December 2025

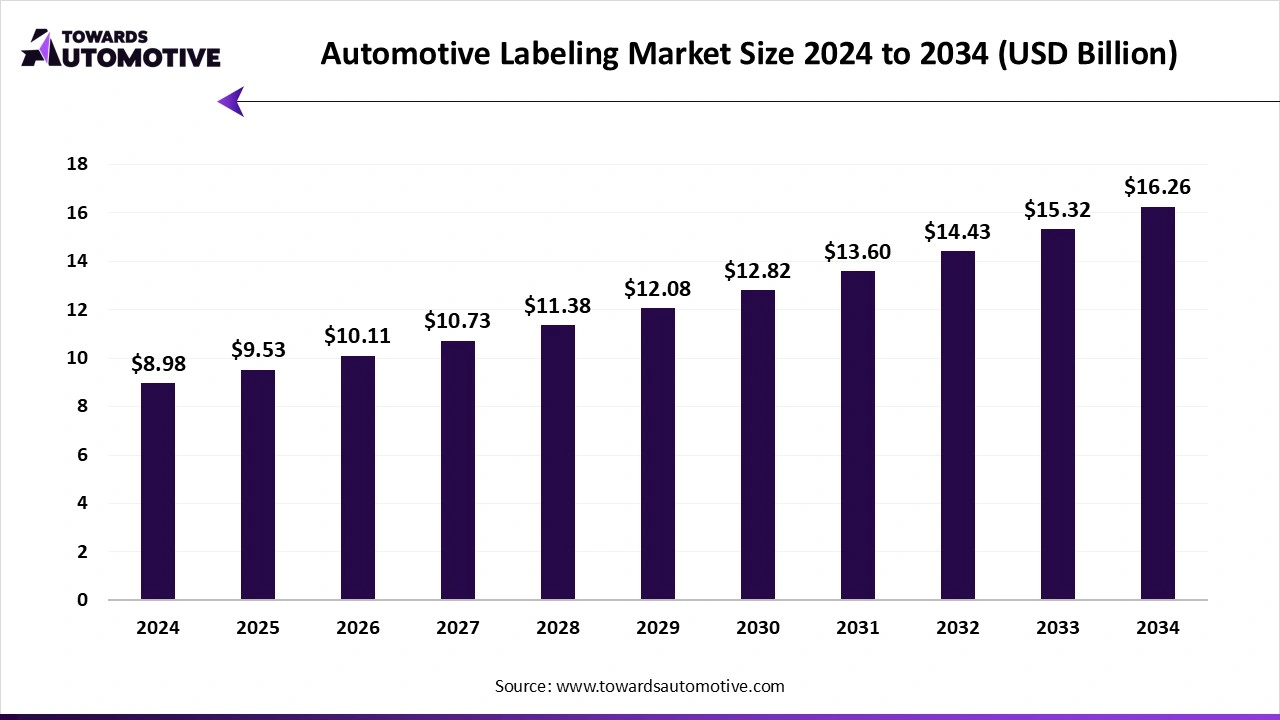

The automotive labeling market is set to grow from USD 9.53 billion in 2025 to USD 16.26 billion by 2034, with an expected CAGR of 6.11% over the forecast period from 2025 to 2034.

