September 2025

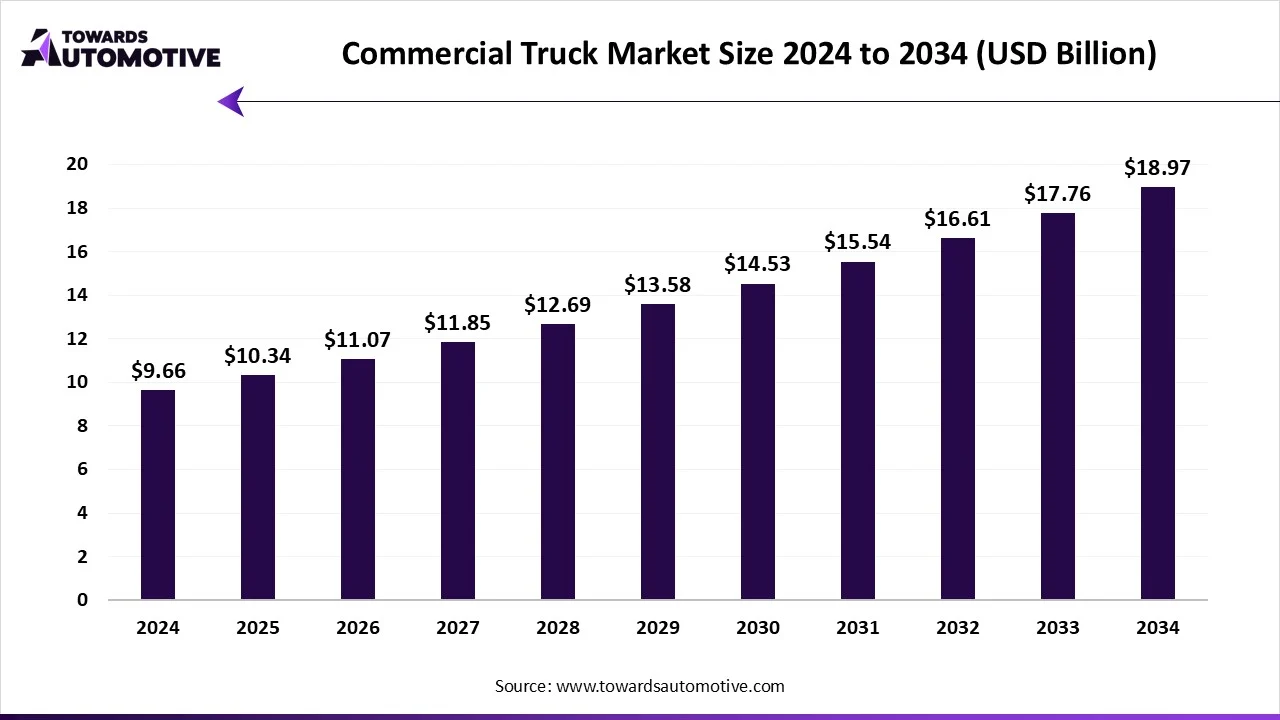

The commercial truck market is expected to increase from USD 10.34 billion in 2025 to USD 18.97 billion by 2034, growing at a CAGR of 7.03% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The commercial truck market is a prominent branch of the commercial vehicle industry. This industry deals in manufacturing and distribution of commercial trucks around the world. There are several types of trucks developed in this sector comprising of class 1 trucks, class 2 trucks, class 3 trucks, class 4 trucks, class 5 trucks, class 6 trucks, class 7 trucks, class 8 trucks and some others. These trucks are powered by different types of fuel consisting of diesel, natural gas, hydrogen, electric and some others. It is owned by numerous entities including fleet operator and owner operator. The commercial trucks find applications in various sectors such as freight delivery, utility services, construction & mining and some others. This market is expected to rise significantly with the growth of the automotive sector across the globe.

| Metric | Details |

| Market Size in 2024 | USD 9.66 Billion |

| Projected Market Size in 2034 | USD 18.97 Billion |

| CAGR (2025 - 2034) | 7.03% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Fuel, By Class, By Application, By Ownership and By Region |

| Top Key Players | Mack Trucks, MAN, Peterbilt, Ford, Daimler, Freightliner, Navistar, Isuzu Motors |

The major trends in this market consists of developments in autonomous trucks, expansion of truck rental services and rapid adoption of electric trucks.

