October 2025

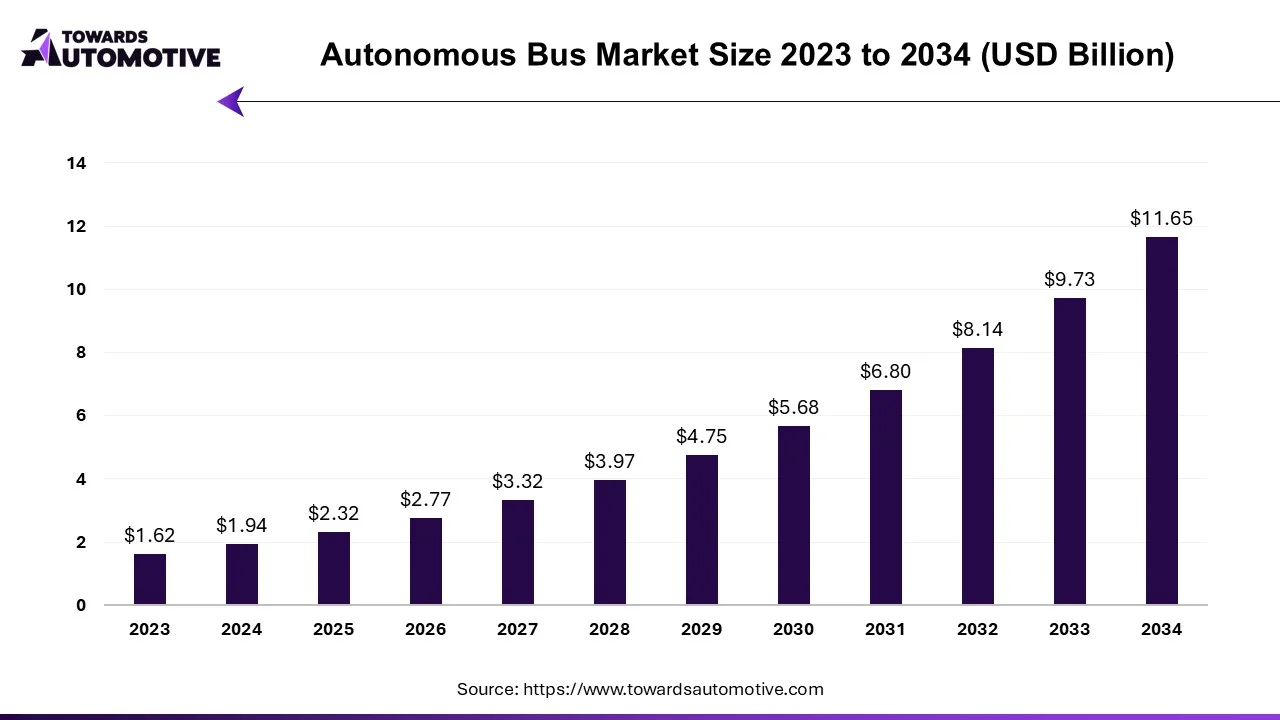

The autonomous bus market is anticipated to grow from USD 2.32 billion in 2025 to USD 11.65 billion by 2034, with a compound annual growth rate (CAGR) of 19.64% during the forecast period from 2025 to 2034.

Urbanization is rapidly transforming the global landscape, with an increasing number of people flocking to cities. According to data from the World Bank, over half of the world's population currently resides in urban areas, a figure expected to swell to 6 billion by 2045 and nearly double to nearly 7 in 10 people by 2050. This urban shift presents both challenges and opportunities for transportation systems, particularly in terms of addressing congestion, improving efficiency, and enhancing safety.

One of the emerging solutions to urban transportation challenges is the adoption of autonomous vehicles, including buses. These driverless vehicles are equipped with advanced technologies such as artificial intelligence (AI), sensors, and analytics, allowing them to navigate urban environments safely and efficiently. By reducing reliance on human drivers, autonomous buses have the potential to significantly decrease the risk of accidents caused by human error, which currently accounts for a majority of traffic incidents globally.

Safety is a paramount concern driving the growth of the global bus industry, with research indicating that autonomous vehicles, when properly tested and regulated, can enhance road safety by minimizing accidents. In response, manufacturers are integrating advanced safety features into autonomous buses to mitigate risks and ensure passenger and pedestrian safety. For example, Volvo Buses has developed driver assistance systems to enhance accuracy and safety during navigation and maneuvering.

In addition to safety, the demand for improved connectivity is fueling growth in the bus industry. Public transportation plays a crucial role in connecting urban intersections and facilitating urban mobility, particularly in densely populated cities where public transit is heavily relied upon. Driverless shuttles, in particular, are poised to revolutionize urban transportation by providing on-demand services and bridging the "last mile" gap between transit hubs and final destinations.

