October 2025

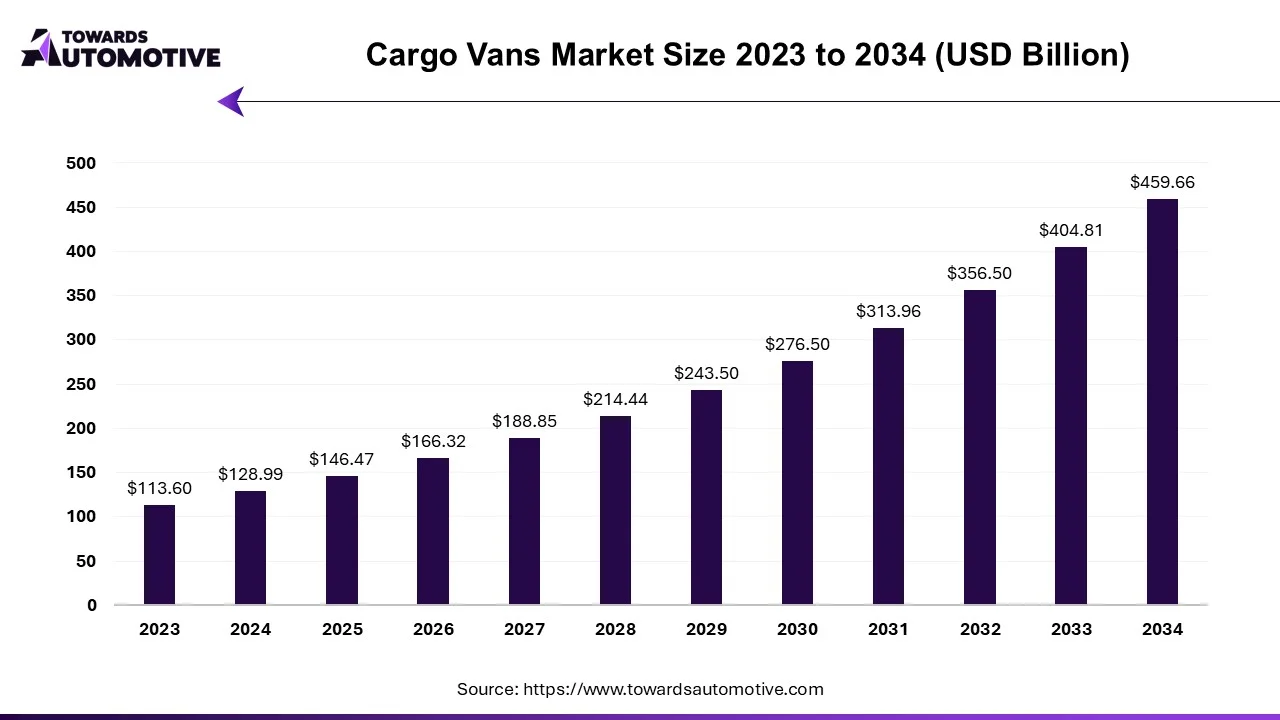

The cargo vans market is projected to reach USD 459.66 billion by 2034, growing from USD 146.47 billion in 2025, at a CAGR of 13.55% during the forecast period from 2025 to 2034.

Trucks play a pivotal role in the growth and operations of logistics and transportation companies, serving as the backbone of supply chains worldwide. Their compact yet spacious design enables efficient transportation of goods between warehouses, distribution centers, and customers, facilitating smooth and timely delivery processes. With the exponential growth of e-commerce, the importance of trucks has surged, as they enable truckers to enhance customer satisfaction by ensuring faster and more precise delivery times.

The increasing demand for vans reflects the expansion of businesses striving to meet customer expectations and accommodate the booming e-commerce landscape. According to the Association of European Automobile Manufacturers, new car sales in the EU surged by 11.2% in the first half of 2023 compared to the same period in 2022, reaching a total of 730,969 units. This robust growth underscores the vital role that vans play in facilitating the movement of goods and meeting the evolving needs of consumers.

However, the business landscape faces significant challenges due to legal changes, particularly stringent emission standards. As environmental concerns intensify, companies are compelled to invest in environmentally friendly technologies to comply with regulations, thereby increasing production costs. Moreover, the complexity of the production process is exacerbated by evolving safety regulations, necessitating continuous adaptation and investment in safety measures.

Trade rules and tariffs pose additional hurdles for businesses, potentially disrupting supply chains and affecting the availability of essential items. The dynamic nature of global trade relations underscores the importance of agility and adaptability in navigating regulatory frameworks and mitigating risks associated with trade disruptions.

