October 2025

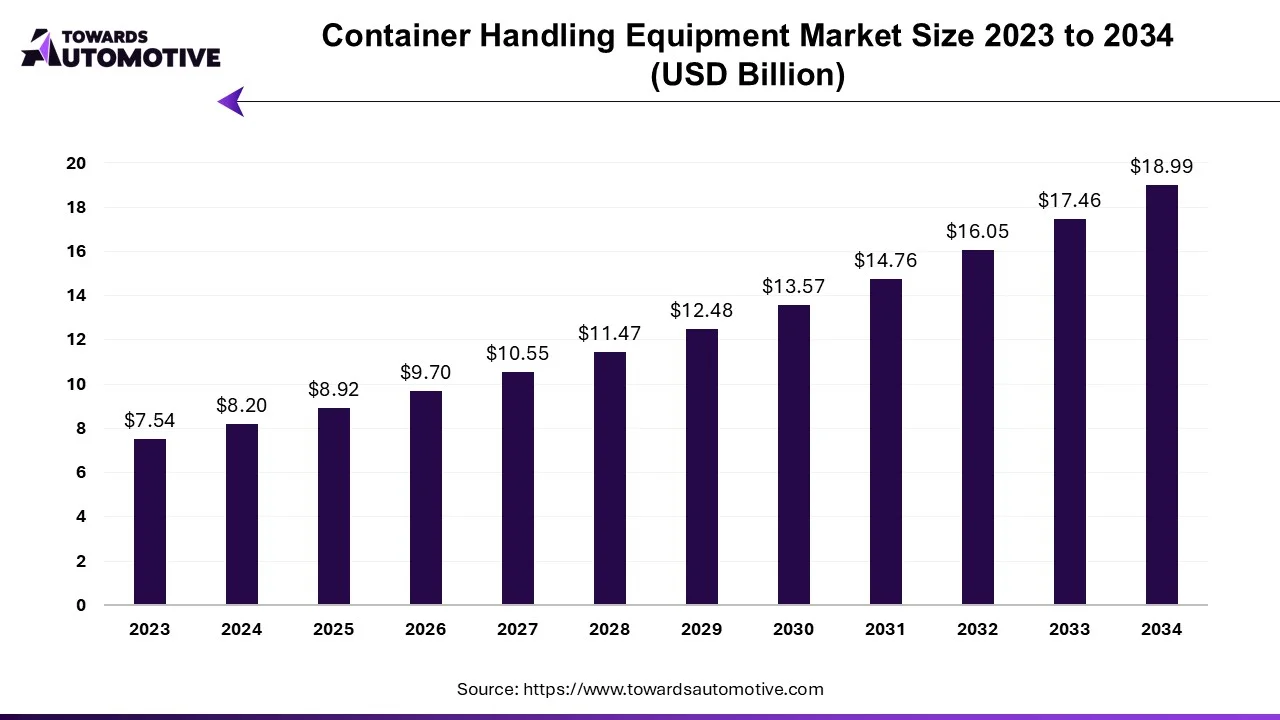

The container handling equipment market is projected to reach USD 18.99 billion by 2034, expanding from USD 8.92 billion in 2025, at an annual growth rate of 8.76% during the forecast period from 2025 to 2034.

