October 2025

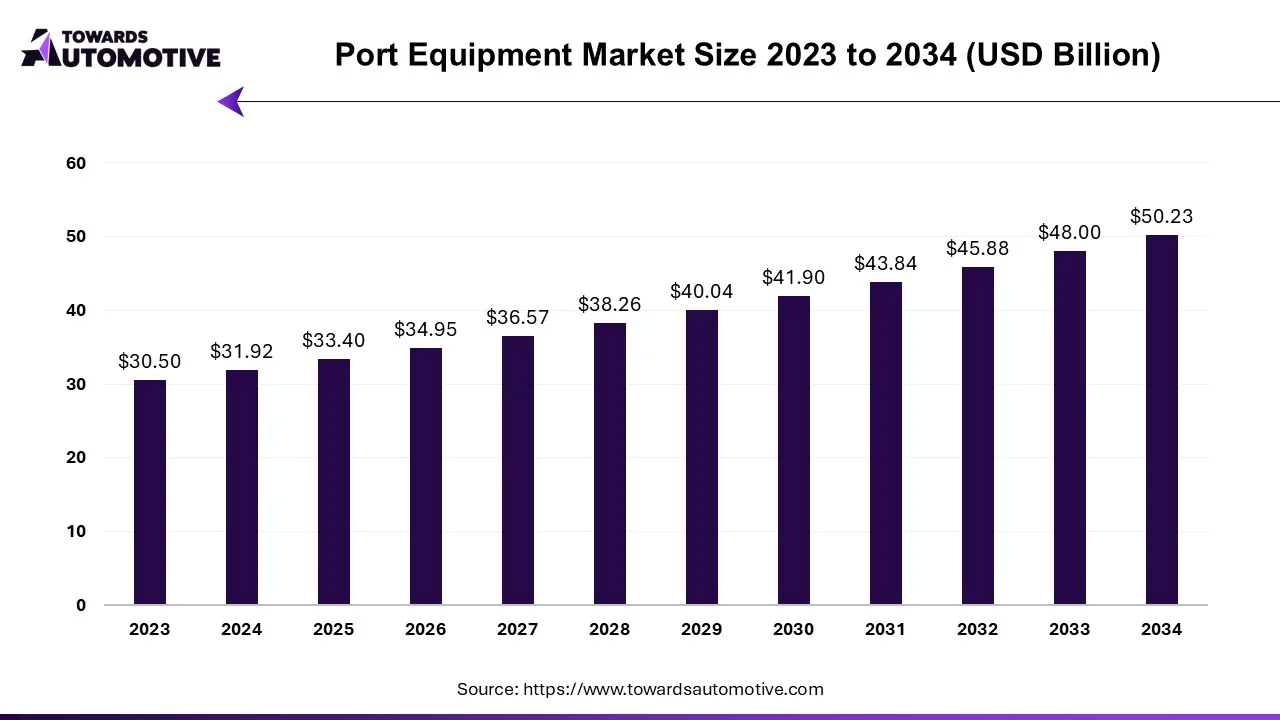

The port equipment market is forecast to grow at a CAGR of 4.64%, from USD 33.40 billion in 2025 to USD 50.23 billion by 2034, over the forecast period from 2025 to 2034. The market is primarily driven by the growth of international trade along with integration of advanced technologies such as IoT and AI in modern ports.

The port equipment market is experiencing significant growth due to the rapid globalization along with technological advancements in maritime sector. This market encompasses a broad range of machinery used in ports and terminals for handling cargo, facilitating vessel operations, and supporting logistics. Technological advancements in port equipment focuses on improving efficiency, reducing costs, and enhancing sustainability through automation, robotics, and digital solutions.

