July 2025

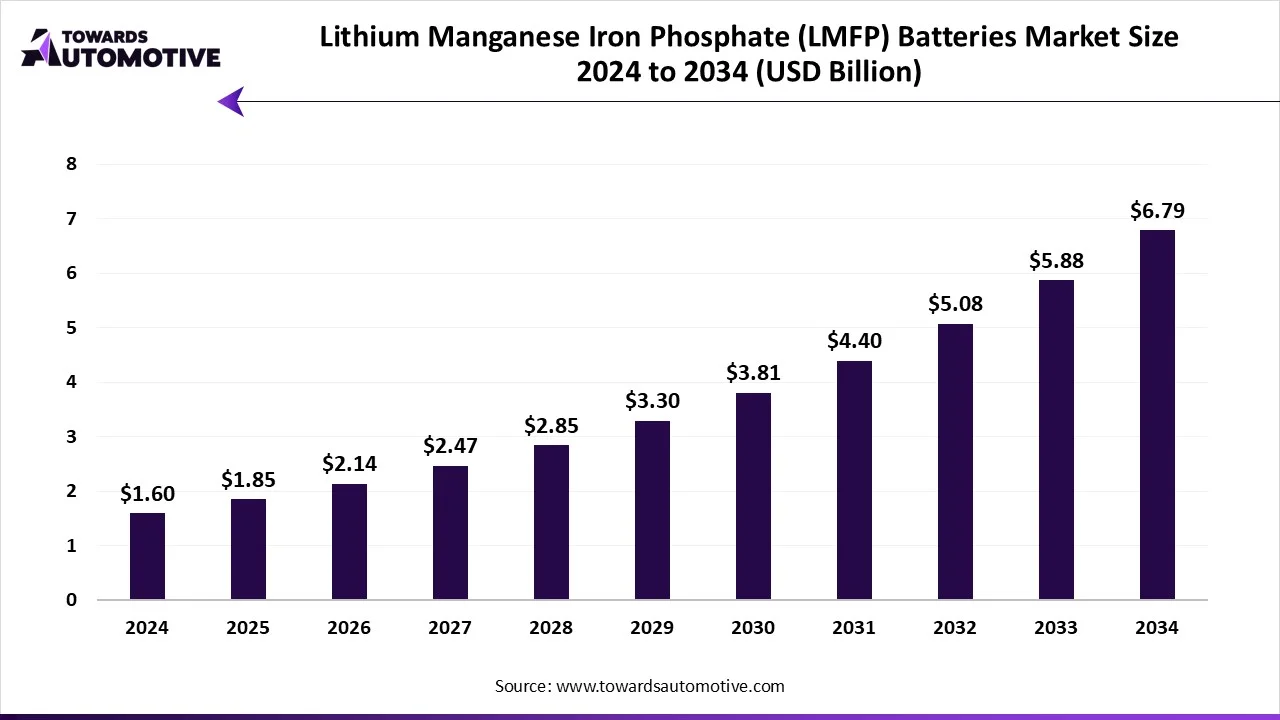

The lithium manganese iron phosphate (LMFP) batteries market is forecasted to expand from USD 1.85 billion in 2025 to USD 6.79 billion by 2034, growing at a CAGR of 15.55% from 2025 to 2034. The growing emphasis of automotive brands to use high-quality LMPF batteries in modern vehicles coupled with rapid investment by government for developing the battery manufacturing sector has fostered the market expansion.

Additionally, the increasing sales of EVs in developed nations along with technological advancements in the battery industry is playing a crucial role in shaping the industrial landscape. The rising use of high-manganese cathodes for manufacturing LMFP batteries is expected to create ample growth opportunities for the market players in the upcoming days.

The demand for lithium manganese iron phosphate (LMFP) batteries has increased rapidly due to rising sales of passenger EVs coupled with technological advancements in LMFP batteries. Lithium Manganese Iron Phosphate (LMFP) batteries are next-gen lithium-ion batteries that helps in enhancing the performance of lithium iron phosphate (LFP) batteries by addition of manganese to the cathode. These batteries are available in different forms including cylindrical, prismatic, pouch and some others. It is manufactured using various technologies such as traditional cathode synthesis, nano-engineered cathodes, coating / surface treatment technologies and some others. The end-users of these batteries consist of passenger EVs, commercial EVs, energy storage systems (ESS), Consumer Electronics, Industrial & Utility and some others. The lithium manganese iron phosphate (LMFP) batteries market is expected to rise significantly with the growth of the automotive sector in different parts of the globe.

