September 2025

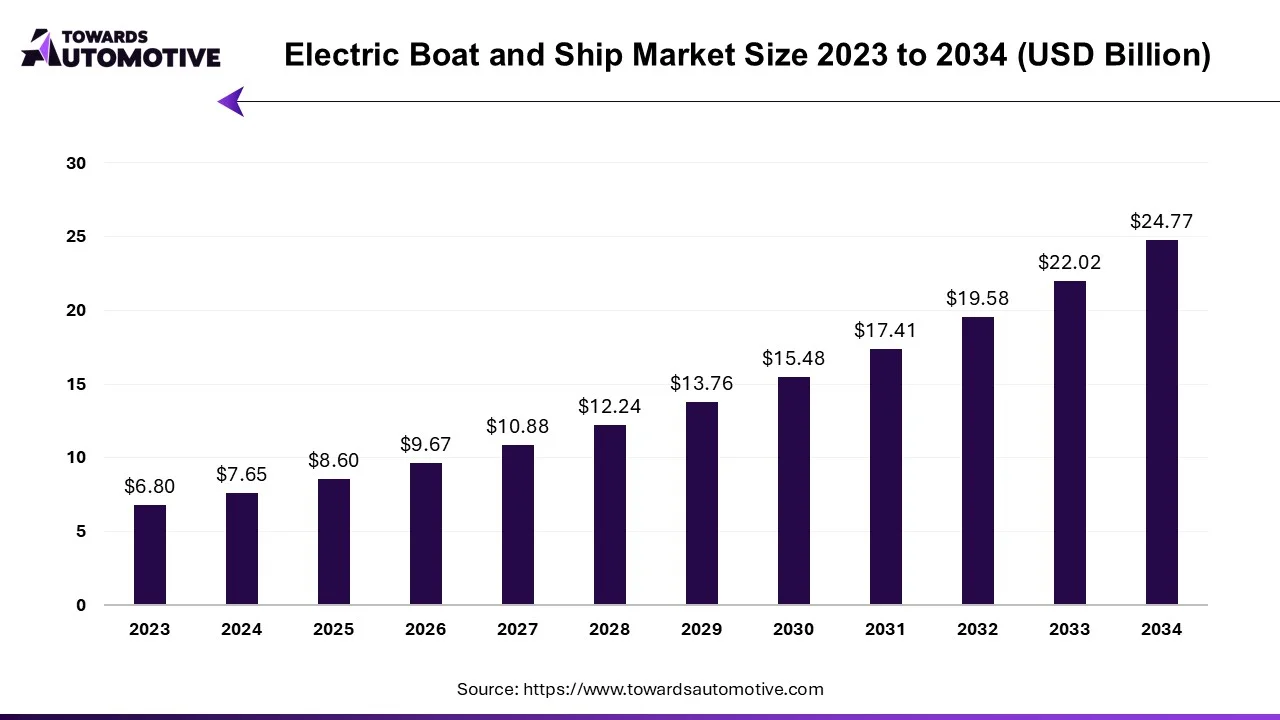

The electric boat and ship market is projected to reach USD 24.77 billion by 2034, expanding from USD 8.60 billion in 2025, at an annual growth rate of 12.47% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The electric boat and ship market is a crucial branch of the ship-building industry. This industry deals in developing electric boats and ships in different parts of the world. There are several types of vessels developed in this sector comprising of electric boats, electric ferries, electric cargo ships, electric yachts and some others. These vessels are powered by different power sources consisting of battery electric, hybrid electric, fuel cell electric and some others. It finds application in various sectors including passenger transportation, freight transport, leisure activities, research & surveys and some others. The end-user of this sector comprises of commercial, government, recreational and some others.