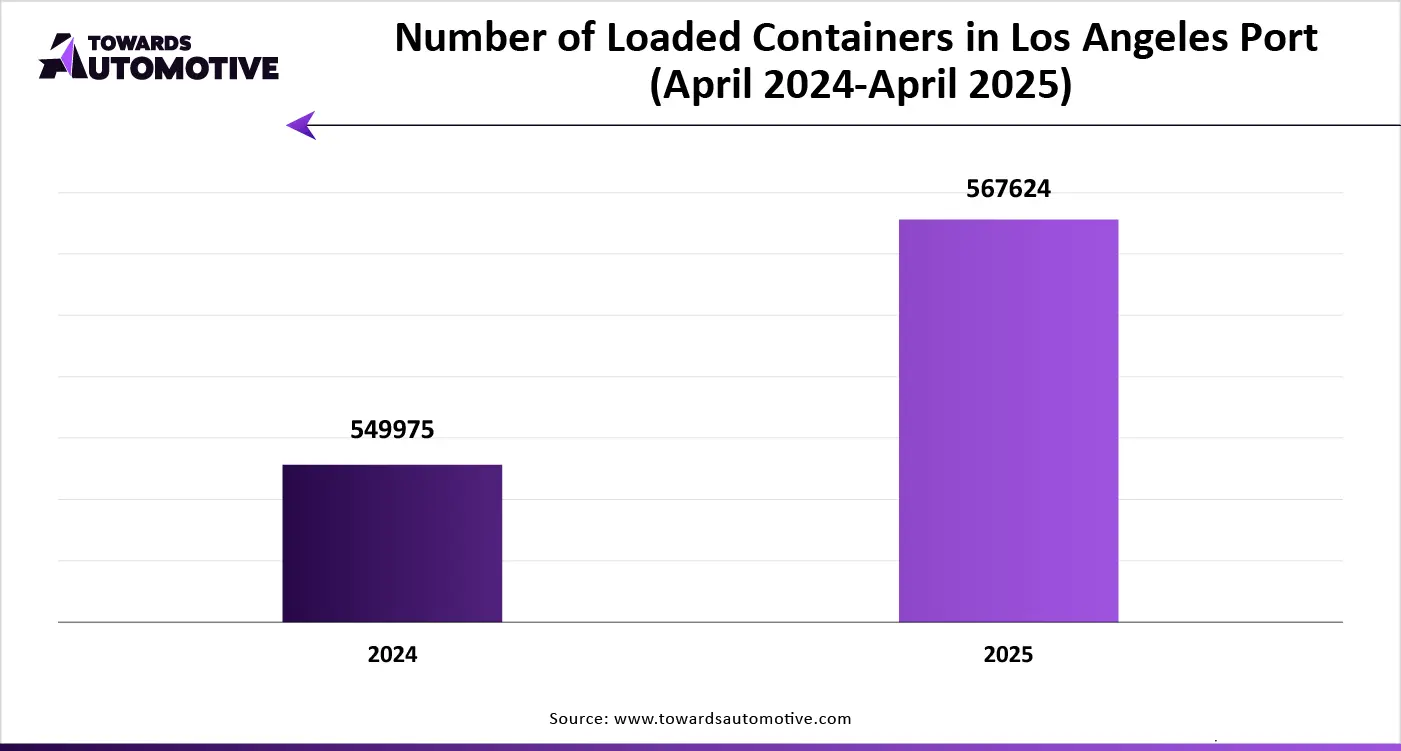

The container handling equipment market is a prominent branch of the heavy equipment industry. This industry deals in manufacturing and distribution of container handling equipment in different parts of the world. There are various types of equipment developed in this industry consisting of forklift trucks, stacking cranes, mobile harbor cranes, AGVs, reach stackers and some others. These equipment are powered by different types of propulsion technology including diesel, electric and hybrid. It finds application in numerous sectors such as port terminals, rail yards, warehouses and some others. The end-users of these equipment consist of logistics, manufacturing, construction and some others. The rise in number of loaded containers from different ports has contributed to the industrial expansion. This market is expected to rise significantly with the growth of the maritime sector around the globe.

