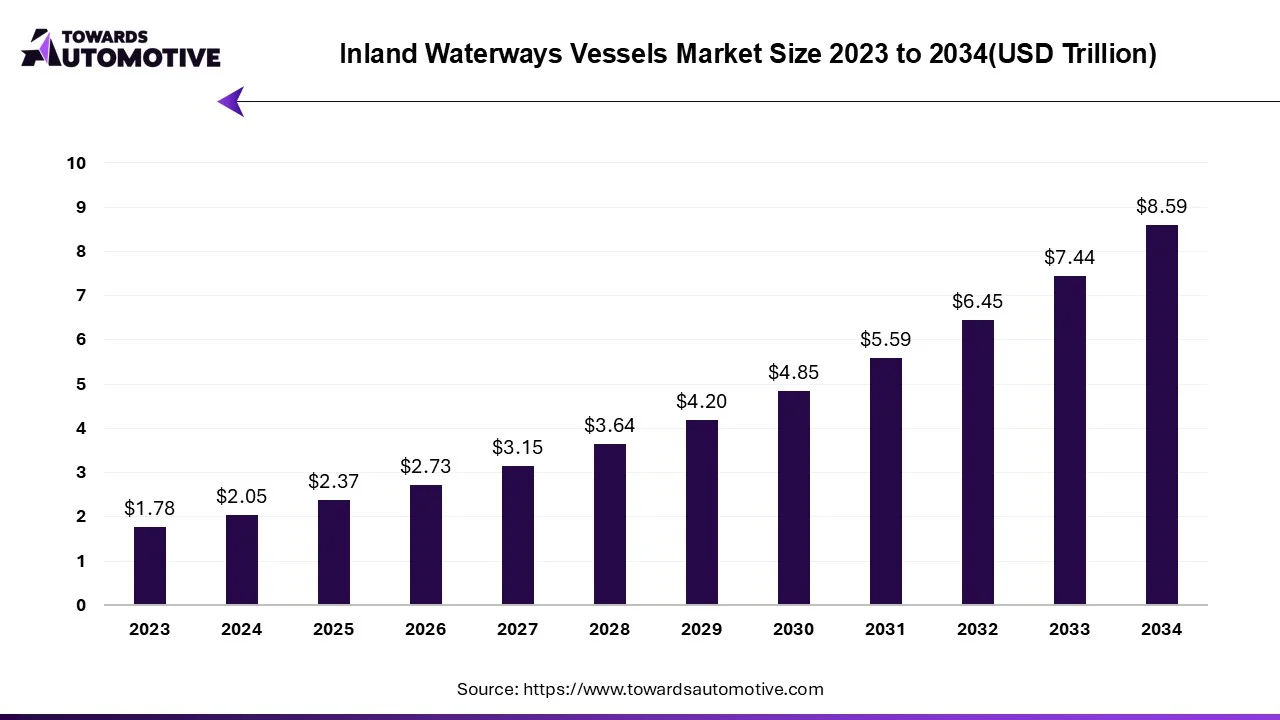

The inland waterways vessels market is projected to reach USD 8.59 trillion by 2034, expanding from USD 2.37 trillion in 2025, at an annual growth rate of 15.38% during the forecast period from 2025 to 2034. The rising awareness of water transportation among the people coupled with numerous government initiatives aimed at strengthening the maritime sector is playing a vital role in shaping the industry in a positive direction.

Additionally, rapid investment by shipbuilding companies for developing advanced vessels for the military sector along with growing development in the e-commerce industry is significantly contributing to the industrial landscape. The rejuvenation activities related to the Inland waterways as well as increasing demand for electric vessels from the logistics sector is expected to create ample growth opportunities for the market players in the upcoming days.

The inland waterways vessels market is a prominent branch of the marine industry. This industry deals in manufacturing and distribution of boats and ships in different parts of the world. There are several types of vessels developed in this sector comprising of freight vessels, tugboats, work boats, ferries and some others. These vessels are powered by different types of fuels consisting of LNG, LSFO, diesel oil, HFO, biofuel and some others. It finds applications in several sector including military, logistics and some others. The rapid investment by public entities for strengthening the ship-building infrastructure is playing a vital role in shaping the industrial landscape. This market is expected to rise significantly with the growth of the water transportation sector around the globe.

