December 2025

The automotive edge computing market is predicted to expand from USD 15.11 billion in 2025 to USD 77.37 billion by 2034, growing at a CAGR of 19.90% during the forecast period from 2025 to 2034.The technological advancements in the automotive industry coupled with rapid popularity of V2X platforms in developed nations has boosted the market expansion.

Additionally, increasing emphasis of government to growing awareness about road safety along with surge in demand for autonomous vehicles is playing a vital role in shaping the industrial landscape. The growing adoption of shared mobility services in urban areas is expected to create ample growth opportunities for the market players in the upcoming days.

The automotive edge computing market is a crucial sector of the automotive industry. This industry deals in developing advanced edge computing solutions for the automotive sector. There are various components of this sector consisting of hardware, software and services. It finds application in numerous automotive operations including autonomous driving, connected vehicles/ V2X communication, advanced driver assistance systems (ADAS), vehicle diagnostics & predictive maintenance, infotainment & digital cockpit, fleet management & telematics and some others. The end-user of this sector comprises of automotive OEMs, tier-1 suppliers, fleet operators, mobility-as-a-service providers and some others. This market is expected to rise significantly with the growth of the software sector in different parts of the globe.

| Metric | Details |

| Market Size in 2025 | USD 15.11 Billion |

| Projected Market Size in 2034 | USD 77.37 Billion |

| CAGR (2025 - 2034) | 19.90% |

| Leading Region | North America |

| Market Segmentation | Intel Corporation, NVIDIA Corporation, Amazon Web Services (AWS), Microsoft (Azure Edge), HPE (Hewlett Packard Enterprise), Cisco Systems, NXP Semiconductors, Bosch, Continental AG, INLINE |

| Top Key Players | By Component, By Application, By Deployment Model, By Vehicle Type, By End-Use and By Region |

The major trends in this market consists of partnerships, V2X-enabled vehicles and government initiatives.

Automotive Edge Computing Market Size, By Component, (USD Billion)

| Year | Hardware | Software | Services |

| 2024 | 6.47 | 3.67 | 2.47 |

| 2025 | 8.02 | 4.22 | 2.86 |

| 2026 | 9.75 | 4.93 | 3.43 |

| 2027 | 12.05 | 5.70 | 3.98 |

| 2028 | 14.74 | 6.63 | 4.66 |

| 2029 | 18.01 | 7.79 | 5.42 |

| 2030 | 21.96 | 9.10 | 6.39 |

| 2031 | 26.47 | 10.63 | 7.79 |

| 2032 | 32.87 | 12.05 | 8.90 |

| 2033 | 39.93 | 13.74 | 10.86 |

| 2034 | 48.39 | 15.77 | 13.21 |

The hardware segment led the market with a share of 50%. The increasing use of AI-enabled chips in software-defined vehicles to enhance autonomous driving has driven the market expansion. Additionally, the integration of edge ECUs and onboard processors in modern cars to deliver numerous benefits including reduced latency, improved safety, efficient data processing and some others is playing a vital role in shaping the industrial landscape. Moreover, the growing application of connectivity modules in vehicles for connecting different networks outside the vehicles is expected to propel the growth of the automotive edge computing market.

The services segment is expected to grow with the highest CAGR during the forecast period. The deployment of cloud-based services in the automotive sector has boosted the market growth. Additionally, the rising emphasis of automotive brands for providing support & maintenance services to automotive consumers is playing a prominent role in shaping the industry in a positive manner. Moreover, partnerships among automotive brands and cloud-solution providers is expected to drive the growth of the automotive edge computing market.

The connected vehicles / V2X segment dominated the market with a share of 35%. The growing popularity of connected vehicles in several countries such as the U.S., Germany, China and some others has boosted the market growth. Additionally, rapid investment by government for strengthening the V2X infrastructure along with technological advancements in telecom sector is playing a vital role in shaping the industrial landscape. Moreover, collaborations among technology providers and telecom operator is expected to propel the growth of the automotive edge computing market.

