December 2025

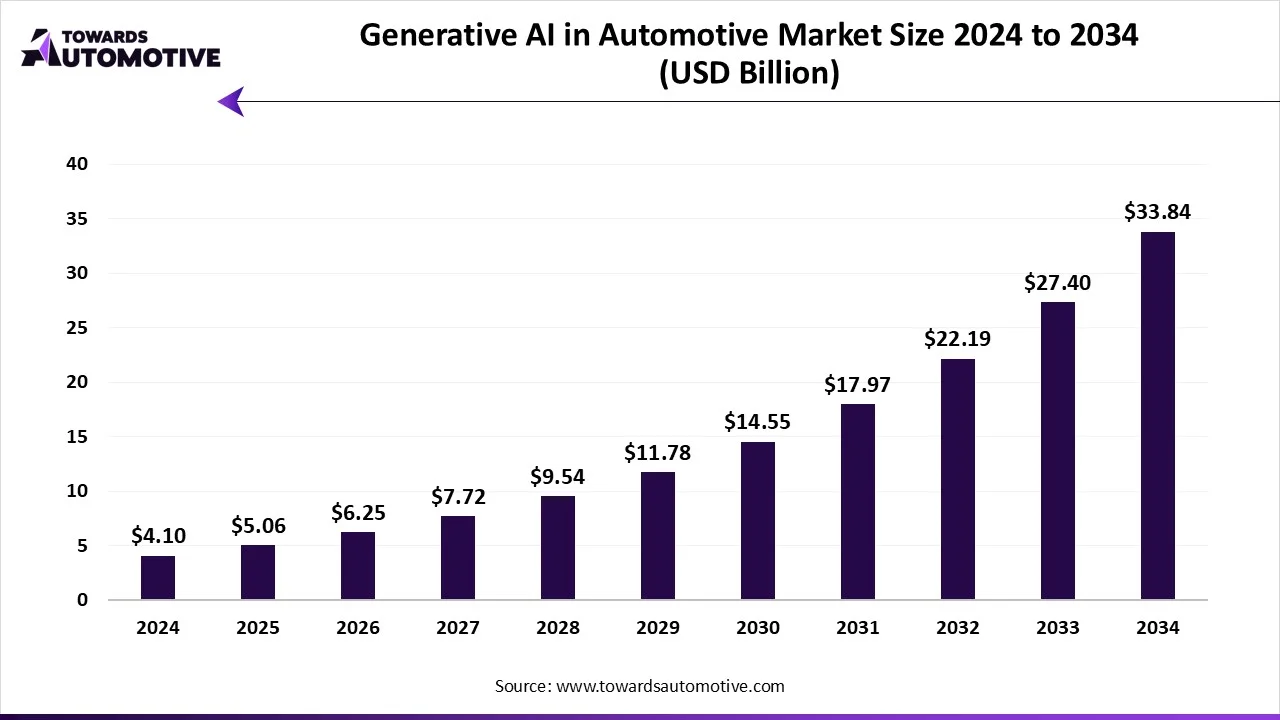

The GenAI in automotive market is projected to reach USD 33.84 billion by 2034, growing from USD 5.06 billion in 2025, at a CAGR of 23.50% during the forecast period from 2025 to 2034. The demand for GenAI in automotive is increasing because automotive manufacturers are constantly searching for smarter and faster ways to design, build, and sell vehicles. GenAI will deliver much-needed efficiencies in car design, improve the safety of safety systems, and potentially even provide better advertising experiences that resonate with potential buyers. GenAI can also provide the data processing abilities needed to support self-driving and autonomous driving technology using massive amounts of driving data.

Moreover, the increase of electric vehicles on the road will also add to the demand for GenAI, as automotive companies will need new data projection options for energy usage, battery management, and other energy uses. The rising drive for cost savings, faster time to market, and improved customer experience is additionally driving the demand for GenAI in automotive.

