September 2025

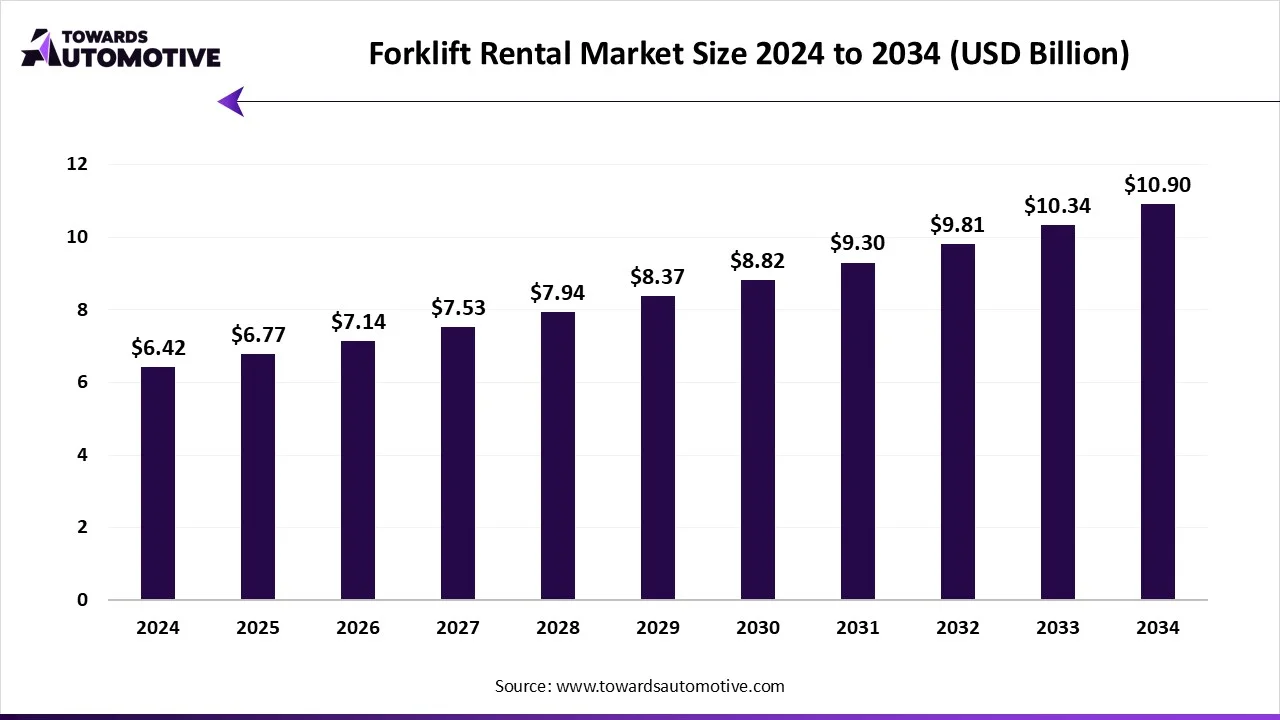

The forklift rental market is forecasted to expand from USD 6.77 billion in 2025 to USD 10.90 billion by 2034, growing at a CAGR of 5.44% from 2025 to 2034. The growing demand for flexible material handling solutions along with rapid expansion of the e-commerce sector has boosted the market expansion. Also, rise in number of logistics warehouses coupled with increasing popularity of forklift rental services is playing a vital role in shaping the industrial landscape.

The increasing adoption of electric forklifts in the manufacturing sector as well as integration of IoT in forklifts is expected to create ample growth opportunities for the market players in the upcoming days.

The forklift rental market is a prominent branch of the automotive industry. This industry deals in providing forklift rental services different parts of the world. There are numerous types of equipment rented by this sector including electric forklifts, internal combustion engine forklifts, warehouse forklifts, heavy-duty forklifts and some others. These forklifts come with different load capacity consisting of below 3 tons, 3-5 tons, 5-10 tons, above 10 tons and some others. It is used in various types of industries such as construction, automotive, aerospace and defense, warehouse & logistics, retail, manufacturing, e-commerce, food & beverage, pharmaceuticals, chemicals and some others. This market is expected to rise significantly with the growth of the manufacturing sector around the globe.

The major trends in this market consists of partnerships, advancements in battery technology and rapid expansion of the e-commerce sector.

The electric forklift segment led the forklift rental market with a share of around 55%. The growing demand for eco-friendly material handling equipment from the e-commerce sector has boosted the market expansion. Additionally, rapid investment by battery manufacturers for developing high-quality forklift batteries is contributing to the industry in a positive manner. Moreover, numerous government initiatives aimed at lowering industrial emission coupled with technological advancements in electric counterbalance forklift is expected to propel the growth of the forklift rental market.

