August 2025

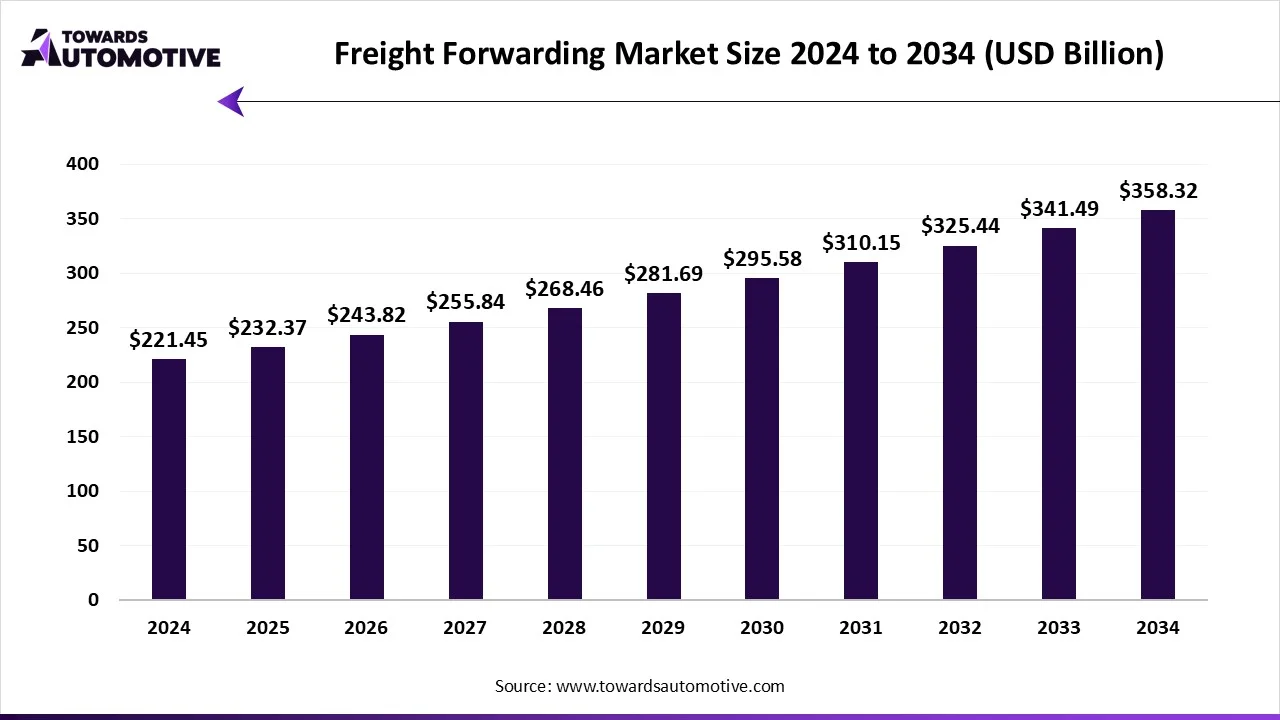

The freight forwarding market is forecast to grow from USD 232.37 billion in 2025 to USD 358.32 billion by 2034, driven by a CAGR of 4.93% from 2025 to 2034. The rapid growth in the e-commerce sector along with numerous government initiatives aimed at developing the road infrastructure is playing a vital role in shaping the industrial landscape.

Moreover, collaborations among logistics companies and manufacturing brands coupled with growing investment by market players for opening new storage facilities has driven the market expansion. The increasing use of drones and autonomous vehicles for operating last-mile delivery services is expected to create ample growth opportunities for the market players in the future.

Unlock Infinite Advantages: Subscribe to Annual Membership

The freight forwarding market is a prominent branch of the logistics industry. This industry deals in providing freight forwarding services in different parts of the world. There are several types of services delivered by this sector comprising of full container load shipping, less than container load shipping, breakbulk cargo handling, e-commerce fulfillment, project cargo & heavy lift, customs brokerage, warehousing & distribution, value-added services and some others. These services are operated by numerous modes of transport consisting of air freight forwarding, sea freight forwarding, road freight forwarding, rail freight forwarding, multimodal transport and some others. The end-users of these services consist of manufacturing & industrial goods, retail & consumer goods, automotive, healthcare & pharmaceuticals, food & beverage, chemicals, agriculture, e-commerce and some others. This market is expected to rise significantly with the growth of the online shopping industry around the globe.

