The end-to-end (E2E) ADAS market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034, powering sustainable infrastructure globally. The growing demand for self-driving vehicles among HNIs coupled with integration of advanced RADAR sensors in luxury cars has driven the market expansion.

Also, numerous government initiatives aimed at mandating ADAS in vehicles along with rise in number of automotive startups in the APAC region is playing a crucial role in shaping the industrial landscape. The rapid shift towards one-stage processing architectures and technological improvements in sensor technology is expected to create ample growth opportunities for the market players in the upcoming years.

The end-to-end (E2E) ADAS market is generally driven by the rising focus of automakers to integrate autonomous driving facilities in their vehicles coupled with rapid investment by automotive companies to develop advanced ADAS solutions for modern cars. The end-to-end ADAS is a system where a single neural network derives raw sensor data for operating numerous automotive functions such as steering, acceleration, and braking. There are various components of E2E ADAS systems including radar sensors, lidar sensors, camera systems, ultrasonic sensors, infrared / night vision sensors, ECUs / controllers, software / AI algorithms and some others.

These components are used for performing several functions consisting of adaptive cruise control (ACC), driver monitoring systems (DMS), lane departure warning / lane keeping assist, blind spot detection, automatic emergency braking (AEB) / forward collision warning, parking assist / reverse cameras / 360° view, traffic sign recognition, night vision / pedestrian detection, head-up display / adaptive lighting and some others. It is designed for different types of vehicles comprising of passenger cars and commercial vehicles. This market is expected to rise significantly with the growth of the automotive sector in different parts of the globe.

| Metric | Details |

| Major Drivers | Increased demand for autonomous vehicles, government mandates for ADAS in vehicles, growing integration of RADAR and LiDAR sensors, rising focus on safety and comfort features. |

| Leading Region | North America |

| Market Segmentation | By System / Solution Type, By Sensor / Component Type, By Vehicle Type, By Application Scope and By Region |

| Top Key Players | Robert Bosch GmbH, Continental AG, Denso Corporation, Aptiv PLC, Magna International Inc., ZF Friedrichshafen AG, Valeo SA, Mobileye (Intel), NXP Semiconductors, HELLA GmbH & Co. KGaA, Autoliv, Inc., Nvidia, Qualcomm, Hyundai Mobis. |

The major trends in this market consists of partnerships, government mandates and rising sales of autonomous vehicles.

The adaptive cruise control (ACC) segment held the largest share of the market. The growing use of ACC in modern cars to enhance safety in modern cars has boosted the market growth. Also, the increasing focus of automakers to integrate adaptive cruise control in autonomous cars along with technological advancements in ADAS systems is playing a vital role in shaping the industrial landscape. Moreover, numerous advantages of adaptive cruise control (ACC) such as reduced driver fatigue, enhanced safety, prevention collision and some others is expected to drive the growth of the end-to-end (E2E) ADAS market.

The driver monitoring systems (DMS) segment is expected to expand with the highest CAGR during the forecast period. The increasing use of driver monitoring systems (DMS) in autonomous cars to monitor driving capabilities has driven the market expansion. Additionally, the growing emphasis of truck manufacturers for integrating driver monitoring systems (DMS) in self-driving trucks is contributing to the industry in a positive manner. Moreover, several advantages of DMS such as accident prevention, cost savings, data collection, attention monitoring and some others is expected to boost the growth of the end-to-end (E2E) ADAS market.

The radar sensors segment led the market. The increasing use of radar sensors in autonomous trucks for detecting objects and calculating their velocity has boosted the market expansion. Additionally, rapid investment by ADAS companies to open new manufacturing units to increase the production of radar sensors is playing a vital role in shaping the industrial landscape. Moreover, numerous advantages of radar sensors including weather resistance, long range, high resolution, accurate speed, cost-effectiveness, low maintenance and some others is expected to propel the growth of the end-to-end (E2E) ADAS market.

The LiDAR sensors segment is expected to rise with the fastest CAGR during the forecast period. The growing application of LiDAR sensors in passenger cars to for create high-resolution, 3D maps of the car's surroundings has boosted the market growth. Also, rapid focus of automotive companies for integrating advanced LiDAR sensors in modern cars to enhance vehicular safety is contributing to the industry in a positive manner. Moreover, several advantages of LiDAR sensors such as high accuracy, precision, speed, efficiency in data collection and some others is expected to foster the growth of the end-to-end (E2E) ADAS market.

