October 2025

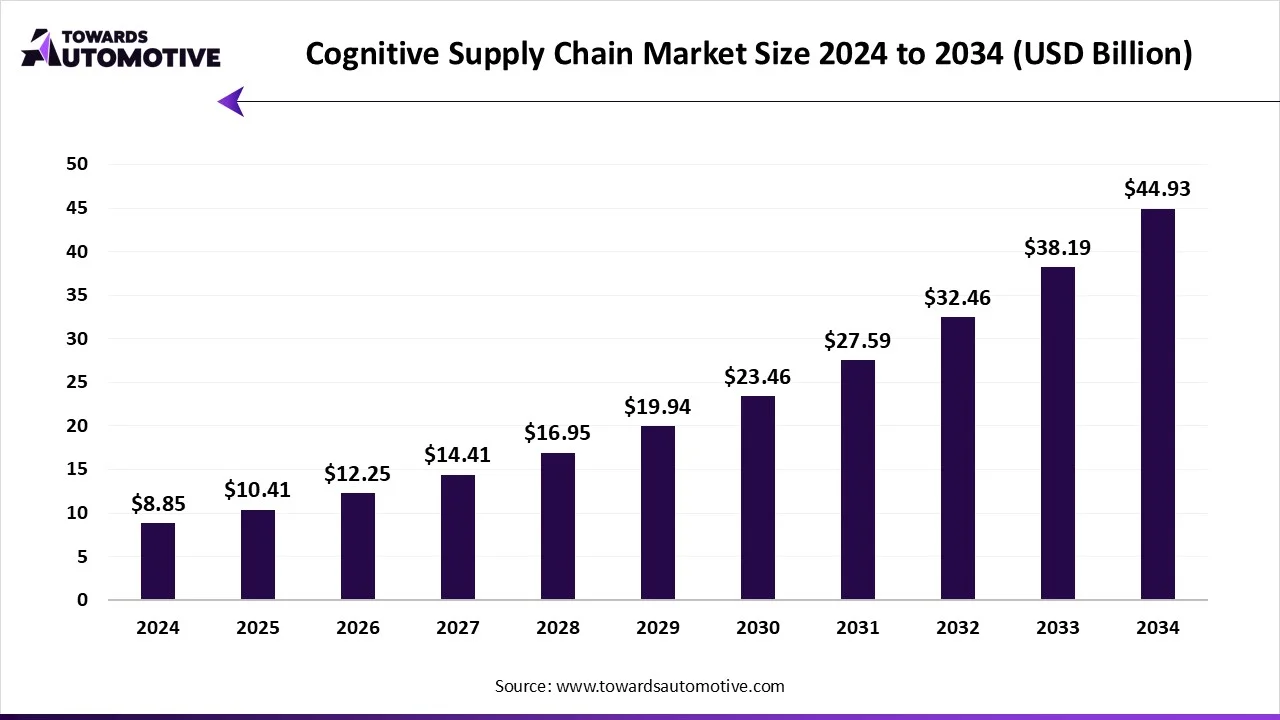

The cognitive supply chain market is expected to increase from USD 10.41 billion in 2025 to USD 44.93 billion by 2034, growing at a CAGR of 17.64% throughout the forecast period from 2025 to 2034. The rapid expansion of the e-commerce sector along with growing demand for predictive analytics & demand forecasting solutions from the manufacturing sector has boosted the market expansion.

Additionally, the integration of AI and ML in supply chain solutions coupled with rise in number of logistics providers in different parts of the world is playing a prominent role in shaping the industrial landscape. The growing use of IoT sensors and GPS devices in supply chain systems for gathering real-time insights about goods and operations is expected to create ample growth opportunities for the market players in the upcoming days.

The cognitive supply chain market is a prominent branch of the logistics industry. This industry deals in providing advanced solutions for automating supply chain operations. These solutions perform several functions including predictive analytics & demand forecasting, prescriptive planning & what-if scenario simulation, autonomous order promising & replenishment, real-time supply-chain visibility & anomaly detection, process mining & root-cause intelligence, cognitive procurement, autonomous logistics orchestration & dynamic routing and some others. Also, these solutions are integrated with different technologies such as machine learning, reinforcement learning for prescriptive/autonomous decisions, natural language processing, computer vision & sensor fusion, process mining + causal inference toolkits, knowledge graphs & causal networks for root-cause analysis and some others. The end-user of this sector comprises of retail & ecommerce, consumer packaged goods (CPG) & FMCG, automotive & aerospace manufacturing, high-tech & electronics, pharmaceuticals & life sciences, 3PLs, logistics & cold-chain operators and some others. It is designed for numerous types of buyers comprising of large global enterprises / multi-national corporations, mid-market, small & regional enterprises, 3PLs / logistics service providers and some others. This market is expected to rise significantly with the growth of the manufacturing sector in different parts of the world.

The major trends in this market consists of partnerships, rapid growth in the e-commerce sector and popularity of AI-based supply chain solutions.

