December 2025

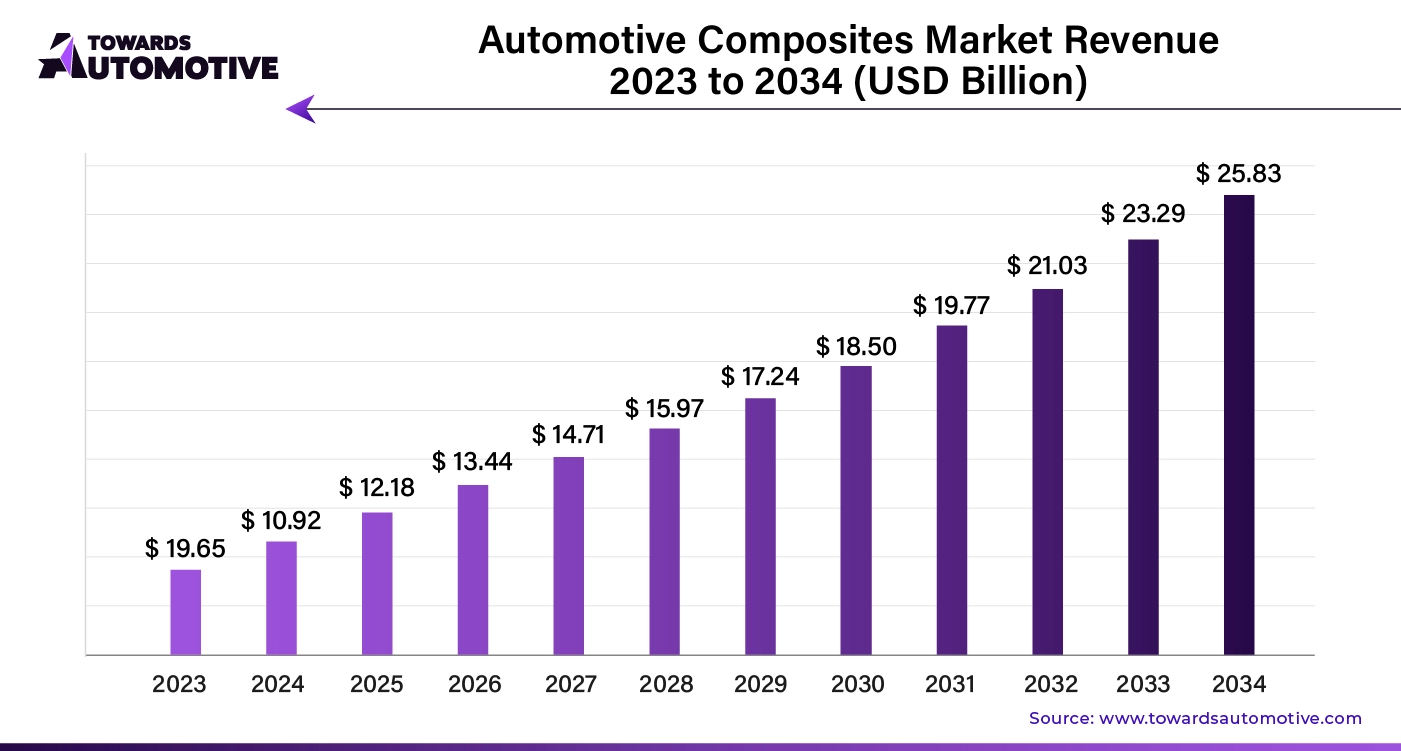

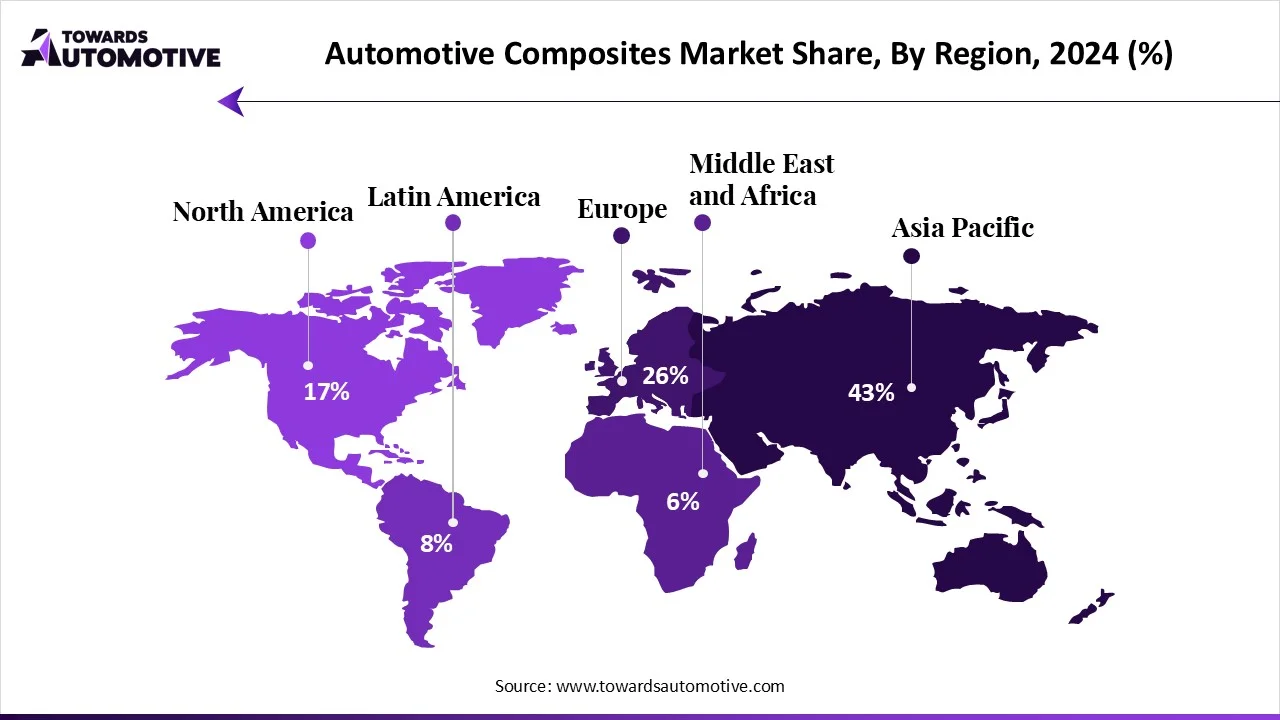

The automotive composites market will grow from USD 12.18 billion in 2025 to USD 25.83 billion by 2034 (CAGR 10.76%). This report quantifies demand by fiber type (glass fiber largest; carbon fiber fastest; others), manufacturing process (compression molding-largest; RTM—fastest; injection molding), and application (exterior largest; interior rapid growth; others) across North America, Europe, Asia Pacific, Latin America, and MEA with APAC leading and North America accelerating on EVs and premium segments.

We benchmark Toray, SGL Carbon, Hexcel, Owens Corning, Solvay, BASF, Covestro, Plasan, RTP, Gurit, Magna, Mitsubishi Chemical, Kolon, DuPont, UFP, SFG on market shares, technology roadmaps (CFRP for EVs, hybrid composites), pricing bands, and margin profiles. The study maps the value chain (precursors/resins - semi-finished (prepregs, fabrics) - molding & modules - OEM/aftermarket), includes trade data for fibers, prepregs, semi-finished and finished parts (volumes, ASPs, key corridors), and profiles manufacturers & suppliers with plant footprints, certifications, and 2024-2025 EBITDA ranges.

