October 2025

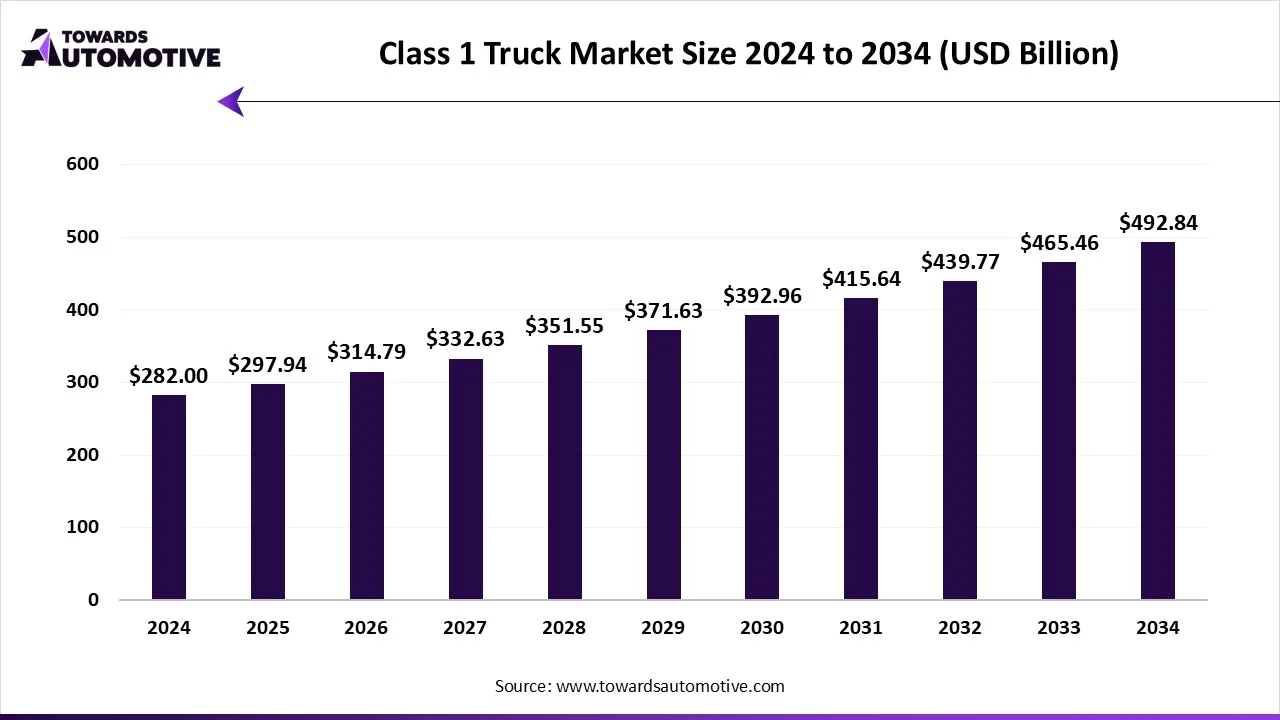

The class 1 truck market is forecast to grow at a CAGR of 5.65%, from USD 297.94 billion in 2025 to USD 492.84 billion by 2034, over the forecast period from 2025 to 2034. The growing application of light-duty truck in the logistics sector along with the ongoing trend of home renovation and DIY projects among residential consumers is playing a vital role in shaping the industrial landscape.

Also, surge in demand for efficient transportation solutions from the construction sector coupled with rapid investment by startups in EV sector has driven the market expansion. The integration of ADAS in light-duty trucks as well as research and development activities related to solid-state batteries is expected to create opportunities for the market players in the future.

The class 1 truck market is a prominent branch of the automotive industry. This industry deals in manufacturing and distribution of light-duty trucks in different parts of the world. There are several types of vehicles developed in this sector consisting of minivan, cargo van, SUV, pickup truck and some others. These vehicles are powered by different types of fuels comprising of diesel, gasoline, alternative fuels and some others. It comes with a payload capacity ranging from 6000 lbs to 14000 lbs. The end-users of these trucks comprise of general freight, construction, food and beverage, logistics and courier services, and some others. This market is expected to rise significantly with the growth of the commercial vehicles industry across the globe.

| Metric | Details |

| Market Size in 2024 | USD 282 Billion |

| Projected Market Size in 2034 | USD 492.84 Billion |

| CAGR (2025 - 2034) | 5.65% |

| Leading Region | North America |

| Market Segmentation | By Engine Type, By Vehicle Configuration, By Payload Capacity, By Application and By Region |

| Top Key Players | Mitsubishi Fuso Truck, SAIC Motor, Isuzu Motors, Hyundai Motor Company, Beiqi Foton Motor, Toyota Motor Corporation |

The major trends in this market consists of rapid growth of the e-commerce sector, popularity of electric trucks, consumer preference towards recreational activities.

