September 2025

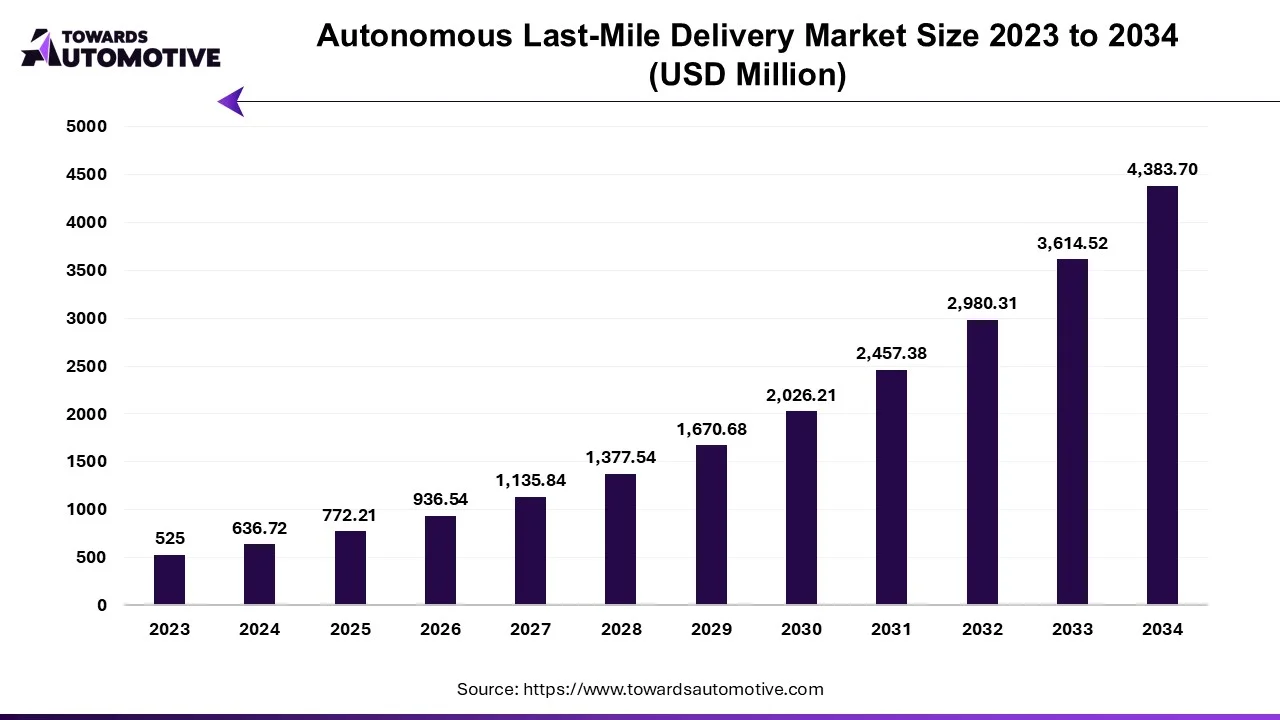

The autonomous last mile delivery market is forecasted to expand from USD 772.21 million in 2025 to USD 4,383.70 million by 2034, growing at a CAGR of 21.28% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The autonomous last mile delivery market is a crucial branch of the logistics industry. This industry deals in delivering goods using autonomous vehicles. There are several types of vehicles used in this sector including ground delivery vehicles (delivery bots and self-driving trucks) and aerial delivery drones. The several components of these vehicles include hardware, software and services. The end-user of this sector comprises of food and beverage, retail, healthcare and some others. The growing development in the e-commerce industry in different parts of the world has contributed to the industrial expansion. This market is expected to rise significantly with the growth of the drone industry across the world.