| Metric | Details |

| Market Size in 2024 | USD 7.65 Billion |

| Projected Market Size in 2034 | USD 24.77 Billion |

| CAGR (2025 - 2034) | 12.47% |

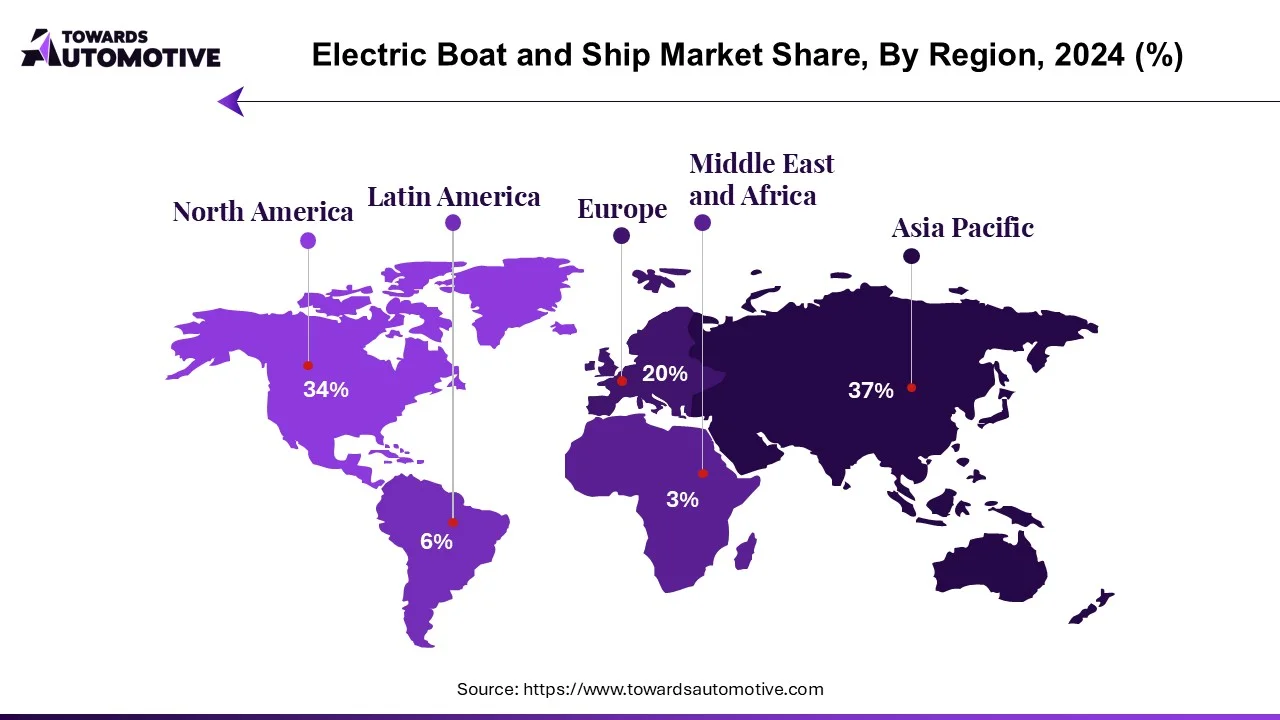

| Leading Region | North America |

| Market Segmentation | By Vessel Type, By Power Source, By Application, By End Use and By Region |

| Top Key Players | ABB, Siemens, Schottel, X Shore, Energica Motor Company, General Electric |

The major trends in this industry consists of technological advancement in propulsion system, luxury motorboat, partnerships and some others.

The boating industry is rapidly gaining traction due to the rapid technological advancements in propulsion systems. For instance, in March 2024, Ingenity Electric launched mCrate electric propulsion system. This propulsion system is designed for modern electric boats. (Source: CHARGED)

The popularity of luxury boats among elite-class people has gained traction in recent times that enabled companies to develop luxury boats based on electricity. For instance, in May 2025, Arc launched Arc Sport. Arc Sport is a luxury electric boat designed for the consumers of the U.S.(Source: Electrek)

Several market players are partnering with each other for developing electric boats to maintain sustainability. For instance, in June 2024, Microvast Holdings, Inc partnered with Evoy. This partnership is done for developing advanced electric boats. (Source: Microvast Holdings, Inc.)

The electric boats segment held the largest share of the market. The growing demand for eco-friendly water transportation has increased the demand for electric boats, thereby driving the market growth. Additionally, numerous government initiatives aimed at lowering marine emission is further contributing to the overall industrial expansion. Moreover, rapid investment by electric startups for developing solar-powered electric boats is anticipated to propel the growth of the electric boat and ship market.

The electric cargo ships segment is anticipated to rise with a notable CAGR during the forecast period. The rising application of merchant ships for transporting goods in different ports has boosted the market growth. Additionally, the growing proliferation of e-commerce sector along with rapid growth in cross-border trade is likely to shape the industry in a positive direction. Moreover, numerous partnerships among logistics companies and ship builders for deploying electric cargos to enhance logistics operations is projected to drive the growth of the electric boat and ship market.

The battery electric segment led the market. The growing popularity of electric yachts among elite-class businessmen to arrange on-the-go meetings has boosted the market growth. Additionally, the increasing emphasis on developing advanced propulsion systems for electric boats and electric ships is further contributing to the industrial expansion. Moreover, rapid investment by battery manufacturers for developing high-quality boat batteries is expected to propel the growth of the electric boat and ship market.

The hybrid electric segment is likely to grow with the highest CAGR during the forecast period. The growing demand for eco-friendly marine transportation has contributed to the market growth. Additionally, technological advancements in hybrid propulsion systems along with rapid adoption of plug-in hybrid vessels for cargo operations is further contributing to the industrial expansion. Moreover, the increasing demand for hybrid boats to enhance crew transportation is likely to foster the growth of the electric boat and ship market.

The passenger transport segment held the largest share of the industry. The growing adoption of electric boats for transporting passengers in short distances has boosted the market growth. Also, numerous fleet operators are deploying hybrid vessels to operate long-distance passenger commute, thereby fostering the industrial expansion. Moreover, partnerships and collaboration among ship builders to develop advanced electric ships with high passenger carrying capacity is anticipated to foster the growth of the electric boat and ship market.

