October 2025

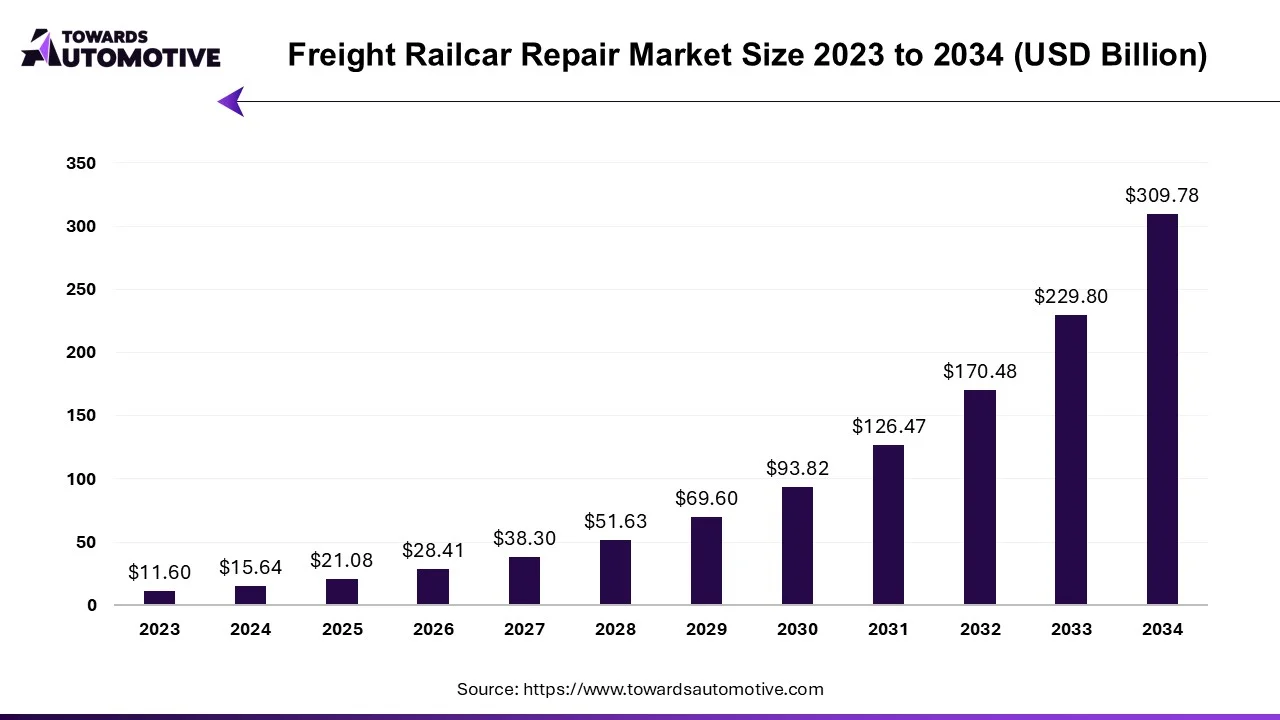

The Freight railcar repair market is projected to reach USD 309.78 billion by 2034, growing from USD 21.08 billion in 2025, at a CAGR of 34.80% during the forecast period from 2025 to 2034.

As per Statistics Netherlands, Dutch railways are anticipated to transport 44.5 million tons of freight in 2022, reflecting a notable increase of 4.3% compared to the previous year. However, this surge in freight volume also translates to heightened wear and tear on trains, necessitating more frequent adjustments and repairs to maintain operational efficiency and safety standards.

Maintenance and repair constitute critical aspects of the railway industry, involving the meticulous inspection and rectification of damaged components to ensure the safe and efficient functioning of trains. Companies operating in this sector prioritize preventive maintenance practices aimed at addressing wear and tear issues proactively while adhering to stringent safety regulations. Timely maintenance not only extends the service life and reliability of trains but also plays a pivotal role in upholding industry standards, thereby fostering business growth by facilitating the uninterrupted operation of freight vehicles.

Delays in the movement of goods pose significant challenges for the rail industry, disrupting maintenance schedules and necessitating adjustments to operational plans. Such delays, if not promptly addressed, can exacerbate competition among industry players as priority fixes are delayed, leading to prolonged repair times. Consequently, the quality of delivery may suffer, potentially straining relationships with customers and jeopardizing long-term business partnerships. Moreover, delays may result in increased costs due to rush orders or alternative transportation arrangements, ultimately impeding economic growth and prosperity.

