December 2025

The automotive camera market is projected to grow from USD 14.32 million in 2025 to USD 38.11 million by 2034, expanding at a CAGR of 11.49 percent. The study covers detailed segmentation by type (stereo, monocular), application (park assist, lane departure warning, blind spot detection, adaptive cruise control, intelligent headlight control, and others), technology (digital, infrared, thermal), and vehicle type (passenger cars, commercial vehicles). Regional data are included for North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The report provides company profiles, competitive benchmarking, trade insights, and value chain mapping, highlighting key players such as Robert Bosch GmbH, Autoliv Inc, Garmin Ltd, Valeo, Continental AG, and Denso Corporation.

The automotive camera market is experiencing significant growth, driven by the increasing demand for advanced driver-assistance systems (ADAS) and the rising focus on vehicle. Cameras play a crucial role in enabling features such as lane departure warning, adaptive cruise control, parking assistance, and collision avoidance that helps in enhancing the overall driving experience. As regulatory bodies worldwide implement stringent safety standards, the adoption of automotive cameras has surged, making them essential components in modern vehicles.

Technological advancements in camera systems, such as high-resolution imaging, improved low-light performance, and integration with artificial intelligence (AI) are further propelling market growth.

The rise of electric vehicles (EVs) also contributes to the automotive camera market. Most of the EV brands have started integrating advanced cameras in their vehicles for delivering real-time insights about the surroundings which is crucial for enhancing safety.

| Metric | Details |

| Market Size in 2024 | USD 12.84 Million |

| Projected Market Size in 2034 | USD 38.11 Million |

| CAGR (2025 - 2034) | 11.49% |

| Leading Region | Europe |

| Market Segmentation | By Type, By Application Type, By Technology Type, By Vehicle Type and By Region |

| Top Key Players | Robert Bosch GmbH (Germany), Autoliv, Inc (Sweden), Garmin Ltd (U.S.) |

The growing demand for 360-degree cameras is significantly driving the expansion of the automotive camera market, as consumers increasingly seek enhanced safety and convenience features in vehicles. 360-degree camera systems provide comprehensive view of the vehicle’s surroundings by eliminating blind spots and improving situational awareness during maneuvers such as parking and lane changes. As automakers integrate advanced driver-assistance systems (ADAS) into their vehicles, the demand for 360-degree camera solutions is surging, aligning with safety regulations and consumer preferences for enhanced vehicle protection.

Artificial intelligence (AI) plays a pivotal role in advancing the capabilities of the automotive camera market, particularly in enhancing safety, driving automation, and overall vehicle intelligence. AI helps in enhancing several features such as object detection, lane recognition, and traffic sign recognition.

Night vision technology amplifies low-light images that enables drivers to see further down the road in darkness. As regulatory bodies implement stricter safety standards and consumers demand more advanced safety features, the integration of thermal imaging and night vision systems in vehicles is expected to rise significantly in the upcoming days.

Automotive cameras play a critical role in autonomous vehicles by providing real-time visual data for navigation and decision-making. Cameras with computer vision algorithms allow autonomous vehicles for detection and recognition of objects such as other vehicles, pedestrians, traffic signs, and lane markings. ADAS features depend on cameras to detect potential risks and provide warnings to the driver or take corrective actions. Multiple autonomous vehicle companies heavily relay on cameras for enhancing the vehicle performance and safety.

Automotive Camera Market Size, By Application Type, (USD Million)

| Application Type (Values in USD Billion) | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Park Assist System | 3.08 | 3.41 | 3.77 | 4.16 | 4.6 | 5.09 | 5.62 | 6.21 | 6.87 | 7.59 | 8.38 |

| Lane Departure Warning System | 1.8 | 1.99 | 2.2 | 2.44 | 2.7 | 2.99 | 3.3 | 3.66 | 4.05 | 4.48 | 4.95 |

| Blind Spot Detection | 1.54 | 1.73 | 1.95 | 2.19 | 2.46 | 2.76 | 3.11 | 3.49 | 3.92 | 4.41 | 4.95 |

| Lane Keep Assist | 1.28 | 1.45 | 1.63 | 1.83 | 2.06 | 2.32 | 2.61 | 2.94 | 3.31 | 3.72 | 4.19 |

| Road Sign Assistance | 0.9 | 1 | 1.12 | 1.25 | 1.39 | 1.55 | 1.73 | 1.92 | 2.15 | 2.39 | 2.67 |

| Adaptive Cruise Control (ACC) | 1.67 | 1.89 | 2.14 | 2.42 | 2.74 | 3.1 | 3.5 | 3.96 | 4.48 | 5.06 | 5.71 |

| Intelligent Headlight Control | 0.77 | 0.86 | 0.96 | 1.07 | 1.19 | 1.33 | 1.48 | 1.65 | 1.84 | 2.05 | 2.29 |

| Others | 1.8 | 1.99 | 2.2 | 2.44 | 2.7 | 2.99 | 3.3 | 3.66 | 4.05 | 4.48 | 4.95 |

The park-assist system segment held the largest share of the market. The growth of the automotive camera market is significantly driven by the increasing adoption of park assist systems in vehicles. As urbanization intensifies and parking spaces become more limited, drivers are seeking solutions that simplify the parking process. Park-assist systems utilize multiple cameras positioned around the vehicle to provide a 360-degree view of the surroundings and helps the drivers to identify obstacles, pedestrians, and other vehicles while parking.

