December 2025

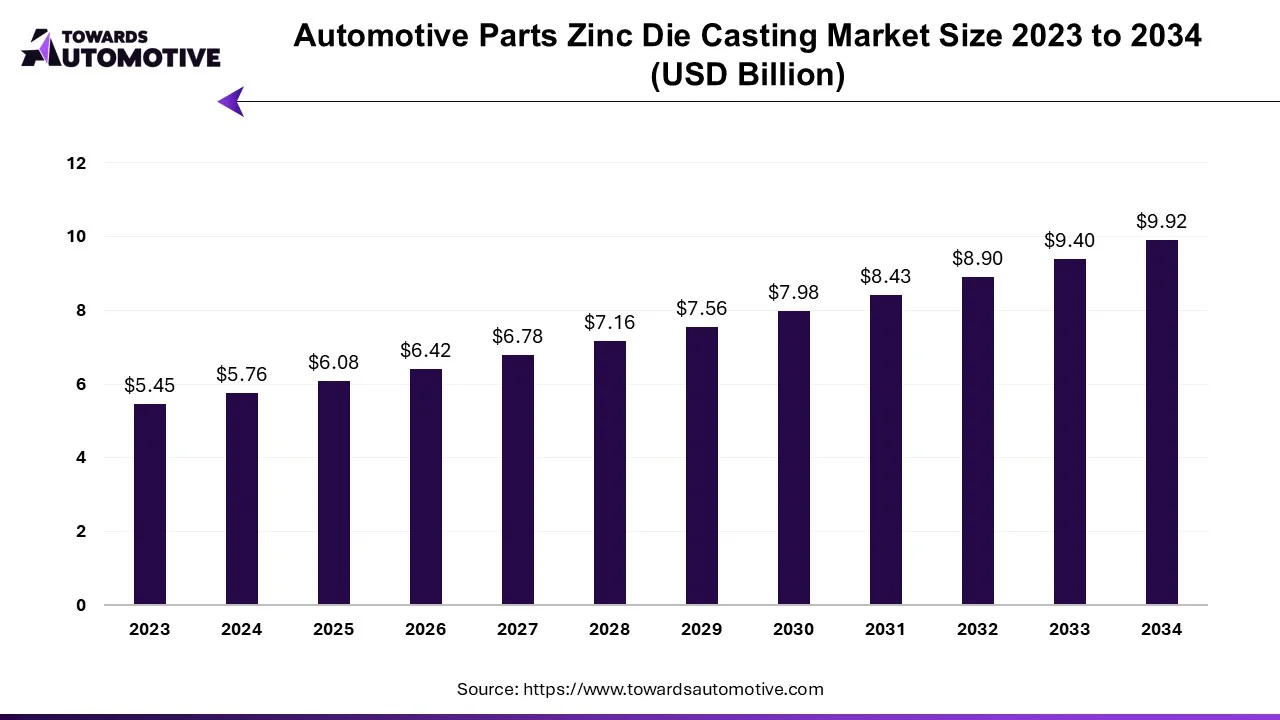

The automotive parts zinc die casting market will expand from USD 6.08 billion in 2025 to USD 9.92 billion by 2034, growing at a CAGR of 5.6%. This growth is driven by the increasing use of lightweight materials to improve vehicle fuel efficiency and comply with EPA and CAFÉ emission standards. Zinc die casting supports cost-effective production of safety-critical components such as seat belt parts, brake systems, and sunroof frames. Segmentally, vacuum die casting leads due to its ability to produce complex, high-integrity transmission and chassis components.

