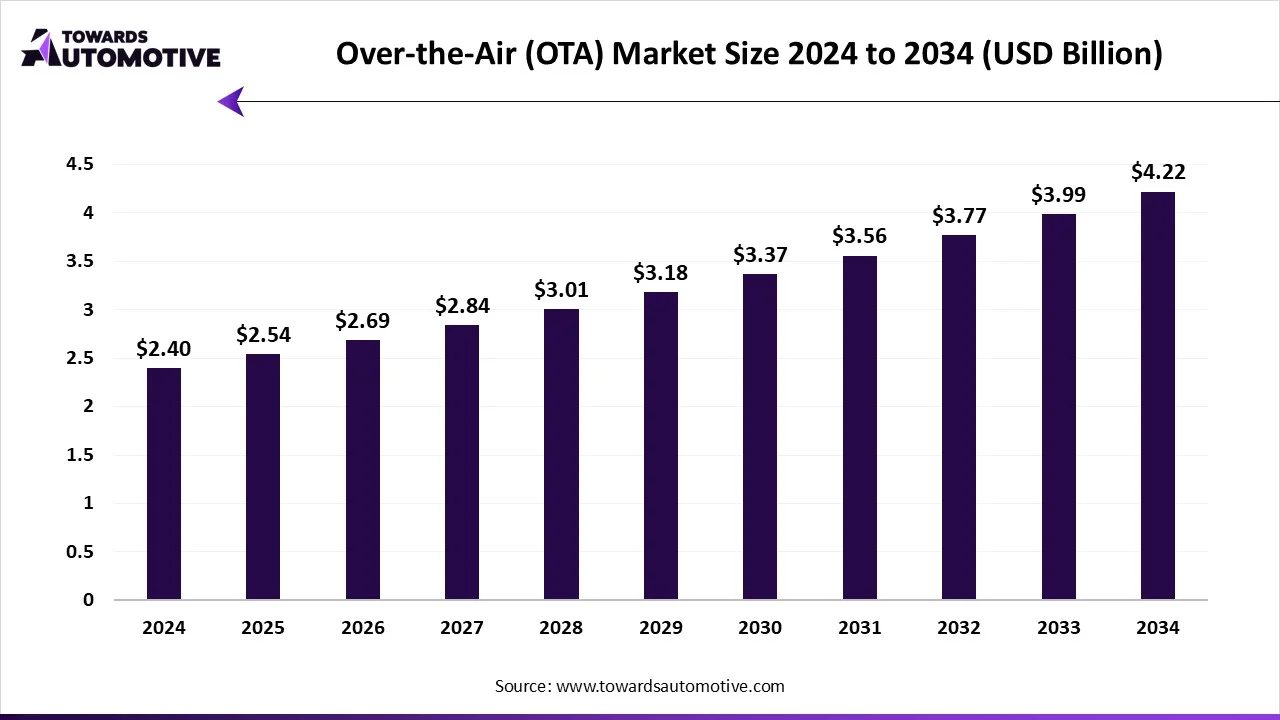

The Over-the-Air (OTA) market is forecasted to expand from USD 2.54 billion in 2025 to USD 4.22 billion by 2034, growing at a CAGR of 5.80% from 2025 to 2034. The Over-the-Air (OTA) market is growing due to the rise of connected vehicles, smart devices, and the Internet of Things (IoT). Automakers and technology companies can use OTA technology to push software updates, enhance security, and remotely fix issues without requiring physical access to the vehicle. The increased desire for real-time updates, seamless user experiences, and cybersecurity are additional reasons for the market growth.

