September 2025

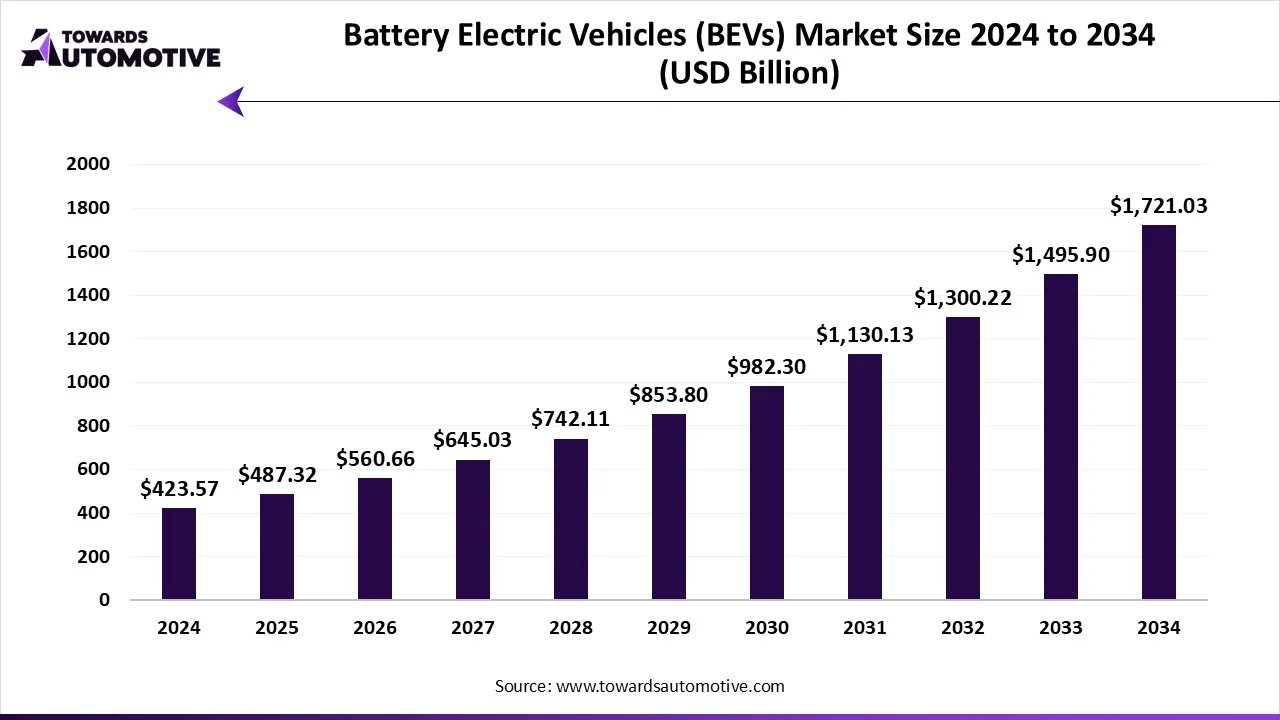

The battery electric vehicles (BEVs) market is forecast to grow from USD 487.32 billion in 2025 to USD 1721.03 billion by 2034, driven by a CAGR of 15.05% from 2025 to 2034. The rising adoption of EVs in different parts of the world with an aim at reducing vehicular emission coupled with numerous incentives and benefits provided by automotive brands on purchasing BEVs has contributed to the industry in a positive direction.

Additionally, rapid investment by government for developing the EV charging infrastructure along with technological advancements in electric vehicle industry is playing a vital role in shaping the industrial landscape. The research activities related to development of cobalt-free batteries is expected to create ample growth opportunities for the market players in the future.

Unlock Infinite Advantages: Subscribe to Annual Membership

The battery electric vehicles (BEVs) market is a crucial segment of the automotive industry. This industry deals in production and distribution of battery electric vehicles around the world. There are several types of vehicles developed in this sector consisting of passenger cars, light commercial vehicles, heavy commercial vehicles, two-wheelers, three-wheelers, buses and some others. These vehicles are powered by different types of batteries comprising of lithium-ion batteries, solid-state batteries, nickel-metal hydride (NiMH) batteries, and some others. It consists of numerous components including battery pack, electric motor, power electronics, thermal management system, vehicle control unit (VCU), charging port and some others. The end-users of these vehicles comprise of personal users, commercial/ ride-hailing fleets, public transport, industrial/utility fleets and some others. This market is expected to rise significantly with the growth of the battery industry in different parts of the globe.

The major trends in this market consists of government investment, rising sales of BEVs and business expansions.