| Metric | Details |

| Market Size in 2024 | USD 2.05 Trillion |

| Projected Market Size in 2034 | USD 8.59 Trillion |

| CAGR (2025 - 2034) | 15.38% |

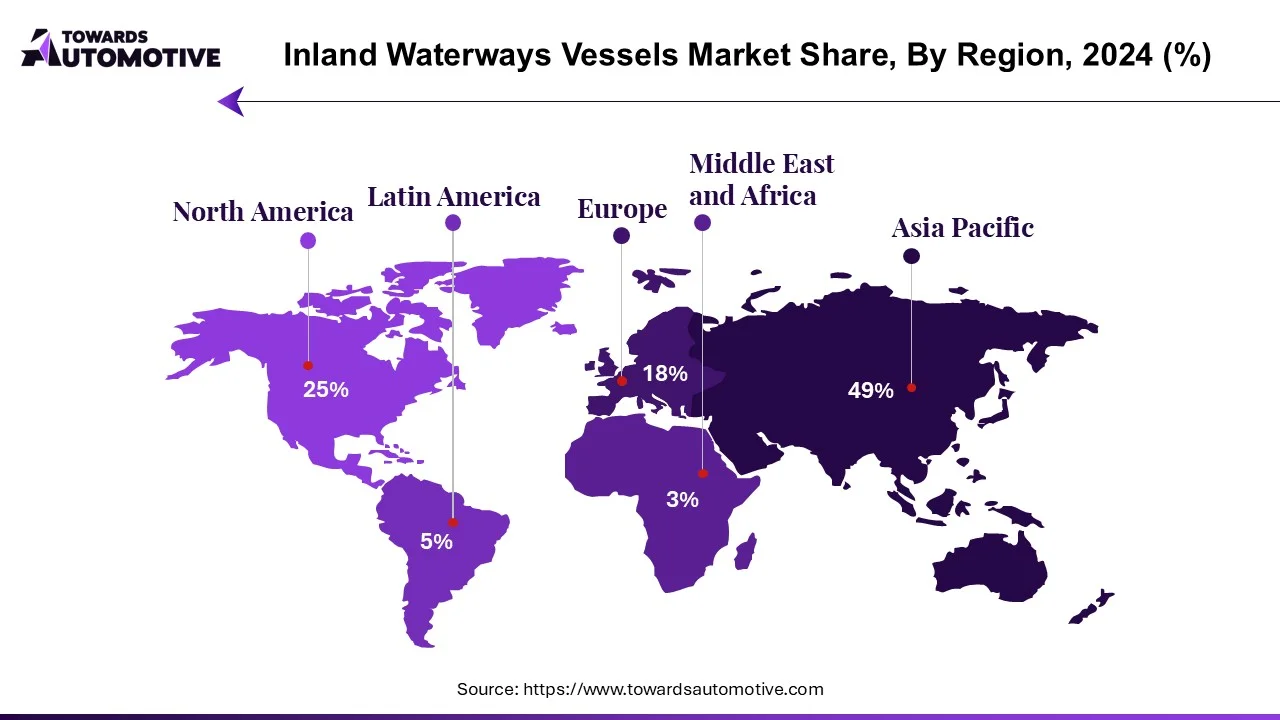

| Leading Region | Asia Pacific |

| Market Segmentation | By Vessel, By Transportation, By Application, By Fuel and By Region |

| Top Key Players | Blount Boats, Inc., Incat Crowther, Horizon Shipbuilding, Inc., Damen Shipyards Group, Viking River Cruises, American Cruise Lines |

The major trends in this market consists of government initiatives, automation in the shipbuilding sector, hybrid vessels.

The government of several countries such as the U.S., South Korea, France and some others are launching numerous initiatives aimed at developing the shipbuilding industry.

The shipbuilding companies are constantly engaged in integrated automated solutions to enhance workflow efficiency and increasing the overall output.

The demand for hybrid vessels has increased rapidly with an aim at reducing marine emission across the world.

The freight vessels segment dominated the market. The growing application of freight vessels for transporting goods and commodities from one port to another is expected to drive the growth of the inland waterways vessels market.

The tugboats segment is expected to rise with a considerable CAGR during the forecast period. The rising use of tugboats for pulling and pushing other marine vehicles is expected to propel the growth of the inland waterways vessels market.

The heavy fuel oil (HFO) segment held the largest share of the industry. The growing use of HFO in the shipping industry due to its high energy density and low cost as compared to other fuels is expected to drive the growth of the inland waterways vessels market.

The diesel oil segment is expected to grow with a notable CAGR during the forecast period. The increasing application of diesel in freight vessels and tugboats for delivering superior performance has driven the growth of the inland waterways vessels market.

