September 2025

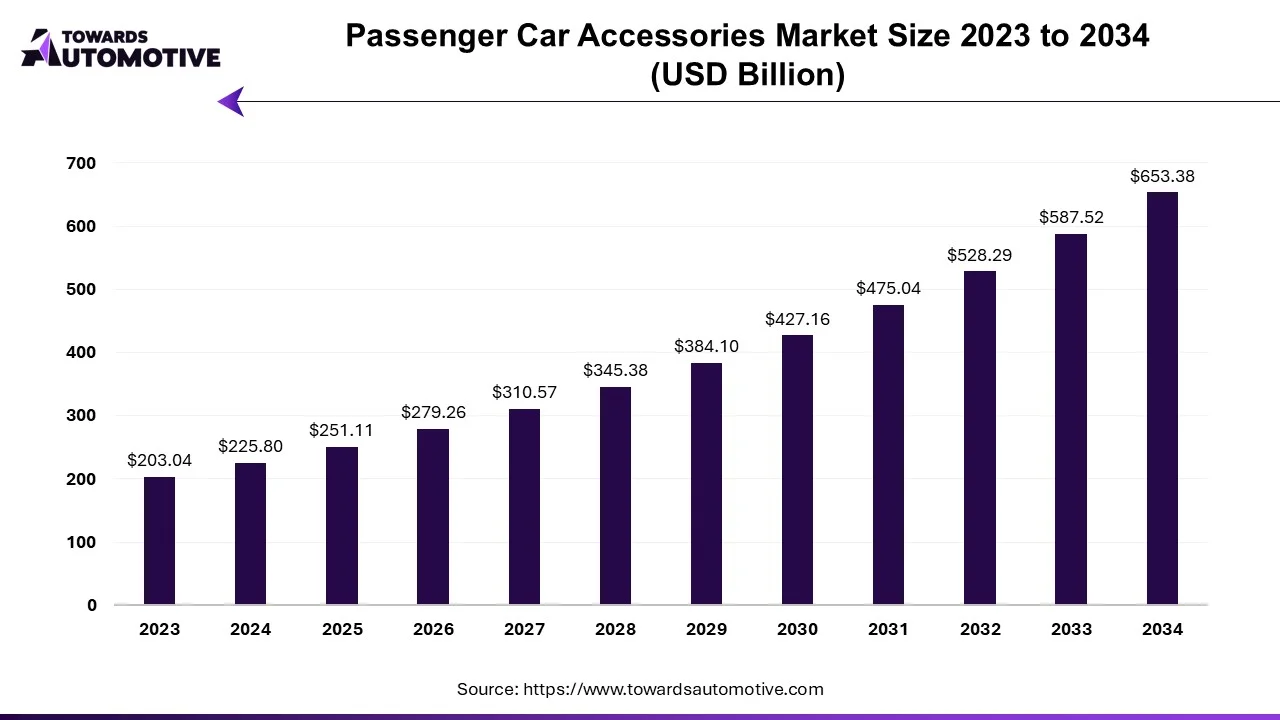

The passenger car accessories market is expected to grow from USD 251.11 billion in 2025 to USD 653.38 billion by 2034, with a CAGR of 11.21% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The Covid-19 pandemic has significantly impacted businesses worldwide, with quarantine measures and social distancing leading to reduced travel and slower economic growth. However, as automakers resume operations and auto sales gradually increase in regions with fewer Covid-19 cases, the market is expected to recover during the forecast period.

Key markets such as the US, China, and India have witnessed growth in auto sales, attributed to the economic recovery from Covid-19. For instance, in 2021, US light vehicle sales reached 14.9 million units, marking a 2.5% increase compared to 2020. Additionally, companies are implementing contingency plans and cost reduction measures to navigate through the uncertainties in the automobile industry.

For example:

In the long term, sales of automobile infotainment systems have surged due to increased smartphone accessibility and high-speed internet availability. Young buyers, in particular, prefer cars with advanced technology features, driving the adoption of Internet of Things (IoT) in automobiles and contributing to the growth of the passenger car accessories market during the forecast period.

