October 2025

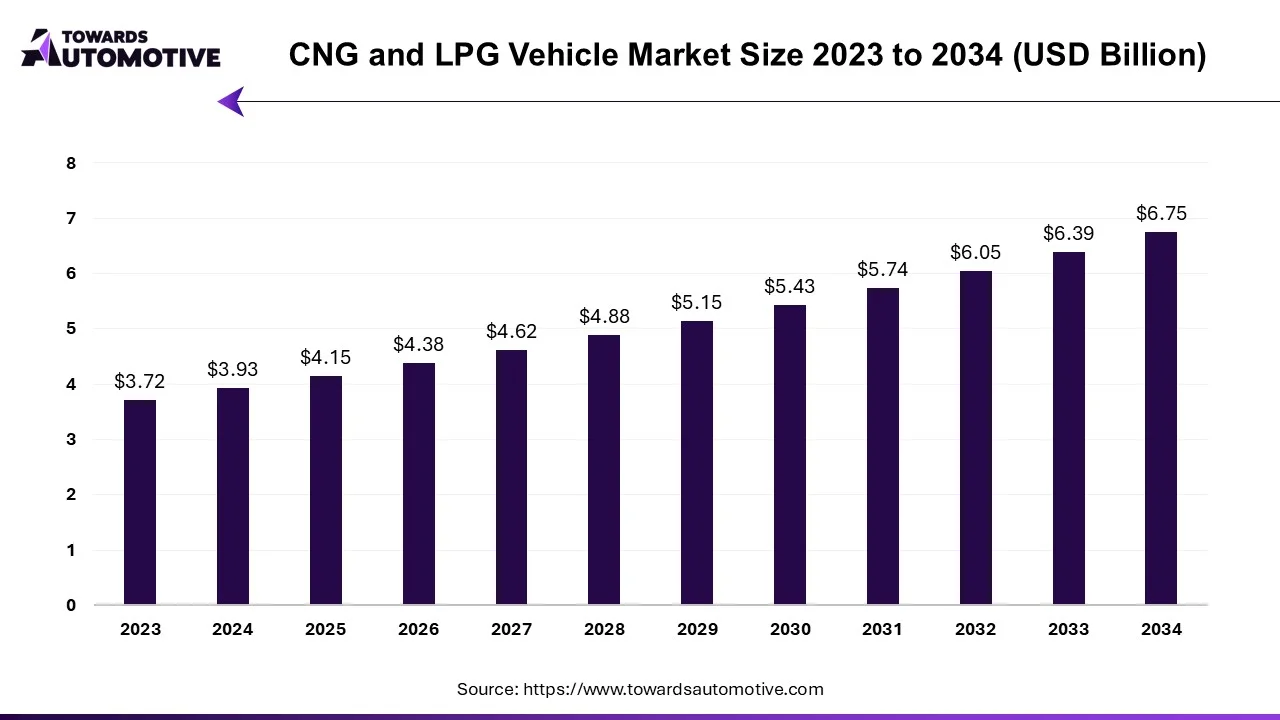

The CNG and LPG market is projected to reach USD 6.75 billion by 2034, expanding from USD 4.15 billion in 2025, at an annual growth rate of 4.93% during the forecast period from 2025 to 2034.