Automotive composites are materials made by blending matrix materials and high-performance fibers to improve the properties of traditional materials such as aluminum and steel. The automotive composites market is witnessing rapid growth as automotive industry is increasingly adopting lightweight and durable materials to enhance vehicle performance, fuel efficiency, and sustainability. Automotive composites include various materials such as carbon fiber, fiberglass, and natural fibers that offers superior strength-to-weight ratio as compared to traditional materials.

The growing demand for lightweight materials is a key driver of the automotive composites market, as automakers are increasingly prioritizing fuel efficiency, performance, and sustainability. Lightweight composites, such as carbon fiber and fiberglass, offer significant advantages over traditional materials, particularly in terms of strength-to-weight ratio.

Hybrid composites are creating significant opportunities in the automotive composites market by combining the strengths of different materials to deliver enhanced performance and versatility. These composites are often made by blending fibers such as carbon, glass, or aramid with thermoplastics or other resins which offer superior mechanical properties such as improved strength, durability, and weight reduction. For automakers, this innovation enables the production of components that are not only lighter but also stronger and more resilient than traditional materials.

Significant performance and design enhancements in the automotive industry are offered by composite materials. Weight reduction, higher strength-to-weight ratios, noise and vibration damping, high corrosion resistance, and energy absorption are some of the performance advancements. Design enhancements catered by composites can be optimized aerodynamics, parts consolidation, customizable properties, design flexibility, and more. For instance, In March 2025, Industrial Summit Technology (I.S.T.) unveiled IMIDETEX. It is a super fiber that enhances performance of composites used in automotive.

CFRP materials are known for their range of properties such as low thermal expansion, high strength-to-weight ratio, superior corrosion resistance, high tensile strength, low thermal conductivity, and some others. The use of these material is rapidly increasing in the EV industry to reduce weight and improve performance. For instance, in April 2024, Hyundai Motor Group and Toray Industries Inc. collaborated to develop a new range of lightweight and high-strength CFRP for EVs.

Automotive Composites Market Size, By Manufacturing Process, (USD Billion)

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| Compression Molding | 6.01 | 6.54 | 7.13 | 7.76 | 8.45 | 9.19 | 10 | 10.87 | 11.82 | 12.85 | 13.96 |

| Injection Molding | 2.73 | 3.06 | 3.43 | 3.84 | 4.3 | 4.82 | 5.4 | 6.05 | 6.78 | 7.59 | 8.5 |

| Resin Transfer Molding | 2.18 | 2.49 | 2.84 | 3.24 | 3.68 | 4.19 | 4.76 | 5.41 | 6.13 | 6.95 | 7.88 |

The compression molding segment holds the largest share of the market due to its cost-effectiveness and efficiency that are used for producing high-strength automotive components. This technique involves molding composite materials under heat and pressure. This process is particularly suited for developing intricate automotive structures such as bumpers, hoods, and interior panels.

One of the main advantages of compression molding is its ability to accommodate a wide variety of composite materials such as carbon fiber, glass fiber, and thermoplastic composites. Additionally, the short cycle times and lower material waste associated with compression molding help to drive down production costs, making composite components accessible for mass-market vehicles. Material manufacturers such as Toray and TenCate utilize compression molding to create complex parts.

The resin transfer molding (RTM) is the fastest-growing manufacturing process in the market. RTM is a composite manufacturing process that requires low pressure to produce several automotive parts. It can be used to create automotive body panels, structures, shells, and engine parts. Manufacturers such as BFG International and DOPAG use RTM to produce high-precision automotive components.

The exterior applications segment is dominating the automotive composites market. Automakers are adopting composite materials for vehicle exterior applications to achieve better performance, aesthetics, and fuel efficiency. Exterior components such as bumpers, hoods, doors, and panels benefit greatly from the use of composites due to their lightweight nature. In addition to performance advantages, the cost-effectiveness of composite materials, particularly in terms of long-term durability, and reduced maintenance make them ideal for automotive exterior applications.