Battery Electric Vehicles (BEVs) Market Size, By Vehicle Type, (USD Billion)

| Year | Passenger Cars | Light Commercial Vehicles (LCVs) | Heavy Commercial Vehicles (HCVs) | Two-Wheelers | Three-Wheelers | Buses |

| 2024 | 232.96 | 50.83 | 33.89 | 42.36 | 21.18 | 42.36 |

| 2025 | 269.00 | 58.97 | 38.99 | 48.24 | 23.88 | 48.24 |

| 2026 | 310.60 | 68.40 | 44.85 | 54.94 | 26.91 | 54.94 |

| 2027 | 358.64 | 79.34 | 51.60 | 62.57 | 30.32 | 62.57 |

| 2028 | 414.10 | 92.02 | 59.37 | 71.24 | 34.14 | 71.24 |

| 2029 | 478.13 | 106.73 | 68.30 | 81.11 | 38.42 | 81.11 |

| 2030 | 552.05 | 123.77 | 78.58 | 92.34 | 43.22 | 92.34 |

| 2031 | 637.40 | 143.53 | 90.41 | 105.10 | 48.60 | 105.10 |

| 2032 | 735.93 | 166.43 | 104.02 | 119.62 | 54.61 | 119.62 |

| 2033 | 849.68 | 192.97 | 119.67 | 136.13 | 61.33 | 136.13 |

| 2034 | 980.99 | 223.74 | 137.68 | 154.89 | 68.84 | 154.89 |

The passenger cars segment dominated the market with a share of around 68%. The growing sales and production of passenger cars in different countries such as India, China, Germany and some others has driven the market expansion. Additionally, the increasing adoption of battery-powered luxury cars by HNIs in developed nations is playing a vital role in shaping the industrial landscape. Moreover, rapid investment by automotive brands to manufacture a wide range of BEVs is expected to boost the growth of the battery electric vehicles (BEVs) market.

The heavy commercial vehicles (HCV) segment is expected to expand with the highest CAGR during the forecast period. The rising demand for heavy-duty battery electric trucks from several sectors including mining, construction, e-commerce and some others has boosted the market expansion. Additionally, the growing emphasis of battery manufacturing companies to develop high-quality batteries for trucks and buses is playing a prominent role in shaping the industry in a positive direction. Moreover, the increasing investment by automotive brands for developing a wide variety of electric buses is expected to boost the growth of the battery electric vehicles (BEVs) market.

The lithium-ion batteries segment dominated the market with a share of around 87%. The growing use of li-ion batteries in heavy-duty vehicles and mid-ranged EVs has boosted the market expansion. Additionally, numerous advantages of these batteries including high energy density, long cycle life, low self-discharge rates and some others is expected to propel the growth of the battery electric vehicles (BEVs) market.

The solid-state batteries segment is expected to rise with the fastest CAGR during the forecast period. The rising application of solid-state batteries in several types of vehicles including passenger cars, trucks, and other specialized vehicles has boosted the market expansion. Moreover, various advantages of these batteries such as high energy density, long lifespan, enhanced safety, faster charging capabilities and some others is expected to boost the growth of the battery electric vehicles (BEVs) market.

The 30-60 kWh segment led the market with a share of around 41%. The growing use of 30-kWh batteries in mid-ranged electric vehicles to deliver superior driving range has boosted the market expansion. Additionally, these batteries offer a balance between cost, range, and vehicle size that makes it suitable for daily commutes and urban driving, thereby fostering the growth of the battery electric vehicles (BEVs) market.

The >100 kWh segment is expected to grow with the fastest CAGR during the forecast period. The rising use of >100 kWh batteries in luxury vehicles to high-driving range and superior performance has driven the market growth. Moreover, rapid investment by automotive brands to integrate these batteries in heavy-duty vehicles is expected to boost the growth of the battery electric vehicles (BEVs) market.

The front-wheel drive (FWD) segment dominated the industry with a share of around 55%. The growing sales of FWD vehicles in developing nations such as India, Vietnam, Thailand and some others has boosted the market expansion. Additionally, rising emphasis of automotive brands for developing affordable BEVs is expected to propel the growth of the battery electric vehicles (BEVs) market.

The all-wheel drive (AWD) segment is expected to rise with the highest CAGR during the forecast period. The rising demand for powerful SUVs among adventure travelers to enhance off-roading activities has boosted the market growth. Moreover, the growing investment by truck manufacturers to integrate all-wheel drive systems in electric trucks is expected to foster the growth of the battery electric vehicles (BEVs) market.

The 300–500 km segment dominated the industry with a share of around 39%. The increasing demand for mid-ranged electric hatchbacks in developing nations has boosted the market expansion. Additionally, the growing emphasis of EV manufacturers to integrate low-maintenance batteries that delivers around 300–500 kms of driving range is expected to drive the growth of the battery electric vehicles (BEVs) market.