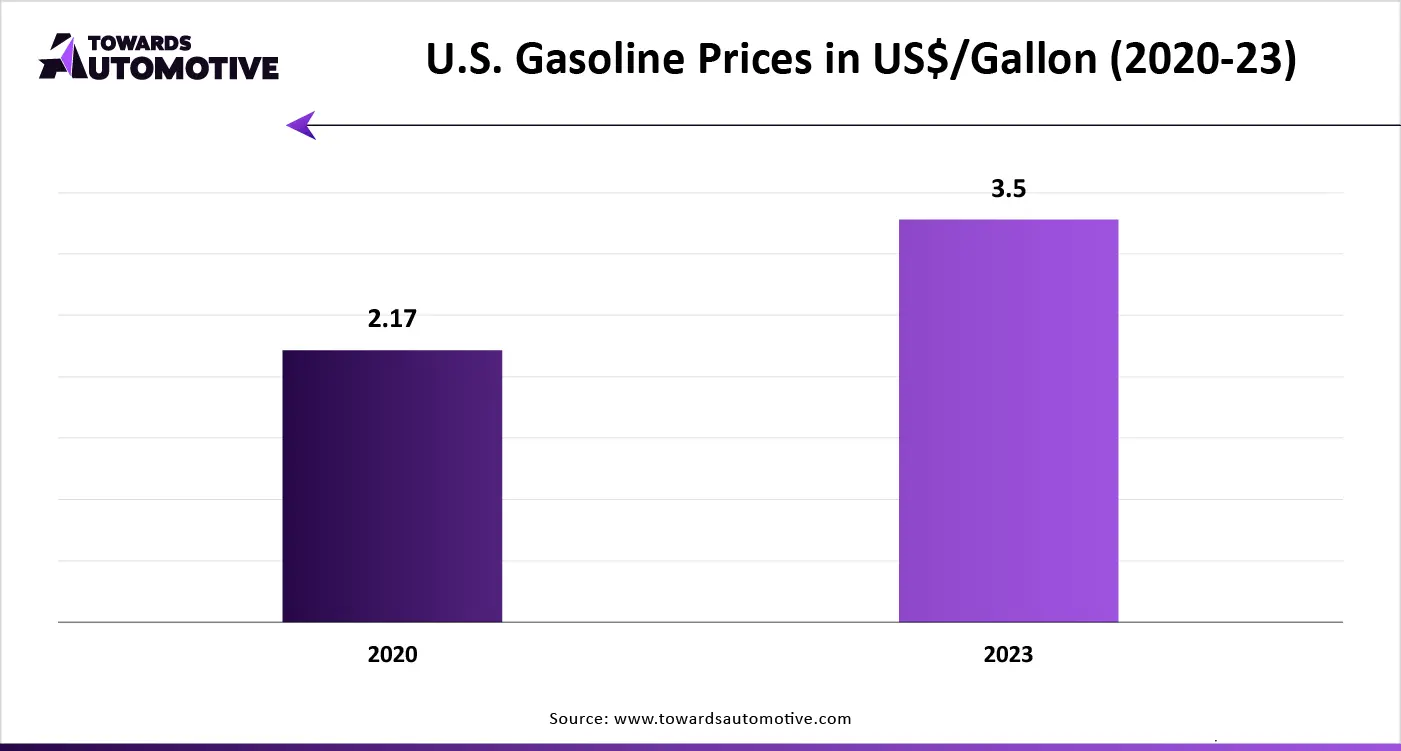

The CNG and LPG vehicle market is a crucial segment of the automotive industry. This industry deals in manufacturing and distribution of LPG and CNG vehicles around the world. There are various types of vehicles developed in this sector including CNG-based passenger cars, LPG-based passenger cars, CNG-based commercial vehicles, LPG-based commercial vehicles and others. These vehicles are integrated with different types of engine systems consisting of dedicated system, bi-fuel system, dual fuel system and some others. The rising prices of gasoline and diesel in different parts of the world has contributed to the overall industrial expansion. This market is expected to rise significantly with the growth of the hybrid vehicles industry in different parts of the world.

| Metric | Details |

| Market Size in 2024 | USD 3.93 Billion |

| Projected Market Size in 2034 | USD 6.75 Billion |

| CAGR (2025 - 2034) | 4.93% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Vehicle Type, By Fuel Type, By Sales Channel and By Region |

| Top Key Players | Maruti Suzuki, Nikki Co. Ltd., Kion Group, Hyundai Motor Company, IVECO, Mahindra & Mahindra |

The passenger car segment held the largest share of the market. The rising demand for affordable cars in mid-income countries such as India, Vietnam, Egypt, Laos and some others is driving the market growth. Additionally, the increasing prices of traditional fuels such as gasoline and diesel has increased the demand for economic alternatives, thereby fostering the industrial expansion. Moreover, rapid investment by several automotive companies for developing CNG-based passenger cars along with technological advancements in LPG industry is further driving the growth of the CNG and LPG vehicle market.

The LCVs segment is anticipated to rise with a notable CAGR during the forecast period. The growing demand for LCVs from several end-users including logistics, construction, e-commerce, utilities and some others has boosted the market growth. Additionally, the increasing adoption of LNG-based LCVs by fleet operators to minimize operational costs is further adding to the industrial expansion. Moreover, numerous partnerships and collaborations among automotive companies for developing CNG-based LCVs is projected to boost the growth of the CNG and LPG vehicle market.