In essence, the railway sector faces multifaceted challenges in ensuring the timely maintenance and repair of freight trains amidst rising freight volumes. Addressing these challenges effectively requires a concerted effort to prioritize preventive maintenance practices, streamline repair processes, and uphold stringent safety standards, thereby promoting the seamless movement of goods and fostering sustainable economic growth.

| Rank | Company (manufacturer / service provider) | Share (%) |

| 1 | UTLX / Procor (Marmon Rail, Berkshire Hathaway) | 9 |

| 2 | TrinityRail (Trinity Industries) | 7 |

| 3 | Greenbrier Rail Services (The Greenbrier Companies) | 6 |

| 4 | Progress Rail (Caterpillar) | 5 |

| 5 | Cathcart Rail | 4 |

| 6 | Watco | 3 |

| 7 | Eagle Railcar Services | 2 |

| 8 | GATX Rail Services | 2 |

| 9 | Rescar (PSC Group acquired 32 sites in 2025)* | 2.5 |

| — | All others (regional shops, Class I in-house shops, Europe & APAC specialists) | 59.5 |

| Total | 100 |

Collaboration aimed at enhancing the safety and environmental responsibility of railway rolling stock is emerging as a driving force behind the progress of the industry. By fostering partnerships and cooperation among industry stakeholders, businesses are demonstrating their commitment to upholding stringent safety standards and implementing environmentally sustainable practices.

An exemplary collaboration in this regard occurred in June 2021, when UTLX and Quala joined forces to offer comprehensive rail services at Quala's Pasadena facility in Texas. Through this partnership, known as Quala Rail & Specialty (QRS), a wide array of rail maintenance services is provided, with UTLX Onsite Services onboard. This integrated approach enables customers to access maintenance, repair, inspection, and qualification services all in one convenient location, streamlining operations and enhancing efficiency.

The escalating demand for reliable and stable railcar performance emerges as a pivotal factor propelling the industry forward. Given that businesses rely heavily on rail transport for the movement of goods, ensuring uninterrupted service and smooth operations is paramount. Consequently, there is a heightened emphasis on investing in regular maintenance, repairs, and upgrades to ensure consistent and reliable wagon performance.

The market has responded to this growing demand by expanding its offerings to meet the evolving needs of customers seeking reliable railcar solutions. By prioritizing proactive maintenance practices and investing in technological advancements, industry players are working towards enhancing the overall reliability and performance of railway rolling stock. In doing so, they are not only meeting the demands of a dynamic market but also contributing to the seamless flow of goods and materials essential for economic prosperity.

Segmented by type of treatment, the market for railway rolling stock maintenance is categorized into mechanical, structural, and internal segments. As of 2022, the mechanical products market is projected to dominate, comprising over 60% of the total market share. This dominance underscores the significance of addressing wear and tear issues, which are integral to the mechanical maintenance requirements of businesses operating in the freight transportation sector. Components such as wheels, axles, and braking systems undergo constant stress during operation, leading to performance degradation over time.

In response, train owners make strategic investments in specialized maintenance to ensure prolonged, safe, and efficient operation of their rolling stock. Mechanical maintenance plays a crucial role in the management of cargo transportation operations, contributing to the overall reliability and performance of freight trains.

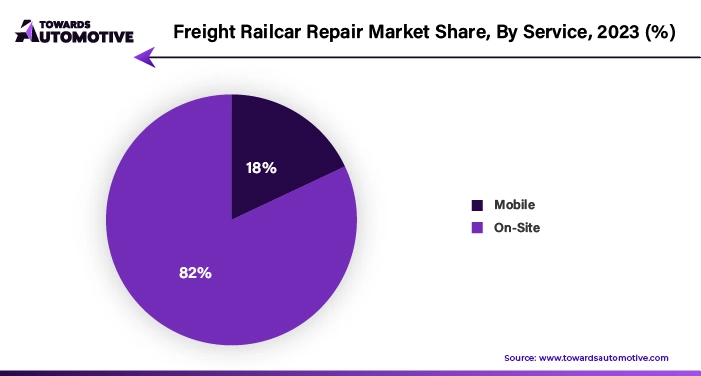

Regarding services, the freight transportation business is segmented into mobile and online domains, with the live segment expected to capture over 75% of the market by 2022. The proliferation of platforms offering comprehensive resources and monitoring capabilities has accelerated the growth of this segment. These platforms serve as centralized hubs offering a wide range of services, including expertise, technology, and collaboration opportunities.

For instance, AIT, a renowned provider of freight industry solutions, launched a dedicated train service for the European region in May 2023. This innovative solution provides European manufacturers, transport companies, and small operators with access to a diverse array of services, expertise, and partnerships. Offerings include fleet management, rental solutions, administration, and operations management, delivering comprehensive support aimed at enhancing customer railcar service and performance. The introduction of such solutions signifies a concerted effort to elevate industry standards and meet the evolving needs of freight transportation stakeholders in the European market.