| Metric | Details |

| Market Size in 2024 | 636.72 Million |

| Projected Market Size in 2034 | USD 4,383.70 Million |

| CAGR (2025 - 2034) | 21.28% |

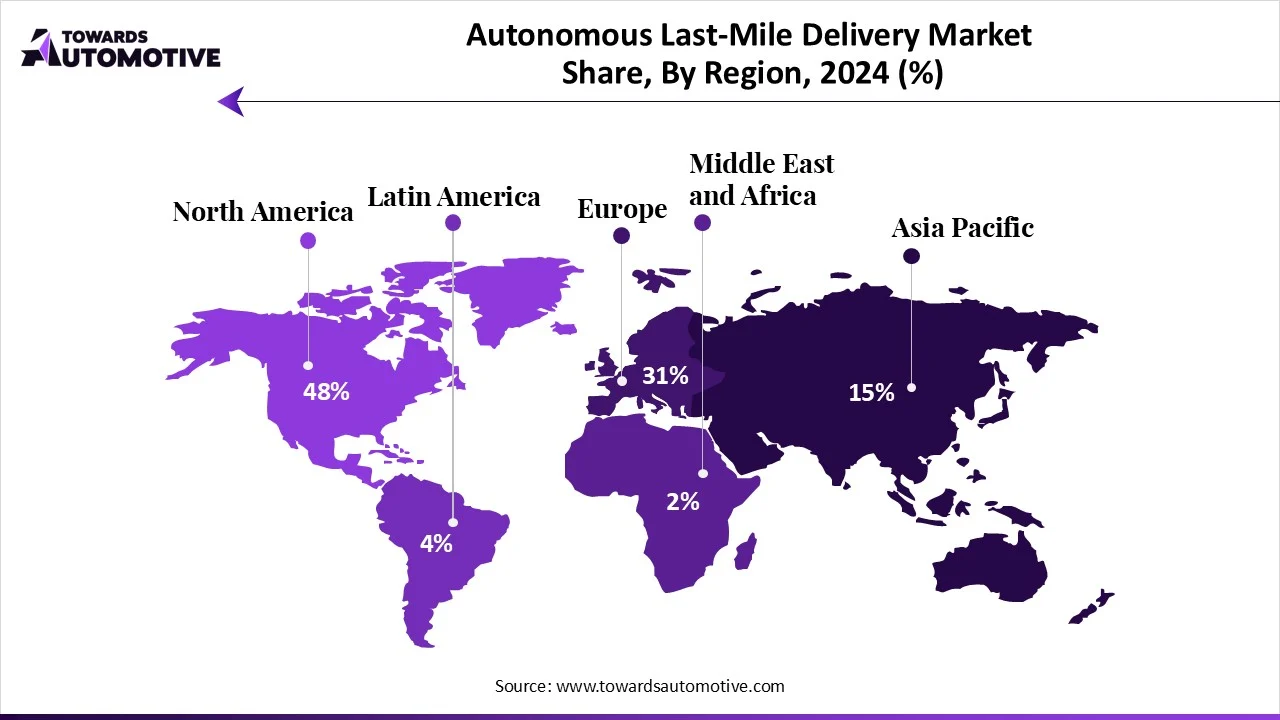

| Leading Region | North America |

| Market Segmentation | By Platform, By Solution, By Range, By End-Use and By Region |

| Top Key Players | Drone Delivery Canada Corp.; Flytrex Inc.; JD.com, Inc.; Udelv Inc.; Wing Aviation LLC |

The major trends in this market consists of partnerships, rapid expansion of the e-commerce sector and growing adoption of AI-enabled drones in logistics sector.

Partnerships

Several market players are partnering with each other to launch autonomous last mile delivery services. For instance, in May 2025, 7X partnered with Zelostech. This partnership is done for launching an autonomous logistics service in UAE. (Source: CBNME)

Rapid expansion of the e-commerce sector

The growing use of various e-commerce companies such as Amazon, Walmart, Alibaba and some others in different parts of the world has increased the demand for autonomous delivery solutions. For instance, in March 2024, DroneUp launched an autonomous drone. This drone is designed for enhancing the delivery operations in the e-commerce sector. (Source: Commerical UAV News)

Growing adoption of AI-enabled drones in logistics sector

The adoption of AI-based drones has increased in the logistics sector for enhancing supply chain operations. For instance, in November 2024, Bon V Aero launched Air Orca. Air Orca is an autonomous drone designed for the logistics sector across India. (Source: Indian Transport & Logistics News)

The ground delivery vehicles led this industry. The growing adoption of delivery bots by retail stores and hospitals has boosted the market growth. Additionally, the rising demand for self-driving trucks from the e-commerce sector is driving the growth of the autonomous last mile delivery market.