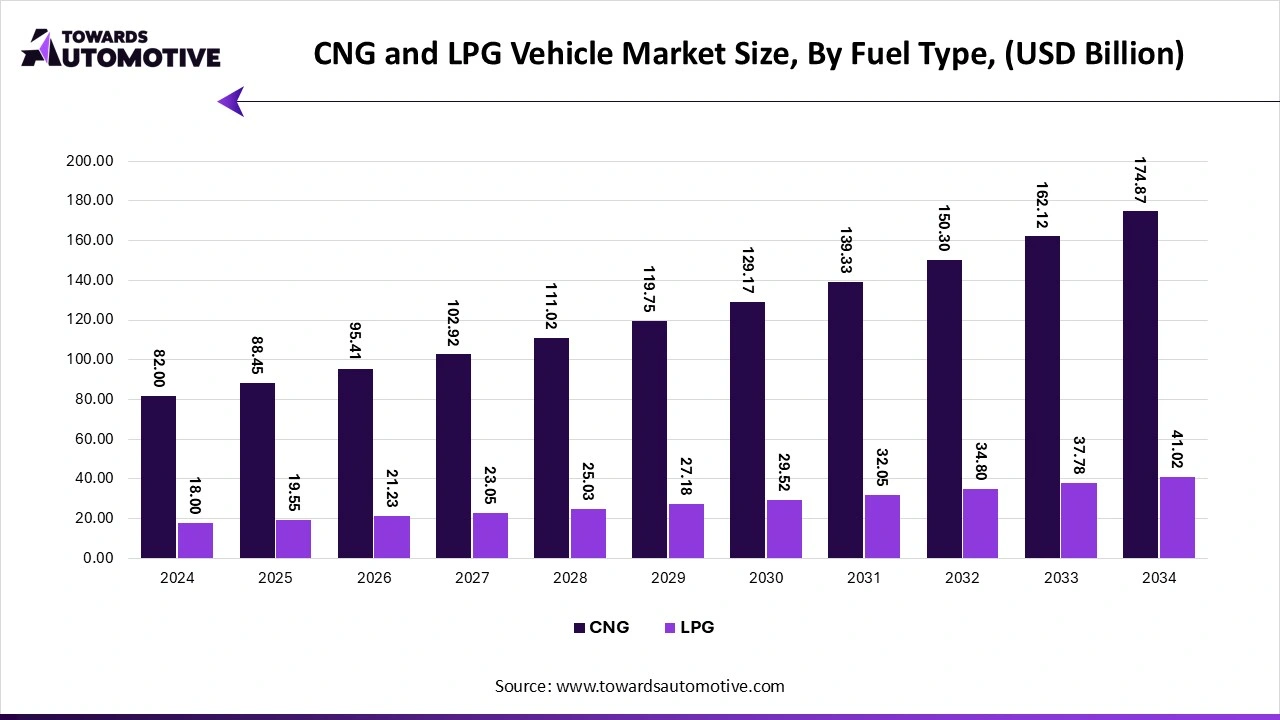

The CNG segment dominated this industry. The growing demand for fuel-efficient vehicles among middle-class people has boosted the market expansion. Additionally, the rising investment by automotive brands for developing high-performance CNG engines for passenger cars and commercial vehicles is further adding to the industrial growth. Moreover, several companies such as Maruti Suzuki, Ashok Leyland, Tata Motors, Nikki Co. Ltd., General Motors Co. and some others is projected to foster the growth of the CNG and LPG vehicle market.

The LPG segment is predicted to rise with a considerable CAGR during the forecast period. The rising demand for autogas vehicles to enhance the driving range of vehicles has boosted the market growth. Also, the growing adoption of factory-fitted LPG vehicles by fleet operators due to its advantages such as optimized performance, easy maintenance, high safety standards and some others ins likely to shape the industry in a positive direction. Moreover, continuous research and development related to LPG vehicles coupled with numerous government initiatives aimed at adopting LPG vehicles is expected to drive the growth of the CNG and LPG vehicle market.

The OEM segment led the industry. The availability of CNG vehicles and LPG trucks in OEM outlets is driving the market expansion. Additionally, the growing consumer preference towards warranty enabled vehicles is further adding to the industrial growth. Moreover, the precision and quality delivered by OEMs is way better as compared to aftermarket sector that in turn is expected to drive the growth of the CNG and LPG vehicle market.

