December 2025

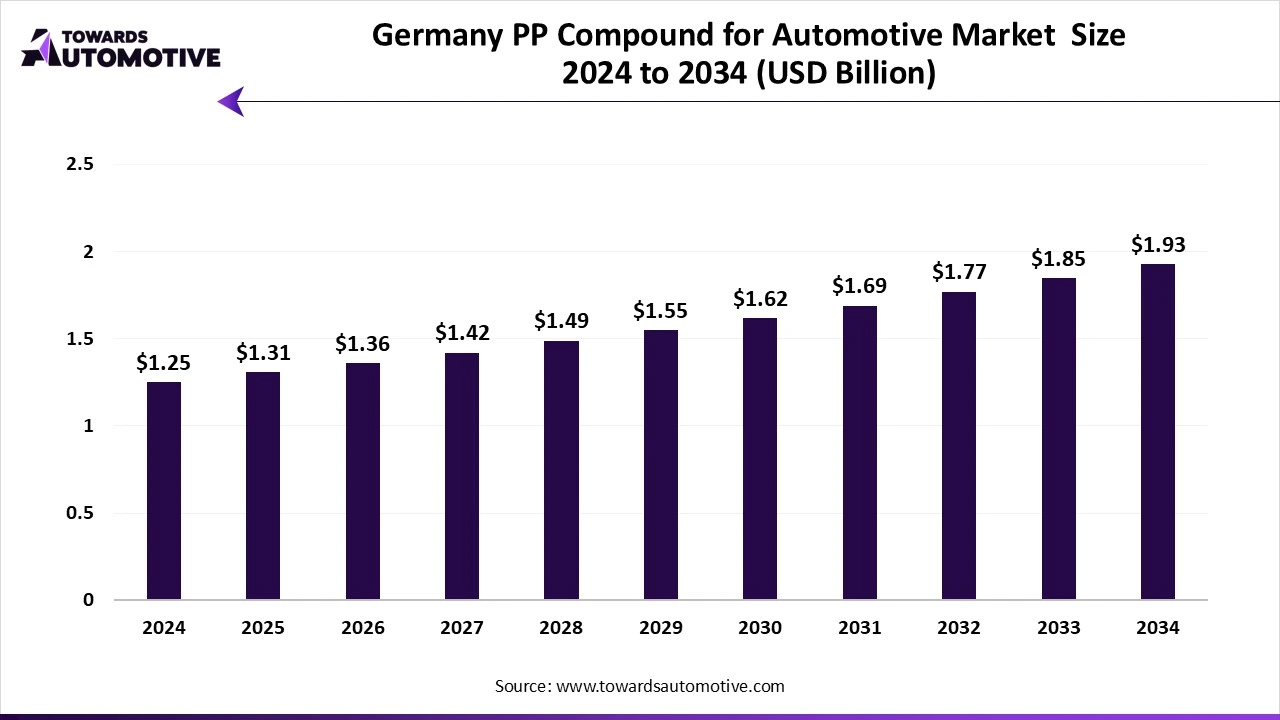

The Germany PP compound for automotive market is forecasted to expand from USD 1.31 billion in 2025 to USD 1.93 billion by 2034, growing at a CAGR of 4.43% from 2025 to 2034.

