December 2025

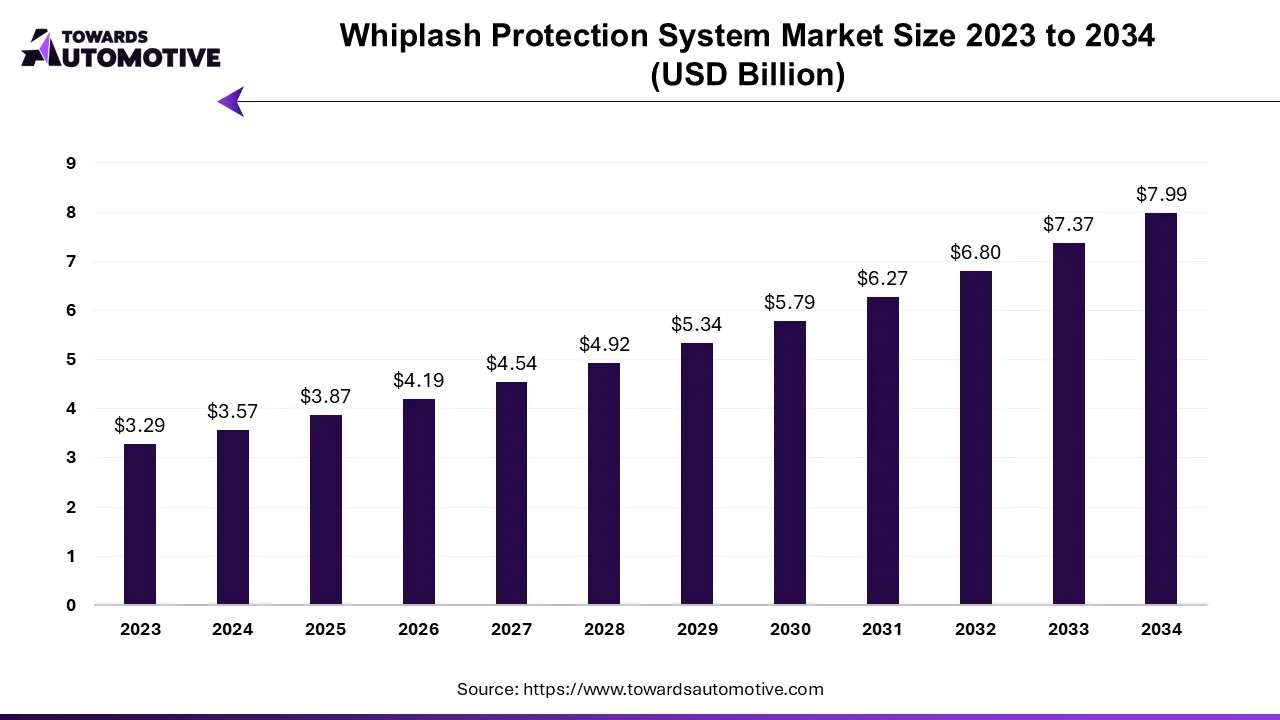

The whiplash protection system market is projected to reach USD 7.99 billion by 2034, growing from USD 3.87 billion in 2025, at a CAGR of 8.4% during the forecast period from 2025 to 2034.

The seat with neck injury protection system is designed to safeguard the front passenger's neck in the event of a rear collision. It features a backrest connected to the seat below via a specially designed hinge, determining the backrest's movement during a rear impact. Additionally, the seat back includes cracks allowing the seat cushion to move slightly backward upon impact, combined with high-mounted head restraints to limit head movement during a crash. Volvo has been at the forefront of researching and developing whiplash prevention systems for over a decade. Their WHIPS system is effective in collisions where factors such as impact angle, speed, and condition of the striking vehicle are involved. Volvo claims significant reductions in both short-term and long-term injuries with the WHIPS system, although its cost remains a limiting factor due to the expenses associated with its construction and testing.

Reactive head restraint systems are anticipated to become the most prevalent anti-whiplash systems in automobiles, while pendulum systems are expected to experience slower growth. Combination drivers are likely to be the primary users of whiplash protection systems in the market.

