October 2025

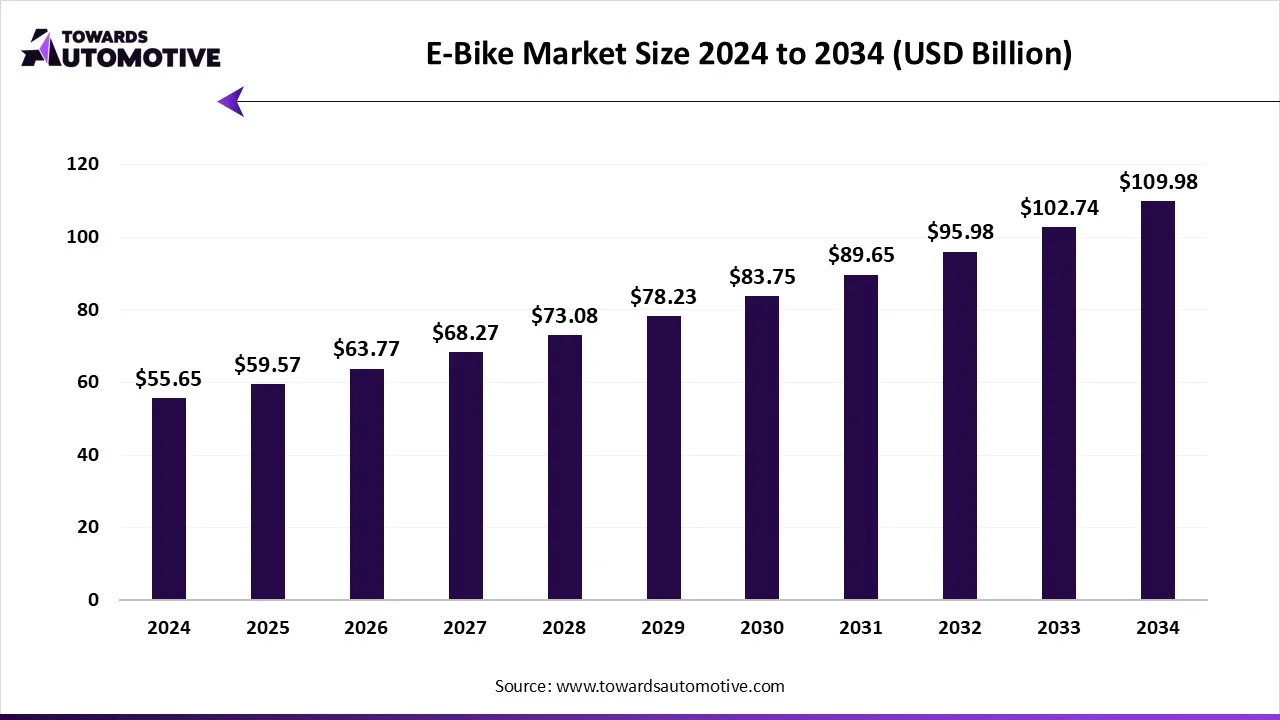

The e-bike market is anticipated to grow from USD 59.57 billion in 2025 to USD 109.98 billion by 2034, with a compound annual growth rate (CAGR) of 7.05% during the forecast period from 2025 to 2034. The e-bike market is experiencing rapid growth due to the growing demand for cost-effective and sustainable forms of transport. Countries around the world are also supporting this shift to green mobility with subsidies for e-bike purchases or cost-free incentives to use e-bikes alongside bike-friendly regulations. Moreover, with the growing costs of transport fuels, cities are starting to feel the impacts of the cost of commuting, traffic congestion, and growing demand for e-bike deliveries, making it an easier solution.

The new battery technology, including lithium-ion and newer solid-state battery designs, in addition to better battery utilization of energy-efficient technology, is making e-bikes lighter, faster, and able to support longer distances. Additionally, the societal shift towards health improvement has also supported greater demand for e-bikes, as e-bikes support a blend of physical activity and transport solutions. In addition to this, the phenomenal growth in consumer and businessvehicle rental, including e-bike rental, and the delivery and logistics sector using e-bikes, is contributing to the rapid adoption of e-bikes.

The e-bike market refers to the global industry focused on the design, manufacturing, distribution, and adoption of electric bicycles equipped with an integrated electric motor and rechargeable battery system to assist or fully power pedaling. These bikes cater to commuting, leisure, cargo, and sports applications, and are gaining traction as a sustainable mobility solution. The market includes pedal-assist (pedelec) and throttle-based e-bikes, powered by various motor and battery technologies, available across online and offline retail channels. Key drivers in the market include rising urbanization, increasing demand for eco-friendly transportation, advancements in battery technology (lithium-ion, solid-state), and the growth of bike-sharing platforms. Government incentives promoting green mobility and heightened consumer awareness of health and environmental sustainability are further boosting market expansion.

Moreover, the e-bike market is also shaped by evolving lifestyles and evolving consumer requirements. In recent times, there has been an increasing number of consumers choosing e-bikes over cars for short and medium trips, so as to reduce time in traffic jams and reduce excess fuel expenses. There is also an increase in the use of cargo e-bikes used by delivery companies and logistics providers as a faster, cleaner means for city deliveries. Additionally, the tourism and outdoor recreation sectors use tours aboard e-bikes for guided tours and adventure riding. Various digital technologies have also enhanced the versatility of e-bikes, such as GPS tracking, mobile applications, and smart displays, which help to enhance e-bike value.

The trends in the e-bike market are collaboration and product launches.

