September 2025

The general delivery & transportation market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. The rising development in cross-border trade activities coupled with rapid investment by government of several countries for developing the logistics sector is driving the market growth.

Additionally, the increasing popularity of e-commerce platforms along with growing adoption of logistics services by retail sector and pharma companies for delivering sensitive goods in isolated areas has played a prominent role in shaping the industrial landscape. The rising emphasis on adopting green logistics is expected to create ample growth opportunities for the market players in the upcoming years.

The general delivery & transportation market is a crucial segment of the logistics industry. This industry deals in delivering goods in different parts of the world. There are several types of services provided by this sector comprising of last-mile delivery service, postal service, courier services, freight services and some others. These services are operated using various modes of transportation including roadways, airways, marine and railways. It finds application in numerous end-user industries consisting of e-commerce, retail, healthcare & pharmaceuticals, automotive, construction & materials, agriculture, manufacturing & industrial, food & beverages, and some others. The growing adoption of EVs in the logistics sector has contributed to the market expansion. This market is expected to rise significantly with the growth of the e-commerce sector around the globe.

| Metric | Details |

| Key Market Drivers | - E-commerce and digital retail growth |

| Leading Region | Asia Pacific |

| Market Segmentation | By Mode of Transportation, By Service Type, By Application/End-Use Industry, By Delivery Timeframe, By Shipment Weight, By Customer Type, By Technology Adoption, By Region |

| Top Key Players | FedEx Corporation, United Parcel Service (UPS), DHL Group (Deutsche Post AG), Amazon Logistics, DB Schenker, Kuehne + Nagel International AG, Maersk Line (AP Moller Maersk), C.H. Robinson. |

The major trends in this market consists of partnerships, opening of warehouses and investments in the logistics sector.

Several market players are partnering with vessels providers to launch new marine-based logistics service to cater the needs of the end-users. For instance, in May 2025, Maersk signed a MoU with Hyundai. This partnership is done for launching a logistics service based on marine transportation. (Source: Maersk)

Numerous logistics companies are opening up new warehouses to enhance the logistics operations in different parts of the world. For instance, in April 2025, Maersk announced to open a new warehouse in France. This new warehouse is inaugurated to enhance the logistics operations in this nation. (Source: Maersk)

Government of several countries are investing heavily for developing the logistics sector around the globe. For instance, in May 2025, the government of Maharashtra in India announced to invest around Rs 5000 crores. This investment is done for enhancing the logistics sector across this nation. (Source: The Economic Times Business Verticals)

The road transport (LCV + HCV) segment led the market with 45%. The increasing demand for delivering dairy items has increased the demand for road logistics, thereby driving the market expansion. Additionally, rapid adoption of electric vehicles in the logistics sector to reduce vehicular emission along with numerous government initiatives aimed at developing the road infrastructure is expected to boost the growth of the general delivery & transportation market.

The drone & air freight segment is expected to expand with the highest CAGR during the forecast period. The growing popularity of last-mile delivery services has increased the demand for UAVs to enhance logistics operations, thereby boosting the market growth. Moreover, rapid investment by battery companies for developing high-quality drone batteries to provide superior backups coupled with rising adoption of drones in the e-commerce sector is expected to propel the growth of the general delivery & transportation market.

The courier, express & parcel (CEP) segment dominated the market with a share of 38%. The growing use of air-based logistics services to transport parcels from one city to another in short duration of time has boosted the market expansion. Moreover, the rapid adoption of express logistics services for faster delivery of medicinal items and important goods is expected to foster the growth of the general delivery & transportation market.

The last-mile delivery segment is expected to rise with the fastest CAGR during the forecast period. The rising popularity of last-mile delivery services in urban areas to deliver goods in proper time period has boosted the market expansion. Moreover, the increasing use of drones for operating last-mile delivery services coupled with growing emphasis on last-mile delivery services by logistics providers is expected to drive the growth of the general delivery & transportation market.

The e-commerce segment led the market with 42%. The rising use of e-commerce platforms for purchasing and selling goods has increased the demand for efficient logistics services, thereby driving the market expansion. Also, numerous benefits and offers provided by e-commerce platforms to purchase goods along with rapid investment by startup companies to develop high-quality drones for the e-commerce sector is expected to drive the growth of the general delivery & transportation market.