The aerial delivery drones segment is expected to grow with the fastest CAGR during the forecast period. The growing adoption of UAVs by e-commerce companies and local restaurant chains for reducing their dependency on employees and enhancing the delivery capabilities has driven the market expansion. Also, the rising investment by private entities for developing the drone-manufacturing sector is expected to drive the growth of the autonomous last mile delivery market.

The hardware segment dominated the industry. The growing use of advanced cameras and nano sensors in autonomous trucks has boosted the market growth. Also, the rising investment by public and private companies for developing advanced batteries to enhance the operational efficiency of drones is expected to propel the growth of the autonomous last mile delivery market.

The services segment is expected to rise with the highest CAGR during the forecast period. The rising adoption of Robot-as-a-Service (RaaS) in the e-commerce sector driven the market expansion. Additionally, the growing demand for subscription-based service models from the local restaurant chains and retail shops is expected to drive the growth of the autonomous last mile delivery market.

The food & beverages segment held the largest share of the market. The growing consumer preference to order food items from online platforms such as Swiggy and Zomato has boosted the market growth. Additionally, the rising trend of cloud kitchen services along with numerous partnerships among logistics companies and restaurant chains to adopt autonomous solutions for delivering food items is expected to propel the growth of the autonomous last mile delivery market.

The retail segment is expected to grow with the fastest CAGR during the forecast period. The growing adoption of drones by local shops to deliver essential items in nearby areas has driven the market growth. Also, the increasing use of technologically advanced mobility solutions in the retail sector to enhance supply chain capabilities is expected to propel the growth of the autonomous last mile delivery market.

North America held the largest share of the last mile delivery market. The growing adoption of online shopping in several countries such as Canada and the U.S. has boosted the market growth. Additionally, surge in demand for autonomous solutions such drones and driverless trucks from the e-commerce sector has contributed to the overall industrial expansion. Moreover, the presence of several market players such as Amazon, Nuro, Inc, Starship Technologies and some others is driving the growth of the autonomous last mile delivery market in this region.

U.S. dominated the market in this region. The rising adoption of advanced technologies such as AI and IoT in the logistics sector has boosted the market expansion. Additionally, the presence of several drone manufacturing companies along with rapid investment in the e-commerce sector is contributing to the industrial expansion.

Asia Pacific is expected to rise with the fastest CAGR during the forecast period. The rising interest of consumers for purchasing and selling goods in e-commerce platforms in numerous countries such as China, India, Vietnam, Taiwan and some others has driven the industrial expansion. Also, the ongoing developments in the drone manufacturing industry along with rapid investment by public-entities for integrating advanced technologies in logistics sector is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as Shenzhen Yiqing Innovation Technology Co., Ltd., Alibaba Group Holding Ltd., SF Express and some others is expected to boost the growth of the autonomous last mile delivery market in this region.

China and India are the significant contributors in this region. In China, the market is generally driven by the technological advancements in the e-commerce sector along with rapid deployment of delivery bots in warehouses. In India, the growing adoption of drones for transporting goods in different cities coupled with rise in number of logistics startups is positively impacting the industry.

The autonomous last mile delivery market is a highly fragmented industry with the presence of numerous dominating players. Some of the prominent companies in this industry consists of Kiwi Campus (Kiwibot); Nuro, Inc.; Refraction AI; Alibaba Group Holding Ltd.; Amazon, Inc.; Drone Delivery Canada Corp.; Flytrex Inc.; JD.com, Inc.; Udelv Inc.; Wing Aviation LLC; A2Z Drone Delivery, LLC, Shenzhen Yiqing Innovation Technology Co., Ltd. (Unity Drive Innovation); Starship Technologies; TeleRetail and some others. These companies are constantly engaged in developing autonomous solutions for logistics sector and adopting numerous strategies such as launches, joint ventures, business expansions, partnerships, acquisitions, collaborations, and some others to maintain their dominance in this industry.

In October 2024, Wing Aviation partnered with Serve Robotics. This partnership aims at launching an eco-friendly autonomous food delivery service in the U.S. (Source: Serve)

According to the annual report of Amazon, the revenue of the company in 2023 was US$ 574783 million that increased to US$ 637959 million in 2024. (Source: Amazon.com, Inc.)

By Platform

By Solution

By Range

By End-Use

By Region

September 2025

September 2025

July 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us