Automotive Actuators Market Expansion Trends and Future Insights

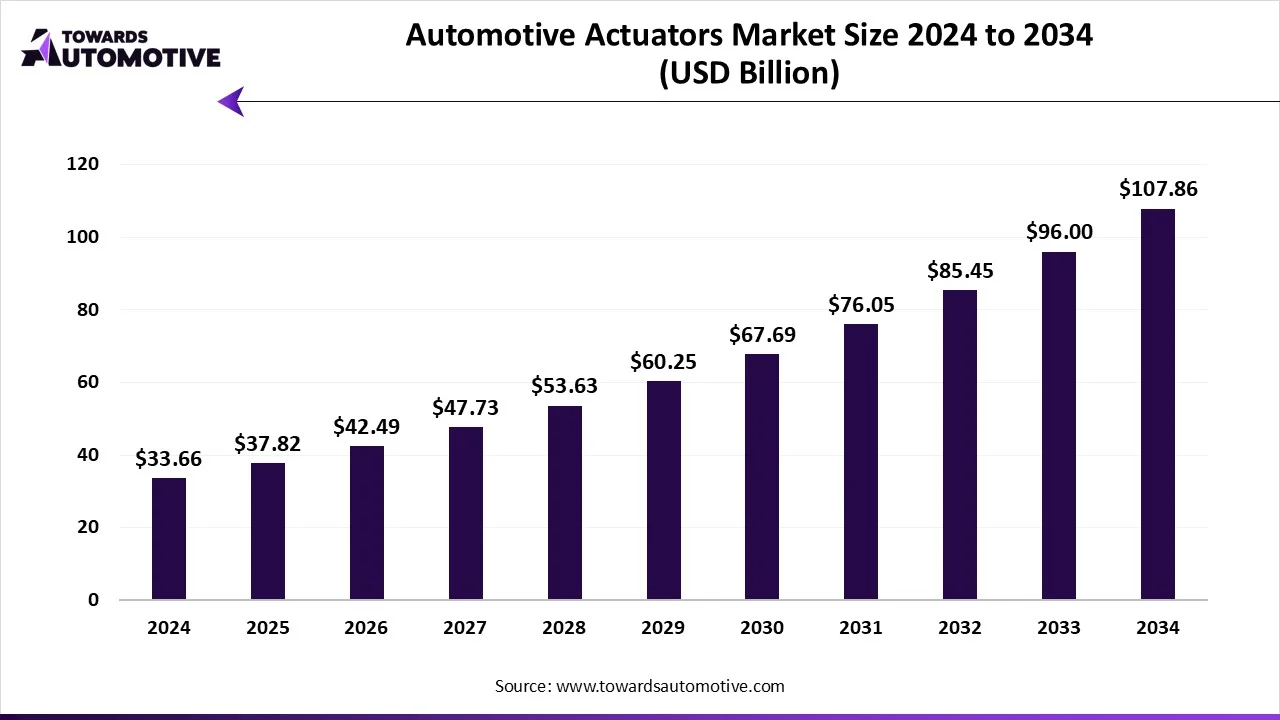

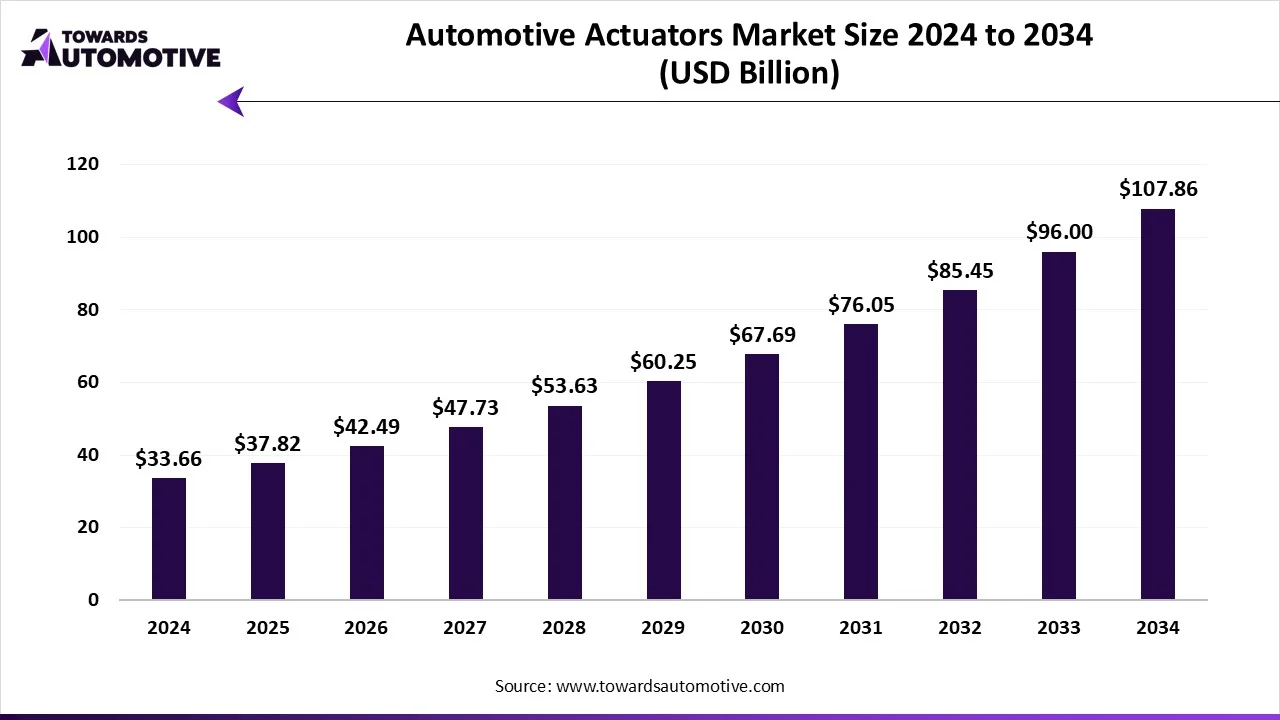

The automotive actuators market is anticipated to grow from USD 36.74 billion in 2025 to USD 104.80 billion by 2034, with a compound annual growth rate (CAGR) of 12.35% during the forecast period from 2025 to 2034.

- Technological improvements in the automobile industry, such as driverless cars and advanced driver assistance systems (ADAS), have considerably boosted the usage of actuators, with features such as adaptive cruise control and adaptive front-lighting systems becoming popular.

- The high cost of BLDC actuators is expected to decline as electronics prices fall, leading to increased deployment in various automotive applications.

- The growing demand for fuel-efficient vehicles and advanced actuator products drives significant manufacturers to invest in R&D activities. For example, Kierkert AG recently introduced a new charging-plug actuator for plug-in hybrid vehicles.

Automotive Actuators Market Trends

Rapid Growth Expected in Seat Adjustment Market

Automotive Actuators Market Size, By Vehicle Type, (USD Billion)

| |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Passenger Cars |

26.25 |

27.85 |

29.55 |

31.35 |

33.26 |

35.28 |

37.43 |

39.7 |

42.11 |

44.67 |

47.39 |

| Commercial Vehicles |

7.41 |

8 |

8.63 |

9.31 |

10.04 |

10.84 |

11.68 |

12.61 |

13.6 |

14.66 |

15.79 |

| Total |

33.66 |

35.85 |

38.18 |

40.66 |

43.3 |

46.12 |

49.11 |

52.31 |

55.71 |

59.33 |

63.18 |

Passenger and automobile sales continue to increase, and OEMs see interior decoration as one of the main focus areas for improving passenger safety and comfort. As part of this effort, the actuators pulled in many colors to make the chair more attractive and smart. In chairs, actuators adjust the lumbar support, seat, angle, and seat slide actuators. Many vehicle adjustment actuators are on the market, such as geared motors for incline adjustment, double output shafts for track drives, and linear actuators for height and incline adjustment.

- The seat adjustment actuator market is expected to expand due to large SUVs and premium car sales worldwide. OEMs use electronics to control nearly every car part to improve the passenger experience.