The leisure activities segment is projected to grow with a considerable CAGR during the forecast period. The growing demand for luxurious marine transportation in several developed nations such as UK, the U.S., France, New Zealand, Australia and some others has boosted the market growth. Additionally, the increasing demand for electric yachts among elite-class consumers to enhance leisure experiences is likely to shape the industry in a positive direction. Moreover, rapid investment by market players for developing luxurious hybrid ships and electric boats is projected to drive the growth of the electric boat and ship market.

North America held the highest share of the electric boat and ship market. The growing demand for eco-friendly marine transportation in several countries such as the U.S. and Canada has boosted the market expansion. Also, numerous government initiatives aimed at lowering emission along with technological advancements in ship-building industry is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as General Dynamics Electric Boat (GDEB), Vision Marine Technologies, ElectraCraft Power Boats and some others is expected to boost the growth of the electric boat and ship market in this region.

U.S. dominated the market in this region. The growing adoption of electric boats along with technological advancements in shipbuilding sector has driven the market growth. Additionally, rapid deployment of hybrid vessels in the logistics sector coupled with presence of several local brands such as Duffy Electric Boat Company and Hinckley Yachts is driving the industrial expansion.

Asia Pacific is expected to grow with a significant CAGR during the forecast period. The growing development in the shipbuilding sector in several countries such as India, China, Japan, South Korea and some others has driven the market growth. Additionally, the rising adoption of electric cargos in the logistics sector along with rise in number of corporate businessmen is likely to shape the industry in a positive direction. Moreover, the presence of several electric boat manufacturers such as Navalt, Far East Boats, Tokyo Kisen and some others is anticipated to drive the growth of the electric boat and ship market in this region.

China and India are the major contributors in this region. In China, the market is generally driven by the presence of well-established shipbuilding industry along with technological advancements in battery manufacturing sector. In India, the growing demand for eco-friendly marine transportation coupled with rise in number of startup brands dealing in electric boats has driven the market growth.

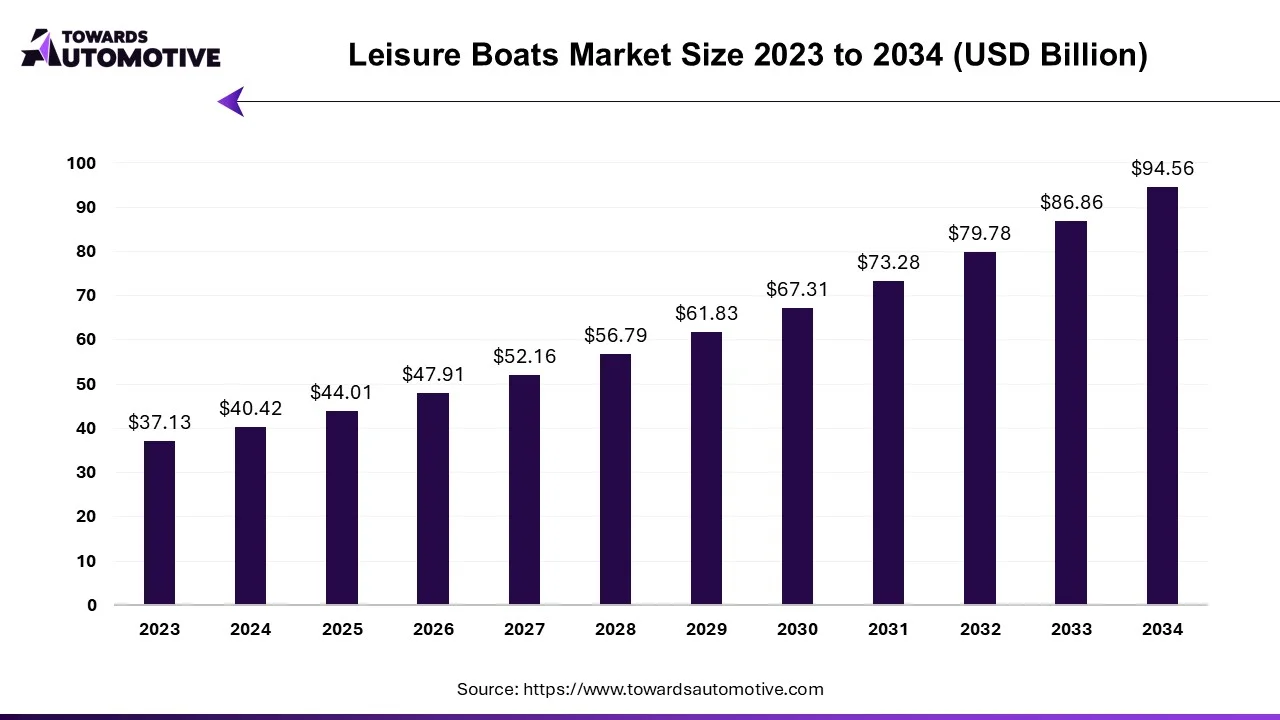

The leisure boats market is projected to reach USD 94.56 billion by 2034, expanding from USD 44.01 billion in 2025, at an annual growth rate of 8.87% during the forecast period from 2025 to 2034.

