October 2025

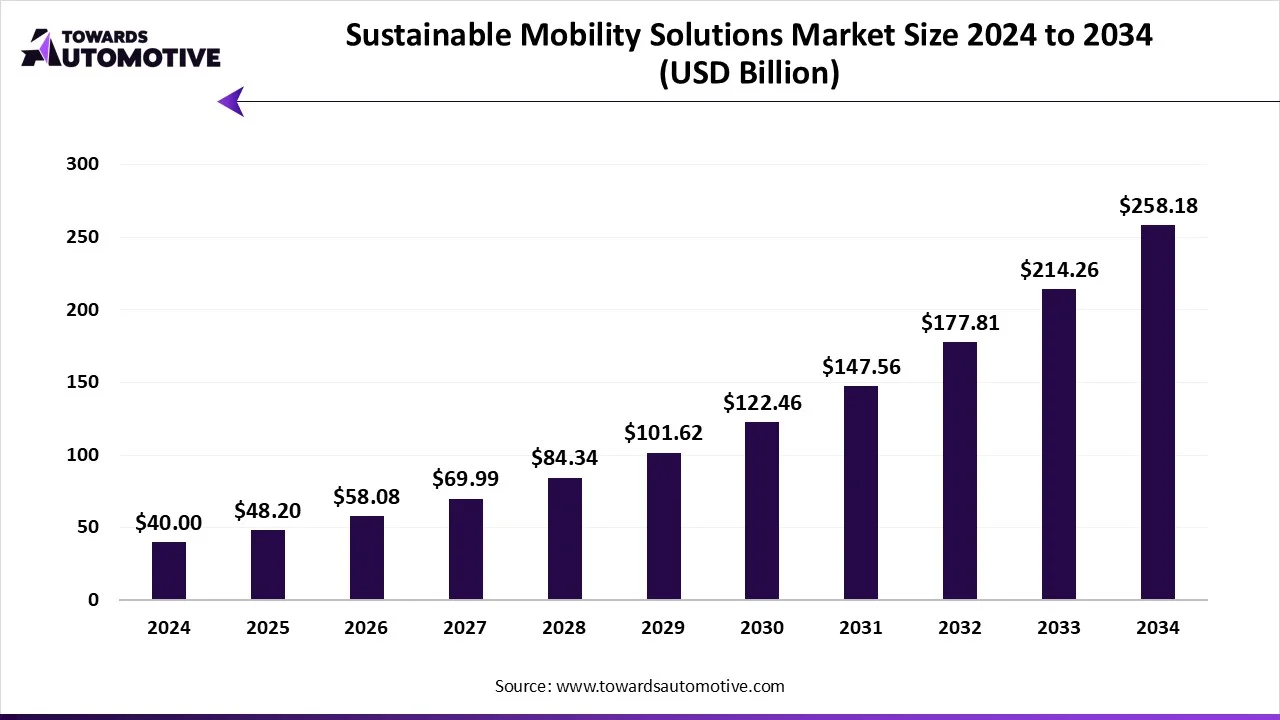

The sustainable mobility solutions market is projected to reach USD 258.18 billion by 2034, growing from USD 48.20 billion in 2025, at a CAGR of 20.5% during the forecast period from 2025 to 2034. The growing demand for battery electric vehicles in the U.S. and Germany coupled with technological advancements in the battery manufacturing sector is playing a vital role in shaping the industrial landscape.

Moreover, the rising adoption of electric vehicles by fleet operators to maximize their profit margins and reduce emission along with numerous government initiatives aimed at increasing awareness about EV adoption has driven the market expansion. The advancements in wireless EV charging technology is expected to create ample growth opportunities for the market players in the upcoming years.

The sustainable mobility solutions market is a prominent segment of the automotive industry. This industry deals in development and distribution of sustainable mobility solutions in different parts of the world. There are several types of vehicles developed in this sector consisting of battery electric vehicles, e-scooters, e-bikes, pedal bikes, electric buses, electric trams and some others. The end-users of this sector comprises of individual/private consumers, government & municipal authorities, corporate fleets & logistics providers, mobility-as-a-service (maas) providers and some others. The growing sales of electric buses in developed nations has boosted the market expansion. This market is expected to rise significantly with the growth of the EV sector around the globe.

The major trends in this market consists of government initiatives, collaborations and popularity of e-scooters.

The personal sustainable vehicles segment dominated the market with a share of 44%. The growing demand for BEVs among individual consumers due to increasing prices of gasoline has boosted the market expansion. Additionally, the increasing adoption of EVs by people of mid-income countries is contributing to the industry in a positive direction. Moreover, numerous government initiatives aimed at providing subsidies to adopt EVs is expected to foster the growth of the sustainable mobility solutions market.

The micromobility segment is expected to grow with the highest CAGR during the forecast period. The rising demand for e-scooters from urban commuters with an aim at reducing vehicular emission has driven the market growth. Additionally, the increasing sales of e-bikes in developing nations such as Vietnam and Indonesia is playing a vital role in shaping the industrial landscape. Moreover, rapid investment by battery companies to develop high-quality batteries for electric two-wheelers is expected to propel the growth of the sustainable mobility solutions market.