The Engine Segment Dominates the Automotive Actuators Market

- Cooling valves, throttle, and brakes are commonly found actuators in all ICE vehicles.

- Smaller GDI engines and gasoline turbochargers are being offered to meet performance and emission standards, necessitating the installation of EGR and turbo actuators.

- The demand for fuel-efficient vehicles has increased, driving the need for automotive actuators in engine applications.

- Both light and heavy commercial vehicles require automotive actuators like cooling valves, throttles, brakes, EGRs, and turbo applications.

- With the growing vehicle production, the automotive actuators market is expected to experience significant growth in the coming years.

Linear Actuators Expected to Dominate the Automotive Actuators Market by Motion

- Linear motion is likely to dominate the worldwide automotive actuators market throughout the forecast period, as it has a wide range of applications in the automobile sector, including controlling engine speed, managing fuel vapour flow, and operating power windows and locks.

- The key advantages of linear actuators include their small size, reliability, long lifespan, superior performance, and cost-effectiveness.

- Due to these benefits, linear actuators play a significant role in various automotive applications, such as raising and lowering hoods, adjusting powered seats and windows, operating pickup truck accessories, managing braking systems, controlling automotive throttling, and operating tailgates.

- Electric linear actuators, known for their versatility and ability to enhance various automotive functions, are increasingly utilized in applications such as power seats, HVAC systems, power windows, and tailgates.

- The consistency and versatility of electric linear actuators position them to dominate the market, especially as these applications continue to gain significant traction in the coming years.