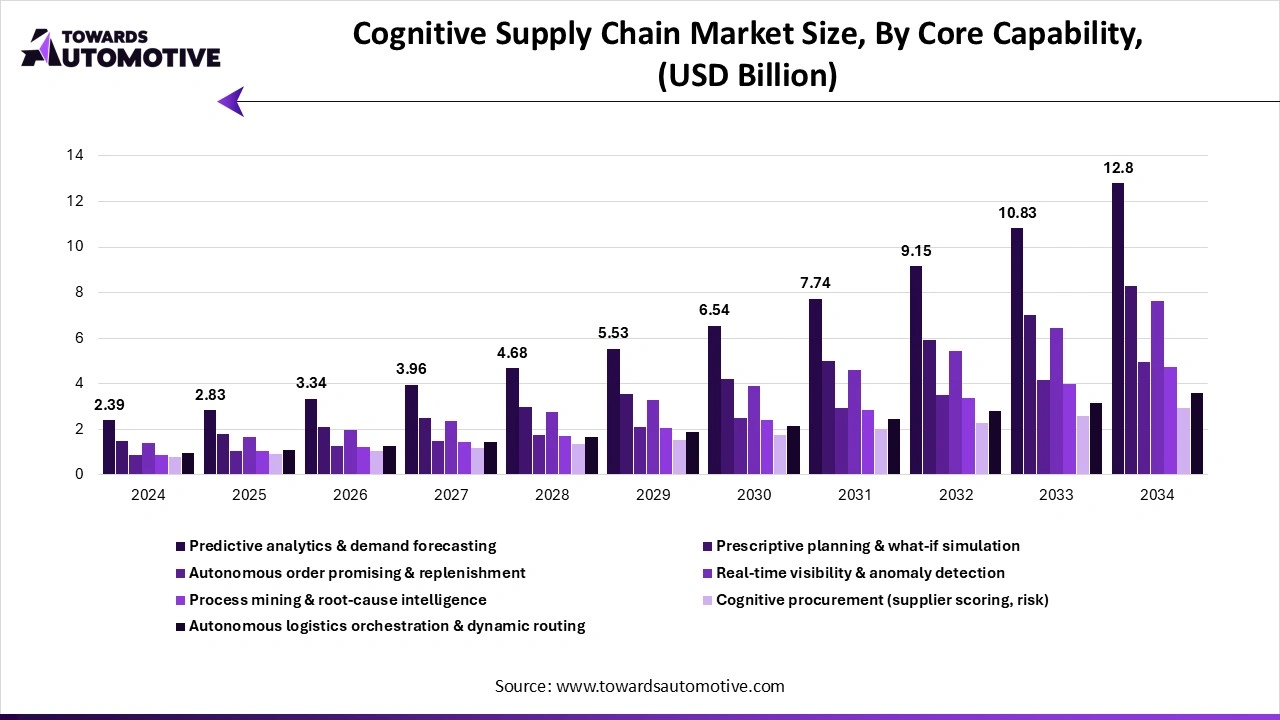

The predictive analytics & demand forecasting segment dominated the cognitive supply chain market. The growing adoption of cognitive supply chain solutions for predicting outcomes in the manufacturing sector has driven the market expansion. Additionally, the rapid deployment of SaaS / cloud-native cognitive platforms in the FMCG sector for improving forecasting capabilities is playing a prominent role in shaping the industrial landscape. Moreover, the integration of advanced supply chain solutions in the logistics sector to forecast upcoming issues related to the transportation of goods is expected to drive the growth of the cognitive supply chain market.

The autonomous logistics orchestration & dynamic routing segment is expected to expand with the highest CAGR during the forecast period. Autonomous Supply Chain Orchestration use advanced technologies such as machine learning, AI, and digital twins to create a synchronized and self-adjusting ecosystem, thereby driving the market expansion. Additionally, the growing emphasis of logistics sector to deploy autonomous logistics orchestration for risk monitoring and predicting outcomes is contributing to the industry in a positive manner. Moreover, the increasing emphasis of e-commerce companies to continuously adjust and optimize delivery routes to maintain supply chain operations is expected to drive the growth of the cognitive supply chain market.

