August 2025

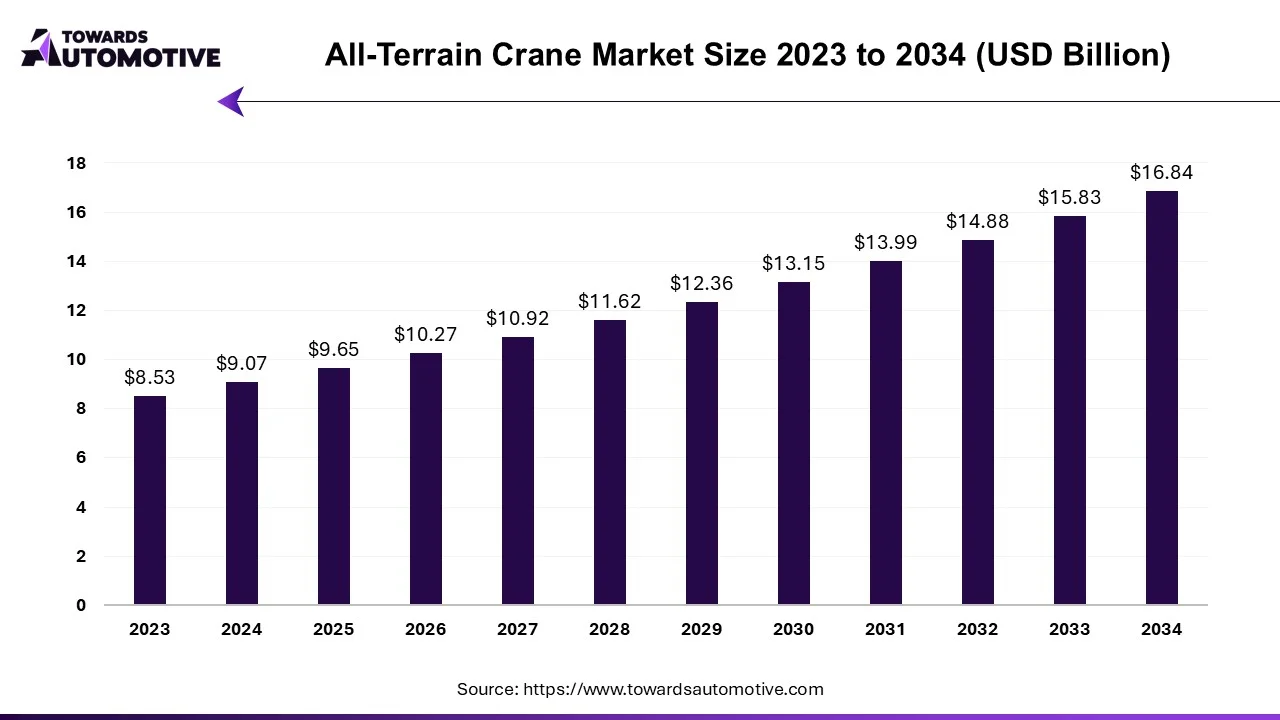

The all-terrain crane market is expected to grow from USD 9.65 billion in 2025 to USD 16.84 billion by 2034, with a CAGR of 6.38% throughout the forecast period from 2025 to 2034.

The all-terrain crane market is a prominent segment of the heavy equipment industry. This industry deals in manufacturing and distribution of all-terrain cranes across the world. These cranes are available in the market by different capacity including less than 200 tons, 200-500 tons, more than 500 tons and some others. It finds applications in various end-use sectors comprising of construction, industries, utilities and some others. The rise in number of residential constructions in different parts of the world has boosted the market expansion. This market is expected to rise significantly with the growth of the mining sector in different parts of the globe.

The major trends in this industry consists of plug-in-hybrid cranes, electric all-terrain cranes, and increase in number of constructions.