The leisure boats market is a dynamic and rapidly growing segment within the global recreational marine industry. Activities like fishing, sailing, cruising, and water sports are the main uses for these boats among families and individuals. Increased participation in outdoor recreational activities, rising disposable incomes, and expanding coastal tourism are the main factors propelling market expansion. Electric propulsion systems, integrated navigation tools, and intelligent onboard systems are examples of technological advancements that are changing user experiences and increasing demand. The use of eco-friendly materials and sustainable boating also affects consumer choices.

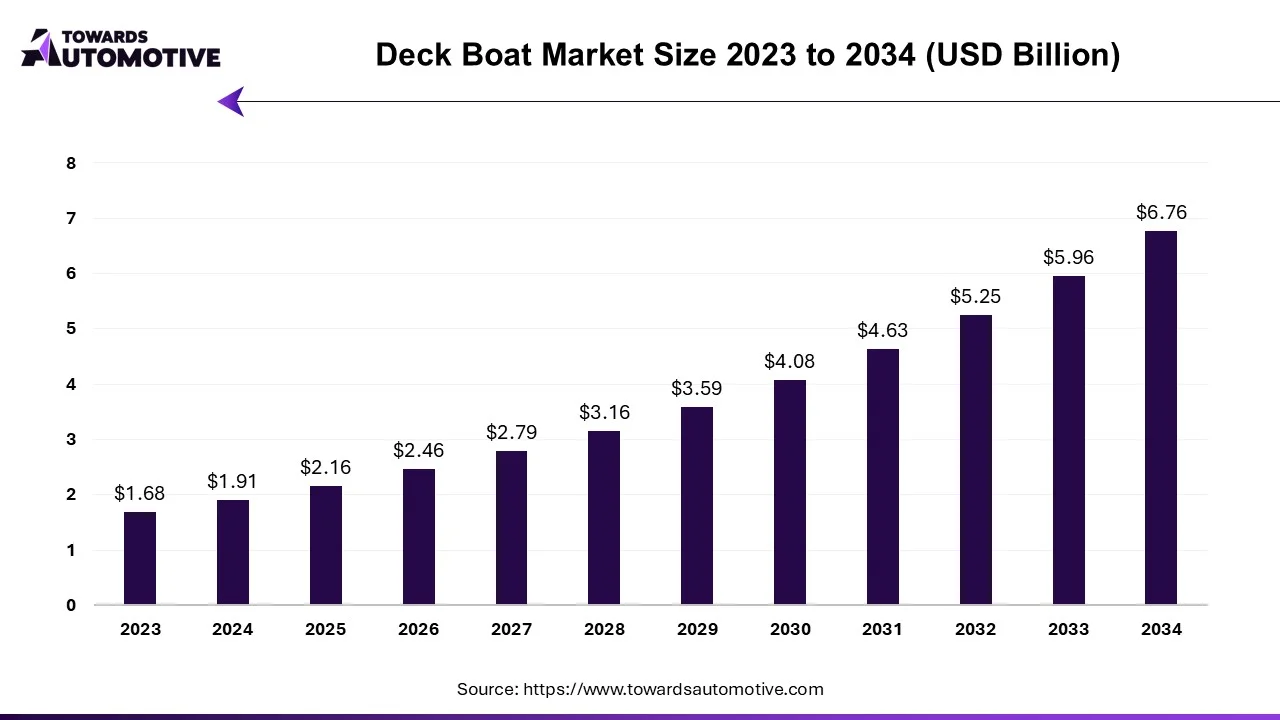

The deck boat market accounted for USD 2.16 billion in 2025 and is expected to reach around USD 6.76 billion by 2034, growing with a CAGR of 13.5% from 2025 to 2034. This market is growing due to increasing demand for versatile recreational watercraft that offers spacious seating and smooth performance for family and group outings.

AI plays a transformative role in predictive maintenance and performance monitoring for deck boats by enabling smarter, real-time decision-making. Sensors IoT devices and AI algorithms can be integrated to continuously monitor vital boat systems for indications of wear irregularities or inefficiencies. AI examines this data to anticipate possible problems before they arise, enabling prompt maintenance that lowers unplanned malfunctions and increases the boat's lifespan.

To maximize fuel efficiency, identify malfunctioning parts and provide boat owners with useful advice. AI-powered systems can also monitor usage trends, environmental factors, and engine performance. This improves safety and the overall boating experience in addition to reducing downtime and repair expenses. AI is transforming deck boat owners' maintenance and performance management by moving from reactive to proactive maintenance.

