October 2025

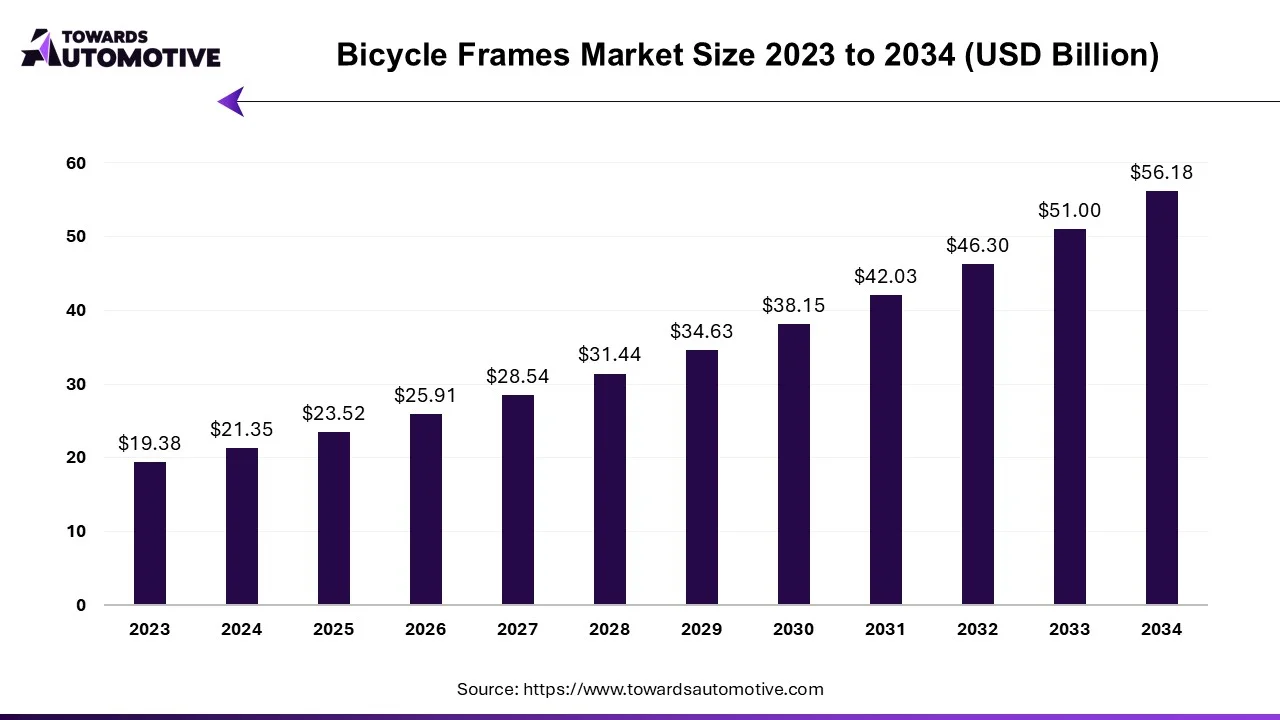

The bicycle frames market is forecasted to expand from USD 23.52 billion in 2025 to USD 56.18 billion by 2034, growing at a CAGR of 10.16% from 2025 to 2034.

Raising capital to expand production capacity in the bicycle industry serves as a catalyst for economic growth, fostering innovation and meeting the increasing demand for high-performance bicycles. One notable example is Rein4ced, which successfully completed Series C financing in May 2022, securing a significant investment of $13.8 million from PMV. This infusion of capital enables Rein4ced to scale up its operations and enhance production capabilities, particularly in the realm of cutting-edge bicycle frames. By leveraging this financial support, the company can invest in advanced technology, expand production facilities, and address the growing market demand for specialized frames that cater to the needs of cyclists worldwide.

The rising popularity of cycling, driven by its appeal as a form of entertainment, social transportation, and fitness activity, contributes significantly to the growth of the bicycle market. As more individuals prioritize health and environmental sustainability, the demand for bicycles continues to escalate. This trend aligns with a broader societal shift towards adopting healthier and eco-friendly lifestyles, driving innovation and performance enhancements within the bicycle industry to meet evolving consumer preferences.