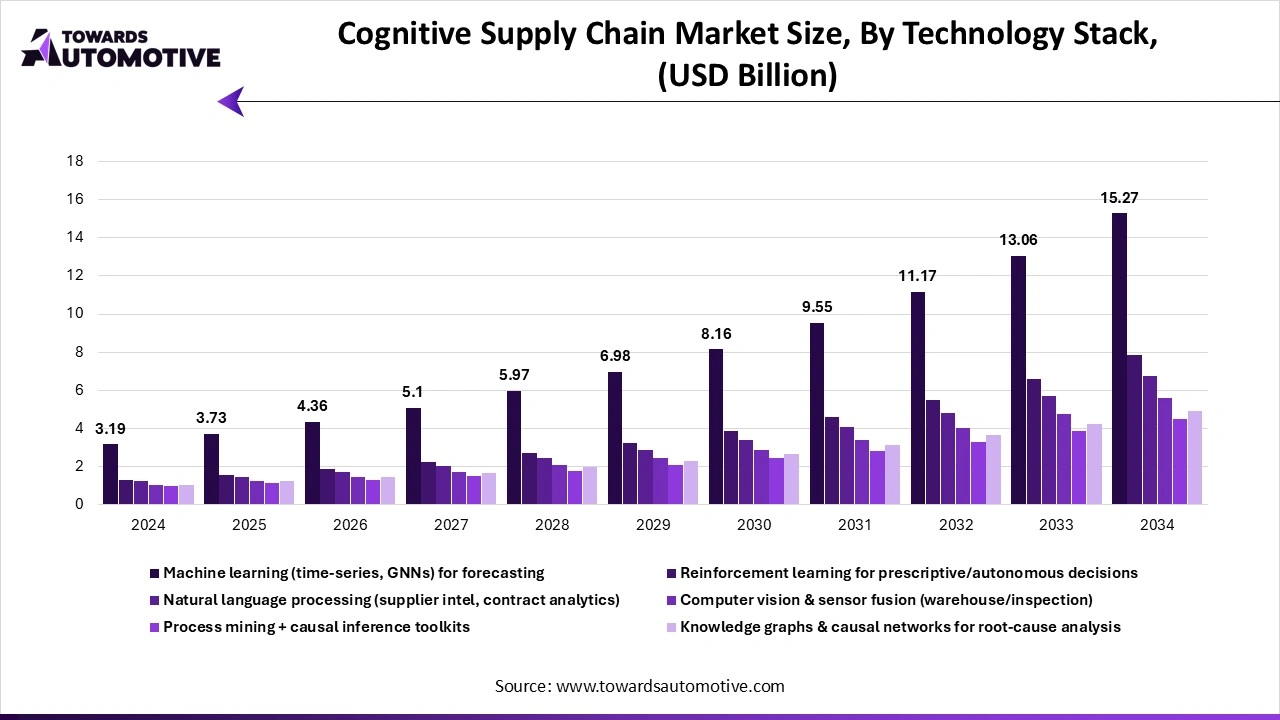

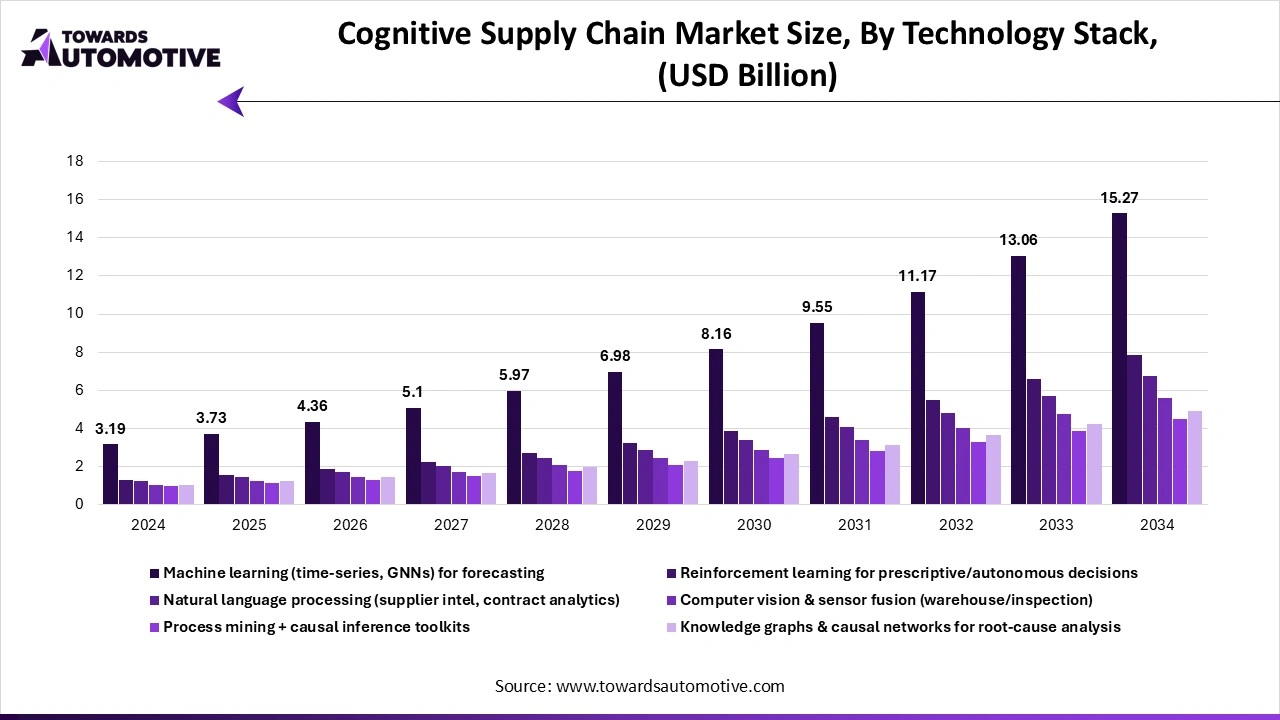

The machine learning segment dominated the cognitive supply chain market. Machine learning helps cognitive supply chains by transforming massive datasets into actionable insights for enhancing numerous applications including inventory optimization, demand forecasting, disruption prediction and some others, thereby driving the market expansion. Also, the integration of ML in supply chain solution for enhancing operational efficiency and reducing costs is playing a prominent role in shaping the industrial landscape. Moreover, numerous advantages of ML such as ability to handle complex datasets, automation of repetitive tasks, improved accuracy and decision-making through data analysis, continuous learning and adaptation and some others is expected to proliferate the growth of the cognitive supply chain market.

The reinforcement learning for prescriptive/autonomous decisions segment is expected to rise with the highest CAGR during the forecast period. The increasing demand for advanced supply chain management solutions that are capable of taking autonomous decisions has driven the market expansion. Additionally, the integration of reinforcement learning in supply chain solutions to optimize complex, dynamic, and uncertain supply chain processes is contributing to the industry in a positive manner. Moreover, partnerships among technology providers and software developers to develop reinforcement learning-based solutions is expected to foster the growth of the cognitive supply chain market.