The OTA market refers to the global industry providing wireless software, firmware, and data update solutions for connected vehicles, mobile devices, IoT devices, and other electronics. In the automotive context, OTA enables remote software updates, feature upgrades, bug fixes, diagnostics, cybersecurity patches, and personalization without requiring physical service visits. OTA adoption is driven by increasing vehicle connectivity, EV and autonomous vehicle proliferation, demand for continuous feature delivery, software-defined vehicle architectures, and digital transformation in automotive and IoT ecosystems. The OTA market is now a key element of the new advanced mobility/connectivity ecosystems of today, supporting bi-directional real-time data exchange and optimization of systems. It further helps manufacturers lower operational costs, enhances customer experience, and provides long-term performance of the products. With the introduction of 5G, AI-enabled integrations into OTAs, and more seamless cloud platform utilization, OTA technology continues to rapidly grow and create more optimized and smarter digital experiences across vehicles and connected devices internationally.

| Metric | Details |

| Market Size in 2024 | USD 2.4 Billion |

| Projected Market Size in 2034 | USD 4.22 Billion |

| CAGR (2025 - 2034) | 5.80% |

| Leading Region | North America |

| Market Segmentation | Amazon Web Services (AWS), Microsoft Corporation, Google (Google Cloud / Android Automotive), Bosch, Airbiquity, Elektrobit, Autotalks, Cohda Wireless |

| Top Key Players | By Deployment Type, By Application, By Software Type/Update Type, By Vehicle Type, By Component/Solution Provider, By Connectivity Type, By End-User/Buyer and By Region |

The trends in the Over-the-Air (OTA) market are partnerships and joint ventures between large companies.

The cloud-based OTA platforms segment dominated and captured almost 65% of the market share due to scalability, flexibility, and cost. These systems allow manufacturers to update devices remotely without physical access. In addition, cloud-based systems will roll out updates faster while offering better data management capabilities. As connected vehicles and IoT devices become more common, the demand for cloud solutions that provide remote diagnostics, allow for data protection, and enable real-time monitoring will continue to increase.

The on-premises OTA segment is expected to grow at the fastest rate in the forecasted period. However, the on-premises OTA segment is becoming a rapidly growing segment due to increasing data privacy and security concerns. Many of the automotive and industrial businesses prefer using on-premises OEM systems to keep sensitive data in-house. One benefit of the on-premises OTA systems is higher customization (less reliance on third-party vendors) and being compliant with data protection laws in the region.

The automotive segment dominated and captured almost 55% of the Over-the-Air (OTA) market share, as new vehicles significantly rely upon software to update performance, safety, and infotainment features. Automakers have engaged in using OTA updates to repair bugs, add new features, and improve vehicle functions without the need for a recall of the vehicle. The demand for connected vehicles and the changes towards electric and automated vehicles are also contributing to the automotive OTA segment.

The industrial IoT & consumer electronics segment is expected to grow at the fastest rate in the forecasted period. The industrial IoT and consumer electronics segment is growing rapidly as connected devices are being introduced. A few examples of connected devices in the commercial electronics segment are smart appliances, wearables, and factory devices. Over-the-air technology allows manufacturers to fix the software issues, improve performance, and interface with new features without user intervention.

The security patches & firmware updates segment dominated and captured around 40% of the Over-the-Air (OTA)market share since these updates are paramount for device safety and performance. They secure the system against cyberattacks, mitigate vulnerabilities, and ensure compliance with regulatory standards. Connected vehicles and an increased use of smart device technology have also created the requirement for more frequent, secure firmware over-the-air updates; as such, the popularity and demand for security patches and firmware updates have risen tremendously.

The feature & application updates segment is expected to be the fastest-growing segment in the forecasted period as more companies adopt OTA systems and continuously enhance the user experience. Manufacturers are expanding existing controls and enhancements to dashboards, features, interfaces, the user experience, and feature development through OTA. This decision allows for customer retention and lowers the hardware replacement cycle. The renewed focus on personalizing features and software-driven innovations in vehicles and electronics has further accelerated the trends of this segment.

The passenger cars segment dominated and captured almost 60% of the Over-the-Air (OTA) market share due to the growing number of connected cars and their adoption. To provide improved convenience, safety, and performance, automakers are introducing vehicles with the ability to implement OTA systems and make system-level updates. Specifically, carmakers are now able to implement remote updates of infotainment systems, navigation systems, and battery management systems. This enables connected and smart vehicles to rapidly enhance user- and customer-experience through continuously improved features.

