August 2025

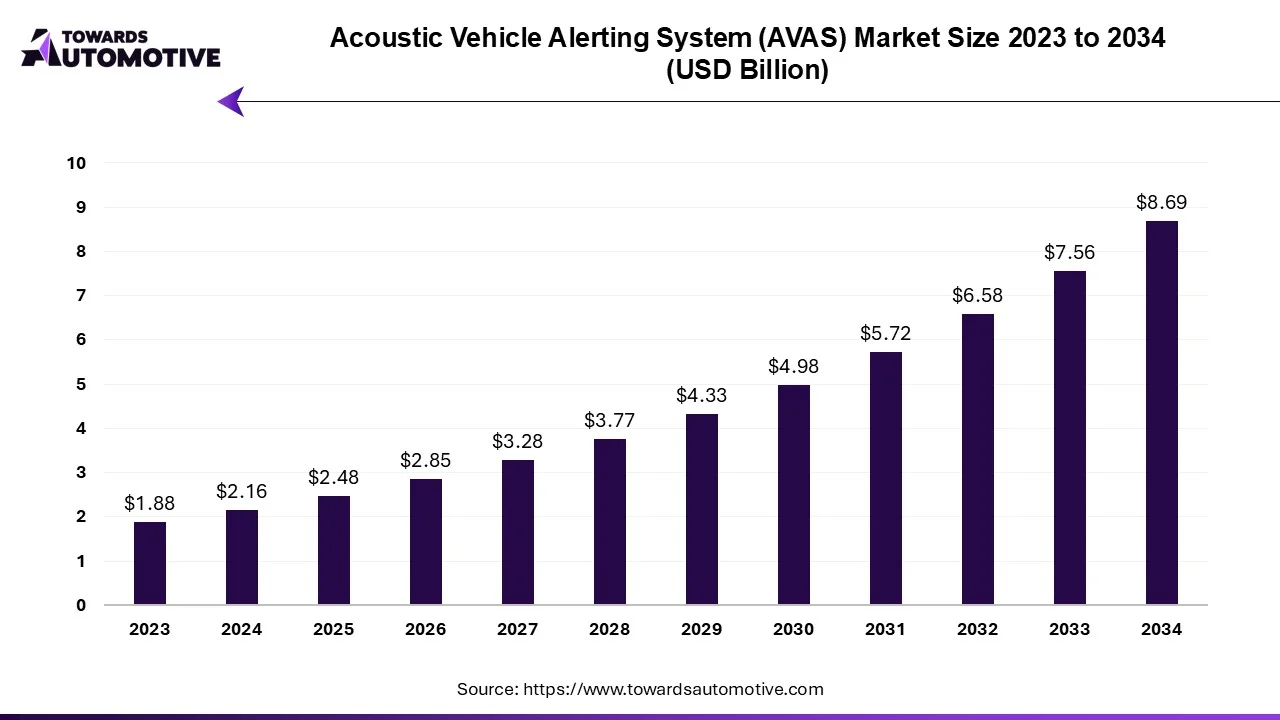

The acoustic vehicle alerting system market is forecast to grow from USD 2.48 billion in 2025 to USD 8.69 billion by 2034, driven by a CAGR of 14.93% from 2025 to 2034. The rising cases of car accidents in several countries coupled with numerous government regulations aimed at mandating the use of AVAS in EVs has boosted the market growth.

Additionally, technological advancements in automotive acoustics systems as well as increasing awareness towards road safety is further contributing to the industry in a positive manner. The integration of advanced technologies such as AI and IoT in AVAS systems to enhance alerting operations is expected to create ample growth opportunities for the market players in the upcoming days.

Unlock Infinite Advantages: Subscribe to Annual Membership

The acoustic vehicle alerting system market is a prominent sector of the automotive industry. This industry deals in manufacturing and distribution of acoustic vehicle alerting system across the world. There are different types of AVAS developed in this sector comprising of active acoustic systems, passive acoustic systems, hybrid acoustic systems and some others. These systems finds applications in numerous types of vehicles consisting of passenger cars, commercial vehicles, two-wheelers and some others. This market is expected to grow significantly with the rise of the EV sector around the globe.

| Metric | Details |

| Market Size in 2025 | USD 2.48 Billion |

| Projected Market Size in 2034 | USD 8.69 Billion |

| CAGR (2025 - 2034) | 14.93% |

| Leading Region | North America |

| Market Segmentation | By Application, By Technology, By Vehicle Type, By End User and By Region |

| Top Key Players | Toyota Motor Corporation, Aisin Seiki Co Ltd, Volkswagen AG, Ford Motor Company, General Motors Company |

The major trends in this market consists of rapid adoption of EVs, government initiatives and partnerships.