The health & pharma segment is expected to grow with the fastest CAGR during the forecast period. The growing demand for air-based logistics services to transport medicinal items such as vaccines, medicines and some others at shorter time period has boosted the market expansion. Additionally, partnerships among logistics companies and pharma brands to launch new logistics services for delivering healthcare products in different parts of the world is expected to boost the growth of the general delivery & transportation market.

The standard (4–7 Days) segment held the dominant share of the industry with 34%. The rising trend of purchasing consumer goods such as smartphones, laptops, tablets and some others from online platforms requires around 4-7 days, thereby driving the market expansion. Moreover, increasing emphasis of logistics companies to launch standard delivery services in isolated areas is expected to propel the growth of the general delivery & transportation market.

The same-day delivery segment is expected to expand with the highest CAGR during the forecast period. The growing use of same-day-delivery services to deliver perishable items such as milk, cheese, yogurt and some others has boosted the market expansion. Additionally, rise in number of logistics startups dealing in same-day delivery services is expected to boost the growth of the general delivery & transportation market.

The 2-20 kg segment dominated the industry with a share of 40%. The rising trend of purchasing grocery items from several online platforms such as Amazon, Flipkart, Walmart and some others has increased the demand for efficient logistics solutions, thereby driving the market growth. Moreover, the growing adoption of two-wheeler for delivery goods that are weighed between 2-20 kg is expected to propel the growth of the general delivery & transportation market.

The <2 kg segment is expected to rise with the fastest CAGR during the forecast period. The availability of light-weight consumer goods in online platforms has increased the demand for quick delivery options, thereby driving the market expansion. Additionally, the increasing adoption of drone-based logistics services for transporting goods that weigh less than 2 kgs in urban areas is expected to drive the growth of the general delivery & transportation market.

The B2C segment held the highest share of the industry with 48%. The growing adoption of air-freight services by e-commerce platforms to deliver goods from one nation to another has boosted the market expansion. Moreover, partnerships among pharmaceutical companies and logistics providers to launch superior logistics services to deliver medicinal products in different regions is expected to proliferate the growth of the general delivery & transportation market.

The C2C segment is expected to rise with the highest CAGR during the forecast period. The rising adoption of road logistics services to deliver goods from local shops to consumers has boosted the market growth. Also, rise in number of startup companies engaged in delivering C2C logistics services in India and Canada is expected to drive the growth of the general delivery & transportation market.

The GPS/telematics segment dominated the industry with a share of 30%. The growing use of GPS trackers in the logistics sector to track the location of goods has boosted the market growth. Additionally, the rising cases of goods misplacement along with integration of advanced telematics solutions in modern warehouses is expected to foster the growth of the general delivery & transportation market.

The AI/ML-based routing & drone systems segment is expected to expand with the highest CAGR during the forecast period. The growing use of drones in the logistics sector for delivering goods in urban areas due to its ability to escape road traffic has boosted the market growth. Additionally, the rising adoption of AI/ML based routing services in the transportation sector to maintain transparency and lessen mistakes is expected to propel the growth of the general delivery & transportation market.

Asia Pacific led the general delivery & transportation market with a share of 38% and is expected to hold its position during the forecast period. The growing popularity of last-mile delivery services in several countries such as India, China, Japan, South Korea, Singapore, Taiwan and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the logistics sector coupled with rise in number of pharmaceutical exporters is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as Kerry Logistics, Yusen Logistics, Nippon Express and some others is expected to propel the growth of the general delivery & transportation market in this region.

China and India contribute significantly in this region. In China, the market is generally driven by the rising sales of consumer electronic items and automotive products. In India, the growing export of medicinal items along with rapid proliferation of online shopping is playing a significant role in shaping the industrial landscape.