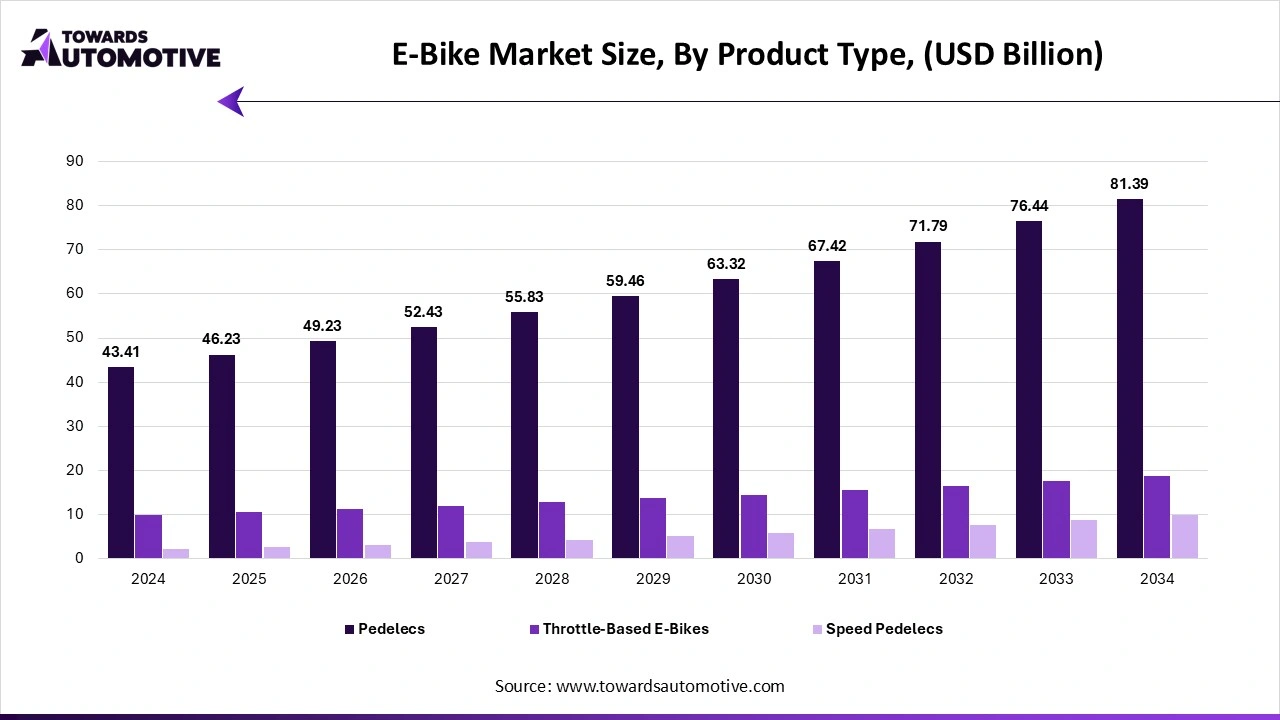

The pedelecs (pedal-assist) segment led the e-bike market as this model provides a similarity to their biodynamic riding style, through the combination of human-powered pedaling with motor power. This design offers improvement in battery life since the pedal-assist system isn't controlled solely by the motor. Also, many customers are more favorable towards pedelecs than throttle-driven e-bikes because pedelecs are sanctioned for use in bike lanes without additional licensing requirements. Moreover, the pedelecs dominate the market due to affordability, efficiency, and their developed popularity in everyday cycling measures, making this form of transportation attractive for urban commuters, university students, and office workers, for exercise and expediency.

The speed pedelecs segment is expected to be the fastest-growing segment in the e-bike market due to their capabilities to provide higher speed-limit riding, often to 45 km/h. Speed pedelecs are famous among long-distance commuters looking to save time in traffic. As cities move to promote more green forms of commuting, many professionals are choosing speed pedelecs as a method of commuting that is fast, green, and much more economical than travelling by car or taxi services. The continuing growth of the significant infrastructure that supports the high-speed e-bike has contributed to their rising adoption and subsequently contributed to their rapid growth in the e-bike market.