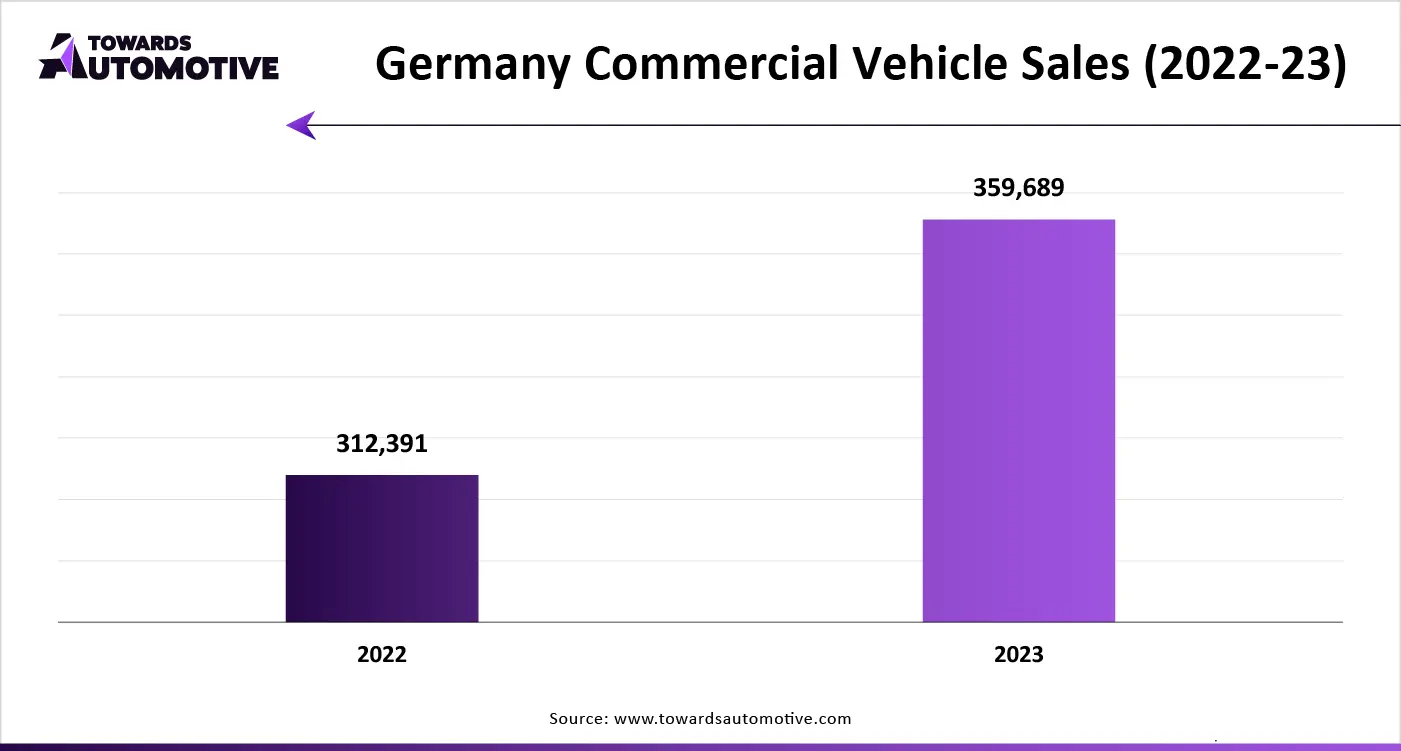

The Germany PP compound for automotive market is an important branch of the automotive industry. This industry deals in manufacturing and distribution of PP compounds for the automotive sector across Germany. There are several types of products manufactured in this sector consisting of mineral-filled PP compounds, glass-reinforced PP compounds, flame-retardant PP compounds and some others. These compounds are designed for numerous types of vehicles including passenger cars, light commercial vehicles, heavy commercial vehicles, electric vehicles and some others. It finds application in developing interior components and exterior components of automotives. The rising sales of commercial vehicles in Germany is expected to boost the market growth. This market is expected to rise significantly with the growth of the electric vehicle industry across Germany.

| Metric | Details |

| Market Size in 2024 | USD 1.25 Billion |

| Projected Market Size in 2034 | USD 1.93 Billion |

| CAGR (2025 - 2034) | 4.43% |

| Market Segmentation | By Product, By Vehicle Type, By Application and By End-User |

| Top Key Players | Knauf Industries GmbH, LyondellBasell Industries Holdings B.V., Mitsui Chemicals Inc. |

The mineral-filled segment held a dominant share of the market. The growing application of mineral-filled PP compounds for manufacturing various automotive parts including door panels, dashboards, trims and some others has boosted the market expansion. Also, the rising emphasis on developing light-weight automotive parts along with technological advancements in polypropylene industry has accelerated the market growth. Additionally, numerous benefits of these PP compounds including dimensional stability, enhanced mechanical properties, cost-effectiveness and some others is expected to boost the growth of the Germany PP compound for automotive market.

The passenger cars segment led the industry. The rising sales and production of passenger cars in Germany has increased the demand for PP compounds, thereby driving the market expansion. Also, the growing investment by automotive companies for using high-quality polypropylene compounds to enhance the aesthetics in passenger vehicles is further accelerating the industrial growth. Moreover, the increasing trend of SUVs among youths coupled with rapid development in the automotive industry is driving the growth of the Germany PP compound for automotive market.

The interior components segment held the lion’s share of the market. The growing use of mineral-filled polypropylene compounds for developing automotive interiors has boosted the market growth. Also, the rising application of PP compounds for manufacturing several components such as door trims, instrument panels, carpet fibers and some others has played a significant role in shaping the industrial landscape. Moreover, numerous benefits of using PP-based interiors including superior mechanical strength, moldability, lightweight, recyclability, cost-effective and some others is proliferating the growth of the Germany PP compound for automotive market.

The original equipment manufacturers segment is likely to rise with a considerable growth rate during the forecast period. The rising demand for polypropylene compounds from automotive manufacturers of Germany for developing interiors parts and exterior parts has boosted the market expansion. Also, the rising emphasis on changing automotive parts in regular intervals along with increasing consumer preference towards genuine automotive components is further accelerating the market growth. Additionally, numerous companies are opening new automotive research centers to cater the needs of the German consumers, thereby fostering the growth of the Germany PP compound for automotive market.