The warehouse forklift segment is expected to expand with a significant CAGR during the forecast period. The growing use of reach trucks and order pickers in warehouses to efficiently lift and move pallets of goods at high altitudes has boosted the market expansion. Additionally, rapid investment by logistics companies for integrating advanced material handling equipment in modern warehouses is playing a vital role in shaping the industrial landscape. Moreover, the rising application of stackers and pallet jacks in smart warehouses for moving heavy loads across short distances is expected to foster the growth of the forklift rental market.

The below 3 tons segment dominated the forklift rental market with a share of around 50%. The growing use of low-capacity forklifts in the retail sector for moving small goods from one place to another has boosted the market expansion. Additionally, the increasing emphasis of e-commerce brands to adopt electric forklifts (below 3 tons) for lowering emission is playing a vital role in shaping the industrial landscape. Moreover, rapid investment by forklift manufacturers and rental companies to deploy low-capacity forklifts in residential sector is expected to foster the growth of the forklift rental market.

The 3-5 tons segment is expected to expand with the fastest CAGR during the forecast period. The increasing application of 3-5 tons forklifts in the logistics sector for transporting bulk shipments in warehouses has driven the market growth. Also, the growing use of heavy-duty forklift in the construction industry along with its numerous operations in the automotive sector is playing a vital role in shaping the industrial landscape. Moreover, surge in demand for high-capacity forklifts from the manufacturing sector is expected to drive the growth of the forklift rental market.

The warehouse & logistics segment led the forklift rental market with a share of around 40%. The growing emphasis of logistics companies to deploy advanced material handling equipment in their storage facilities has boosted the market expansion. Additionally, rapid investment by logistics brands for constructing smart warehouses is playing a vital role in shaping the industrial landscape. Moreover, partnerships among logistics operators and forklift rental companies is expected to boost the growth of the forklift rental market.

The e-commerce segment is expected to grow with the highest CAGR during the forecast period. The rapid expansion of the e-commerce industry in several countries including the U.S., Canada, China, India and some others has boosted the market expansion. Also, rising investment by e-commerce brands such as Amazon, Walmart, Flipkart and some others to deploy electric forklifts in their storage facilities is contributing to the industry in a positive manner. Moreover, collaboration among online shopping platforms and forklift rental companies is expected to drive the growth of the forklift rental market.

The indoor operations segment led the market with a share of around 36%. The growing use of forklifts in modern warehouses for transporting bulk goods from one place to another has driven the market expansion. Additionally, the increasing application of heavy-duty forklifts in e-commerce storage facilities coupled with numerous advantages of forklifts in indoor operations is playing a vital role in shaping the industrial landscape. Moreover, joint ventures among logistics brands and rental companies to deploy electric forklifts in smart warehouses is expected to boost the growth of the forklift rental market.

The specialized application segment is expected to rise with the fastest CAGR during the forecast period. The rising use of heavy-duty forklifts in cold storage warehouses has boosted the market expansion. Additionally, the deployment of electric forklifts for handling automated guided vehicles (AGVs) is contributing to the industry in a positive manner. Moreover, the increasing emphasis of chemical brands for handling hazardous materials is expected to propel the growth of the forklift rental market.

The long-term rentals segment led the industry with a share of around 65%. The rising emphasis of logistics companies to adopt long-term forklift rental services has driven the market expansion. Additionally, numerous advantages of long-term rental services including low maintenance cost, less regulatory scrutiny, potential tax benefits, less management effort and some others is expected to drive the growth of the forklift rental market.

The monthly segment is expected to rise with the fastest CAGR during the forecast period. The increasing adoption of monthly forklift subscription services by SMEs has boosted the market growth. Also, numerous benefits of monthly services including flexibility, predictable costs, high income potential and some others is expected to boost the growth of the forklift rental market.

Asia Pacific dominated the forklift rental market with a share of around 35%. The growing development in the e-commerce sector in several countries such as India, China, Japan, South Korea and some others has boosted the market expansion. Also, rise in number of logistics warehouses coupled with technological advancements in the automotive sector is playing a vital role in shaping the industrial landscape. Moreover, the presence of numerous market players such as XCMG Group, ZPMC, Hyundai Construction Equipment, Doosan Bobcat and some others is expected to drive the growth of the forklift rental market in this region.

Middle East & Africa is expected to expand with the highest CAGR during the forecast period. The rapid growth in the oil and gas industry in various nations such as UAE, Saudi Arabia, Qatar and some others has boosted the market growth. Also, rapid adoption of electric forklifts in the manufacturing sector coupled with rise in number of forklift rental companies is contributing to the industry in a positive manner. Moreover, the presence of various market players such as Linde Material Handling, GENAVCO, Liftstein, CHL Material Handling and some others is expected to boost the growth of the forklift rental market in this region.