The autonomous driving segment is expected to expand with the fastest CAGR during the forecast period. The increasing adoption of autonomous vehicles in several countries such as the U.S., China, Germany and some others has driven the market expansion. Additionally, technological advancements in the ADAS industry coupled with rapid adoption of self-driving cars by ride-hailing companies is playing a prominent role in shaping the industry in a positive direction. Moreover, rising emphasis of automotive brands for developing advanced autonomous vehicles is expected to boost the growth of the automotive edge computing market.

The onboard vehicle edge segment led the market with a share of 52%. The growing use of onboard vehicle edge computing for providing enhanced safety and improved data security has boosted the market expansion. Additionally, integration of on-board vehicle edge services in luxury cars is playing a vital role in shaping the industrial landscape. Moreover, numerous advantages of onboard vehicle edge services including real-time decision making, improved driver assistance, fast response time, real-time vehicle monitoring and some others is expected to drive the growth of the automotive edge computing market.

The infrastructure edge segment is expected to expand with the fastest CAGR during the forecast period. The integration of infrastructure edge solutions in modern cars to enhanced security and improving reliability has driven the market growth. Additionally, several advantages of these edge solutions including real-time insights, enhanced bandwidth utilization, data sovereignty, low latency and some others is expected to boost the growth of the automotive edge computing market.

The passenger vehicles segment dominated the industry with a share of 48%. The growing sales of passenger cars in several countries such as India, China, Germany, the U.S. and some others has boosted the market expansion. Additionally, the integration of advanced technologies such as AI, IoT and blockchain, edge computing and some others in the automotive sector coupled with increasing demand for luxury cars is playing a prominent role in shaping the industrial landscape. Moreover, partnerships among automotive brands and technology providers is expected to drive the growth of the automotive edge computing market.

The electric vehicles segment is expected to rise with the highest CAGR during the forecast period. The increasing adoption of electric vehicles in numerous countries such as Canada, Germany, India and some others has driven the market expansion. Additionally, numerous government initiatives aimed at developing the EV infrastructure coupled with technological advancements in the EV industry is contributing to the industry in a positive direction. Moreover, the integration of edge computing technologies in electric vehicles to enhance driving range and improve performance is expected to boost the growth of the automotive edge computing market.