However, the high production costs associated with autonomous buses pose a significant challenge to market expansion. Advanced technologies, including sensors and AI systems, drive up overall costs, limiting accessibility and affordability for transportation operators. Moreover, cybersecurity concerns surrounding the connectivity of autonomous vehicles present additional barriers to market growth, necessitating robust cybersecurity measures to safeguard against potential cyber attacks.

Despite these challenges, the emergence of 5G technology is expected to drive market growth by providing robust and secure connectivity for autonomous buses. 5G technology holds the promise of enabling seamless communication between vehicles and infrastructure, enhancing the efficiency and reliability of autonomous transportation systems.

Overall, as cities continue to grow and traffic congestion worsens, autonomous buses offer a promising solution to urban transportation challenges. Their potential to improve safety, enhance connectivity, and reduce environmental impact aligns with government initiatives and consumer preferences for sustainable transportation options. However, ongoing investment in research and development is essential to address safety concerns and ensure the widespread adoption of autonomous buses in the future.

| Rank | Manufacturer (bus/shuttle OEM) | 2024 Share (%) |

| 1 | Yutong | 22 |

| 2 | King Long (Apolong program with Baidu Apollo) | 20 |

| 3 | EasyMile (EZ10) | 12 |

| 4 | Karsan (Autonomous e-ATAK, with ADASTEC) | 10 |

| 5 | Toyota (e-Palette / Autono-MaaS pilots) | 8 |

| 6 | AB Volvo (pilot programs, controlled environments) | 7 |

| 7 | Daimler/Mercedes-Benz (pilot and tech programs) | 6 |

| 8 | Navya (legacy fleets & select Level-4 ops via partners) | 5 |

| 9 | Others (BYD, MAN, VW, New Flyer, Ohmio, etc.) | 10 |

The rapid transition in transportation from fossil fuels to electric buses is poised to drive the growth of the autonomous bus industry in the coming decade. With a heightened emphasis on safety and sustainability, autonomous buses are increasingly turning to electricity and other sustainable energy sources. This shift aligns with global efforts to reduce emissions and promote environmentally friendly public transport solutions

In response to these trends, bus companies are actively developing innovative transportation solutions aimed at mitigating greenhouse gas emissions and supporting the expansion of the autonomous bus industry. For instance, in September 2023, Schaeffler and VDL Groep announced a strategic collaboration to explore the design and production of high-performance electric buses for public transportation. This partnership underscores a commitment to advancing sustainable mobility solutions and leveraging cutting-edge technology.

The introduction of electric autonomous buses offers numerous benefits, including reduced air pollution, lower operating costs, and enhanced passenger safety. By combining electric propulsion with autonomous driving technology, these buses have the potential to revolutionize urban transportation systems and contribute to a cleaner, more sustainable future.

Furthermore, events like the IAA Mobility fair in Munich serve as platforms for showcasing the latest advancements in electric vehicles and autonomous technology. Such demonstrations not only highlight the capabilities of electric autonomous buses but also foster collaboration among industry stakeholders and accelerate the adoption of innovative transportation solutions.

Overall, the convergence of electric propulsion, autonomous technology, and sustainability initiatives is driving significant growth and innovation in the autonomous bus industry. As governments, transit agencies, and private companies increasingly prioritize clean energy and safety in public transportation, the demand for electric autonomous buses is expected to continue rising, further propelling the industry forward.

Depending on the level of autonomy, Level 1 autonomous driving is projected to capture 40% of the market share by 2022. This level of autonomy encompasses basic driver assistance features like cruise control and lane departure warnings, representing a significant step towards self-regulation. The increased demand for improved safety, reduced human error, and enhanced driving comfort are driving factors behind the adoption of Level 1 autonomy. Moreover, with evolving regulations and advancements in technology, Level 1 autonomy is viewed as a precursor to higher levels of autonomy, fostering its uptake in public transportation.

The Phase 1 segment garnered considerable market share in 2020, marking the initial integration of electronic systems to control vehicles, albeit with occasional limitations. Meanwhile, Level 2 automation is anticipated to witness substantial growth during the forecast period from 2021 to 2028. At Level 2, vehicles are capable of controlling speed and steering under specific conditions, offering driver assistance. The proliferation of Level 2 automated buses globally is expected to drive demand in this segment.

In the propulsion segment, electric buses dominated in 2020. Several factors contribute to the growth of the electric bus market, including the rising sales of electric vehicles worldwide, governmental backing for public transport electrification, and initiatives by both public and private entities to curb pollution through grants and policies. The hybrid autonomous bus market is poised to experience significant growth owing to reduced maintenance costs, lower emissions, and enhanced performance.

