September 2025

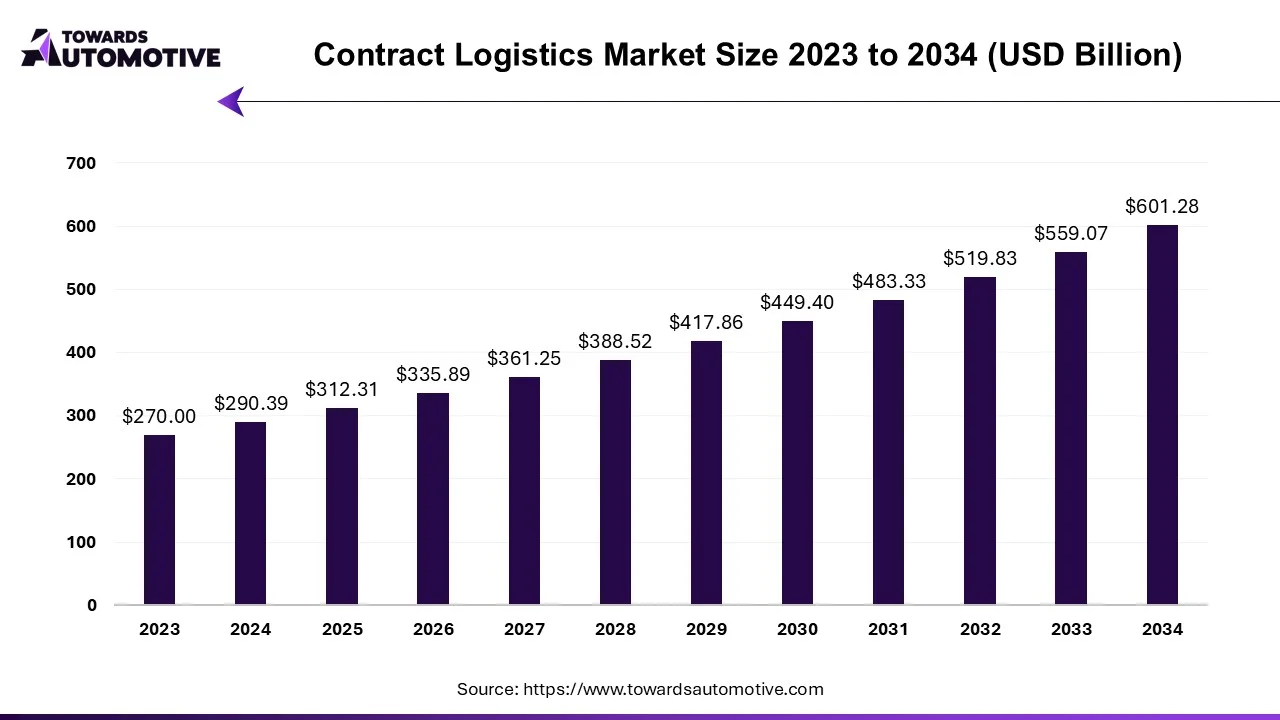

The contract logistics market is predicted to expand from USD 312.31 billion in 2025 to USD 601.28 billion by 2034, growing at a CAGR of 7.55% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The contract logistics market is a crucial segment of the logistics industry. This industry deals in providing third-party logistics services around the globe. There are several types of services delivered by this sector comprising of transportation services, warehousing services, distribution services, aftermarket logistics and some others. These logistics operations are based on different transportation modes including roadways, railways, airways, waterways and some others. The end-users of this sector consist of numerous industries such as retail and e-commerce, automotive, pharma and healthcare, industrial and manufacturing, aerospace and defense, high-tech and electronics, and some others. The rising adoption of contract logistics in e-commerce sector has contributed to the overall industrial expansion. This market is expected to rise significantly with the growth of the transportation sector across the world.

The major trends in this industry consists of partnerships, business expansions and online shopping.

Several retail companies are partnering with logistics operators to maintain the supply chain in different regions. For instance, in May 2025, GXO Logistics, Inc partnered with Toolstation. Through this partnership, GXO Logistics will deliver Toolstation’s products in Netherlands, Europe. (Source: GlobeNewswire)

Various market players are opening up new warehouses for enhancing logistics operations. For instance, in May 2025, CEVA Logistics announced to open a warehouse in Singapore. This warehouse is inaugurated to enhance logistics operation in this country. (Source: CEVA Logistics)