With the increasing sales of EVs, the demand for advanced AVAS is steadily rising to enhance the sound experience.

Government of several countries have put forwarded numerous initiatives to mandate AVAS in vehicles to improve safety.

Numerous market players are partnering with one another to manufacture AVAS systems for hybrid cars.

The passenger vehicles segment dominated the market. The growing sales and production of affordable hatchbacks in several developing nations such as India, Vietnam, Thailand and some others has boosted the market expansion. Additionally, the integration of advanced acoustic systems to enhance alerting options in modern cars is further adding to the industrial growth. Moreover, rapid investment by market players for developing high-quality AVAS to cater the needs of passenger vehicles is accelerating the growth of the acoustic vehicle alerting system market.

The commercial vehicles segment is expected to expand with a considerable CAGR during the forecast period. The growing integration of advanced AVAS systems in modern trucks for enhancing driving safety has boosted the market expansion. Additionally, the increasing sales of electric buses for reducing vehicular emission coupled with rise in number of startup companies engaged in manufacturing AVAS for commercial vehicles is further adding to the overall industrial growth. Moreover, partnerships among AVAS companies and PHEV brands for developing AVAS systems is expected to boost the growth of the acoustic vehicle alerting system market.

The internal combustion engine vehicles segment held the largest share of the market. The growing use of AVAS systems in ICE vehicles to enhance vehicular safety has boosted the market expansion. Additionally, constant research and development activities associated with production of ICE-based AVAS systems is playing a vital role in shaping the industrial landscape. Moreover, the increasing sales of diesel trucks in developed nations is expected to propel the growth of the acoustic vehicle alerting system market.

The electric vehicles segment is expected to rise with a notable CAGR during the forecast period. The rising sales of EVs in various western nations such as the U.S., UK, Germany and some others has increased the demand for AVAS systems, thereby driving the market expansion. Additionally, numerous government initiatives aimed at developing the EV charging infrastructure coupled with rise in number of EV startups is positively impacting the industry. Moreover, the integration of AVAS in EV to enhance driving experience is expected to drive the growth of the acoustic vehicle alerting system market.

The automobile manufacturers segment led the market. The growing demand for AVAS from automobile manufacturers to enhance vehicular safety has boosted the market expansion. Additionally, partnerships among automotive brands and market players to integrate AVAS systems in modern cars is playing a vital role in shaping the industrial landscape. Moreover, the rising use of acoustic vehicle alerting system in electric and hybrid vehicles to alert pedestrians and other road users is expected to propel the growth of the acoustic vehicle alerting system market.

The government agencies segment is expected to rise with a significant CAGR during the forecast period. The rising use of AVAS in government vehicles to clear road traffic during emergency has driven the market expansion. Additionally, numerous government initiatives aimed at mandating AVAS in modern cars is further contributing to the industrial growth. Moreover, collaborations among market players and government organizations for developing advanced AVAS to cater the needs of government cars is expected to drive the growth of the acoustic vehicle alerting system market.