However, the bicycle market is not immune to challenges, including fluctuations in equipment prices. Variations in the prices of essential materials such as steel and composite materials can significantly impact production costs for bicycle manufacturers. As a result, companies may struggle to maintain competitive prices and profit margins, leading to potential price increases for bicycles and impacting consumer affordability. This can potentially restrict market accessibility and limit overall market growth.

| Rank | Supplier | HQ | FY-2024 EBITDA Margin (%) |

| 1 | Giant Manufacturing Co., Ltd. | Taiwan | 8.35% |

| 2 | Merida Industry Co., Ltd. | Taiwan | -0.60% |

| 3 | Ideal Bike Corporation | Taiwan | -9.40% |

The burgeoning demand for high-performance electric bicycles is propelling the growth of the industry, as consumers increasingly seek e-bikes equipped with advanced features that elevate their riding experience. This surge in interest has spurred the need for frames specifically designed to optimize performance and durability in the context of electric-powered cycling. A notable example of this trend occurred in September 2023, when Moots introduced a groundbreaking e-bike crafted from carbon fiber, a material renowned for its exceptional strength-to-weight ratio and performance characteristics. The e-bike boasts GRX RX-870 carbon fiber wheels paired with Panaracer GravelKing SK + 50c tubeless tires, showcasing a meticulous attention to detail and a commitment to maximizing performance.

The industry's forward momentum is further propelled by continuous research and data-driven innovation, which serve as catalysts for technological advancements in frame design and materials. Manufacturers are investing in research and development initiatives focused on materials such as carbon fiber composites, advanced alloys, and hybrid designs, with the goal of engineering frames that strike the optimal balance between strength, weight reduction, and performance enhancement. By staying at the forefront of technological innovation, manufacturers can effectively address the evolving needs of cyclists, who demand frames that prioritize attributes such as lightness, durability, and efficiency.

The e-bike industry is witnessing a paradigm shift driven by a growing appetite for high-performance electric bicycles equipped with cutting-edge features. Through continuous research and innovation, manufacturers are poised to push the boundaries of frame design and materials, ushering in a new era of e-bike technology characterized by enhanced performance, durability, and rider satisfaction.

In 2023, brick-and-mortar bicycle shops are expected to rake in a whopping $12.6 billion in revenue, thanks to their knack for building trust and confidence among customers. These shops are like your friendly neighborhood bike hub, staffed with experts who guide you through the sea of options to find the perfect ride tailored just for you. This personal touch, combined with a wide selection of bikes, makes traditional stores the go-to spot for those who value quick service and a hands-on experience.

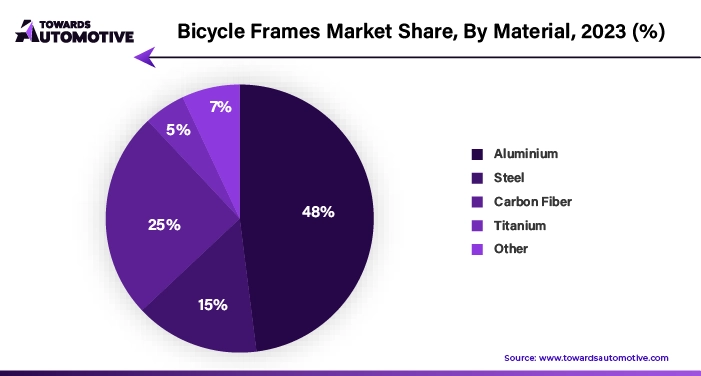

Meanwhile, aluminum bikes are set to take over more than 40% of the market by 2023. Manufacturers are jumping on the eco-friendly bandwagon, using low-carbon materials to make bikes lighter and kinder to the planet. By going green, these bikes not only meet the demand for speed and performance but also align with the growing consciousness about environmental impact.

Take the partnership between Hydro and Brompton, for example. They're teaming up to create folding bikes with reduced emissions and a smaller carbon footprint. Companies across the board are doubling down on sustainability efforts, exploring ways to incorporate recycled materials into their products. It's not just about selling bikes; it's about making a difference and leaving a greener footprint on the world.