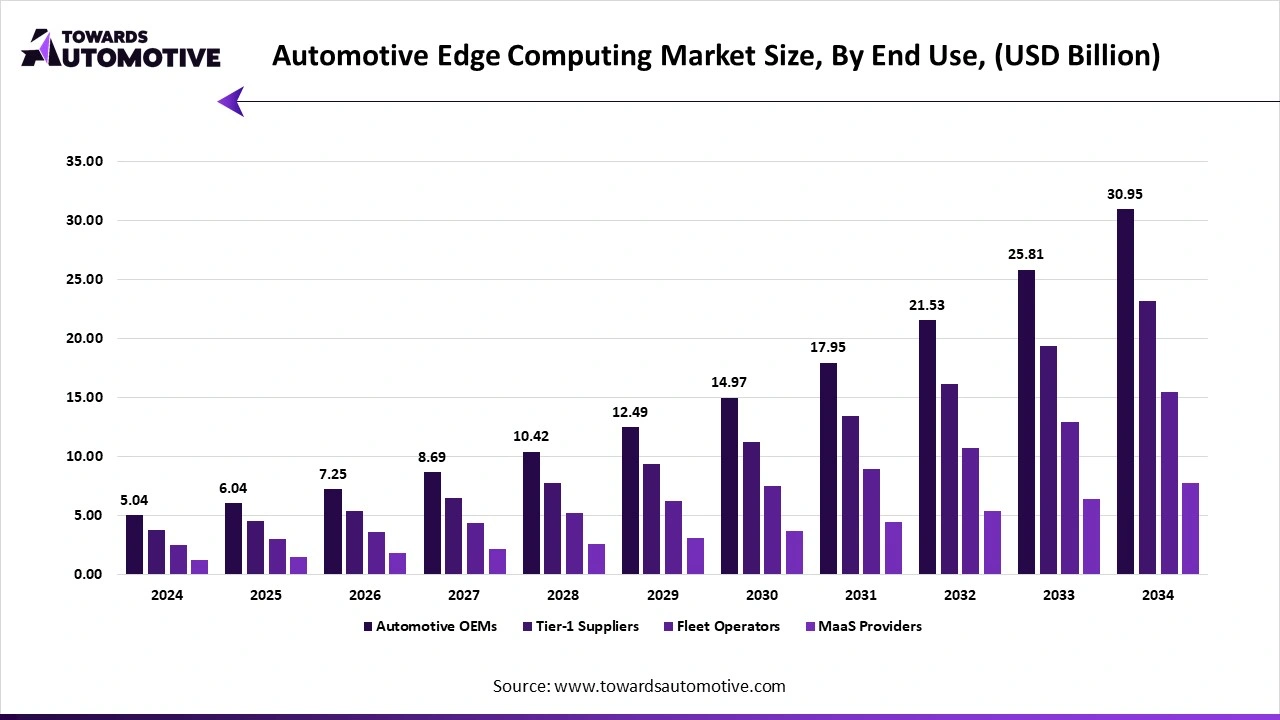

The automotive OEMs segment dominated the market with a share of 58%. The rising adoption of cloud-based services by automotive OEMs to enhance productivity has boosted the market expansion. Additionally, rapid investment by automotive brands to deploy edge computing services in service centers along with increasing consumer interest to opt for genuine car services is playing a prominent role in shaping the industrial landscape. Moreover, joint ventures among automotive brands and technology providers is expected to drive the growth of the automotive edge computing market.

The mobility-as-a-service providers segment is expected to expand with the highest CAGR during the forecast period. The growing adoption of autonomous cars by ride-hailing companies to enhance vehicular safety and reduce dependency on manual drivers has boosted the market expansion. Additionally, the popularity of V2X technology coupled with rapid investment by telecom companies to enhance mobility-as-a-service capabilities in urban areas is contributing to the industry in a positive manner. Moreover, partnerships among automotive brands and fleet operators to deploy edge computing technologies in rental cars is expected to boost the growth of the automotive edge computing market.

