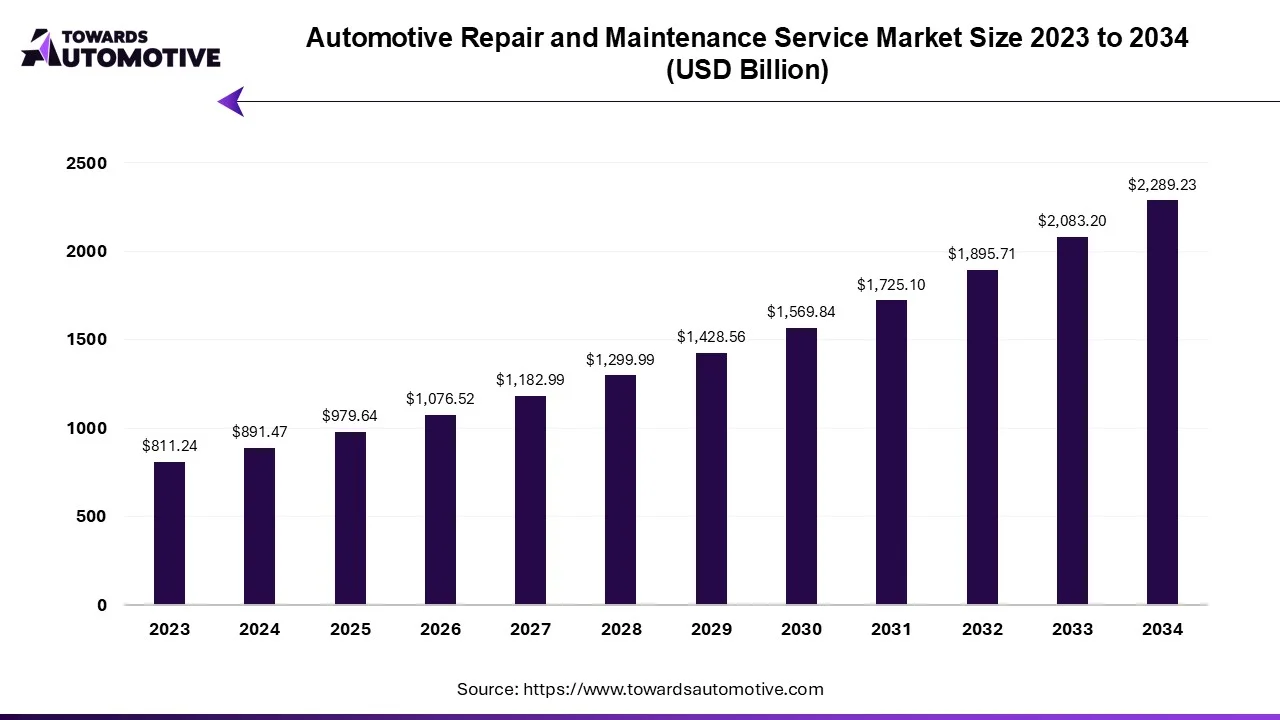

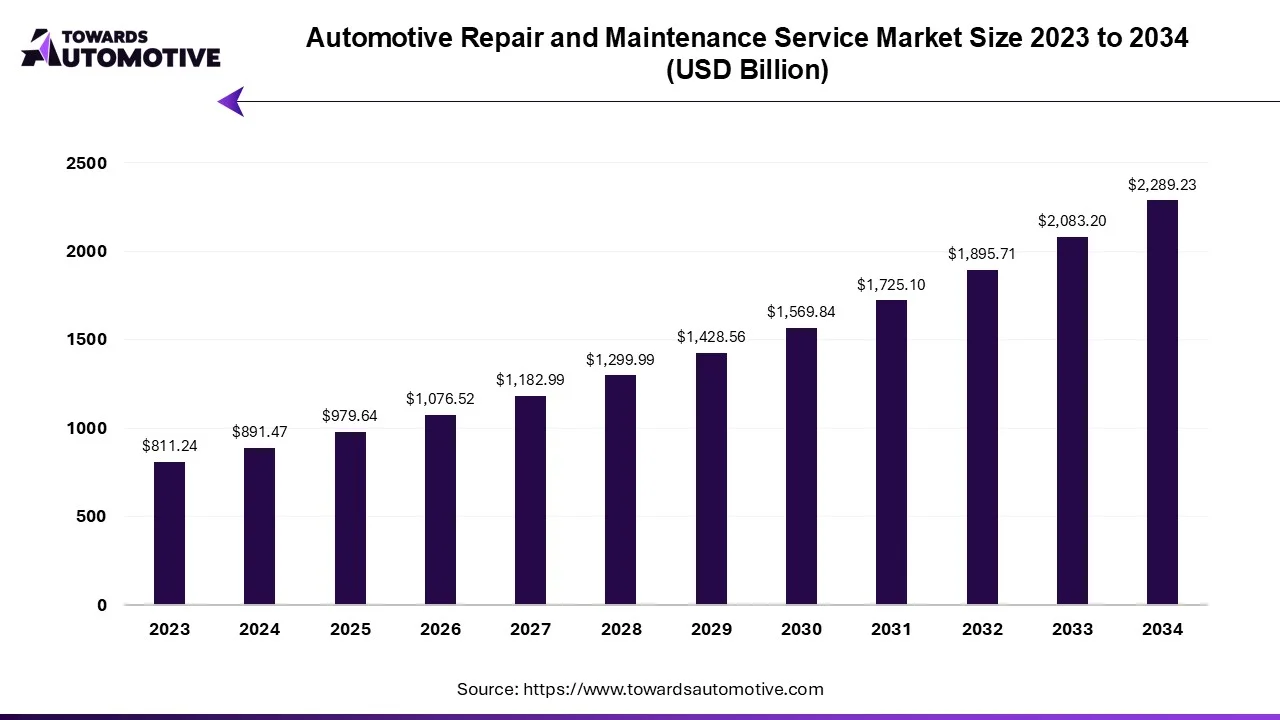

The automotive repair and maintenance service market is forecasted to expand from USD 979.64 billion in 2025 to USD 2,289.23 billion by 2034, growing at a CAGR of 9.89% from 2025 to 2034.

The automotive repair and maintenance service market play a vital role in ensuring the safety, reliability, and longevity of vehicles worldwide. With the automotive industry evolving rapidly and vehicles becoming more technologically advanced, the demand for repair and maintenance services continues to grow.

Keeping Vehicles Running Smoothly

The automotive repair and maintenance service market encompass a wide range of services aimed at diagnosing, repairing, and maintaining vehicles to ensure optimal performance and safety. From routine maintenance tasks such as oil changes and tire rotations to complex engine diagnostics and electrical system repairs, automotive service providers play a crucial role in keeping vehicles running smoothly and efficiently.

Key Components and Functions of Automotive Repair and Maintenance Services

- Service Providers: Automotive repair and maintenance services are offered by a diverse ecosystem of providers, including independent repair shops, dealership service centers, franchise chains, and mobile service technicians. These service providers employ skilled technicians equipped with diagnostic tools, specialized equipment, and manufacturer-specific training to diagnose and repair vehicles accurately and efficiently.

- Diagnostic Technologies: Diagnostic technologies such as onboard diagnostics (OBD), computerized scanning tools, and diagnostic software play a critical role in identifying vehicle issues and troubleshooting complex problems. Technicians use diagnostic tools to retrieve fault codes, monitor sensor data, and perform system tests to pinpoint the root cause of vehicle malfunctions and determine the necessary repairs or adjustments.

- Repair and Replacement Services: Automotive repair and maintenance services encompass a wide range of repair and replacement tasks, including engine repairs, transmission overhauls, brake system replacements, suspension repairs, and electrical system diagnostics. Service providers use genuine OEM (original equipment manufacturer) parts or high-quality aftermarket components to ensure compatibility, reliability, and performance, meeting manufacturer specifications and customer expectations.