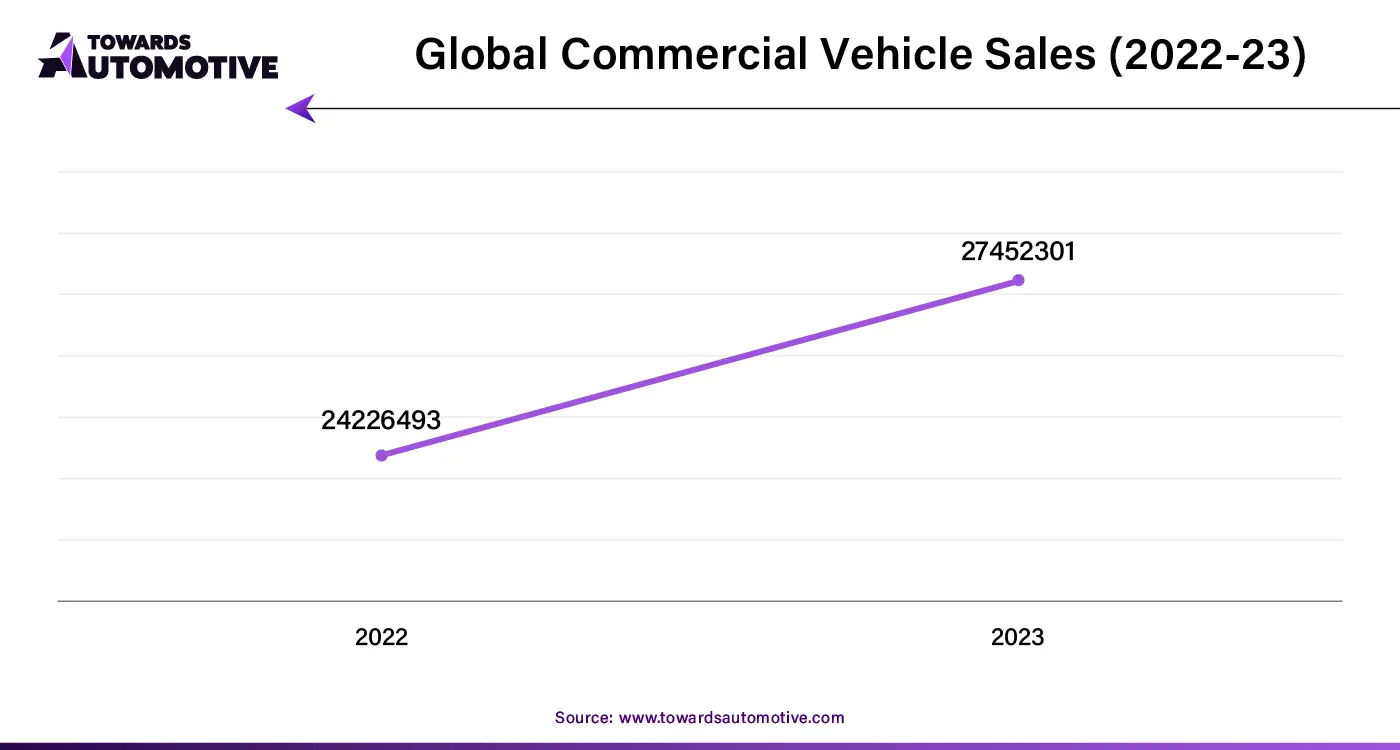

The automotive labeling market is a crucial branch of the automotive industry. This industry deals in manufacturing and distribution of labeling solutions for the automotive industry. There are several types of labeling products developed in this sector comprising of pressure sensitive labels, glue applied labels, sleeve labels, in-mould labels and some others. These products are manufactured using various materials consisting of polyethylene, poly vinyl, polycarbonate, polyester and some others. It finds application in for labeling automotive interior, vehicle exterior, under hood and some others. The rising sales of vehicles in different parts of the world has boosted the market expansion. This market is expected to rise significantly with the growth of the automotive component industry around the globe.

| Metric | Details |

| Market Size in 2024 | USD 8.98 Billion |

| Projected Market Size in 2034 | USD 16.26 Billion |

| CAGR (2025 - 2034) | 6.11% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Material, By Type, By Application and By Region |

| Top Key Players | Avery Dennison Corporation, Resource Label Group LLC, CILS International, Brady Worldwide Inc. |

The polyester segment held a dominant share of the market. The growing use of polyester for manufacturing automotive labeling solutions has boosted the market expansion. Also, the rising demand for polyester from automotive sector for manufacturing warning labels and regulatory labels is playing a vital role in shaping the industrial landscape. Moreover, polyester comes with various advantages such as durability, wrinkle resistance, ease of care, affordability and some others is likely to propel the growth of the automotive labeling market.

The poly vinyl segment is likely to rise with the fastest CAGR during the forecast period. The rising demand for reflective labels from the EV industry has driven the market growth. Additionally, the growing application of poly vinyl labels for labeling various interior parts of vehicles is playing a vital role in shaping the industry in a positive direction. Moreover, poly vinyl-based label comes with numerous benefits including chemical resistance, tear resistance, flexibility, cost-effectiveness and some others is projected to boost the growth of the automotive labeling market.

