August 2025

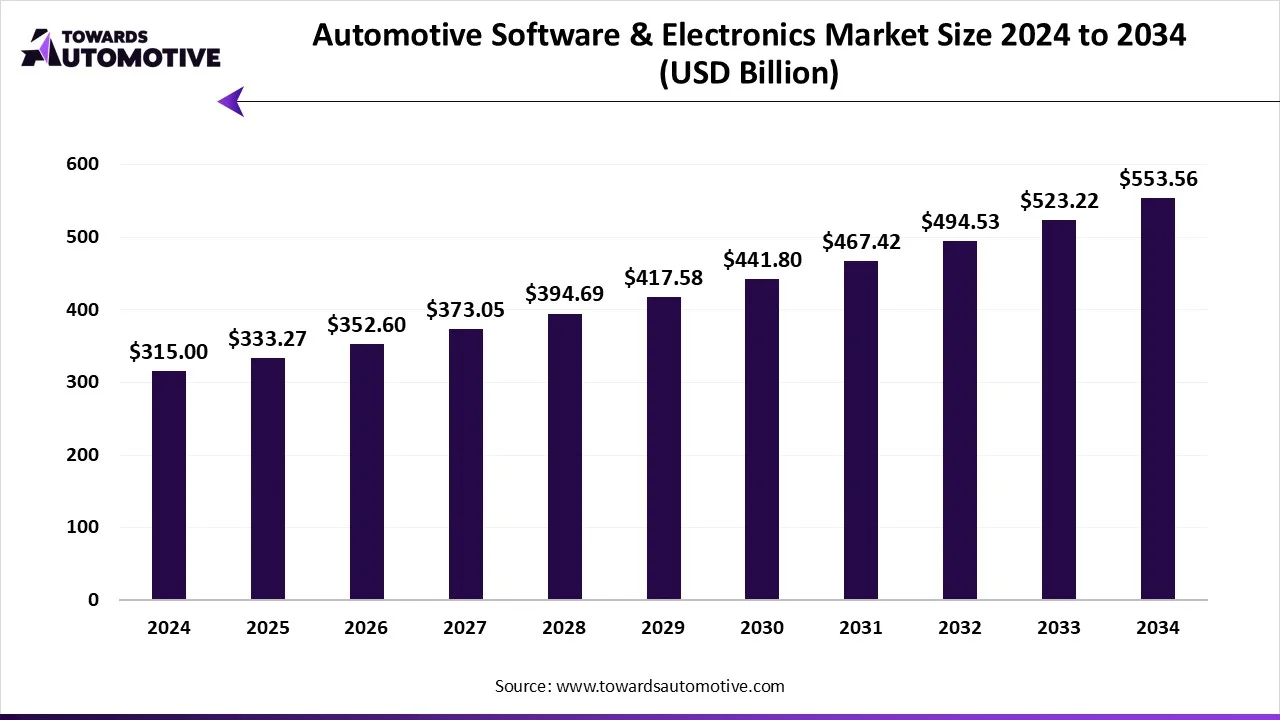

The automotive software & electronics market is set to grow from USD 333.27 billion in 2025 to USD 553.56 billion by 2034, with an expected CAGR of 5.8% over the forecast period from 2025 to 2034. The growing popularity of software-defined vehicles coupled with rapid investment by public-sector entities in the semiconductor industry is playing a vital role in shaping the industrial landscape.

Additionally, the rise in number of car rental companies along with increasing demand for driverless cars in developed nations has boosted the market expansion. The integration of AI and IoT in modern cars for enhancing the driving experience is expected to create ample growth opportunities for the market players in the upcoming days.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive software & electronics market is a prominent segment of the automotive industry. This industry deals in development and distribution of software and electronics for the automotive sector. There are numerous electronic components manufactured in this sector comprising of sensors, ECUs, power electronics, connectivity modules, microcontrollers, processors, displays and some others. Also, various types of automotive software are developed in this sector consisting of ADAS & safety software, powertrain software, infotainment & connectivity software, autonomous driving software, vehicle diagnostics software and some others. These electronics and software are designed for different types of vehicles including passenger cars, light commercial vehicles, heavy commercial vehicles, electric vehicles and some others. The end user of this sector consists of OEMs, tier 1 suppliers, aftermarket service providers, fleet operators and some others. The growing use of advanced electronic systems in modern cars has boosted the market expansion. This market is expected to rise significantly with the rise of the software industry around the world.

| Metric | Details |

| Market Size in 2025 | USD 333.27 Billion |

| Projected Market Size in 2034 | USD 553.56 Billion |

| CAGR (2025 - 2034) | 5.8% |

| Leading Region | Europe |

| Market Segmentation | By Component, By Software Type, By Vehicle Type, By Application, By Deployment Type, By End User and By Region |

| Top Key Players | Robert Bosch GmbH, Continental AG, Aptiv PLC, Denso Corporation, NXP Semiconductors, Renesas Electronics Corporation, NVIDIA Corporation, Infineon Technologies AG |

The major trends in this market consists of partnerships, business expansion and growing sales of passenger vehicles.