| Metric | Details |

| Market Size in 2024 | USD 1.6 Billion |

| Projected Market Size in 2034 | USD 6.79 Billion |

| CAGR (2025 - 2034) | 15.55% |

| Leading Region | Asia-Pacific |

| Market Segmentation | By Form Factor, By Capacity Range, By Application / End-Use Industry, By Voltage / Configuration, By Battery Module / Pack Type, By Manufacturing / Technology, By Distribution / Sales Channel and By Region |

| Top Key Players | BYD Co. Ltd. (China), Gotion High-Tech (China), Sunwoda Electronic Co., Ltd. (China), CALB (China), Farasis Energy (China), SK On Co., Ltd. (South Korea), Phylion (China) |

The major trends in this market consists of business expansions, partnerships and government initiatives.

The lithium manganese iron phosphate (LMFP) segment dominated the market and is expected to expand with the highest CAGR during the forecast period. The growing adoption of nano-engineered technology in the battery industry for manufacturing high-quality lithium manganese iron phosphate batteries has boosted the market growth. Also, the rising application of these batteries in electric vehicles (EVs) for improving driving range coupled with its usage in stationary energy storage sector due to its enhanced safety and cost-effectiveness is playing a prominent role in shaping the industrial landscape. Moreover, rapid investment by automotive companies for developing a wide range of LMFP batteries to cater the needs of EVs is expected to propel the growth of the lithium manganese iron phosphate (LMFP) batteries market.

The lithium iron phosphate (LFP) segment held a considerable share of the market. The increasing use of lithium iron phosphate (LFP) batteries in commercial EVs such as electric buses and hybrid trucks has boosted the market growth. Also, the growing demand for these batteries from grid operators for delivering backup power coupled with technological advancements in LFP batteries is playing a vital role in shaping the industrial landscape. Moreover, rapid investment by battery manufacturers for opening new production plants to increase the production of lithium iron phosphate (LFP) batteries in the APAC region is expected to boost the growth of the lithium manganese iron phosphate (LMFP) batteries market.

The prismatic segment held the highest share of the market. The technological advancements in the electrode fabrication process along with rapid adoption of automated tools for manufacturing prismatic cells has boosted the market growth. Additionally, the growing use of prismatic batteries in electric vehicles (EVs) and hybrid vehicles (HEVs), large-scale energy storage systems and some others is playing a prominent role in shaping the industry in a positive direction. Moreover, numerous advantages associated with prismatic batteries such as space efficiency, lower internal resistance, good cycle life, robust casing and some others is expected to boost the growth of the lithium manganese iron phosphate (LMFP) batteries market.

The pouch segment is expected to rise with the highest CAGR during the forecast period. The rising application of pouch cells in laptops, tablets, smartphones, electric vehicles (EVs) and some others has boosted the market growth. Additionally, rapid investment by market players for opening new manufacturing plants to increase the production of these batteries coupled with rising emphasis of battery companies to develop high-quality pouch batteries is contributing to the industry in a positive manner. Moreover, several benefits of pouch cell batteries such as lightweight design, flexible and customizable, efficient space utilization, cost-effectiveness and some others is expected to drive the growth of the lithium manganese iron phosphate (LMFP) batteries market.

The 50–200 Ah segment led the market. The growing use of low capacity li-ion batteries in electronic items such as mobile phones, cameras, drones and some others has boosted the market growth. Also, the increasing emphasis of battery manufacturers for developing LMFP batteries in capacity ranging between 50–200 Ah to cater the needs of end-users is playing a prominent role in shaping the industrial landscape. Moreover, collaborations among battery manufacturers and industrial sector is expected to foster the growth of the lithium manganese iron phosphate (LMFP) batteries market.

The >200 Ah segment is expected to rise with the fastest CAGR during the forecast period. The growing demand for high-capacity li-ion batteries from automotive brands for integrating into EVs has boosted the market expansion. Also, rising emphasis of battery manufacturers for developing a wide range of powerful LMFP batteries for commercial EVs is playing a crucial role in shaping the industry in a positive direction. Moreover, the rising application of more than >200 Ah batteries in the heavy industries is expected to propel the growth of the lithium manganese iron phosphate (LMFP) batteries market.

The electric vehicles (EVs) segment dominated the market. The growing sales of EVs in several countries such as the U.S., India, China, Denmark and some others has boosted the market growth. Also, numerous government initiatives aimed at developing the EV industry along with rapid investment by automotive brands for developing numerous types of EVs is playing a vital role in shaping the industrial landscape. Moreover, partnerships among EV makers and battery companies for developing high-quality LMFP batteries is expected to propel the growth of the lithium manganese iron phosphate (LMFP) batteries market.