The automotive companies are constantly engaged in developing autonomous trucks to reduce dependency on truck drivers. For instance, in April 2025, Aurora partnered with Continental and Nvidia. This partnership is done for launching a new range of autonomous trucks by 2027. (Source: Texas Border Business)

The expansion of truck rental companies has increased the demand for fuel-efficient trucks to cater the needs of numerous end-user industries. For instance, in February 2024, Daimler Truck launched a new truck rental service in Brazil. This service is designed for small and medium-sized fleet owners of this nation. (Source: Fleet Equipment)

Nowadays, the mining companies are adopting electric trucks at a rapid pace with an aim to reduce emission. For instance, in April 2024, Sany India launched SKT105E. SKT105E is an electric dump truck designed for the mining sector of India. (Source: Motorindia)

The freight delivery segment dominated the market. The rising demand for heavy-duty trucks from several e-commerce brands such as Amazon, Walmart, Alibaba, Flipkart and some others has boosted the market growth. Additionally, the growing application of class 1 trucks for transporting goods in different parts of the world is playing a vital role in shaping the industrial landscape. Moreover, the increasing adoption of hydrogen-trucks for freight delivery is expected to drive the growth of the commercial truck market.

The construction & mining segment is expected to rise with a considerable CAGR during the forecast period. The rise in number of residential constructions in various countries such as India, the U.S., Canada and some others has driven the market expansion. Also, numerous government initiatives aimed at developing the mining sector is playing a positive role in shaping the industry. Moreover, the increasing adoption of electric and hybrid trucks in several sectors including construction and mining is expected to propel the growth of the commercial truck market.

Commercial Truck Market Size, By Fuel, (USD Billion)

| Segment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Diesel | 8.31 | 8.73 | 9.16 | 9.62 | 10.09 | 10.58 | 11.09 | 11.63 | 12.18 | 12.75 | 13.34 |

| Natural Gas | 0.68 | 0.78 | 0.89 | 1.01 | 1.14 | 1.29 | 1.45 | 1.63 | 1.83 | 2.05 | 2.29 |

| Hybrid Electric | 0.68 | 0.84 | 1.02 | 1.22 | 1.45 | 1.70 | 1.97 | 2.28 | 2.63 | 3.01 | 3.43 |

| Total | 9.66 | 10.34 | 11.07 | 11.84 | 12.68 | 13.57 | 14.52 | 15.54 | 16.63 | 17.80 | 19.06 |

The diesel segment held the largest share of this industry. The growing demand for heavy-duty trucks from several industries such as mining, chemicals, oil & gas, metals and some others has increased the demand for diesel-powered trucks, thereby driving the market growth. Additionally, the rapid adoption of diesel-powered trucks by fleet owners to facilitate long-distance freight operations is contributing to the industrial expansion. Moreover, numerous advantages of diesel trucks including enhanced fuel efficiency, high torque, improved durability and some others is expected to foster the growth of the commercial truck market.

The hybrid electric segment is expected to grow with the highest CAGR during the forecast period. The growing adoption of electric trucks in several e-commerce companies such as Ebay, Walmart, Amazon and some others has boosted the market growth. Additionally, rapid deployment of hybrid trucks in the mining sector is playing a crucial role in shaping the industrial landscape. Moreover, the growing sales of electric trucks in different parts of the world is expected to propel the growth of the commercial truck market.

Commercial Truck Market Size, By Region, (USD Billion)

| Segment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| North America | 2.32 | 2.47 | 2.63 | 2.81 | 2.99 | 3.19 | 3.40 | 3.62 | 3.86 | 4.11 | 4.38 |

| Europe | 2.13 | 2.26 | 2.41 | 2.57 | 2.74 | 2.92 | 3.11 | 3.31 | 3.53 | 3.76 | 4.00 |

| Asia-Pacific | 4.06 | 4.36 | 4.69 | 5.05 | 5.43 | 5.83 | 6.27 | 6.75 | 7.25 | 7.80 | 8.38 |

| Latin America | 0.68 | 0.72 | 0.77 | 0.83 | 0.89 | 0.95 | 1.02 | 1.09 | 1.16 | 1.25 | 1.33 |

| Middle East & Africa | 0.48 | 0.52 | 0.55 | 0.59 | 0.63 | 0.68 | 0.73 | 0.78 | 0.83 | 0.89 | 0.95 |

| Total | 9.66 | 10.34 | 11.07 | 11.84 | 12.68 | 13.57 | 14.52 | 15.54 | 16.63 | 17.80 | 19.06 |

Asia Pacific led the commercial truck market. The growing demand for advanced trucks from several industries such as e-commerce, mining, electronics and some others has driven the market expansion. Also, numerous government initiatives aimed at developing the logistics sector coupled with increasing sales of electric trucks in numerous countries such as India, China, South Korea and some others is contributing to the overall industrial growth. Moreover, the presence of several market players such as Tata Motors, Isuzu, Dongfeng Motors and some others is expected to drive the growth of the commercial truck market in this region.