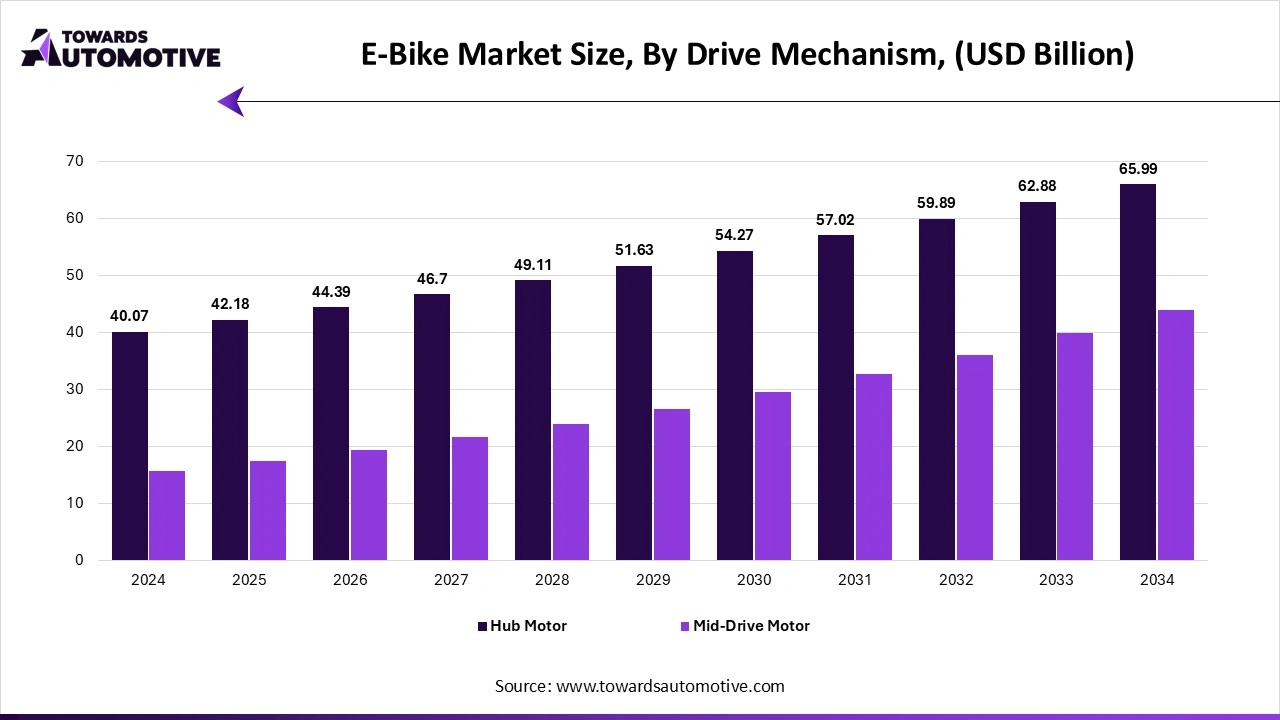

The hub motor segment dominated the e-bike market. Hub motors currently dominate the electric bike market as they are easy to design, cheaper, and require minimal maintenance. Hub motors are easy to build into the wheels of the bike, making the bike less expensive and more lightweight than a mid-drive system. Hub motors are great for more casual riders or travelers as they can rely on their performance and don't have to deal with overly technical maintenance of mid-drive systems. They also can be designed to run without mechanical noise and provide good overall acceleration characteristics. Because of all of these benefits, they continue to be the go-to motor for entry class e-bikes and mass-the market e-bikes across the globe.

The mid-drive motor segment is expected to be the fastest growing segment in the market. Mid-drive motors are rapidly becoming the popular option as they have better performance, balance, and efficiency compared to hub motors. Since they are positioned and weight centered at the crank of the bike, they are the best location for balance, creating a very stable platform. The experience a rider gets includes better torque to go up steep roads and in off-road conditions than a hub motor can provide. This torque allows a rider to get up steep hills and make off-road rides more realistic. Mid-drives are also more efficient thus extending operating cycles. The e-bike community is demanding higher performance and premium e-bikes to use for sports and adventure purposes and mid-drives are the norm and the preferred choice. This shift will allow the e-bike market and mid-drive motor share to experience rapid growth.

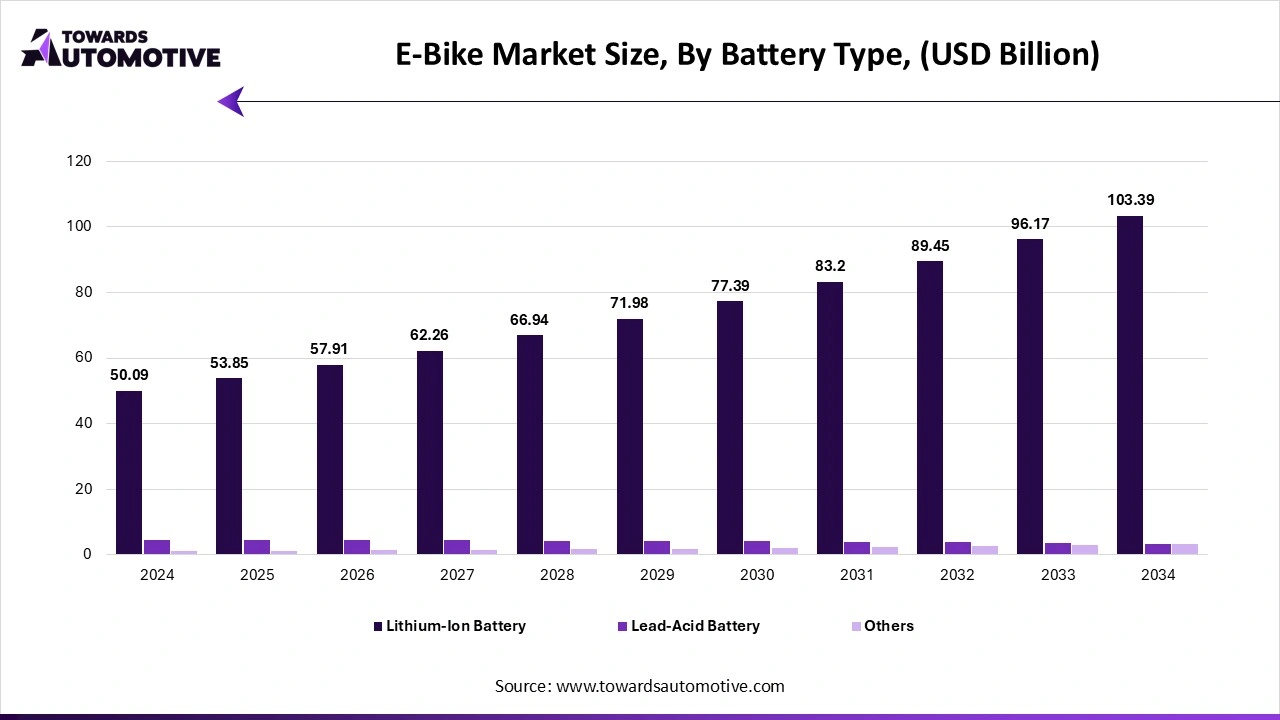

The lithium-ion battery segment captured the largest share of the e-bike market as they are lighter, last longer, and have a greater energy density, which allows e-bikes to travel longer distances on a single charge. They also charge faster and are effectively better than previous batteries as well, resulting in lower costs over the long term. As battery technology improves, prices have continued to fall, so lithium-ion batteries are now being mass-produced and sold at an affordable price. In summary, the above benefits of these types of batteries have led many manufacturers of e-bikes to adopt them for most of the standard power sources they offer.