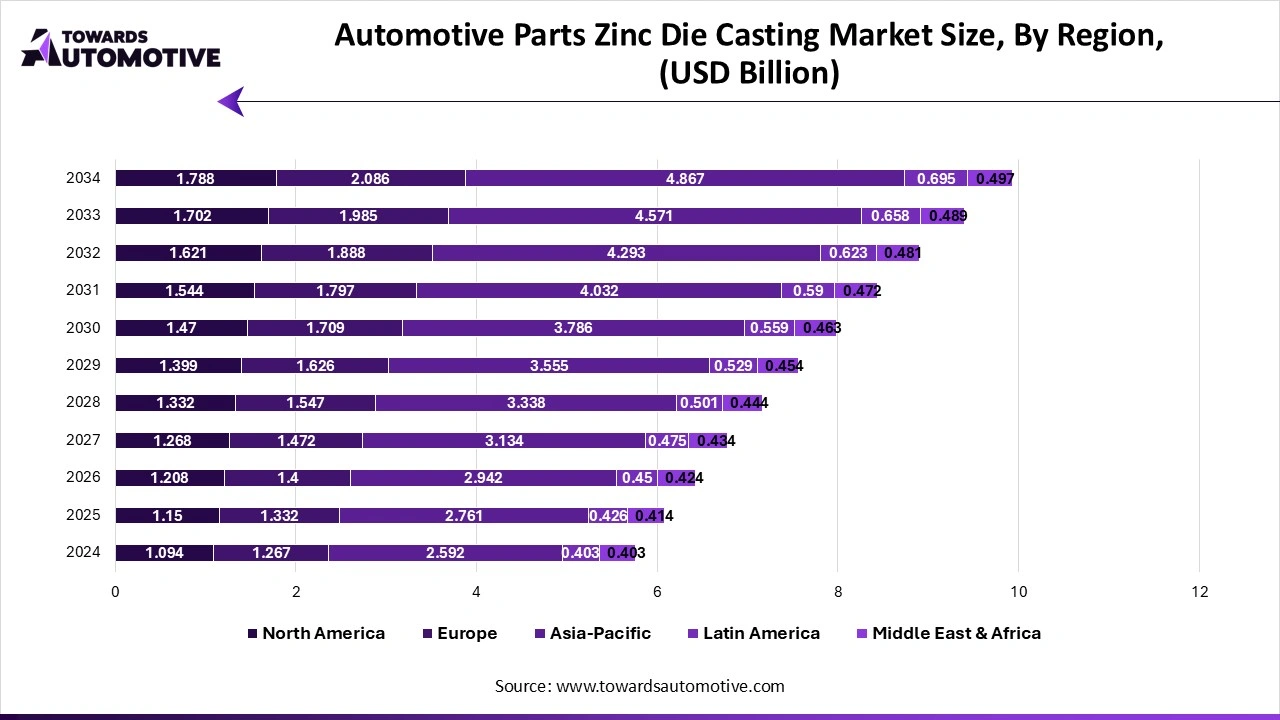

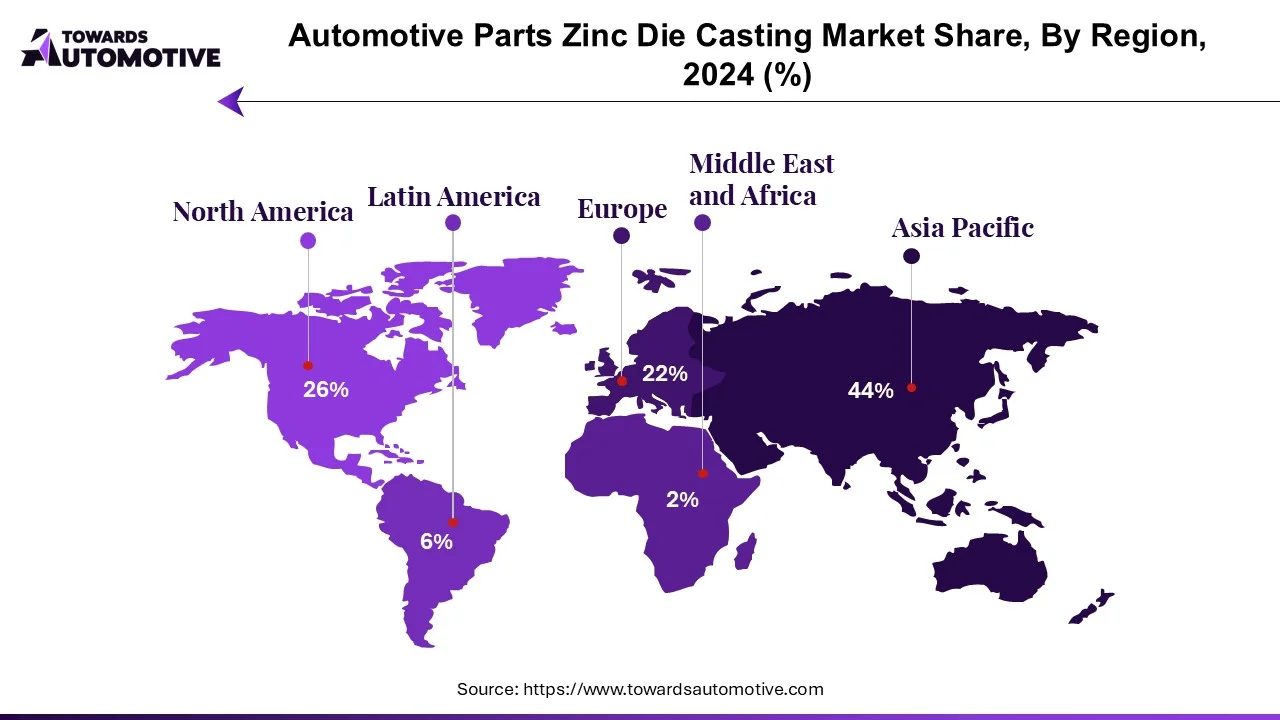

Asia-Pacific dominates global revenue, fueled by rising EV production in China, India, Japan, and South Korea, while Europe and North America follow, driven by advanced manufacturing and lightweight design trends. The value chain spans zinc alloy supply, tooling, die manufacturing, casting, machining, and assembly. Major participants Pace Industries, Dynacast, Sandhar Technologies, Minda Corporation, Bruschi S.p.A., PHB Corp., Empire Casting, and Cascade Die Casting Group focus on automation and vertical integration to maintain margins. Trade analytics highlight growing exports of die-cast automotive parts from China and India to Europe and North America.

The COVID-19 pandemic disrupted business focus for 2020, mainly due to a decline in global auto sales and production. Global auto sales fell 16% in 2020 compared to 2019. All major car-producing countries saw declines from 11% to nearly 40%. Europe accounts for approximately 22% of global production. However, with the start of automobile production in mid-2020, the market began to grow. In 2021, global auto sales will continue to increase over 2020.

In the long run, lightweight cars are becoming increasingly popular among automakers because they increase the fuel economy of the car by using lightweight automotive materials to create significant products. The increase in consumer demand for automotive safety products will also bring growth in the market. Because zinc die castings are used in the production of car safety parts, including other parts such as seats, brakes and sunroof.

To reduce vehicle emissions and increase fuel efficiency, CAFÉ standards and EPA regulations are forcing automakers to reduce vehicle weight by using stainless steel. The adoption of die castings as a weight reduction strategy is a major driver in the automotive industry. Although heavier than aluminum, these materials' lower cost and higher hardness make them better for certain applications.

Some automobile companies focus on zinc parts because zinc casting products go directly into the assembly process because zinc casting products already have a better quality, which reduces the special process. Zinc die castings generally have better properties (such as toughness) and better thermal and electrical properties compared to other die castings; This will increase the demand for zinc die castings in automobiles.

For example:

The automotive parts zinc die casting market is dominated by the Asia-Pacific region, followed by Europe and North America. With the development of light vehicles and the expansion of business and production, the automotive zinc die casting market in the Asia-Pacific region is growing rapidly. India is improving its position thanks to strong domestic and international demand for quality zinc die castings at low cost. The rapid expansion of small and medium-sized enterprises in the region will lead to economic growth.

