October 2025

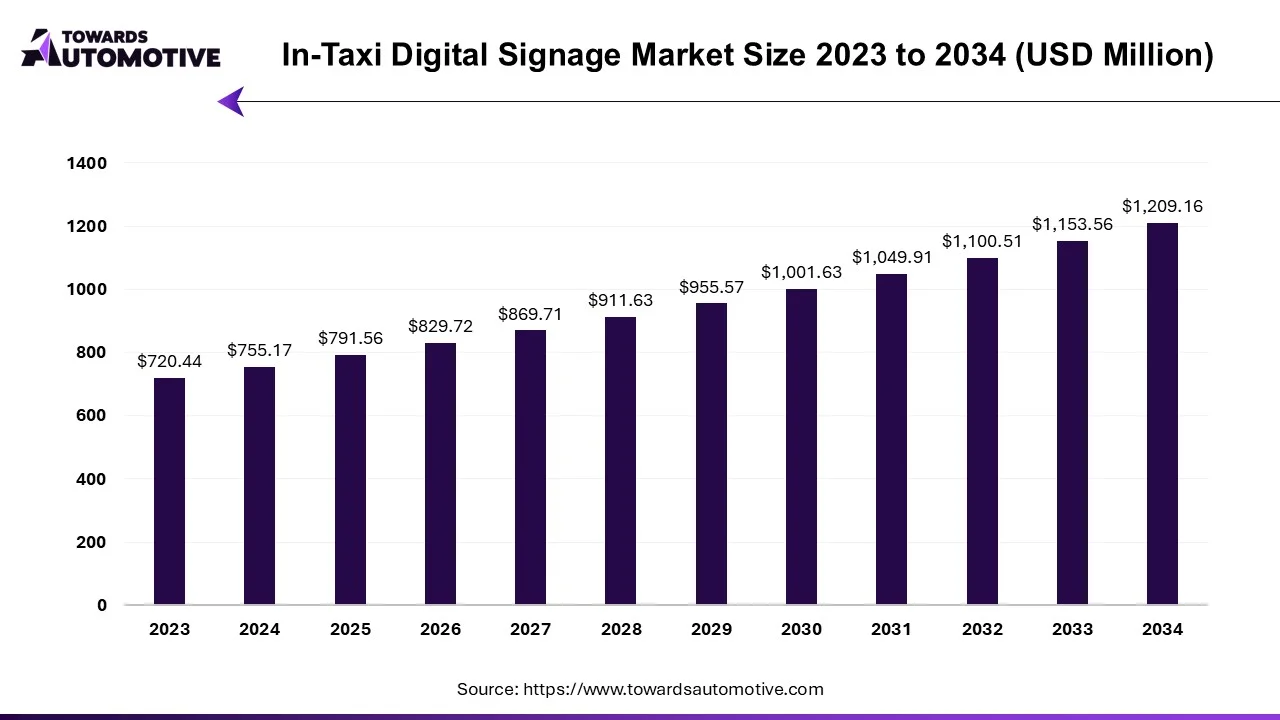

In-taxi digital signage market is forecast to grow at a CAGR of 4.82%, from USD 791.56 million in 2025 to USD 1,209.16 million by 2034, over the forecast period from 2025 to 2034.

In today's automotive communications landscape, there's a notable surge in investment pouring into startups dedicated to enhancing communication and business platforms within the sector. These forward-thinking ventures are at the forefront of leveraging cutting-edge technologies to revolutionize how advertisers and travelers interact through digital devices.

One standout example is Startup 4.screen, which burst onto the scene in April 2023. This innovative company is reshaping the retail landscape by facilitating the delivery of products to drivers through cleverly designed car accessories. Bolstering their offerings is a sophisticated financial platform employing 11 slides, which recently secured an impressive $23 million in funding. Spearheaded by early-stage investment firm S4S Ventures and with partial support from S4 Capital, this injection of capital underscores the immense potential of such ventures.

Fueling this growth is a burgeoning demand for novel solutions and advertising strategies in the industry. Advertisers are increasingly seeking dynamic platforms to engage with diverse urban populations. In-cabin digital signage emerges as a pivotal solution, delivering personalized and location-specific content to passengers. Its effectiveness in tailoring messages, amplifying brand awareness, and crafting engaging advertising campaigns has propelled rapid business expansion in this space.

