December 2025

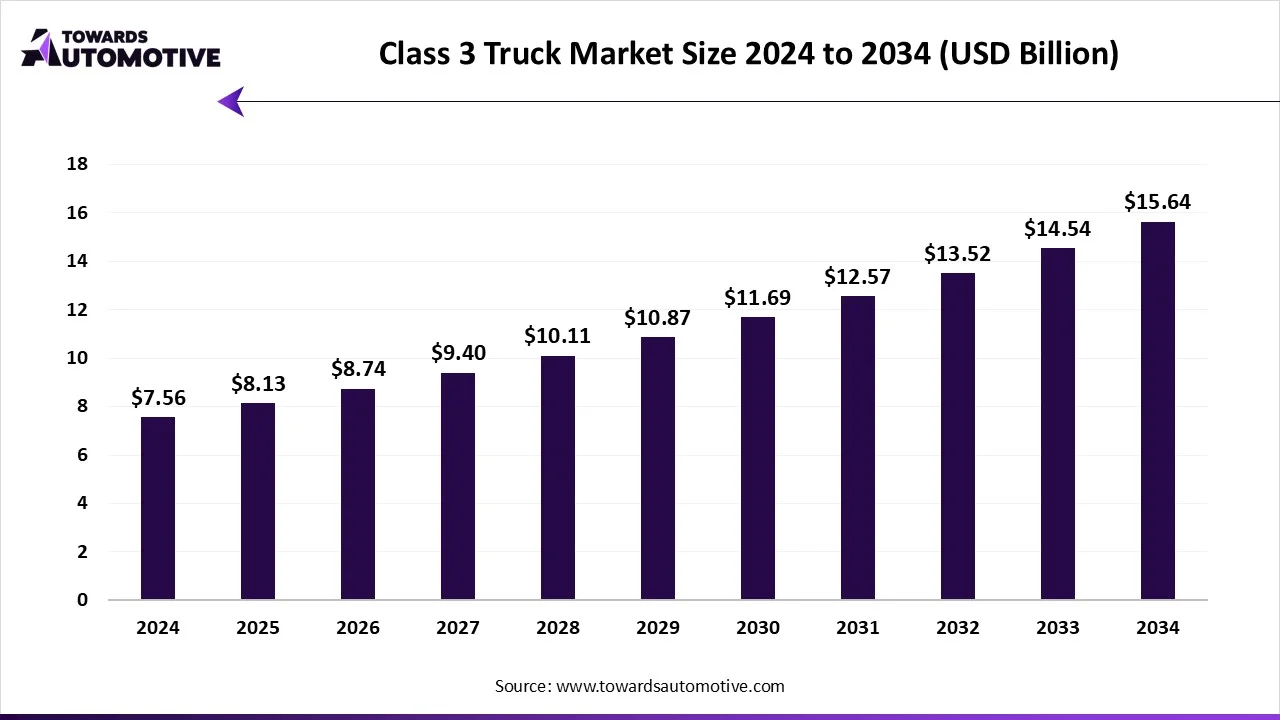

The class 3 truck market is anticipated to grow from USD 8.13 trillion in 2025 to USD 15.64 trillion by 2034, with a compound annual growth rate (CAGR) of 7.54% during the forecast period from 2025 to 2034. The growing demand for box trucks in last-mile delivery services coupled with numerous government initiatives aimed at developing the EV charging infrastructure is playing a vital role in shaping the industrial landscape.

Additionally, the rapid expansion of the e-commerce sector as well as technological advancements in the automotive sector has driven the market growth. The integration of ADAS in class 3 trucks to enable autonomous driving is expected to create ample growth opportunities for the market players in the upcoming days.

The class 3 truck market is a crucial segment of the automotive industry. This industry deals in manufacturing and distribution of class 3 trucks around the world. There are several types of vehicles developed in this sector comprising of walk-in trucks, box truck, city delivery trucks, heavy-duty pickup trucks and some others. These trucks are powered by different types of fuels such as gasoline, diesel, hybrid, electric and some others. It finds numerous applications in industrial sector and commercial sector. This market is expected to rise significantly with the growth of the commercial vehicles industry in different parts of the globe.

| Metric | Details |

| Market Size in 2024 | USD 7.56 Trillion |

| Projected Market Size in 2034 | USD 15.64 Trillion |

| CAGR (2025 - 2034) | 7.54% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Vehicle, By Fuel, By Application, By Configuration and By Region |

| Top Key Players | Daimler AG, Ford Motor, General Motors, International Trucks, Traton, Isuzu Motors Limited |

The major trends in this market consists of rise in number of truck companies, rapid adoption of electric trucks and government initiatives.