The Chinese government plans to ban all diesel and gasoline vehicles by 2040, provide subsidies to automakers and encourage consumers to use electric vehicles. Increased production of electric vehicles such as passenger cars and commercial vehicles will support the sale of vehicles made from dead materials.

The European automobile industry is the most technological and innovative industry in the world. Due to the economic and political crisis, reducing fuel consumption and CO2 emissions has become an important criterion for automobile manufacturers in the region. This was achieved thanks to reduced weight of the car and better design and structure, which seems to be the best solution at the moment.

European Non-Ferrous Casting's average production per worker is 20 tons and the maximum is 58 tons. Additionally, more than 80% of the castings produced in Europe are delivered to the European region.

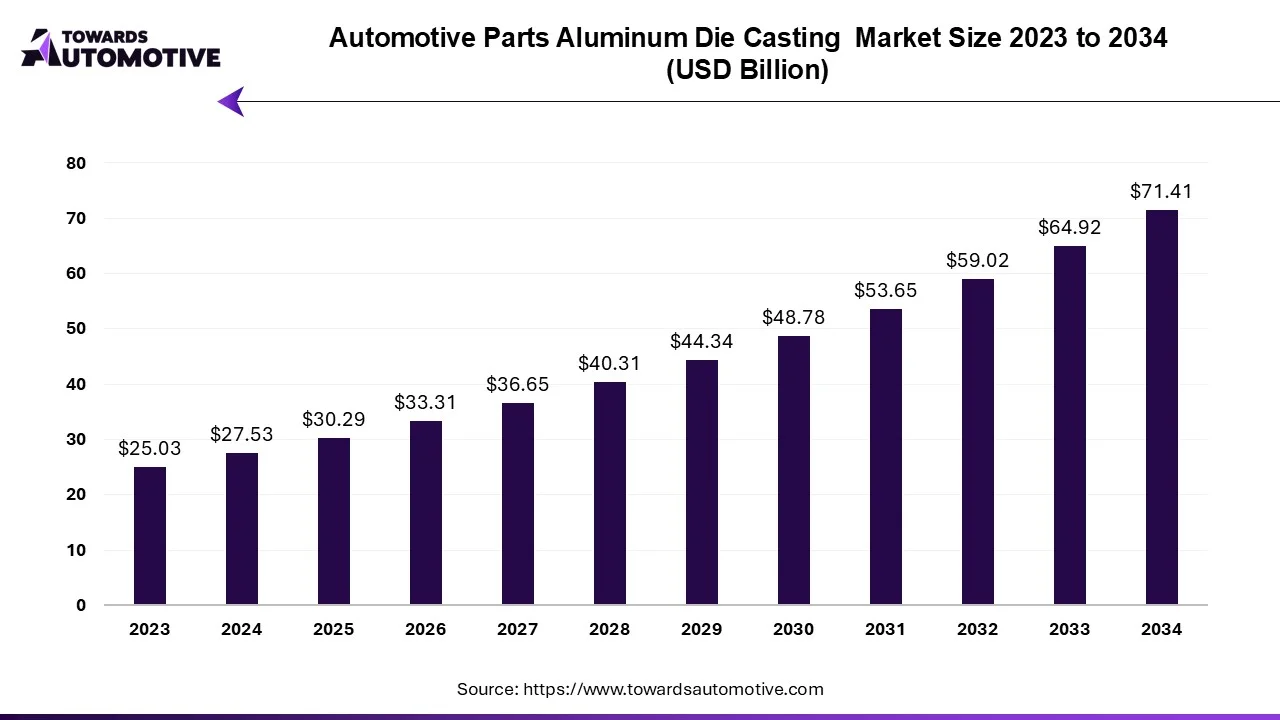

The automotive parts aluminum die casting market is expected to grow from USD 30.29 billion in 2025 to USD 71.41 billion by 2034, with a CAGR of 10% throughout the forecast period from 2025 to 2034.