| Metric | Details |

| Market Size in 2024 | USD 31.92 Billion |

| Projected Market Size in 2034 | USD 50.23 Billion |

| CAGR (2025 - 2034) | 4.64% |

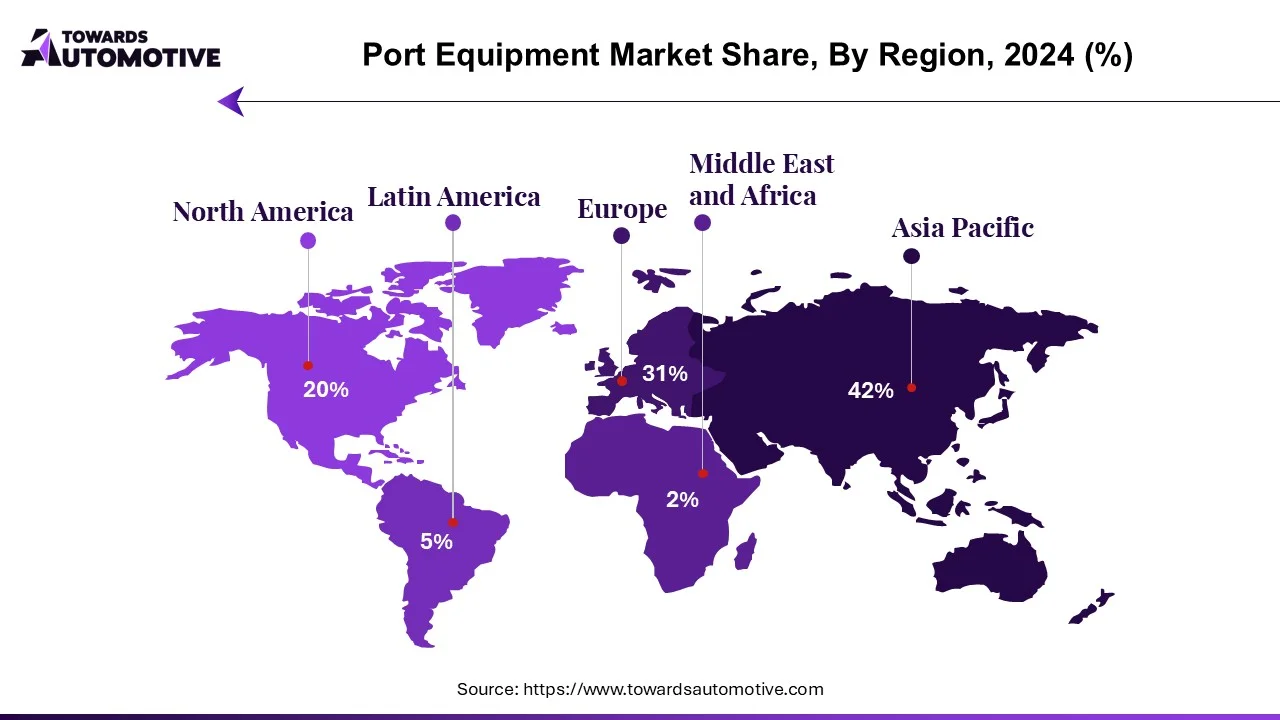

| Leading Region | Asia Pacific |

| Market Segmentation | By Operation, By Power, By Equipment Type and By Region |

| Top Key Players | LONKING HOLDINGS LIMITED, Emerson Electric Co., Cargotec Corporation, Konecranes Abp, AMERICAN CRANE AND EQUIPMENT |

Key trends of this market include port equipment automation, electrification, and smart container tracking.

Port Equipment Automation

It includes the utilization of technology to optimize various port operations to increase efficiency, improve safety, and reduce costs. Automated cranes and other equipment are used to load and unload container from ships. Technologies such as Closed-Circuit Television (CCTV) and remote monitoring systems are incorporated to enhance port operations and quickly address any issues. Different port authorities are increasingly prioritizing fully-automated ports for enabling smooth operations. For instance, in April 2024, Busan port authority unveiled first fully automated container terminal in Korea. (Source: Port Technology International)

Smart Container Tracking

It includes the usage of technologies such as sensors and GPS to monitor the location, condition, and security of shipping containers throughout their journey which provides real-time visibility and helps in optimizing supply chain. Smart container tracking is being adopted by multiple logistics and shipping providers. For instance, in May 2025, Maersk released OneWireless, a digital platform to enable smart container and cargo tracking. (Source: ARC Advisory Group)

Electrification of Ports

It involves replacement of fossil fuel-powered equipment with electrically powered alternatives to reduce environmental impact and operational costs. Electric trucks are used for moving containers within the port whereas electric cranes are better alternative for lifting and moving containers. Electrical connections can be provided to docked ships, resulting in reduced emissions from engines. Electric forklifts and electric reach stackers can be used for handling cargo. For instance, in April 2025, APM Terminal invested US$60 million in a port-equipment electrification pilot program. This investment is done for adopting electrification in various ports including Aqaba, Barcelona, , Pier 400 Los Angeles, and Suez Canal Container Terminal. (Source: APMTerminals)

The conventional port equipment segment led the port equipment market. The rising investment by government of several countries for the developing the port infrastructure has boosted the market growth. Also, the growing use of traditional port equipment such as forklift, cranes, tractors and some others further drive the growth of the port equipment market.