The rise in number of truck companies in different parts of the world has increased the sales of class 3 trucks.

The adoption of electric trucks has increased rapidly in the e-commerce sector to reduce vehicular emission.

Numerous governments are investing heavily for developing the road infrastructure that in turn increases the demand for class 3 trucks.

The commercial segment dominated the market. The growing use of class 3 trucks for transporting goods from one city to another has boosted the market expansion. Additionally, rapid adoption of electric-based class 3 trucks in the e-commerce sector coupled with rise in number of fleet operators is playing a vital role in shaping the industrial landscape. Moreover, partnerships among fleet companies and trucks manufacturers to deploy high-performance class 3 trucks for commercial applications is expected to drive the growth of the class 3 truck market.

The industrial segment is expected to rise with a considerable CAGR during the forecast period. The growing application of class 3 trucks in the mining industry for handling medium-duty applications has boosted the market expansion. Additionally, rapid investment by automotive brands for developing class 3 trucks to cater the needs of the industrial sector is playing a vital role in shaping the industry in a positive direction. Moreover, the increasing adoption of hybrid trucks in the industrial sector is expected to propel the growth of the class 3 truck market.

The 2WD segment held the largest share of the market. The growing demand for affordable medium-duty trucks from the construction sector has boosted the market expansion. Additionally, the rising sales of 2WD trucks in developing nations such as India, Vietnam, Thailand and some others due to numerous applications in the logistics sector is playing a vital role in shaping the industrial landscape. Moreover, numerous advantages of 2WD class 3 trucks including high towing capacity, simplicity and maintenance, maneuverability, cost-effectiveness and some others is expected to boost the growth of the class 3 truck market.

The 4WD segment is expected to grow with a notable CAGR during the forecast period. The increasing demand for 4WD trucks from the agricultural sector coupled with technological advancements in the automotive sector has boosted the market expansion. Additionally, partnerships among automotive companies and powertrain developers to integrate powerful powertrains in class 3 trucks is contributing to the industrial growth. Moreover, numerous benefits of 4WD class 3 trucks such as enhanced traction control, increased capability, extra durability and some others is expected to propel the growth of the class 3 truck market.

Asia Pacific led the class 3 truck market. The growing demand for light-duty trucks in several countries such as China, India, Japan, South Korea and some others has driven the market expansion. Additionally, the increasing sales of box trucks and walk-in trucks coupled with rapid developments in the logistics sector is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as Toyota Motors, Isuzu Motors, Nissan Motor and some others is expected to drive the growth of the class 3 truck market in this region.

China held the largest share of the industry. The rising adoption of hybrid trucks in the mining sector coupled with rapid investment by startup companies for developing the EV industry has boosted the market expansion. Additionally, the presence of several local automotive manufacturers as well as numerous government initiatives aimed at developing the agricultural sector is contributing to the overall industrial growth.

North America is expected to grow with a significant CAGR during the forecast period. The rising adoption of electric class 3 trucks in the U.S. and Canada for numerous applications in the construction sector has played a vital role in shaping the industry in a positive direction. Additionally, rapid investment by government for strengthening the EV charging infrastructure coupled with technological advancements in the automotive sector has contributed to the industrial expansion. Moreover, the presence of numerous market players such as General Motors, Ford Motor, International Trucks and some others is expected to boost the growth of the class 3 truck market in this region.

U.S. is the major contributor in this region. In the U.S., the market is generally driven by the growing demand for medium-duty trucks from the construction sector. Additionally, several government initiatives aimed at enhancing the import capabilities of automotive coupled with abundance of skilled workforce is playing a crucial role in shaping the industrial landscape.

