October 2025

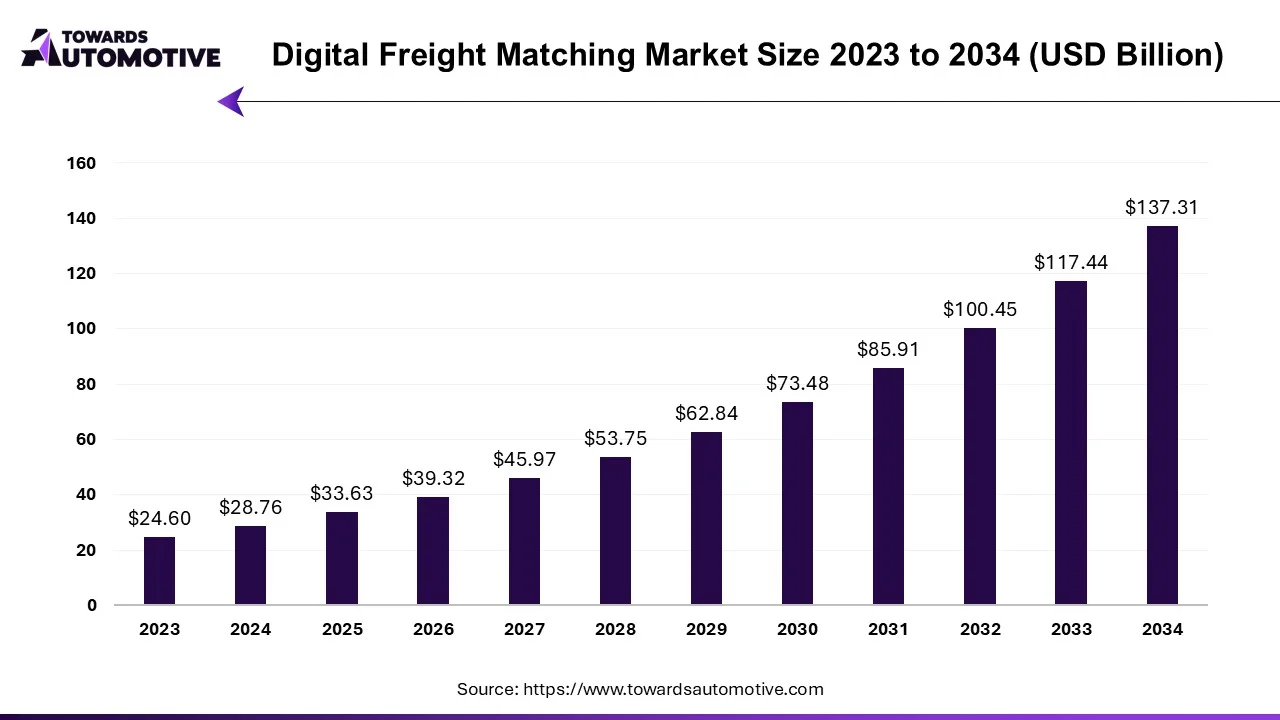

The digital freight matching market is expected to grow from USD 33.63 billion in 2025 to USD 137.31 billion by 2034, with a CAGR of 16.92% throughout the forecast period from 2025 to 2034.

With a compound annual growth rate (CAGR) surpassing 16%, this market segment is at the forefront of transforming traditional freight brokerage and logistics operations.

The fragmentation within the logistics industry presents a significant challenge for the digital freight matching sector. Coordinating processes becomes challenging as stakeholders employ varying methods and systems. Integrating these disparate systems poses challenges, impeding seamless communication between shippers and carriers. To address these hurdles, it's imperative to establish standardized procedures and business models to facilitate information exchange and enhance the efficacy of digital freight across different logistics domains.

The COVID-19 pandemic has catalyzed the adoption of digital freight solutions, boosting operational efficiency. Faced with supply chain disruptions and heightened competition, businesses are increasingly turning to digital platforms to optimize long-haul transportation operations. The growing preference for contactless and efficient solutions has fueled greater acceptance of digital freight services, fostering economic growth and showcasing the technology's adaptability during crises.

Security in load matching is a key driver of growth in the digital freight matching industry. Measures such as QR code scanning and advanced authentication systems bolster trust between shippers and carriers while mitigating fraud risks. For instance, in August 2023, digital product comparison startup Transfix introduced a security system employing QR barcodes to authenticate smartphones, enhancing the industry's ability to combat rising carrier fraud.