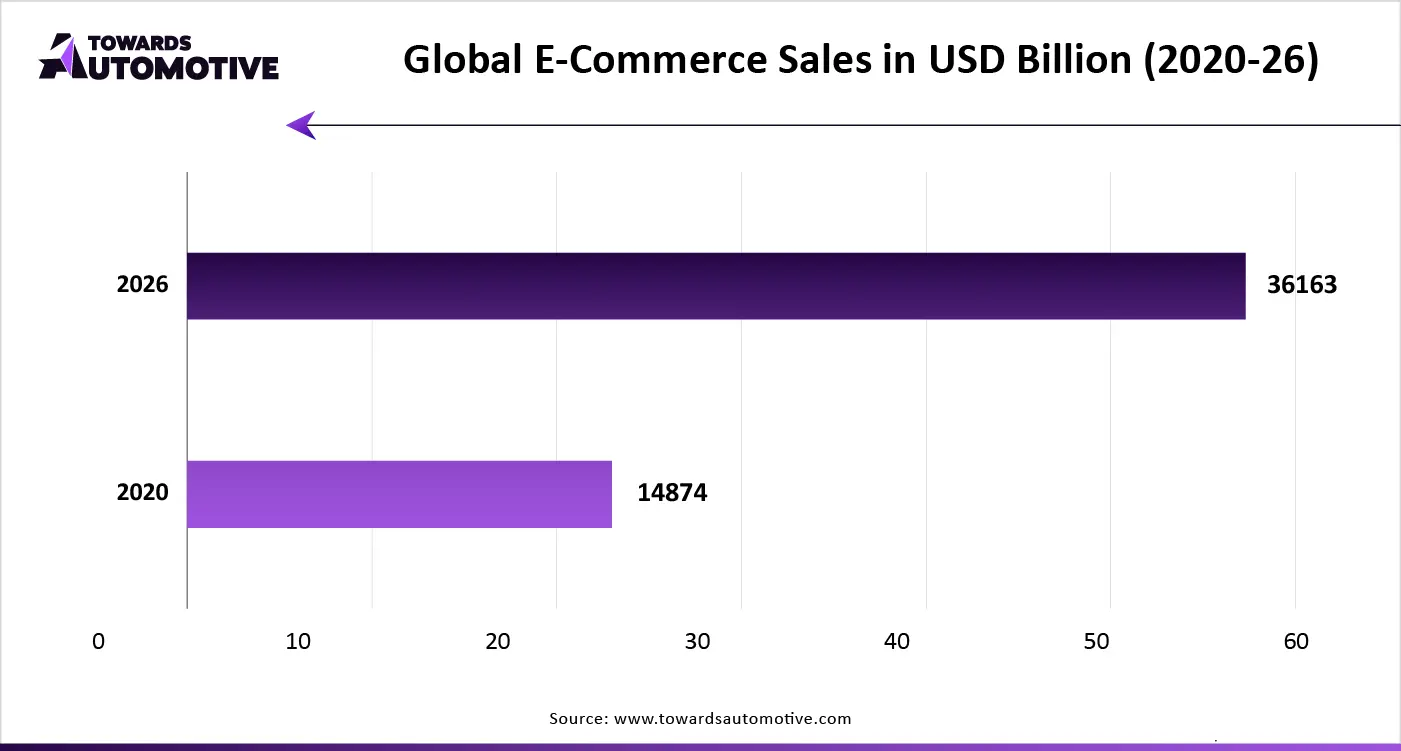

The rising consumer preference to purchase goods from online platforms has increased the demand for advanced contract logistics solutions. According to the India Brand Equity Foundation, the Indian B2B online market place is expected to reach US$ 200 billion by 2030. (Source: India Brand Equity Foundation (IBEF))

The outsourcing segment dominated this industry. The rising adoption of outsourcing logistics by e-commerce brands such as Amazon, Walmart, Ebay and some others has boosted the market expansion. Additionally, numerous advantages of these logistic services including cost-savings, flexibility, reduced overhead and some others has contributed significantly to the industrial growth. Moreover, numerous partnerships among logistics companies and healthcare brands is anticipated to foster the growth of the contract logistics market.

The insourcing segment is predicted to rise with a significant CAGR during the forecast period. The rising adoption of insourcing logistics by several aerospace companies to ensure their data security has driven the market growth. Additionally, numerous advantages of these logistic services including flexibility, improved quality, scalability, enhanced collaboration and some others is projected to drive the growth of the contract logistics market.

The roadways segment led the industry. The growing adoption of roadways for enhancing contract logistics services has boosted the market growth. Additionally, numerous government initiatives aimed at developing the road infrastructure is contributing to the industrial expansion. Moreover, several advantages of roadway-based logistics services including flexibility, accessibility, cost-effectiveness and some others is expected to boost the growth of the contract logistics market.

The airways segment is likely to grow with the fastest growth rate during the forecast period. The rising demand for high-speed logistics to deliver pharmaceutical goods such as vaccines and medicines has boosted the market growth. Additionally, rapid investment by airline companies for deploying cargo airplanes to enhance supply chain operations is likely to shape the industry in a positive direction. Moreover, numerous advantages of airway-based logistics service including superior speed, increased efficiency, enhancing cross border operations and some others is expected to propel the growth of the contract logistics market.

The retail & e-commerce segment held the largest share of the industry. The rapid adoption of e-commerce platforms for purchasing numerous types of goods such as clothes, utilities, medicines, electronics and some others has boosted the market growth. Also, numerous partnerships among e-commerce brands and logistics operators for enhancing supply-chain operations is expected to propel the growth of the contract logistics market.

The pharma & healthcare segment is projected to rise with the highest CAGR during the forecast period. The growing demand for international medicines has increased the demand for efficient logistics services, thereby driving the market growth. Additionally, numerous market players are opening up new warehouses for storing pharma products that in turn drives the growth of the contract logistics market.