Manufacturers are actively investing in impact protection technology to enhance product quality and reduce costs. Volvo's recent safety initiative, announced on March 20, 2020, aims to share safety-related information with all original manufacturers and suppliers. These factors are expected to drive market growth during the forecast period.

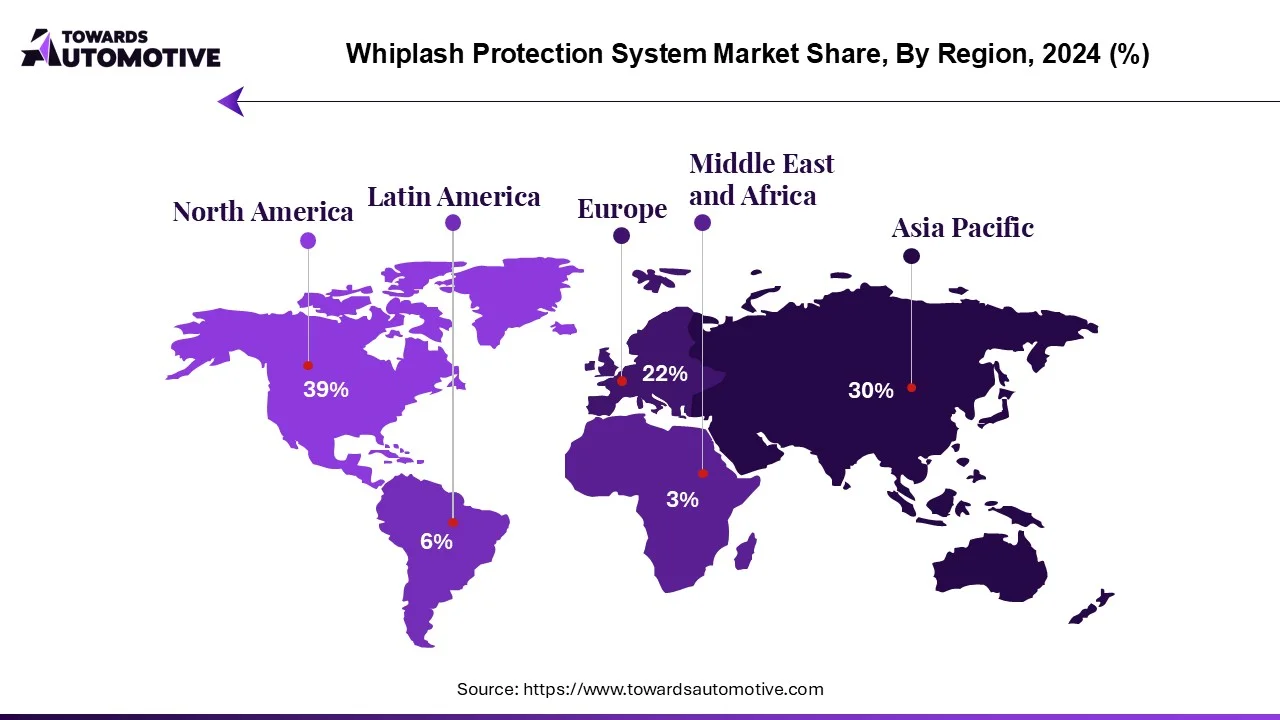

The United States maintains its dominant position in the whiplash protection market, owing to its leadership in automobile sales, which exceeded 4.7 million vehicles in 2019. With diverse market demands, the U.S. stands out as a major manufacturer of automotive safety products. In 2019 alone, approximately 17 million car headlights were sold in the country. The surge in luxury car sales across the U.S. has notably impacted the automotive neck response systems industry, prompting original equipment manufacturers (OEMs) to intensify research and development efforts aimed at creating effective and cost-efficient whiplash protection systems. Luxury brands such as BMW, Mercedes-Benz, and Lexus, which respectively sold 324,830 units, 316,090 units, and 298,110 units in 2019, contribute significantly to this trend. As the U.S. market continues to flourish, it reinforces the country's leading position in automobile whiplash prevention, poised for further growth in the forecast period. However, OEMs must remain vigilant in delivering on their safety promises to avoid falling behind on advancements and risking product obsolescence. Furthermore, the integration of government-mandated security measures into safety systems can significantly influence consumer preferences and needs in the market.

By Vehicle Type

By System Type

By Geography

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us