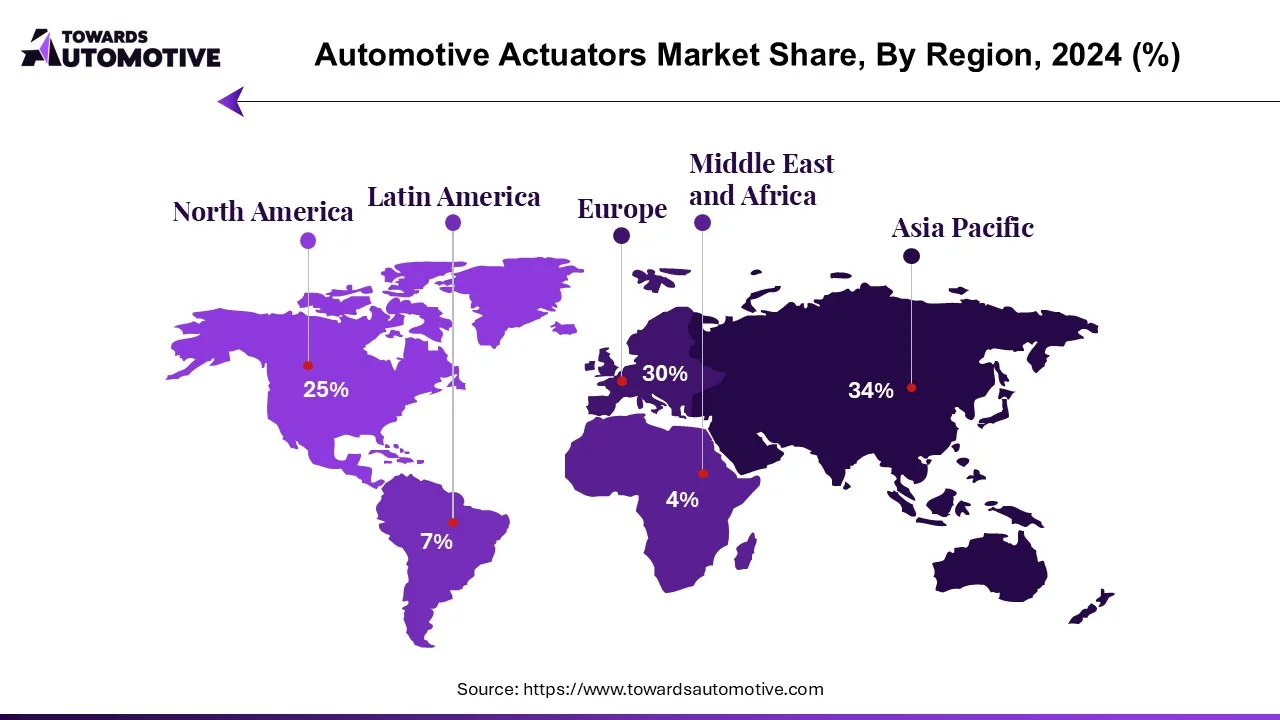

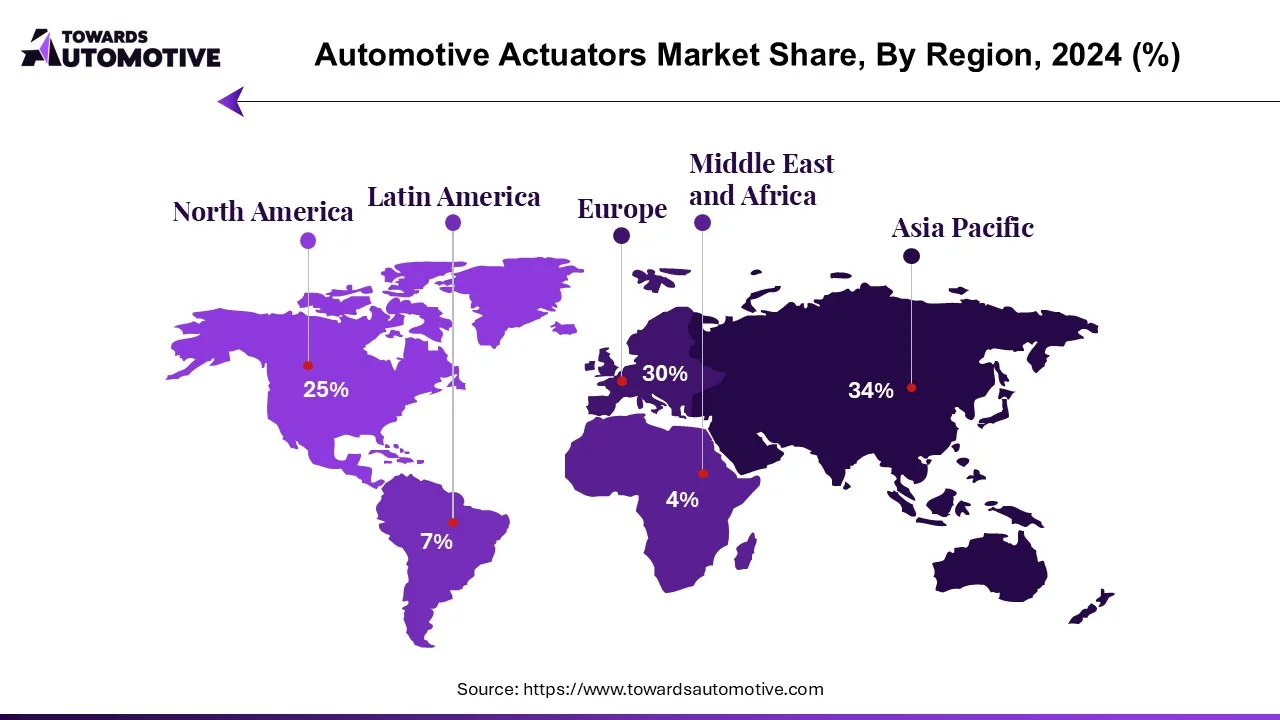

Asia-Pacific Maintains Major Market Share Capture

Automotive Actuators Market Size, By Region, (USD Billion)