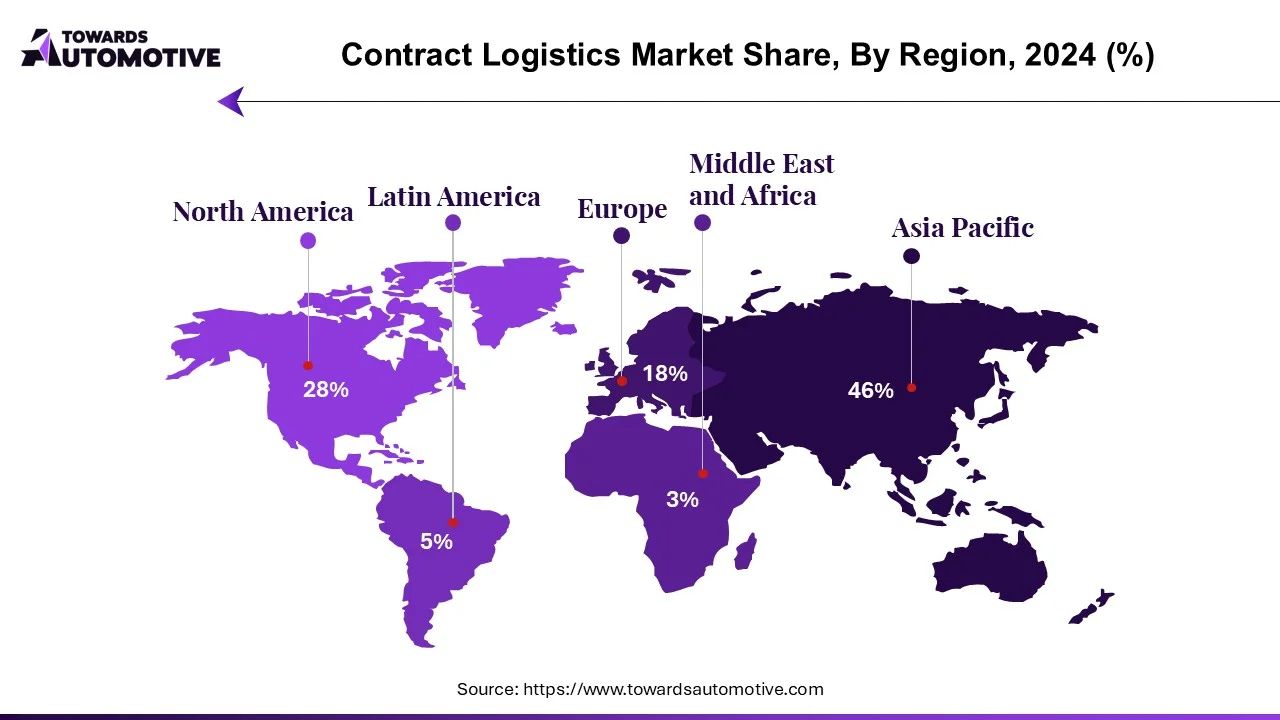

Asia Pacific held the highest share of the contract logistics market. The rising development in the pharma and healthcare sector has increased the demand for contract logistics, thereby driving the market expansion. Additionally, the rapid growth in cross border trade along with launch of new logistics services is contributing to the industrial growth. Moreover, the presence of various market players such as Blue Dart, Nippon Express, JD Logistics and some others is expected to drive the growth of the contract logistics market in this region.

China and India are the significant contributors in this region. In China, the market is generally driven by the growing adoption of contract logistics in the automotive sector along with rapid growth in the e-commerce industry. In India, the rising demand for outsourcing logistics services by pharmaceutical companies to deliver medicines has contributed to the market growth.

Europe is expected to grow with a significant CAGR during the forecast period. The growing adoption of third-party logistics services by automotive brands and aerospace companies in numerous countries such as Germany, France, UK, Italy and some others has driven the market growth. Also, the rising trend of tailored warehousing and reverse logistics in manufacturing sector is playing a positive role in shaping the industrial landscape. Moreover, the presence of numerous logistics brands such as DB Schenker, Kuehne + Nagel, DHL Supply Chain and some others is projected to foster the growth of the contract logistics market in this region.

Germany dominated this region. The rising demand for contract logistics from various end-use sectors including aerospace, electronics, automotive and some others has driven the market expansion. Additionally, the rapid adoption of automation solutions in logistics sector coupled with numerous government initiatives aimed at road infrastructure is likely to shape the industry in a positive direction.

The contract logistics market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of GXO Logistics, Inc.; United Parcel Service, Inc.; DB Schenker; DHL Supply Chain (a division of Deutsche Post AG); Kuehne + Nagel International AG; DSV A/S; Nippon Express Co., Ltd.; CEVA Logistics; GEODIS SA; Ryder System, Inc. and some others. These companies are constantly engaged in providing contract logistics services and adopting numerous strategies such as partnerships, business expansions, collaborations, launches, acquisitions, joint ventures, and some others to maintain their dominance in this industry.

By Service

By Type

By Transportation Mode

By Industry Vertical

By Region

September 2025

August 2025

August 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us