The electric vehicles & autonomous platforms segment is expected to grow at the fastest rate in the forecasted period due to their reliance on software and coding practices. OTA updates are essential to enhance battery performance in EV vehicles, as well as the operating automation, which utilizes heavy reliance on software updates. Tesla and other EV companies that can rely on OTA technology are influencing the legacy automotive vehicle companies to adopt their technologies.

The cellular segment dominated and captured almost 70% of the Over-the-Air (OTA) market share due to its extensive coverage, reliability, and capacity to transmit large amounts of data. Cellular networks allow for real-time communication between devices and servers and for updates to be accomplished seamlessly, even in remote locations. With 4G and LTE being widely available, cellular connectivity has been adopted as a standard by automotive manufacturers and IoT manufacturers for their OTA services, which not only remain effective globally but also maintain consistency of connectivity and performance.

The 5G-based OTA segment is expected to grow at the fastest rate in the forecasted period due to its high speeds and ultra-reliable low-latency potential. 5G networks allow vehicles and devices to be delivered OTA updates more quickly and increase security while enabling an update that is larger than either 4G or LTE would allow. The improvement is significant for vehicles that are autonomous and for IoT devices that require instant communication and real-time data processing.

The automotive OEMs segment dominated and captured almost 55% of the Over-the-Air (OTA)market share. OEMs utilize OTA for a variety of reasons, including maintaining the necessary control over vehicle-level software, improving vehicle performance, and reducing costs related to recalls. Constant upgrades delivered by OTA solutions also increase customer satisfaction a mobility and logistics capability developed over time. As the industry trend continues to move toward more software-defined vehicles, OTA will also play an increasingly prominent role in OEM strategies.

The Tier-1 suppliers/fleet operators' segment is expected to grow at the fastest rate in the forecasted period due to expanding roles in connected ecosystems across the globe. Tier-1 suppliers and fleet operators are the administrative OTA end-user segment growing the fastest. First suppliers are providing OTA capacity in such included components along the vehicle level, such as electronic control units (ECUs) and infotainment systems. In the instance of fleet operations, OTA updates help fleet operators maintain their vehicles' health and performance by using OTA updates in a more efficient way.

There have been several noteworthy technological transitions in the Over-the-Air (OTA) market such as 5G connectivity, artificial intelligence (AI), and machine learning for predictive maintenance and data analytics; edge computing for the delivery of real-time OTA updates; advances in cybersecurity and blockchain-focused authentication to improve data security; as well as a travel-and-industry gravitational pull toward software-defined vehicles (SDV) and IoT integration to advance OTA usage across many industries, the automotive and electronics sectors, in particular.

North America dominated and captured around 40% of the total Over-the-Air (OTA) market share, due to its strong automotive industry, its technology adoption, and the widespread deployment of the 5G network. North America already had many connected vehicles and roaming IoT devices, which led to a greater demand for secure, efficient, and fast software updates. Auto manufacturers and tech companies were heavily investing in OTA solutions, both to enhance the customer experience and reduce vehicle maintenance costs. They were beginning to see and were trying to address autonomous driving systems, but there were also opportunities for the development of electric vehicles (EVs) and data-driven OTA platforms to improve safety and vehicle performance.

The U.S. led the North American Over-the-Air (OTA) market due to the presence of large tech companies and positive research infrastructure. Companies like Tesla, Ford, and General Motors were already using OTA technology to push over-the-air software updates and vehicle enhancements. The U.S. was supporting the fast growth of OTA solutions with the published adoption of IoT and 5G technologies. The ongoing investment in cybersecurity and innovation would lead to a high assurance of future advancement in OTA.

Canada is expected to grow at a considerable rate in the Over-the-Air market, due to resilient connected vehicle production and state assistance for digital transformation. The expansion of 5G networks in Canada and the governmental focus on smart transportation contributed to OTA technology uptake. Automakers and technology companies in Canada have invested in areas such as remote diagnostics, security, and real-time software control. Moreover, partnerships between large organizations and utilizing emerging global automotive suppliers provided new opportunities for secure OTA platform development, especially in the electric and autonomous vehicle ecosystem in the country.