| |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

6.73 |

7.15 |

7.59 |

8.06 |

8.56 |

9.09 |

9.65 |

10.24 |

10.87 |

11.55 |

12.26 |

| Europe |

7.41 |

7.86 |

8.34 |

8.85 |

9.39 |

9.96 |

10.57 |

11.21 |

11.9 |

12.63 |

13.4 |

| Asia-Pacific |

16.49 |

17.61 |

18.8 |

20.07 |

21.43 |

22.87 |

24.42 |

26.07 |

27.83 |

29.71 |

31.72 |

| Latin America |

1.68 |

1.8 |

1.92 |

2.05 |

2.18 |

2.33 |

2.49 |

2.65 |

2.83 |

3.02 |

3.22 |

| Middle East & Africa |

1.35 |

1.43 |

1.53 |

1.63 |

1.74 |

1.87 |

1.98 |

2.14 |

2.28 |

2.42 |

2.58 |

| Total |

33.66 |

35.85 |

38.18 |

40.66 |

43.3 |

46.12 |

49.11 |

52.31 |

55.71 |

59.33 |

63.18 |

- The Asia-Pacific market is expected to grow faster; India, Japan, and China will gradually become automakers and supply countries like the USA and Germany. The increase in passenger and commercial vehicle sales guided the market.

- Some major players in China include Limon Precision & Speed, Nutork Actuators & Valve, Brose, HELLA China, Mitsubishi, Changzhou, and Shengjie Electronics Co., Ltd.

- Innovations on the Chinese market are small electric actuators that help track the head while driving and illuminate the road. Many high-end models have this feature.

- China is one of the largest actuator markets due to the concentration of domestic products and low prices as people buy more cars.

Automotive Actuators Industry Overview

- Key players in the automotive actuators market include Robert Bosch GmbH, Nidec Corporation, Denso Corporation, Johnson Electric, and Aptiv PLC, among others.

- Robert Bosch GmbH held a significant share, accounting for nearly 20% of the global automotive actuators market in 2018.

- The company has established dominance by consistently supplying actuators to significant OEMs such as Volkswagen, GM, BMW, Daimler, Ford, Peugeot, and others across Asia-Pacific, Europe, and North America.

Automotive Actuators Market Leaders

Automotive Actuators Market News

- In April 2021, Arkamys collaborated with Continental on automotive solutions and installed Continental voice actuators in demonstration vehicles initially equipped with audio equipment. Arkamys offers its audio enhancement software with various speaker and operator configurations. The demo car offers many sound reproduction and manufacturer-friendly benefits, such as increased power, space, weight, reduced materials, and integration.

- In January 2020, Continental and Sennheiser jointly developed a "speechless" audio system for car interiors. Sennheiser claims that it extracts the sound by supporting the space inside the car, thus creating a good experience. Continental actuator solution Ac2ated Sound reduces weight and space by 90% compared to conventional models.

Recent Developments

- In May 2023, HELLA will expand its product range with electronic valve actuators (eVA), adding another critical element to its existing electronic products. In thermal management, this eVA controls the valves and helps ensure that coolant flows as required. Therefore, the service life and performance of lithium-ion batteries and all-electric drives can be increased. Hella will supply valve actuators for the German automaker's electric motors. Production is planned to start in 2025 at Hella's electronics facility in Bremen.

- In April 2023, Johnson Electric presented its technology solution at Auto Shanghai 2023, held at the National Exhibition and Convention Center in Shanghai. Solutions include thermal management, autonomous powertrain, chassis, and autonomous vision solutions. Vision solutions can have LuMEMS sensors for headlight detection, controllers, and a digital headlight steering actuator. Johnson Electric helps customers embrace the future trends of an increasingly mobile world.

- In January 2022, Johnson Electric created a combination of new energy solution packages. The device is currently in production and covers many applications, from parking safety and four-wheel drive mode to electronic driving position sensing. Johnson Motor has introduced a new solution that uses an electric motor and humidity controller to remove moisture inside the lamp. This CMD (condensation control device) actuator provides a new level of protection and temporarily reduces condensation.

Automotive Actuators Industry Segmentation

An actuator is a component of a machine, that is responsible for moving and controlling a mechanism or system; for example, by opening or closing a valve. Automotive actuators find their applications in vehicles, for performing functions, such as throttling, braking, operating the headlight, HVAC, electronic clutch actuation, closures, and others, which have been considered in the scope of the market.

Market Segmentation

By Application Type

- Throttle Actuator

- Seat Adjustment Actuator

- Brake Actuator

- Closure Actuator

- Other Application Types

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Geography

- North America

- United States

- Canada

- Rest of North America

- Europe

- Germany

- United Kingdom

- France

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East and Africa

- South Africa

- Rest of Middle East and Africa