The solid-state & advanced lithium battery segment is expected to grow at the fastest rate in the forecasted period. Solid-state and advanced lithium batteries also have advantages over traditional lithium-ion batteries with faster charging, greater energy efficiency, longer life span, and increased safety, which involves battery overheating or catching fires. Additionally, with solid-state and advanced lithium batteries being able to store a greater amount of energy for a given size, they can still function when used for longer-range e-bikes. The increase in speed of advancements in this area of battery technology due to increased funds being spent by several companies on advanced battery research, development, and commercialization advances the solid-state and advanced lithium batteries segment to be the fastest-growing segment in the market.

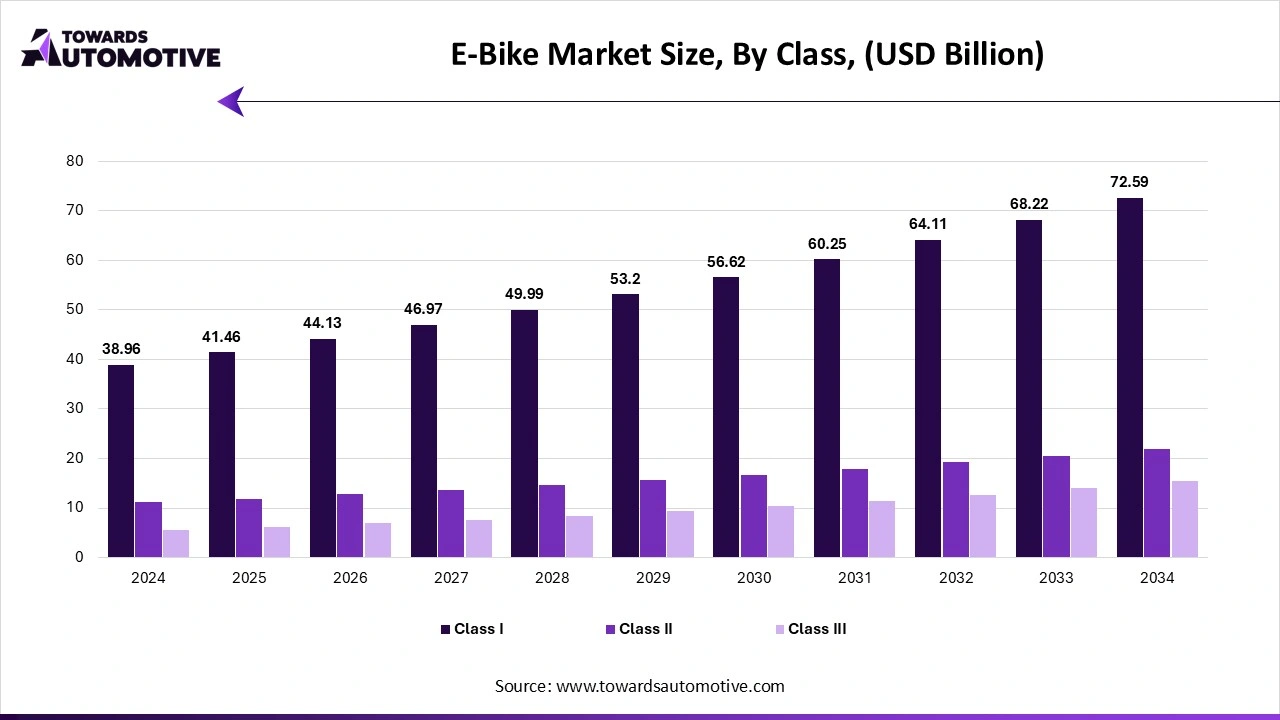

The class I segment dominated with the highest market share in the e-bike market, as these e-bikes offer pedal-assist only and are typically capped at slower speed limits, and therefore legal for the owner to use nearly everywhere without any special licensing requirements. Also, the style of riding is less complicated in general for commuters. Many governments even support Class I e-bikes as safe and environmentally friendly models to promote, which makes Class I e-bikes emerge in more countries worldwide.

The class III segment is expected to be the fastest-growing segment in the forecasted period. Class III e-bikes provide higher speeds, which go up to 28 mph (45 km/h), and these e-bikes are proving to be popular these days for commuters and urban professionals commuting medium to longer distances. They offer quicker travel times, which is quite effective and better than some vehicles, and the continued growth of urban cycling infrastructure and facilities is a good sign for those using higher-speed e-bikes. Moreover, those seeking cheap options to fuel efficient or green vehicles are also choosing to purchase Class III eco-friendly e-bikes.