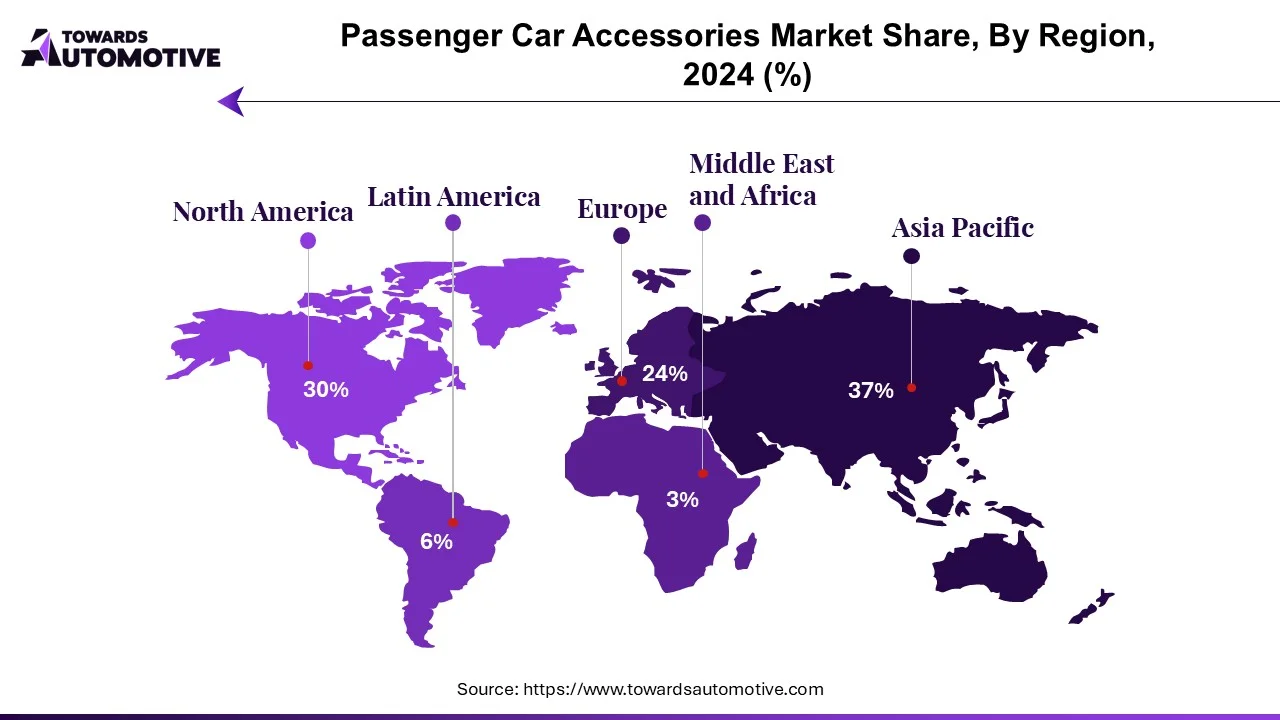

From a geographical perspective, the Asia-Pacific region is poised to emerge as the largest market for passenger car accessories, driven by the presence of major automotive OEMs such as China and the increasing popularity of connected vehicles. Countries like Japan and South Korea are also witnessing rapid expansion in internet connectivity.

Furthermore, partnerships between elite companies and automobile OEMs are expected to further bolster the passenger car accessories market. For instance, in November 2022, Samsung Electronics' Harman International announced a partnership with Renault SA to supply custom-designed, high-performance Harman Kardon speakers for Renault Austral, indicating a positive outlook for market expansion in the forecast period.

The basic infotainment system in modern cars typically includes features such as a CD player, Bluetooth connectivity, USB port, cigarette lighter port, auxiliary port, video panel, radio, GPS, multiple speakers, and a control panel. However, the trend in the automotive industry is shifting towards advanced infotainment systems that offer enhanced connectivity and driving experiences, as car buyers increasingly prioritize connectivity features over other functionalities.

Investments by automakers and technology companies, as well as collaborations between them, are expected to further strengthen the infotainment industry.

For Instance,

The sales of vehicle infotainment systems have been accelerated by the increasing use of the Internet of Things (IoT) and navigation systems, along with the growing accessibility to the internet. Many companies are now introducing new cars with touchscreen-based infotainment systems as standard features, thereby contributing to the growth of the driving infotainment system market.