The major trends in this market consists of partnerships, opening of new warehouses and government initiatives.

The sea freight forwarding segment dominated the market with a share of around 40%. The growing investment by government of several countries for developing the waterways sector has driven the market expansion. Additionally, partnerships among logistics companies and ship building companies for launching sea-based freight services is expected to propel the growth of the freight forwarding market.

The air freight forwarding segment is expected to grow with the highest CAGR during the forecast period. The rising adoption of air freight forwarding services by e-commerce brands for transporting goods internationally has boosted the market growth. Also, rapid investment by logistics companies to purchase new aircrafts for speeding up delivery operations is expected to drive the growth of the freight forwarding market.

The full container load (FCL) shipping segment dominated the market with a share of around 35%. The growing emphasis of e-commerce companies to adopt full container load services to distribute goods in different parts of the world has boosted the market expansion. Additionally, numerous advantages of FCL shipping services including efficiency, security, cost-effectiveness and some others is expected to drive the growth of the freight forwarding market.

The e-commerce fulfilment & value-added services segment is expected to expand with the fastest CAGR during the forecast period. The increasing adoption of air-based logistics services by e-commerce brands for transporting goods internally has driven the market growth. Additionally, the growing demand for several value-added services such as insurance, packaging, tracking and some others is expected to foster the growth of the freight forwarding market.

The manufacturing & industrial goods segment led the market with a share of around 30%. The growing development in the manufacturing sector in various countries such as China, Germany, India, the U.S., and some others has boosted the market expansion. Additionally, collaborations among manufacturing companies and logistics operators to enhance transportation of goods is expected to propel the growth of the freight forwarding market.

The e-commerce segment is expected to grow with the fastest CAGR during the forecast period. The rapid growth in the e-commerce sector in various countries such as the U.S., Canada, Germany, France, UK and some others has driven the market growth. Also, partnerships among e-commerce companies and logistics providers to enhance goods transportation is expected to foster the growth of the freight forwarding market.

The B2B segment led the market with a share of around 75%. The growing demand for high-quality logistics services from the manufacturing sector has boosted the market expansion. Additionally, partnerships among logistics companies and automotive brands for delivering goods in different parts of the world is expected to boost the growth of the freight forwarding market.

The B2C segment is expected to rise with the fastest CAGR during the forecast period. The increasing preference of consumers to adopt online shopping for purchasing and selling items has driven the market expansion. Additionally, rapid investment by logistics companies to launch new services to cater the needs of individual consumers is expected to drive the growth of the freight forwarding market.

The large enterprises segment led the market with a share of around 60%. The rising adoption of air-based logistics services by large business enterprises for transporting goods efficiently has boosted the market expansion. Additionally, collaborations among large companies and logistics providers to launch new trade routes is expected to drive the growth of the freight forwarding market.

The SMEs segment is expected to rise with the highest CAGR during the forecast period. The growing adoption of road-based logistics services by small and medium enterprises to deliver goods locally has driven the market expansion. Additionally, partnerships among railway operators and logistics companies for launching advanced services to cater the needs of SMEs is expected to boost the growth of the freight forwarding market.

The direct contracts with freight forwarders segment dominated the industry with a share of around 55%. The rising adoption of advanced freight services by e-commerce brands to enhance delivery of goods in short time duration has driven the market expansion. Also, partnerships among manufacturing companies and freight operators is expected to propel the growth of the freight forwarding market.

The online freight booking platforms segment is expected to rise with the highest CAGR during the forecast period. The growing preference of consumers to book freight services from online platforms to enhance scalability and flexibility has boosted the market growth. Additionally, the availability of online freight booking platforms in the Apps Store and Play Store is expected to drive the growth of the freight forwarding market.

