October 2025

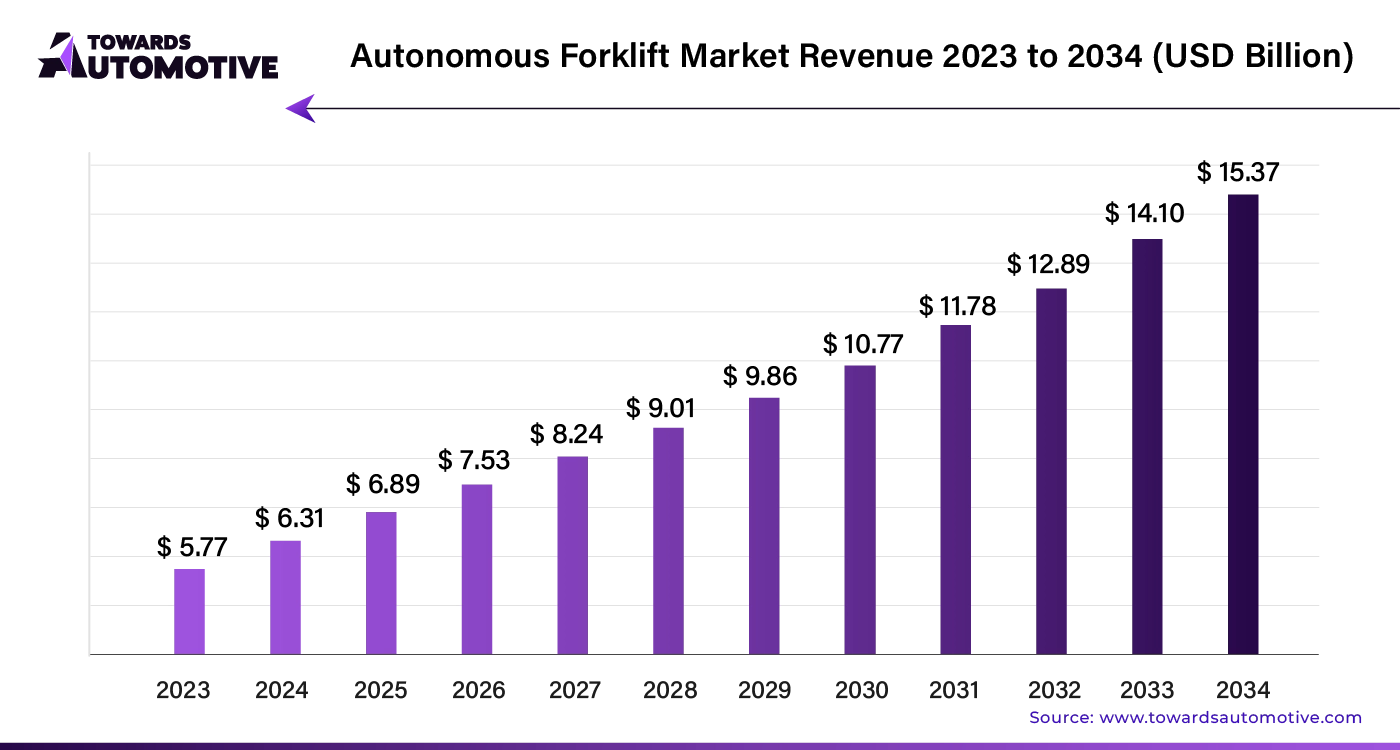

The autonomous forklift market is set to grow from USD 6.89 billion in 2025 to USD 15.37 billion by 2034, with an expected CAGR of 9.2% over the forecast period from 2025 to 2034. The growing demand for advanced equipment in the warehouses coupled with technological advancements in the logistics sector has driven the market expansion.

Additionally, numerous government initiatives aimed at enhancing safety in the manufacturing sector along with rapid investment by logistics companies for deploying autonomous forklifts in their storage hubs is playing a prominent role in shaping the industrial landscape. The increasing use of advanced sensors in autonomous forklifts is expected to create ample growth opportunities for the market players in the upcoming days.