The generative AI (GenAI) in automotive market refers to the adoption of artificial intelligence models and algorithms that generate, simulate, and optimize automotive designs, processes, and customer experiences. These systems are used across design engineering, autonomous driving, predictive maintenance, supply chain optimization, marketing personalization, and in-vehicle infotainment. Market growth is fueled by rising digital transformation in the automotive sector, demand for faster design-to-production cycles, the evolution of autonomous and connected vehicles, and increasing investments in AI-driven research and development. In addition, GenAI can also be used to design simulations for driving scenarios, as a more realistic way to train self-driving vehicles. There are additional uses for GenAI in the automotive world, such as customer service processes and enhancing a smoother purchasing experience for customers. Opportunities in the GenAI in automotive market are the rising trend of electric vehicles and smart mobility and boosting innovation capabilities across industries.

| Metric | Details |

| Market Size in 2025 | USD 5.06 Billion |

| Projected Market Size in 2034 | USD 33.84 Billion |

| CAGR (2025 - 2034) | 23.50% |

| Leading Region | North America |

| Market Segmentation | By Application, By Technology, By Deployment Mode, By End-User and By Region |

| Top Key Players | NVIDIA Corporation, Microsoft Corporation, Alphabet Inc. (Google), IBM Corporation, OpenAI, Autodesk, Inc., PTC Inc., Unity Technologies, Applied Intuition, Cognata Ltd. |

The trends in the GenAI in automotive market are product launches, strategic partnerships, and collaboration.

GenAI enables automakers to design and develop vehicles much more quickly than before. Rather than spending months developing car concepts, automakers can apply AI to produce many advanced concepts in a short time and can simulate what these concepts might perform in real-world scenarios. This process saves time and money and allows mechanical and other engineers to focus more on creative work while the AI steps in to handle large data tasks. GenAI supports new models coming to market at an accelerated rate, which allows automotive companies to leap ahead of the competition and deliver changes in customer needs more quickly.

GenAI also enhances the safety and intelligence of vehicles by using large data sets about driving to draw inferences about risks and provide feedback. For instance, AI helps in designing better driver-assist systems and helps in testing self-driving cars. Moreover, AI also helps in predictive maintenance, so automobile owners are aware of the potential problems in their vehicles. This enhances safety and additionally reduces repair costs. GenAI helps to create smarter features such as voice assistants and personalized driver settings that enhance the driving experience. In summary, GenAI increases the overall safety of the vehicle and provides a seamless driving experience to the driver.

The design & engineering segment captured around 35% of the total market share. The design and engineering space runs in the arena of generative AI with the automotive environment due to the reason automobile makers are looking for fast and efficient ways to design automobile models. Generative AI can be utilized to design car bodies with better aerodynamics, materially optimize for durability and price, and overall, improve the design process. Traditional methodologies take months to design a car body, whereas AI can produce several designs in a matter of days including running simulated tests to measure performance on the design. This shortens time to market, lessens costs, and helps businesses stay ahead of competition. The ability to explore new and innovative ideas while staying true to safety parameters in the industry is exactly why we see this as the area with the most impact level.

The autonomous driving & in-vehicle systems segment is expected to witness the fastest growth in the forecasted period due to the increase in demand for self-driving cars and smart safety systems. GenAI contributes to path planning, scenario simulation, and predictive safety by studying enormous datasets of driving behavior. This enables the development of autonomous systems more efficiently, which does not require them to constantly be exposed to real-world testing, which is costly and dangerous. Automotive companies and technology companies are investing heavily in advanced driver-assistance systems, and GenAI can provide the appropriate tools for development and accelerate the development process. In addition, as governments look for safer modes of mobility and consumers demand more convenient options, the uptake of in-vehicle systems powered by AI will continue to increase, which is why it is the fastest-growing application of GenAI.