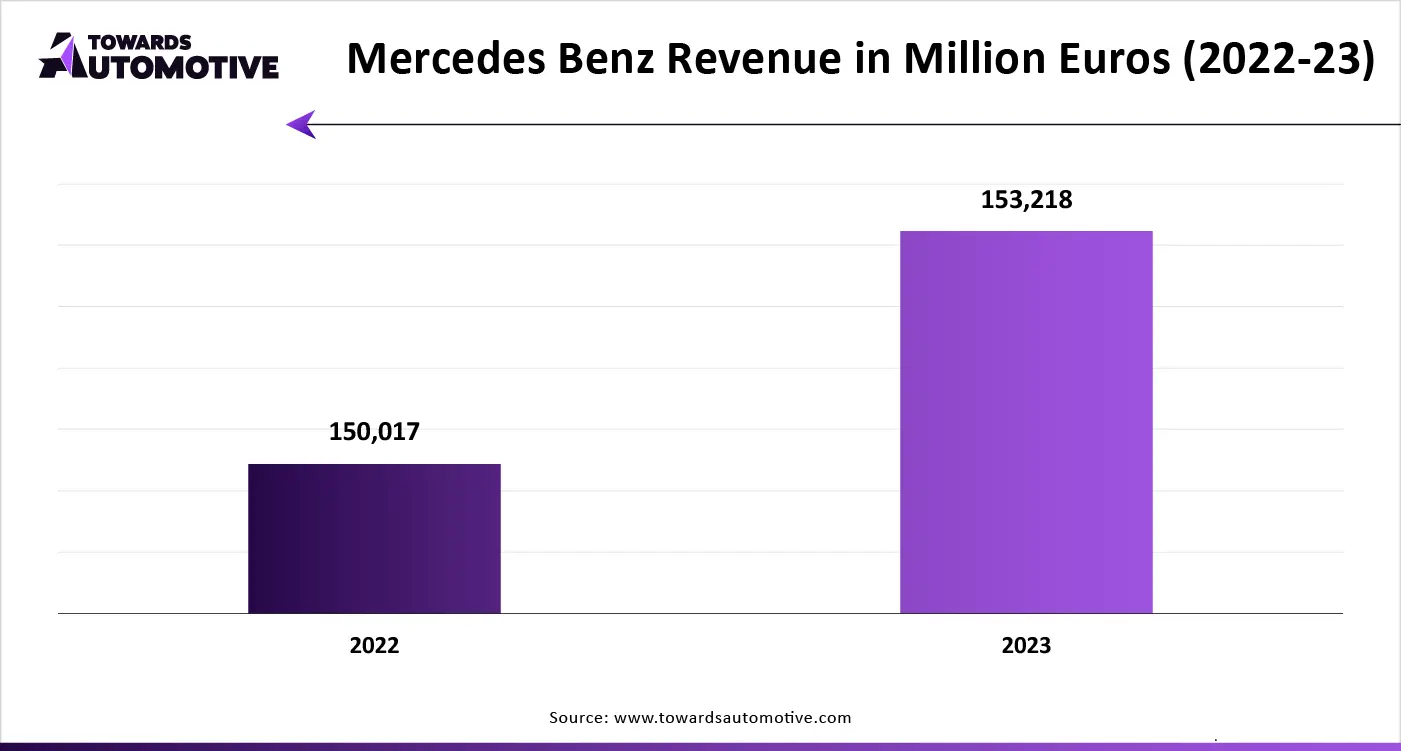

Stuttgart held the highest share of the Germany PP compound for automotive market. The rising demand for luxury vehicles among the people of this city has contributed significantly to the industrial expansion. Also, the presence of several prominent automotive companies such as Mercedes-Benz, Porsche and some others coupled with technological advancements in the automotive sector is playing a vital role in shaping the industrial landscape. Moreover, availability of essential metals along with abundance of skilled workforce is further accelerating the growth of the Germany PP compound for automotive market.

Wolfsburg is expected to grow with a significant CAGR during the forecast period. The increasing demand for sports cars along with rapid adoption of EVs has boosted the market growth. Also, the presence of several automotive brands such as Volkswagen Group (VW), Skoda and some others is further aiding to the industrial expansion. Additionally, the rise in number of rich people coupled with growing trend of hybrid vehicles has driven the growth of the Germany PP compound for automotive market.

The Germany PP compound for automotive market is a fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Saudi Basic Industries Corporation (SABIC), Hexpol AB (RheTech), Ravago, Avient Corporation, Knauf Industries GmbH, LyondellBasell Industries Holdings B.V., Mitsui Chemicals Inc., Borealis AG, Washington Penn Plastic Co. Inc., Japan Polypropylene Corporation, Sumitomo Chemical Co., Ltd., and some others. These companies are constantly engaged in manufacturing polypropylene compounds for the automotive sector and adopting numerous strategies such as partnerships, collaborations, joint ventures, product launches, business expansion, acquisition, and some others to maintain their dominant position in this industry. For instance, in November 2023, LyondellBasell announced to open an advanced recycling demonstration plant at its Wesseling, Germany. This plant is opened to increase the production of polymer-based products. Also, in October 2023, Knauf Industries acquired Neopolen expanded polypropylene. This acquisition is done for manufacturing large amount of PP compound to cater the demands of the German automotive sector.

By Product

By Vehicle Type

By Application

By End-User

According to forecasts, the global military trucks market will grow from USD 25.70 billion in 2024 to USD 35.88 billion by 2034, with an expected CAGR...

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us