The energy storage systems (ESS) segment is expected to grow with the highest CAGR during the forecast period. The growing emphasis of power generation sector to adopt LMFP batteries for delivering backup power outputs during load-shedding has boosted the market growth. Also, rapid investment by government of various countries for strengthening the power generation sector coupled with technological advancements in energy storage systems (ESS) is contributing to the industry in a positive manner. Moreover, collaborations among grid service providers and battery manufacturers is expected to accelerate the growth of the lithium manganese iron phosphate (LMFP) batteries market.

The high voltage segment held the highest share of the industry. The rising application of high-voltage LMFP batteries in the industrial and power generation sector has boosted the market growth. Also, the growing emphasis of battery manufacturers for developing high voltage batteries for utility equipment coupled with constant research activities related to powerful batteries is playing a prominent role in shaping the industrial landscape. Moreover, rapid investment by market players for opening up new production centers to increase the production of heavy batteries is expected to drive the growth of the lithium manganese iron phosphate (LMFP) batteries market.

The medium voltage segment is expected to rise with the fastest CAGR during the forecast period. The growing use of medium voltage LPF batteries in numerous types of electric vehicles such as sedans, SUVs, hatchbacks and some others has driven the market expansion. Additionally, the increasing application of these batteries in the residential sector for acting as a backup power source is playing a crucial role in shaping the industry in a positive direction. Moreover, partnerships among battery manufacturers and technology providers to integrate AI in these batteries is expected to boost the growth of the lithium manganese iron phosphate (LMFP) batteries market.

The standard modules segment held the highest share of the market. The rising use of standard batteries from the industrial sector for operating numerous applications has boosted the market growth. Also, the growing emphasis on manufacturing standard battery modules using cathode synthesis process is contributing to the industry in a positive manner. Moreover, partnerships among battery manufacturing companies and electronics manufacturers for developing standard batteries is expected to propel the growth of the lithium manganese iron phosphate (LMFP) batteries market.

The high-performance modules segment is expected to expand with the fastest CAGR during the forecast period. The growing use of nano-engineering techniques for developing high-performance modules has driven the market growth. Additionally, the rising demand for high-quality LMFP batteries from automotive brands for integrating into commercial vehicles such as electric trucks and electric buses is playing a prominent role in shaping the industry in a positive manner. Moreover, numerous advantages of high-performance battery modules including Improved performance, enhanced safety, robustness & reliability, high energy density and some others is expected to accelerate the growth of the lithium manganese iron phosphate (LMFP) batteries market.

The traditional cathode synthesis segment led the market. The growing focus of battery manufacturers to develop high-quality batteries at low prices has boosted the market expansion. Also, the increasing focus of market players to use traditional cathode synthesis method for developing LMFP batteries is playing a vital role in shaping the industrial landscape. Moreover, numerous advantages of traditional cathode synthesis process including controlled morphology and composition, high purity and crystallinity, scalability and flexibility, and some others is expected to drive the growth of the lithium manganese iron phosphate (LMFP) batteries market.

The nano-engineered cathodes & coating technologies segment is expected to rise with the fastest CAGR during the forecast period. The rising emphasis of automotive brands for adopting nano-engineered cathodes technology for manufacturing EV batteries has boosted the industrial growth. Also, constant research and development associated with nano-engineering coupled with rapid adoption of coating technologies in the battery manufacturing sector is contributing to the industry in a positive manner. Moreover, various benefits of nano-engineering cathodes such as superior rate capability, improved cycle stability, high energy density, and some others is expected to boost the growth of the lithium manganese iron phosphate (LMFP) batteries market.

The OEM supply segment led the industry. The increasing consumer preference to purchase batteries from OEM platforms for getting superior after-sales services has boosted the market expansion. Additionally, rapid investment by battery companies for opening up new retail outlets to gain maximum consumer attraction is playing a crucial role in shaping the industrial landscape. Moreover, partnerships among automotive brands and battery manufacturers to develop high-quality LMFP batteries is expected to propel the growth of the lithium manganese iron phosphate (LMFP) batteries market.

The aftermarket / replacement market segment is expected to grow with a considerable CAGR during the forecast period. The growing emphasis of middle-class consumers to adopt low-range batteries from aftermarket platforms has driven the market growth. Also, numerous offers and benefits provided by aftermarket companies along with rise in number of battery startups is contributing to the industry in a positive manner. Moreover, the availability of wide range of LMFP batteries in various online platforms such as Amazon, Ebay, Walmart and some others is expected to drive the growth of the lithium manganese iron phosphate (LMFP) batteries market.