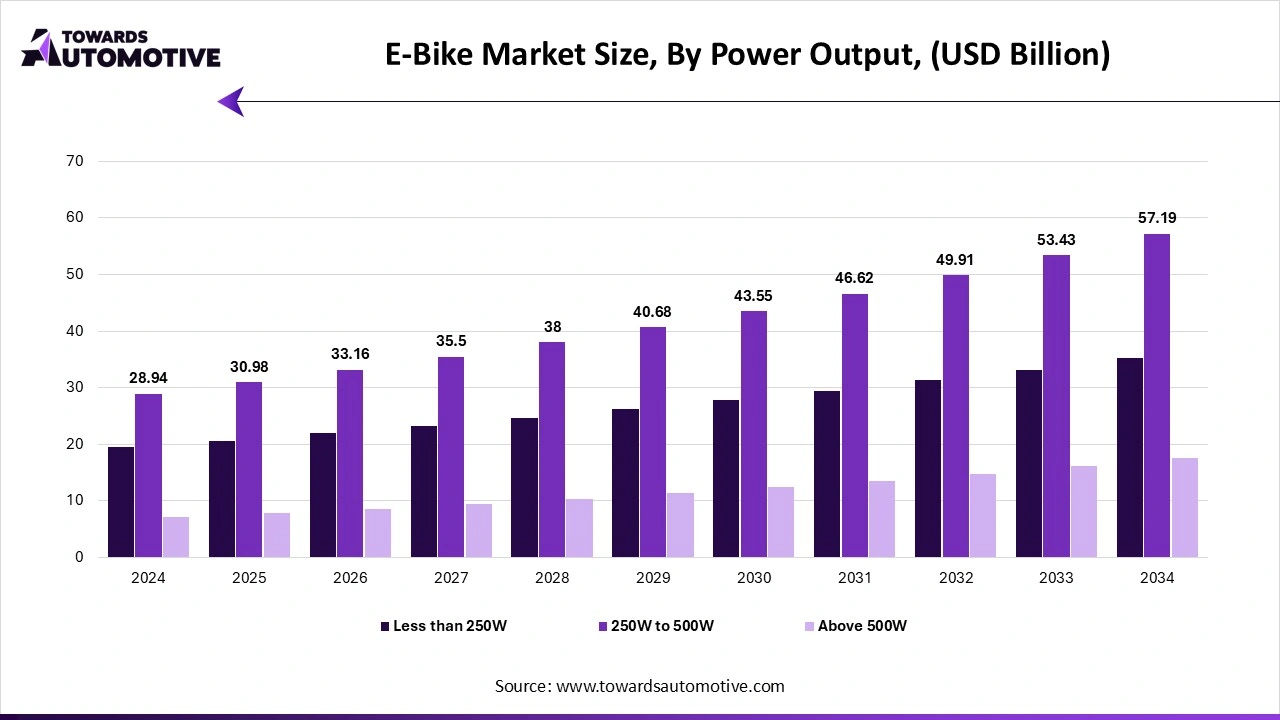

The 250W to 500W segment dominated the e-bike market due to the overall suitability of the key performance indicators balanced against price. This power output range offers enough performance for city commuting, light cycling, and everyday transport needs. The vast majority of bikes also accommodate e-bike regulations around the world, which typically designate 250W or 500W limits on maximum allowable motor powers. Moreover, these bikes built under these specifications also tend to be the lightest, which is the reason why riders choose this power output range in both developed and developing markets.

The above 500W segment is expected to grow at the fastest rate in the market. E-bikes with motor or watt outputs above 500W are growing fast as they appeal to riders requiring extra power for steep climbs, heavy loads, and long-distance rides. This is especially true for cargo bikes, adventure riding, and off-road. Additionally, there is demand for high-performance e-bikes that can replace a motorcycle or scooter. There is a growing interest in sport e-bikes and utility e-bikes. All of this increases the demand for powerful motors as the market grows in this segment.

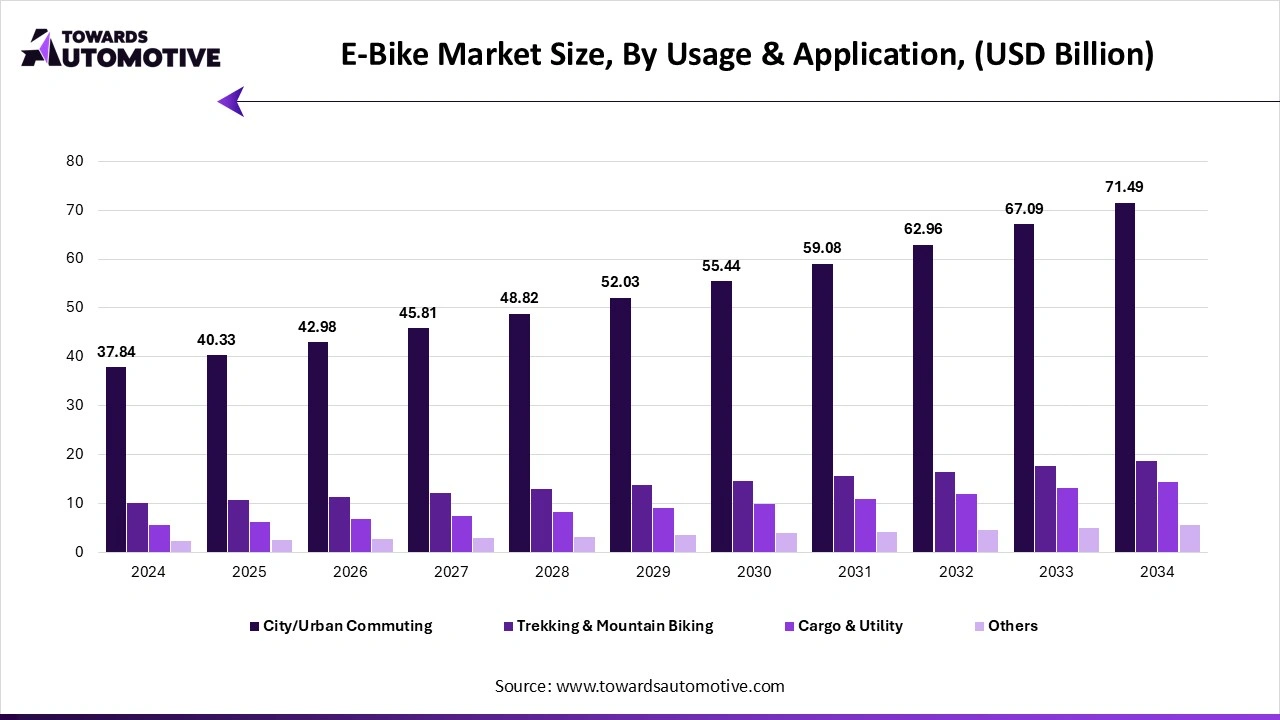

The city/urban commuting segment led the e-bike market. City and urban commuting is the most popular segment in the market because e-bikes provide a quick, efficient mode of daily transport in increasingly crowded urban environments. E-bikes can ease commuting times, bypass growing congested roadways, and allow users to save on fuel costs. Current environmental concerns are getting local and state governments to invest in bicycle infrastructure and provide funding support, making it easier for commuters to choose e-bikes. Moreover, e-bikes are booming among urban workers and students due to their convenience and affordability for city/urban commuting.