Trucks play a crucial role in driving the growth of logistics and transportation companies, they also face challenges stemming from legal changes, emission standards, safety regulations, and trade dynamics. Despite these obstacles, the resilience and adaptability of businesses will be critical in overcoming challenges and capitalizing on opportunities in the ever-evolving business landscape.

| Rank | Supplier (Cargo-van leader) | Business unit / scope | 2024 profitability metric | 2024% |

| 1 | Mercedes-Benz | Mercedes-Benz Vans (global) | Adjusted Return on Sales (EBIT margin) | 14.60% |

| 2 | Ford | Ford Pro (commercial vehicles & services) | EBIT margin | 13.50% |

| 3 | Volkswagen Group | Commercial Vehicles business area (MAN, Scania, VW CV, Navistar) | Operating return on sales (EBIT margin) | 9.10% |

| 4 | Renault Group | Group (no van-only EBITDA/EBIT disclosed) | Operating margin (group, EBIT) | 7.60% |

| 5 | Stellantis | Group (Pro One LCV not broken out for EBITDA) | Adjusted Operating Income margin (group, EBIT) | 5.50% |

The rising demand for electric and environmentally friendly transportation solutions is driving significant advancements in the sector, with companies increasingly prioritizing sustainability and emissions reduction. Electric trucks are emerging as a popular choice for businesses seeking to minimize their carbon footprint and lower operating costs.

For Instance,

The development of online stores has played a pivotal role in driving the expansion of businesses, particularly in the realm of e-commerce. As online retail continues to evolve, there is an increasing need for efficient and timely delivery services over long distances. Trucks serve as the backbone of the distribution network, providing businesses with reliable solutions for transporting goods to customers' doorsteps.

The growing emphasis on door-to-door delivery services has spurred significant investment in delivery trucks, as they play a crucial role in facilitating the rapid expansion of online shopping. By offering businesses a dependable means of transporting goods efficiently and cost-effectively, delivery trucks contribute to the seamless operation of e-commerce businesses and the fulfillment of customer orders.

The convergence of increasing demand for electric vehicles and the growth of e-commerce is driving transformative changes in the transportation sector. Electric trucks, with their environmentally friendly features and operational efficiency, are poised to play a central role in meeting the evolving needs of businesses and consumers in the digital age. As companies continue to prioritize sustainability and adapt to changing market dynamics, the demand for electric trucks and efficient delivery solutions is expected to further accelerate.

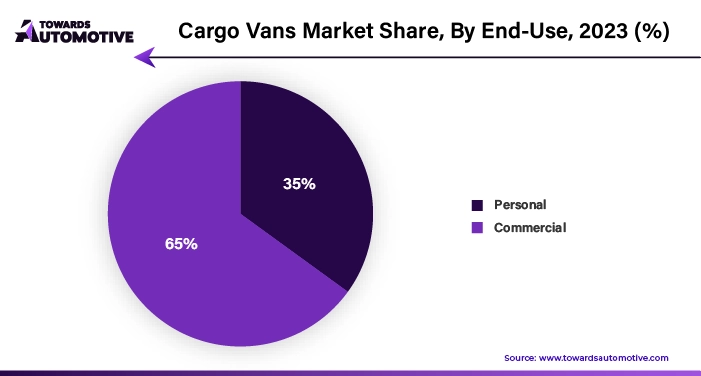

According to end use, the market for trucks is segmented into commercial enterprises and personal enterprises, with the commercial segment holding a substantial market share exceeding 55% by 2022. The increasing demand for end-to-end services, driven by the growing prevalence of online shopping, is a key factor fueling growth in the end-use market. Businesses rely on efficient and timely delivery services to meet customer demands, and vans play a crucial role in fulfilling this need by offering a variety of electric vehicles tailored for local deliveries.

In terms of thrust power, the market is divided into combustion engine and electric segments. As of 2022, the combustion engine (ICE) segment is projected to dominate, accounting for approximately 96% of the market share. Combustion engine-powered trucks are valued for their significant load-carrying capacity and long-distance transportation capabilities. Their design allows for the installation of larger fuel tanks without compromising cargo space, enabling them to transport large items efficiently over extended distances. This capability is particularly important for businesses requiring reliable transportation solutions for their operations.