The machine learning & deep learning segment dominated and captured almost 40% of the total market share due to the fact that these technologies underpin most AI applications. These technologies can also be found analyzing sensor data, optimizing supply chains, improving predictive maintenance, and enhancing customer personalization. The strong flexibility that these technologies exhibit in their use of models makes them valuable in design and real-time driving systems. Car manufacturers prefer the use of ML and DL technologies since they are well-understood, have clinical proof of usage, and have a lot of industrial applications. Coupled with the improved access to substantial computational power and strong datasets, the reliability of ML and DL models' ease of use makes them advantageous to use, and this is the reason why they are the most commonly used in the market.

The GANs & digital twin platforms segment is expected to grow at the fastest rate in the forecasted period, as they provide innovative methods for simulating and testing vehicles. GANs can generate synthetic driving data, which is beneficial for training autonomous vehicles with limited real-world driving data. Digital twin platforms allow automakers to build virtual digital replicas of cars and test those replicas under thousands of simulated conditions, which is a more time- and cost-effective method of testing before proving out a new car in the real-world system. While GANs and digital twin technology are newer than ML or DL technology, these tools have as much value in simulated realism and predictive modeling as they do in current or future automotive testing and deployment. As organizations pursue better autonomous driving capabilities and optimized manufacturing, this segment will grow faster than other segments.

The cloud-based segment dominated the market and captured around 55% of the GenAI in automotive market. It fosters scalability, flexibility, and a cost-effective mechanism for those using GenAI in automakers. Cloud-based systems allow for cost-effective scaling and processing an enormous amount of drive and design data without the costly investment in risky infrastructure. Moreover, cloud-based platforms furnish a collaborative environment that allows globally placed teams to utilize for high-efficiency cloud computing. In addition, the connected car, a burgeoning phenomenon, has driven the demand for significant real-time processing of driving data, in which cloud systems are efficient. Furthermore, the security and continuous system updates of the cloud are appealing, which, coupled with the low cost, flexibility, and access, provide the ease of acceptance of cloud in the GenAI in automotive market.

The hybrid deployments segment is expected to witness the fastest growth in the forecasted period as it offers the best of both edge computing and cloud-enabled systems. Connected vehicles require certain data processing to occur on the vehicle (edge) right away, and other data in mass volume can be sent to the cloud temporarily for data storage and processing. The tradeoff is more optimal for speed, latency, and safety-critical systems, which require communication to occur as fast as possible. Also, hybrid deployment has now become mandatory for autonomous and smart vehicles needing real-time decision-making. Moreover, the emergence of 5G networks will only expedite hybrid deployment, enabling more seamless connectivity. Automakers are widely adopting to meet performance and efficiency expectations.