However, amidst this growth, challenges persist, with connectivity issues posing significant hurdles, particularly in resource-constrained areas. Robust network connectivity is paramount for delivering real-time content and maintaining system performance. A weak connection can lead to disruptions, delays, and even signal degradation, significantly impacting user experience and advertiser outcomes. Overcoming this challenge demands substantial investment in communication infrastructure to ensure seamless and consistent connections, ultimately benefiting people, travelers, and advertisers alike.

| Rank | Manufacturer (global) | 2024 Share (%) | What they mainly sell |

| 1 | NSELED (Shenzhen NSE) | 21 | Taxi-top LED displays & controllers |

| 2 | JASIONLED | 9 | Taxi-top LED displays |

| 3 | HSC LED | 8 | Taxi-top LED displays (TD series) |

| 4 | EagerLED | 6 | Taxi-top LED displays & housings |

| 5 | 3U View | 5 | Taxi-top LED displays |

| 6 | Proluxon | 4 | Taxi-top LED displays |

| 7 | VisionLedPro | 4 | Taxi-top LED displays |

| 8 | YUCHIP | 3 | Taxi-top LED displays (China focus) |

| 9 | Unit/Unilumin (incl. OEM supply) | 2 | LED modules & OEM supply used in taxi units |

| 10 | Other regional manufacturers | 38 | Numerous small OEMs & city-specific suppliers |

Collaborating with automakers presents a significant opportunity for businesses in the digital signage industry to enhance their profitability and expand their market reach. Through strategic partnerships, companies can seamlessly integrate their digital signage systems into new vehicle models, thereby extending their business scope and tapping into new customer bases.

A notable example of such collaboration is the partnership between Yahoo and Xperi Inc., announced in October 2023. By integrating Yahoo Video content, including Yahoo Finance, Insider News, and Yahoo Sports, into Xperi's DTS AutoStage video service, the companies aim to enhance the passenger experience in vehicles. This integration, first implemented in the latest BMW 5 Series and future BMW models, marks a significant milestone in the convergence of automotive and entertainment technologies, showcasing Yahoo's foray into car entertainment content.

Location-based targeting represents another key aspect of business expansion in the digital signage industry. Leveraging advanced geotargeting technology, advertisers can deliver relevant content to passengers based on the vehicle's location. By tailoring advertising campaigns to specific demographics, local events, or markets, companies can significantly enhance the effectiveness of their messaging. This targeted approach ensures that content not only captures passengers' attention but also resonates with their immediate surroundings, maximizing impact and engagement.

Overall, strategic partnerships with automakers and the implementation of location-based targeting strategies are instrumental in driving business growth and profitability in the digital signage industry. By harnessing these opportunities, companies can stay at the forefront of innovation, deliver compelling content experiences, and unlock new avenues for revenue generation in the evolving automotive ecosystem.

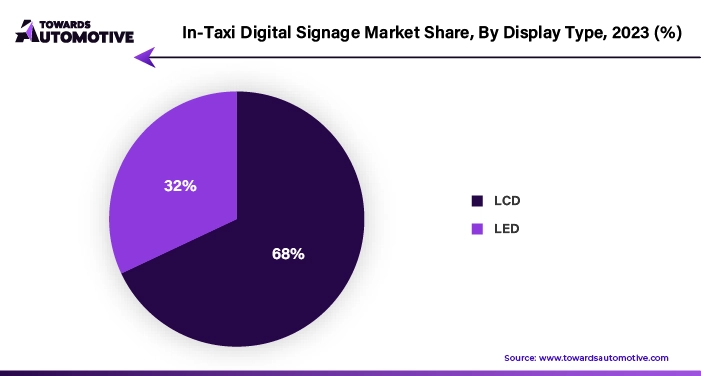

The digital signage market for in-taxi displays is segmented based on display type, with LCD and LED being the two primary categories. By 2022, the LCD segment is expected to dominate, capturing approximately 58% of the market share. This dominance can be attributed to the increasing adoption and versatility of LCD monitors, which have rapidly gained traction across various industries.