The >500 km segment is expected to rise with the highest CAGR during the forecast period. The growing emphasis of automotive brands for developing long-range EVs has driven the market growth. Moreover, the increasing use of solid-state batteries in luxury cars to deliver superior driving range of more than 500 kms is expected to foster the growth of the battery electric vehicles (BEVs) market.

The slow charging (AC) segment dominated the industry with a share of around 58%. The increasing adoption of AC charging due to their cost-effectiveness and low maintenance has boosted the market expansion. Additionally, the availability of AC charging stations in developing nations is expected to drive the growth of the battery electric vehicles (BEVs) market.

The fast charging (DC) segment is expected to grow with the fastest CAGR during the forecast period. The growing demand for fast-chargers from the fleet management platforms and ride-hailing companies has boosted the industrial growth. Moreover, rapid investment by government for constructing fast-charging stations is expected to propel the growth of the battery electric vehicles (BEVs) market.

The battery pack segment dominated the market with a share of around 42%. The growing use of high-quality batteries in modern EVs to deliver superior driving range has boosted the market growth. Additionally, partnerships among automotive brands and battery manufacturers to develop EV batteries is expected to propel the growth of the battery electric vehicles (BEVs) market.

The power electronics segment is expected to expand with the highest CAGR during the forecast period. The increasing application of several electronic components such as inverters, DC-DC converters, and on-board/off-board chargers in electric vehicles has boosted the market expansion. Moreover, the availability of essential electronic components in automotive OEMs is driving the growth of the battery electric vehicles (BEVs) market.

The OEM sales segment led the market with a share of around 93%. The availability of EV components in automotive OEMs has boosted the market growth. Additionally, rapid investment by automotive companies to open new service centers and EV showrooms is expected to boost the growth of the battery electric vehicles (BEVs) market.

The aftermarket segment is expected to rise with the highest CAGR during the forecast period. The rising consumer preference to purchase EV components from online platforms has driven the market expansion. Moreover, the availability of various EV parts in aftermarket stores and automotive shops is expected to drive the growth of the battery electric vehicles (BEVs) market.

The personal use segment led the market with a share of around 61%. The growing adoption of BEVs by individual consumers to reduce vehicular emission has boosted the market expansion. Moreover, numerous government initiatives for providing incentives to individuals for purchasing EVs is expected to propel the growth of the battery electric vehicles (BEVs) market.

The commercial/ride-hailing fleets segment is expected to rise with the highest CAGR during the forecast period. The rising adoption of electric vehicles by ride-hailing companies to gain maximum profits has boosted the market expansion. Additionally, the deployment of electric buses by transport organizations and increasing application of electric trucks in the mining sector is expected to boost the growth of the battery electric vehicles (BEVs) market.

Battery Electric Vehicles (BEVs) Market Size, By Region, (USD Billion)

| Year | North America | Europe | Asia-Pacific | Latin America | Middle East & Africa |

| 2024 | 84.71 | 105.89 | 169.43 | 33.89 | 29.65 |

| 2025 | 96.98 | 121.34 | 196.39 | 38.50 | 34.11 |

| 2026 | 111.01 | 139.04 | 227.63 | 43.73 | 39.25 |

| 2027 | 127.07 | 159.32 | 263.82 | 49.67 | 45.15 |

| 2028 | 145.45 | 182.56 | 305.75 | 56.40 | 51.95 |

| 2029 | 166.49 | 209.18 | 354.33 | 64.04 | 59.77 |

| 2030 | 190.57 | 239.68 | 410.60 | 72.69 | 68.76 |

| 2031 | 218.12 | 274.62 | 475.79 | 82.50 | 79.11 |

| 2032 | 249.64 | 314.65 | 551.29 | 93.62 | 91.02 |

| 2033 | 285.72 | 360.51 | 638.75 | 106.21 | 104.71 |

| 2034 | 327.00 | 413.05 | 740.05 | 120.47 | 120.47 |

Asia Pacific led the battery electric vehicles (BEVs) market with a share of around 57%. The growing adoption of BEVs in several countries such as India, China, South Korea, Japan has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the EV charging infrastructure coupled with rapid investment by automotive brands for opening up new BEV manufacturing centers is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as Tata Motors, BYD, Xpeng, Hyundai and some others is expected to boost the growth of the battery electric vehicles (BEVs) market in this region.

China is the major contributor in this region. In China, the market is generally driven by the rapid investment by automotive brands for developing a wide range of BEVs coupled with technological advancements in the battery manufacturing sector. Additionally, the presence of numerous automotive companies such as SAIC, NIO Inc., Li Auto Inc. and some others is playing a prominent role in shaping the industrial landscape.

Europe is expected to grow with the highest CAGR during the forecast period. The increasing demand for luxury BEVs in several prominent nations such as Germany, France, Italy, UK and some others has boosted the market growth. Also, rapid investment by government for developing the EV sector along with rise in number of EV startups is playing a prominent role in shaping the industrial landscape. Moreover, the presence of numerous market players such as Volvo Cars, BMW Group, Volkswagen AG and some others is expected to propel the growth of the battery electric vehicles (BEVs) market in this region.