- Preventive Maintenance Programs: Preventive maintenance programs are designed to proactively identify and address potential issues before they escalate into costly repairs or breakdowns. These programs typically include scheduled maintenance tasks such as fluid changes, filter replacements, belt and hose inspections, and tire rotations, aimed at optimizing vehicle performance, fuel efficiency, and safety while extending the lifespan of vehicle components.

Market Dynamics and Trends

- Technological Advancements: Technological advancements in automotive systems, including engine management, vehicle electrification, advanced driver assistance systems (ADAS), and telematics, are driving the evolution of automotive repair and maintenance services. Service providers are investing in training, equipment, and software to stay abreast of emerging technologies and perform diagnostics and repairs on modern vehicles effectively.

- Shift Towards Electric Vehicles: The growing adoption of electric vehicles (EVs) is reshaping the automotive repair and maintenance service market, as EVs feature fewer moving parts, simplified drivetrains, and unique maintenance requirements compared to internal combustion engine vehicles. Service providers are adapting their skills, tools, and facilities to support EV servicing, including battery diagnostics, charging infrastructure installations, and software updates for electric propulsion systems.

- Emphasis on Customer Experience: Customer experience is a key differentiator in the automotive repair and maintenance service market, with service providers focusing on convenience, transparency, and personalized service offerings to attract and retain customers. Digitalization, online appointment scheduling, vehicle health reports, and transparent pricing models enhance the customer service experience, fostering trust and loyalty among vehicle owners.

- Regulatory Compliance and Certification: Regulatory compliance and certification requirements, including environmental regulations, safety standards, and emissions testing programs, impact automotive repair and maintenance service providers' operations. Service providers must adhere to local, state, and federal regulations, obtain relevant certifications, and invest in training and equipment to ensure compliance and uphold industry best practices.

