October 2025

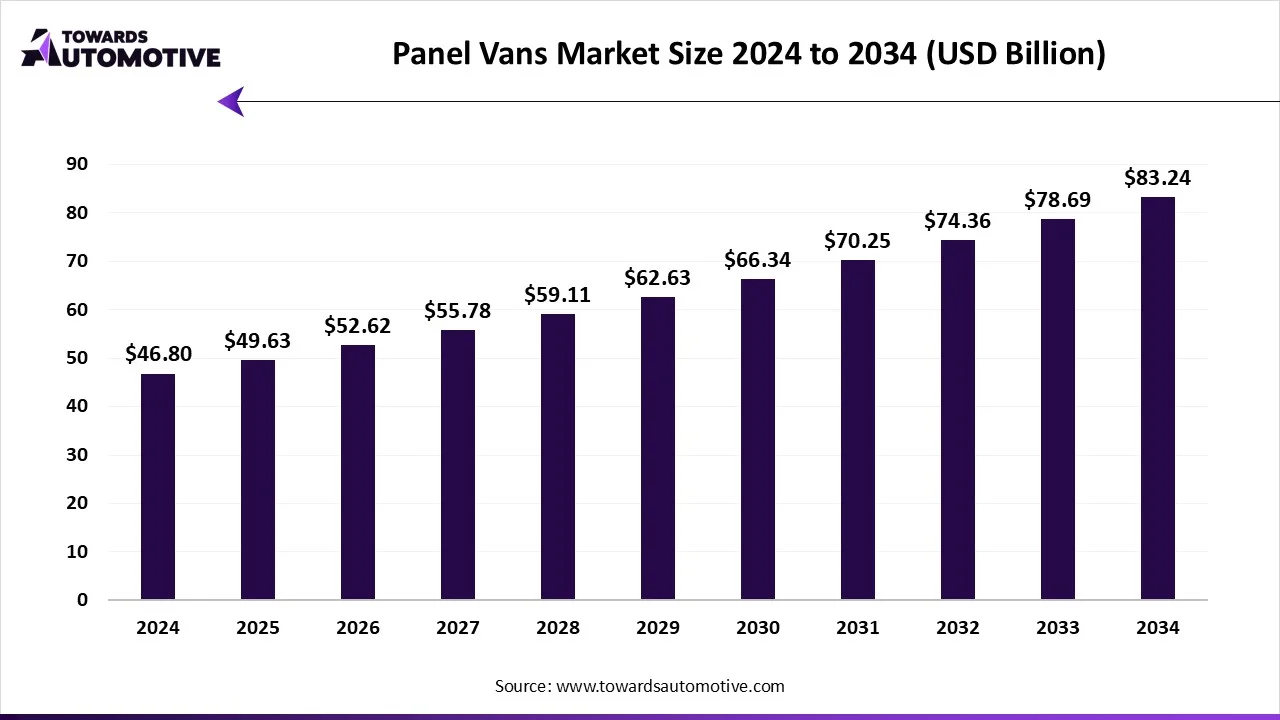

The panels vans market is projected to reach USD 83.24 billion by 2034, expanding from USD 49.63 billion in 2025, at an annual growth rate of 6.05% during the forecast period from 2025 to 2034.

The panel vans market is a crucial segment of the commercial vehicle industry. This industry deals in manufacturing and distribution of panel vans in different parts of the world. These vans are powered by different propulsion technologies including ICE, electric, hybrid and some others. It comes with various weighing capacity such as below 2 tons, 2 to 3 tons, above 3 tons and some others. The end-users of these vans consist of several sectors such as freight delivery, utility services, construction and mining, and some others. The rapid growth of the e-commerce sector in numerous developed nations such as UK, France, China and some others has contributed to the overall industrial expansion. This market is expected to rise significantly with the growth of the automotive sector around the globe.

| Metric | Details |

| Market Size in 2024 | USD 46.80 Billion |

| Projected Market Size in 2034 | USD 83.24 Billion |

| CAGR (2025 - 2034) | 6.05% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Propulsion, By Tonnage, By End Use and By Region |

| Top Key Players | Peugeot, Renault, Toyota, Fiat, Ford, Iveco |

The major trends in this market consists of partnerships, popularity of hybrid panel vans and rapid adoption of van rental services.