Furthermore, companies are prioritizing sustainable transportation solutions to curtail mileage, decrease fuel consumption, and minimize emissions in alignment with sustainability objectives. For example, in January 2023, Nexocode announced that logistics firms can leverage GPS tracking devices, sensors, and various IoT devices to monitor the real-time location and status of their vehicles, enabling effective tracking of shipping assets.

Digital freight matching (DFM) platforms revolutionize the way shippers, carriers, and freight brokers connect and transact by leveraging technology to automate and optimize the process of matching available freight with carrier capacity. From real-time load tracking and tendering to dynamic pricing and optimization algorithms, DFM platforms offer unprecedented efficiency, transparency, and agility in freight logistics.

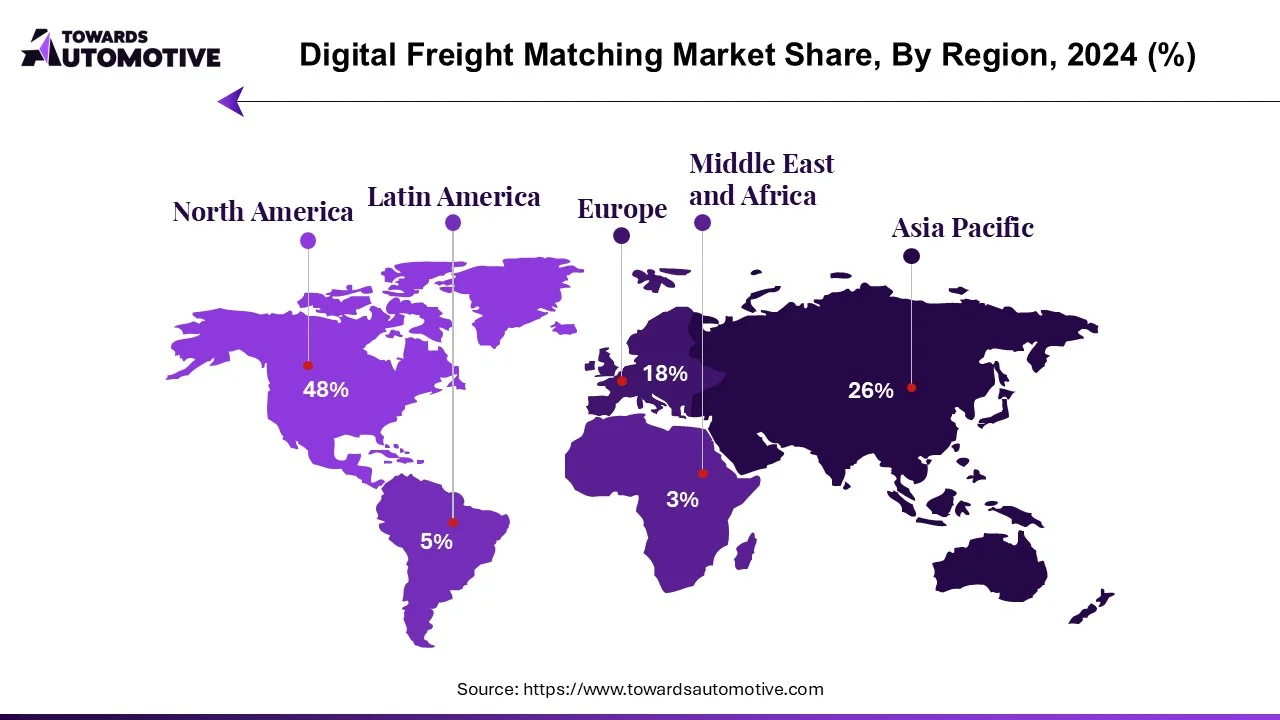

Fueled by technological advancements, the North American digital load matching market reached an estimated value of $7.7 billion in 2023, positioning itself at the vanguard of innovation. The region boasts a robust IT infrastructure and a culture that embraces early adoption of technology, facilitating the development and deployment of digital solutions. Leveraging innovations like artificial intelligence and the Internet of Things, companies are enhancing the efficiency of digital freight platforms. This technological progress solidifies North America's leadership position, propelling the growth and evolution of digital freight services across the region.

