August 2025

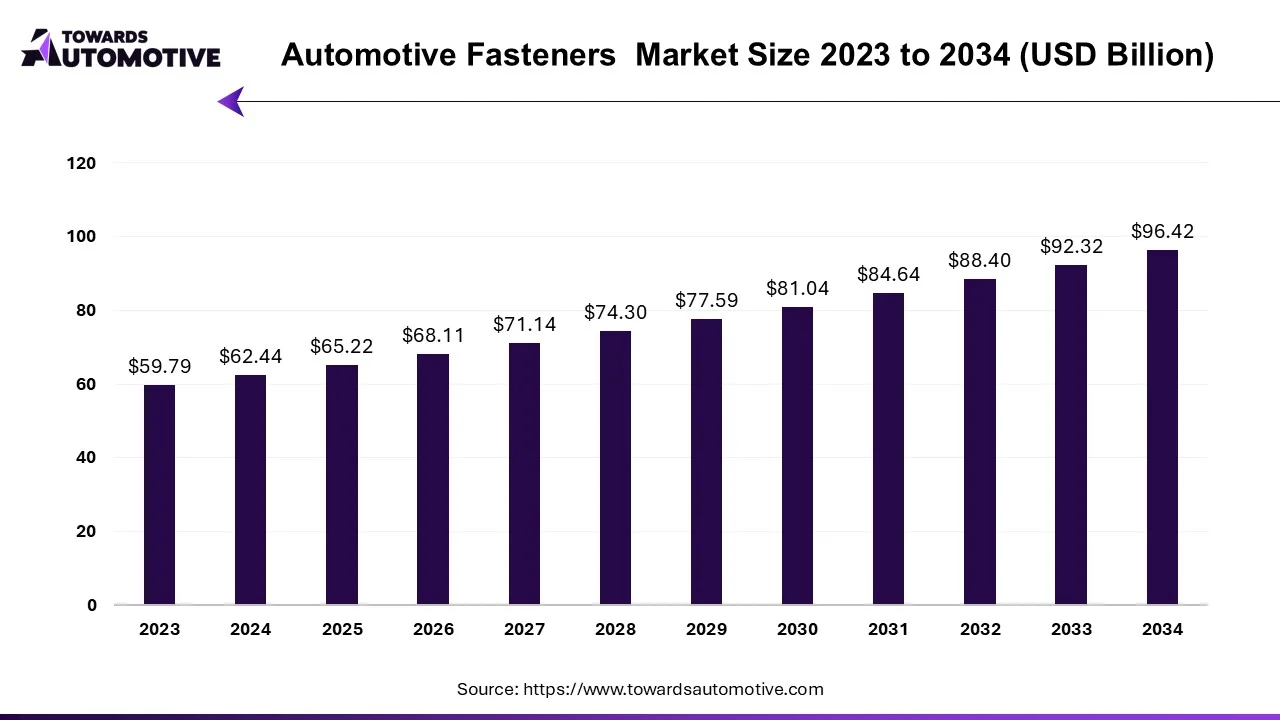

The automotive fasteners market is projected to reach USD 96.42 billion by 2034, growing from USD 65.22 billion in 2025, at a CAGR of 4.44% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive fasteners market is a crucial sector of the automotive industry. This industry deals in manufacturing and distribution of fasteners used in the automotive sector. There are several types of fasteners developed in this sector comprising of bolts, nuts, screws, washers, rivets and some others. These fasteners are manufactured using various materials consisting of steel, aluminum, plastic, titanium, copper and some others. It finds applications in numerous automotive components including body structure, chassis, engine components, transmission, interior and some others. The growing use of fasteners in passenger vehicles has boosted the market expansion. This market is expected to rise significantly with the growth of the EV sector in different parts of the world.

| Metric | Details |

| Market Size in 2024 | USD 62.44 Billion |

| Projected Market Size in 2034 | USD 96.42 Billion |

| CAGR (2025 - 2034) | 4.44% |

| Leading Region | North America |

| Market Segmentation | By Application, By Type, By Materials, By End Use and By Region |

| Top Key Players | Bolts Manufacturing Co, Illinois Tool Works Inc, Bulten AB, Rivnuts Ltd, Vossloh AG, Märken, LISI Group |

The major trends of automotive fasteners market include rising investment in aluminum industry, growing sales of EVs and rapid adoption of self-clinching fasteners.

