October 2025

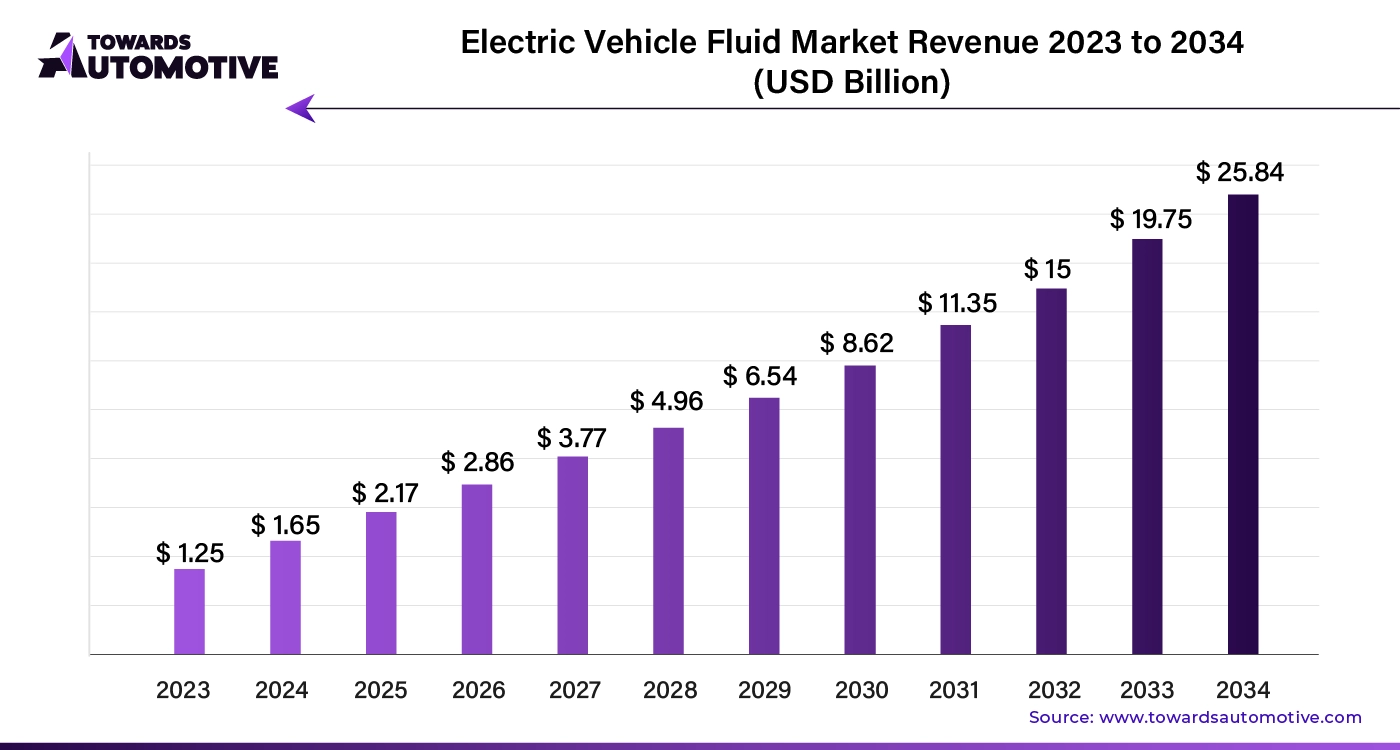

The electric vehicle fluid market is projected to reach USD 25.84 billion by 2034, expanding from USD 2.17 billion in 2025, at an annual growth rate of 31.80% during the forecast period from 2025 to 2034. The growing investment by automotive companies to manufacture several types of electric vehicles coupled with numerous government initiatives aimed at adopting EVs has boosted the market expansion.

Additionally, rapid growth in the petrochemicals industry along with technological advancements in the EV manufacturing sector is playing a prominent role in shaping the industrial landscape. The research and development activities related to bio-based EV fluids is expected to create ample growth opportunities for the market players in the upcoming years to come.