Asia-Pacific led the lithium manganese iron phosphate (LMFP) batteries market. The growing sales of EVs in several countries such as China, India, South Korea, Japan and some others has driven the market expansion. Additionally, the rising investment by government for strengthening the battery manufacturing sector coupled with rapid expansion of lithium mining is playing a crucial role in shaping the industry in a positive manner. Moreover, the presence of several market players such as CATL, CALB, BYD, Envision AESC and some others is expected to boost the growth of the lithium manganese iron phosphate (LMFP) batteries market in this region.

China is the major contributor in this region. The growing demand for high-quality batteries from the automotive sector coupled with technological advancements in the battery manufacturing sector has boosted the market growth. Also, the availability of essential raw materials at low prices along with opening of new production facilities is playing a crucial role in shaping the industrial landscape.

Europe is expected to expand with the fastest CAGR during the forecast period. The increasing sales and production of commercial EVs in numerous countries such as UK, Germany, France, Italy and some others has boosted the market growth. Also, numerous government initiatives aimed at developing the lithium mining sector coupled with rapid investment by battery manufacturers for opening new research centers is playing a prominent role in shaping the industrial landscape. Moreover, the presence of various market players such as Northvolt AB, Verkor, FIAMM and some others is expected to drive the growth of the lithium manganese iron phosphate (LMFP) batteries market in this region.

Germany and Italy are the significant contributors in this region. In Germany, the market is generally driven by the increasing demand for EV batteries coupled with technological advancements in the lithium engineering sector. In Italy, the growing emphasis of automotive brands to use lithium-based batteries along with rapid application of LMPF batteries in the industrial & utility sector is driving the market growth.

The foundation of LMFP battery production lies in the extraction and supply of essential minerals such as lithium, cobalt, mangesium, nickel, and graphite.

The raw materials are processed into small battery-grade components including cathodes, anodes, electrolytes, and separators.

Cells are assembled in pouch,cylindrical, or prismatic form under strict quality and thermal control standards.

Battery cells are configured into modules and packs, integrated with advanced battery management systems (BMS) for real-time monitoring, safety, and efficiency.

Completed battery packs are delivered to electric vehicle manufacturers, electronic brands, power generation sector and some others for operating heavy-duty applications.

| September 2025 | Announcement |

| Dr. Zhu Lingbo, CTO of CATL's International Business Unit | Shenxing Pro seamlessly fuses world-class safety standards with mobility needs, delivering a safer, more efficient, and carefree experience for every journey, with uncompromised range, charging, and durability, Shenxing Pro is the ultimate solution for electric mobility in Europe |

| June 2024 | Announcement |

| Dr. Raj DasGupta, CEO at Electrovaya | We are thrilled to introduce our first LFP based Infinity cells to the market. We expect that given the lower cost profile, the LFP based Infinity cell will open up new market opportunities for Electrovaya, including the fast-growing stationary energy storage market to support growing data center build-outs and other high value installations. With enhanced longevity, safety, and cost-effectiveness, our latest EV series continues to demonstrate the core advantages of Electrovaya’s Infinity technology. |

| October 2024 | Announcement |

| Magnus Ohlsson, the Senior Business Director at Exide | We are excited to introduce the Solition Material Handling battery. Its performance, reliability, and sustainability make it the perfect choice for businesses seeking to enhance their productivity and reduce their environmental impact |

| December 2024 | Announcement |

| John Elkann, the Chairman of Stellantis | Stellantis is committed to a decarbonized future, embracing all available advanced battery technologies to bring competitive electric vehicle products to our customers, This important joint venture with our partner CATL will bring innovative battery production to a manufacturing site that is already a leader in clean and renewable energy, helping drive a 360-degree sustainable approach. I want to thank all stakeholders involved in making today’s announcement a reality, including the Spanish authorities for their continued support |

| March 2025 | Announcement |

| Behnam Hormozi, the Founder and CEO at Integrals Power | We’re extremely proud of the test results QinetiQ achieved using our LMFP cathode active materials because they show that we’ve delivered higher C-rate performance and higher retained capacity compromise. Together with the proven energy density improvements of up to 20% compared to LFP unlocked by our 80% Manganese content and higher voltage profile of 4.1 V, we are able to demonstrate to our customers around the world that we can enable significant cost and weight reductions, and more compact, more sustainable, and longer-lasting battery pack designs. |