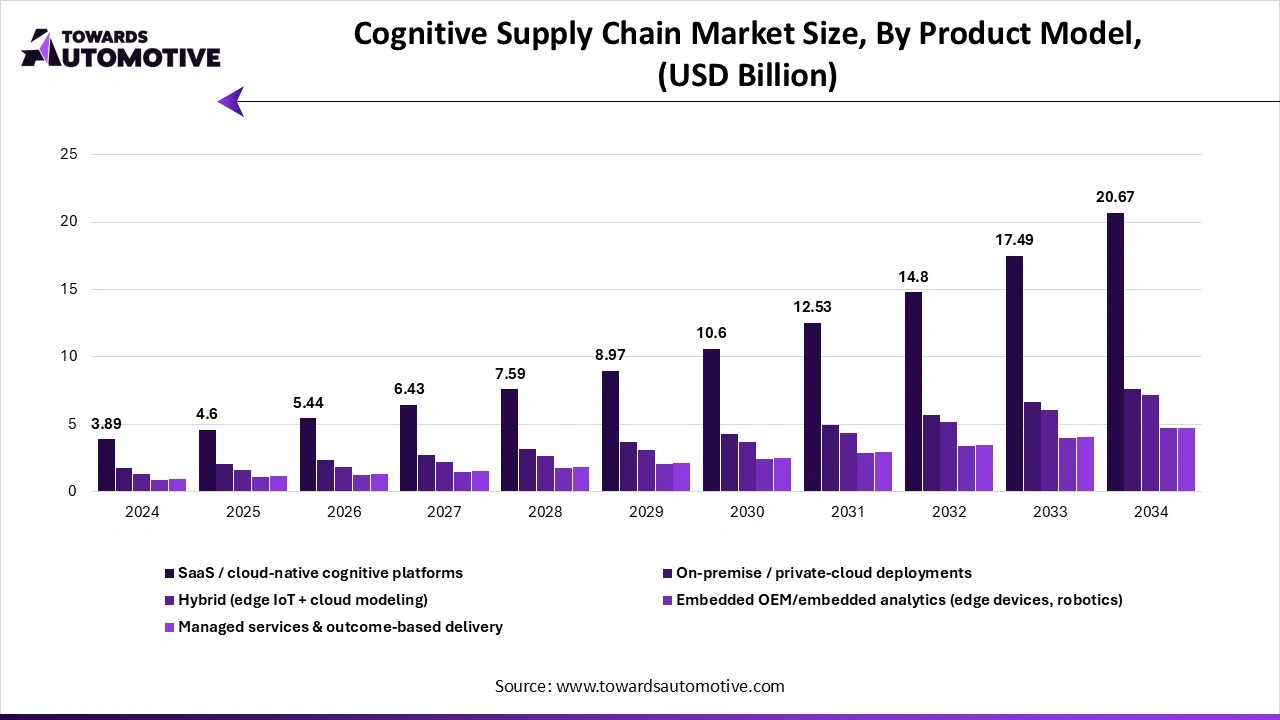

The SaaS / cloud-native segment dominated the cognitive supply chain market. The growing adoption of cloud-native supply chain solutions in the manufacturing sector has boosted the market expansion. Also, rapid investment by market players for developing cognitive supply chain solutions to cater the needs of end-users is playing a vital role in shaping the industrial landscape. Moreover, numerous advantages of SaaS-based supply chain solutions including enhanced security, improved scalability, automated workflows and some others is expected to boost the growth of the cognitive supply chain market.

The hybrid (edge IoT + cloud modeling) segment is expected to grow with the fastest CAGR during the forecast period. The rising adoption of hybrid supply chain solutions in the logistics sector to enhance flexibility and improve efficiency has driven the market growth. Additionally, numerous advantages of these supply chain solutions such as enhanced efficiency, increased resilience, greater scalability, lower costs and some others is contributing to the industry in a positive direction. Moreover, collaborations among technology providers and healthcare sector to deploy hybrid solutions is expected to drive the growth of the cognitive supply chain market.

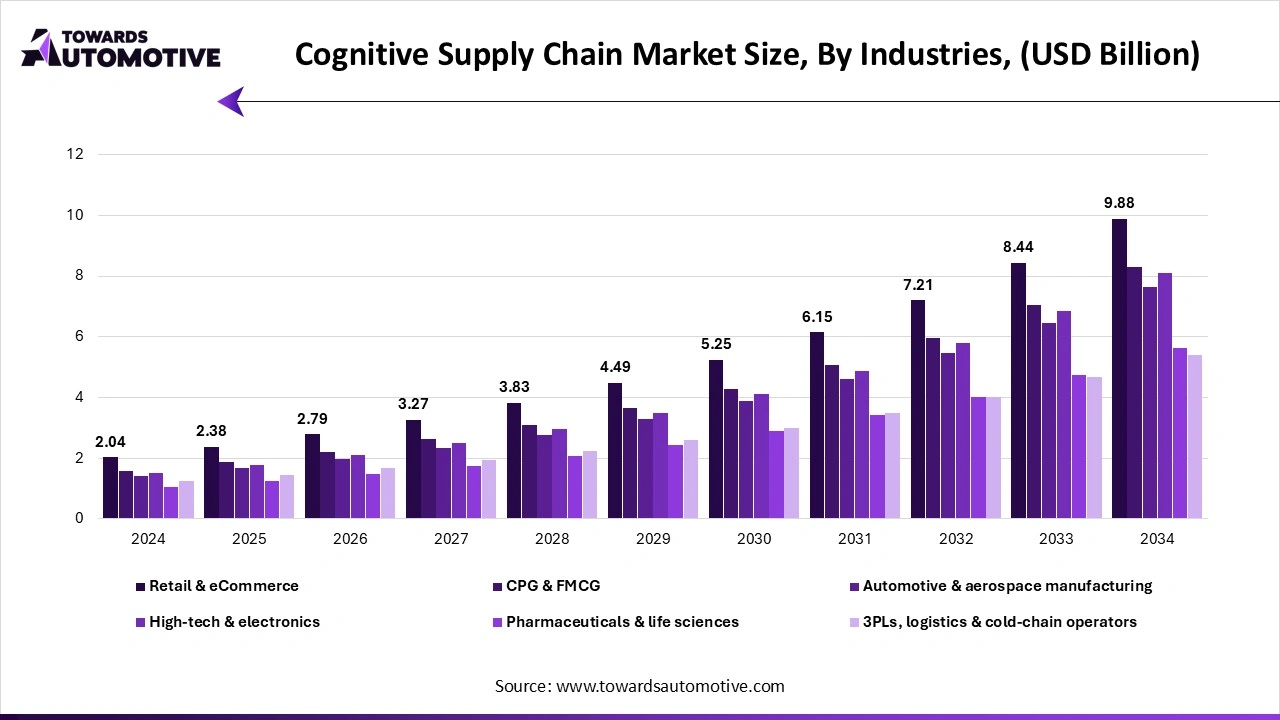

The retail & eCommerce segment led the cognitive supply chain industry. The rapid expansion of the e-commerce sector in several countries such as the U.S., France, China and some others has driven the market expansion. Additionally, rise in number of retail outlets coupled with rapid investment by e-commerce brands to integrate automated solutions in warehouses for enhancing supply chain operations is playing a prominent role in shaping the industrial landscape. Moreover, the increasing adoption of omnichannel supply chains in e-commerce platforms is expected to drive the growth of the cognitive supply chain market.

The pharmaceuticals & life sciences segment is expected to rise with the fastest CAGR during the forecast period. The rising development in the pharmaceutical sector in different nations such as India, the U.S., UK, UAE and some others has boosted the market expansion. Additionally, the growing adoption of cloud-native supply chain solutions in the pharma sector for ensuring safety and improving efficiency is contributing to the industry in a positive manner. Moreover, partnerships among pharma companies and technology providers to integrate advanced supply chain solutions for transporting medicinal items in different parts of the world is expected to foster the cognitive supply chain market.