The stereo segment held a dominant share of the market. The integration of stereo camera systems in automotive helps in enhancing vehicle perception and safety features. These cameras utilize two or more lenses to capture images from different angles to deliver clear view of the outdoor environment. Additionally, advancements in image processing algorithms and artificial intelligence are further optimizing the performance of stereo camera systems, making them more reliable and efficient.

The monocular segment is expected to show substantial growth during the forecast period. Monocular cameras are used in vehicles for enhancing driver assistance systems and improving autonomous driving capabilities. These cameras help in object detection, lane boundary identification, and tracking objects in surroundings. They are cost-effective and can provide valuable information for features such as lane departure warnings and collision warnings. It has a simple design as compared to stereo cameras that makes it easier to integrate into modern vehicle. Tesla, Audi, Volvo, Nissan, Ford, BMW, and General Motors (GM) are some of the major companies which use monocular cameras in their vehicles.

The digital camera segment led the market. The rapid adoption of digital cameras in modern cars is a key factor driving the growth of the automotive camera market. Digital cameras provide high-resolution and superior imaging capability that improves the accuracy of advanced driver-assistance systems. Moreover, advancements in digital imaging technology, such as improved low-light performance and enhanced image processing capabilities, further enhance the effectiveness of automotive camera systems.

The thermal camera segment is likely to grow with a significant CAGR during the forecast period. Thermal cameras are used in vehicles for enhancing safety and enabling advanced driver-assistance systems (ADAS) in adverse conditions. These cameras detect objects by sensing heat signatures and allow vehicles to see through visual obstructions during night driving. Multiple companies are investing heavily on developing advanced thermal cameras to improve night driving experience in automotives.

The passenger cars segment held the highest share of the industry. The growth of the automotive camera market is significantly driven by the increasing demand for passenger cars equipped with enhanced safety and convenience features. Also, the integration of smart cameras in luxury cars to monitor the activities outside the vehicles has also contributed to the market growth.

The commercial vehicles segment is expected to grow rapidly during the forecast period. Commercial vehicles utilize a variety of camera systems for safety, security, and driver assistance. Dash cameras, rearview cameras, side cameras, and interior cameras are commonly used in trucks, buses, taxis, and delivery vehicles.

Automotive Camera Market Size, By Region, (USD Million)

| Region (Values in USD Billion) | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| North America | 3.34 | 3.71 | 4.13 | 4.6 | 5.12 | 5.7 | 6.34 | 7.05 | 7.85 | 8.73 | 9.72 |

| Europe | 3.85 | 4.29 | 4.77 | 5.31 | 5.91 | 6.58 | 7.32 | 8.15 | 9.07 | 10.1 | 11.24 |

| Asia-Pacific | 3.6 | 4.02 | 4.5 | 5.04 | 5.63 | 6.3 | 7.05 | 7.89 | 8.83 | 9.88 | 11.05 |

| Latin America | 1.03 | 1.15 | 1.28 | 1.42 | 1.59 | 1.77 | 1.97 | 2.2 | 2.45 | 2.73 | 3.05 |

| Middle East & Africa | 1.03 | 1.15 | 1.28 | 1.42 | 1.59 | 1.77 | 1.97 | 2.2 | 2.45 | 2.73 | 3.05 |

Europe dominated the automotive camera market due to the rising demand for advanced driver-assistance systems (ADAS), technological advancements in automotive sector, and rapid urbanization. The increasing focus on road safety has led consumers to seek vehicles equipped with innovative safety features, such as driver assist, automatic adaptive cruise control, lane-keeping emergency braking to enhance safety and performance of vehicles. These features rely heavily on automotive cameras to provide accurate data for real-time decision-making, thereby contributing to the market growth.

The integration of advanced technologies such as AI and IoT in automotive cameras further accelerates the industrial expansion in this region. The rapid urbanization in Europe is contributing to the demand for automotive cameras due to the increasing traffic congestion and the need for efficient navigation. Europe is an automotive camera exporter and its export destinations are China, Japan, India, U.S. and others.