Global Trends and Market Outlook

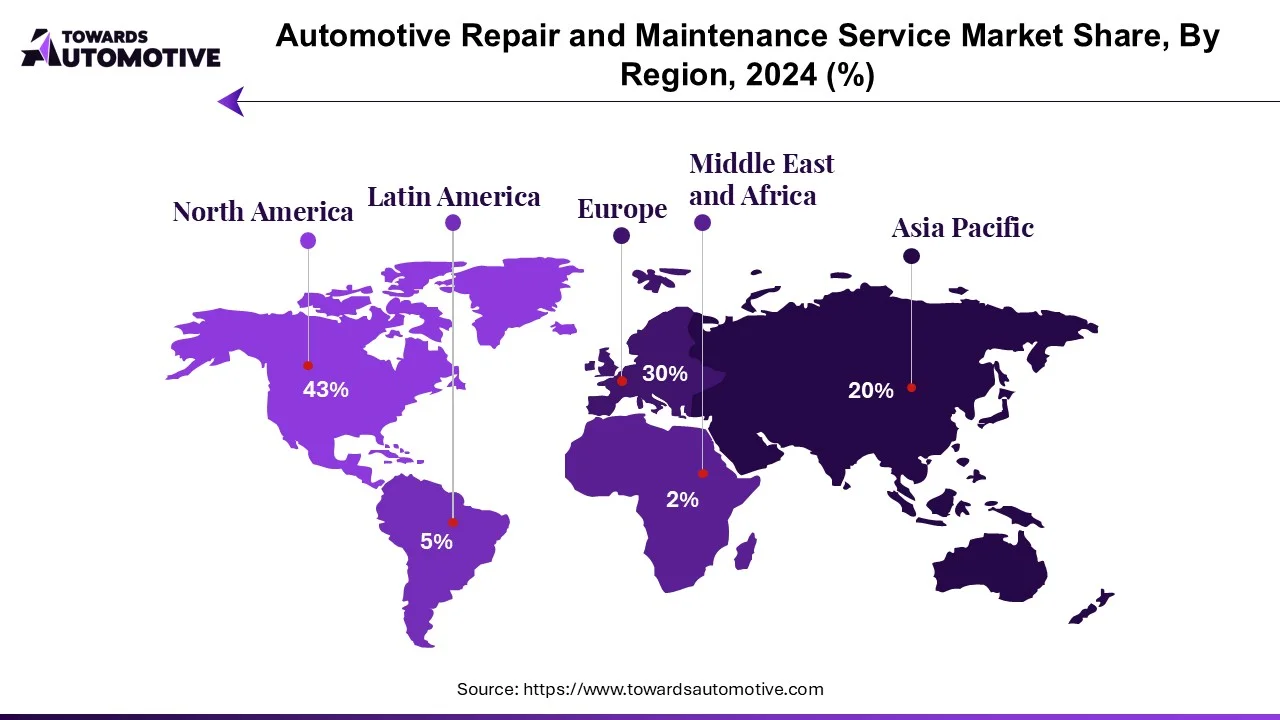

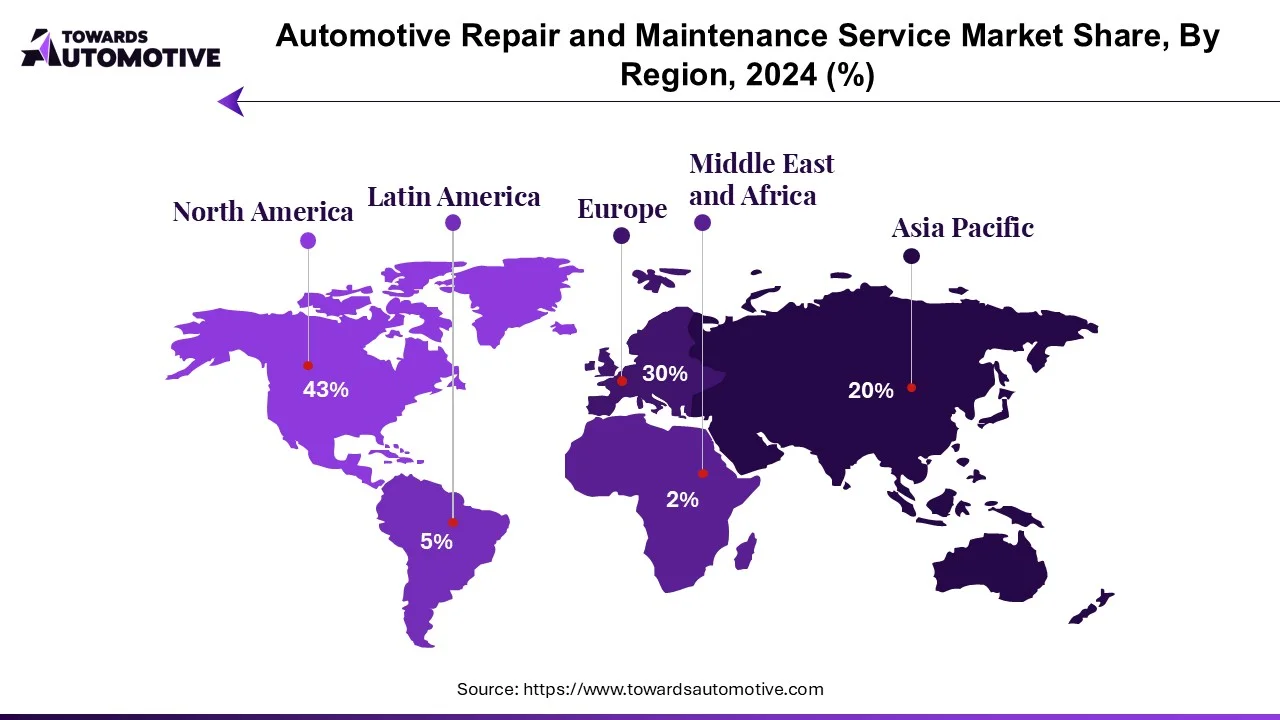

North America dominates the automotive repair and maintenance service market, driven by a large vehicle parc, a strong aftermarket industry, and consumer demand for quality automotive services. Independent repair shops, dealership service centers, and franchise chains compete for market share, offering a wide range of services, warranties, and customer incentives to attract vehicle owners.