The battery electric vehicles (BEVs) segment held the largest share of the market with 52%. The growing sales of BEVs in several countries such as China, the U.S., India, Germany and some others has boosted the market expansion. Additionally, rapid investment by automotive brands for developing numerous types of BEVs coupled with opening of new EV manufacturing centers is playing a vital role in shaping the industrial landscape. Moreover, collaborations among EV companies and battery manufacturers to develop high-quality EV batteries is expected to propel the growth of the sustainable mobility solutions market.

The fuel cell electric vehicles (FCEVs) segment is expected to expand with the fastest CAGR during the forecast period. The rising demand for hybrid vehicles in various nations such as Canada, Japan, Italy, Norway and some others has driven the market growth. Additionally, rapid investment by automotive companies for developing FCEV powertrains is contributing to the industry in a positive direction. Moreover, the increasing emphasis of government for expanding the hydrogen refueling infrastructure is expected to foster the growth of the sustainable mobility solutions market.

The EV charging infrastructure segment led the market with a share of 36%. The growing demand for ultra-fast chargers from individual consumers to charge their vehicles quickly has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the EV charging infrastructure coupled with rapid investment by EV companies to open new EV charging stations is playing a prominent role in shaping the industrial landscape. Moreover, the deployment of wireless EV chargers in several European roads is expected to drive the growth of the sustainable mobility solutions market.

The smart mobility platforms (MaaS) segment is expected to grow with the fastest CAGR during the forecast period. The increasing adoption of electric two-wheelers by mobility providers to enhance their profit margins and minimizing traffic congestions has boosted the market expansion. Additionally, partnerships among MaaS platforms and EV brands to deploy BEVs in their fleet is contributing to the industry in a positive direction. Moreover, the availability of MaaS applications in Google Play Store and Apps Store is expected to boost the growth of the sustainable mobility solutions market.

The individual/private consumers segment led the industry with a share of 47%. The growing adoption of electric two-wheelers among individuals of developing nations such as India, Vietnam, Thailand and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at providing incentives for purchasing EVs is playing a vital role in shaping the industrial landscape. Moreover, the increasing demand for electric luxury cars from the HNIs of developed countries is expected to boost the growth of the sustainable mobility solutions market.

The government & municipal authorities segment is expected to rise with the highest CAGR during the forecast period. The increasing adoption of electric cars by government offices and municipal authorities with an aim to reduce vehicular emission has boosted the market growth. Additionally, rapid investment by government for launching electric bus services in urban areas is contributing to the industry in a positive direction. Moreover, partnerships among government organizations and automotive brands for deploying EVs to operate official services is expected to propel the growth of the sustainable mobility solutions market.

Europe led the sustainable mobility solutions market with a share of 39%. The growing sales of electric vehicles in several countries such as UK, Germany, France, Italy, Denmark and some others has driven the market expansion. Additionally, numerous government initiatives aimed at developing the EV charging infrastructure coupled with rapid adoption of e-scooters by fleet operators is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as Volvo Group, Alstom S.A., BMW Group, Bosch Mobility Solutions and some others is expected to drive the growth of the sustainable mobility solutions market in this region.

Germany is the major contributor in this region. The rising consumer awareness related to the benefits of EVs coupled with rapid popularity of e-mobility services has driven the market expansion. Additionally, the growing investment by EV brands for opening up new manufacturing centers along with presence of numerous automotive companies such as BMW, Audi, Volkswagen and some others is playing a vital role in shaping the industrial landscape.

Asia Pacific is expected to rise with the fastest CAGR during the forecast period. The rising adoption of BEVs by individual consumers of several countries such as India, China, Japan, South Korea and some others has boosted the market growth. Additionally, rapid investment by government for deploying fast chargers for EVs coupled with technological advancements in the EV battery industry is playing a vital role in shaping the industry in a positive direction. Moreover, the presence of several market players such as BYD Company Ltd., Hyundai Motor Company, Tata Motors, Honda Motors and some others is expected to propel the growth of the sustainable mobility solutions market in this region.

China and India are the significant contributors in this region. In China, the market is generally driven by the growing developments in the battery manufacturing sector along with rise in number of EV startups. In India, the growing sales of electric two-wheelers coupled with numerous government initiatives aimed at developing the EV charging infrastructure has driven the market expansion.

The sustainable mobility solutions market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Tesla Inc, Hyundai Motor Company, Rivian Automotive, Inc., BYD Company Ltd., Uber Technologies Inc., Ola Electric Mobility Pvt. Ltd., Volvo Group, ChargePoint Holdings, Inc., BMW Group, Waymo (Alphabet Inc.), Bosch Mobility Solutions, Moovit (Intel), Alstom S.A., GreenMobility A/S and some others. These companies are constantly engaged in providing sustainable mobility solutions and adopting numerous strategies such as business expansions, launches, partnerships, joint ventures, acquisitions, collaborations and some others to maintain their dominance in this industry.

By Transportation Format

By Solution Type

By Propulsion Technology

By End-User

By Region

October 2025

September 2025

July 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us