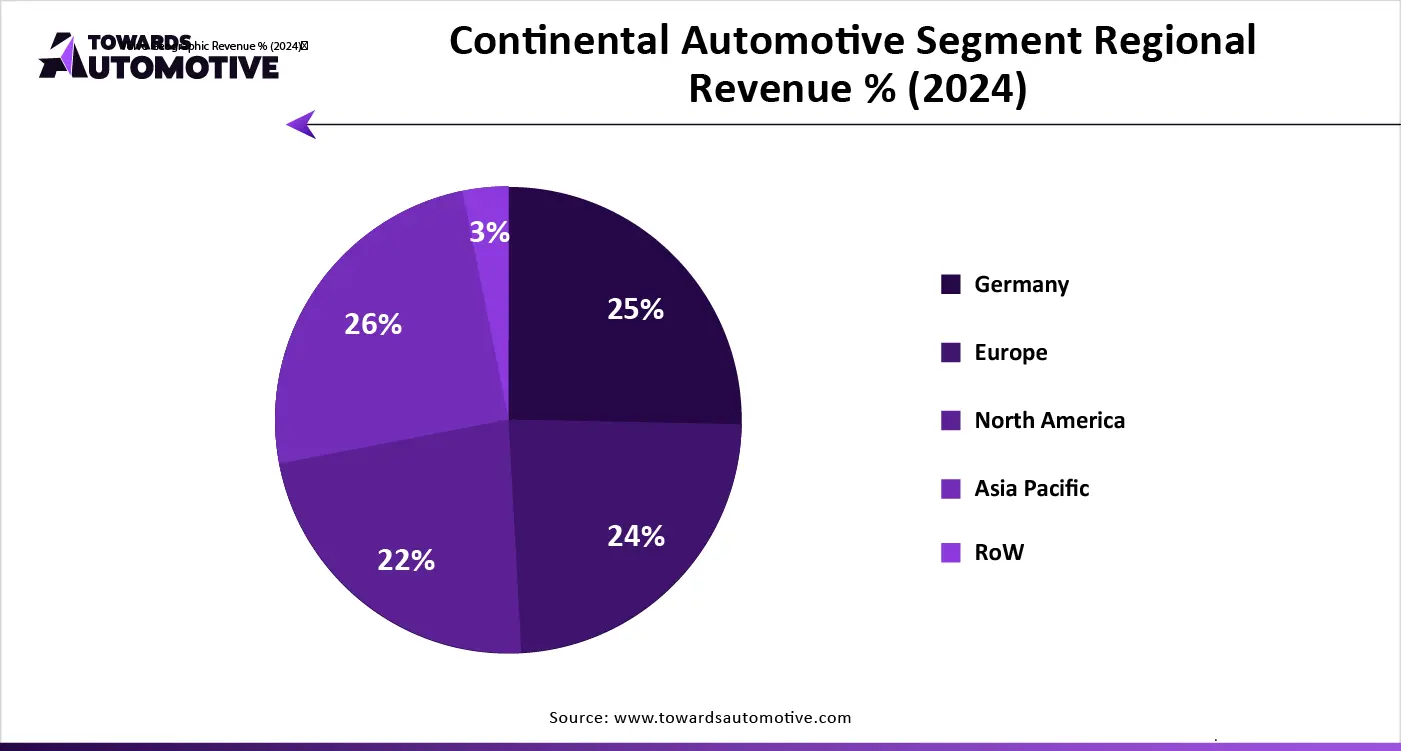

North America led the acoustic vehicle alerting system market. The growing demand for EVs in the U.S. and Canada has increased the demand for AVAS, thereby driving the market expansion. Additionally, numerous government initiatives aimed at increasing awareness to reduce road accidents coupled with rising emphasis towards enhancing vehicular safety is further contributing to the industrial growth. Moreover, the presence of numerous market players such as Harman International, Ford Motor Company, General Motors Company and some others is expected to drive the growth of the acoustic vehicle alerting system market in this region.

Asia Pacific is expected to expand with a significant CAGR during the forecast period. The rising sales of passenger cars in several countries such as India, China, Japan, South Korea and some others has boosted the market growth. Also, rapid adoption of electric scooters for reducing vehicular emission coupled with rise in number of AVAS startups is contributing to the overall industrial expansion. Moreover, the presence of various AVAS manufacturers such as Hyundai Motor Company, Honda Motor Co Ltd, Aisin Seiki Co Ltd, and some others is expected to foster the growth of the acoustic vehicle alerting system market in this region.

The acoustic vehicle alerting system market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Subaru Corporation, Toyota Motor Corporation, Aisin Seiki Co Ltd, Volkswagen AG, Ford Motor Company, General Motors Company, Daimler AG, Nissan Motor Co Ltd, Voxx International, BMW AG, Hyundai Motor Company, Harman International, Honda Motor Co Ltd, Bose, Continental AG and some others. These companies are constantly engaged in developing vehicle alerting system and adopting numerous strategies such as launches, partnerships, business expansions, acquisitions, joint ventures, collaborations and some others to maintain their dominance in this industry.

By Application

By Technology

By Vehicle Type

By End User

By Region

August 2025

August 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us