Several automotive brands are partnering with capital investors for developing panel vans to cater the needs of the commercial users. For instance, in February 2025, Everlectric partnered with UPD. This partnership is done for launching a new range of panel vans in South Africa. (Source: Cleantechnica)

The demand for hybrid panel vans has increased rapidly in the western nations with an aim to reduce emission. For instance, in April 2025, Volkswagen launched Multivan eHybrid 4MOTION in the UK region. Multivan eHybrid 4MOTION is a hybrid panel van equipped with a 1.5 TSI engine and DSG 4MOTION powertrain to deliver superior driving range. (Source: Theevreport.com)

The logistics companies have started adopting van rental services to enhance the delivery process in different parts of the world. For instance, in November 2024, Turo announced to launch a rental service of Mullen ONE. This service is launched for the logistics providers of the U.S. region. (Source: Service Truck)

The ICE segment generated highest revenue in this industry. The demand for ICE-based panel vans has increased rapidly in the e-commerce sector, thereby driving the market growth. Additionally, the growing adoption of CNG-based vans in developing nations such as India, Vietnam, Indonesia and some others to deduct fuel expenses is further adding to the overall industrial expansion. Moreover, continuous research and development activities by market players for developing powerful panel vans is expected to drive the growth of the panel vans market.

The electric segment is expected to rise with a considerable CAGR during the forecast period. The growing demand for eco-friendly panel vans in different parts of the world has driven the market expansion. Additionally, numerous government initiatives aimed at adopting commercial EVs along with rising development in the EV charging infrastructure is playing a vital role in shaping the industrial landscape. Moreover, rapid investment by automotive brands for developing electric panel vans to curb emission is expected to propel the growth of the panel vans market.

The freight delivery segment dominated the market. The rising trend of customized freight delivery solutions in numerous developed nations such as UK, France, the U.S. and some others has driven the market growth. Additionally, the increased adoption of electric vans for freight delivery is further contributing to the overall industrial expansion. Moreover, the growing demand for heavy-duty panel vans from the logistics sector to enhance goods transportation is expected to foster the growth of the panel vans market.

The utility services segment is expected to rise with a notable CAGR during the forecast period. The growing use of panel vans for delivering postal items has driven the market expansion. Additionally, the rising demand for hybrid panel vans from electricity departments is playing a crucial role in shaping the industrial landscape. Moreover, the rapid adoption of heavy-duty panels vans in utility departments is expected to foster the growth of the panel vans market.

Asia Pacific led the panel vans market. The growing demand for diesel-powered panel vans from the mining and construction sector in numerous countries such as India, China, Japan and some others has boosted the market expansion. Additionally, the rapid growth of the e-commerce sector coupled with rise in number of EV startups is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as Toyota, Nissan, Hyundai and some others is expected to propel the growth of the panel vans market in this region.

China dominated the market in this region. In China, the market is generally driven by the presence of well-established automotive industry along with rapid development of the e-commerce sector. Moreover, technological advancements in the logistics sector coupled with increasing awareness of people to reduce vehicular emission is further adding to the industrial expansion.

Europe is expanding with a significant CAGR during the forecast period. The rising adoption of electric panels vans in several nations such as UK, France, Germany and some others to reduce emission has boosted the industrial expansion. Also, the numerous government initiatives aimed at establishing EV charging stations coupled with rapid development in the logistics sector is positively contributing to the overall market growth. Moreover, the presence of several panel van manufacturers such as Volkswagen, Citroën, Mercedes-Benz and some others is expected to drive the growth of the panel vans market in this region.

Germany is the major contributor in this region. The growing adoption of eco-friendly panels vans in the construction sector coupled with rapid investment by government for developing the EV charging infrastructure has bolstered the market expansion. Also, the presence of prominent automotive manufacturers along with increasing trend of last-mile delivery is further adding to the industrial growth.

The panel vans market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Citroën, Peugeot, Renault, Toyota, Fiat, Ford, Iveco, Mercedes-Benz, Nissan, Volkswagen and some others. These companies are constantly engaged in developing advanced panel vans and adopting numerous strategies such as joint ventures, launches, collaborations, partnerships, business expansions, acquisitions, and some others to maintain their dominance in this industry.

By Propulsion

By Tonnage

By End Use

By Region

According to market projections, the car DVR industry is expected to grow from USD 3.40 billion in 2024 to USD 5.56 billion by 2034, reflecting a CAGR...

According to market projections, the U.S. aerial work platform (AWP) industry is expected to grow from USD 7.02 billion in 2024 to USD 12.60 billion b...

According to market projections, the locomotive industry is expected to grow from USD 8.32 billion in 2024 to USD 17.94 billion by 2034, reflecting a ...

October 2025

June 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us