August 2025

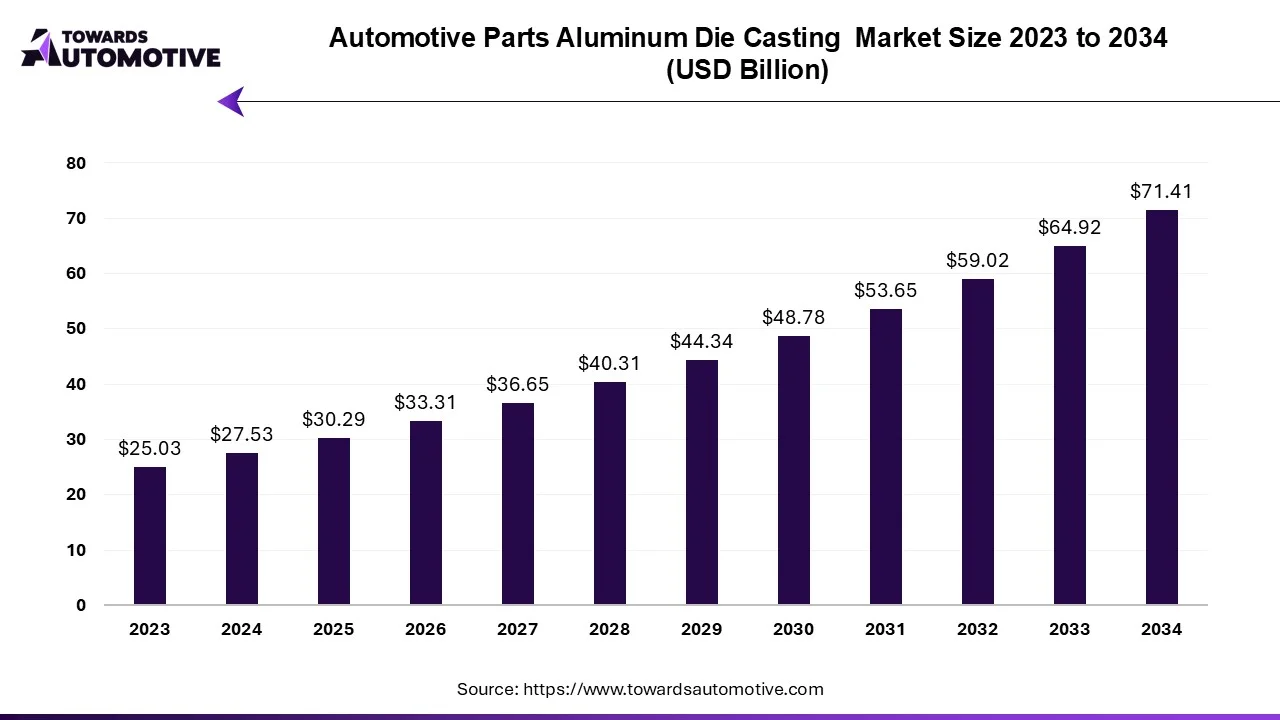

The automotive parts aluminum die casting market is expected to grow from USD 30.29 billion in 2025 to USD 71.41 billion by 2034, with a CAGR of 10% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive industry is experiencing major changes due to increasing demand for more efficient vehicles, strict environmental regulations and the advancement of electric and hybrid vehicles. One of the key factors for this trend is the increasing use of aluminum in automotive molding products, which is expected to drive market growth during the forecast period.

Demand for light-duty vehicles is increasing steadily, driven by factors such as increased fuel efficiency, reduced emissions and increased productivity. For this reason, automobile manufacturers are turning to heavy materials such as aluminum instead of heavy metals in vehicle construction. This trend is also supported by stringent environmental regulations and Corporate Average Fuel Economy (CAFE) standards in many regions to encourage the use of more fuel-efficient vehicles and lower emissions.

In addition, the increase in demand for electric vehicles and hybrid vehicles has accelerated the production of heavy equipment in the automotive industry. Known for its lightness and durability, aluminum has become the top choice for electric vehicle manufacturers looking to increase the performance and performance of electric and hybrid vehicles. The shift in focus to heavy-duty products has led the automotive industry to invest in increased capacity to meet the growing demand for aluminum die castings. For example, in August 2022, Wencan Group Co., Ltd. Lu'an announced a major plan at Economic and Technological Development to invest 1 billion yuan ($140 million) to build a new energy vehicle (NEV) aluminum casting.