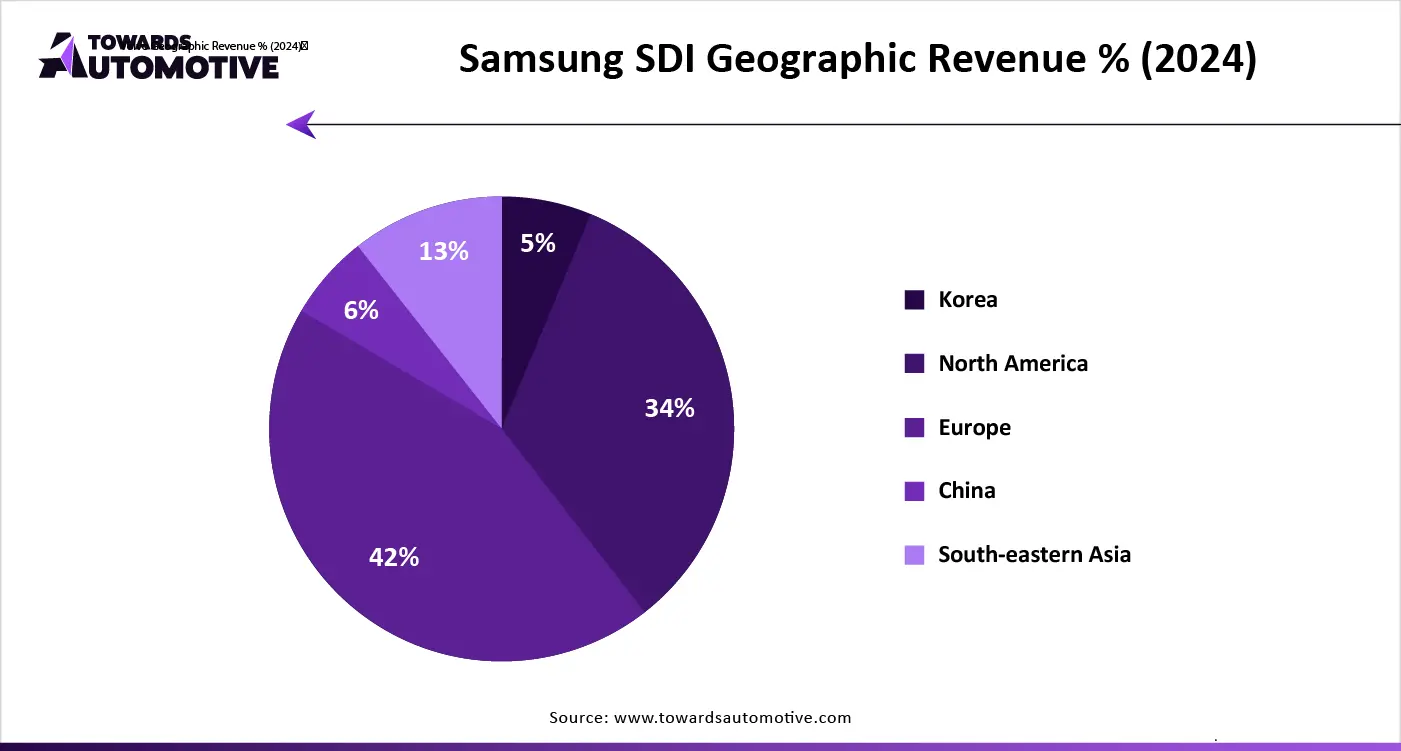

The lithium manganese iron phosphate (LMFP) batteries market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Farasis Energy (China), Blue Solutions (France), CALB (China), CATL (Contemporary Amperex Technology Co. Ltd., China), BYD Co. Ltd. (China), Tesla, Inc., LG Energy Solution (South Korea), Samsung SDI (South Korea), A123 Systems LLC (USA / China JV), EVE Energy Co., Ltd. (China), Wanxiang Group (China), SK On Co., Ltd. (South Korea), Envision AESC (China / Japan), Northvolt AB (Sweden), Toshiba Corporation (Japan) and some others. These companies are constantly engaged in developing lithium manganese iron phosphate (LMFP) batteries and adopting numerous strategies such as collaborations, partnerships, business expansions, launches, acquisitions, joint ventures and some others to maintain their dominance in this industry.

Tier 1

Tier 2

Tier 3

By Form Factor

By Capacity Range

By Application / End-Use Industry

By Voltage / Configuration

By Battery Module / Pack Type

By Manufacturing / Technology

By Distribution / Sales Channel

By Region

The Automotive Carbon Ceramic Brake Market revenue to increase from USD 682.18 million in 2025 to USD 1,107.72 million in 2030. During this period, th...

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us