The rising consumer preference for buying and selling goods in online platforms has increased the application of class 1 trucks.

The electric trucks are gaining popularity in recent times due to the increasing prices of diesel and rising demand to reduce vehicular emission.

The use of class 1 trucks has increased among adventurers to enhance their recreational experiences.

The diesel segment dominated the market. The growing use of diesel engines in light-duty trucks to deliver high fuel efficiency has boosted the market expansion. Additionally, rapid investment by engine manufacturers to develop small-sized diesel engines for class 1 trucks is contributing to the overall industrial growth. Moreover, several advantages of diesel-engines such as heavy-duty application, enhanced torque, longer lifespan as compared to gasoline engines and some others is expected to propel the growth of the class 1 truck market.

The alternative fuel segment is expected to rise with a significant CAGR during the forecast period. The technological advancements in hydrogen engines coupled with numerous government initiatives aimed at developing the hydrogen refueling infrastructure has driven the market growth. Also, rapid investment by startup companies for developing class 1 electric trucks is further contributing to the industrial expansion. Moreover, the increasing sales of CNG-based light trucks is expected to drive the growth of the class 1 truck market.

The straight truck segment dominated the industry. The growing adoption of straight trucks in the e-commerce sector for transporting goods from warehouses to logistics facilities is driving the market expansion. Additionally, the rising application of these trucks in the construction sector for delivering essential raw materials is contributing to the overall industrial growth. Moreover, partnerships among automotive companies and battery manufacturers to develop advanced batteries for straight trucks is expected to drive the growth of the class 1 truck market.

The tractor truck segment is expected to grow with a considerable CAGR during the forecast period. The rising use of tractor trucks for operating long-haul transportation has driven the market expansion. Additionally, collaborations among trailer manufacturers and logistics sector for developing electric tractor trucks is expected to boost the growth of the class 1 truck market.

The general freight segment led the market. The growing use of class 1 truck for transporting goods from one place to another has boosted the market growth. Additionally, rising adoption of class 1 hybrid trucks by fleet operators to lower vehicular emission and reducing maintenance is contributing to the industrial expansion. Moreover, partnerships among freight operators and truck companies to deploy heavy-duty trucks in several sectors is expected to boost the growth of the class 1 truck market.

The construction segment is expected to rise with a significant CAGR during the forecast period. The rise in number of residential constructions in several countries such as the U.S., India, Singapore, Germany and some others has driven the market expansion. Additionally, rapid investment by government of several countries for developing the building infrastructure is further adding to the industrial growth. Moreover, collaborations among construction companies and automotive brands for deploying superior class 1 trucks in construction sites is expected to drive the growth of the class 1 truck market.

North America led the class 1 truck market. The rise in number of commercial constructions in the U.S. and Canada has boosted the market growth. Additionally, the increasing awareness of consumers to reduce CO2 emission coupled with rapid adoption of hybrid trucks in the e-commerce sector is contributing to the industrial expansion. Moreover, the presence of several market players such as General Motors, Ford, Navistar and some others is expected to drive the growth of the class 1 truck market in this region.

U.S. dominated the market in this region. The growing adoption of light-duty trucks by food and beverage sector coupled with technological advancements in the logistics industry has driven the market expansion. Additionally, the presence of several automotive brands along with integration of ADAS in light-duty trucks is contributing to the industrial growth.

Asia Pacific is expected to rise with the fastest CAGR during the forecast period. The growing adoption of light-duty electric trucks in several nations such as China, Japan, India, South Korea and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the logistics sector as well as rapid growth of the e-commerce industry is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as Mitsubishi Fuso Truck, Toyota Motor Corporation, Hyundai Motor Company and some others is expected to propel the growth of the class 1 truck market in this region.