The electric vehicle fluid market is a crucial sector of the automotive industry. This industry deals in manufacturing and distribution of different types of fluid for the EV sector. There are several types of fluids developed in this sector comprising of engine oil, coolant, transmission fluids and some others. These fluids are designed for different types of vehicles consisting of battery electric vehicles and hybrid electric vehicles. The increasing demand for electric vehicles in different parts of the world has contributed to the industrial growth. This market is expected to rise significantly with the growth of the oil and gas industry across the world.

The major trends in this market consists of partnerships, business expansions and government initiatives.

The hybrid electric vehicle (HEVs) segment dominated the market. The increasing sales of hybrid vehicles in several countries such as Singapore, Germany, Norway and some others has boosted the market expansion. Additionally, the use of synthetic engine oils in hybrid vehicles coupled with advancements in hybrid engine technology is playing a vital role in shaping the industrial landscape. Moreover, rapid investment by petrochemical brands for increasing the manufacturing output of coolants for hybrid vehicles is expected to propel the growth of the electric vehicle fluid market.

The battery electric vehicle (BEVs) segment is expected to expand with a notable CAGR during the forecast period. The increasing adoption of BEVs in numerous countries such as India, China, the U.S., UK and some others with an aim at reducing vehicular emission has driven the market growth. Additionally, technological advancements in EV battery manufacturing sector coupled with numerous government initiatives aimed at adopting EVs is contributing to the industry in a positive manner. Moreover, the growing use of advanced greases and bio-fluids in EVs is expected to foster the growth of the electric vehicle fluid market.

The passenger segment led the market. The demand for passenger EVs has increased rapidly due to rising prices of gasoline has boosted the market expansion. Additionally, numerous benefits provided by automotive brands for purchasing electric vehicles to individuals coupled with integration of advanced technologies in modern EVs is playing a vital role in shaping the industrial landscape. Moreover, rapid investment by automotive brands for manufacturing different types of passenger EVs is expected to boost the growth of the electric vehicle fluid market.

The commercial segment is expected to rise with a robust CAGR during the forecast period. The increasing demand for electric buses in several countries such as Germany, France, India and some others has boosted the market expansion. Additionally, rising emphasis of market players for manufacturing different types of fluids for commercial EVs is playing a vital role in shaping the industry in a positive direction. Moreover, financial assistance provided by the BFSI sector to fleet operators for purchasing PHEVs is expected to drive the growth of the electric vehicle fluid market.

The engine oil segment held the largest share of the market. The growing use of high-quality synthetic oil in hybrid vehicles for delivering superior performance has boosted the market expansion. Additionally, rapid investment by market players for opening new engine oil manufacturing facilities coupled with technological advancements in lubricant industry is playing a vital role in shaping the industry in a positive direction. Moreover, partnerships among EV companies and lubricant manufacturers to develop new varieties of engine oils is expected to boost the growth of the electric vehicle fluid market.

The coolant segment is expected to grow with a considerable CAGR during the forecast period. The increasing use of coolant in electric vehicles for maintaining the temperature of drivetrains has boosted the market growth. Additionally, collaborations among hybrid vehicle companies and lubricant providers to manufacture a wide range of coolants is contributing positively in the industry. Moreover, rising emphasis of lubricant companies to construct new coolant production facilities in the Europe is expected to foster the growth of the electric vehicle fluid market.

Asia Pacific dominated the electric vehicle fluid market. The increasing sales of electric vehicles in prominent countries such as India, China, Japan, South Korea, Australia and some others has boosted the market expansion. Additionally, the rapid investment in the petrochemicals industry by public sector entities coupled with numerous government initiatives aimed at rising awareness about the benefits of EVs is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as Reliance Industries, Sinopec, Mitsubishi Chemical, ENEOS Corp and some others is expected to boost the growth of the electric vehicle fluid market in this region.

Europe is expected to rise with a significant CAGR during the forecast period. The growing demand for luxury EVs in various countries such as Germany, France, Italy, UK and some others has driven the market growth. Also, rapid investment by government for providing subsidies and incentives to individuals for purchasing EVs coupled with opening up new fluid manufacturing plants is contributing to the industry in a positive direction. Moreover, the presence of various market players such as Castrol, Repsol, TotalEnergies, Shell Plc and some others is expected to propel the growth of the electric vehicle fluid vehicle in this region.