Several public companies are investing heavily in aluminum industry to cater the needs of the end-users. For instance, in March 2025, Hindalco Industries Ltd announced to invest around US$ 5.21 billion. This investment is done for enhancing the manufacturing capacity of aluminum in India. (Source: Recycling Today)

The sales of EVs have increased due to numerous government initiatives along with growing prices of gasoline. With the rising demand for EVs, the demand for fasteners has increased rapidly due to their applications in body structures and powertrain components. According to the International Energy Agency, around 6500000 PHEVs were sold globally in 2024. (Source: International Energy Agency (IEA))

The use of self-clinching nuts and studs for attaching brackets or panels in vehicle frames is an ongoing trend in the industry. For instance, in January 2025, TR Fastenings launched a new range of self-clinching fasteners. These fasteners find several applications in the automotive sector (Source: TR Fastenings Ltd)

The engine components segment held the largest share of the market. The rising use of washers for preventing leaks and distributing pressure in automotive engines has boosted the market expansion. Additionally, the growing application of fasteners for securing various engine parts such as cylinder heads, engine blocks, pistons and some others is playing a crucial role in shaping the industrial landscape. Moreover, the rapid adoption of quick-release latches and springs for joining several engine components is expected to propel the growth of the automotive fasteners market.

The body structure segment is anticipated to rise with a significant CAGR during the forecast period. The growing use of screws for joining body panels and chassis in automotive has boosted the market expansion. Also, surge in demand for advanced fasteners for securing numerous components such as wheels, bumpers, interior trim and some others is likely to shape the industry in a positive direction. Moreover, the increasing adoption of plastic fasteners and self-clinching fasteners in doors handles is likely to boost the growth of the automotive fasteners market.

The steel segment dominated this industry. The growing use of steel bolts in vehicles for joining engine components and body panels has driven the market expansion. Additionally, numerous government initiatives aimed at developing the steel manufacturing sector is playing a crucial role in shaping the industry in a positive direction. Moreover, numerous advantages of steel-based fasteners including high strength, cost-effectiveness, durability and some others has boosted the growth of the automotive fasteners market.

The aluminum segment is predicted to rise with a considerable CAGR during the forecast period. The rising use of aluminum fasteners in racing cars has boosted the market expansion. Additionally, technological advancements in aluminum refining coupled with rapid adoption of robotics in aluminum industry is likely to shape the industrial landscape. Moreover, numerous benefits of aluminum fasteners including corrosion resistance, thermal conductivity, electrical conductivity, light-weight and some others is anticipated to propel the growth of the automotive fasteners market.