China and India are the major contributors in this region. In China, the market is generally driven by the presence of several truck manufacturers along with rapid investment in automotive sector. In India, the growing adoption of electric trucks in the agricultural sector coupled with rise in number of truck rental companies has driven the market expansion.

North America is expected to grow with a significant CAGR during the forecast period. The growing adoption of hydrogen trucks in several industries such as oil & gas, automotive, retail and some others has boosted the market expansion. Also, the rise in number of truck operators along with rise in number of residential constructions is playing a vital role in shaping the industrial landscape. Moreover, the presence of various commercial truck companies such as Ford, Mack Trucks, Inc., Kenworth and some others is expected to boost the growth of the commercial truck market in this region.

U.S. dominated the market in this region. The growing development in the e-commerce sector coupled with rapid adoption of hybrid trucks in construction sector has boosted the market expansion. Additionally, the rising investment by government for developing the mining sector is playing a vital role in shaping the industrial landscape.

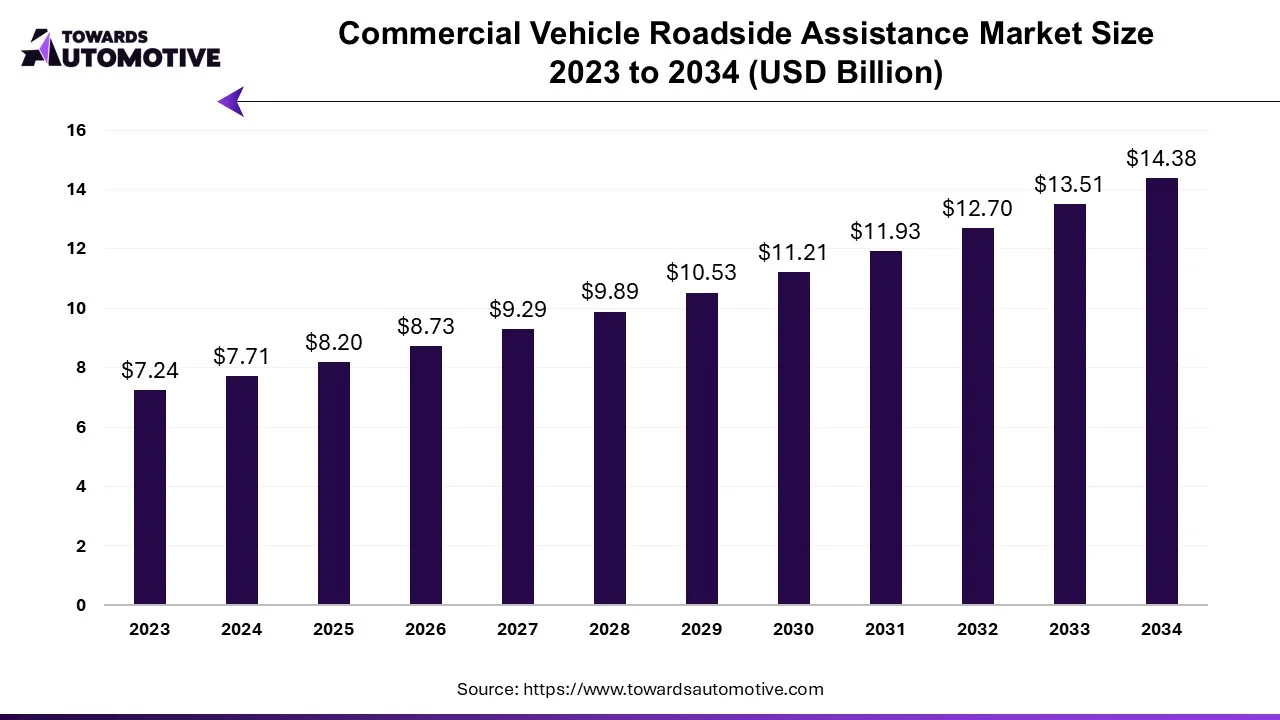

The commercial vehicle roadside assistance market size is forecast to grow from USD 8.2 billion in 2025 to USD 14.38 billion by 2034, driven by a CAGR of 6.44% from 2025 to 2034.