Several crane manufacturers have started developing plug-in-hybrid all-terrain cranes to reduce emission. For instance, in April 2025, Manitowoc launched a plug-in hybrid all-terrain crane. This crane supports HVO 100 fuel that helps in reducing 90% emission while travelling. (Source: OEM Off-Highway)

Various market players are investing heavily for designing electric all-terrain cranes which helps in combating pollution and reducing maintenance cost. For instance, in April 2025, Liebherr launched an electric all-terrain crane named as ‘LTM 1150-5.4E’. This crane is equipped with weighing capacity of around 150 tons. (Source: Liebherr)

The demand for all-terrain cranes has gained traction in recent times due to rise in number of commercial constructions in developed nations. According to the Australian Bureau of Statistics, around 6104 private office construction were approved in Australia during May 2025. (Source: ABS business)

The less than 200 tons segment held the largest share of the market. The demand for less than 200 tons cranes has rapidly increased due to its application in constructing bridges and roads, thereby driving the market growth. Additionally, the rising use of these cranes for installing wind turbines in remote areas is further adding to the industrial expansion. Moreover, the increased emphasis on developing electric cranes with weighing capacity of less than 200 tons is likely to propel the growth of the all-terrain crane market.

The 200-500 tons segment is anticipated to rise with a considerable CAGR during the forecast period. The demand for 200-500 tons cranes has rapidly increased in mining sector and oil & gas industry, thereby driving the market growth. Also, the rising applications of these cranes in port and harbor operations for handling heavy cargo and loading containers is contributing positively to the overall industrial expansion. Moreover, numerous advantages of 200-500 tons all-terrain cranes such as mobility, versatility, flexibility, adaptability and some others is likely to foster the growth of the all-terrain crane market.

The construction segment dominated this industry. The rise in number of office building in numerous countries such as the U.S., India, Japan, UK, Germany and some others has driven the market growth. Additionally, rapid investment by government for developing the road infrastructure in different countries is further contributing to the industrial growth. Moreover, constant research and development related to production of all-terrain cranes to cater the needs of the construction sector is likely to boost the growth of the all-terrain crane market.

The industries segment is predicted to rise with a significant CAGR during the forecast period. The rising use of all-terrain cranes in oil and gas industry for pipeline installation and heavy equipment handling has boosted the market expansion. Additionally, numerous applications of these cranes in power management industry and mining sector is contributing to overall the industrial growth. Moreover, market players are constantly engaged in designing new cranes to cater the needs of diverse industries, thereby driving the growth of the all-terrain crane market.

North America held the highest share of the all-terrain crane market. The rise in number of residential constructions in several places such as Ontario, New York, Chicago, San Diego, Toronto, Montreal and some others has increased the demand for all-terrain cranes, thereby driving the market expansion. Also, the rapid adoption of these cranes in numerous industries such as mining and telecommunication is further contributing to the industrial growth. Moreover, the presence of several market players such as Elliott Equipment Company, Manitex International Inc., Link-Belt Cranes, Altec Industries and some others is projected to boost the growth of the all-terrain crane market in this region.

U.S. dominated the market in this region. The growing adoption of electric all-terrain cranes in construction sectors for reducing emission has boosted the market growth. Additionally, rapid investment by government for strengthening the maritime industry is further contributing to the overall industrial expansion.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The rise in number of multistoried buildings in several countries such as China, Japan, India and some others is increasing the demand for all-terrain cranes, thereby fostering the industrial growth. Additionally, the technological advancements in heavy equipment industry along with rapid investment in renewable energy sector is likely to contribute to the market expansion. Moreover, the presence of various crane manufacturers such as SANY GROUP, KATO WORKS CO., LTD, XCMG Group and some others is expected to drive the growth of the all-terrain crane market in this region.

China is the major contributor in this region. In China, the market is generally driven by the rapid investment in construction sector along with technological advancements in crane manufacturing sector. Additionally, the availability of skilled operators coupled with rise in number of ports is contributing to the market growth.