For example,

With the rise in the use of electric cars and driverless vehicles, the demand for infotainment systems is expected to increase further. The widespread adoption of digital platforms in software-defined vehicles is anticipated to drive the market growth during the forecast period.

For Instance,

In conclusion, the considerations outlined above should inform the management of infotainment systems in passenger car interior products, emphasizing the importance of advanced connectivity features and technological advancements in enhancing the driving experience.

Asia Pacific is anticipated to emerge as the largest market for passenger car infotainment systems, primarily driven by several key factors. The region boasts a robust presence of auto parts original equipment manufacturers (OEMs) and experiences high sales of connected vehicles, particularly among young and affluent buyers who prefer vehicles equipped with advanced connectivity features. Moreover, the widespread use of smartphones and the burgeoning automotive industry further contribute to the growth of the market in this region. As internet access and electricity availability continue to improve, automobile sales are witnessing a significant uptick.

A notable trend in the region is the transition from basic voice-controlled systems to touch-screen infotainment systems that offer a plethora of features such as navigation, Apple CarPlay, Android Auto, telematics, and more. This shift is particularly evident in countries like India and China, where consumers are increasingly demanding advanced infotainment functionalities. Previously, infotainment systems were primarily available in higher-end car models. However, OEMs are now offering these systems even in mid-range and entry-level models to cater to evolving consumer preferences. In China, where infrastructure development is advanced, navigation systems have become a standard feature in nearly every car.

For Instance,

While Asia Pacific leads the market, North America and Europe are also significant players in the passenger car infotainment market. These regions boast large vehicle fleets and have established dominance in connected car technologies. Additionally, the easy availability of new connectivity technologies such as the Internet of Things (IoT) and 5G networks further propels the growth of the market in these regions. Moreover, stable sales of electric and connected cars contribute to sustained growth in North America and Europe.

The passenger car accessories market is a thriving sector characterized by numerous local stores and several major players. Among the prominent companies in the industry are Harman International Industries Inc., Faurecia, Denso Corporation, Robert Bosch, and Aptiv PLC. These key players are actively engaged in introducing new products, forming collaborations, and expanding their operations to stay competitive and meet evolving consumer demands.

For Instance,

These strategic initiatives underscore the commitment of major players in the passenger car accessories market to leverage technology and innovation to deliver enhanced driving experiences and cater to the evolving needs of consumers.