The electronic control units (ECUs) segment dominated the market. The growing application of ECUs in modern vehicles for managing electronic components has boosted the market expansion. Also, the rising use of ECUs in EVs for managing several safety features such as anti-lock braking systems (ABS), airbags, and stability control is playing a vital role in shaping the industry in a positive direction. Moreover, the integration of advanced ECUs for operating several functions such as lighting, door locks, climate control and some others is expected to foster the growth of the automotive software & electronics market.

The connectivity modules segment is expected to rise with the fastest CAGR during the forecast period. The growing use of advanced hardware components for connecting external networks and devices in automotive has boosted the market growth. Also, the rising application of automotive IoT modules and connectivity hubs in modern cars is contributing to the industrial expansion. Moreover, numerous advantages of connectivity modules such as enhanced safety, improved efficiency, remote vehicle management and some others is expected to boost the growth of the automotive software & electronics market.

The ADAS & safety software segment held the largest share of the market. The growing demand for ADAS-enabled vehicles in developed nations has boosted the market growth. Also, numerous government initiatives aimed at mandating ADAS in modern cars is playing a crucial role in shaping the industry in a positive direction. Moreover, the integration of advanced software in luxury cars to enhance vehicular safety is expected to boost the growth of the automotive software & electronics market.

The autonomous driving software segment is expected to rise with the fastest CAGR during the forecast period. The growing popularity of driverless vehicles in various developed nations such as the U.S., Singapore, China and some others has boosted the market growth. Also, the integration of advanced software in SDVs to enhance autonomous driving coupled with rapid investment by software companies to develop autonomous driving software is playing a positive role in shaping the industrial landscape. Moreover, the increasing adoption of autonomous cars by fleet operators to reduce dependency on drivers is expected to drive the growth of the automotive software & electronics market.

Automotive Software & Electronics Market Size, By Vehicle Type, (USD Billion)

| Year | Passenger Cars | Light Commercial Vehicles (LCVs) | Heavy Commercial Vehicles (HCVs) | Electric Vehicles (EVs) |

| 2024 | 141.75 | 63.00 | 47.25 | 63.00 |

| 2025 | 149.55 | 65.95 | 51.34 | 66.43 |

| 2026 | 158.54 | 69.55 | 52.92 | 71.60 |

| 2027 | 167.94 | 74.18 | 55.04 | 75.90 |

| 2028 | 174.12 | 79.37 | 63.62 | 77.58 |

| 2029 | 183.81 | 82.23 | 64.36 | 87.18 |

| 2030 | 200.79 | 85.14 | 67.81 | 88.06 |

| 2031 | 211.60 | 87.77 | 74.49 | 93.57 |

| 2032 | 219.09 | 96.00 | 77.09 | 102.36 |

| 2033 | 234.44 | 101.67 | 85.17 | 101.94 |

| 2034 | 253.80 | 99.97 | 93.89 | 105.90 |

The passenger cars segment led the market. The growing production of passenger vehicles in several nations such as India, China, Germany, Japan and some others has driven the market growth. Also, the rising popularity of luxury vehicles among HNIs coupled with integration of advanced software in modern cars to enhance safety is playing a vital role in shaping the industry in a positive direction. Moreover, the increasing application of advanced electronics in SUVs to improve off-roading capabilities is expected to propel the growth of the automotive software & electronics market.

The electric vehicles (EVs) segment is expected to expand with the fastest CAGR during the forecast period. The rising adoption of electric vehicles in several countries such as India, China, Canada, Germany and some others has boosted the market expansion. Additionally, the integration of advanced software in EVs to monitor battery health and enhance EV range is playing a crucial role in shaping the industrial landscape. Moreover, numerous government initiatives aimed at EV charging infrastructure along with rapid use of advanced electronics in EVs is expected to boost the growth of the automotive software & electronics market.

The ADAS & autonomous driving segment led the industry. The growing demand for autonomous cars in the U.S. and Germany has boosted the market expansion. Also, the integration of ADAS in mid-range vehicles for enhancing safety along with technological advancements in ADAS components is contributing to the industrial growth. Moreover, the increasing adoption of autonomous cars by ride-sharing companies is expected to propel the growth of the automotive software & electronics market.