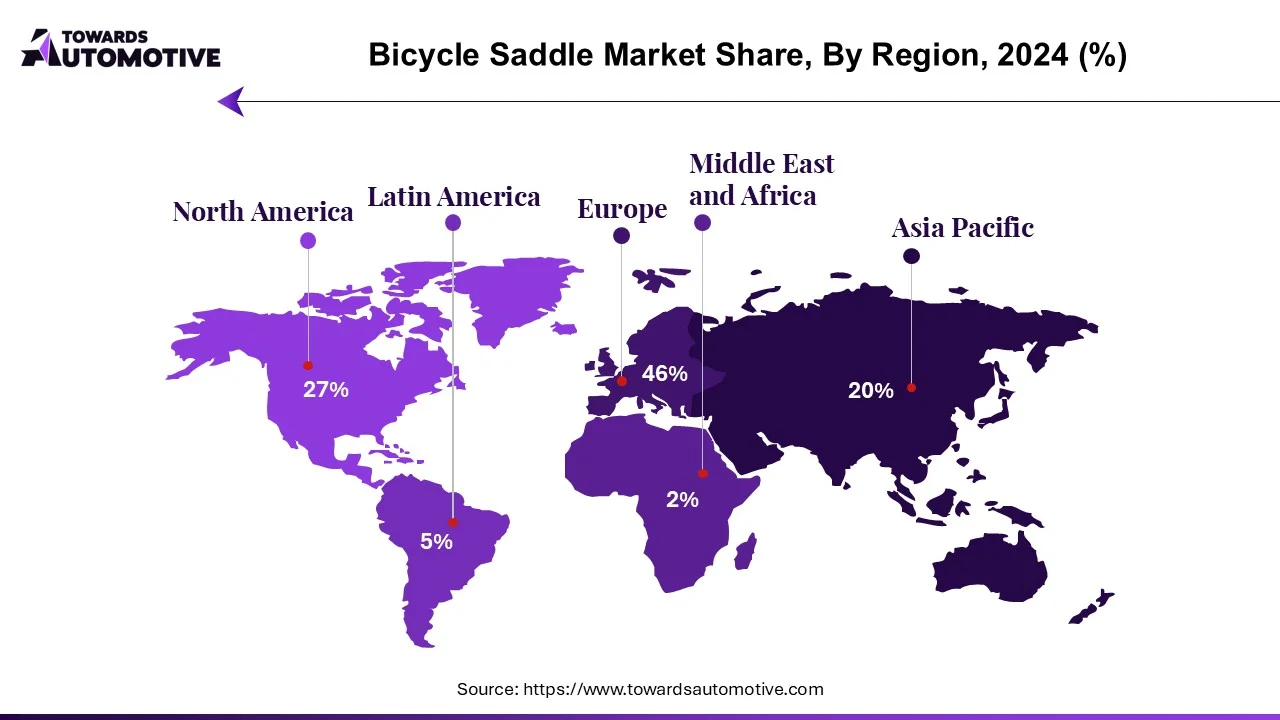

By 2023, the bicycle frame market in the Asia-Pacific region is poised to claim a substantial 35% share of revenue. This surge is closely tied to the region's robust economic progress, which is steering the overall economy towards prosperity. With rising disposable incomes, more individuals are embracing leisure pursuits like cycling. This economic upturn has spurred a heightened demand for top-notch bikes and frames, driven by the quest for dependable and efficient modes of transportation.

The expanding middle class, particularly evident in countries like China and India, has significantly bolstered the ranks of consumers seeking bicycles and frames for both daily commuting and long-distance journeys. As aspirations for a better quality of life soar alongside economic growth, the allure of cycling as a practical and enjoyable means of travel continues to captivate more people across the region.

In the fiercely competitive landscape of the bicycle industry, Glant Manufacturing Inc. Ltd., Merida, and Trek stand out as major players, constantly vying for market dominance. These companies spare no effort in their strategic maneuvers, pouring substantial resources into research and development, forging pivotal partnerships to enrich their product portfolios, and embracing cutting-edge technologies. Such strategic endeavors are meticulously crafted to fortify their competitive edge, penetrate new markets, and cater to the diverse needs of cyclists worldwide.

Take Glant Manufacturing Inc. Ltd., for instance. With its diverse array of bicycles spanning road, mountain, urban commuting, and e-bikes, the company boasts an extensive product line tailored to cater to a broad spectrum of cycling enthusiasts. This comprehensive approach enables Glant to cast a wide net in the market and effectively address the varied demands of cyclists, ensuring that they remain a formidable force in the industry.

Major companies operating in the bicycle frames Industry are

By Material

By Frame Type

By Sales Channel

By Distribution Channel

By Geography

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us