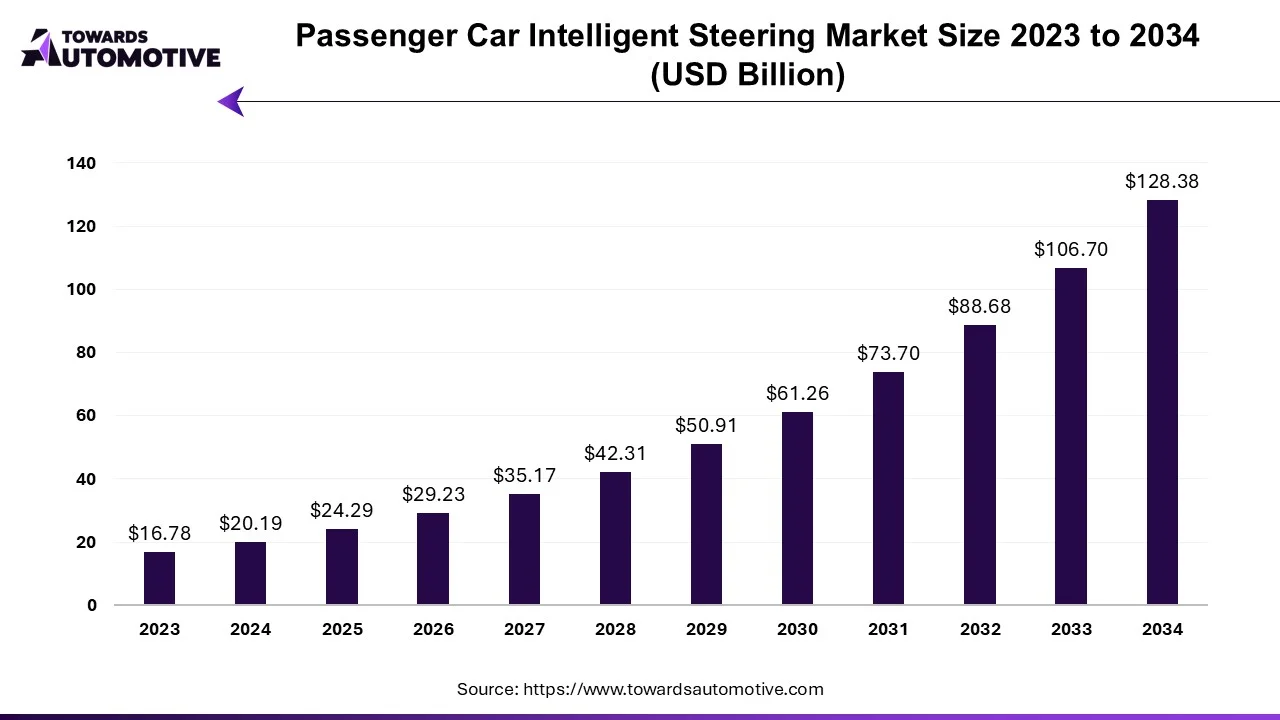

The passenger car intelligent steering market is forecasted to expand from USD 24.29 billion in 2025 to USD 128.38 billion by 2034, growing at a CAGR of 20.32% from 2025 to 2034.

The passenger car intelligent steering market is experiencing rapid growth and technological innovation, driven by the increasing demand for safety, convenience, and automation in automotive vehicles. Intelligent steering systems play a crucial role in enhancing vehicle maneuverability, stability, and safety, offering drivers improved control and responsiveness in various driving conditions. As automotive technology continues to evolve, intelligent steering systems will play an increasingly integral role in shaping the future of mobility, paving the way for safer, smarter, and more connected vehicles on the road.

The passenger car intelligent steering market is witnessing remarkable growth as automotive technology continues to advance. With innovations such as autonomous driving and advanced driver assistance systems (ADAS) reshaping the automotive landscape, intelligent steering systems are becoming increasingly integral to the driving experience. This blog explores the dynamics driving the growth of the passenger car intelligent steering market, key components and functions of these systems, emerging trends, global market outlook, challenges, opportunities, and major players in the industry.