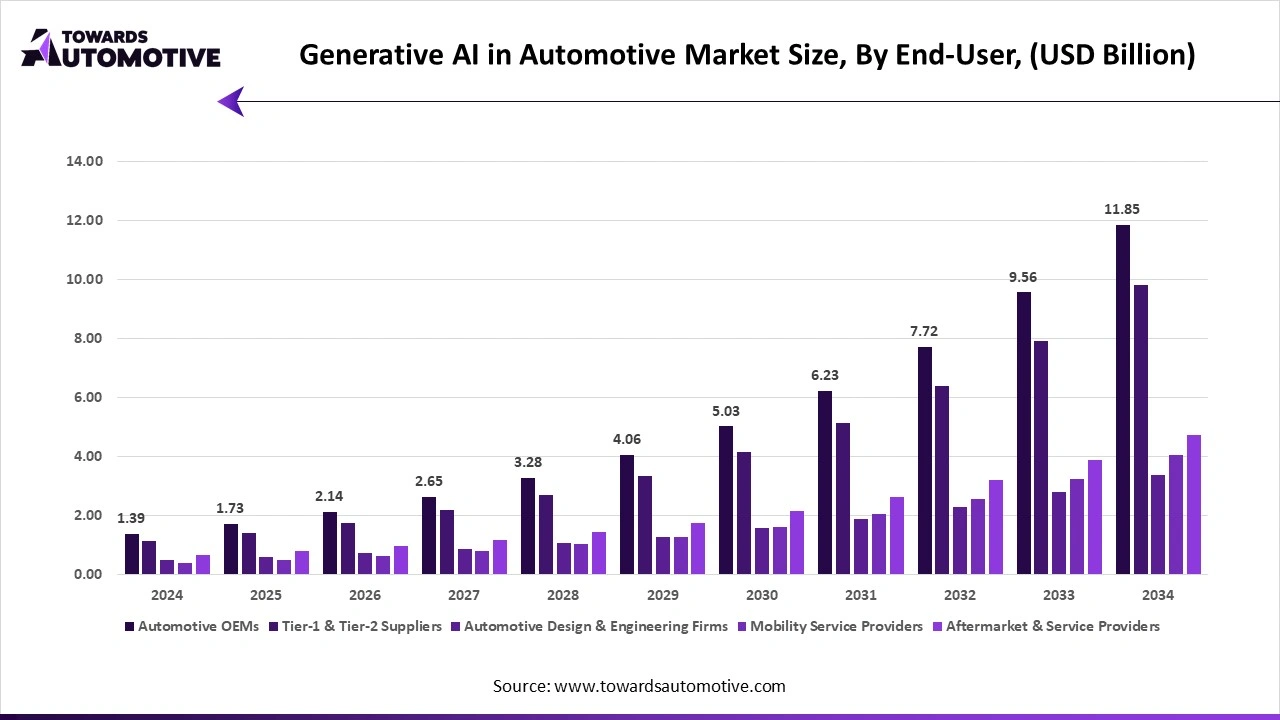

The automotive OEMs segment dominated and captured almost 45% of the total market share, as the original equipment manufacturers control every stage of the lifecycle of a vehicle, from the design stage to the sale of the vehicle. In addition, OEMs will be the first primary adopters of GenAI for design, engineering, supply chain, and in-vehicle purposes. Further, OEMs have the financial resources to advance sophisticated AIs and have the capacity to leverage large numbers of AIs deployed at scale. OEMS use the advantages of GenAI to limit costs of production, reduce the time to develop new products, and deploy features that enhance the user experience. OEMs will continue to be the main player in product innovation and user experience; therefore, OEMs will remain the dominant end-users of GenAI solutions for the automotive market.

The mobility service providers & aftermarket players segment is expected to grow at the fastest rate in the forecasted period due to the swiftly growing acceptance of shared mobility, ride-hailing services, and connected, all-in-one or fleet vehicle solutions. These specific companies will leverage Gen AI capabilities to predict demand trends, optimize routing, and configure the service to personalize it for their customers. For the aftermarket, it is predictive maintenance, repair services, and smart part replacements where GenAI is utilized. The main reason why mobility service providers and aftermarket players are more quickly adopting Gen AI technologies versus the other sectors is that the automotive companies are completely focused on customer experience. In summary, as the demand for affordable, safe, and personalized mobility continues to grow, this segment will continue to grow. The shift to smart and shared mobility will only aid this segment to grow faster than institutional organizations compared to their traditional counterparts.