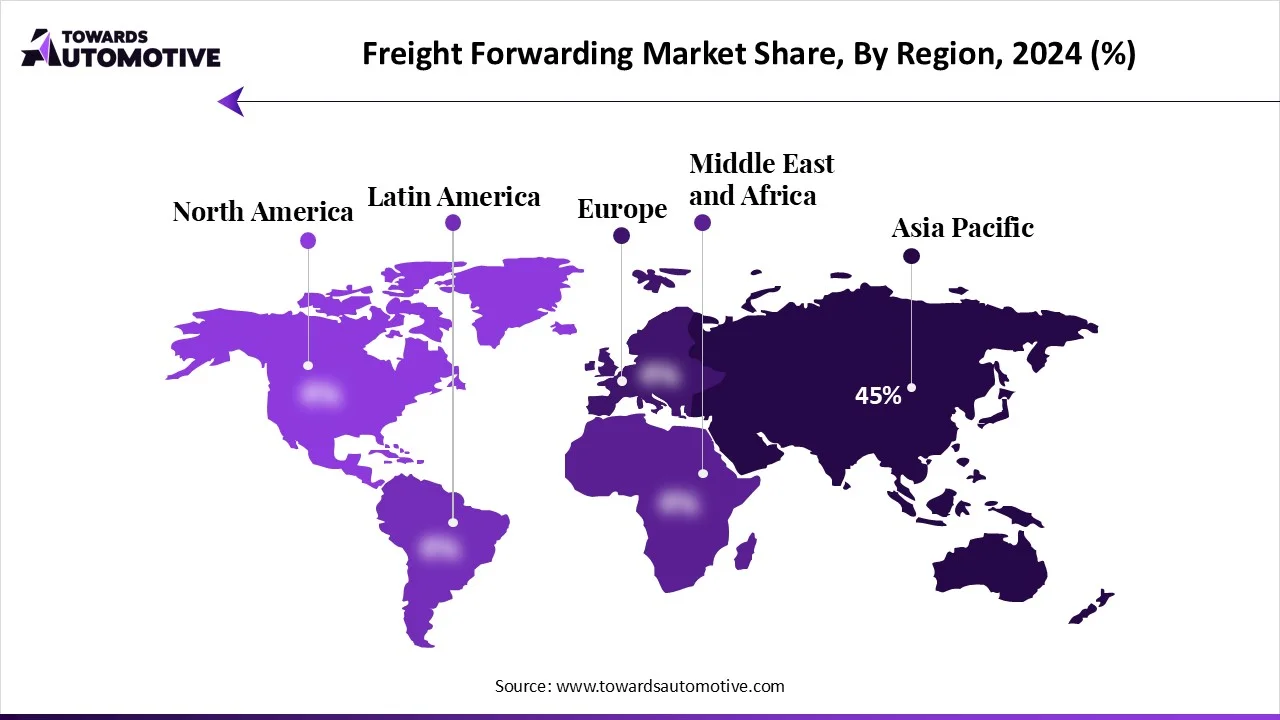

Asia Pacific dominated the freight forwarding market with a share of around 45%. The growing demand for advanced logistics services in several countries such as India, China, Japan, South Korea and some others has driven the market expansion. Additionally, numerous government initiatives aimed at developing the water transportation sector coupled with rapid investment by logistics companies to open new warehouses is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as Nippon Express, Sinotrans, CJ Logistics and some others is expected to boost the growth of the freight forwarding market in this region.

China and India led the market in this region. In China, the market is generally driven by the rapid growth of the e-commerce sector coupled with rising popularity of last-mile delivery services. In India, the growing development in the pharma sector along with rise in number of logistics startups is contributing to the industry in a positive manner.

The Middle East & Africa is expected to rise with the fastest CAGR during the forecast period. The rapid growth of the e-commerce sector in several countries such as UAE, Saudi Arabia, Qatar, South Africa and some others has boosted the market growth. Also, rising investment by logistics providers for launching new services along with growing development in the chemical industry is contributing to the industry in a positive direction. Moreover, the presence of various market players such as Aramex, Agility Logistics, RAK Logistics and some others is expected to drive the growth in this region.

UAE is a prominent contributor in this region. The rapid growth in the manufacturing sector coupled with technological advancements in the logistics industry is contributing to the industry in a positive manner. Additionally, numerous government initiatives aimed at developing the air transportation along with opening of new warehouses has driven the market expansion.

