April 2025

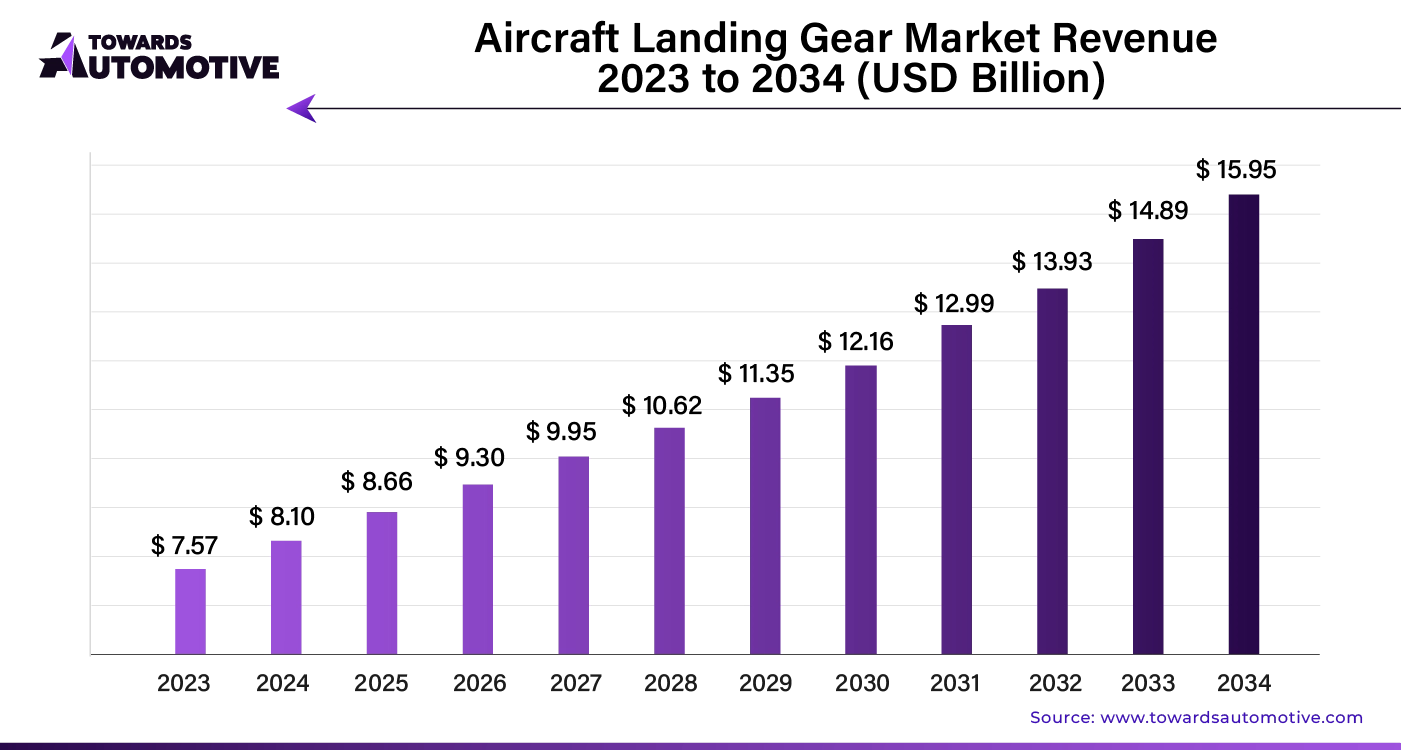

The aircraft landing gear market is predicted to expand from USD 8.66 billion in 2025 to USD 15.95 billion by 2034, growing at a CAGR of 7% during the forecast period from 2025 to 2034. The increasing demand for commercial flights in developed nations coupled with rapid investment by airline companies for deploying high-quality aircrafts to enhance passenger transportation has boosted the market expansion.