Asia Pacific led the inland waterways vessels market. The growing development in the shipbuilding industry in several countries such as India, Japan, South Korea, China and some others has driven the market expansion. Additionally, numerous government initiatives aimed at developing the logistics industry coupled with rapid growth in the tourism sector is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as Bharati Shipyard Limited, Samsung Heavy Industries, China State Shipbuilding Corporation (CSSC) and some others is expected to drive the growth of the inland waterways vessels market in this region.

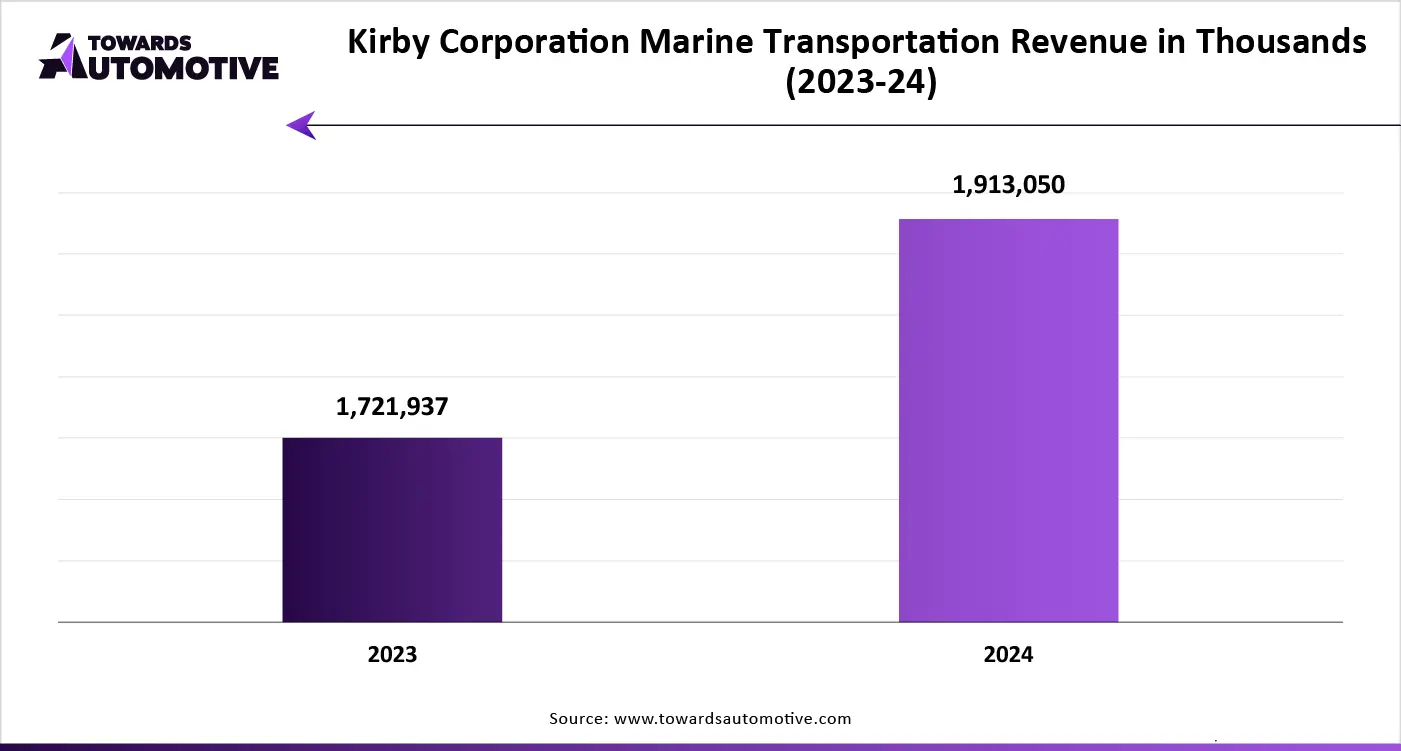

North America is expected to rise with a significant CAGR during the forecast period. The rapid growth of the e-commerce sector in the U.S. and Canada has increased the demand for freight vessels, thereby driving the market growth. Also, rapid investment by government for strengthening the shipbuilding industry coupled with growing adoption of electric vessels in the military sector is shaping the industry in a positive direction. Moreover, the presence of several vessel manufacturers including Bollinger Shipyards, Kirby Corporation, American River Transportation Company and some others is expected to foster the growth of the inland waterways vessels market in this region.