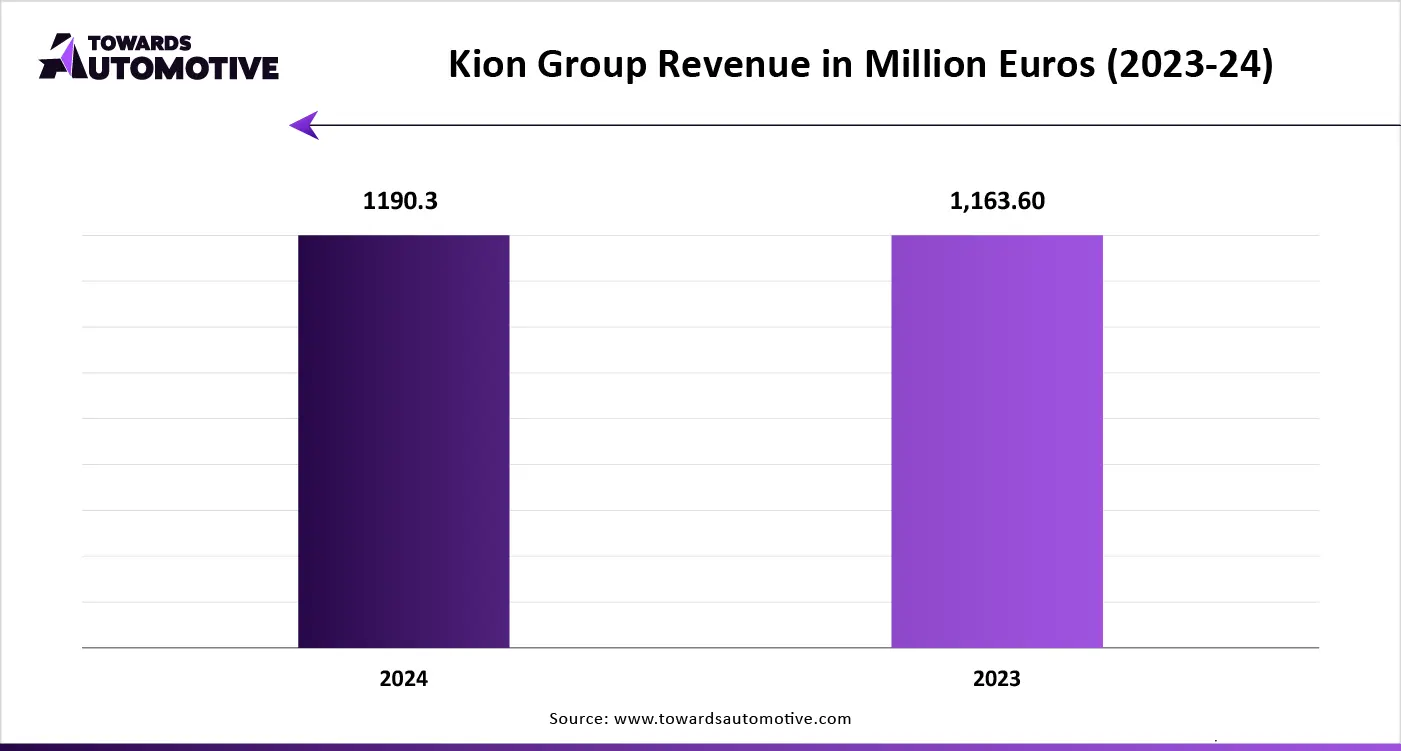

The forklift rental market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of SANY Group, XCMG Group, Toyota Industries Corporation, KION Group (Linde, Baoli), Jungheinrich AG, Crown Equipment Corporation, Mitsubishi Logisnext, Hyster-Yale Materials Handling, Doosan Bobcat, Hangcha Group, Lonking Holdings Limited, Komatsu Ltd., Clark Material Handling Company, UniCarriers Americas Corporation, Hyundai Construction Equipment, Manitou Group, Moffett Forklifts, Kalmar (Cargotec), ZPMC (Shanghai Zhenhua Heavy Industries), Nissan Forklift Corporation and some others. These companies are constantly engaged in providing forklift rental services and adopting numerous strategies such as acquisitions, collaborations, launches, partnerships, business expansions, joint ventures and some others to maintain their dominance in this industry.

By Equipment Type

By Load Capacity

By End Use Industry

By Application

By Rental Duration

By Region

The power sport accessories industry is expected to grow from USD 4.71 billion in 2024 to USD 14.86 billion by 2034, driven by a CAGR of 12.17%. The g...

September 2025

July 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us