The passenger cars segment led the market. The growing sales of passenger vehicles in numerous countries such as India, China, the U.S, Canada, Germany and some others has boosted the market growth. Also, rapid investment by automotive companies for opening up new manufacturing plants to increase the production of autonomous cars is playing a prominent role in shaping the industry in a positive direction. Moreover, partnerships among car manufacturers and ADAS providers to deploy advanced ADAS solutions in passenger vehicles is expected to boost the growth of the end-to-end (E2E) ADAS market.

The commercial vehicles segment is expected to grow with the highest CAGR during the forecast period. The growing demand for autonomous buses in several countries such as Germany, India, the U.S. and Canada has boosted the market growth. Additionally, numerous government initiatives aimed at mandating ADAS in commercial vehicles coupled with rapid investment by automotive brands for opening new production units to increase the manufacturing of self-driving trucks is playing a vital role in shaping the industrial landscape. Moreover, collaborations among commercial vehicle brands and sensor manufacturers is expected to propel the growth of the end-to-end (E2E) ADAS market.

The OEM-fitted segment led the market. The increasing emphasis of automotive consumers for using OEM-based ADAS components in their vehicles due to their trust and reliability has boosted the market growth. Additionally, rapid investment by automotive companies for opening up new service centers along with increasing focus of ADAS brands to deliver a wide range of ADAS solutions is playing a vital role in shaping the industrial landscape. Moreover, partnerships among automotive OEMs and ADAS developers to deploy advanced ADAS solutions is modern vehicles is expected to boost the growth of the end-to-end (E2E) ADAS market.

The aftermarket segment is expected to rise with the fastest CAGR during the forecast period. The growing focus of automotive aftermarket companies to deliver ADAS components at less prices has driven the market expansion. Additionally, the surging demand for cost-effective ADAS solutions from the people living in developing regions is shaping the industry in a positive direction. Moreover, the availability of numerous types of ADAS hardware in several online platforms such as Amazon, Ebay, Walmart and some others is expected to drive the growth of the end-to-end (E2E) ADAS market.

The safety / collision prevention segment held the largest share of the market. The increasing focus of automotive brands for integrating ADAS in their vehicles to enhance safety has driven the market expansion. Additionally, rapid investment by automakers to develop high-quality sensors for prevention collision in autonomous vehicles is playing a vital role in shaping the industrial landscape. Moreover, partnerships among automakers and ADAS developers to develop advanced collision avoidance systems is expected to drive the growth of the end-to-end (E2E) ADAS market.

The comfort / convenience features segment is expected to rise with the highest CAGR during the forecast period. The growing emphasis of automotive manufacturers to integrate advanced solutions for enhancing comfort in modern cars has driven the market growth. Additionally, rapid investment by automakers for opening up new production facilities to increase the manufacturing of ADAS components is contributing to the industry in a positive manner. Moreover, collaborations among EV brands and ADAS companies to integrate advanced sensors in vehicles to enhance driving convenience is expected to propel the growth of the end-to-end (E2E) ADAS market.