Germany led the market in this region. In Germany, the market is driven by the rising sales of BEVs coupled with numerous government initiatives aimed at developing the EV infrastructure. Moreover, the presence of several EV truck manufacturers in Berlin, Munich, Hamburg, and Cologne is contributing to the industry in a positive manner.

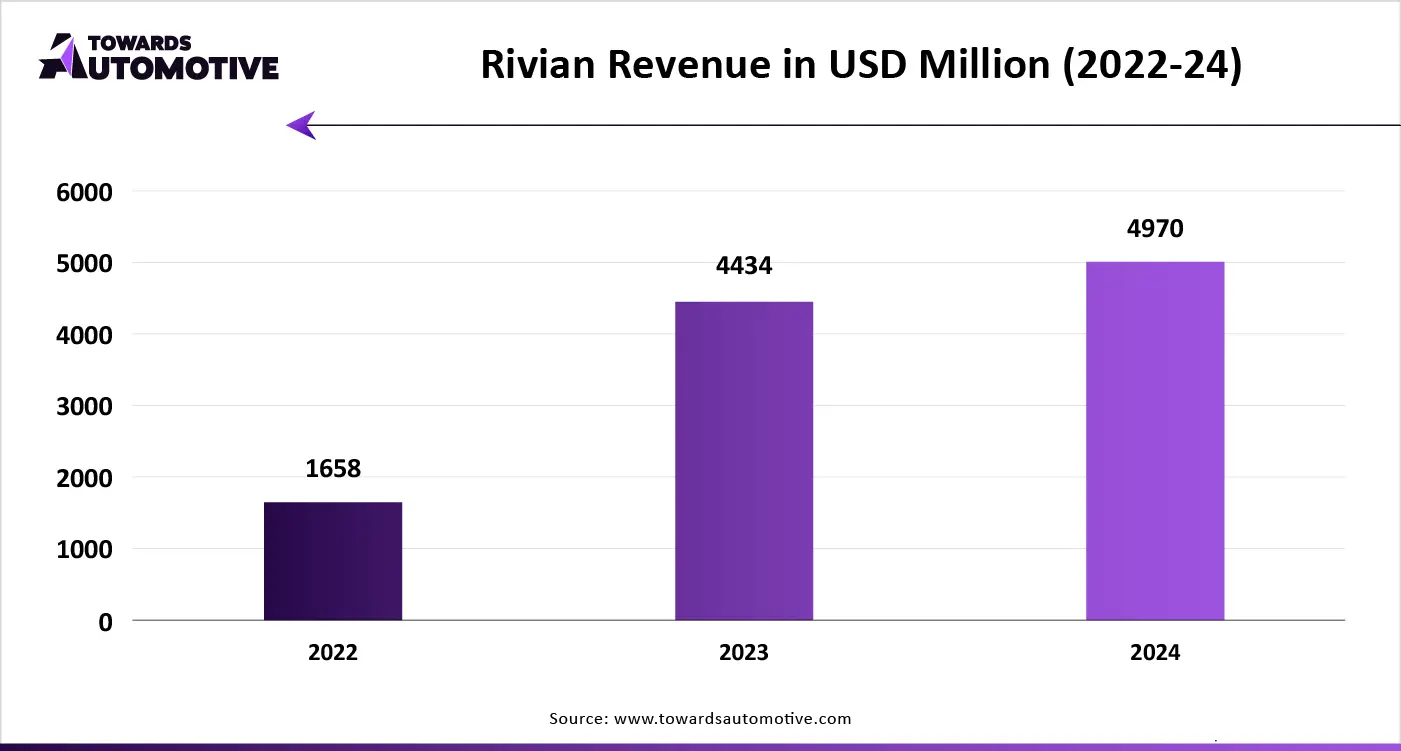

The battery electric vehicles (BEVs) market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Volvo Cars, Rivian Automotive, Inc., Tesla, Inc., BYD Auto Co., Ltd., Volkswagen AG, Hyundai Motor Company, General Motors, BMW Group, Mercedes-Benz Group AG, Kia Corporation, Tata Motors, Renault Group, Lucid Motors, XPeng Motors, Li Auto Inc., NIO Inc. and some others. These companies are constantly engaged in developing battery electric vehicles and adopting numerous strategies such as acquisitions, business expansions, joint ventures, collaborations, launches, partnerships, and some others to maintain their dominance in this industry.

By Vehicle Type

By Battery Type

By Battery Capacity

By Drive Type

By Range

By Charging Type

By End-Use Application

By Component

By Sales Channel

By Region

September 2025

September 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us