The infotainment & telematics segment is expected to grow with a significant CAGR during the forecast period. The growing use of advanced infotainment systems to enhance music experience in luxury vehicles has boosted the market expansion. Also, advancements in 5G technology coupled with deployment of advanced telematics solutions in modern cars to analyze data remotely is contributing to the industrial growth. Moreover, partnerships among automotive brands and infotainment providers is expected to boost the growth of the automotive software & electronics market.

The embedded segment dominated this industry. The integration of advanced hardware components in modern vehicles to enhance driving experience has boosted the market growth. Additionally, the growing application of ECUs, controllers and sensors in modern cars to improve vehicular performance is playing a vital role in shaping the industrial landscape. Moreover, the rising demand for numerous automotive components such as power electronics, infotainment systems, displays & HMI Devices, connectivity modules from the automotive sector is expected to boost the growth of the automotive software & electronics market.

The cloud-based segment is expected to expand with the highest CAGR during the forecast period. The growing use of cloud software in modern cars to optimize vehicular functions has boosted the market expansion. Additionally, numerous offers launched by Google, Amazon and some others to provide cloud-services for the automotive consumers is contributing to the industrial growth. Moreover, several benefits of cloud-software including cost savings, scalability, enhanced collaboration, increased accessibility and some others is expected to propel the growth of the automotive software & electronics market.

The OEMs segment led the market. The growing demand for numerous electronics components such as ECUs, sensors, controllers, displays and some other from the automotive OEMs has boosted the market expansion. Also, the rising emphasis of OEMs to integrate advanced software in automotive to enhance vehicular performance is playing a vital role in shaping the industrial landscape. Moreover, collaborations among automotive brands and software providing for developing advanced automotive solutions is expected to foster the growth of the automotive software & electronics market.

The fleet operators segment is expected to rise with the fastest CAGR during the forecast period. The rise in the number of EV fleet operators in developed nations for reducing vehicular emission has driven the market expansion. Additionally, the growing use of advanced tracking solutions in commercial vehicles to maintain transparency in modern fleets is contributing to the industrial growth. Moreover, the rising adoption of advanced software by fleet operators to monitor fleet activities is expected to drive the growth of the automotive software & electronics market.

Automotive Software & Electronics Market Size, By Region, (USD Billion)

| Year | North America | Europe | Asia-Pacific | Latin America | Middle East & Africa |

| 2024 | 78.75 | 94.50 | 88.20 | 31.50 | 22.05 |

| 2025 | 83.31 | 100.44 | 93.71 | 32.56 | 23.25 |

| 2026 | 89.06 | 105.54 | 99.08 | 32.87 | 26.04 |

| 2027 | 92.64 | 109.21 | 106.72 | 38.04 | 26.44 |

| 2028 | 98.79 | 120.83 | 107.75 | 42.37 | 24.94 |

| 2029 | 111.68 | 125.80 | 116.75 | 39.26 | 24.09 |

| 2030 | 114.94 | 135.93 | 114.30 | 42.17 | 34.47 |

| 2031 | 115.19 | 146.42 | 122.18 | 47.92 | 35.73 |

| 2032 | 125.25 | 151.88 | 131.24 | 47.36 | 38.80 |

| 2033 | 128.36 | 154.46 | 143.36 | 52.03 | 45.00 |

| 2034 | 167.62 | 155.14 | 150.77 | 43.32 | 36.71 |

Europe dominated the automotive software & electronics market. The growing demand for sports cars in several countries such as Germany, Italy, France and some others has boosted the market growth. Also, numerous government initiatives aimed at rising awareness about road safety coupled with rapid investment by automotive brands such as BMW, Audi, Porsche and some others for opening new manufacturing facilities is further adding to the industrial expansion. Moreover, the presence of various market players such as ZF Friedrichshafen AG, Valeo SA, NXP Semiconductors and some others is expected to boost the growth of the automotive software & electronics market in this region.

Germany led the market in this region. The growing demand for luxury vehicles coupled with technological advancements in the automotive sector has boosted the market expansion. Additionally, the presence of several automotive electronics companies along with rising production of commercial vehicles is accelerating the industry in a positive way.

Asia Pacific is expected to expand with the fastest CAGR during the forecast period. The rising sales of affordable EVs in various countries such as Indonesia, China, Vietnam, India and some others has driven the market growth. Also, the growing awareness of consumers to purchase high-safety vehicles coupled with rapid development in the software industry is contributing to the industry in a positive direction. Moreover, the presence of several market players such as Denso Corporation, Huawei Technologies, Samsung, LG Innotek, Panasonic Corporation and some others is expected to propel the growth of the automotive software & electronics market in this region.

China is the major contributor in this region. In China, the market is generally driven by the growing sales of EVs coupled with abundance of essential raw materials at low prices. Moreover, the rise in number of automotive research institutes along with presence of several automotive brands such as BYD, XPENG, Xiaomi and some others is contributing to the market growth.

