September 2025

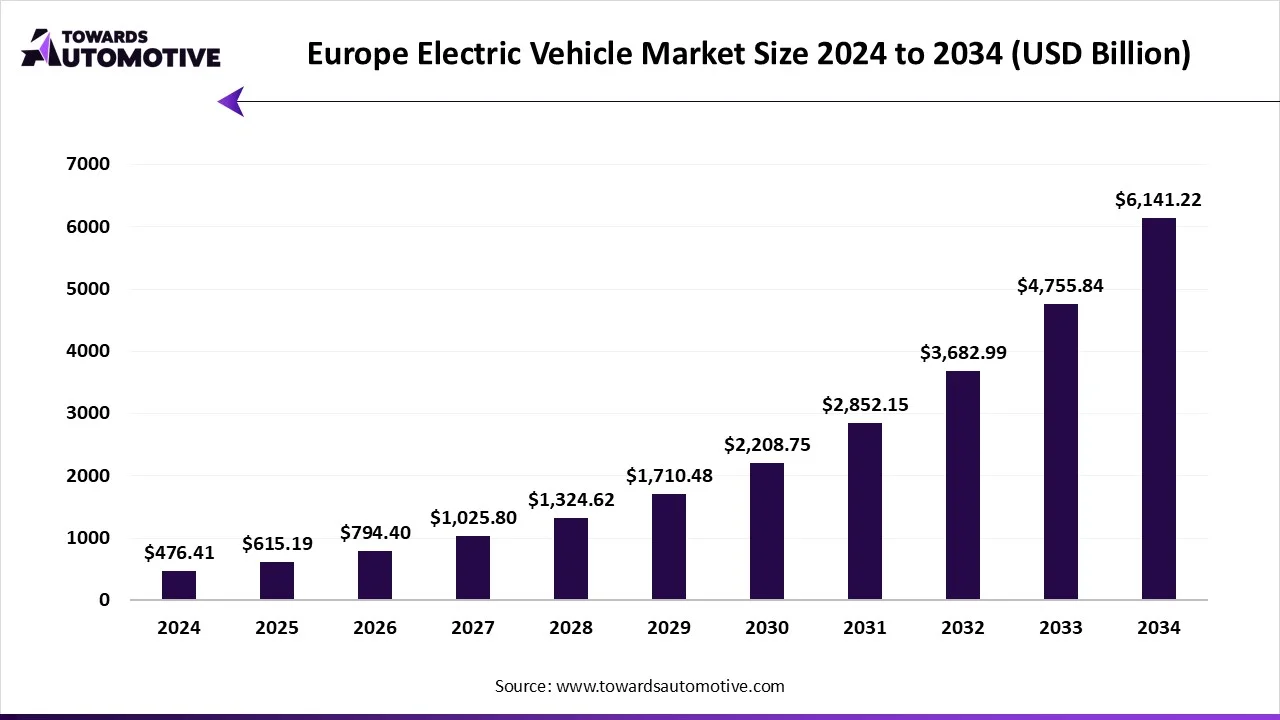

The Europe electric vehicle market is projected to reach USD 6141.22 billion by 2034, expanding from USD 615.19 billion in 2025, at an annual growth rate of 29.13% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The Europe electric vehicle truck market is a crucial segment of the automotive industry. This industry deals in manufacturing and distribution of EVs in the European region. There are different types of vehicles manufactured in this sector consisting of two-wheelers, passenger cars, commercial vehicles and some others. These vehicles are integrated with various types of drivetrains including front-wheel drive, rear-wheel drive and all-wheel drive. The EVs are powered by numerous types of batteries comprising of sealed lead acid, nickel metal hydride (NiMH), lithium-ion and some others. It finds application in several end-use sectors consisting of personal, commercial, government and private. The growing adoption of EVs due to high prices of gasoline has propelled the industrial expansion. This industry is likely to experience significant rise with the growth of the battery industry across Europe.

| Metric | Details |

| Market Size in 2024 | USD 476.41 Billion |

| Projected Market Size in 2034 | USD 6141.22 Billion |

| CAGR (2025 - 2034) | 29.13% |

| Leading Country | Germany |

| Market Segmentation | By Vehicle, By Drive, By Propulsion, By Battery, By Range, By End Use and By Region |