Germany dominated the European automotive camera market due to the presence of strong automotive industry with several market players such as BMW, Mercedes, Audi and some others. Major players such as Robert Bosch GmbH, ZF Friedrichshafen AG, and Continental AG are some of the important Germany-based automotive camera suppliers.

Asia Pacific is expected to grow with a significant CAGR during the forecast period. The automotive camera market in the Asia Pacific region is witnessing robust growth driven by the growing demand for autonomous vehicles, rising vehicle production and sales, and rapid awareness of road safety. As countries such China and India invest heavily in autonomous vehicles (AV) infrastructure, the demand for advanced cameras has been increasing at a rapid pace in recent times. Automotive cameras are integral to these vehicles as it provides essential data for enabling several features such as lane departure warning, adaptive cruise control, and collision avoidance systems that are crucial for enhancing driver and pedestrian safety.

Additionally, the rising vehicle production and sales in Asia Pacific contributes to the increased adoption of automotive camera systems. As more consumers enter the automotive market, manufacturers are bound to incorporate advanced technologies into their vehicles to meet consumer expectations and comply with regulatory requirements. Asia Pacific is a significant exporter of automotive cameras. The major export destinations include the U.S., Canada, Germany, France, the UK and some others.

China is the major contributor of the automotive camera market in Asia Pacific region due to large scale vehicle production, increasing safety concerns, and technological advancements. China is the largest consumer as well as exporter of automotive cameras. United States, Malaysia, Hong Kong, the Netherlands, and Singapore are the major export destinations. SmartSens, BYD Semiconductor, GalaxyCore, and QOHO are some of the major automotive camera companies based in China.

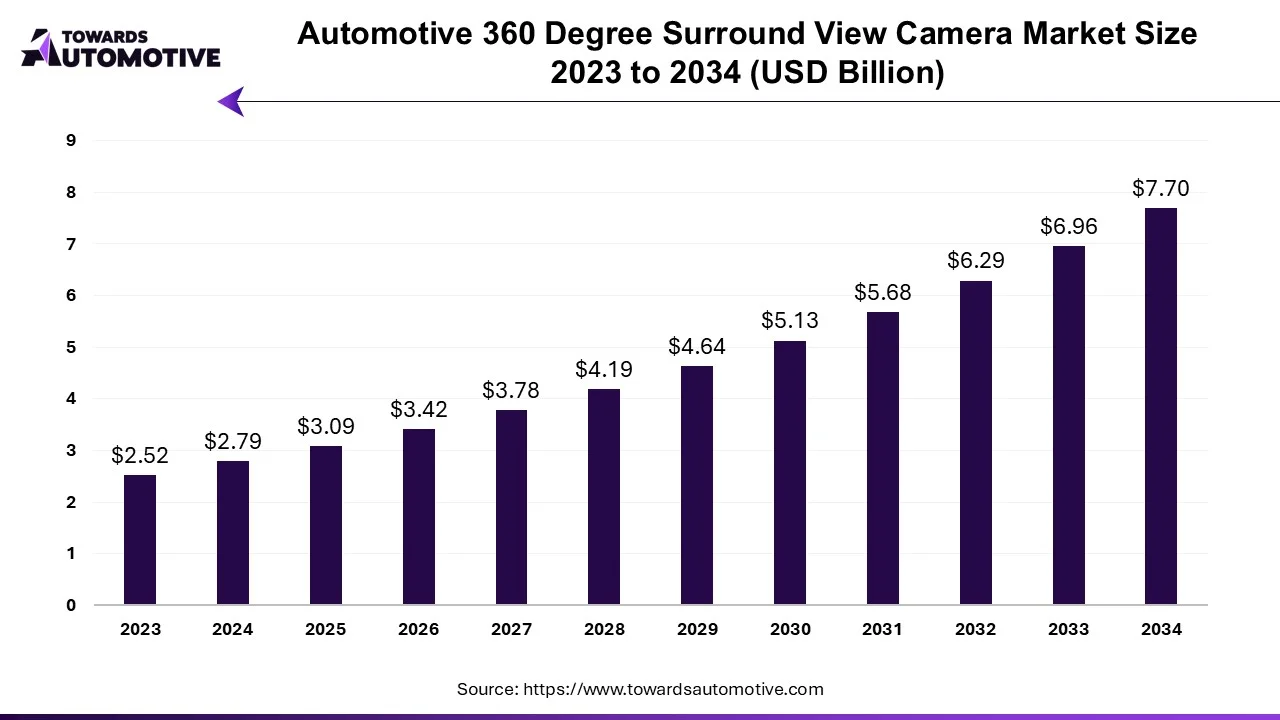

The automotive 360 degree surround view camera market is expected to increase from USD 3.09 billion in 2025 to USD 7.7 billion by 2034, growing at a CAGR of 10.69% throughout the forecast period from 2025 to 2034.