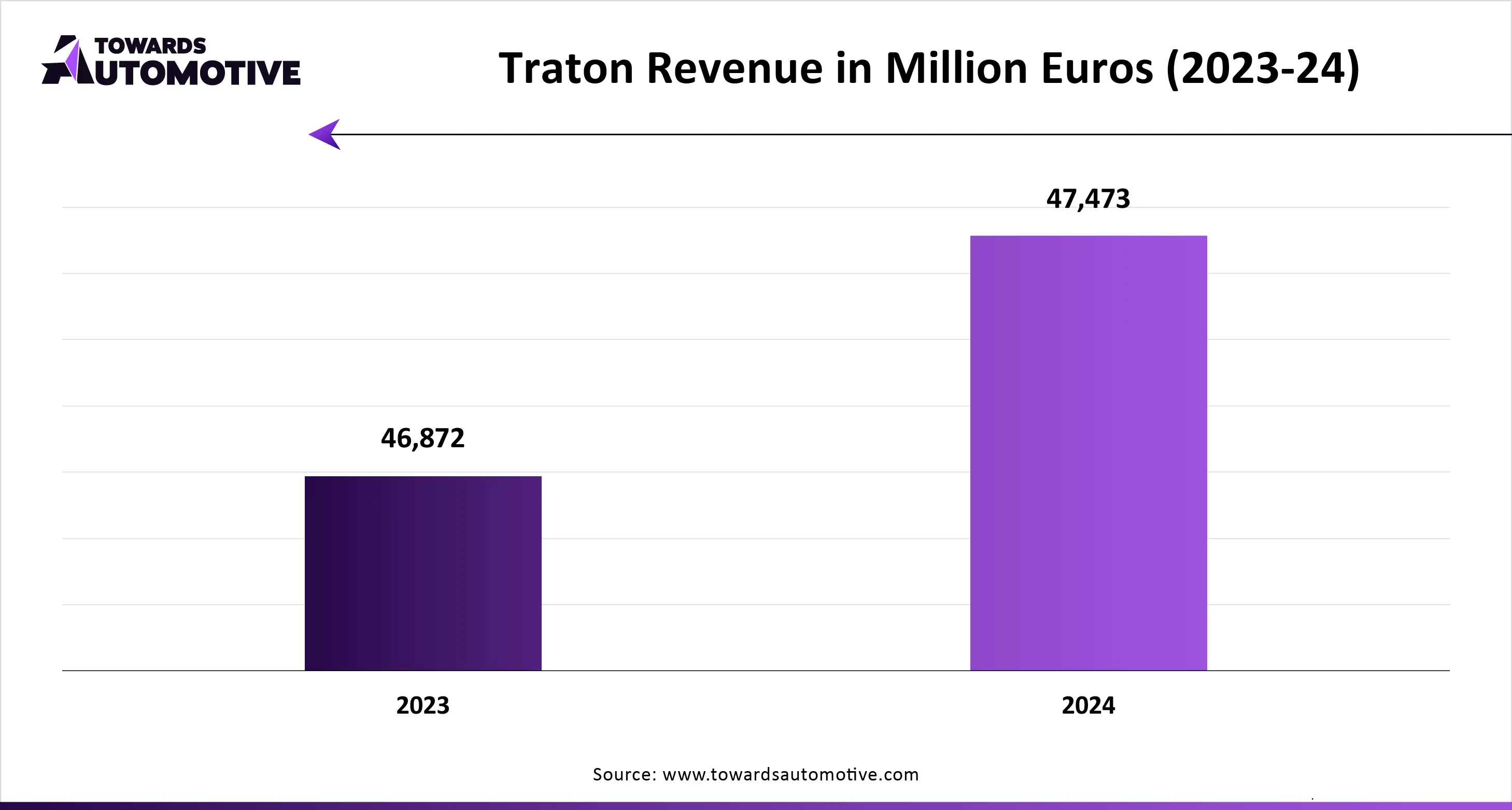

The class 3 truck market is a highly developed industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Daimler AG, Ford Motor, General Motors, International Trucks, Traton, Isuzu Motors Limited, Nissan Motor, Stellantis, Toyota Motors and some others. These companies are constantly engaged in developing class 3 trucks and adopting numerous strategies such as partnerships, joint ventures, acquisitions, launches, collaborations and some others to maintain their dominance in this industry.

By Vehicle

By Fuel

By Application

By Configuration

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us