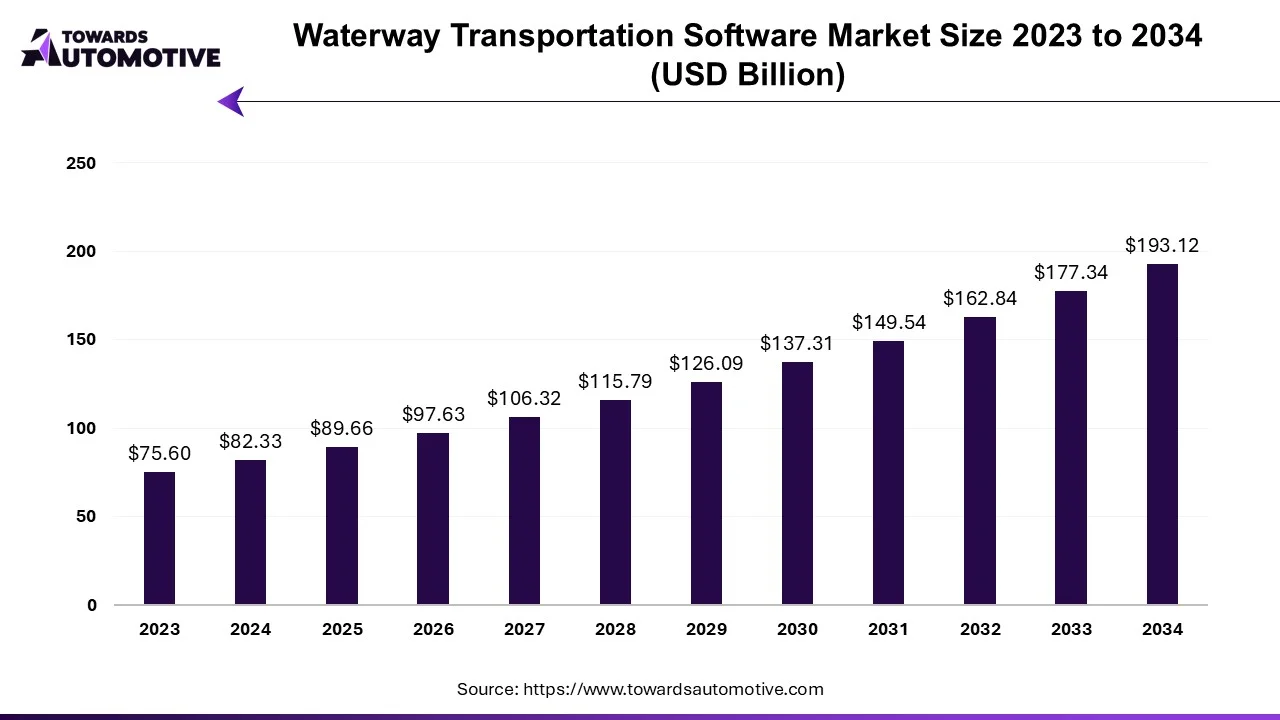

The waterway transportation software market is projected to reach USD 193.12 billion by 2034, growing from USD 89.66 billion in 2025, at a CAGR of 8.9% during the forecast period from 2025 to 2034.

The waterway transportation software market is a crucial branch of the maritime industry. This industry deals in developing advanced software for enhancing the capabilities of marine transportation. There are various types of software developed in this sector consisting of vessel tracking software, maritime software, yard management software, freight security software, ship broker software and some others.

These software finds application in several sectors including fleet management, cargo tracking, port management, safety management and some others. The end-user of this sector consists of logistics companies, shipping lines, port authorities, government agencies and some others. The growing deployment of cloud-based software in modern ports for tracking vessels has contributed to the overall industrial expansion. This market is likely to experience significant growth with the rise of the software industry in different parts of the globe.

The inland waterways vessels market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Blount Boats, Inc., Incat Crowther, Horizon Shipbuilding, Inc., Damen Shipyards Group, Viking River Cruises, American Cruise Lines, Aqua Expeditions, Fincantieri S.p.A., Meyer Werft GmbH & Co. KG, Chantiers de l'Atlantique, STX Offshore & Shipbuilding Co., Ltd., Irrawaddy Flotilla Company, Nichols Brothers Boat Builders, Kirby Corporation, Metal Shark Boats, and some others. These companies are constantly engaged in manufacturing different types of vessels and adopting numerous strategies such as acquisitions, joint ventures, collaborations, launches, partnerships, and some others to maintain their dominance in this industry.

By Vessel

By Transportation

By Application

By Fuel

By Region

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us