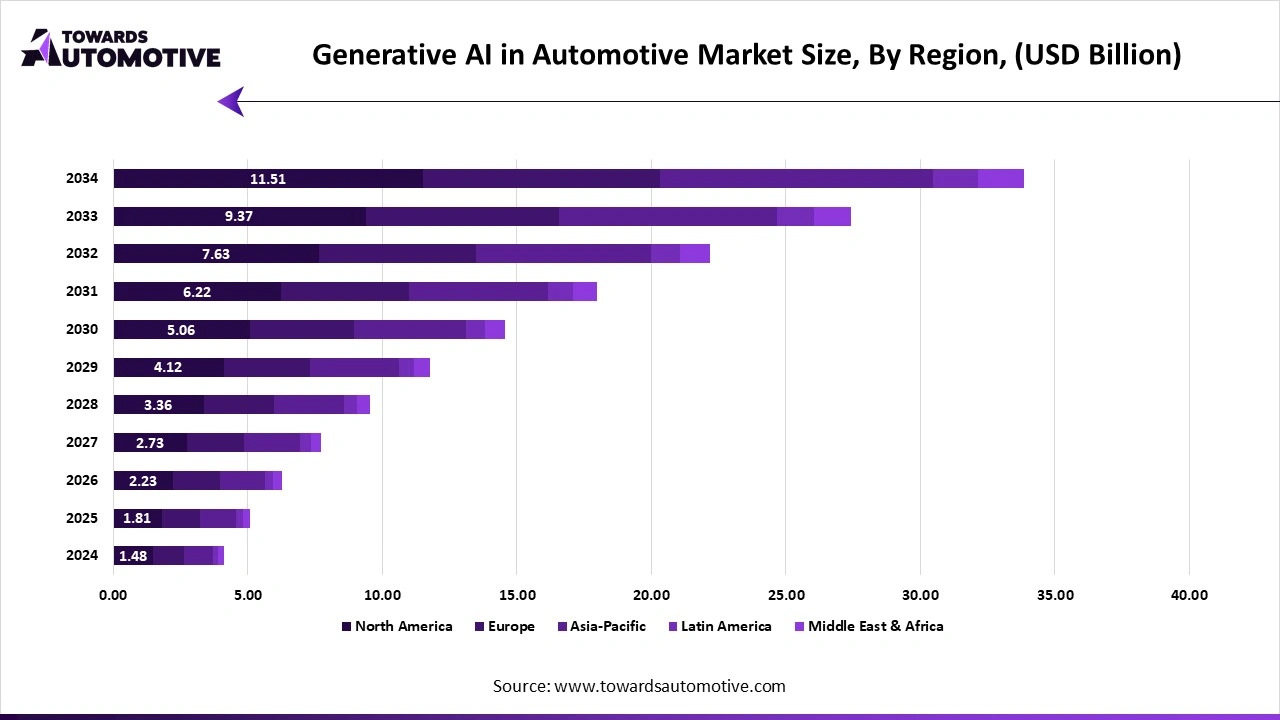

North America dominated the GenAI in the automotive market due to its large automotive manufacturers, advanced technological companies, and rapid adoption of AI tools in the region. A combination of established demand for smart connected vehicles, substantial investment in electric vehicles and autonomous vehicles, a strong research-linked laboratory ecosystem, and access to the largest diverse dataset of driving behaviors creates a compelling economic proposition for North America over other regions. In addition, governments in countries such as the U.S., Canada, and Mexico are generally supportive of cleaner modes of transportation, which has incentivized more companies to adopt GenAI. The opportunity to enter expanding autonomous vehicle workflows, battery efficiency outcomes, and customer service platforms, or the Metaverse, are just some examples of possibilities. Ultimately, it is the scale of financial freedom from institutional investors, top-tier professionals, research institutions, and other organizations in North America, and potentially, that will equip the market with enough momentum for North America to be most actively supportive of GenAI in automotive.

The U.S. led the North American GenAI in the automotive market, as it comprises many of the largest automotive manufacturers and major leaders in AI technology. U.S. companies are investing significant funds in research and development in order to develop smarter cars, safer systems, and more energy-efficient designs. In addition, the U.S. has made advancements in infrastructure that are necessary to test autonomous vehicles and produce electric vehicles. Many new startups and universities are contributing to innovation, keeping the United States at the forefront. The U.S. has ample venture capital funding for early adopters, as well as government support for green energy, making it the primary engine for GenAI implementation in the automotive space.