The glue applied labels segment held the largest share of the market. The rising use of glue applied labels in automotive sector for labeling composite materials has boosted the market expansion. Additionally, technological advancements in various printing technologies including flexographic printing and gravure printing is further adding to the industrial growth. Moreover, the rapid adoption of these labels in vehicles due to various advantages such as versatility, durability, affordability, durability and some others is anticipated to propel the growth of the automotive labeling market.

The pressure sensitive labels segment is anticipated to witness the fastest growth during the forecast period. The rising use of linerless labels in automotive sector for labelling several interior components and exterior components has boosted the market expansion. Also, the growing application of these labels for component identification and shipping of automotive parts is contributing to the overall industrial growth. Moreover, these labels provide various advantages such as ease of application, versatility, durability and some others is likely to boost the growth of the automotive labeling market.

The interior segment dominated this industry. The growing use of polyester labels for labeling interior components of vehicles has boosted the market expansion. Also, the rising adoption of poly vinyl materials for manufacturing different types of labels such as warning labels, instructional labels, asset labels, VIN labels and some others is likely to shape the industrial landscape. Moreover, the rapid integration of high-quality materials by automotive brands for labeling several interior components of vehicles is projected to drive the growth of the automotive labeling market.

The underhood segment is predicted to rise with a notable CAGR during the forecast period. The rising emphasis on adopting sustainable labelling solutions for identifying engine components has boosted the market expansion. Additionally, the growing use of polyester labels for identifying clutch number and gear number is further adding to the industrial growth. Moreover, the increasing use of warning labels and safety labels for providing information about the electronic components of vehicles is likely to drive the growth of the automotive labeling market.

Asia Pacific held the highest share of the automotive labeling market. The rising sales and production of commercial vehicles in countries such as India, China, Japan, South Korea and some others has boosted the market expansion. Additionally, rapid investment by labelling brands to develop high-quality labeling solutions for the automotive sector coupled with growing use of RFID tags for enhancing toll operations is shaping the industry in a positive direction. Moreover, the presence of several market players such as Asean Pack, Multipack, Xinxing Label, Shenzhen S.Y. Label Co. Ltd., Gloex Products, ZHUONUO WINSKYS TECH CO.LTD. and some others is driving the growth of the automotive labeling market in this region.

India and China are the major contributors in this region. In India, the market is generally driven due to the rising awareness of consumers regarding vehicle safety along with the presence of several automotive labeling companies. In China, the rising development in the automotive industry coupled with integration of advanced technologies such as AI, ML, blockchain, robotics and some others in labeling industry has driven the market growth. Additionally, the presence of numerous automotive brands such as BYD, XPENG, Geely, Changan, SAIC Motor Corp., Ltd and some others is further contributing positively to the industrial expansion.

North America is expected to grow with a significant CAGR during the forecast period. The growing adoption of electric vehicles in countries such as the U.S. and Canada has increased the demand for high-grade labeling solutions has boosted the market expansion. Also, numerous automotive companies are partnering with labelling brands to use high-quality labels in modern vehicles has further accelerated the industrial growth. Moreover, the presence of various automotive brands such as Ford, Tesla, Chevrolet, General Motors, Rivian, Cadillac and some others is expected to boost the growth of the automotive labeling market in this region.

U.S. is the major contributor of this region. In U.S., the market is generally driven by the surging demand for luxury vehicles along with numerous government regulations for enhancing automotive safety. Moreover, the presence of various automotive labeling solution providers such as 3M Company, Avery Dennison Corporation, Resource Label Group, Polyonics Inc. and some others is driving the growth of the automotive labeling market in this region.

The automotive labeling market is a developing industry with the presence of a several dominating players. Some of the prominent companies in this industry consists of Avery Dennison Corporation, Resource Label Group LLC, CILS International, Brady Worldwide Inc., Asean Pack, Polyonics Inc. and some others. These companies are constantly engaged in developing labeling solutions for the automotive sector and adopting numerous strategies such as launches, partnerships, acquisitions, business expansions, collaborations, joint ventures, and some others to maintain their dominant position in this industry. For instance, in April 2025, Avery Dennison announced to open a RFID manufacturing plant in Pune, India. This production facility is inaugurated to manufacture RFID stickers at a large scale.

By Material

By Type

By Application

By Region

According to market projections, the global automotive rubber-molded component market, valued at USD 46.01 billion in 2024, is anticipated to reach US...

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us