The interior applications segment is experiencing significant growth due to the growing demand for aesthetics in vehicles. Carbon fiber, thermoplastic materials, glass fibers, and some others are used in manufacturing of interior components of vehicles. Composites are used to produce interior vehicle components such as door panels, dashboards, seat structures, trim, and acoustic insulation.

The glass fiber segment is dominating the automotive composites market. The glass fiber segment is a key contributor to the growth of the automotive composites market, owing to its versatility, cost-effectiveness, and strong mechanical properties. These composites are widely used in for manufacturing various automotive components including structural parts, body panels, and interior elements. It also helps to improve fuel efficiency in vehicles and lower CO2 emissions.

Carbon fiber is the fastest-growing fiber type due to its high strength-to-weight ratio. Carbon fiber-based vehicle parts can absorb a large amount of impact and reduces the risk of passenger injury. The lightweight factor of the composite allows vehicles to achieve better speed and superior performance.

Automotive Composites Market Size, By Region, (USD Billion)

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| North America | 2.83 | 3.1 | 3.38 | 3.7 | 4.04 | 4.42 | 4.81 | 5.26 | 5.74 | 6.25 | 6.82 |

| Europe | 2.95 | 3.23 | 3.54 | 3.87 | 4.24 | 4.64 | 5.08 | 5.56 | 6.08 | 6.66 | 7.28 |

| Asia-Pacific | 4.15 | 4.65 | 5.23 | 5.86 | 6.57 | 7.37 | 8.27 | 9.27 | 10.39 | 11.64 | 13.05 |

| Latin America | 0.55 | 0.62 | 0.7 | 0.79 | 0.89 | 1 | 1.13 | 1.27 | 1.43 | 1.62 | 1.82 |

| Middle East & Africa | 0.44 | 0.49 | 0.55 | 0.62 | 0.69 | 0.77 | 0.87 | 0.97 | 1.09 | 1.22 | 1.37 |