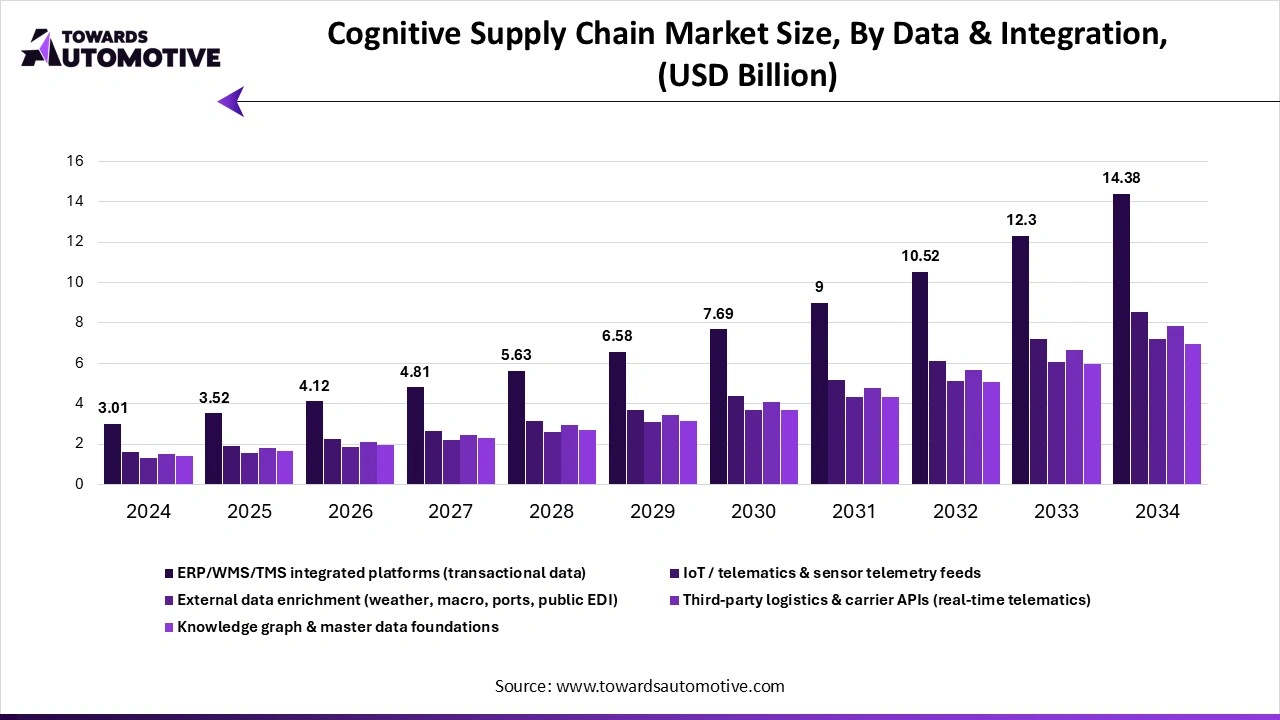

The ERP + telemetry integrations segment held the largest share of the cognitive supply chain market. The growing integration of ERP based solutions in the logistics sector for providing better supply chain visibility has boosted the market expansion. Additionally, the deployment of telemetry improves efficiency and reduces costs by providing data to optimize routes and schedules for facilitating supply chain management, thereby contributing to the industry in a positive manner. Moreover, the integration of telemetry and ERP solutions in the e-commerce sector for managing supply chain operations is expected to boost the growth of the cognitive supply chain market.

The external data enrichment segment is expected to grow with the highest CAGR during the forecast period. The integration of external data enrichment in supply chain solutions helps in streamlining operations and reducing costs, thereby driving the market expansion. Also, rapid focus of market players on developing external data enrichment-based solutions to cater the needs of logistics sector is contributing to the industry in a positive manner. Moreover, numerous advantages of external data enrichment including improving decision making, better segmentation, enhanced data quality, superior operational efficiency and some others is expected to drive the growth of the cognitive supply chain market.

The single-site segment led the cognitive supply chain market. The increasing adoption of single-site supply chain solutions in modern warehouses to optimize supply chain operations has boosted the market growth. Also, rapid investment by e-commerce brands to deploy advanced automated solutions to enhance numerous applications in warehouses is playing a prominent role in shaping the industry in a positive direction. Moreover, numerous advantages of single-site architecture such as faster UX experience, simplified navigation, improved performance and stability, reduced server load and some others is expected to foster the growth of the cognitive supply chain market.

The global multi-echelon cognitive networks segment is expected to expand with the highest CAGR during the forecast period. Multi-echelon inventory optimization ensures optimal stock levels throughout the supply chain and helps in enhancing an enterprise's agility for responding quickly and strategically to market and supply volatility anywhere in their distribution networks, thereby driving the market expansion. Additionally, rapid adoption of these solutions in the logistics sector for enhancing supply chain operations coupled with technological advancements in multi-echelon cognitive networks is playing a prominent role in shaping the industrial landscape. Moreover, numerous advantages of these networks including enhanced agility and resilience, cost reduction, demand forecasting capability, optimized inventory levels and some others is expected to propel the growth of the cognitive supply chain market.