Asia-Pacific is expected to be the fastest growing region in the Over-the-Air (OTA) market, and this is driven by increased smartphone usage, rising automotive production, and an increasing number of electric vehicle adopters. Countries in the Asia-Pacific rapidly adopted connected technologies and invested in digital infrastructure in order to expand the adoption of OTA and connected technologies. Furthermore, the growing middle-class population and smart city initiatives in the Asia Pacific have improved demand for products enabled by OTA. Opportunities existed due to the technology ecosystems required for connected technologies, the strong electronics industry in the region, the growing EV sector, and the movement toward 5G products in order to provide updatable products for consumer and industrial applications.

China has the highest level of OTA adoption in the Asia-Pacific region due to its rapidly growing electric vehicle and smart device industries. Automakers such as BYD and NIO developed and used OTA technology to improve vehicle performance and to add new features to vehicles. Additionally, the country has a large number of active smartphone users, and support from the government for digitalization encouraged the adoption of OTA. Moreover, the widespread 5G rollout and rapid technological innovations in China provided considerable opportunities for automotive and IoT OTA solutions.

Japan is expected to grow at a considerable rate in the Over-the-Air market, due to the focus on vehicle safety, innovation, and automation. Japan’s biggest automakers, such as Toyota, Honda, Nissan, and a few more, have incorporated OTA systems to deliver software upgrades, evolve user experience in infotainment systems, and reduce product recall risk. Japan’s well-developed 5G network and relatively strong data security standards gave greater benefits to faster and safer OTA implementation. Japan's automotive and consumer electronics segment, which can include robust technologies, especially for connected and autonomous vehicles, could provide large opportunities for OTA technology.

Europe's Over-the-Air (OTA) market is expected to experience considerable growth due to the rapid increase in electric and connected vehicles. Automakers in places like Germany, France, and the U.K. concentrated resources into both digital infrastructure and smart mobility technologies. The EU's regulatory framework with stringent data privacy regulations and sustainability targets encouraged automakers to consider OTA for software broadcasting and remote diagnostics. In addition, opportunities in the European Over-the-Air market included the EU's growing EV market, its focus on decreasing vehicular emissions, and the rising demand for an improved wireless communications system.

Germany was leading the OTA market growth in the European region due to its robust automotive sector, which has utilized connected technologies for an extended period. European leading Original Equipment Manufacturer (OEM) automakers and their suppliers concentrated on OTA applications as a tool to improve vehicle performance, safety, and energy management. Additionally, the German market has seen commitments from its stakeholders with extensive investments in engineering product development capabilities for EV and autonomous vehicles. In Germany, this has resulted in a critical mass of demand for a dependable OTA platform. Moreover, with its strong research capacity and 5G mobility infrastructure, Germany has become a leading OTA development and software defined vehicle laboratory.

| August 2025 | Announcement |

| Toshiya Otowa, Manager of Solution Marketing Department, Mobile Solutions Division at Anritsu. | Thanks to our collaboration with MVG, we are now able to conduct testing of NTN-compatible mobile and IoT devices under conditions that closely resemble real-world environments. Thereby, we are pleased to contribute to the realization of a truly connected society enabled by NTN technology, where connectivity is available anytime, anywhere. |

| August 2025 | Announcement |

| MVG's OTA Product Manager, Sebastien Gaymay. | By adapting our test chambers to operate with the MT8821C, we're giving R&D teams the ability to emulate key NTN communication scenarios directly in the lab.' This, he adds, 'enables earlier debugging and faster development cycles for satellite-capable Mobile and IoT devices. |