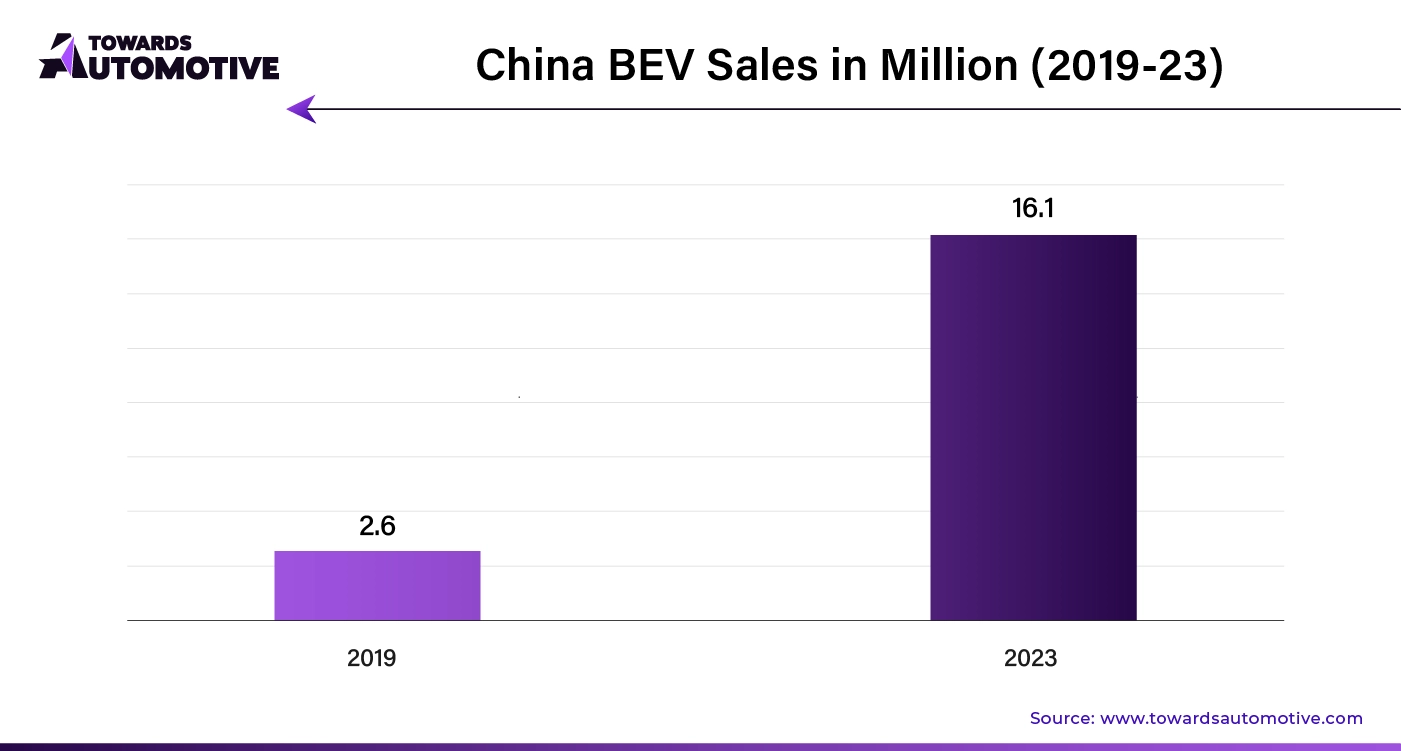

Asia Pacific is the dominating region of the automotive composites market, driven by increased vehicle production, rising demand for electric vehicles (EVs), and advancements in composite manufacturing technologies. The rapid expansion of the automotive industry in nations such as China, India, Japan, and South Korea is creating a robust demand for lightweight, high-performance materials that in turn contributes to the industrial expansion.

Additionally, advancements in composite manufacturing technologies such as automated production processes and 3D printing are revolutionizing the industry. These innovations make the production of composite parts more cost-effective and scalable, allowing for broader application in both high-performance and mass-market vehicles. The reduced costs and improved efficiency of composite manufacturing contribute to the widespread adoption of these materials, driving substantial growth in the automotive composites market in this region.

China is the major contributor in this region due to the large number of vehicle production, EV sales, government initiatives, and urbanization. The presence of well-established automotive industry, rising sales of commercial vehicles, and heavy investments in the EV sector by major companies are some other factors driving the market. Jiangsu Hengshen, Jiangsu Kangde Xin Composite Material, and Jilin Tangu Carbon are some of the China-based key players engaged in carbon fiber-based composite production. China exports automotive composites and parts to several countries such as Japan, Mexico, Germany, Poland, and South Korea.

The Indian automotive composites industry is growing at a rapid pace due to the increasing adoption of EVs, technological advancements in composite manufacturing, and growing sustainability awareness. India exports automotive components and composites to different destinations including US, Europe, and Asia.