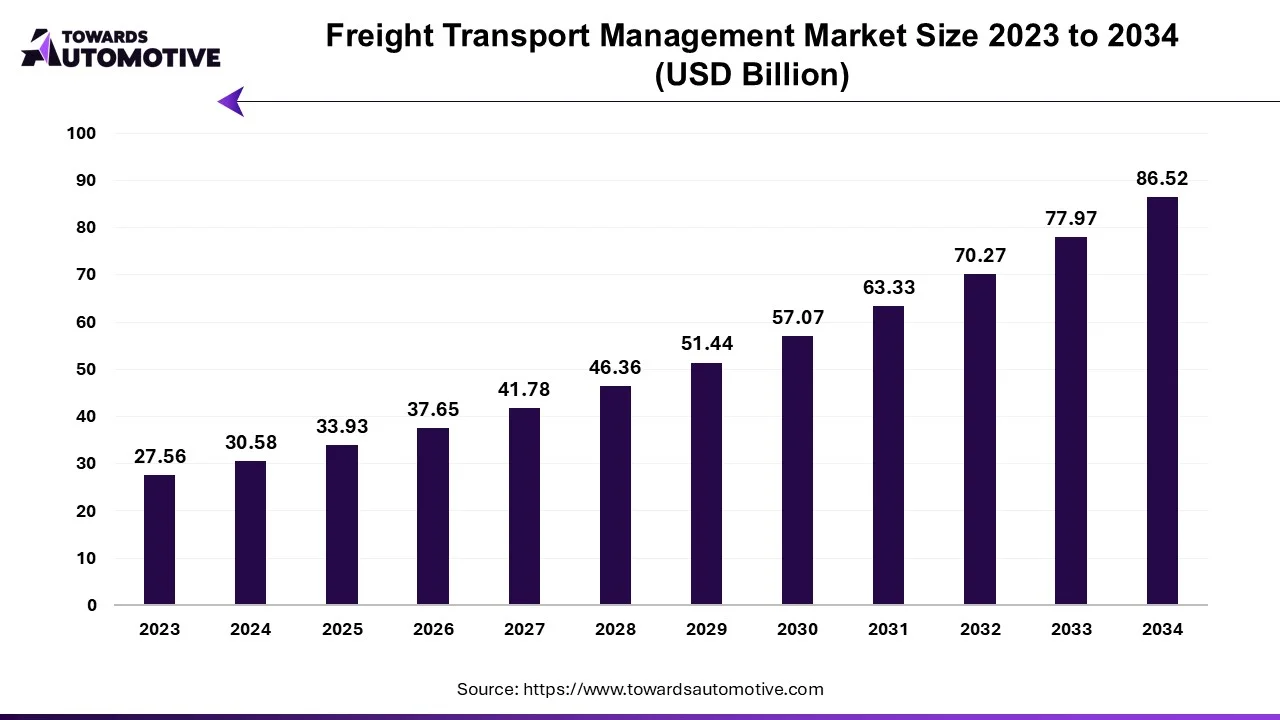

The freight transport management market is projected to reach USD 86.52 billion by 2034, expanding from USD 33.93 billion in 2025, at an annual growth rate of 10.96% during the forecast period from 2025 to 2034. The rising development in the logistics sector coupled with integration of AI in freight management platforms has driven the market expansion.

Additionally, the growing adoption of 3PL logistics by pharmaceutical companies along with technological advancements in modern warehouses is shaping the industry in a positive direction. The growing adoption of cloud-based fleet management solutions in large organizations as well as rapid urbanization in the developed nations is expected to create ample growth opportunities for the market players in the upcoming days.

The freight transportation management market is a prominent segment of the logistics industry. This industry deals in developing advanced solutions for managing freight transportation in different parts of the world. There are various solutions developed in this sector including freight transportation cost management solution, freight security and monitoring system, freight mobility solution, freight 3PL solution, and some others. The end-user of these solutions consists of manufacturing, retail, healthcare, oil and gas, food and beverage and some others. This market is expected to grow significantly with the rise of the e-commerce sector across the globe.