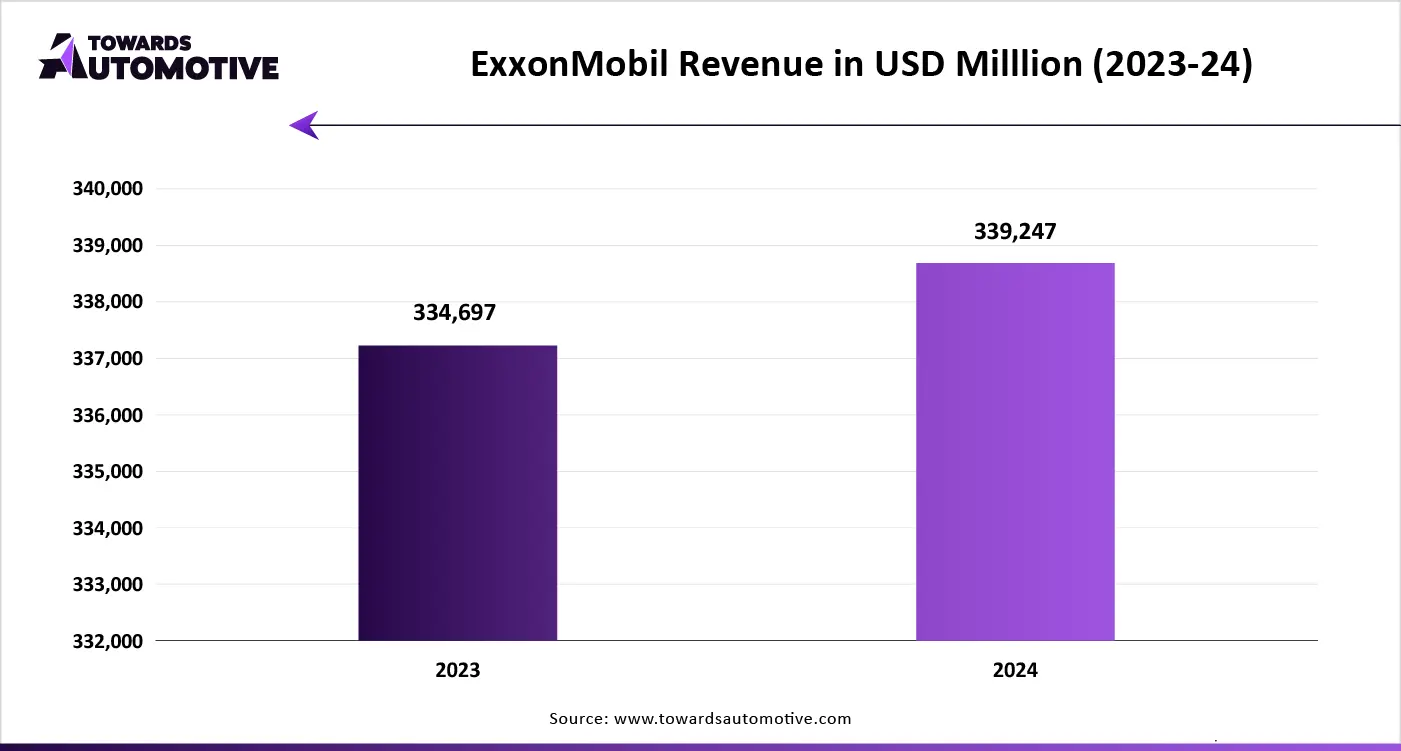

The electric vehicle fluid market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Petroliam Nasional Berhad (PETRONAS); Saudi Arabian Oil Co.; BP Plc; ENEOS Corp. Shell Plc; Exxon Mobil Corp.; FUCHS; TotalEnergies; Repsol; ENEOS Corp.; Gulf Oil International Ltd and some others. These companies are constantly engaged in manufacturing fluids for the EV sector and adopting numerous strategies such as partnerships, joint ventures, business expansions, launches, acquisitions, collaborations and some others to maintain their dominance in this industry.

By Product

By Propulsion Type

By Vehicle Type

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us