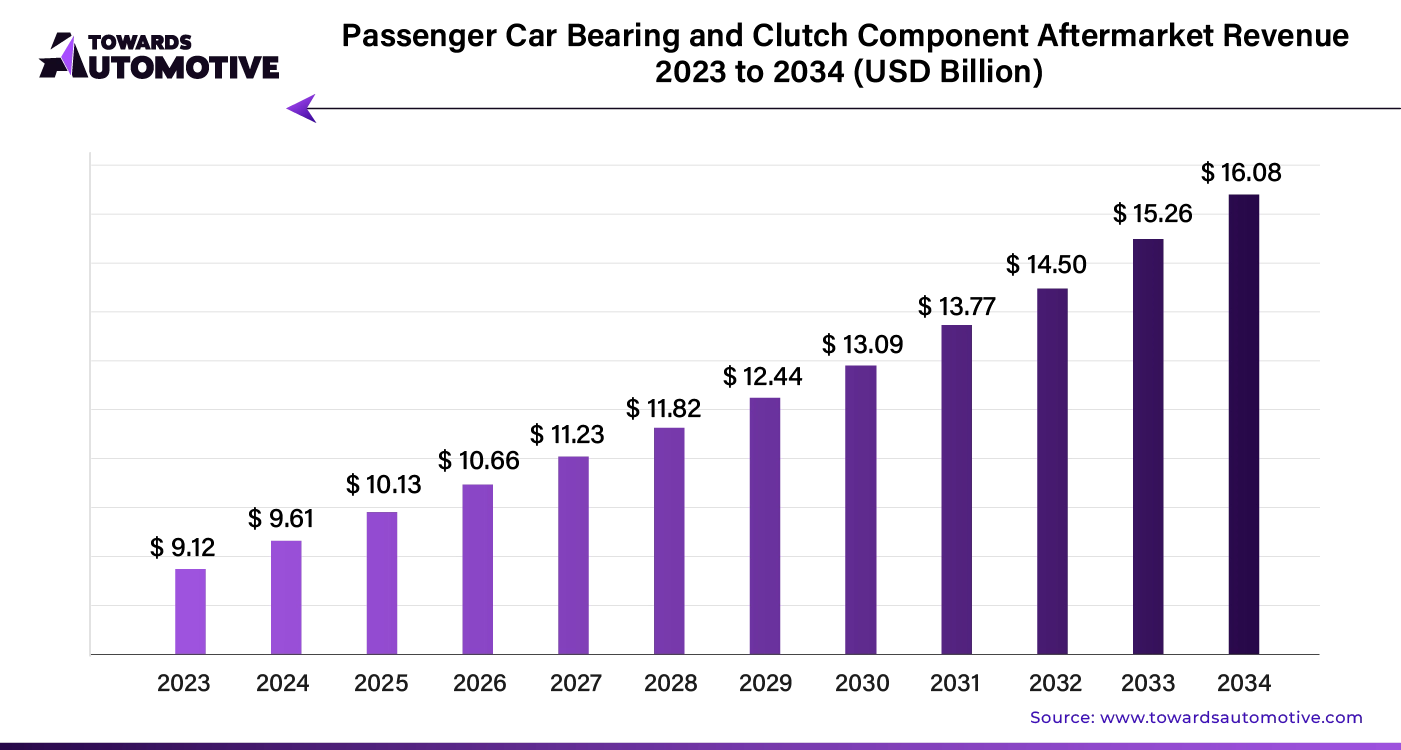

The passenger car bearing and clutch component aftermarket is anticipated to grow from USD 10.13 billion in 2025 to USD 16.08 billion by 2034, with a compound annual growth rate (CAGR) of 5.26% during the forecast period from 2025 to 2034. The growing sales and production of passenger cars in India and China coupled with rapid investment by automotive brands for integrating high-quality components in passenger cars is playing a vital role in shaping the industrial landscape.

Moreover, the rising demand for luxury cars from HNIs along with partnerships among automotive companies and clutch manufacturers has boosted the market expansion. The increasing use of sustainable materials for manufacturing automotive components is expected to create ample growth opportunities for the market players in the future.

The passenger car bearing and clutch component aftermarket is a prominent branch of the automotive industry. This industry deals in manufacturing and distribution of clutch and bearing components to cater the needs of passenger vehicles. There are different types of clutches developed in this sector comprising of single-plate clutch, multi-plate clutch, cone clutch, hydraulic clutch, electromagnetic clutch and some others. These clutches are manufactured using various types of materials including steel, plastic, composites, ceramic and some others. It is available in a well-established distribution channel consisting of online platforms and retail outlets.