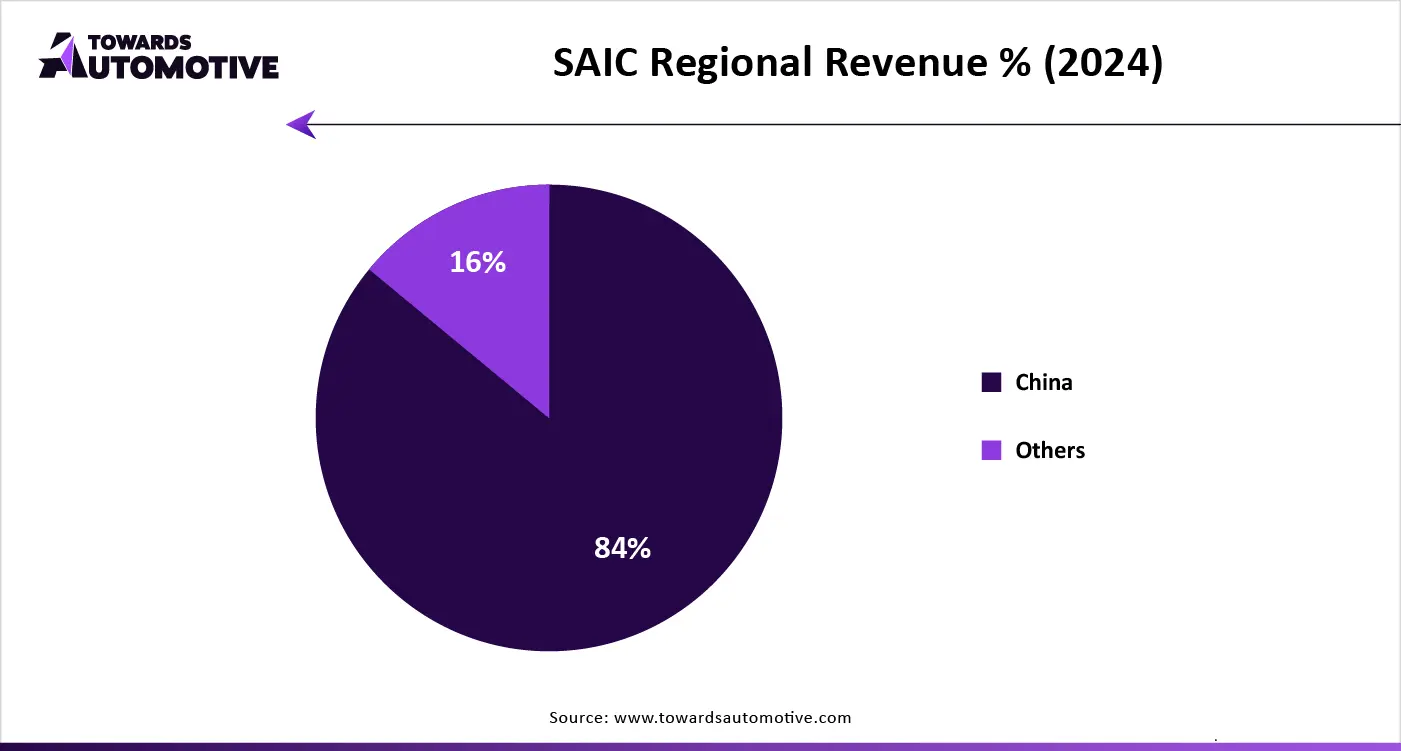

China led the market in this region. The rapid investment by government for strengthening the EV charging infrastructure coupled with presence of well-established automotive industry is contributing to the overall industrial growth. Additionally, technological advancements in the battery manufacturing sector as well as development of the logistics sector is driving the market expansion.

The class 1 truck market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Mitsubishi Fuso Truck, SAIC Motor, Isuzu Motors, Hyundai Motor Company, Beiqi Foton Motor, Toyota Motor Corporation, and Bus Corporation, Daimler Truck, Volvo Group, Hino Motors, Dongfeng Motor Group and some others. These companies are constantly engaged in manufacturing class 1 trucks and adopting numerous strategies such as joint ventures, acquisitions, partnerships, launches, collaborations and some others to maintain their dominance in this industry.

By Engine Type

By Vehicle Configuration

By Payload Capacity

By Application

By Region

October 2025

October 2025

October 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us