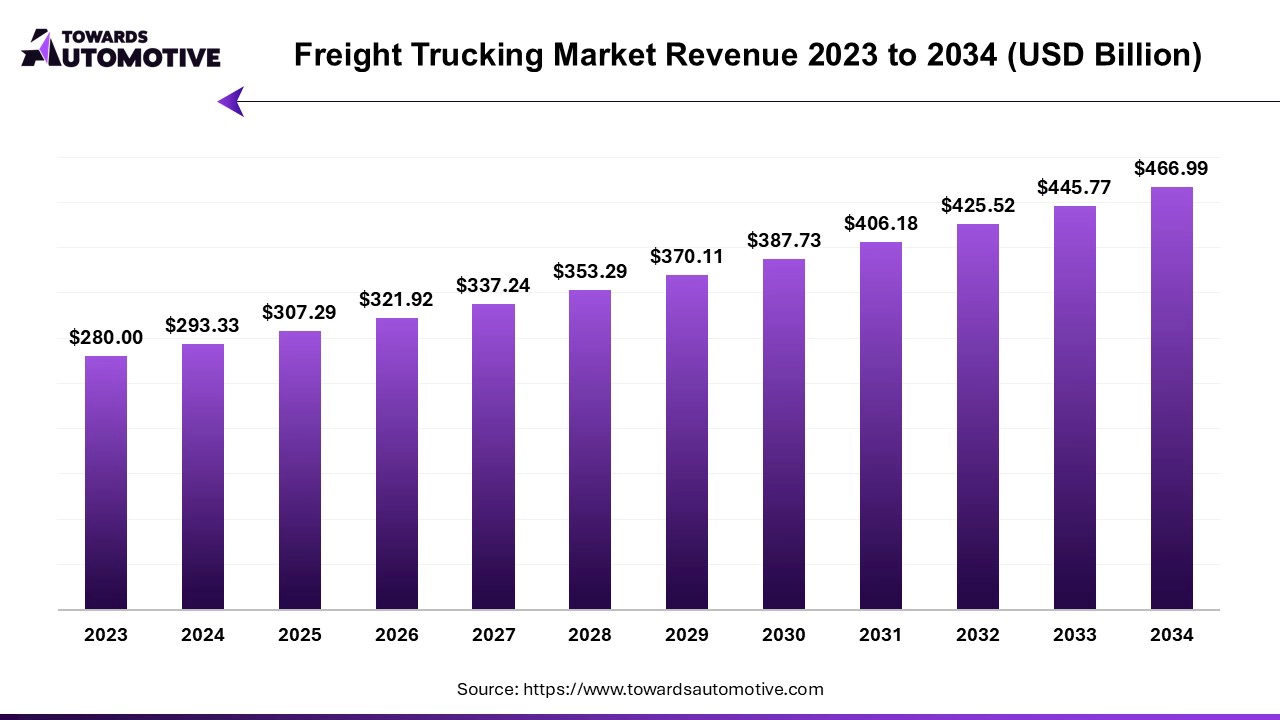

The freight trucking market is expected to increase from USD 307.29 billion in 2025 to USD 466.99 billion by 2034, growing at a CAGR of 4.76% throughout the forecast period from 2025 to 2034.

The freight trucking market is a prominent branch of the automotive industry. This industry deals in transporting goods using heavy-duty trucks. There are numerous types of trucks used in this sector including refrigerated trucks, tankers, dry van, flatbed and some others. The end-user of these trucks consists of various industries comprising of automobiles, machinery, apparels & footwears, pharmaceutical products, retail, electronics, petrochemicals, agriculture, building materials and some others. This market is expected to grow significantly with the rise of the logistics sector around the globe.