The Asia Pacific region is expected to be the fastest-growing region in GenAI in the automotive market due to the large number of private automobile owners, the ongoing strong demand for electric vehicles, and society's embracing of digital technologies. The Asia Pacific region has a broad manufacturing base, which allows it to be a major manufacturer of automobiles globally for the integration of GenAI. Integrating GenAI in automobiles enhances costs, reduces design time, and increases automobile safety. Also helping to enhance acceptance, governments of countries such as China, India, and Japan have approved clean energy and smart mobility initiatives. Growth opportunities include affordable AI-enabled design practices, predicting when maintenance will be needed at scale, and greater testing of autonomous vehicles. In summary, the Asia Pacific region is growing at the fastest rate due to consumer demand for advanced mobility and acceptance of technology.

China dominates the Asia-Pacific GenAI in the automotive market as it has the largest automobile market in the world and is the largest producer of electric vehicles. Chinese companies have adopted GenAI to enhance their battery systems, simplify the complicated battery production time, and quickly design smart features. Government support in terms of subsidies and policies in the adoption of AI and EV use has accelerated the adoption of AI, relying on the use of GenAI. Moreover, strong domestic tech companies, tech startups, and many research institutes continue enhancing the innovation of particular GenAI tech in EV use. Furthermore, to have a greater stream of data, China's large driving population provides significant volumes of data to train AI models at a much quicker and effective rate. All the scales of these perspectives, along with the government support for innovation, support China in leading the Asia-Pacific region in GenAI in the automotive market.

| September 2025 | Announcement |

| Karim Jeribi, Vice President Global Industries at DXC Technology. | We strive to transform breakthrough innovation to deliver real-world impact at global scale. Through our collaboration with STARTUP AUTOBAHN and the incredible startups in their ecosystem, we’re not just experimenting with AI, we’re pushing industries forward by solving some of our customers’ most pressing challenges. |

| March 2025 | Announcement |

| Mary Barra, chair and CEO of General Motors. | GM has enjoyed a longstanding partnership with NVIDIA, leveraging its GPUs across our operations. AI not only optimizes manufacturing processes and accelerates virtual testing but also helps us build smarter vehicles while empowering our workforce to focus on craftsmanship. By merging technology with human ingenuity, we unlock new levels of innovation in vehicle manufacturing and beyond. |

| February 2025 | Announcement |

| Ned Curic, Stellantis Chief Engineering & Technology Officer. | There are many players in the AI space, and we’re particularly happy to partner with Mistral AI for its strong ability to adapt quickly and drive meaningful results in a highly collaborative way. Together, we are exploring AI’s potential across several domains to enhance our product development, customer experience and deliver real benefits. |

| January 2025 | Announcement |

| Nakul Duggal, group general manager, automotive, industrial and cloud, Qualcomm Technologies, Inc. | Our ongoing relationship with Panasonic Automotive Systems spans over a decade and underscores our commitment to redefining the automotive industry with proven, scalable, and innovative technologies. As one of our most powerful automotive platforms, the Snapdragon Cockpit Elite, is designed to meet modern vehicle demands with natural language processing, predictive maintenance, and adaptive user interfaces, raising the bar for in-vehicle technology with immersive multimedia, optimized gaming, and advanced 3D graphics. |

| October 2024 | Announcement |

| Abdallah Shanti, Chief Information Officer, Volkswagen Group of America. | We're driven to introduce new technologies and features that enhance the ownership experience for all of our Volkswagen customers and create love for our vehicles. AI is emerging as a utility tool for Volkswagen owners to better understand their vehicles and get answers to questions faster and easier. Thanks to our strong collaboration with Google Cloud, we're able to bring valuable technology into our vehicles that help us successfully connect to the car and our customers. |