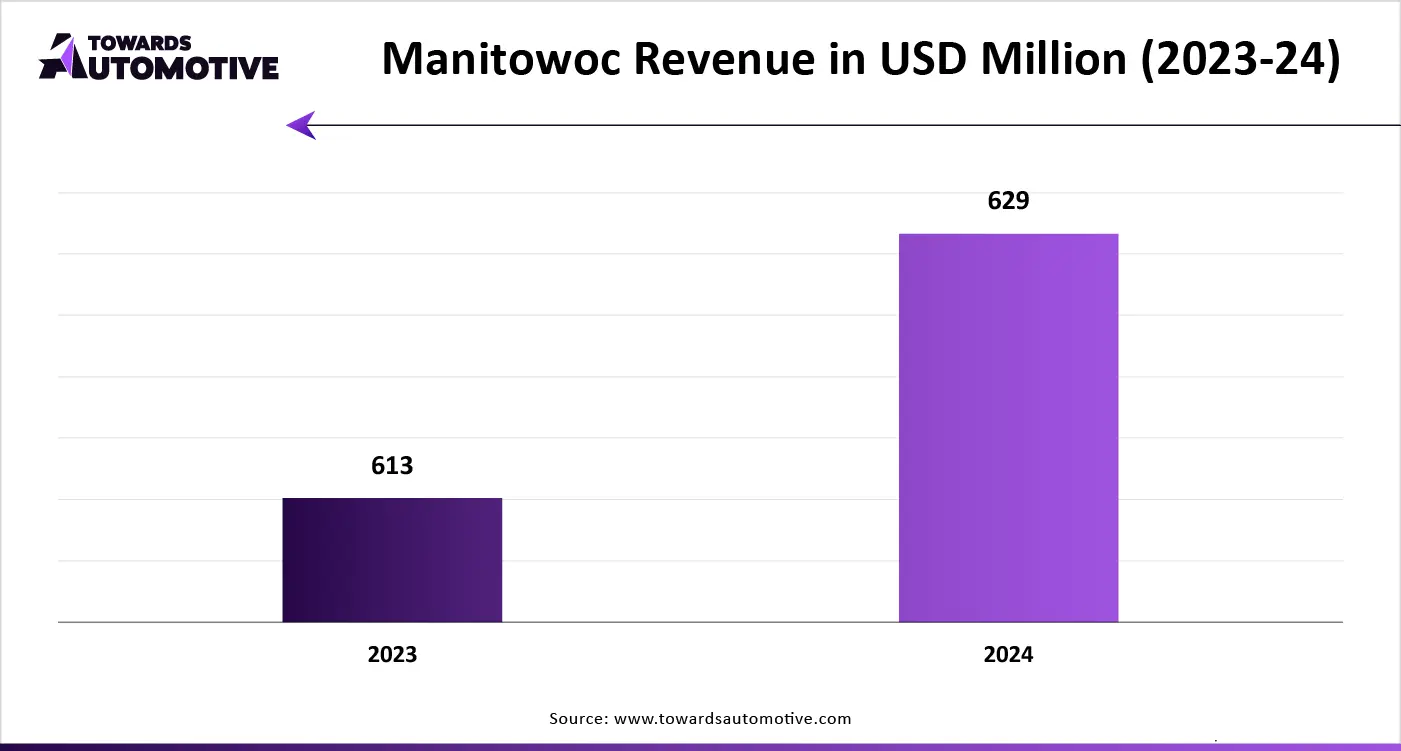

The all-terrain crane market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of CERTEX USA; KITO CORPORATION; Komatsu Ltd; Demag Cranes & Components GmbH; GORBEL INC.; Hitachi Construction Machinery Europe NV; BUCKNER HEAVYLIFT CRANES, LLC; CARGOTEC CORPORATION; Caterpillar; Konecranes; LIEBHERR; PALFINGER AG; Pelloby Premier Cranes; SANY Group; Street Crane Company Limited; Tadano Ltd; Terex Corporation; Manitowoc Company, Inc.; Zoomlion, XCMG; and some others. These companies are constantly engaged in developing all-terrain cranes and adopting numerous strategies such as collaborations, launches, partnerships, business expansions, acquisitions, joint ventures, and some others to maintain their dominance in this industry.

By Type

By Application

By Region

The global riding gear market, valued at USD 7.88 billion in 2024, is anticipated to reach USD 11.25 billion by 2034, growing at a CAGR of 3.65% over ...

August 2025

August 2025

June 2025

June 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us