In terms of application, urban settings are poised to witness over 85% of buses being autonomous by 2022. Driverless buses are gaining traction in urban environments for their potential to revolutionize urban transportation by addressing issues like traffic congestion, pollution, and the need for sustainable transit. They offer efficient, safe, and eco-friendly transportation solutions, filling the "last mile" gap and reducing dependence on private vehicles. As urban populations burgeon, driverless buses offer an effective, environmentally conscious, and convenient mode of transportation to meet the evolving needs of modern cities.

While the urban segment saw the most substantial increase in 2020, driven by rising urban tourism, significant growth is anticipated in the intercity market during the forecast period from 2021 to 2028.

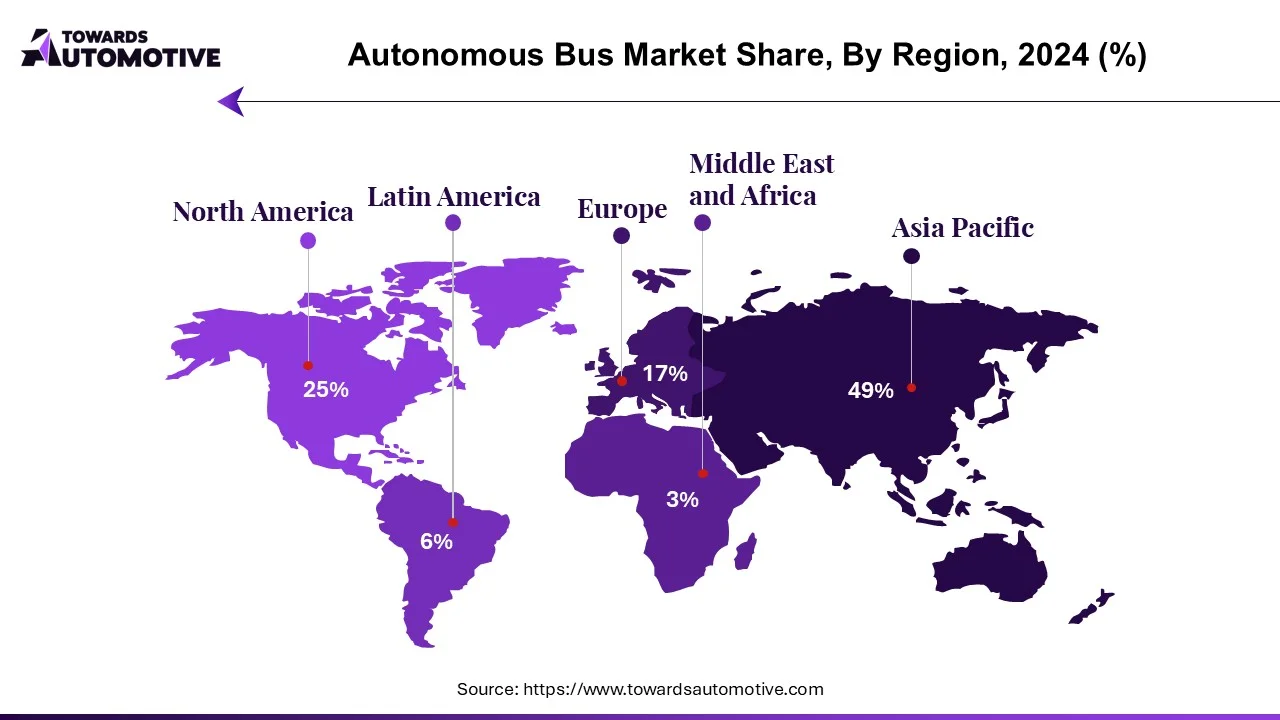

By 2022, the Asia-Pacific region is projected to dominate the autonomous bus market, accounting for over 50% of total revenue. China, in particular, is experiencing rapid growth in its driverless bus industry, driven by its robust commitment to technological advancement and substantial investments in driverless research and development. The country's large and expanding urban population necessitates efficient public transportation solutions. Moreover, supportive government policies promoting energy-efficient transportation practices have created a conducive environment for business expansion.

China's high production efficiency and concurrent development of the electric bus industry are synergistic with the growth of the autonomous bus sector. This parallel advancement enables China to achieve commercial expansion within the country. With a focus on innovation and technological prowess, China's autonomous bus industry is poised for significant growth, solidifying the Asia-Pacific region's leadership position in the global autonomous bus market.

Major companies operating in the autonomous bus industry are:

Companies operating in the autonomous bus sector are proactively implementing diverse strategies to bolster their market presence. These initiatives encompass leveraging cutting-edge artificial intelligence and cloud technologies, fostering strategic collaborations, diversifying service offerings, and enhancing data analytics capabilities. The overarching goal of these endeavors is to effectively address customer requirements while navigating the regulatory landscape, which often varies across different geographical regions. By embracing innovation and fostering partnerships, companies in the autonomous bus industry are poised to capitalize on emerging opportunities and cement their foothold in the market.

By Level of Autonomy

By Fuel

By Application

By Geography

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us