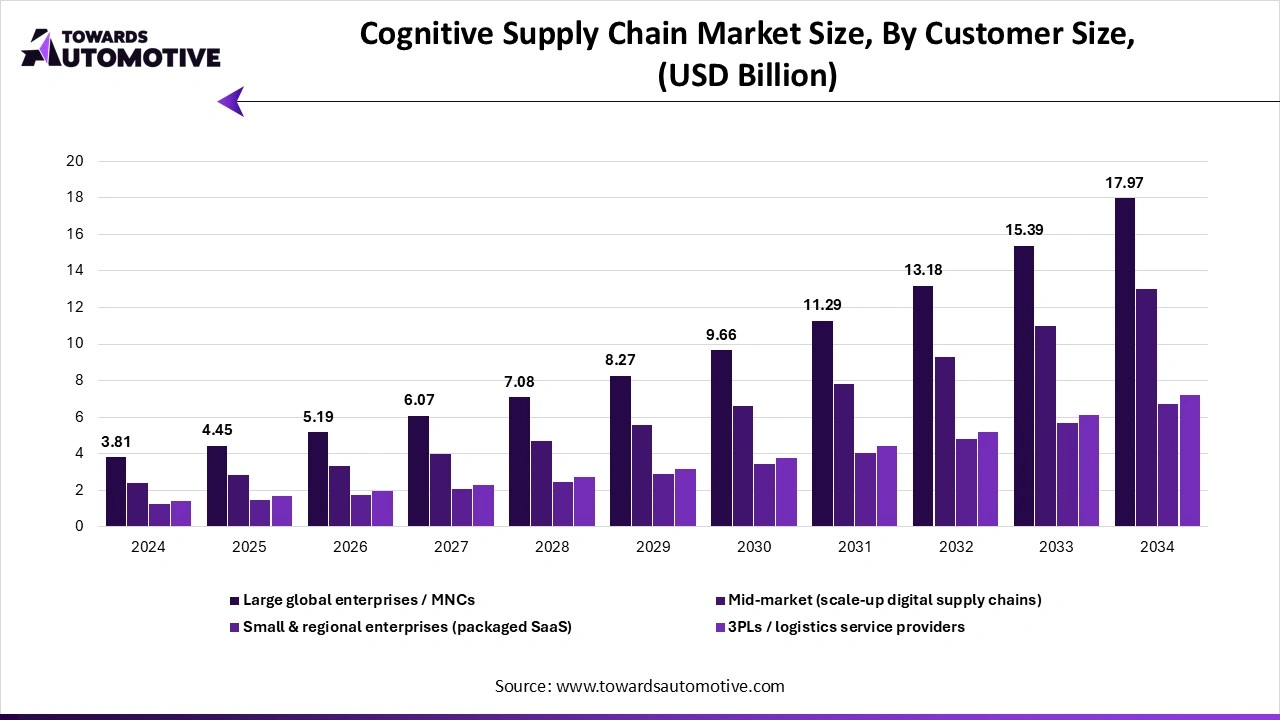

The large global enterprises / multi-national corporation segment held the largest share of the cognitive supply chain market. The growing demand for cloud-based supply chain solutions from large enterprises to maintain proper workflow has driven the market expansion. Additionally, rapid investment by MNCs to deploy AI-integrated supply chain solutions to process vast amounts of data, automate complex decisions, gather real-time insights and some others is playing a vital role in shaping the industrial landscape. Moreover, partnerships among global enterprises and market players to deploy advanced supply chain solutions is expected to drive the growth of the cognitive supply chain market.

The mid-market segment is expected to grow with the highest CAGR during the forecast period. The rising focus of mid-sized companies to deploy advanced supply chain solutions to enhance their operational efficiency has boosted the industrial expansion. Additionally, the growing adoption of ML-based solutions by mid-sized e-commerce companies to efficiently transport goods from one region to another is contributing to the industry in a positive manner. Moreover, collaborations among systems integrators and mid-sized brands to deploy cost-effective supply chain solutions is expected to propel the growth of the cognitive supply chain market.

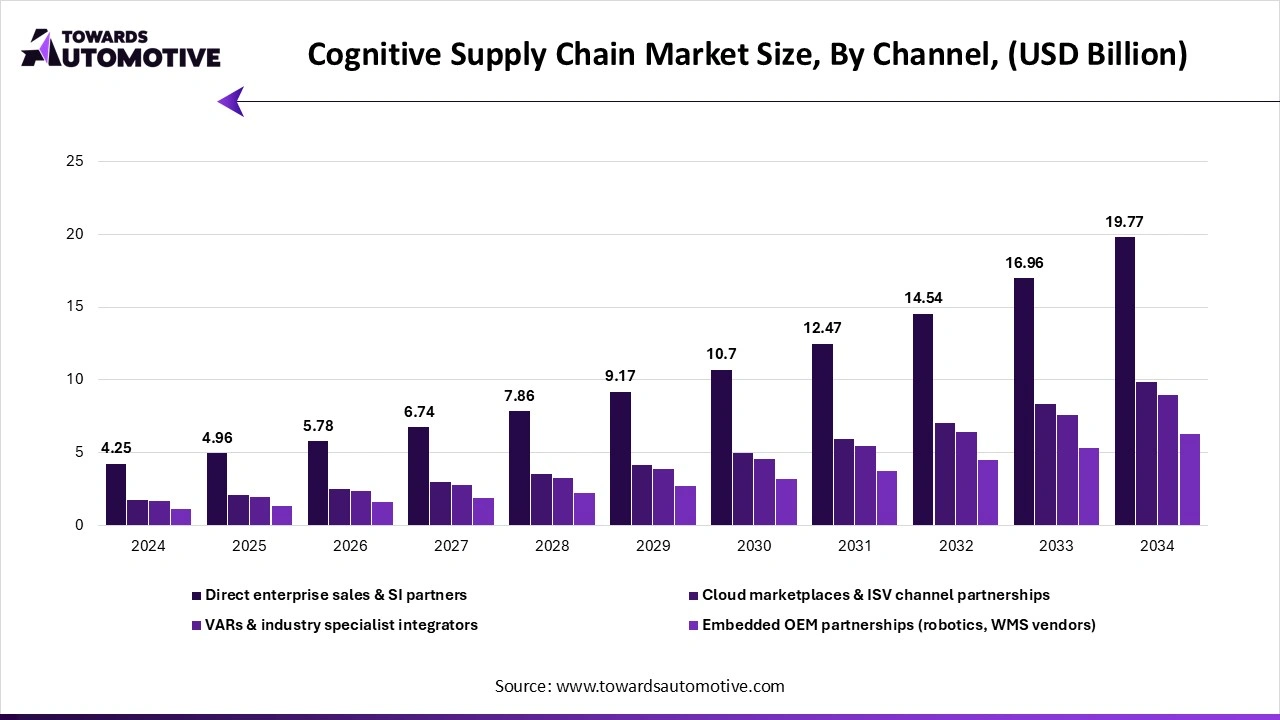

The direct enterprise sales & systems integrators segment dominated the cognitive supply chain market. The growing emphasis of individual consumers to purchase cognitive supply chain solutions from the retail enterprises has boosted the market expansion. Also, the availability of advanced software in retail outlets allow businesses to choose according to their requirements, thereby contributing to the industry in a positive manner. Moreover, partnerships among system integrators and logistics companies to deploy high-quality software for enhancing supply chain operations is expected to foster the growth of the cognitive supply chain market.