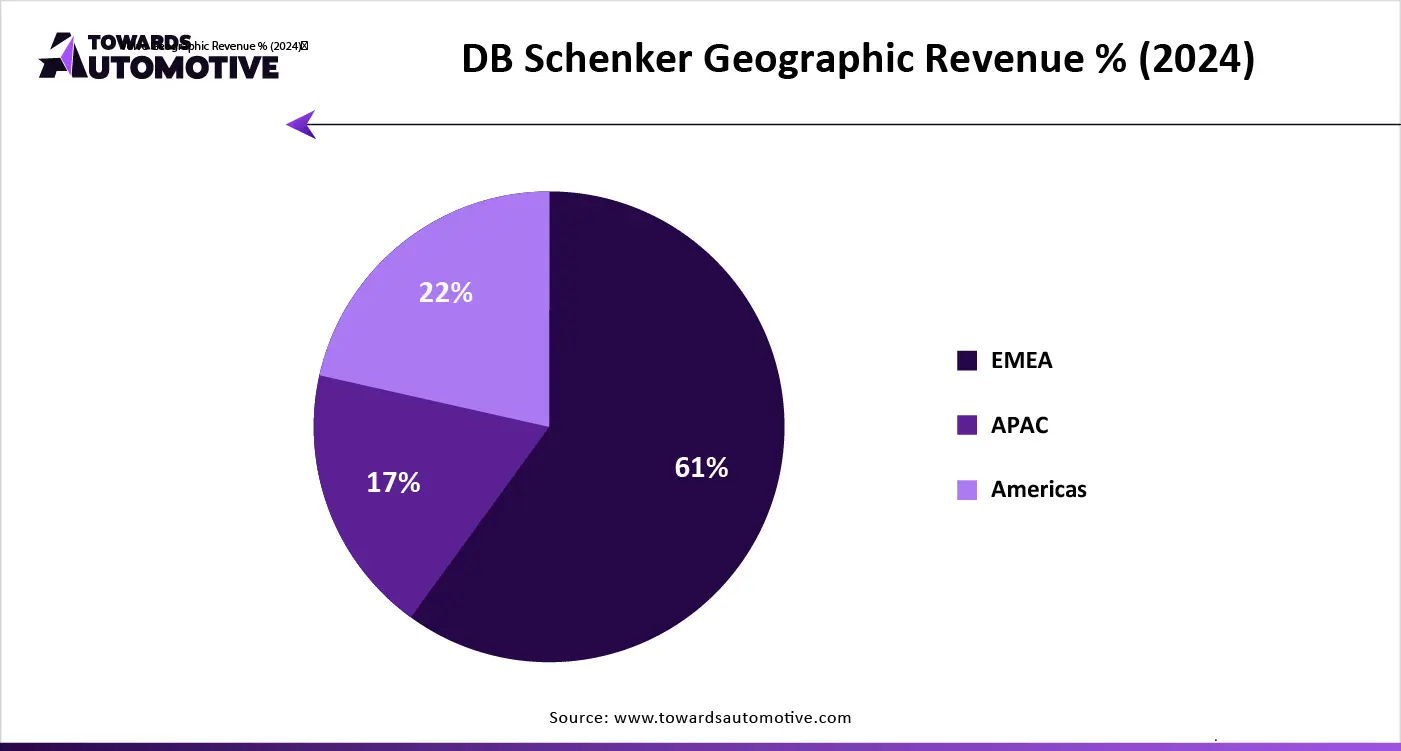

The freight forwarding market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Expeditors International of Washington, Inc.; CEVA Freight forwarding; Kuehne+Nagel; Deutsche Post AG; DB Schenker; DSV; FedEx; Uber Technologies, Inc.; United Parcel Service of America, Inc.; Nippon Express Holdings and some others. These companies are constantly engaged in providing logistics solutions for transporting goods and adopting numerous strategies such as partnerships, business expansions, acquisitions, collaborations, launches, expansions, joint ventures and some others to maintain their dominance in this industry.

By Mode of Transportation

By Service Type

By End-Use Industry

By Customer Type

By Organization Size

By Distribution Channel

August 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us