In April 2025, Jack Weast, the vice president and general manager of Intel Automotive made an announcement stating that, "Intel is redefining automotive compute with our second-generation SDV SoC, combining the flexibility of chipset technology with our proven whole-vehicle approach. Together with our partners, we're solving real industry challenges from energy efficiency to AI-driven experiences to make the software-defined vehicle revolution a reality for all."

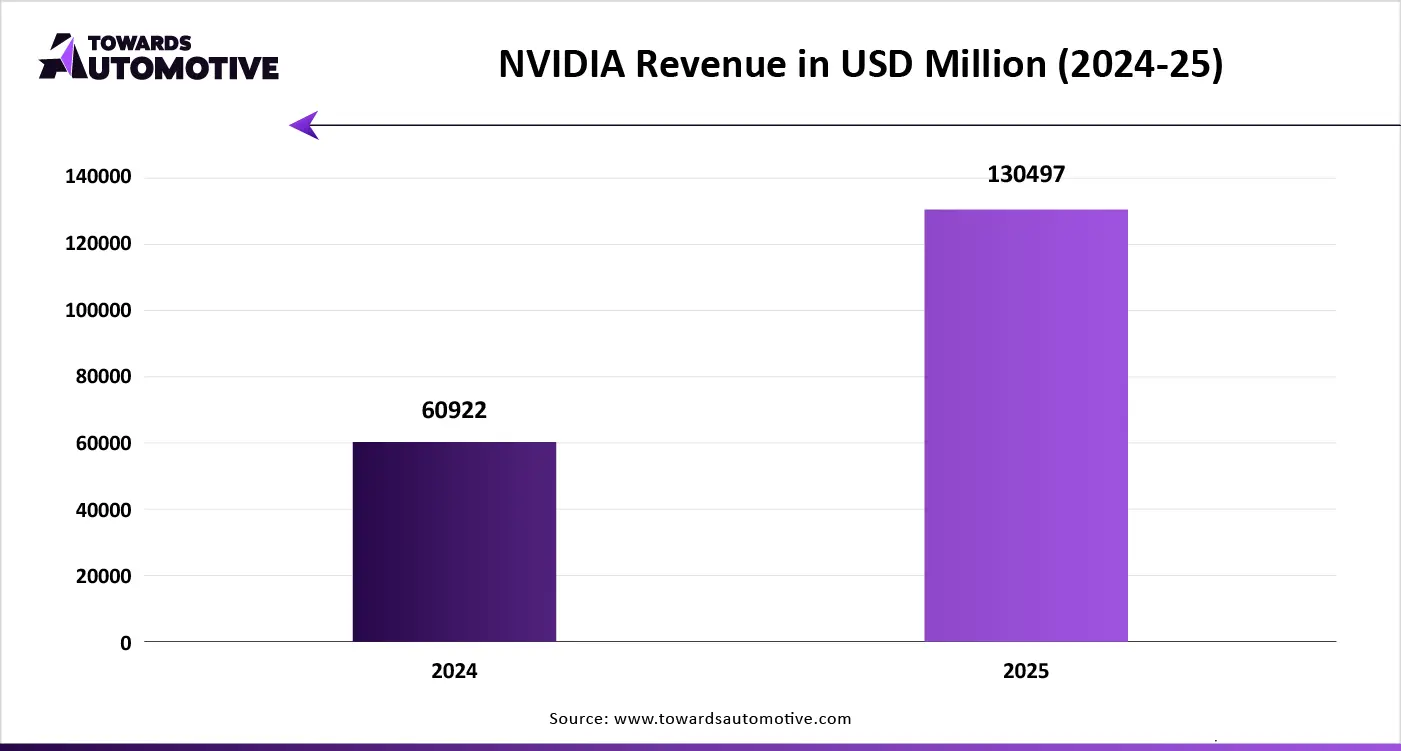

The automotive software & electronics market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Robert Bosch GmbH, Continental AG, Aptiv PLC, Denso Corporation, NXP Semiconductors, TTTech Auto, Magna International Inc., Renesas Electronics Corporation, NVIDIA Corporation, Infineon Technologies AG, Texas Instruments Inc., Harman International (Samsung), BlackBerry QNX, Panasonic Corporation, Visteon Corporation, ZF Friedrichshafen AG, Intel Corporation (Mobileye), Elektrobit (Continental AG), Valeo SA, Huawei Technologies Co., Ltd. and some others. These companies are constantly engaged in developing electronics and software for the automotive sector and adopting numerous strategies such as joint ventures, business expansions, launches, collaborations, partnerships, acquisitions, and some others to maintain their dominance in this industry.

By Component

By Software Type

By Vehicle Type

By Application

By Deployment Type

By End User

By Region

August 2025

August 2025

August 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us