The cargo & utility segment is expected to be the fastest-growing segment in the market. Cargo and utility e-bikes are the fastest-growing segment because they facilitate last-mile delivery. The logistics, food delivery, and retail industries are using cargo e-bikes to save on fuel costs while also decreasing their carbon footprint. Moreover, cargo e-bikes are becoming more critical to logistics and e-commerce businesses as urban delivery services expand. The adoption of e-bikes for both personal leisure use and commercial use is growing exponentially.

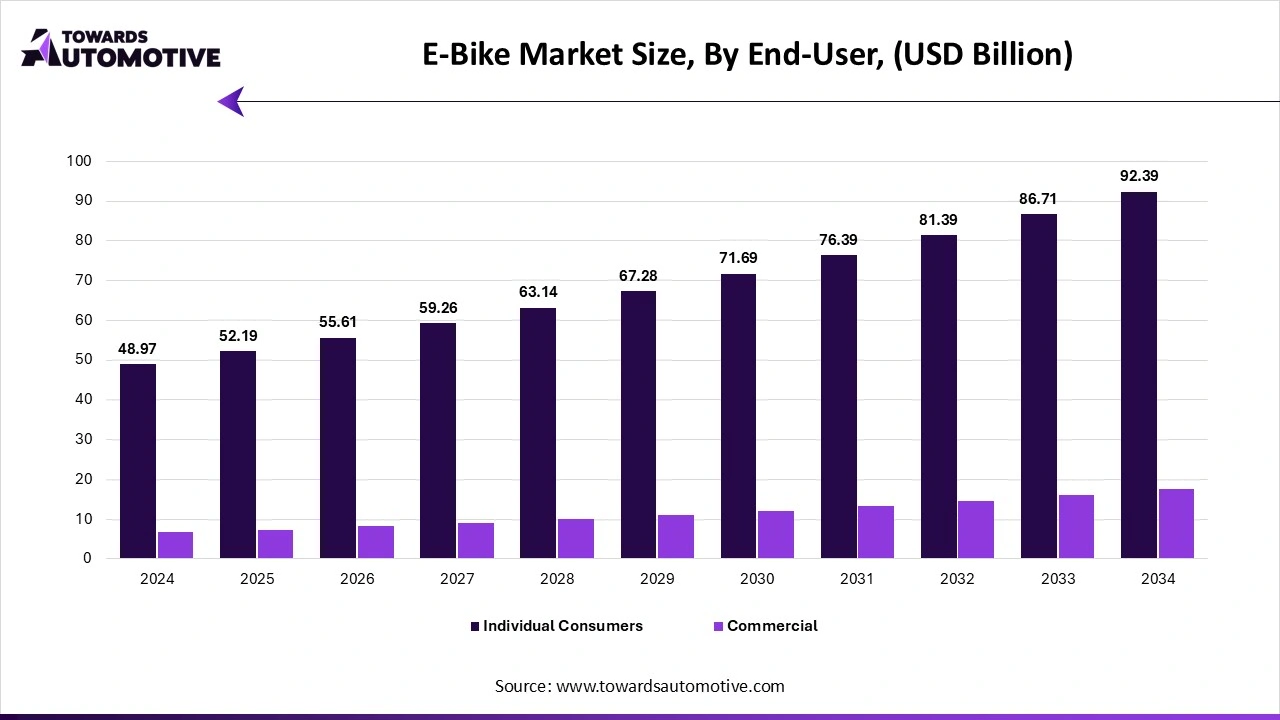

The individual consumers segment captured the largest share in the e-bike market. The retail consumer segment of the e-bike market dominates the market as consumers primarily utilize e-bikes for commuting to work/school, fitness, and leisure activities. Unlike other passenger vehicles, e-bikes provide a relatively inexpensive, sustainable way to travel in urban distances, and there is a growing interest in using e-bikes as a function of overall health and a better understanding of sustainability. The universal ease of use and financial incentives from governments in some countries can serve as an effective reason to adopt an e-bike lifestyle.

The commercial use segment is expected to be the fastest-growing segment in the forecasted period. The commercial consumer portion of the e-bike market is significantly expanding as companies are increasingly adopting e-bikes for the purposes of deliveries, rentals, and shared mobility services. E-bikes attract businesses by lowering the cost of transportation and providing reduced emissions, but also improve overall travel time in congested urban areas. The vendors driving this market trend are food delivery services, courier services, and shared e-bike services. In summary, the overall market for the e-bikes commercial segment is expected to grow at the fastest rate, due to government support for sustainable logistics and companies looking to improve on sustainability.