The cloud marketplaces & ISV channel partnerships segment is expected to grow with the fastest CAGR during the forecast period. The rising adoption of cloud-based supply chain solutions by the e-commerce brands to minimize risks during product delivery has boosted the market expansion. Additionally, the cloud companies are investing heavily for developing AI-integrated supply chain solutions to cater the needs of logistics sector that in turn helps in shaping the industry in a positive manner. Moreover, numerous advantages of cloud solutions including reduced capital expenditure, enhanced flexibility and scalability, advanced security and some others is expected to propel the growth of the cognitive supply chain market.

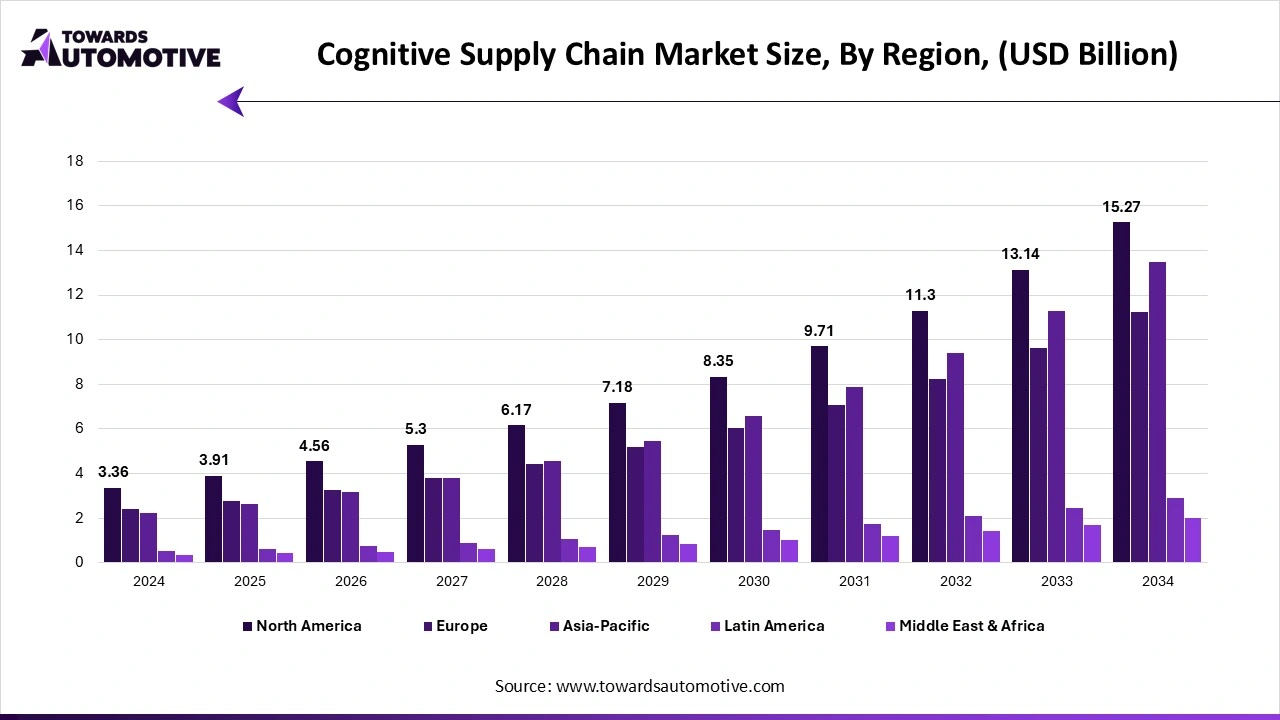

North America dominated the cognitive supply chain market. The rapid expansion of the e-commerce sector in the U.S. and Canada has driven the market expansion. Additionally, numerous government initiatives aimed at developing the 5G infrastructure coupled with rise in number of aerospace startups is playing a prominent role in shaping the industrial landscape. Moreover, the presence of several market players such as IBM, Descartes Systems Group Inc., Microsoft and some others is expected to drive the growth of the cognitive supply chain market in this region.

U.S. led the market in this region. The growing demand for advanced supply chain operations along with technological advancements in the manufacturing sector has driven the market expansion. Additionally, rise in number of startup companies dealing in supply chain solutions coupled with integration of AI-enabled platforms in the logistics sector is playing a crucial role in shaping the industrial landscape.

Asia-Pacific is expected to grow with the highest CAGR during the forecast period. The growing development in the manufacturing industry in several countries such as India, China, Japan, South Korea and some others has boosted the market growth. Also, rapid focus of automotive brands to integrate high-end supply chain management solutions in their manufacturing facilities coupled with technological advancements in the logistics sector is contributing to the industry in a positive manner. Moreover, the presence of various market players such as Panasonic, Tech Mahindra, Tata Consultancy Services and some others is expected to foster the growth of the cognitive supply chain market in this region.