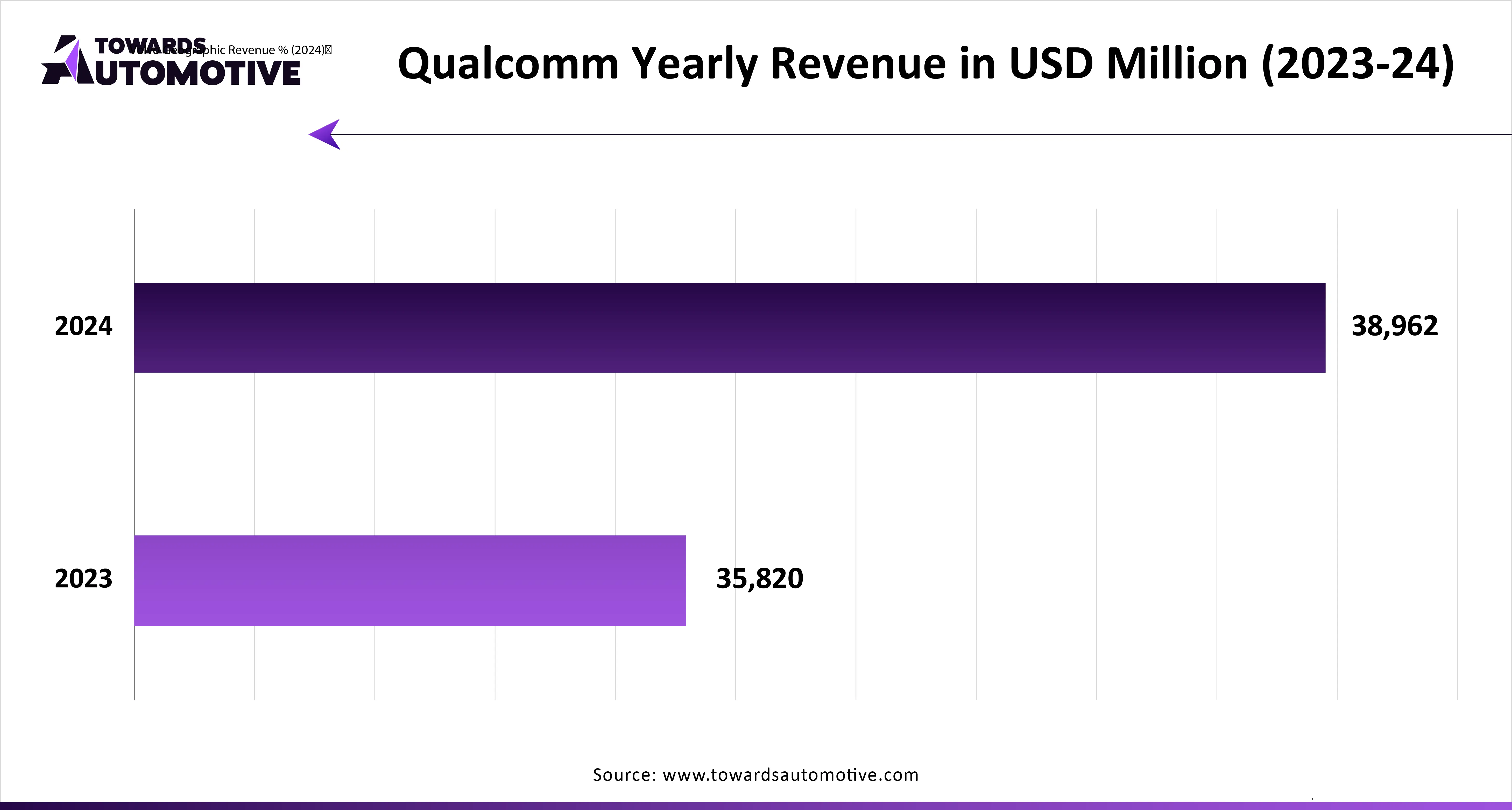

North America dominated the end-to-end (E2E) ADAS market. The increasing demand for autonomous vehicles in the U.S. and Canada for lowering the dependency on manual labors has boosted the market growth. Additionally, rising focus of government for strengthening the V2X infrastructure coupled with rapid investment by several automotive brands such as Ford, General Motors, Tesla, Rivian and some others to develop high-quality ADAS solutions is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as Nvidia, Qualcomm, Mobileye and some others is expected to foster the growth of the end-to-end (E2E) ADAS market in this region.

U.S. led the market in this region. The growing adoption of self-driving cars by fleet operators coupled with rapid investment by government for developing the road infrastructure has boosted the market expansion. Additionally, the increasing emphasis of automotive companies for developing new R&D centers is playing a prominent role in shaping the industrial landscape.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The increasing demand for autonomous trucks from various countries such as India, China, Japan, South Korea, Australia and some others has boosted the market growth. Also, numerous government initiatives aimed at mandating ADAS in vehicles along with rise in number of ADAS startups is contributing to the industry in a positive manner. Moreover, the presence of several market players such as Panasonic Corporation, Denso Corporation, Hyundai Mobis and some others is expected to propel the growth of the end-to-end (E2E) ADAS market in this region.