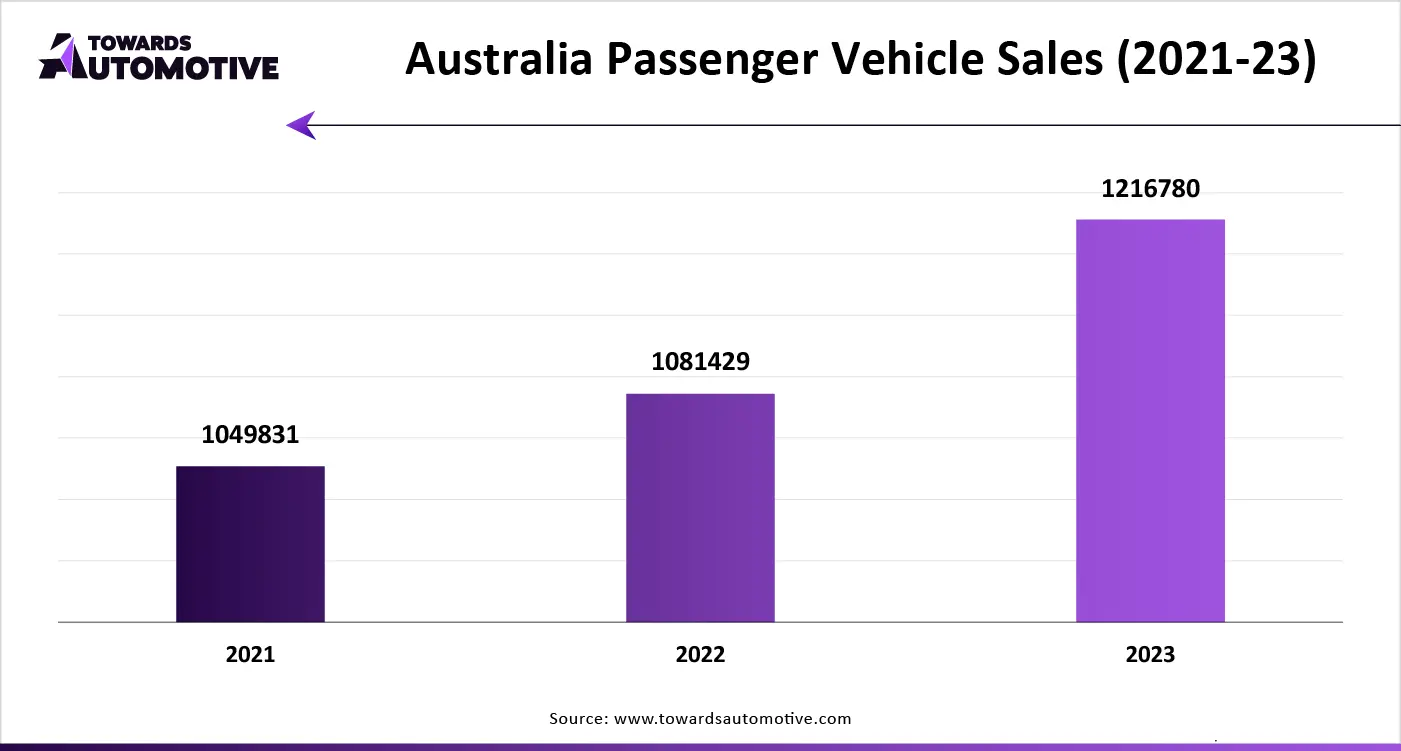

The passenger vehicles segment led the industry. The rapid adoption of electric SUVs in developed nations such as UK, U.S., France, Germany, and some others has boosted the market growth. Also, the growing production of passenger vehicles in several countries such as India and China is playing a significant role in shaping the industrial landscape. Moreover, the increasing use of sustainable fasteners in passenger cars for joining body panels and engine components is driving the growth of the automotive fasteners market.

The two-wheeler segment is projected to grow with a notable CAGR during the forecast period. The growing sales and production of affordable scooters in mid-income countries such as India, Vietnam, Indonesia and some others has boosted the market expansion. Additionally, the rising adoption of aluminum fasteners in superbikes along with increasing use of hex head bolts for assembling structural components in two-wheelers has played a crucial role in shaping the industry in a positive direction. Moreover, rapid investment by two-wheeler brands for manufacturing electric bikes and e-scooters has further fostered the growth of the automotive fasteners market.