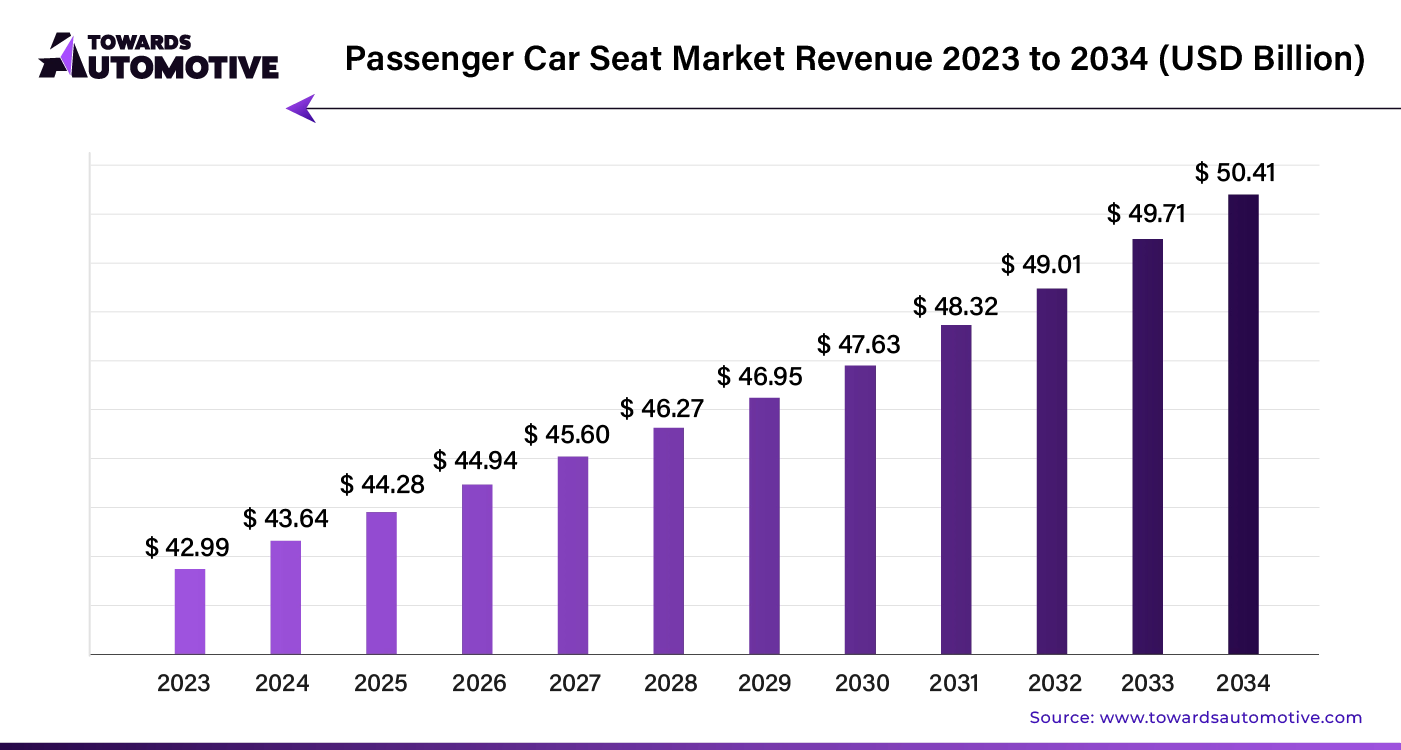

The global passenger car seat market is projected to reach USD 50.41 billion by 2034, growing from USD 44.28 billion in 2025, at a CAGR of 1.54% during the forecast period from 2025 to 2034.

Automotive manufacturers are increasingly using lightweight materials like high-strength steel, aluminum, and carbon fiber composites to reduce vehicle weight and boost fuel efficiency. This shift is also shaping the design of car seats, driving the development of lighter, more efficient seating solutions. The rise of electric vehicles (EVs) is creating new opportunities for car seat manufacturers. With EVs prioritizing interior comfort due to the absence of engine noise, there’s growing demand for premium seating options.

Customization and personalization are becoming more popular among consumers, particularly in vehicle interiors like car seats. Manufacturers are responding by offering a broader range of customization options, including materials, colors, and features. Car seats are evolving to include advanced features like integrated entertainment systems, massage functions, and connectivity options. These innovations enhance the appeal and value of car seats, contributing to market growth.

Automotive accessories encompass a wide range of products or add-ons designed to enhance both the exterior and interior performance of passenger cars, thereby offering passengers complete comfort and convenience. The segmentation of the passenger car accessories market is based on various factors, including application, sales channel, and region. In terms of application, accessories are categorized into interior accessories and exterior accessories. Interior accessories include items such as infotainment systems, seat covers, carpets and mats, electrical systems, security systems, and more. On the other hand, exterior accessories comprise LED lights, alloy wheels, body kits, luggage racks, window films, coatings, impact protection, and others.

Furthermore, passenger car accessories are also segmented based on the sales channel through which they are distributed. This includes original equipment manufacturers (OEMs) and the aftermarket. OEM accessories are those that are provided by the vehicle manufacturer at the time of purchase, while aftermarket accessories are those that are purchased separately and added to the vehicle later. Lastly, the passenger car accessories market is segmented by region, encompassing key geographical areas such as North America, Europe, Asia Pacific, and the rest of the world. This segmentation allows for a better understanding of regional preferences, trends, and market dynamics, enabling businesses to tailor their offerings and strategies accordingly.

By Application

By Sales Channel

By Geography

September 2025

August 2025

August 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us