Additionally, the growing emphasis of market players for opening new aircraft component manufacturing plants along with surging demand for military helicopters in the defense sector is playing a crucial role in shaping the industrial landscape. The rising use of carbon fiber composites for manufacturing landing gears is expected to create ample growth opportunities for the market players in the future.

Unlock Infinite Advantages: Subscribe to Annual Membership

The aircraft landing gear market is a prominent branch of the aerospace and defense industry. This industry deals in development and distribution of landing gears for the aircrafts. There are various types of landing gears manufactured in this sector comprising of nose landing gear and main landing gear. These landing gears consist of different components including retraction system, breaks and wheels, steering and some others. The end-user of this sector consists of OEMs and aftermarket. This market is expected to rise significantly with the growth of the aviation sector around the globe.

The major trends in this market consists of business expansion, rising defense expenditure and growth in commercial aviation.

The main landing gear segment dominated the market. The growing use of main landing gear for supporting the weight of an aircraft during takeoff, taxiing, landing and some others has boosted the market expansion. Moreover, numerous advantages of these landing gears including stability, maneuverability, shock absorption and some others is expected to drive the growth of the aircraft landing gear market.

The nose landing gear segment is expected to grow with the highest CAGR during the forecast period. The increasing use of nose landing gear in commercial aircrafts for managing impact forces has driven the market expansion. Additionally, numerous benefits of these landing gears including improved ground handling, better forward visibility for pilots, enhanced braking capabilities and some others is expected to boost the growth of the aircraft landing gear market.

The fixed-wing segment held the largest share of the market. The increasing use of fixed-wings in commercial aircrafts has boosted the market expansion. Additionally, numerous advantages of fixed-wing platforms such as improved speed and efficiency, enhanced stability, high versatility, superior endurance and some others is expected to boost the growth of the aircraft landing gear market.

The rotary-wing segment is expected to rise with the fastest CAGR during the forecast period. The growing application of rotary-wing in helicopters has driven the market growth. Moreover, numerous benefits of this platform consisting of flexibility, maneuverability, improved stability and control, hovering capability and some others is expected to propel the growth of the aircraft landing gear market.

The retraction system segment led the market. The increasing use of retraction systems in aircrafts for reducing drag and improving fuel efficiency has boosted the market expansion. Additionally, numerous advantages of these systems including improved aerodynamics, better performance, increased speed and range, and some others is expected to boost the growth of the aircraft landing gear market.

The brakes & wheels segment is expected to expand with a significant CAGR during the forecast period. The increasing use of titanium-based wheels in aircrafts for enhancing the landing capabilities has boosted the market growth. Moreover, the growing adoption of thrust reversers and air brakers in fighter jets is expected to propel the growth of the aircraft landing gear market.

North America dominated the aircraft landing gear market. The growing demand for private planes in the U.S. and Canada has driven the market expansion. Additionally, rapid investment by government for strengthening the aviation sector coupled with increasing emphasis of aerospace companies for opening new manufacturing plants is playing a crucial role in shaping the industrial landscape. Moreover, the presence of various market players such as Alaris Aerospace, Collins Aerospace, Otto Aviation, SPP Canada Aircraft Inc., Triumph Group Inc., AAR Corporation, Hawker Pacific Aerospace and some others is expected to drive the growth of the aircraft landing gear market in this region.

Europe is expected to rise with a considerable CAGR during the forecast period. The increasing demand for commercial planes from the airline companies to enhance passenger transportation has boosted the market expansion. Additionally, growing adoption of military helicopters by the armed forces coupled with technological advancements in the aerospace sector is contributing to the industry in a positive manner. Moreover, the presence of several market players such as Safran SA, GKN Aerospace, Liebherr Group AG and some others is expected to boost the growth of the aircraft landing gear market in this region.