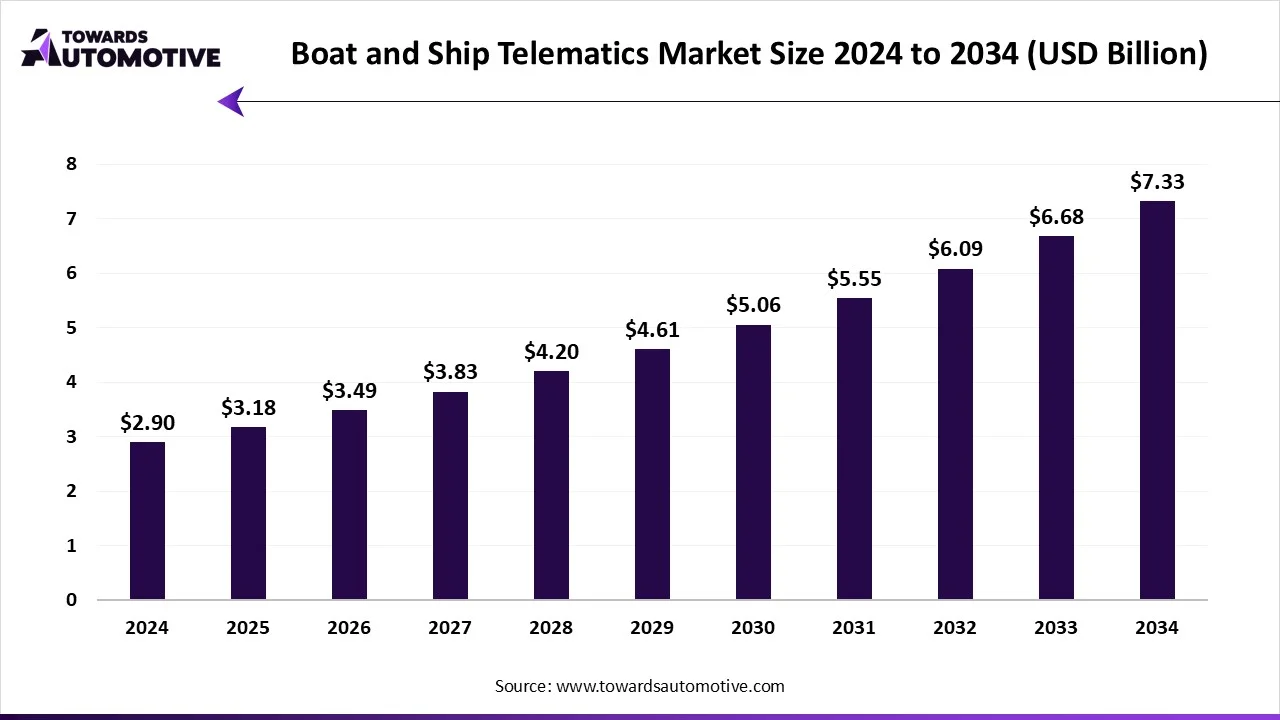

The boat and ship telematics market is projected to reach USD 7.33 billion by 2034, expanding from USD 3.18 billion in 2025, at an annual growth rate of 9.72% during the forecast period from 2025 to 2034.

The boat and ship telematics market is a prominent branch of the marine industry. This industry deals in developing solutions for tracking boats and ships across the world. There are various components of these solutions including hardware, software and services. These solutions use different types of technologies such as GPS tracking, satellite communication, IoT enabled devices, telematics software and some others. It finds numerous applications in fleet management, navigation and safety, cargo management, performance monitoring and others. The end-users of these solutions include commercial vessels, private yachts, cargo ships, fishing boats and some others. The rising use of maritime transportation for import and export of goods in different nations has boosted the market expansion. This market is expected to rise significantly with the growth of the telematics industry around the globe.