The commercial vehicle roadside assistance market is an integral segment of the automotive industry. This industry deals in providing roadside assistance service for commercial vehicles in different parts of the world. There are various types of services of this industry consisting of towing, tire replacement, jump start, fuel delivery, lockout service and some others. These services are provided by numerous providers consisting of automobile manufacturers, insurance companies, independent service providers and others.

It generally caters to several types of vehicles comprising of light commercial vehicles and heavy commercial vehicles. The growing demand for commercial vehicles across the world has contributed to the industrial development. This market is expected to rise significantly with the growth of the logistics and transportation industry.

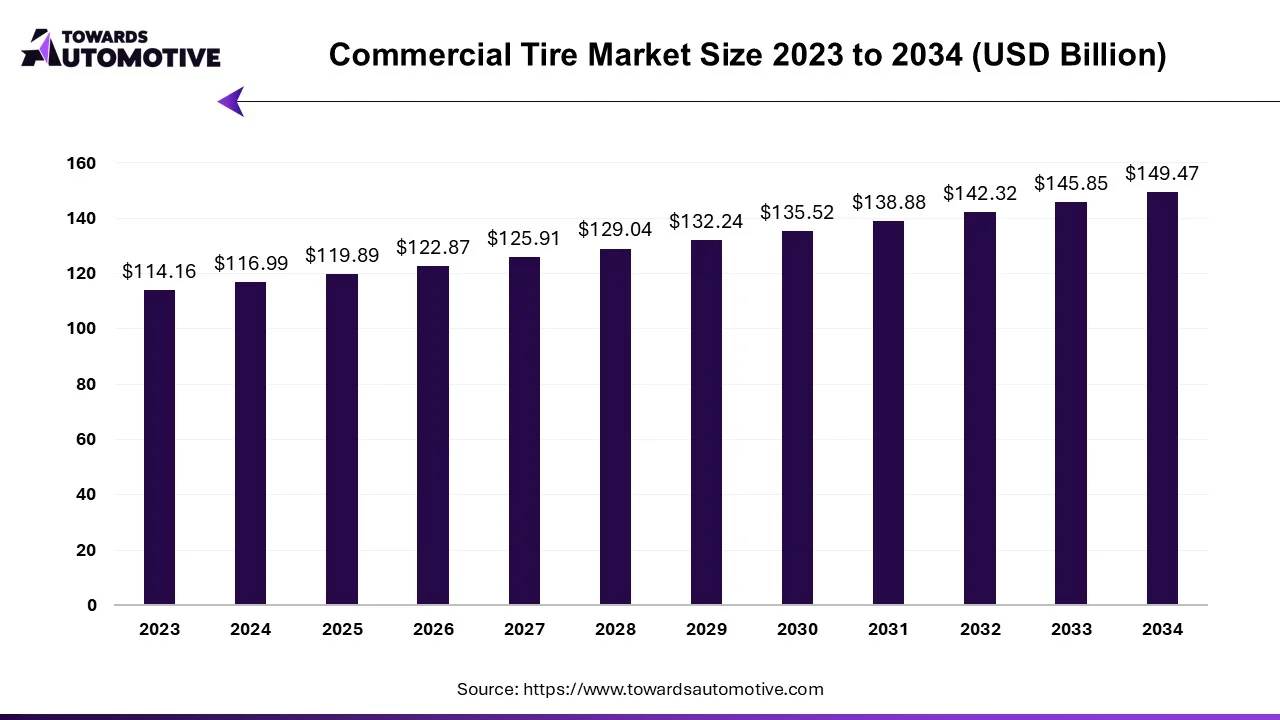

The commercial tire market is expected to increase from USD 119.89 billion in 2025 to USD 149.47 billion by 2034, growing at a CAGR of 2.48% throughout the forecast period from 2025 to 2034.

The commercial tire market is a crucial branch of the automotive materials industry. This industry deals in manufacturing and distribution of tires for commercial vehicles. There are different types of tires developed in this sector consisting of radial tires, bias tires and solid tires. These tires are designed for numerous vehicles such as light commercial vehicles, medium commercial vehicles and heavy commercial vehicles. It finds various application in several sectors including transportation, construction, agriculture, mining and some others. The growing demand for commercial vehicles in different parts of the world has contributed to the market expansion. This market is expected to grow drastically with the growth of the tire industry across the globe.