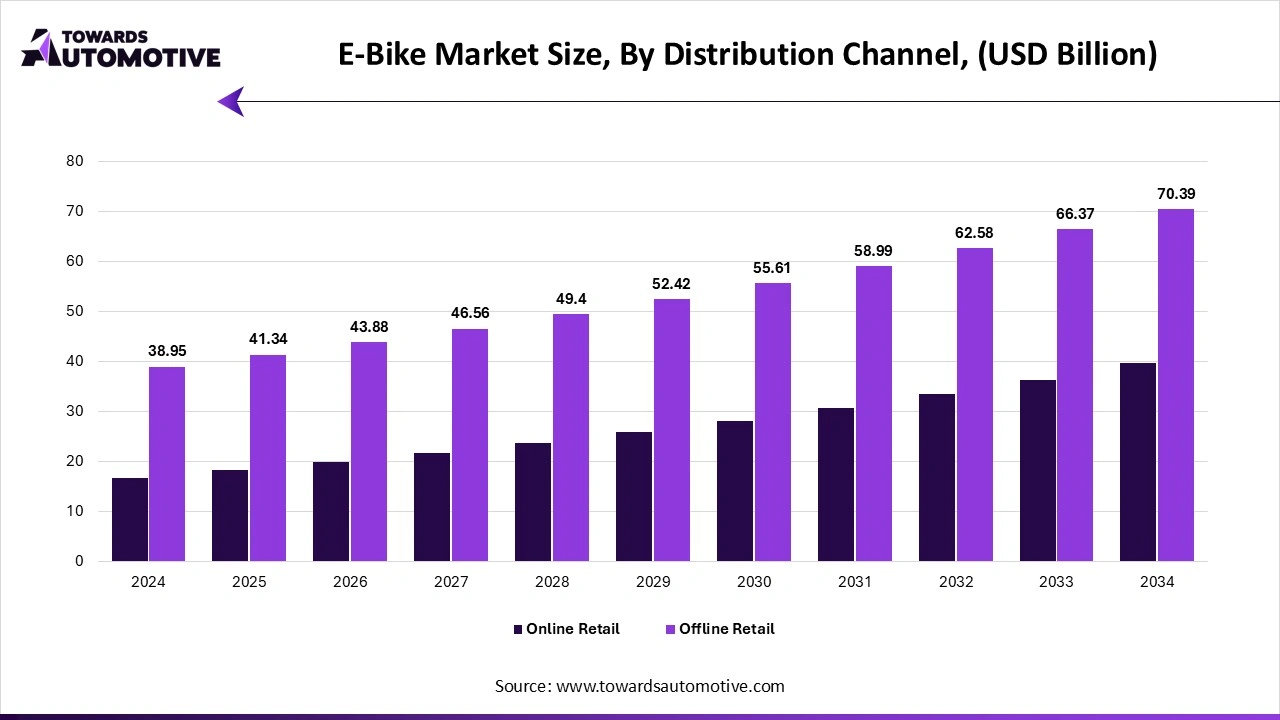

The offline retail segment dominated the e-bike market. Offline retail remains the preferred sales channel, since many consumers prefer to test ride an e-bike before purchase. Physical shops allow customers to cross-compare models, quickly retrieving answers to any questions, and ensuring that after-sales service is direct and accessible. In addition, many e-bike buyers are new to e-bikes and demand expert advice prior to purchasing, and this is satisfied with offline channels. Furthermore, retail shops often assist the customer in servicing and repairs, including battery assistance, and they are a reliable point of contact when customers need assistance.

The online retail segment is expected to grow at the fastest rate in the forecasted period. Online retail has been increasing rapidly, as it has the widest choice of products available, discounts, and convenience, as products can be delivered directly to the purchaser's home. Consumers are becoming increasingly comfortable with, and are generally willing to purchase, high-value items online, including e-bikes. Some factors, such as detailed product descriptions, evaluative reviews, financing options, and others available on the e-commerce platform, also ease the purchase. Moreover, the rise of direct-to-consumer e-bike brands that sell online has also contributed to growth. Therefore, as internet penetration and digital payments continue to increase, the number of online sales of e-bikes will rapidly increase.