| Top Key Players | Audi, Dacia, Renault, Volvo, BMW Group, Mercedes-Benz |

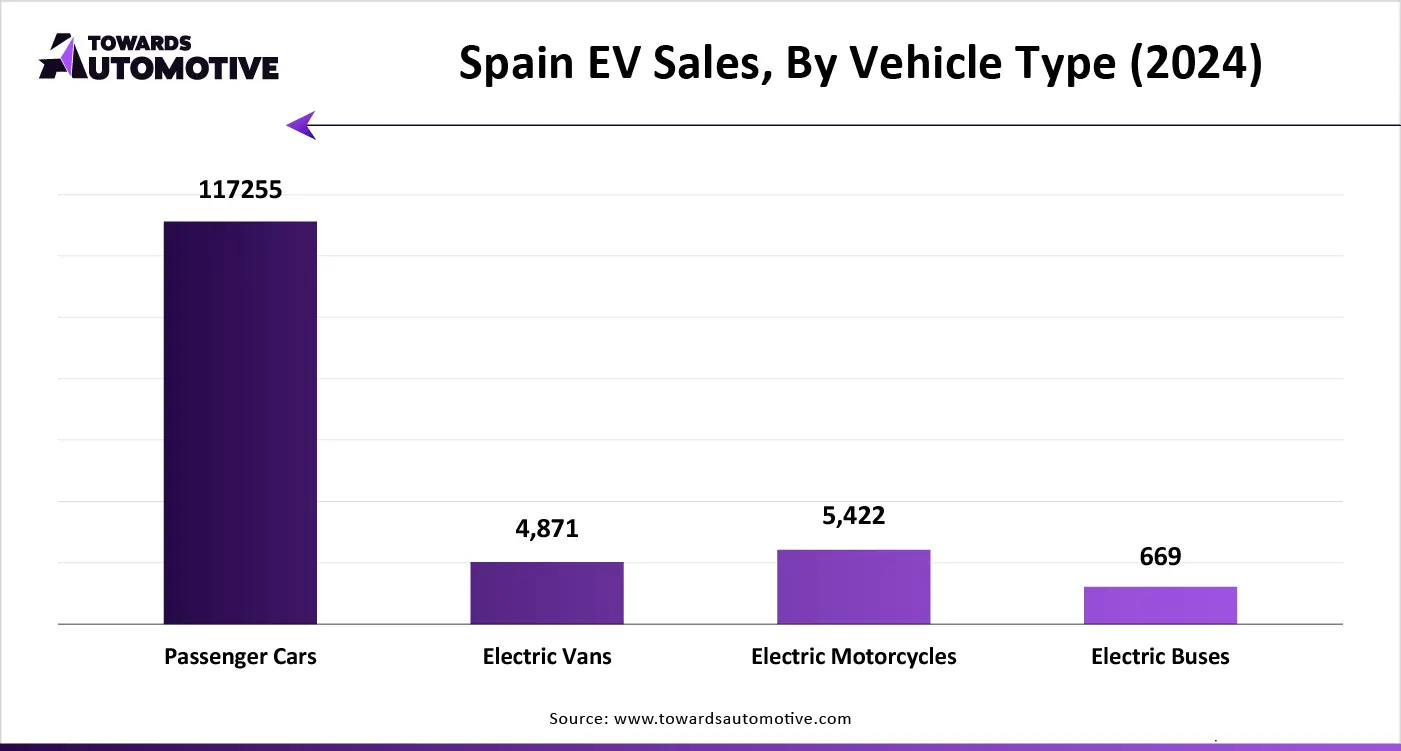

The passenger vehicles segment held a dominant share of the market. The growing demand for eco-friendly passenger cars in countries such as Germany, France, UK and some others has boosted the market expansion. Also, the rising government initiatives aimed at providing subsidies for purchasing EVs coupled with rapid deployment of fast-chargers across Europe is playing a vital role in shaping the industrial landscape. Moreover, the increasing trend of luxury EVs and electric SUVs among the European population is expected to propel the growth of the Europe electric vehicle market.

The commercial vehicles segment is predicted to grow with a notable growth rate during the forecast period. The rising adoption of electric two-wheelers by fleet operators of Europe has driven the market growth. Also, numerous truck companies are investing heavily for developing electric trucks for the heavy industries of Europe, thereby contributing to the industrial expansion. Moreover, rapid deployment of electric buses for city tours coupled with launches of several electric vans is likely to proliferate the market growth in this region.

The front wheel drive segment held the lion’s share of the market. The growing demand for mid-ranged EVs for daily usage has boosted the market growth. Also, the rising trend of hatchbacks along with advancements in lightweight hybrid systems is playing a crucial role in shaping the market expansion. Moreover, several advantages of front wheel drive systems including superior traction, enhanced space efficiency, low maintenance cost and some others is projected to boost the growth of the Europe electric vehicle market.

The rear-wheel drive segment is likely to grow with a considerable growth rate during the forecast period. The growing demand for luxury SUVs among off-roading enthusiasts boosts the market expansion. Additionally, the rising integration of rear-wheel drive system in high-performance electric vehicles further accelerates the market growth. Moreover, numerous benefits of rear-wheel drive systems including enhanced stability, superior acceleration, high towing capacity and some others is predicted to drive the growth of the Europe electric vehicle market.

Germany held the highest share of the Europe electric vehicle market. The growing demand for luxury EVs among elite-class consumers drives the market growth. Also, numerous EV battery companies are investing heavily to open new EV battery recycling plants in Germany along with rapid adoption of technologies such as AI, IoT, big data analytics and others in EV factories is likely to foster the development of the industry. Moreover, the presence of various automotive companies such as Volkswagen, Audi, Porsche, Mercedes-Benz and some others further propels the market expansion in this nation.