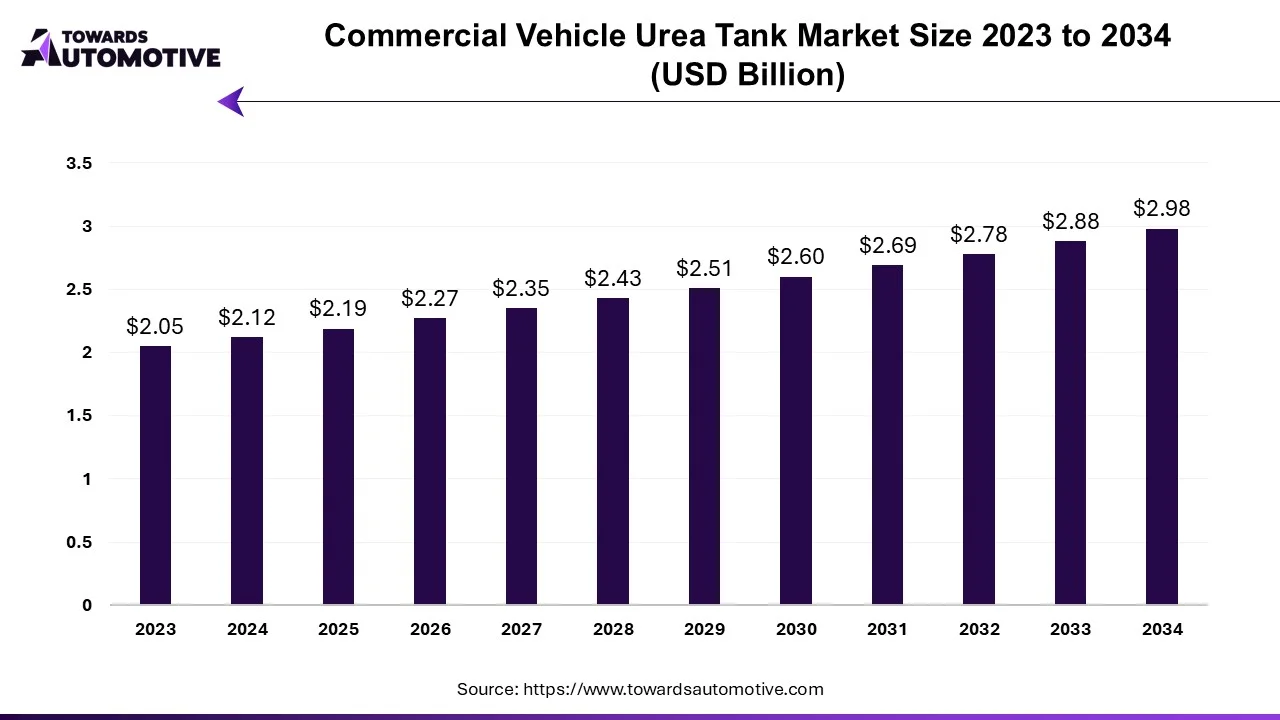

The commercial vehicle urea tank market is forecast to grow from USD 2.19 billion in 2025 to USD 2.98 billion by 2034, driven by a CAGR of 3.43% from 2025 to 2034.

The commercial vehicle urea tank market is an integral segment of the automotive components industry. This market deals in manufacturing and distribution of diesel exhaust fluid (DEF) tanks around the world. These tanks are manufactured using several materials consisting of stainless steel, plastics and composites. The urea tanks are available in different capacities in the market comprising of below 50 liters, 50 to 100 liters, above 100 liters and some others. It finds application in numerous vehicles including light commercial vehicles (LCVs), medium commercial vehicles (MCV) and heavy commercial vehicles (HCV). The availability of these tanks in e-commerce platforms has contributed to the overall market expansion. This market is expected to rise drastically with the growth of the commercial vehicle industry in different parts of the world.

The commercial truck market is a highly competitive industry with the presence of numerous dominating players. Some of the prominent companies in this industry consists of Mack Trucks, MAN, Peterbilt, Ford, Daimler, Freightliner, Navistar, Isuzu Motors, Kenworth, Scania AB, Volvo Trucks and some others. These companies are constantly engaged in developing trucks for numerous industries and adopting numerous strategies such as joint ventures, acquisitions, collaborations, business expansions, partnerships, launches, and some others to maintain their dominance in this industry.

By Fuel

By Class

By Application

By Ownership

By Region

September 2025

September 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us