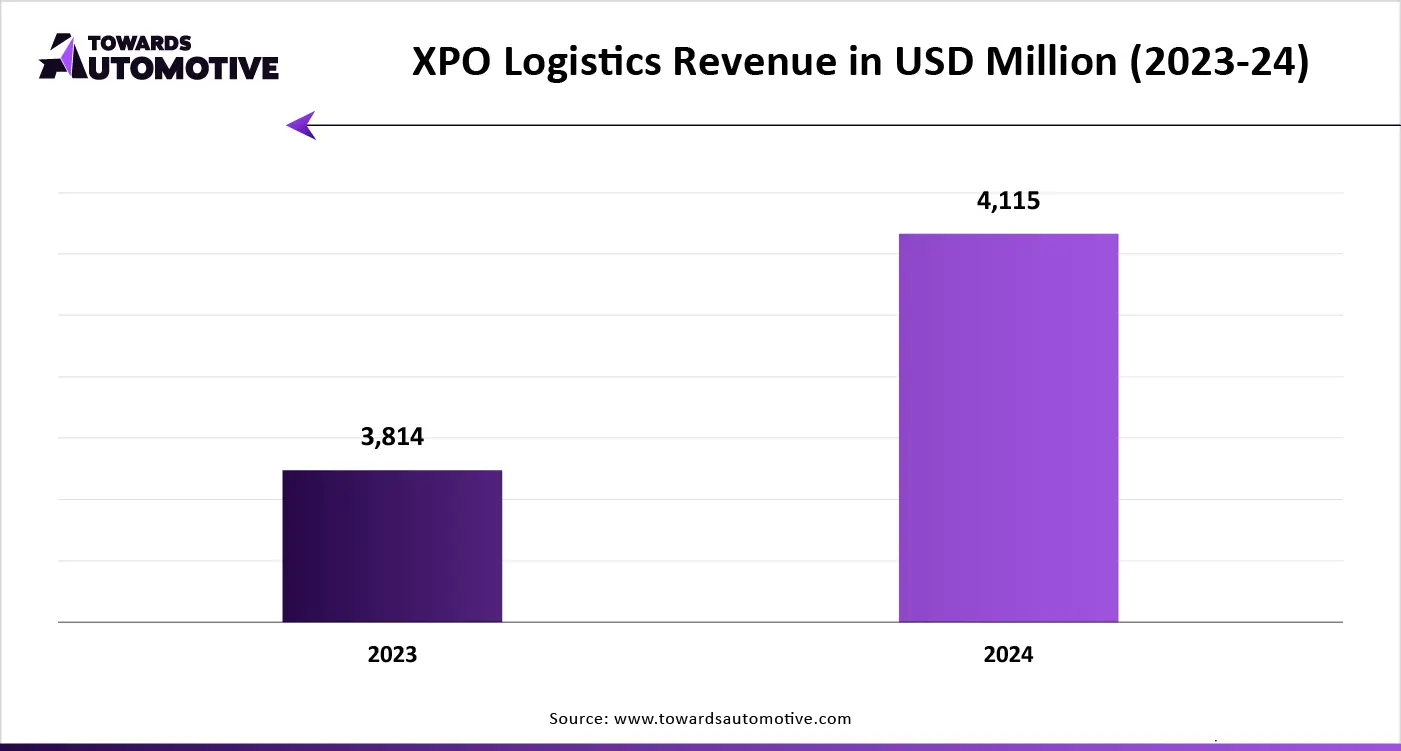

North America is expected to rise with a significant CAGR during the forecast period. The rising adoption of e-commerce platforms for purchasing goods in the U.S. and Canada has increased the demand for superior logistics services, thereby driving the market growth. Also, rapid investment by government for adopting green logistics coupled with increasing adoption two-wheelers for delivering retail items is further contributing to the industrial expansion. Moreover, the presence of various logistics companies such as C.H. Robinson, XPO Logistics, UPS and some others is expected to drive the growth of the general delivery & transportation market in this region.

U.S. dominated the market in this region. The market is generally driven by the rapid development in the e-commerce sector coupled with the increasing demand for military logistics services. Moreover, the growing adoption of electric bikes for delivering goods along with rapid investment by market players to construct new warehouses is further contributing to the industry in a positive manner.

The general delivery & transportation market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Kuehne + Nagel International AG, Maersk Line (AP Moller Maersk), FedEx Corporation, United Parcel Service (UPS), DHL Group (Deutsche Post AG), Amazon Logistic, SF Express, Blue Dart Express Ltd, XPO Logistics, DB Schenker, C.H. Robinson, DHL Supply Chain, Nippon Express Co., Ltd., Yamato Holdings, Cainiao (Alibaba Logistics), China Post Group, La Poste (GeoPost), TNT Express (FedEx), J.B. Hunt Transport Services, CEVA Logistics (CMA CGM Group) and some others. These companies are constantly engaged in providing superior logistics services and adopting numerous strategies such as launches, collaborations, business expansions, acquisitions, partnerships, joint ventures, and some others to maintain their dominance in this industry.

By Mode of Transportation

By Service Type

By Application/End-Use Industry

By Delivery Timeframe

By Shipment Weight

By Customer Type

By Technology Adoption

By Region

September 2025

October 2025

September 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us