The retrofitting segment is likely to grow with a significant rate during the forecast period. The rise in number of aftermarket service centers in different parts of the world has boosted the market expansion. Additionally, surge in demand for fuel-efficient among middle class population has enabled them to integrated CNG tanks from aftermarket sector, thereby fostering the industrial growth. Moreover, the growing investment by aftermarket service centers to deploy advanced machineries and skilled labors for enhancing CNG integration process is further anticipated to foster the growth of the CNG and LPG vehicle market.

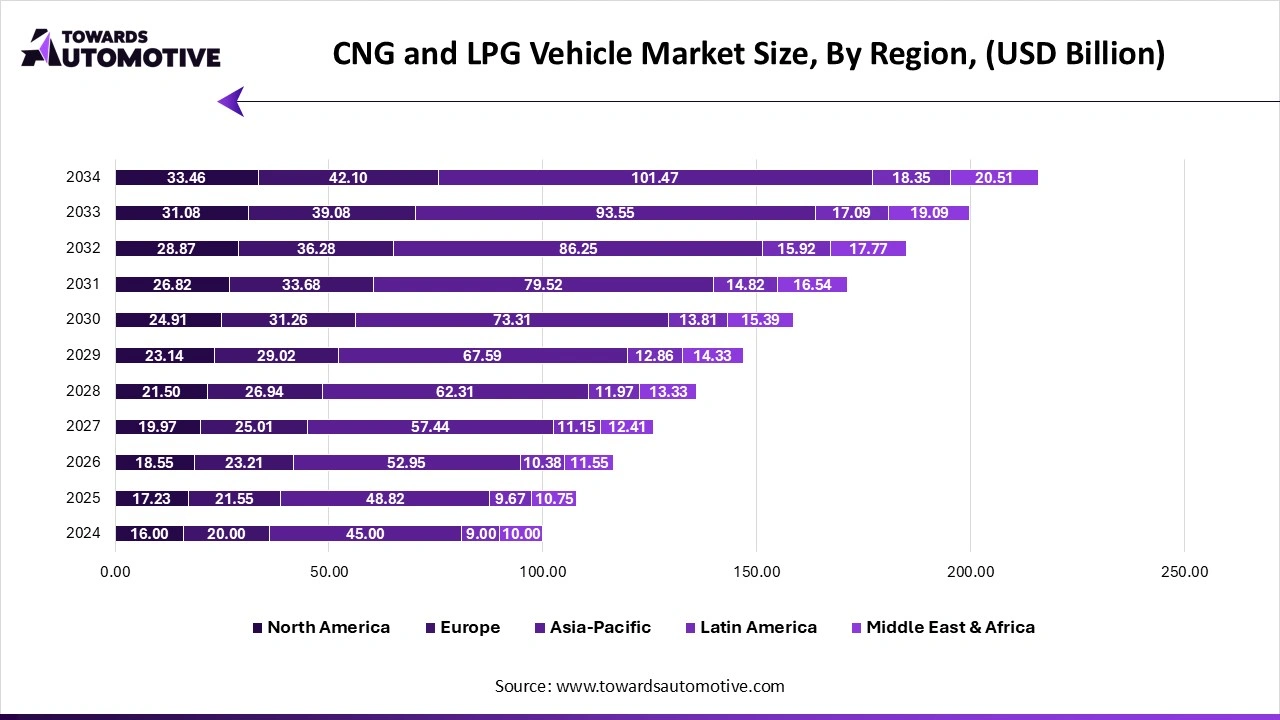

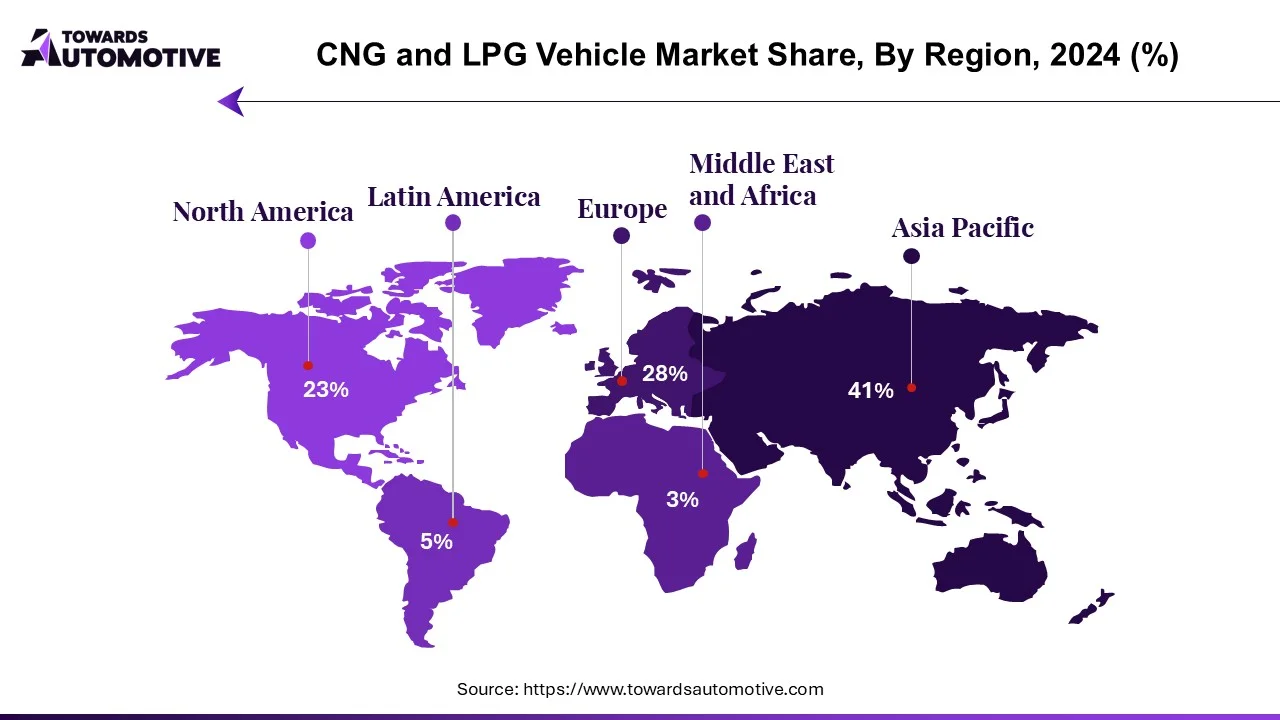

Asia Pacific held the highest share of the CNG and LPG vehicle market. The growing demand for fuel-efficient vehicles in countries such as India, Japan, China, South Korea and some others has boosted the market expansion. Additionally, the rapid adoption of CNG-powered taxis by ride-hailing companies such as Uber, Rapido, Ola and some others is playing a positive role in the industrial growth. Moreover, the presence of various market players such as Tata Motors, Maruti Suzuki, Honda Motor Company, Hyundai Motor Group and some others is projected to foster the growth of the CNG and LPG vehicle market in this region.

China is the major contributor in this region. In China, the market is generally driven by the rising demand for CNG-powered LCVs along with well-established network of refueling stations. Additionally, the presence of several CNG vehicle manufacturers such as Shacman, Zhongtong, JAC and some others is driving the market growth in this nation.