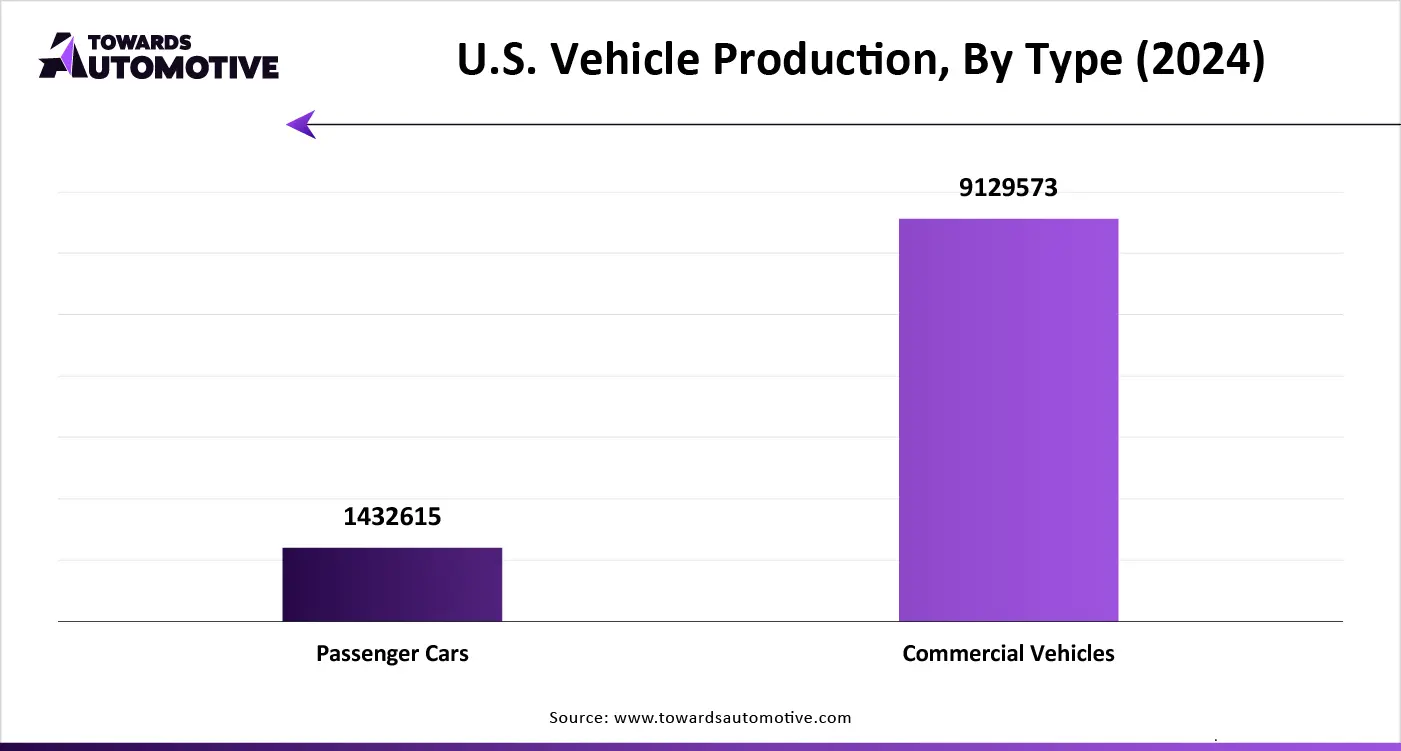

North America is experiencing substantial growth. A primary catalyst is the increasing focus on high-performance racing cars as well as the growing trend of luxury vehicles. These segments demand advanced materials that offer superior strength, durability, and design flexibility. These materials enhance vehicle performance and helps in enhancing aesthetic and functional requirements of high-end automotive applications.

The U.S. is the dominating country in this region. The market is generally driven by the presence of key players, growing production of vehicles and penetration of EVs. Owens Corning, Cytec Industries, and Hexcel Corporation are some major players in the U.S. striving to research and develop new composite materials.

The automotive composites market is highly competitive due to the presence of several key players. These companies are continuously working on research and development to make progress in this market by coming up with new composites using latest technologies. Toray Industries, Plasan Carbon Composites, RTP Company, Owens Corning, BASF SE, Solvay S.A., UFP Technologies, GURIT, Magna International Inc., Covestro AG, SFG Composites, Mitsubishi Chemical Holdings Corp, KOLON Corp., SGL Carbo n, DuPont and others are some leading players in the market. The market players are adopting several strategies including collaboration, launches, business expansions and some others to maintain their dominant position in this industry. For instance, in February 2025, Bcomp (Switzerland) collaborated with SFG Composites to bring flax fiber composite that is expected to provide an eco-friendly, high-performance, and lightweight alternative to glass, plastic and carbon fiber materials.

By Fiber Type

By Manufacturing Process

By Application

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us