| Metric | Details |

| Market Size in 2024 | USD 8.20 Billion |

| Projected Market Size in 2034 | USD 18.99 Billion |

| CAGR (2025 - 2034) | 8.76% |

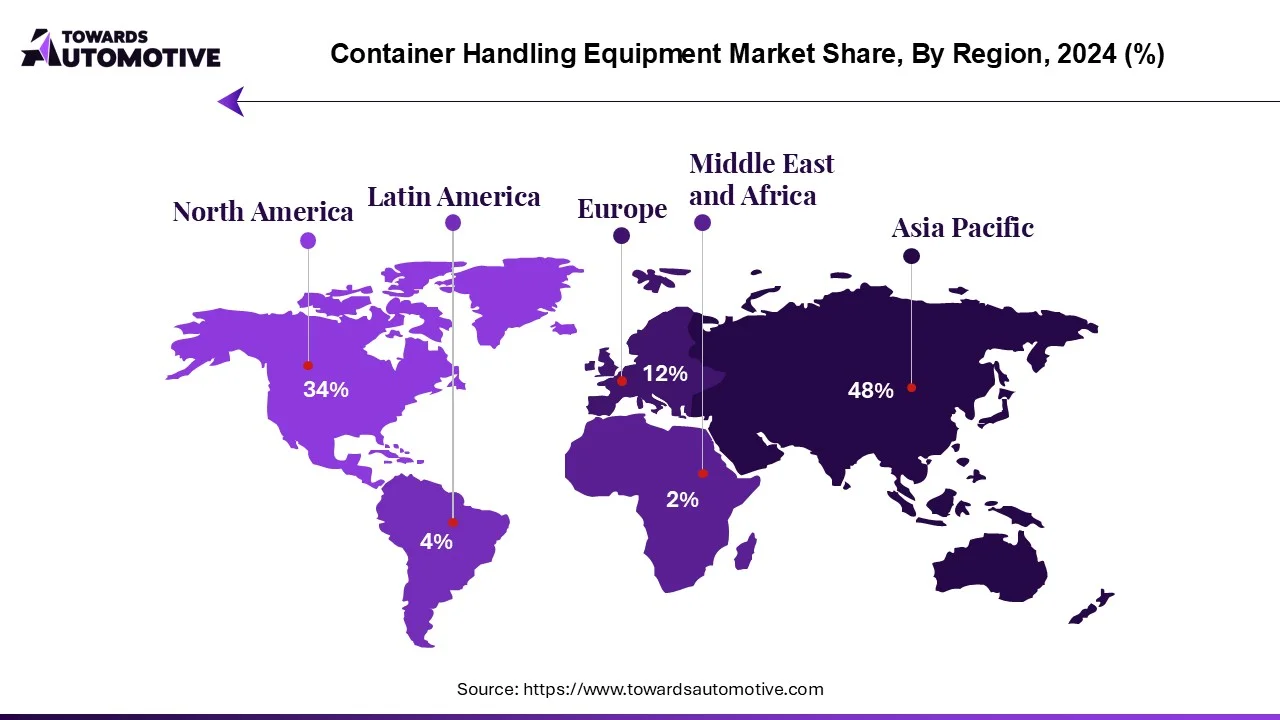

| Leading Region | Asia Pacific |

| Market Segmentation | By Equipment Type, By Application, By Propulsion Type, By End-User and By Region |

| Top Key Players | Terex Corporation; The Manitowoc Company, Inc.; XCMG; Demag Cranes & Components GmbH; GORBEL INC.; Hitachi Construction Machinery Europe NV |

The major trends in this industry consists of rapid adoption of electric forklifts, government investment in ports, partnerships and smart ports.

The demand for electric forklifts has increased rapidly for lowering emission arising from port operations. For instance, in August 2024, Sany launched SCPE350. SCPE350 is an electric forklift equipped with a loading capacity of around 35 tons that helps in enhancing numerous applications in ports. (Source: SANY)

Government of several countries such as India, U.S., UK and some others have started investing heavily for developing ports to enhance logistics operations. For instance, in November 2024, the government of U.S. announced to invest around US$ 580 million. This investment is done for developing the ports of this nation. (Source: Container-News)

Numerous ports are partnering with equipment manufacturers for deploying advanced machineries to upscale port operations. For instance, in January 2025, Kalmar partnered with Maputo Port Development Company. Through this partnership, Kalmar will deliver 5 Kalmar T2i terminal tractors, 4 Kalmar heavy forklift trucks and 1 Kalmar medium forklift truck to the Maputo Port Development Company. (Source: Kalmar)

Advancement in technologies such as AI, blockchain, IoT are integral for the development of smart ports. These ports deliver several features including real-time data integration, optimized vessel scheduling, automation, digital connectivity, predictive maintenance and some others. Various organizations are collaborating with educational institutions to develop smart ports. For instance, in February 2025, the Indian Ports Association (IPA) collaborated with C3iHub, IIT Kanpur. This collaboration is done for developing the smart ports of India. (Source: Passionate in Marketing (PIM))

The forklift trucks segment held the largest share of the market. The growing demand for container forklifts in ports for handling cargo containers and pallets has boosted the market growth. Also, the rising application of advanced forklifts in modern ports due to their cost-effectiveness and increased efficiency is likely to shape the industry in a positive direction. Moreover, the increasing adoption of hybrid forklifts and electric forklifts in smart ports is driving the growth of the container handling equipment market.

The automated guided vehicles (AGVs) segment is anticipated to rise with a notable CAGR during the forecast period. The rising application of automated guided vehicles (AGVs) for transporting containers in ports has boosted the market growth. Also, rapid development in several AGV technologies such as laser guidance technology and inductive guidance technology is further adding to the industrial expansion. Additionally, numerous partnerships among logistics companies and AGV solution providers for developing advanced AGVs is anticipated to propel the growth of the container handling equipment market.