Europe is witnessing a shift towards digitalization and connectivity in automotive repair and maintenance services, with service providers adopting digital tools, remote diagnostics, and predictive maintenance technologies to streamline operations and enhance service delivery. Digital platforms, mobile apps, and telematics solutions enable real-time monitoring, remote troubleshooting, and data-driven insights, improving efficiency and customer satisfaction.

Asia-Pacific Expands Aftermarket Opportunities: Asia-Pacific represents a growing market for automotive repair and maintenance services, fueled by increasing vehicle ownership, urbanization, and disposable incomes in countries such as China, India, and Southeast Asian nations. Independent repair shops, aftermarket distributors, and e-commerce platforms cater to diverse customer segments, offering affordable and convenient service solutions tailored to local market needs.

Challenges and Opportunities

- Technological Complexity: The increasing complexity of modern vehicles, including advanced electronics, hybrid powertrains, and autonomous driving features, poses challenges for automotive repair and maintenance service providers. Technicians require specialized training, diagnostic tools, and access to manufacturer-specific information to diagnose and repair complex vehicle systems effectively, highlighting the need for ongoing skills development and investment in technology.

- Competition from OEM Service Centers: Original equipment manufacturer (OEM) service centers pose competition to independent repair shops and aftermarket service providers, as OEMs offer warranty-covered maintenance services and brand-specific expertise to vehicle owners. Independent service providers must differentiate themselves through superior customer service, technical expertise, and value-added offerings to compete effectively in the market.

Key Players in the Automotive Repair and Maintenance Service Market

The automotive repair and maintenance service market comprise a diverse range of providers, including:

- Independent Repair Shops

- Dealership Service Centers

- Franchise Chains

- Mobile Service Technicians

- Online Service Platforms

Market Segmentation and Regional Outlook

By Service Type

- Mechanical Repairs

- Electrical Repairs

- Preventive Maintenance

- Tire Services

- Bodywork and Paint Services

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles

- Hybrid Vehicles

By Region

- North America

- United States

- Canada

- Rest of North America

- Europe

- Germany

- United Kingdom

- France

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle-East and Africa

- South Africa

- Rest of Middle-East and Africa

Automotive Repair and Maintenance Service Market Recent Developments

- In December 2023, AAA (American Automobile Association) launched its Digital Garage platform, offering online appointment scheduling, vehicle diagnostics, and repair estimates for AAA-approved repair facilities. The Digital Garage platform provides convenience and transparency for AAA members seeking automotive repair and maintenance services, enhancing the customer experience and fostering trust in the AAA network of service providers.

- In November 2023, Bosch Automotive Service Solutions introduced its eMobility Service Center program, providing training, equipment, and support for automotive service providers transitioning to electric vehicle servicing. The eMobility Service Center program equips service providers with the knowledge and tools to diagnose and repair electric vehicle components, including batteries, charging systems, and power electronics, ensuring readiness for the growing EV market.

- In October 2023, Bridgestone Corporation launched its Total Tyre Care service platform, offering comprehensive tire maintenance and replacement services for fleet operators and commercial vehicle owners. The Total Tyre Care platform includes tire inspection, pressure monitoring, tread depth analysis, and predictive maintenance solutions, optimizing tire performance, fuel efficiency, and safety for commercial vehicle fleets.

- In September 2023, Jiffy Lube International expanded its service offerings to include hybrid vehicle maintenance and repair services, addressing the growing demand for specialized servicing of hybrid vehicles. Jiffy Lube technicians receive training and certification in hybrid vehicle systems, including battery diagnostics, regenerative braking systems, and hybrid drivetrain maintenance, ensuring quality service for hybrid vehicle owners.

- In August 2023, Mobile Mechanics Group launched its on-demand mobile repair service platform, connecting vehicle owners with certified mobile technicians for onsite repairs and maintenance services. The Mobile Mechanics platform offers convenience, flexibility, and transparency for customers, enabling them to schedule appointments, track service progress, and receive real-time updates from mobile technicians, enhancing the accessibility of automotive repair and maintenance services.