The GenAI in the automotive market is highly competitive. Some of the prominent players in the market are NVIDIA Corporation, Microsoft Corporation, Alphabet Inc., IBM Corporation, OpenAI, Autodesk, Inc., Dassault Systèmes, Siemens Digital Industries Software, PTC Inc., Unity Technologies, Applied Intuition, Cognata Ltd., Scale AI, Continental AG, and Bosch Global. They are proactively seeking partnerships, mergers, alliances, and/or acquisitions to maneuver towards robust AI models and high-performance computing. Many are putting substantial investments into digital tools to boost efficiency in design and manufacturing to lower cycle time and total cost associated with each model. Moreover, companies are collecting staggering amounts of data from their fleet of vehicles (including sensors, as well as driver behavior) so they can rapidly improve features or build better simulations. Some companies are even building their own teams in AI, so they don't have to rely on external suppliers.

| Company | About |

| NVIDIA Corporation | NVIDIA Corporation was established in 1993. It fuels GenAI in automotive by providing high-performance chips and platforms for training self-driving vehicles, running driving simulations, and hosting AI tools that help enhance vehicle safety, design, and in-vehicle experience. |

| Microsoft Corporation | Microsoft Corporation was established in 1975. It utilizes GenAI in the automotive industry by providing high-performance chips and platforms for training self-driving cars, running driving simulations, and making it easier to improve vehicle safety, design, and in-car experiences tools with AI. |

| Alphabet Inc. | Alphabet Inc. was established in 2015. With their AI and autonomous driving arms, they utilize GenAI for developing self-driving cars, predictive safety and smarter in-vehicle systems, helping to provide advanced mobility solutions and more efficient transportation technologies. |

| IBM Corporation | IBM Corporation was established in 1911. It uses GenAI in the automotive space for AI-driven data analytics, supply chain optimization, and predictive maintenance, allowing car makers to increase efficiency, design more quickly, and offer smarter vehicle systems that are more secure and reliable. |

| OpenAI | OpenAI was established in 2015. It serves the automotive industry with GenAI, developing advanced generative models to support natural language assistants, design generation and training for simulations, enhancing car innovation and customer interaction experience. |

| Autodesk, Inc. | Autodesk, Inc. was established in 1982. They make use of GenAI to benefit automotive design and engineering and offer tools to generate advanced 3D models, optimize materials, and improve overall vehicle development time with AI-based simulations and design automation tools. |

| Dassault Systèmes | Dassault Systèmes was established in 1981. They use GenAI in automotive with its 3D experience platforms, digital twin technology, and simulation software, allowing car makers to design smarter cars and you can virtually test the performance before making a physical prototype. |

| Siemens Digital Industries Software | Siemens Digital Industries Software was started in 2007. It combines GenAI with automotive clusters, roadside systems, engineering tools, and environmental analytics to help cities manage mobility and optimize the use of existing assets. |

| PTC Inc. | PTC Inc. was founded in 1985. It uses GenAI through product lifecycle data sources, engineering simulation tools, and context-aware product data management tools to help manufacturers improve quality, reduce scrap, and make strategic product decisions. |

| Unity Technologies | Unity Technologies was incorporated in 2004. It is using GenAI in automotive and product lifecycle management, digital twin and design software, allowing manufacturers to optimize vehicle performance, reduce design errors, and improve connected car functionality. |

| Applied Intuition | Applied Intuition was established in 2017. It assists the automobile industry in employing GenAI by delivering advanced simulation and testing systems for self-driving cars and supports customers in training safer autonomous systems in a shorter amount of time and at a lower cost. |

| Cognata Ltd. | Cognata Ltd. was established in 2016. It utilizes GenAI technology in the automotive industry by building high-fidelity driving simulations and digital twins to produce synthetic datasets that will enable safer and quicker training of autonomous vehicles or advanced driver assistance systems. |

| Scale AI | Scale AI was founded in 2016. The services it provides to the automotive sector include high-quality labeled data and AI learning tools that are critical for developing self-driving cars, predictive safety models, and advanced in-vehicle systems. |

Tier 1

Tier 2

Tier 3

By Application

By Technology

By Deployment Mode

By End-User

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us