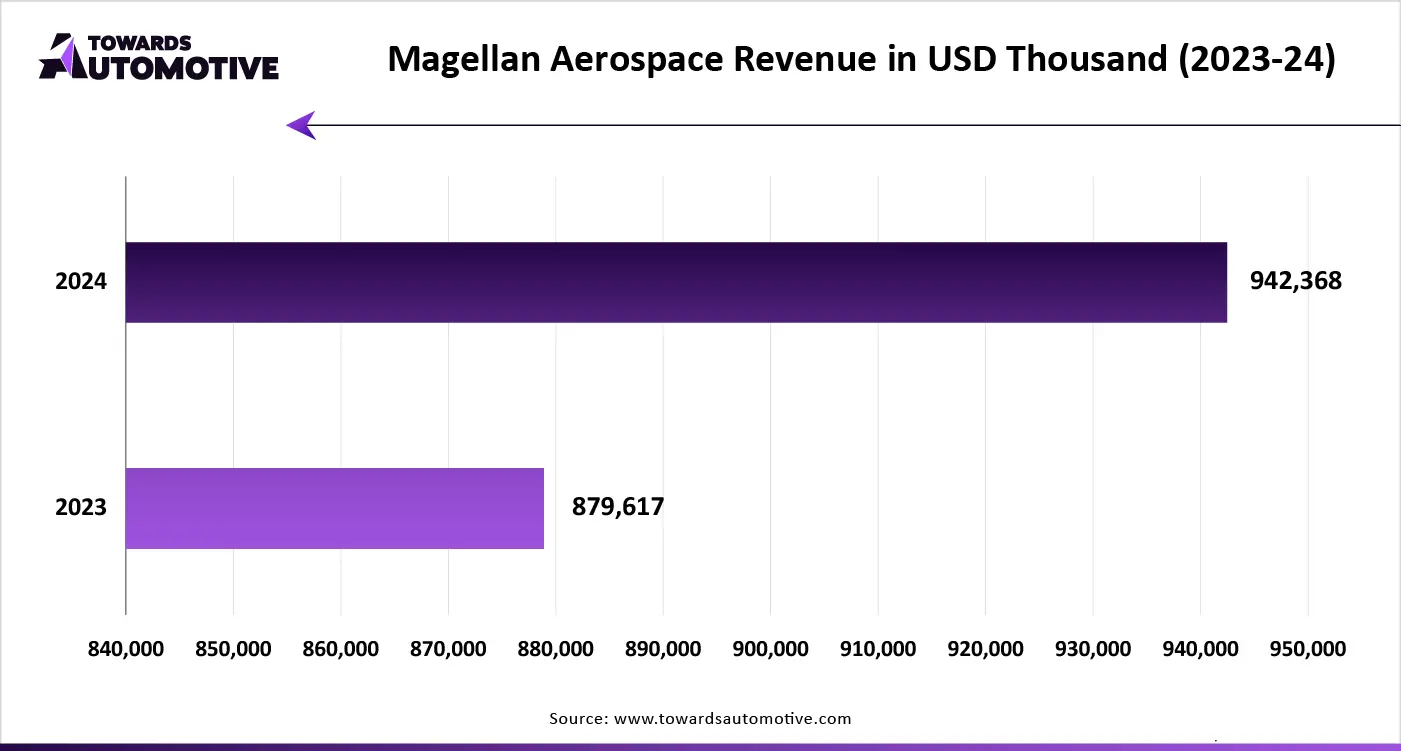

The aircraft landing gear market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Honeywell International Inc.; MAG Inc.; AAR; Advantage Aviation Technologies; Magellan Aerospace Corporation; Liebherr; Circor Aerospace Products Group; Eaton; Héroux-Devtek; Sumitomo Precision Products Co., Ltd. (SPP); Safran Landing Systems; UTC Aerospace Systems (United Technologies Corporation (UTC)); Triumph Group; Whippany Actuation Systems and some others. These companies are constantly engaged in developing aircraft landing gear and adopting numerous strategies such as joint ventures, acquisitions, business expansions, collaborations, launches, partnerships and some others to maintain their dominance in this industry.

By Type

By Platform

By Arrangement

By Component

By End-User

By Region

April 2025

April 2025

April 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us