China and Japan are the significant contributors in this region. In China, the market is generally driven by the presence of several technology providers coupled with rapid growth of the automotive sector. In Japan, the growing adoption of automated solutions in the logistics warehouses along with technological advancements in the high-tech & electronics industry is playing a crucial role in shaping the industry in a positive manner.

| April 2025 | Announcement |

| Victor Morales, the VP of Global System Integrators Partnerships, Google Cloud | With our new lights, we are not only focusing on technical innovation, but also on emotionally accessible communication, our superheroes are designed to motivate children to engage with the topic of safety – and at the same time show parents how important good bicycle lighting is. |

| April 2025 | Announcement |

| Javier Selgas, the CEO of Fr8Tech | Freight Technologies’ AI Lab marks a new era in logistics, where AI is not just a tool but a foundational pillar of innovation. With a commitment to research, collaboration, and technological advancement, the Company is poised to transform the logistics landscape, making cross-border freight more efficient, intelligent, and future-ready. |

| April 2025 | Announcement |

| Duncan Angove, the chief executive officer of Blue Yonder | We’ve been very pragmatic; we’ve worked with customers and been very responsible in thinking about the role that generative AI plays in improving supply chains, supply chains are critical as it relates to precision of decisioning, and generative AI has had issues over the last two years of hallucinating and not being the most accurate. |

| June 2024 | Announcement |

| Srini Kompella, the Senior Vice President, Data and AI, at HCLTech | HCLTech Enterprise AI Foundry will simplify the foundational AI infrastructure, enable integrating enterprise data with AI, streamline the creation of AI-powered applications and ensure trust, safety and reliability, fostering confident adoption. |

| May 2024 | Announcement |

| Vaibhav Vohra, the Chief Product & Technology Officer at Epicor | We know the keys to realizing the full power of AI revolve around two important things: applying AI to a well-defined, practical business issue, and leveraging high quality data, our new Epicor Grow portfolio delivers on both fronts, putting workers at the center of the intelligence ecosystem. We’re delivering deep AI integration across real-world industry workflows – unlike ‘one size fits all’ industry-agnostic ERPs – to surface actionable insights and drive efficiencies. And we’re empowering users with a rich, industry-centric data platform and no-code tools to create purpose-built data pipelines to help solve specific challenges. |

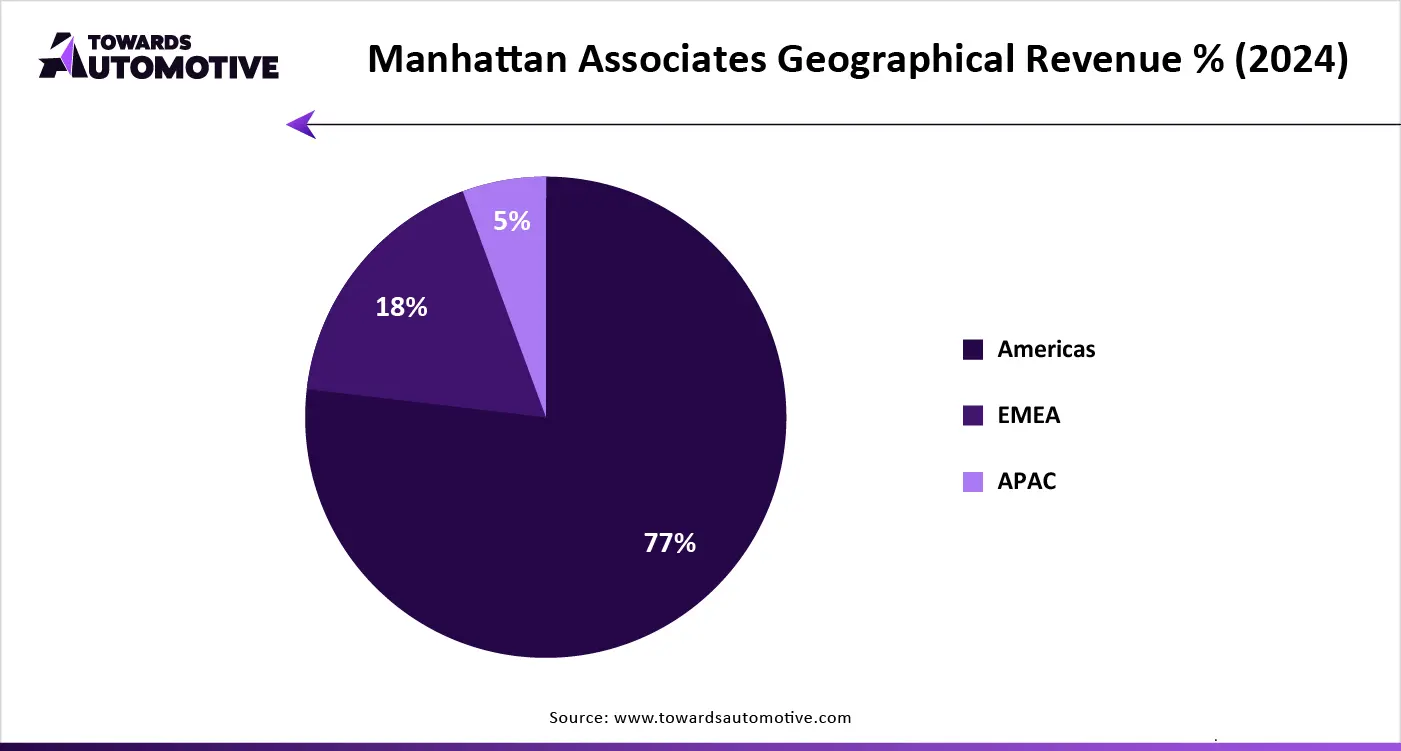

The cognitive supply chain market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of IBM, Kinaxis, Blue Yonder, Celonis, Coupa, Descartes Systems Group, E2open, Llamasoft, Manhattan Associates, Microsoft and some others. These companies are constantly engaged in providing automated solutions for enhancing supply chain operations and adopting numerous strategies such as launches, partnerships, collaborations, business expansions, acquisitions, joint ventures and some others to maintain their dominance in this industry.

By Core Capability / Functional Offering

By Technology Stack/ AI Approach

By Product Model/ Deployment

By Industries/ End-Market

By Data & Integration Layer

By Scale & Architecture

By Customer Size / Buyer Type

By Channel / Go-to-Market

By Region

October 2025

October 2025

March 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us