The region is the manufacturing base of Anhui Province, China. Similarly, in May 2022, the Tamil Nadu Small Industries Development Corporation invested Rs 580,000 (about $700,000) to set up an integrated plant for aluminum high pressure casting, adding to the importance of aluminum in the automotive industry. br>But despite the possibility of success, the aluminum die casting industry must face certain challenges. One challenge is the volatility of the price of aluminum, which can be affected by things like sanctions and trade disputes between countries. Additionally, the use of new technologies such as 3D printing in the automotive industry poses a threat to the pressure casting process.

The automotive industry's shift to heavy-duty materials such as aluminum in die casting is driven by the need to increase fuel efficiency, reduce emissions and improve reliability performance. While the industry has many growth opportunities, challenges such as aluminum price changes and advances in casting techniques need to be addressed to maintain long-term growth and competitiveness.

The demand for aluminum in automobile construction is increasing, mainly due to the penetration of aluminum into die castings, especially hybrid and electric cars. For example, lead content per vehicle in North America increased significantly, reaching 459 pounds (208 kg) in 2020, and is expected to reach 570 pounds (258 kg) in 2030. The main reason for this growth is the transition to light trucks and trucks.

By 2026, each truck will need approximately 550 pounds (250 kilograms) of aluminum, increasing the amount used in many things, such as car body panels, casting, and extrusion. A prime example is Tesla’s company specifically Model-S which is a BEV, which uses more than 800 pounds (360 kilograms) of aluminum to create various components, castings, extrusions, and the entire body.

However, despite the expected growth, economic growth may be affected by risks related to inflation and raw material purchases. The looming trade war between the United States and other countries has increased recent pressure on metal prices and created competition for the industry. Tariffs on aluminum products chosen by the president, particularly from U.S. allies such as the European Union, Mexico, and Canada, are expected to increase domestic aluminum prices.

Despite these challenges, the automotive aluminum casting industry is expected to grow thanks to passenger car production and sales in new markets such as India, Thailand, Indonesia, Egypt, and other Middle Eastern and African markets. The country is growing. These regions represent significant opportunities for business expansion during the forecast period.