The automotive industry is experiencing major changes due to increasing demand for more efficient vehicles, strict environmental regulations and the advancement of electric and hybrid vehicles. One of the key factors for this trend is the increasing use of aluminum in automotive molding products, which is expected to drive market growth during the forecast period.

Demand for light-duty vehicles is increasing steadily, driven by factors such as increased fuel efficiency, reduced emissions and increased productivity. For this reason, automobile manufacturers are turning to heavy materials such as aluminum instead of heavy metals in vehicle construction. This trend is also supported by stringent environmental regulations and Corporate Average Fuel Economy (CAFE) standards in many regions to encourage the use of more fuel-efficient vehicles and lower emissions.

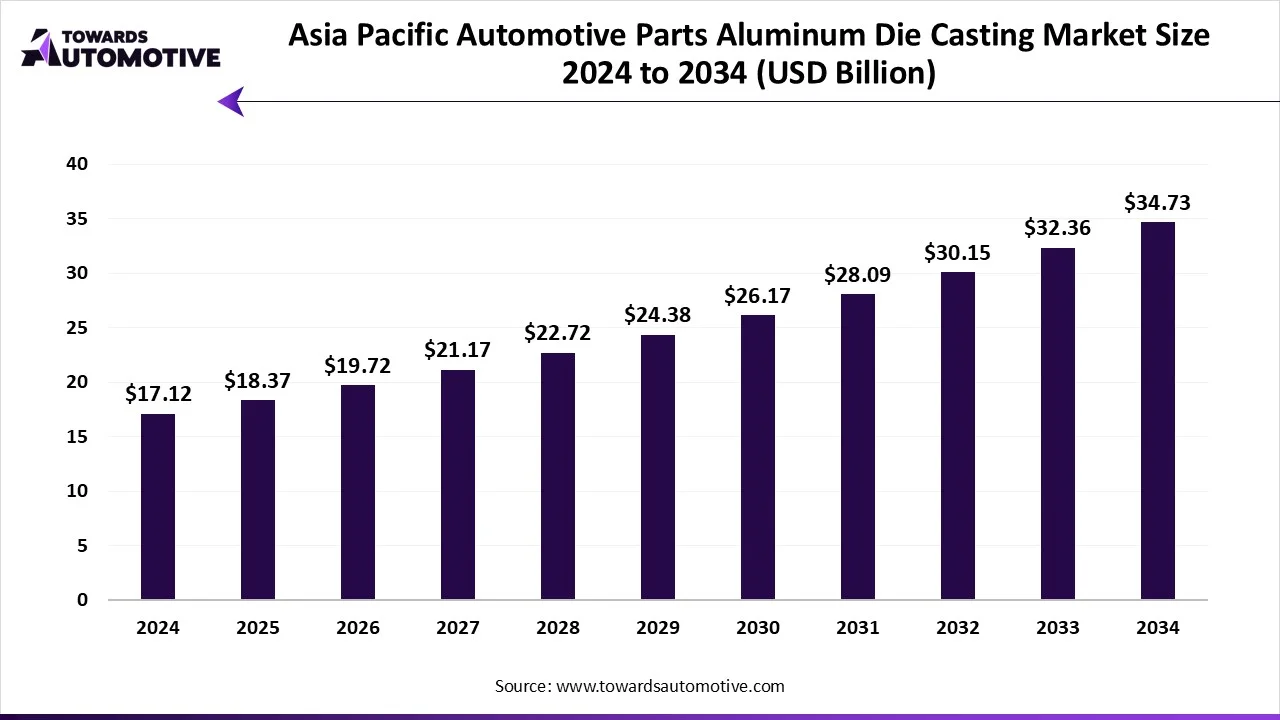

The Asia Pacific automotive parts aluminum die casting market is anticipated to grow from USD 18.37 billion in 2025 to USD 34.73 billion by 2034, with a compound annual growth rate (CAGR) of 7.33% during the forecast period from 2025 to 2034.