LCD monitors offer a reliable and comprehensive solution for broadcasters and service providers, contributing to their widespread acceptance. Their availability in a variety of sizes further enhances their versatility, allowing them to be seamlessly integrated into different car models and interiors. This flexibility aligns well with the evolving needs of the automotive industry, where customization and adaptability are paramount.

Moreover, the increasing prevalence of LCD technology underscores its suitability for digital signage in taxis, enabling these displays to achieve recognition and performance comparable to larger screens. As a result, LCD monitors are positioned as the preferred choice for in-taxi digital signage solutions, offering a combination of reliability, adaptability, and performance that meets the demands of both advertisers and passengers alike.

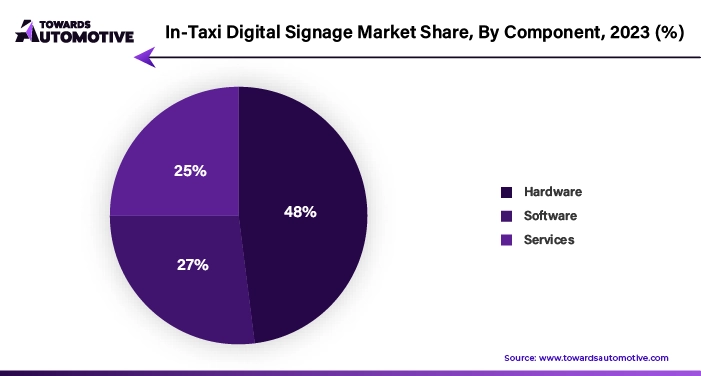

In the digital in-cabin signage market, the components are segmented into hardware, software, and services. By 2022, hardware is expected to hold approximately 40% of the market share. The growth of the hardware segment is being propelled by the introduction of advanced multimedia devices equipped with unique features.

These multimedia devices are designed to enhance the in-cabin experience by offering a range of innovative functionalities. They incorporate the latest technology to ensure seamless connectivity, high-performance systems, and compatibility with popular platforms. For instance, in July 2023, Uno Minda Ltd. introduced the WTUNES-649TAACP, a 9-inch universal Android player targeted at the Indian market.

Powered by the robust T5 processor system, this GM multimedia unit offers seamless wireless connectivity with Android Auto and Apple CarPlay, providing passengers with a convenient and enjoyable in-cabin entertainment experience. Such advancements in hardware technology contribute to the overall growth and competitiveness of the digital in-cabin signage market, catering to the evolving needs and preferences of passengers and advertisers.

North America is poised to dominate the in-cabin digital signage market, capturing a substantial share of over 37% by 2022. The region's dominance is attributed to its strong commitment to technological advancement, which is propelling the growth of the market. There is an intense interest in embracing new technologies across various sectors in North America, fostering innovation in advertising solutions and driving the development of professional digital signage systems and large screens in taxis.

This commitment to innovation creates an environment conducive to the adoption of cutting-edge technologies and the exploration of new advertising mediums. As technology continues to evolve rapidly, the industry in North America benefits from a highly receptive market that aligns with the interests of advertisers and consumers alike. This convergence of technological innovation and consumer demand creates a fertile ground for the expansion and diversification of in-cabin digital signage solutions, driving the growth of the market in the region.

Major players operating in the in-taxi digital signage industry are:

In the fiercely competitive landscape of the in-cabin digital signage market, major players are vying for market share by deploying aggressive strategies and leveraging technological advancements. These advancements, such as enhanced social networking capabilities and optimized content delivery mechanisms, are key drivers behind the continuous improvement of their products.

Moreover, partnerships with automakers play a pivotal role in ensuring seamless integration of digital signage solutions into vehicles, thereby expanding market reach and enhancing product accessibility to a broader consumer base. By forging strategic alliances with automakers, companies in the market can tap into existing distribution networks and capitalize on established customer relationships, thereby gaining a competitive edge.

This competitive environment fosters a culture of innovation and drives companies to constantly enhance their offerings in terms of functionality, usability, and performance. By staying at the forefront of technological innovation and actively seeking collaborative opportunities, major players in the market strive to maintain their competitive advantage and solidify their position in the rapidly evolving landscape of in-cabin digital signage.

By Component

By Vehicle Type

By Display type

By Screen Size

By Application

By Geography

October 2025

October 2025

October 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us