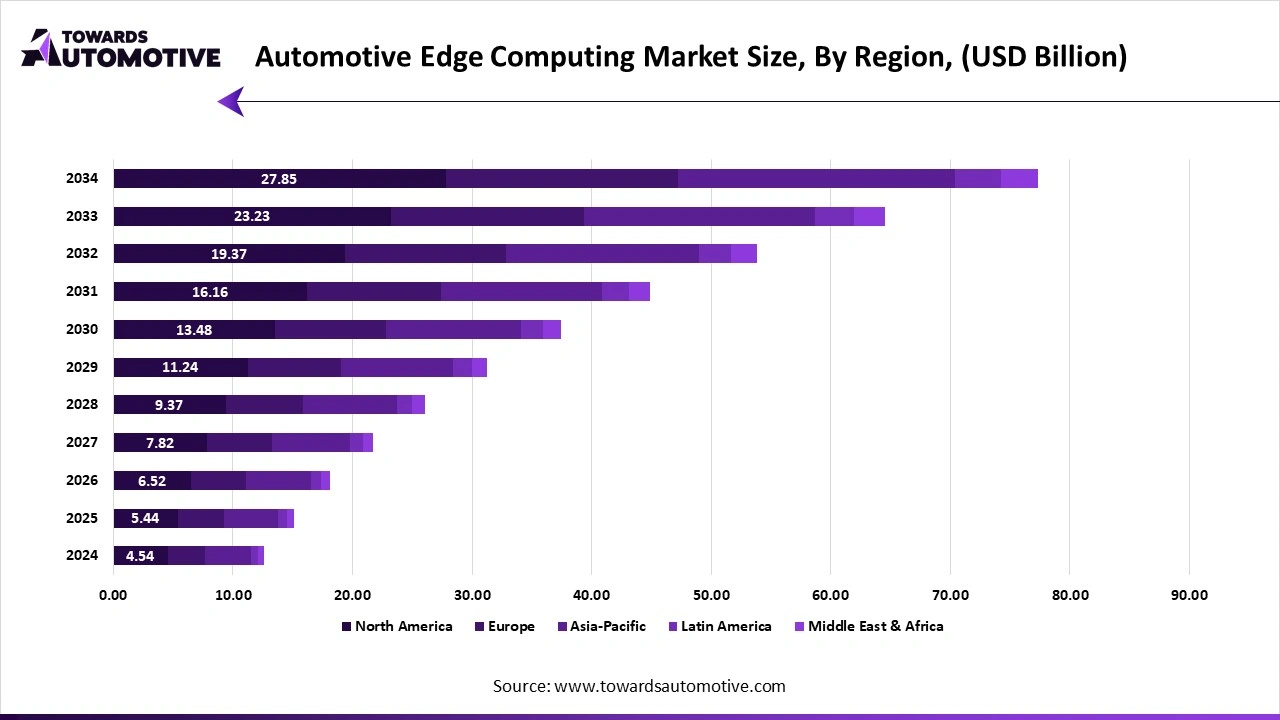

North America dominated the automotive edge computing market with a share of 38%. The growing adoption of autonomous vehicles in the U.S. and Canada has driven the market expansion. Additionally, numerous government initiatives aimed at enhancing vehicular safety coupled with technological advancements in the telecom sector is playing a vital role in shaping the industry in a positive direction. Moreover, the presence of several market players such as Intel Corporation, Amazon Web Services, Qualcomm Technologies Inc. and some others is expected to drive the growth of the automotive edge computing market in this region.

U.S. led the market in this region. The rising adoption of self-driving vehicles by ride-hailing companies coupled with rapid investment by government for strengthening the V2X infrastructure has boosted the market expansion. Additionally, the presence of several automotive brands such as Ford, Tesla, General Motors and some others is playing a vital role in shaping the industrial landscape.

Asia Pacific is expected to rise with the highest CAGR during the forecast period. The rising demand for connected vehicles in several countries such as India, China, Japan, South Korea and some others has driven the market expansion. Additionally, rapid adoption of driverless cars by fleet operators along with increasing cases of road accidents is contributing to the industry positively. Moreover, the presence of numerous market players such as Huawei, Samsung Electronics, ADLINK Technology Inc. and some others is expected to propel the growth of the automotive edge computing market in this region.

China is the major contributor in this region. The rising sales and production of electric vehicles coupled with rapid investment by public-sector entities in the automotive sector is playing a vital role in shaping the industry in a positive direction. Also, the deployment of autonomous trucks in several sectors including mining, e-commerce, construction and some others has contributed to the industrial growth.

The automotive edge computing market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Qualcomm Technologies Inc., NXP Semiconductors, Huawei, Samsung Electronics, Intel Corporation, NVIDIA Corporation, Bosch, Continental AG, Renesas Electronics Corporation, Mobileye, Amazon Web Services (AWS), Microsoft (Azure Edge), HPE (Hewlett Packard Enterprise), Cisco Systems, Dell Technologies and some others. These companies are constantly engaged in developing edge computing solutions for the automotive sector and adopting numerous strategies such as business expansions, launches, partnerships, joint ventures, acquisitions, collaborations, and some others to maintain their dominance in this industry.

By Component

By Application

By Deployment Model

By Vehicle Type

By End-Use

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us