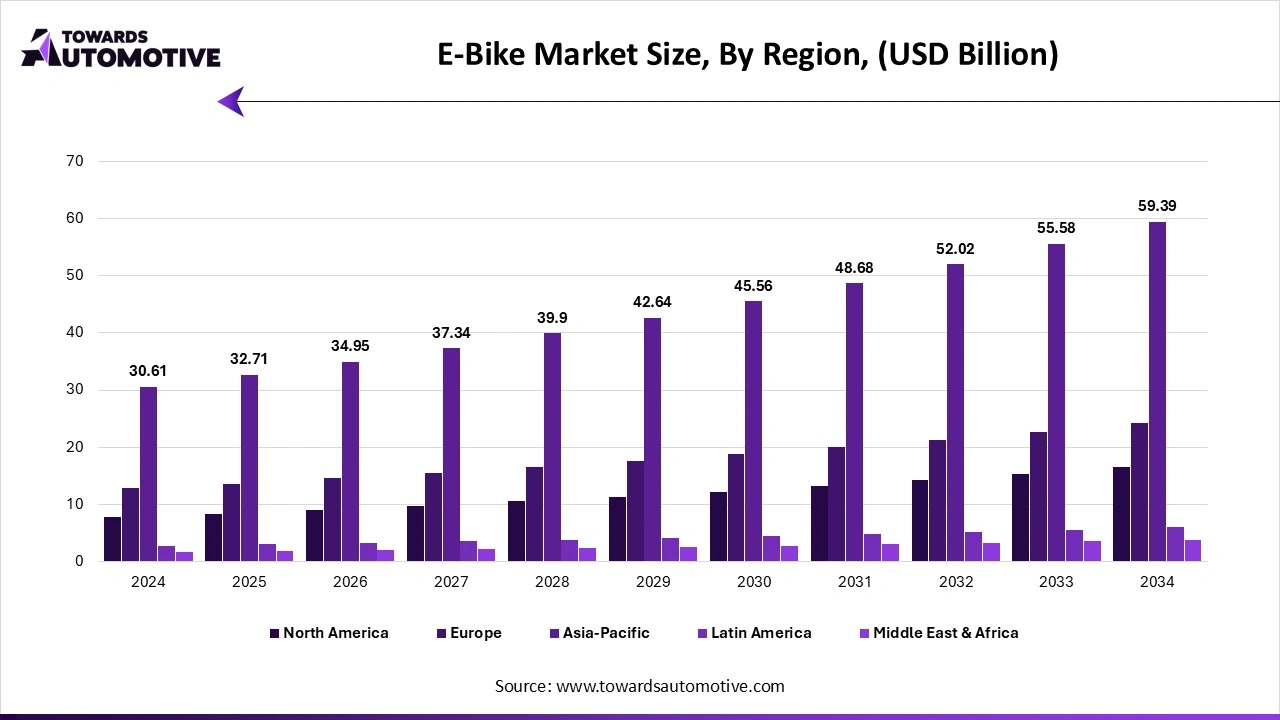

The Asia-Pacific region dominated the e-bike market due to very large urban populations in several countries. More traffic, reducing air quality, and increasing costs for fossil fuels are making e-bikes the transportation mode of choice for many consumers travelling for daily life purposes. The governments in these countries also support electric mobility through subsidies for both purchasing electric bikes and cycling activity by creating cycling-only lanes, and some encourage the added manufacturing work. The possibilities in this region for the application of e-bikes also include extending logistics using cargo e-bikes for last-mile deliveries, building battery-swap stations, and launching smart-app ride services. With strong manufacturing, growing consumer intent to adopt e-bikes, government support, and other favorable factors, the Asia Pacific region is the largest market for e-bikes.

China is the primary market for e-bikes in the Asia Pacific due to a high urban population and increasing pollution in urban areas. They are an important mode of transport in terms of personal choice. Additional factors include government support with subsidies and laws in place on fuel-based scooters, as well as the presence of leading battery and motor manufacturers in China that lower unit costs and increase exports. China has developed a strong infrastructure for e-bikes, including charging points and bike lanes. E-bikes are also widely used by delivery service companies for last-mile logistics, increasing demand and support for these products. Because of both the domestic use of e-bikes and heavy export to other countries, China has the most influence and plays a leading role in the current development and shaping of the regional e-bike market.

Europe is the fastest-growing e-bike market due to strong administration and environmental policy. Many countries are installing cycling lanes in urban settings, with government support and subsidies. Increased health awareness has opened the door to promote cycling as part of a clean commuting strategy, and urban travel, and leisure is also expanding due to higher fuel prices, leading to crowded cities and other development challenges. Moreover, tourists and outdoor enthusiasts are driving demand for mountain bikes and trekking e-bikes. The market opportunities include high-end or performance e-bikes, cargo e-bikes for urban freight logistics, and smart connected bikes enabled with GPS and trackable functions. In addition, with government support coupled with a growing eco-awareness among the people, Europe is expected to grow at a rapid pace in the adoption of e-bikes in the global market.

Germany dominates the European e-bike market due to its strong cycling culture, influenced by government incentives and advanced manufacturing capabilities. German companies are focused on quality engineering, in particular mid-drive motors and premium battery systems. The German government is one of several governments throughout Europe that is creating a legal framework for e-mobility and providing tax incentives or PRA to encourage mobility businesses and green commuting options. Many German cities are prime examples of cycling infrastructure, paving the path to using everyday applications for the daily commuter and recreational cycling. Both consumers and companies within the mobility space (such as logistics and rental services) are adapting to e-bikes and are now rapidly adopting them. Furthermore, Germany is also a large exporter of premium e-bikes. In summary, due to an established cycling culture rooted in sustainability, innovation, and increased consumer adoption, Germany dominates the European e-bike market.

The raw material required in making e-bike components are aluminum, steel, and carbon fiber for frames, lithium, nickel, and cobalt for batteries, and copper for motors and wiring.

The components required in the e-bikes are electric motors, batteries, controllers, sensors, brakes, and gear systems.

The frame, batteries and motor & wiring are assembled for the production of e-bikes.

| December 2024 | Announcement |

| Daniel Wolde-Giorgis, Head of Brose E-Bike | Our collaboration with Waldbike has always been based on mutual appreciation. We are therefore very happy that it will continue in the coming years. The company's philosophy of quality and sustainability is a perfect fit for us and our products manufactured in Germany. All this makes Waldbike an ideal partner for the market launch of the new Brose system. |

| April 2025 | Announcement |

| Ferdinando Sorrentino, CEO of SEG Automotive. | We are committed to our vision: we are the motor for the mobility of today and tomorrow, Together, Octagon and SEG Automotive will not only create solutions for new e-bikes but also pioneer refurbishment initiatives for the second-hand market, reinforcing our shared commitment to sustainability and the circular economy. |

| November 2024 | Announcement |

| Philippe Roy, a representative of UNIVELO | AIMA’s strength as a global leader in electric two-wheelers is evident in their product quality and innovation. We are thrilled to introduce their world-class e-bikes to the Canadian market, helping shape the future of sustainable transportation. |

| January 2025 | Announcement |

| Agustin Guilisasti, CEO & Co-Founder of Forest | We are delighted to announce our strategic partnership with Bird Global, opening access for its five million users to Forest bike share services. This collaboration represents a powerful step toward unifying the fragmented micro-mobility market, demonstrating the potential of innovation to drive sustainable change. By making it easier for visitors to London to experience the city like locals, we aim to boost the share of daily trips made by bike and magnify the transformative benefits of shared travel for communities and the environment. |

The e-bike market is highly competitive. Some of the prominent players in the market are Giant Manufacturing Co. Ltd., Trek Bicycle Corporation, Yamaha Motor Co. Ltd., Pedego Electric Bikes, Accell Group N.V., Merida Industry Co. Ltd., Rad Power Bikes LLC, Specialized Bicycle Components Inc., Bulls Bikes GmbH, Haibike GmbH, Riese & Müller GmbH, VanMoof BV, Cannondale Bicycle Corporation, Scott Sports SA, and Brompton Bicycle Ltd. These companies are constantly investing heavily in product innovation, supply-chain control, and new business models to gain market dominance. Additionally, these companies are developing advanced motors and lightweight systems. Opportunities for companies arise in the expansion of their businesses into untapped regions where e-bikes can revolutionize mobility.

By Product Type

By Drive Mechanism

By Battery Type

By Class

By Power Output

By Usage/Application

By End-User

By Distribution Channel

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us