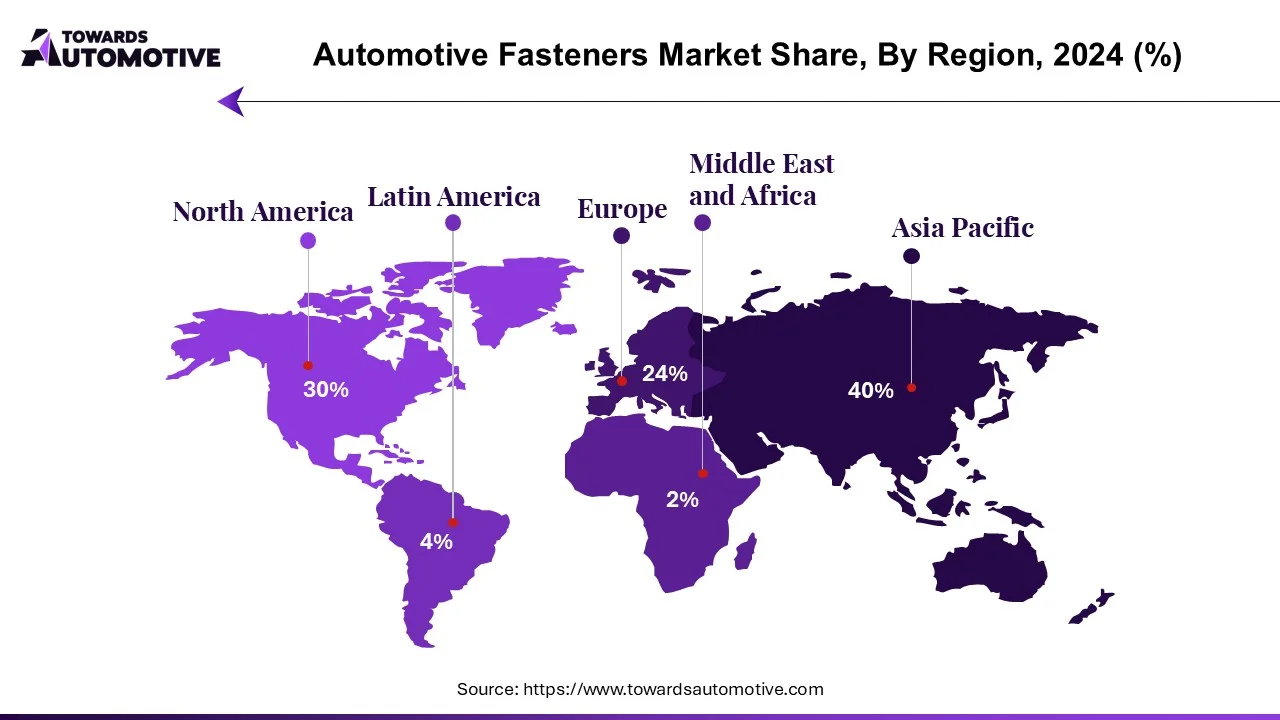

North America held the largest share of the automotive fasteners market. The growing demand for luxury cars has increased the demand for aluminum fasteners, thereby driving the market growth. Additionally, numerous government initiatives aimed at developing the EV manufacturing sector coupled with ongoing trend of vehicle modification in the U.S. and Canada has further added to the industrial expansion. Moreover, the presence of several automotive brands such as Buick, Rivian, Tesla, Ford and some others is expected to drive the growth of the automotive fasteners market in this region.

U.S. dominated the market in this region. The market is generally driven by the growing adoption of electric vehicles along with rapid development in titanium industry. Additionally, the presence of several fastener companies such as Stanley Black & Decker, Blue Ribbon Fastener, MacLean-Fogg Component Solutions and some others is projected to drive the market growth.

Asia Pacific is expected to grow with the fastest CAGR during the forecast period. The rising adoption of hybrid vehicles in several countries including China, India, Japan and some others has boosted the market expansion. Also, the growing sales of sports bike along with rapid developments in the aluminum industry is likely to shape the industrial landscape. Moreover, the presence of several market players such as Toneji Co.,Ltd., TAKENAKA SEISAKUSHO CO., LTD, Shanghai Prime Machinery Company, Sundram Fasteners, Shinko Bolt, Delta Fitt INC, IWATA BOLT, Tohoku bolt MFG. Co., Ltd and some others is driving the growth of the automotive fasteners market in this region.

China is the major contributor in this region. The growing production for electric vehicles coupled with availability of essential raw materials has boosted the market growth. Moreover, the presence of various automotive brands such as BYD, XPENG, Dongfeng Motor Corporation, Geely and some others further adds to the industrial expansion.

The automotive fasteners market is a highly competitive industry with the presence of a various dominating players. Some of the prominent companies in this industry consists of Trinity Structural Towers, Acument Global Technologies, Mecatech SA, Stanley Black and Decker, Nifco Inc, Screws and Bolts Manufacturing Co, Illinois Tool Works Inc, Bulten AB, Rivnuts Ltd, Vossloh AG, Märken, LISI Group, Araymond, Ganter Norm, Fortress Tech and some others. These companies are constantly engaged in manufacturing fasteners and adopting numerous strategies such as launches, business expansions, collaborations, partnerships, joint ventures, acquisitions and some others to maintain their dominance in this market.

By Application

By Type

By Materials

By End Use

By Region

August 2025

August 2025

August 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us