India and China are the prominent contributors in this region. In China, the market is driven by the rapid shifts of automotive brands towards autonomous vehicles coupled with availability of raw materials at less prices. In India, the rising emphasis of EV brands to integrate ADAS in their vehicles to enhance safety along with technological advancements in the software industry is playing a prominent role in shaping the industry in a positive manner.

| August 2025 | Announcement |

| Qasar Younis, co-founder and CEO of Applied Intuition | Our vision is to enable every automaker to build vehicles that are not only safer and more capable, but are also continuously improving as the industry enters a new era in which vehicle intelligence will define the winners. This is about accelerating the global shift to intelligent mobility. SDS for Automotive puts the full autonomy stack in the hands of OEMs, giving them the visibility, flexibility and control they need to differentiate. |

| September 2025 | Announcement |

| Joachim Mathes, the Chief Technology Officer of Valeo Brain division | Ensuring seamless integration and robust testing is crucial for safety on the road. We are proud to leverage our complex systems integration expertise to deliver cutting-edge solutions that drive innovation and performance in the automotive industry. With this ADAS system, Valeo is taking ADAS to the next level and we are looking forward to working with Capgemini to deliver the best and most reliable solution to drivers worldwide. |

| September 2025 | Announcement |

| Dr Mihiar Ayoubi, senior VP development driving experience, BMW Group | Together with Qualcomm Technologies, we’ve created a groundbreaking system, which is a significant contribution to the big technological leap we take with our Neue Klasse. This collaboration has enabled us to develop a cutting-edge driver assistance system, setting a new benchmark. Smart, symbiotic and safe is the core of the BMW philosophy when it comes to ADAS – our new BMW iX3 will deliver this on an unprecedented level. |

| January 2025 | Announcement |

| Mahesh Kailasam, general manager at Hexagon’s Manufacturing Intelligence division | We embarked on a journey to build our cloud-based ADAS simulation software from the ground up with CI/CT processes in mind, addressing the software development challenges our automotive customers face today. Whether aiming to increase test coverage, shorten test cycles, or automate workflows, our VTDx solution offers significant benefits. |

| June 2025 | Announcement |

| Vladislav Voroninski, CEO and founder of Helm.ai. | Robust urban perception, which culminates in the BEV fusion task, is the gatekeeper of advanced autonomy.Helm.ai Vision addresses the full spectrum of perception tasks required for high end Level 2+ and Level 3 autonomous driving on production-grade embedded systems, enabling automakers to deploy a vision-first solution with high accuracy and low latency. Starting with Helm.ai Vision, our modular approach to the autonomy stack substantially reduces validation effort and increases interpretability, making it uniquely suited for nearterm mass market production deployment in software defined vehicles. |

| July 2025 | Announcement |

| Alan Hagerty, alignment product manager for Hunter | HawkEye Elite X provides a scalable foundation for a profitable alignment business that includes steering system resets and dynamic calibrations today, with the option to expand into a profitable static ADAS calibrations business in the future. |

| May 2025 | Announcement |

| Antonio Polo, Sr. Vice-President of Product and Business Development at LeddarTech | Automotive companies face exponential challenges in the cost, complexity and scale of the data required to deploy safety-compliant and regulation-ready ADAS and AD systems at scale. LeddarSim brings the latest advances in AI-powered, multi-modal sensor dataset generation to recreate real-world driving scenarios with high fidelity. We believe LeddarSim fills a critical gap in the market. As the demand for simulation tools grows with the industry expected to surpass $4.6 billion by 2035 this solution is poised to help address the massive data and validation challenge. LeddarSim is available for trial evaluation and offers the flexibility to be used as a stand-alone tool or integrated within existing simulation toolchains. |

| April 2025 | Announcement |

| Dr.Xiaoxin Qiu, founder and chairman of Axera | It is a great honor to establish strategic partnership with STRADVISON. STRADVISON has a profound accumulation in the field of deep learning perception algorithms and extensive experience in the mass production of global vehicle models. The Axera M57 series chips, and upcoming automotive chips are high-performance and designed for global market. We look forward to working together to expand our presence in the global intelligent automotive market and stepping onto an even bigger stage. |

The end-to-end (E2E) ADAS market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Robert Bosch GmbH, Continental AG, Denso Corporation, Aptiv PLC, Magna International Inc, ZF Friedrichshafen AG, Valeo SA, Mobileye (Intel), NXP Semiconductors, HELLA GmbH & Co. KGaA, Autoliv, Inc., Nvidia, Qualcomm, Panasonic Corporation, Hyundai Mobis and some others. These companies are constantly engaged in developing ADAS solutions for the automotive sector and adopting numerous strategies such as acquisitions, business expansions, launches, partnerships, collaborations, joint ventures and some others to maintain their dominance in this industry.

Tier 1

Tier 2

Tier 3

By System / Solution Type

By Sensor / Component Type

By Vehicle Type

By Application Scope

By Region

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us