The automotive 360-degree surround view camera market is a prominent sector of the automotive industry. This industry deals in manufacturing and distribution of 360-degree cameras for automotives. There are several types of products developed in this sector comprising of 4 camera systems, 6 camera systems, 8 camera systems and some others. These cameras are designed for various types of vehicles consisting of sedans, SUVs, pickups and vans. The growing sales of luxury cars in different parts of the world has driven the industrial expansion. This market is expected to grow drastically with the rise of the automotive e-commerce sector in different parts of the world.

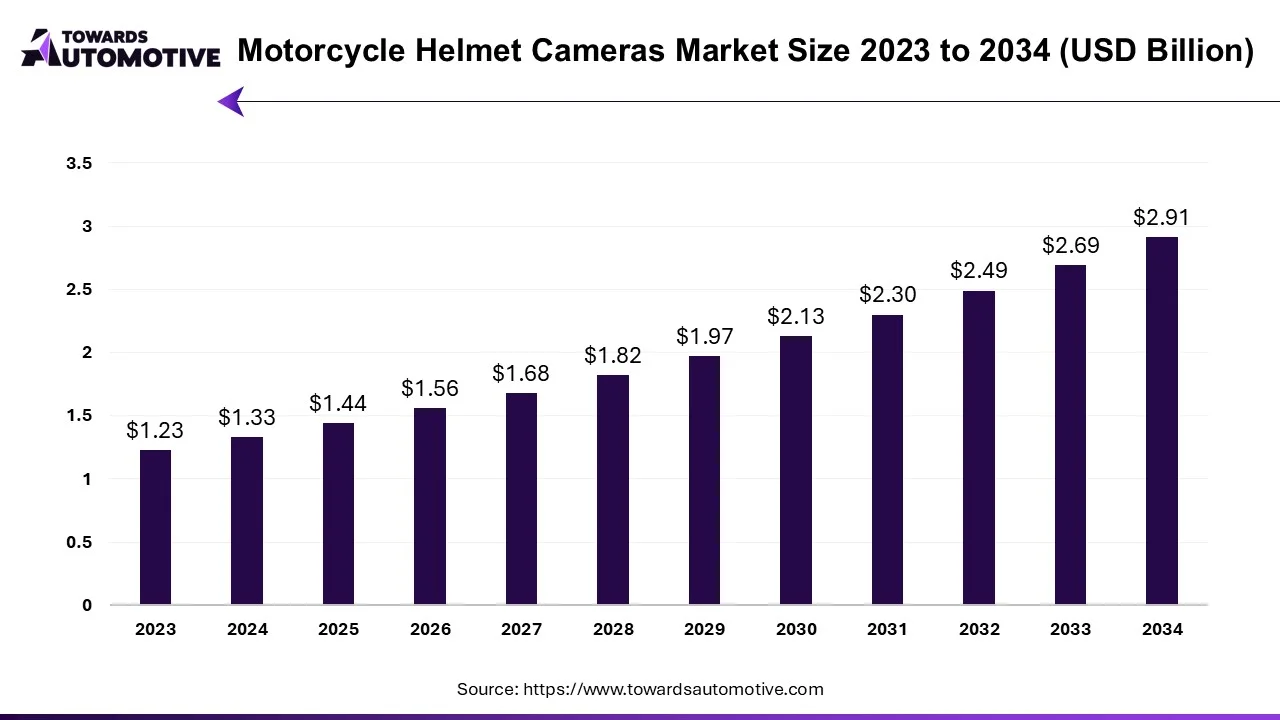

The motorcycle helmet cameras market is forecasted to expand from USD 1.44 billion in 2025 to USD 2.91 billion by 2034, growing at a CAGR of 8.14% from 2025 to 2034.

The motorcycle helmet cameras market is a crucial branch of the automotive accessories industry. This industry deals in manufacturing and distribution of helmet cameras for motorcyclists around the globe. There are several types of products developed in this industry consisting of action cameras, dash cameras and 360’ degree cameras. These cameras are used for several applications including professional and recreational. It is available in a distribution channel comprising of online stores, specialty stores, supermarkets and hypermarkets.

The automotive camera market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Robert Bosch GmbH (Germany), Autoliv, Inc (Sweden), Garmin Ltd (U.S.), Valeo (France), OmniVision (U.S.), Continental AG (Germany), Denso Corporation (Japan), Ricoh (Germany), Magna International Inc. (Canada), Mobileye (Israel), Metavista3D Inc, Aptiv Plc (Ireland), Brigade Electronics Group Plc (U.K.) and some others. These companies adopt multiple strategies such as product launches, partnerships, business expansion, acquisition, and some others to maintain their dominant position in this industry.

By Type

By Application Type

By Technology Type

By Vehicle Type

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us