The Asia Pacific automotive parts aluminum die casting market is a crucial segment of the automotive industry. This industry deals in developing metal-forming process for creation of complex aluminum parts used in the automotive sector. There are various production processes used in this sector comprising of pressure die casting, vacuum die casting, squeeze die casting, gravity die casting and some others. These processes are used for manufacturing different automotive parts consisting of body parts, engine parts, transmission parts, battery and related components, and some others. The growing application of aluminum parts in commercial vehicles has boosted the market expansion. This industry is expected to rise significantly with the growth of the automotive components industry across Asia Pacific region.

For example:

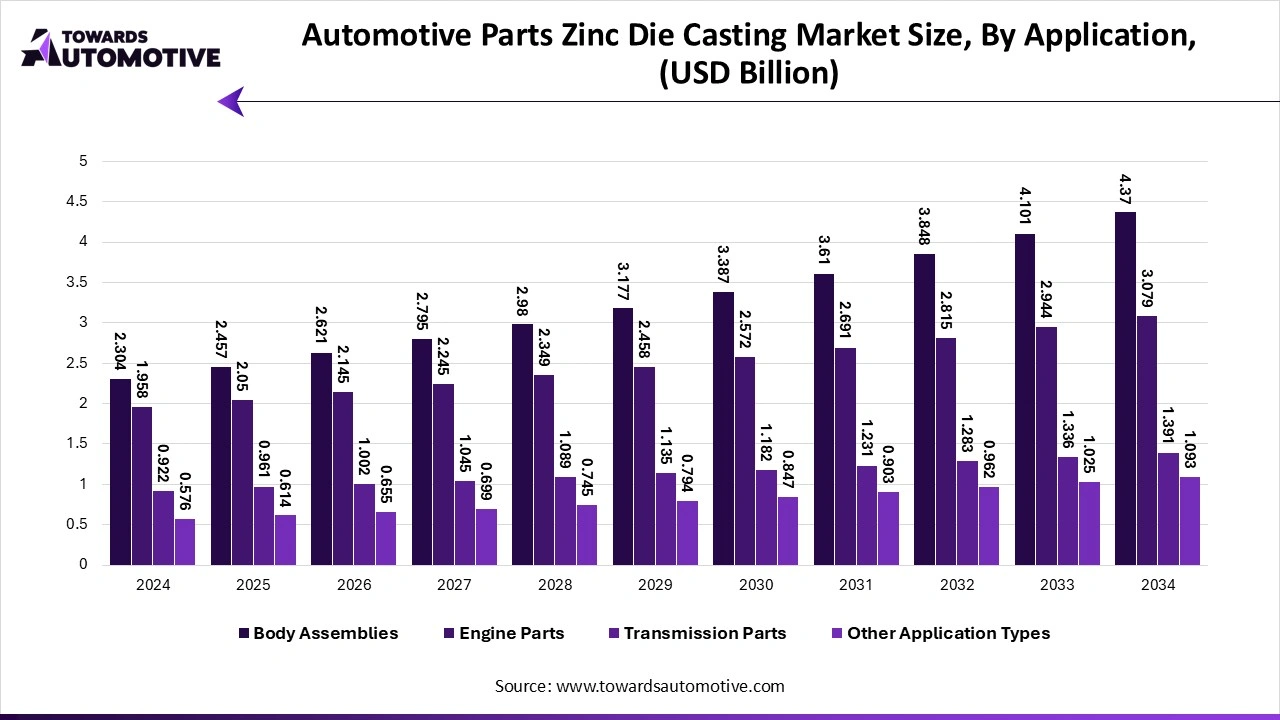

Die casting is pouring molten metal into a mold cavity at high pressure to make a custom-shaped object. Zinc metal is more accessible to cast than aluminum or magnesium metal. Zinc die casting has high productivity, excellent quality, and cost-effectiveness. Zinc die castings make vehicle parts, including seat belts, windscreen wipers, sunroofs, and chassis. The automobile parts zinc die casting industry is divided into three segments: production process, application type, and region.

By Production Process Type

By Application Type

By Geography

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us