North America is expected to grow with a significant CAGR during the forecast period. The growing demand for eco-friendly trucks in countries such as Canada and the U.S. has boosted the market growth. Also, the technological advancements in automotive sector coupled with rapid investment in CNG infrastructure by private-sector entities is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as General Motors Co., Ford Motor Co., Chevrolet and some others is driving the growth of the CNG and LPG vehicle market in this region.

The CNG and LPG vehicle market is a rapidly developing industry with the presence of a several dominating players. Some of the prominent companies in this industry consists of Maruti Suzuki, Nikki Co. Ltd., Kion Group, Hyundai Motor Company, IVECO, Mahindra & Mahindra, MAN SE, AC Spolka, Landi Renzo S.P.A and some others. These companies are constantly engaged in developing vehicles based on LPG & CNG and adopting numerous strategies such as business expansions, partnerships, acquisitions, collaborations, launches, joint ventures, and some others to maintain their dominant position in this industry. For instance, in March 2025, Iveco launched S-Way CNG 6x2 tractor. This vehicle is developed in a collaboration between Iveco and Astra Vehicle Technologies. Also, in September 2024, Maruti Suzuki launched Swift CNG in India. This car is expected to deliver a mileage of around 32.85 km/kg.

By Vehicle Type

By Fuel Type

By Sales Channel

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us