| February 2025 | Announcement |

| Jonathan Randall, president of Mack Trucks North America. | These enhanced connected vehicle capabilities demonstrate Mack’s ongoing commitment to providing insights and support that help our customers perform at their best. By automating and simplifying the software update process, we’re helping customers maximize their return on investment and better serve their own customers, while reducing the administrative burden of fleet management. |

| November 2024 | Announcement |

| RJ Scaringe, Founder and CEO of Rivian. | Today’s finalization of our joint venture with Volkswagen Group marks an important step forward in helping transition the world to electric vehicles. We’re thrilled to see our technology being integrated in vehicles outside of Rivian, and we’re excited for the future. Rivian will continue to stay focused on creating best in class products and services that benefit our customers, helping to drive EV adoption. |

| November 2024 | Announcement |

| Oliver Blume, CEO of Volkswagen Group. | The partnership with Rivian is the next logical step in our software strategy. With its implementation, we will strengthen our global competitive and technological position. Today’s launch of the joint venture demonstrates the potential we want to leverage together in the coming years. We have a clear plan to offer our customers the best products and digital experiences at attractive prices through state-of-the-art development processes, innovative technological approaches, and a competitive cost base driven by synergies. |

The Over-the-Air (OTA) market is highly competitive. Some of the prominent players in the market are Airbiquity, Harman International, Aptiv PLC, Continental AG, Elektrobit (EB), Salesforce, Microsoft, Amazon Web Services, Bosch, Continental Telematics/V2X divisions, Panasonic Automotive & Connected Solutions, Karamba Security, ZF Friedrichshafen, NXP Semiconductors, and Redbend/Harman Connected Services. These companies are increasingly allocating resources to building AI and machine-learning capabilities for improving user experience of personalization, travel, or product bundle suggestions, and predicting user preferences. They are also working to enhance the functionality of mobile apps, in addition to working to establish loyalty programs, expanding payment and fintech partnerships, and expediting decision-making using data analytics. Major players are also seeking to distribute OTA technology worldwide by entering into emerging markets with local payment and language options, while constantly striving to expand and expedite infrastructure.

| Company | About |

| Airbiquity | Airbiquity was established in 1997. The firm specializes in connected vehicle software and over-the-air (OTA) update platforms. In the area of OTA services, the company provides support to automobile manufacturers to aid in delivering software updates, managing data, and enhancing cybersecurity relating to connected vehicles and mobility solutions. |

| Harman International | Harman International was incorporated in 1980. The company supplies audio solutions as well as connected car alternatives. In the OTA services area, the organization provides remote software management, updates to infotainment, and connected vehicle services designed to maintain the car profile and enable the driver to receive new digital service offerings. |

| Aptiv PLC | Aptiv PLC was established in 2011. The firm specializes in mobility and smart vehicle technology. In the OTA area, Aptiv provides electronic architectures that can sustain secure OTA-style software updates to vehicles, which increase vehicle safety, automation, and software-defined functionality. |

| Continental AG | Continental AG was founded in 1871. Continental is a global supplier of automotive parts. In the OTA market, Continental supports connected vehicle solutions and software updates for infotainment systems in vehicles, telematics, and safety-based systems, ensuring the vehicle remains secure and capable of safety improvements. |

| Elektrobit (EB) | Elektrobit (EB) was established in 1985. The company provides embedded software for the automotive industry. In the OTA domain, EB supplies automobile manufacturers with a platform enabling remote software management and over-the-air updates that can be delivered to the car without a physical recall. |

| Salesforce | Salesforce was established in 1999 as a cloud-based software company. In the OTA market, Salesforce aids customer data integration and cloud management, allowing automakers to use data insights to improve customer experiences and the delivery of OTA services. |

| Microsoft | Microsoft was established in 1975 as a global technology company. In the OTA market, Microsoft supports automakers with cloud infrastructure (Azure) that enables secure software delivery for real-time remote diagnostics and seamless OTA services for connected devices. |

Tier 1

Tier 2

Tier 3

By Deployment Type

By Application

By Software Type/Update Type

By Vehicle Type

By Component/Solution Provider

By Connectivity Type

By End-User/Buyer

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us