For Instance,

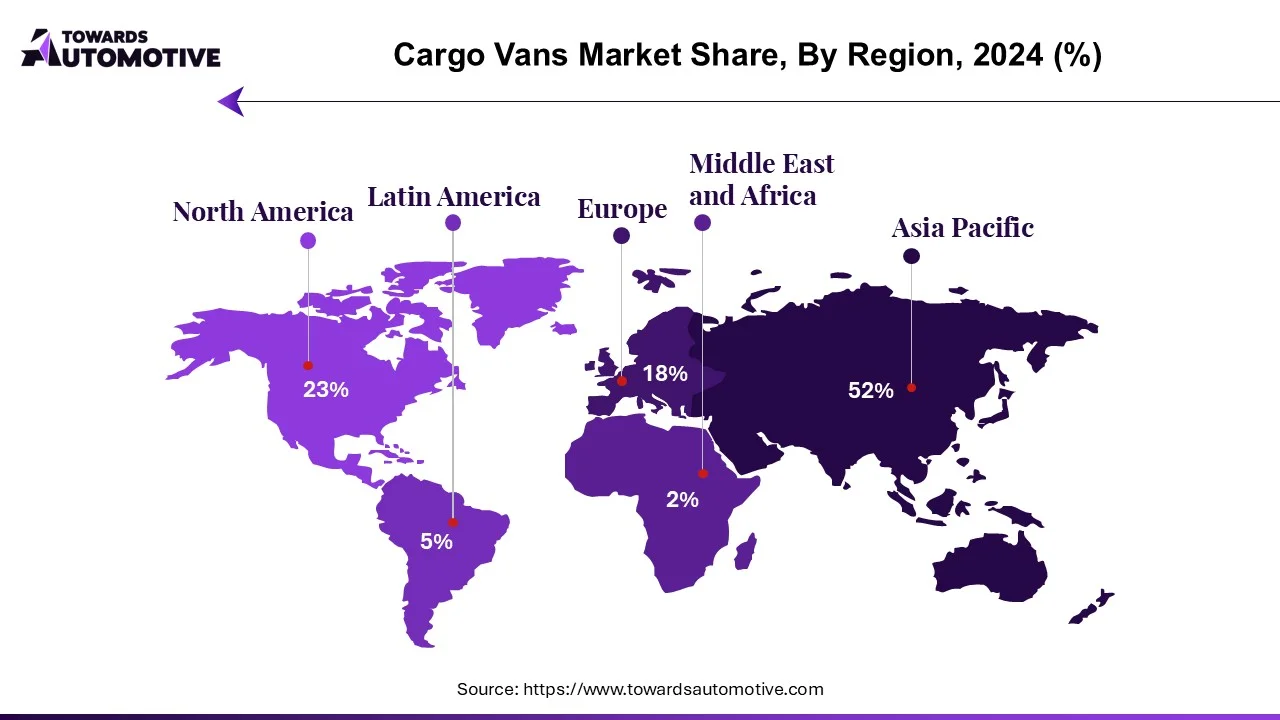

The Asia-Pacific region emerges as a significant player in the automotive market, boasting revenues of $68.1 billion in 2022. This region undergoes rapid transformation, particularly with the transition to electric vehicles, reshaping its economy and driving innovation in the automotive sector.

The integration of advanced technologies such as remote data processing, software development, and Internet of Things (IoT) solutions is revolutionizing fleet management and enhancing operational efficiency. These technological advancements enable real-time monitoring, predictive maintenance, and optimization of fleet performance, thereby streamlining operations and reducing costs for businesses operating in the region.

Moreover, there is a growing emphasis on environmentally friendly transportation solutions, driven by increasing awareness of sustainability issues and regulatory initiatives promoting clean energy adoption. As a result, there is a rising demand for electric trucks as businesses seek sustainable alternatives to traditional combustion engine vehicles. Electric trucks offer several advantages, including lower emissions, reduced operating costs, and enhanced environmental sustainability, aligning with the growing global focus on green transportation solutions.

The Asia-Pacific region's embrace of electric vehicles and innovative technologies underscores its commitment to driving positive change in the automotive industry. By leveraging advanced technologies and embracing sustainability initiatives, businesses in the region are poised to lead the transition towards a cleaner, more efficient transportation ecosystem, contributing to both economic growth and environmental conservation.

Major players operating in the cargo vans industry are:

The competitive landscape within the automotive industry is undergoing a transformative shift, marked by a concerted focus on electric vehicles (EVs) and cutting-edge performance technology. Key players in the market, including industry giants like Mercedes-Benz and Ford, are strategically investing in EV development, integrating intelligent features, and enhancing energy efficiency to maintain their competitive edge and drive innovation.

Mercedes-Benz, a renowned luxury automobile manufacturer, has made substantial investments in electric mobility, positioning itself as a frontrunner in the EV market. The company's commitment to electric vehicles is evident through its expanding lineup of electric models, innovative battery technology, and investment in smart features aimed at enhancing the overall driving experience. By embracing EVs, Mercedes-Benz is not only meeting evolving consumer preferences but also driving technological advancements that redefine the automotive landscape.

Similarly, Ford, a leading American automaker, has prioritized the development of electric vehicles as part of its strategic vision for the future. The company's focus on EVs encompasses the integration of advanced performance technology, smart connectivity features, and sustainable manufacturing practices. By leveraging its expertise in automotive engineering and innovation, Ford aims to deliver electric vehicles that offer superior performance, enhanced safety features, and increased energy efficiency, catering to the needs of today's environmentally conscious consumers.

The investments made by industry leaders like Mercedes-Benz and Ford in electric vehicles and performance technology are driving significant advancements within the automotive sector. These initiatives not only foster innovation and technological breakthroughs but also contribute to economic growth by creating new opportunities for sustainable transportation solutions. As the industry continues to evolve, competition among manufacturers will likely intensify, further accelerating the pace of innovation and shaping the future of mobility.

By Propulsion

By Tonnage Capacity

By Geography

October 2025

October 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us