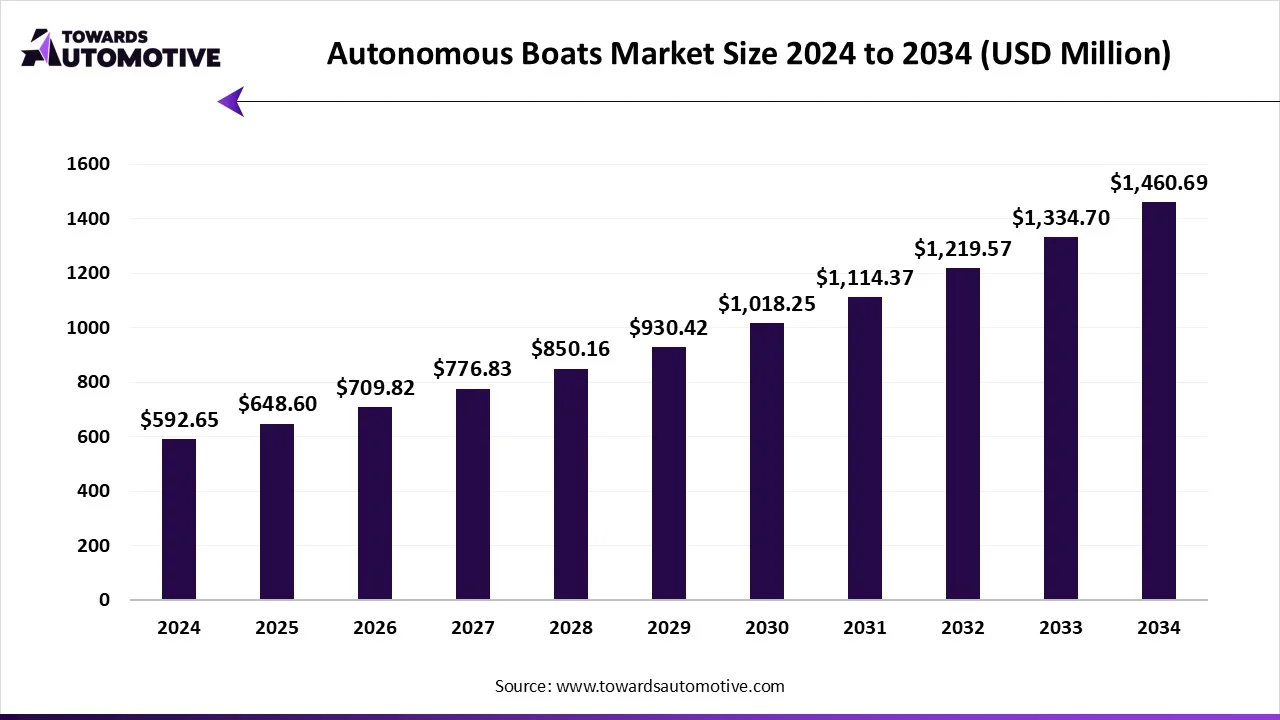

The autonomous boats market is forecast to grow from USD 648.60 million in 2025 to USD 1460.69 million by 2034, driven by a CAGR of 9.44% from 2025 to 2034.

The autonomous boats market is a prominent sector of the marine industry. This industry deals in manufacturing and distribution of self-driving boats across the world. There are various types of boats developed in this sector comprising of fully autonomous boats, semi-autonomous boats, remote controlled boats and others. These boats are powered using different propulsion technology consisting of hybrid electric, fuel powered, fully electric and others. It finds application in numerous sectors including surveillance and security, environmental research and monitoring, commercial shipping and cargo, search and rescue, passenger transportation and some others. The rising cases of boating deaths has increased the demand for autonomous boats, thereby fostering the industrial expansion. This market is expected to rise significantly with the growth of the ship-building industry across the globe.