Autonomous port equipment segment is likely to experience highest growth during the forecast period. Autonomous equipment can operate without human intervention and help in enhancing productivity and reducing turnaround times for vessels. These equipment minimizes human error, reduces the chances of accidents and enhances overall port safety, thereby boosting the growth of the port equipment market.

Diesel-powered port equipment dominated the market. The growing demand for diesel-powered port equipment due to their application in heavy-duty port operations has driven the market growth. Several equipment manufacturers have started investing heavily for developing diesel-based forklifts and tractors to enhance material handling capabilities, thereby driving the growth of the port equipment market.

Electrically-powered port equipment is the fastest-growing segment in the port equipment market due to the growing demand for environment-friendly equipment to reduce carbon emission. There are different types of electric port equipment available in the market including electric forklift, terminal tractors, reach stackers, and cranes. Additionally, the rapid adoption of electric equipment in modern ports due to government regulations is further driving the growth of the port equipment market.

The reach stackers segment held the largest share of the market. The demand for reach stackers has increased due to its flexibility and mobility. Reach stackers are used in ports and terminals for handling containers. They can handle containers of various sizes and weight by allowing containers to move easily around the terminal. It can also help in stacking of containers up to threshold limits. Reach stackers are also used in container terminal for loading and unloading, lifting, moving heavy containers and cargos. It is powered by different propulsion technology such as diesel-powered, hybrid, and electric.

The terminal tractor port equipment segment is expected to grow with a significant CAGR during the forecast period. These tractors are also known as yard or shunt tractors that are designed for moving containers and trailers within the ports. Multiple types of containers and trailers are efficiently handled by terminal tractors by providing sufficient power and speed for smooth container movement. Terminal tractors streamline container movement by reducing turnaround times.

Asia Pacific dominated the port equipment market. The growing integration of automated solution in ports of several countries such as India, China, Japan, South Korea and some others has driven the market expansion. Additionally, numerous government initiatives aimed at developing the port infrastructure along with rapid investment in logistics sector is playing a vital role in shaping the industry in a positive direction. Moreover, the rising emphasis on facilitating cross-border trade coupled with presence of several market players such as Hitachi Construction Machinery, Shanghai Zhenhua Heavy Industries, Anhui Heli and some others is expected to drive the growth of the port equipment market in this region.

North America is expected to grow with a significant CAGR during the forecast period. The rising adoption of hybrid equipment for handling materials in ports has boosted the market growth. Also, the integration of technologies such as AI, RFID, IoT, Blockchain and some others in modern ports for enhancing numerous operations is further adding to the industrial expansion. Moreover, the rapid adoption of automated guided vehicles (AGVs) and remote-controlled cranes in ports due to lack of skilled operators is driving the growth of the port equipment market in this region.

U.S. dominated the market in this region. In the U.S., the market is driven by the rapid adoption of automated technologies in ports along with rising investment by government for developing the ports across this nation. Additionally, the presence of various port equipment manufacturers such as AMERICAN CRANE AND EQUIPMENT, Hyster-Yale Materials Handling, Emerson Electric Co and some others is contributing to the market growth.

The port equipment market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry are APM Terminals, Shanghai Zhenhua Heavy Industries, Sany Heavy Industry Co. Ltd., Liebherr Group, Toyota Material Handling, LONKING HOLDINGS LIMITED, Emerson Electric Co., Cargotec Corporation, Konecranes Abp, AMERICAN CRANE AND EQUIPMENT, Anhui Heli Co. Ltd., CVS FERRARI, Gaussin Group, SIEMENS AG, Kalmar, and ABB. These companies are adopting numerous strategies such as product launches, partnerships, business expansion, acquisition, and some others to maintain their dominance in this industry.

By Operation

By Power

By Equipment Type

By Region

October 2025

October 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us