UK is expected to grow with a significant CAGR during the forecast period. The rising demand for sustainable transportation among the people of UK has bolstered the market expansion. Additionally, numerous government initiatives aimed at strengthening the EV charging infrastructure coupled with growing consumer interest towards electric supercars has further boosted the market growth. Also, the increasing adoption of e-bikes by ride-hailing companies along with presence of several EV brands such as Ashton Martin, McLaren, Land Rover and some others is anticipated to boost the market growth in this nation.

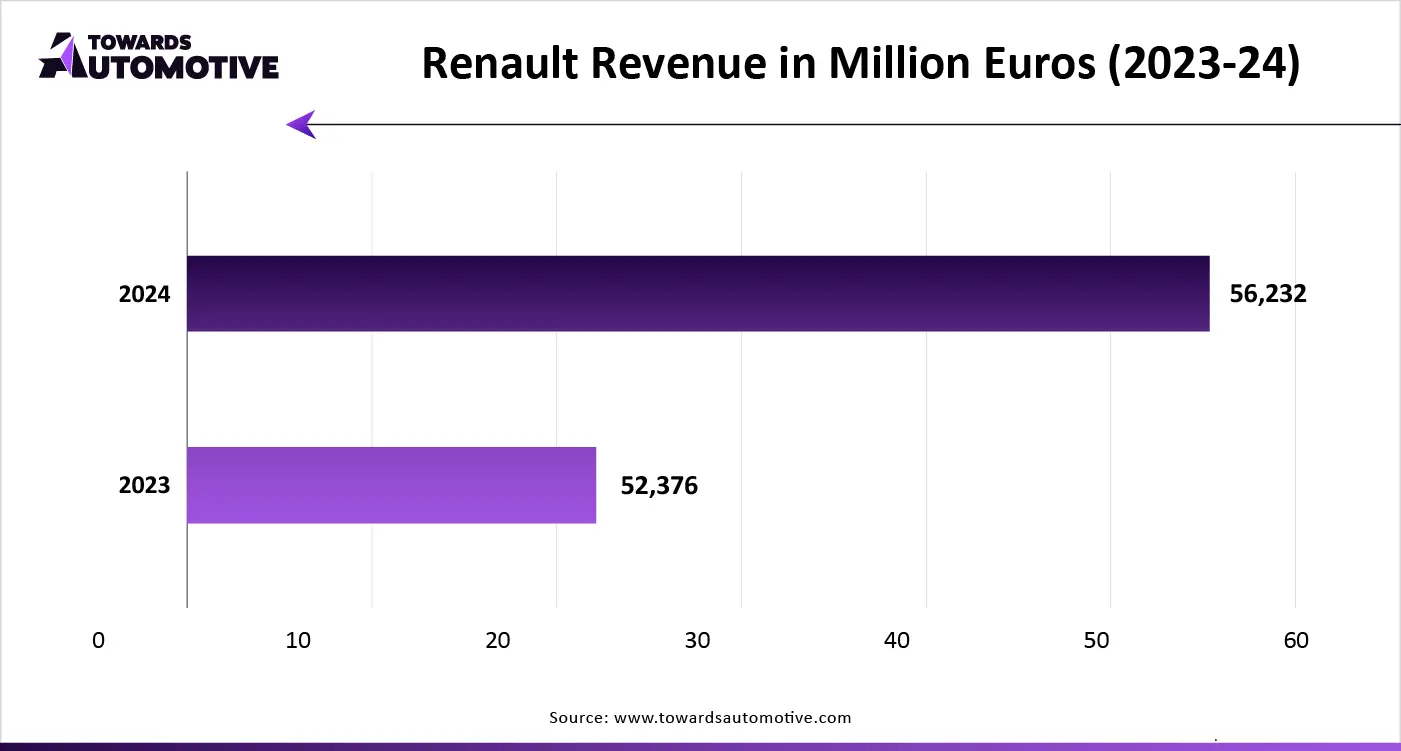

The Europe electric vehicle market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Audi, Dacia, Renault, Volvo, BMW Group, Mercedes-Benz and some others. These companies are constantly engaged in developing electric vehicles for the European region and adopting numerous strategies such as business expansion, acquisition, collaborations, joint venture, product launches, partnerships, and some others to maintain their dominant position in this industry. For instance, in April 2024, Volvo announced that the EU commission announced to invest around 267 million euros. This investment is done for enhancing the EV manufacturing capacity in the Slovakia plant. Also, in March 2024, Audi launched Q6 e-tron in Europe. Q6 e-tron is a mid-size SUV segment EV that comes with fast charging capabilities.

By Vehicle

By Drive

By Propulsion

By Battery

By Range

By End Use

By Region

September 2025

September 2025

September 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us