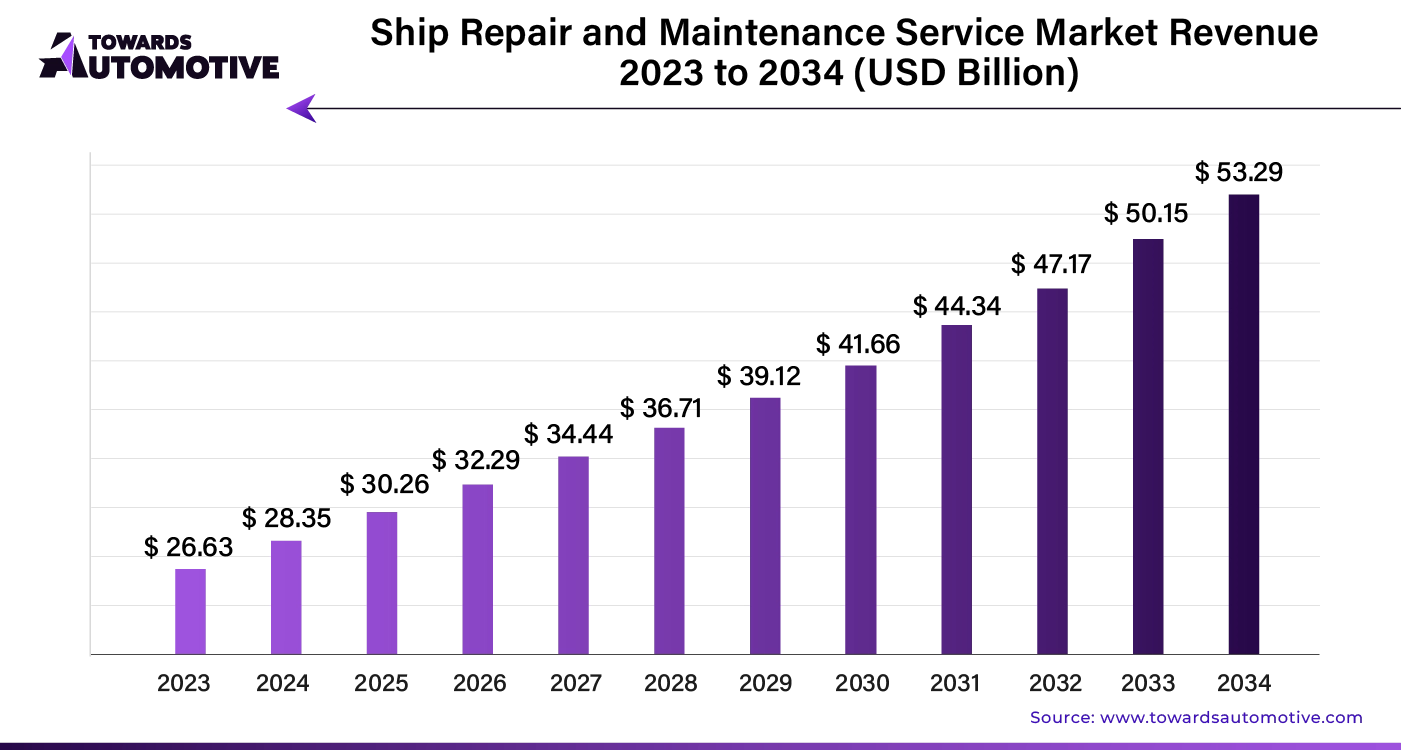

The ship repair and maintenance service market is projected to reach USD 53.29 billion by 2034, expanding from USD 30.26 billion in 2025, at an annual growth rate of 6.63% during the forecast period from 2025 to 2034.

AI integration is revolutionizing the ship repair and maintenance service market by enhancing efficiency and reducing costs. Predictive maintenance, powered by AI, allows for early detection of potential issues, enabling timely repairs before they escalate into costly problems. AI algorithms analyze data from sensors and historical records to predict when parts will fail, optimizing maintenance schedules and minimizing downtime.

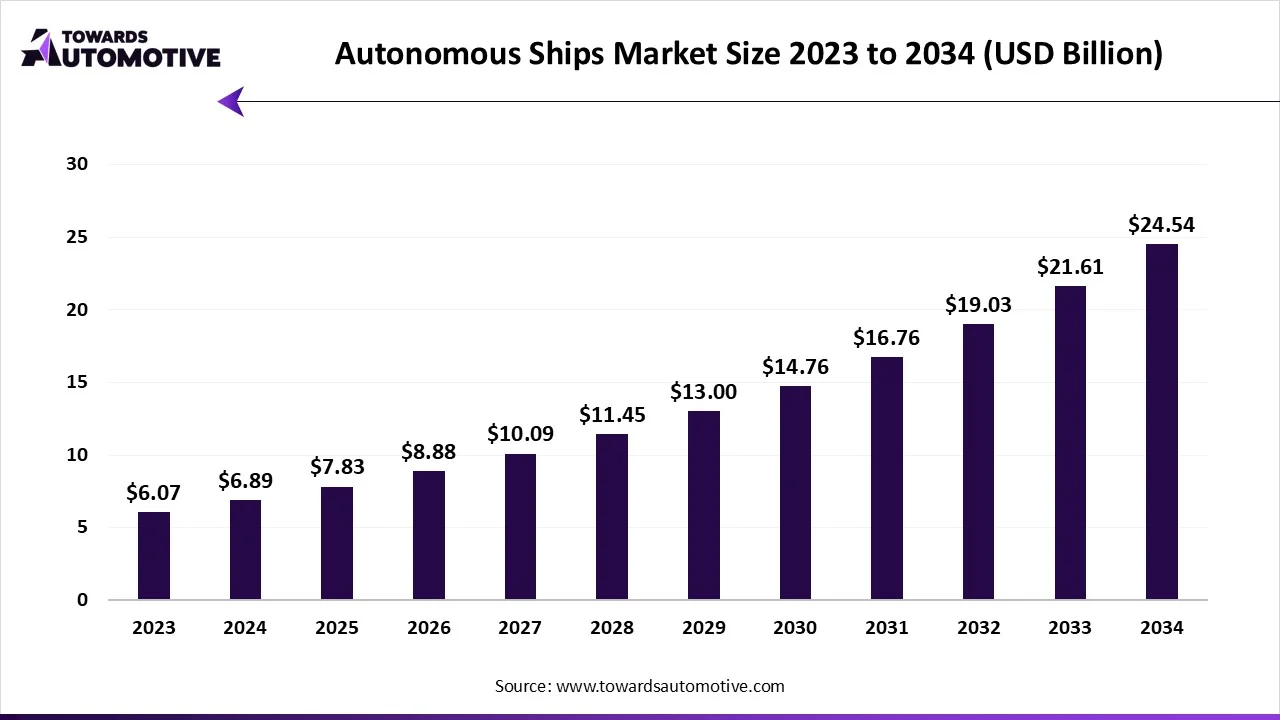

The autonomous ships market is forecast to grow at a CAGR of 13.54%, from USD 7.83 billion in 2025 to USD 24.54 billion by 2034, over the forecast period from 2025 to 2034.