The autonomous forklift market is a prominent sector of the automotive industry. This industry deals in manufacturing and distribution of autonomous forklift in different parts of the world. There are several types of forklifts developed in this sector consisting of pallet jacks forklifts, counterbalance forklifts, reach trucks, order pickers, stacker forklifts and some others. It finds application in warehouse automation, material handling, logistics & freight automation, cold storage and temperature-controlled environment, automated loading & unloading systems, and some others. The end-user of this sector comprises of chemical, food and beverage, automotive, aerospace and defense, e-commerce and some others. This market is expected to rise significantly with the growth of the logistics sector around the globe.

The major trends in this market consists of partnerships, booming e-commerce sector and advancements in battery technology.

The counterbalance forklifts segment dominated the market. The increasing demand for counterbalance forklifts from several sectors including chemical, logistics, automotive and some others has driven the market expansion. Additionally, the integration of heavy-duty AC drive and hydraulic motors in these forklifts is playing a vital role in shaping the industrial landscape. Moreover, numerous advantages of counterbalance forklifts including stability, versatility, efficiency and some others in material handling operations is expected to drive the growth of the autonomous forklift market.

The order pickers segment is expected to expand with the highest CAGR during the forecast period. The growing use of order picker forklifts in warehouses and distribution centers for retrieving items from storage locations to fulfil orders has boosted the market growth. Additionally, rapid investment by market players for developing high-level order pickers and stock pickers to cater the needs of end-user industries is contributing to the industry in a positive manner. Moreover, several advantages of these forklifts including increased efficiency, reduced travel time, improved safety and some others is expected to boost the growth of the autonomous forklift market.

The warehouse automation segment held the largest share of the market. The increasing use of automated solutions in modern warehouses to streamline and optimize operations has boosted the market expansion. Additionally, the deployment of autonomous forklifts in logistics warehouses to lift, move, and stack goods is expected to foster the growth of the autonomous forklifts market.

The automated loading & unloading systems segment is expected to rise with the fastest CAGR during the forecast period. The growing adoption of autonomous forklifts in the manufacturing sector for loading and unloading goods has boosted the market growth. Also, rapid investment by the market players for developing advanced forklifts to enhance loading and unloading activities is expected to propel the growth of the autonomous forklifts market.

The logistics segment led the market. The deployment of advanced equipment in the logistics sector in several countries such as the U.S., Canada, Germany, China and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the logistics industry coupled with integration of WMS and ERP in forklifts is playing a crucial role in shaping the industrial landscape. Moreover, collaborations among forklift manufacturers and logistics providers is expected to boost the growth of the autonomous forklift market.

The retail & e-commerce segment is expected to grow with the fastest CAGR during the forecast period. The growing use of autonomous forklifts in the e-commerce sector for handling goods in warehouses has boosted the market expansion. Additionally, rapid deployment of advanced equipment in the retail sector for streamlining operations, lowering labor costs, and enhancing inventory management is playing a prominent role in shaping the industry in a positive direction. Moreover, partnerships among market players and e-commerce brands to deploy autonomous forklifts for enhancing material handling operations is expected to propel the growth of the autonomous forklift market.

Asia Pacific held the largest share of the autonomous forklift market. The growing demand for autonomous forklifts from several industries such as manufacturing, chemical, food and beverage, and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at enhancing safety of workers in heavy industries coupled with rapid integration of advanced equipment in modern warehouses is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as Toyota Industries Corporation, Mitsubishi, Doosan Corporation, Komatsu and some others is expected to propel the growth of the autonomous forklift market in this region.