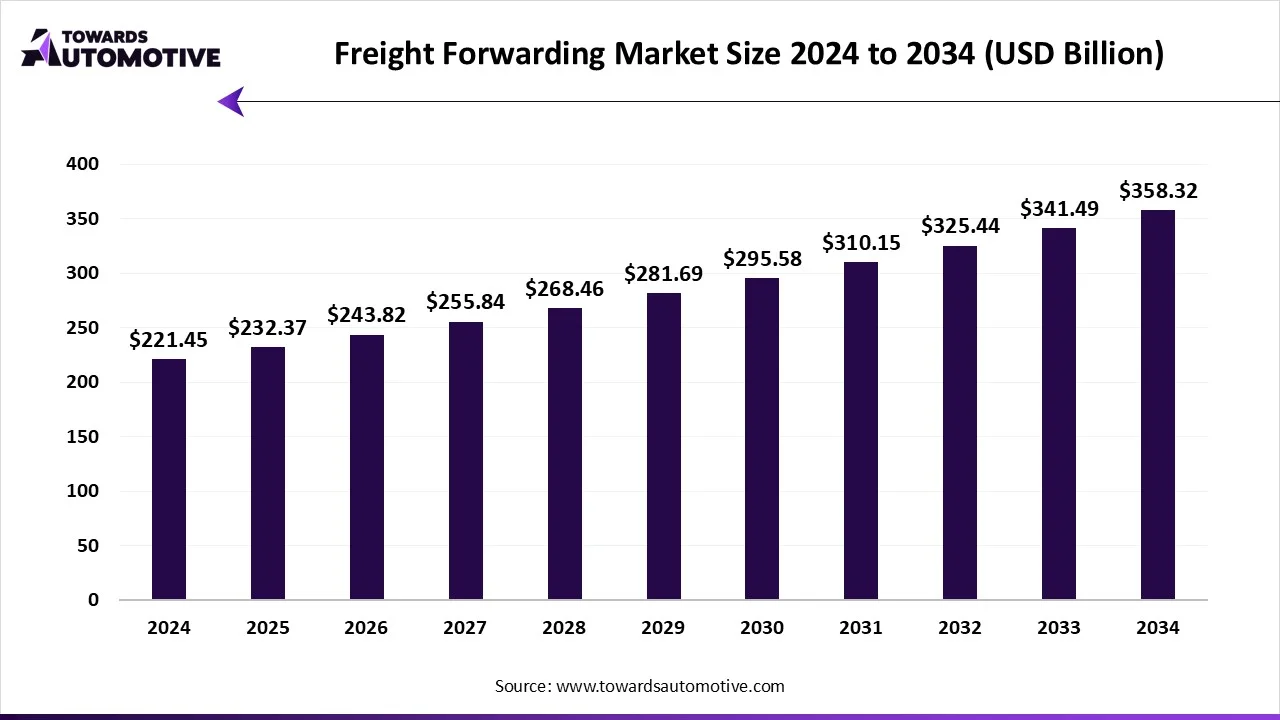

The freight forwarding market is forecast to grow from USD 232.37 billion in 2025 to USD 358.32 billion by 2034, driven by a CAGR of 4.93% from 2025 to 2034. The rapid growth in the e-commerce sector along with numerous government initiatives aimed at developing the road infrastructure is playing a vital role in shaping the industrial landscape.

Moreover, collaborations among logistics companies and manufacturing brands coupled with growing investment by market players for opening new storage facilities has driven the market expansion. The increasing use of drones and autonomous vehicles for operating last-mile delivery services is expected to create ample growth opportunities for the market players in the future.

The freight forwarding market is a prominent branch of the logistics industry. This industry deals in providing freight forwarding services in different parts of the world. There are several types of services delivered by this sector comprising of full container load shipping, less than container load shipping, breakbulk cargo handling, e-commerce fulfillment, project cargo & heavy lift, customs brokerage, warehousing & distribution, value-added services and some others. These services are operated by numerous modes of transport consisting of air freight forwarding, sea freight forwarding, road freight forwarding, rail freight forwarding, multimodal transport and some others. The end-users of these services consist of manufacturing & industrial goods, retail & consumer goods, automotive, healthcare & pharmaceuticals, food & beverage, chemicals, agriculture, e-commerce and some others. This market is expected to rise significantly with the growth of the online shopping industry around the globe.

The digital freight matching market is characterized by a diverse ecosystem of technology providers, logistics companies, and industry disruptors driving innovation and transformation.

Some of the prominent players in the market include

By Platform Type

By Deployment Model

By End-User

By Geography

Digital Freight Matching market, LogiTech Solutions, a prominent player in digital freight management, unveiled its latest Freight Optimization and Allocation Platform (FOAP) in December 2023. This innovative platform is designed to streamline the process of matching freight loads with available transportation capacity, leveraging advanced algorithms and predictive analytics to optimize freight allocation in real-time. With FOAP, shippers and carriers can efficiently identify suitable matches for their freight requirements, resulting in improved asset utilization, reduced empty miles, and enhanced overall operational efficiency. By harnessing technology to automate and optimize freight matching processes, LogiTech Solutions aims to drive cost savings, minimize environmental impact, and improve service levels across the logistics supply chain.

October 2025

October 2025

October 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us