The autonomous ships market is a crucial branch of the maritime transportation industry. This industry deals in manufacturing and distribution of autonomous ships in different parts of the world. There are different types of ships developed in this sector comprising of semi-autonomous ships, remotely operated ships and fully autonomous ships. These ships are powered using various propulsion technology including fully electric, hybrid and conventional. The end-user of this sector comprises of commercial sector and military & defense sector. The rising application of ships in logistics sector is crucial for the market expansion. This market is expected to grow significantly with the rise of the shipping industry in different parts of the world.

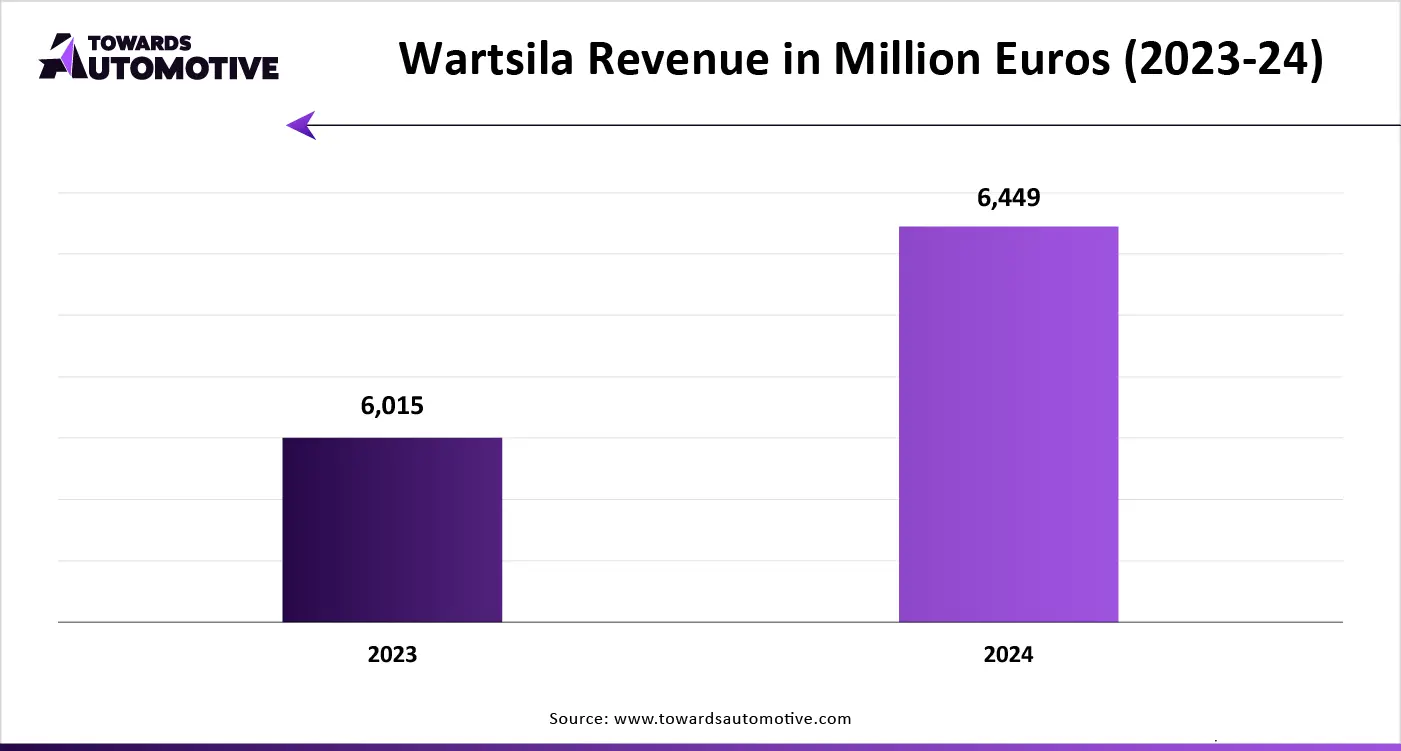

The electric boat and ship market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of ABB, Siemens, Schottel, X Shore, Energica Motor Company, General Electric, Sunseeker International, Wartsila, Babcock International, Cantiere Navale Cassarin, US Electric Boat Company, Naval Group and some others. These companies are constantly engaged in developing electric boats & ships and adopting numerous strategies such as acquisitions, joint ventures, collaborations, launches, business expansions, partnerships, and some others to maintain their dominance in this industry.

By Vessel Type

By Power Source

By Application

By End Use

By Region

September 2025

September 2025

September 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us