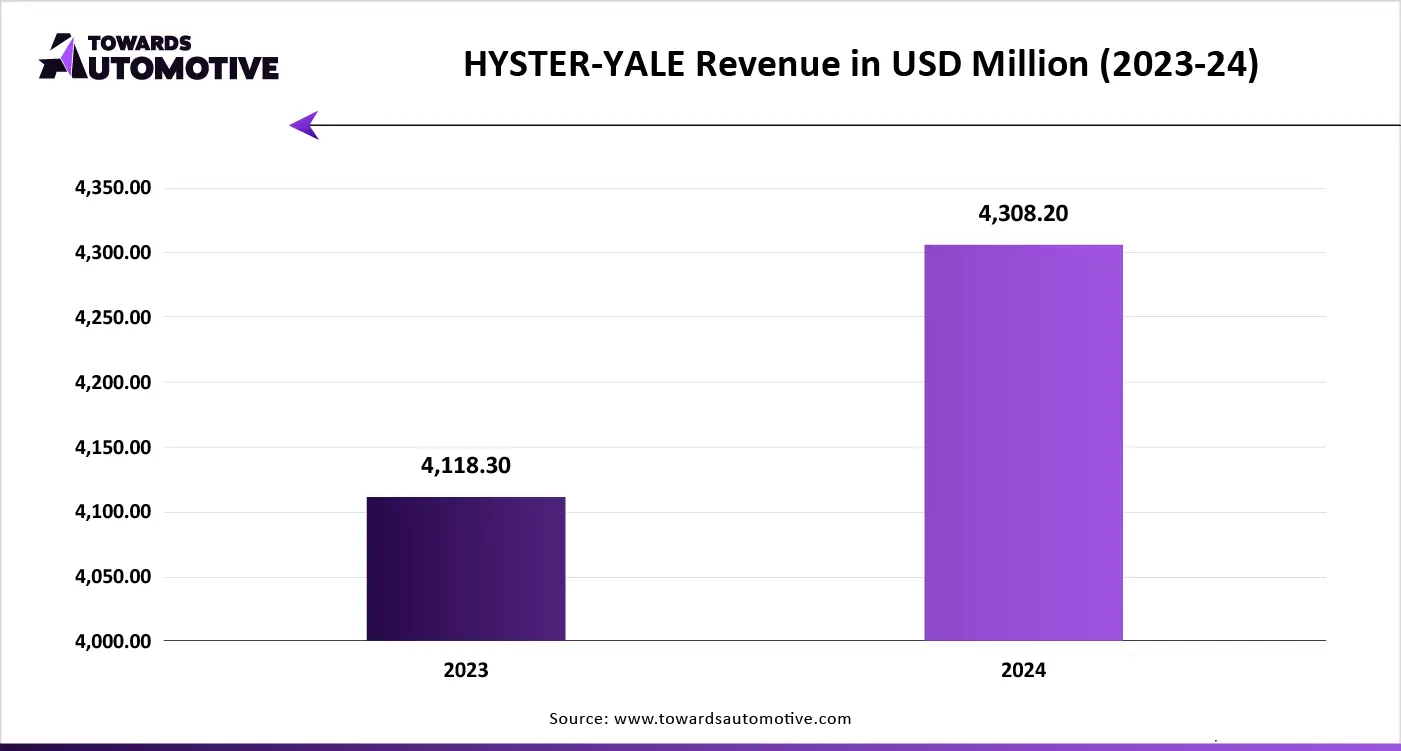

North America is expected to grow with a significant CAGR during the forecast period. The increasing use of autonomous forklifts in various sectors including e-commerce, aerospace, automotive and some others has driven the market growth. Additionally, rapid investment by the logistics companies to deploy automated solutions in modern warehouses along with scarcity of manual laborers is contributing to the industry in a positive direction. Moreover, the presence of various market players such as Crown Equipment Corporation, Hyster-Yale Materials Handling, Kollmorgen Corporation and some others is expected to foster the growth of the autonomous forklift market in this region.

The autonomous forklift market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Crown Equipment Corporation; SSI Schäfer Group; Mitsubishi Logisnext Co., Ltd.; Seegrid Corporation; Toyota Industries Corporation; Hyster-Yale Materials Handling, Inc.; KION Group AG; Jungheinrich AG; AGILOX Services GmbH; Oceaneering International Inc. and some others. These companies are constantly engaged in developing autonomous forklifts and adopting numerous strategies such as launches, partnerships, business expansions, joint ventures, acquisitions, collaborations, and some others to maintain their dominance in this industry.

By Forklift Type

By Navigation Technology

By Load Capacity

By Autonomy

By Application

By End User

By Region

October 2025

September 2025

August 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us