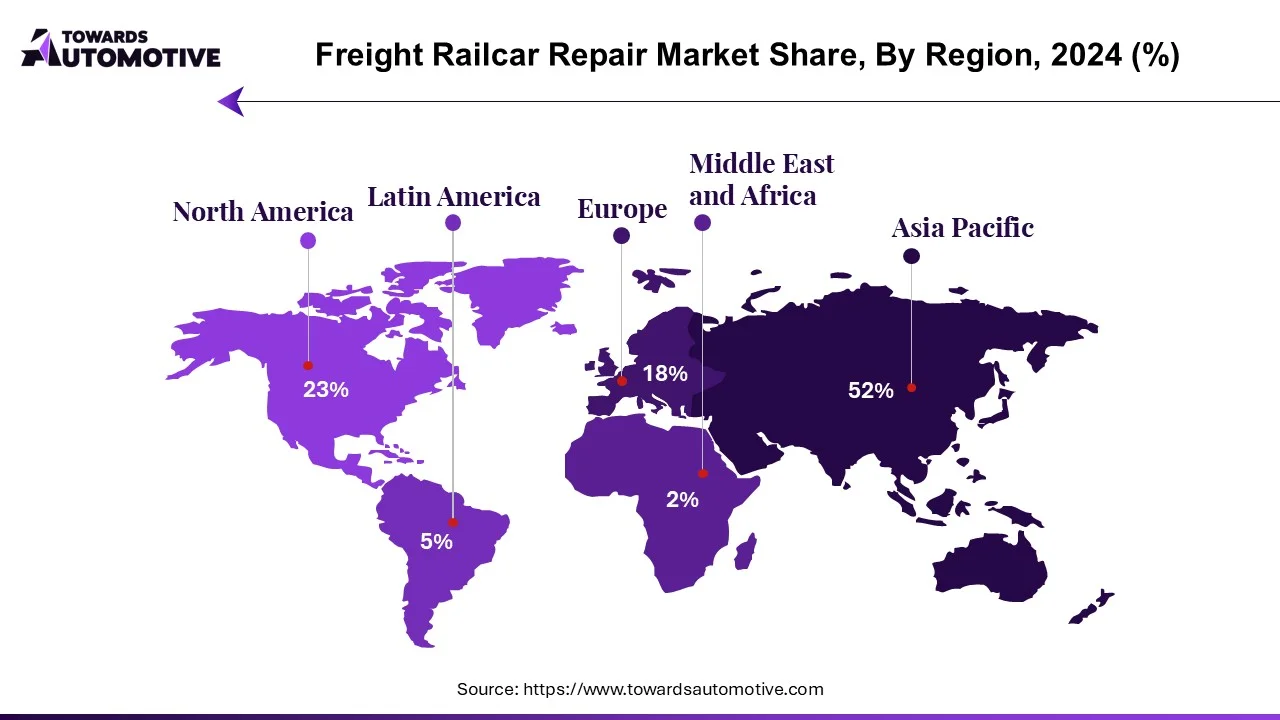

The Asia-Pacific region stands at the forefront of the transportation sector, commanding a significant share that is projected to exceed 45% by 2022. A key driver of this growth is the rapid development of infrastructure in China, which serves as a primary engine propelling the region's economic expansion. As China continues to expand its railway network to accommodate the burgeoning demand for transportation services, there is a commensurate increase in the need for maintenance and repair services. The proliferation of large-scale trains further underscores the importance of constant monitoring and upkeep, leading to heightened demand for maintenance and repair services across the Asia-Pacific region.

This escalating demand fosters intense competition within the sector, driving revenue growth for railcar maintenance businesses and creating lucrative opportunities for service providers. Moreover, the robust growth of the railway maintenance industry contributes to the overall dynamism of the business environment in the Asia-Pacific region, bolstering economic activity and supporting sustainable growth across various sectors.

Asia-Pacific region's dominance in the transportation sector is underpinned by the concerted efforts to expand and modernize railway infrastructure, with maintenance and repair services playing a crucial role in ensuring the continued reliability and efficiency of transportation networks. As the region continues on its trajectory of growth and development, the demand for railway maintenance services is poised to remain robust, further solidifying the Asia-Pacific region's position as a global leader in the transportation sector.

Major players operating in the freight railcar repair industry are:

Union Tank Car Company (UTLX) and The Greenbrier Companies are indeed significant players in the North American rolling stock industry, with both companies vying for market share through a variety of strategies.

Comprehensive Services: Both UTLX and The Greenbrier Companies offer a wide range of services to their customers, including leasing, maintenance, repair, and management of rolling stock. By providing comprehensive solutions, they cater to the diverse needs of their clientele.

Technological Innovation: Both companies invest in technological innovation to enhance the performance, safety, and efficiency of their rolling stock. This includes advancements in materials, design, and onboard systems to meet evolving industry standards and customer expectations.

Compliance Management: Compliance with regulatory standards and industry best practices is paramount in the rolling stock industry. UTLX and The Greenbrier Companies prioritize compliance management to ensure the safety and reliability of their equipment, fostering trust and confidence among customers and regulatory authorities.

Effective Collaboration: Collaboration with customers, suppliers, and industry partners is essential for success in the rolling stock industry. UTLX and The Greenbrier Companies engage in effective collaboration to address customer needs, drive innovation, and optimize supply chain efficiency.

Quality, Efficiency, and Customer Satisfaction: Ultimately, both companies recognize that maintaining high standards of quality, operational efficiency, and customer satisfaction is essential for sustaining a competitive advantage in the market. By delivering superior products and services, they aim to retain existing customers and attract new ones, driving growth and profitability.

UTLX and The Greenbrier Companies are major players in the North American rolling stock industry, competing through a combination of services, technological innovation, compliance management, and effective collaboration. Their commitment to quality, efficiency, and customer satisfaction underscores their efforts to maintain a strong foothold in the market.

By Repair Type

By Service

By Geography

October 2025

September 2024

March 2025

February 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us