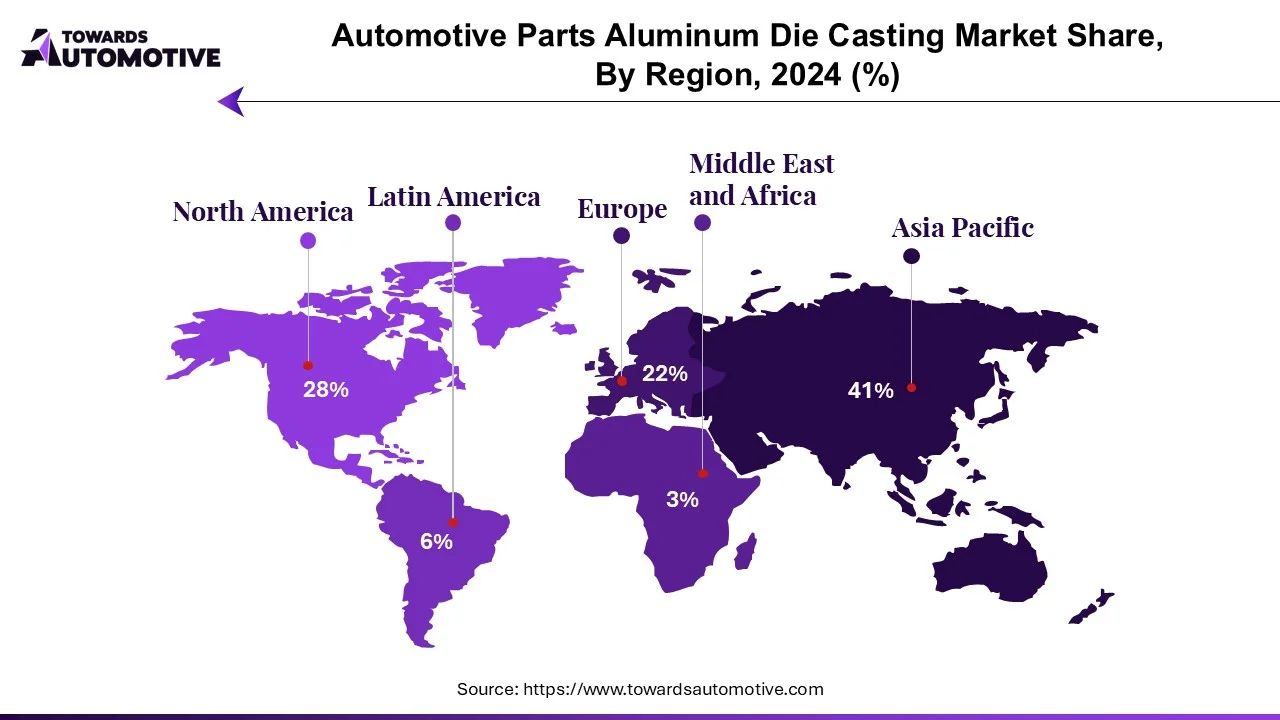

During the forecast period, Asia-Pacific will be the largest region in the automotive die-casting market. Major countries such as India, China, and Japan are expected to play an essential role in driving the market in this region. China is a significant producer of die-casting, and the growth in passenger cars in the region is expected to impact market growth positively.

Automotive Parts Aluminum Die Casting Market Size, By Region, (USD Billion)

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| North America | 4.68 | 5.18 | 5.73 | 6.34 | 7.01 | 7.76 | 8.58 | 9.5 | 10.5 | 11.62 | 12.85 |

| Europe | 6.33 | 6.87 | 7.46 | 8.1 | 8.79 | 9.53 | 10.34 | 11.21 | 12.16 | 13.18 | 14.28 |

| Asia-Pacific | 12.94 | 14.35 | 15.92 | 17.66 | 19.59 | 21.73 | 24.09 | 26.72 | 29.62 | 32.85 | 36.42 |

| Latin America | 1.93 | 2.09 | 2.27 | 2.46 | 2.66 | 2.88 | 3.12 | 3.38 | 3.66 | 3.96 | 4.28 |

| Middle East & Africa | 1.65 | 1.79 | 1.93 | 2.08 | 2.26 | 2.44 | 2.64 | 2.84 | 3.07 | 3.3 | 3.58 |

For Instance,

As one of the world's largest automobile manufacturers, the Asia-Pacific region has attracted the attention of major investors. Many companies have adopted growth strategies such as geographical and capacity expansion to compete in this market.

For Instance,

Although many factors can affect the business, such as regulatory changes and competition in the supply chain, consumers are strong against aluminum products, and the aluminum consumption trend has created growth opportunities for the industry.

Automotive Parts Aluminum Die Casting Market Size, By Application Type, (USD Billion)

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| Body Parts | 6.88 | 7.63 | 8.46 | 9.38 | 10.4 | 11.53 | 12.78 | 14.16 | 15.7 | 17.4 | 19.28 |

| Engine Parts | 8.81 | 9.33 | 9.86 | 10.41 | 10.96 | 11.53 | 12.1 | 12.66 | 13.22 | 13.76 | 14.28 |

| Transmission Parts | 4.96 | 5.3 | 5.66 | 6.05 | 6.45 | 6.87 | 7.32 | 7.78 | 8.26 | 8.76 | 9.28 |

| Battery and Related Components | 3.3 | 4.12 | 5.06 | 6.16 | 7.42 | 8.87 | 10.53 | 12.45 | 14.64 | 17.14 | 19.99 |

| Other Application Types | 3.58 | 3.9 | 4.27 | 4.64 | 5.08 | 5.54 | 6.04 | 6.6 | 7.19 | 7.85 | 8.58 |

| Total | 27.53 | 30.28 | 33.31 | 36.64 | 40.31 | 44.34 | 48.77 | 53.65 | 59.01 | 64.91 | 71.41 |

Global and regional manufacturing players dominate the automotive parts aluminum die-casting industry. These companies use many strategies to manage their business, such as innovation, collaboration, and consensus.

For Instance,

Some of the key players in the market include Linmar Corporation, Nemak, Koch Enterprises, Rheinmetall AG, and George Fischer Limited. These companies have played an essential role in developing the automotive aluminum casting industry with their innovative approaches and effective collaborations.

Aluminum die casting for automotive parts is a manufacturing process in which molten aluminum is injected into a steel mold under high pressure to create precise, complex and high-quality automotive parts. These materials are often used in areas such as engine blocks, transmissions and wiring harnesses.

By Production Process

By Application Type

By Geography

August 2025

August 2025

August 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us