The diesel segment led the market. The increasing use of diesel-forklifts in traditional ports for operating several port applications such as loading, unloading, movement of cargo and some others is driving the market expansion. Also, the rising application of diesel-powered terminal tractors in ports for shipping containers in terminals has further contributed to the industrial growth. Moreover, the growing adoption of heavy-duty cranes in manufacturing sector for several applications such as lifting, lowering, and moving heavy loads is anticipated to propel the growth of the container handling equipment market.

The electric segment is likely to grow with the highest CAGR during the forecast period. The growing adoption of electric reach stackers in logistics sector for handling containers in warehouses has driven the market growth. Additionally, the rising demand for electric forklift due to its numerous benefits such as reduced operating costs, environmental benefits, improved ergonomics and some others is positively shaping the industry. Moreover, the increasing application of electric cranes in construction sector is driving the growth of the container handling equipment market.

The logistics segment held the largest share of the industry. The rising development in the logistics sector due to integration of advanced technologies such as AI, ML, Big Data Analytics and some others has driven the market growth. Additionally, the growing adoption of electric equipment for handling logistics operations with an aim to reduce emission is further adding to the industrial development. Moreover, the rapid growth in the e-commerce sector along with increasing fundings by government to strengthen the logistics industry is anticipated to drive the growth of the container handling equipment market.

The manufacturing segment is projected to grow with considerable CAGR during the forecast period. The growing adoption of advanced equipment in the manufacturing sector for enhancing supply-chain operations has driven the market expansion. Also, the advent of smart tracking solutions for monitoring container handling equipment in manufacturing industry is further adding to the industrial expansion. Moreover, numerous collaborations among market players and manufacturing companies for deploying electric equipment in production facilities is projected to drive the growth of the container handling equipment market.

Asia Pacific held the highest share of the container handling equipment market. The growing investment by government of several countries such as China, India, Japan, South Korea, Taiwan and some others for developing the logistics sector has boosted the market growth. Also, the rise in number of government buildings and residential apartments has increased the demand for advanced equipment to handle containers, thereby driving the industrial expansion. Moreover, the presence of several market players such as Sany Group, Shanghai Zhenhua Heavy Industries Co. Ltd (ZPMC), Anhui HELI Forklifts Group Co. Ltd and some others is driving the growth of the container handling equipment market in this region.

China is the major contributor in this region. The growing demand for advanced container handling equipment from the logistics sector along with integration of advanced technologies such as AI and IoT in the manufacturing sector has contributed to the industrial expansion. Moreover, rapid investment by government for developing the road infrastructure further adds to the market growth.

North America is expected to grow with a significant CAGR during the forecast period. The rising development in the online shopping sector due to presence of e-commerce giants such as Ebay, Amazon, Walmart and some others had increased the demand for advanced container handling equipment, thereby driving the market growth. Additionally, the rise in number of ports in the U.S. and Canada has further contributed to the industrial expansion. Moreover, the presence of several container handling equipment companies such as Hyster-Yale Materials Handling, Inc., Terex Corporation, Manitowoc Company, Inc and some others is likely to propel the growth of the container handling equipment market.

U.S. dominated this region. The growing development in the port infrastructure due to numerous government initiatives and technological advancements has bolstered the market growth. Additionally, the availability of a well-established logistics sector for facilitating cross-border trades is further adding to the industrial expansion.

The container handling equipment market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Komatsu Ltd; Konecranes; LIEBHERR; PALFINGER AG; Pelloby Premier Cranes; SANY Group; Street Crane Company Limited; Tadano Ltd; Terex Corporation; The Manitowoc Company, Inc.; XCMG; Demag Cranes & Components GmbH; GORBEL INC.; Hitachi Construction Machinery Europe NV; BUCKNER HEAVYLIFT CRANES, LLC; CARGOTEC CORPORATION; Caterpillar; CERTEX USA; KITO CORPORATION and some others. These companies are constantly engaged in developing a wide range of container handling equipment and adopting numerous strategies such as joint ventures, collaborations, business expansions, acquisitions, launches, partnerships, and some others to maintain their dominance in this industry.

By Equipment Type

By Application

By Propulsion Type

By End-User

By Region

October 2025

March 2025

March 2025

March 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us